| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Caffeinated Beverage Market Size 2024 |

USD 14,377.74 million |

| Germany Caffeinated Beverage Market, CAGR |

5.67% |

| Germany Caffeinated Beverage Market Size 2032 |

USD 22,343.81 million |

Market Overview

Germany Caffeinated Beverage market size was valued at USD 14,377.74 million in 2024 and is anticipated to reach USD 22,343.81 million by 2032, at a CAGR of 5.67% during the forecast period (2024-2032).

The Germany Caffeinated Beverage market is driven by increasing consumer demand for energy-boosting products, with energy drinks and ready-to-drink coffees gaining popularity. A growing preference for convenience and on-the-go consumption, alongside expanding retail distribution networks, supports market growth. Additionally, the trend toward healthier options, including low-sugar, sugar-free, and organic beverages, is reshaping consumer choices. Innovations in product formulations, such as functional ingredients like vitamins and electrolytes, further boost the market’s appeal. The rise in health-consciousness among German consumers, coupled with a fast-paced lifestyle, is creating opportunities for brands to introduce specialized products targeting different segments, including athletes, busy professionals, and younger demographics. Moreover, the increasing availability of caffeinated beverages in online channels is expanding market access, enhancing consumer convenience and fueling demand across the country.

The Germany Caffeinated Beverage market is driven by key players such as Nestlé, Dr Pepper Snapple Group, Monster Energy Company, PepsiCo, and Red Bull GmbH, each contributing significantly to the country’s diverse beverage landscape. These companies offer a wide range of products, including energy drinks, ready-to-drink coffee and tea, and carbonated beverages, catering to the growing demand for both convenience and health-conscious options. Geographically, regions like Berlin, Munich, Hamburg, and Bremen exhibit distinct consumer preferences, with Berlin leading in trend-driven choices, Munich emphasizing premium and organic products, Hamburg showcasing a mix of traditional and innovative options, and Bremen focusing on more conservative tastes. As consumer preferences evolve, these players continue to innovate, introducing new flavors, healthier formulations, and functional ingredients to stay competitive in the dynamic German market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Germany Caffeinated Beverage market was valued at USD 14,377.74 million in 2024 and is projected to reach USD 22,343.81 million by 2032, growing at a CAGR of 5.67% during the forecast period.

- The global caffeinated beverage market was valued at USD 252,050.67 million in 2024 and is expected to reach USD 369,284.04 million by 2032, growing at a CAGR of 4.89%.

- Growing consumer demand for energy-boosting products, especially among busy professionals and young adults, is a major market driver.

- Health-conscious trends are reshaping the market, with rising preference for low-sugar, organic, and functional beverages.

- The increasing demand for on-the-go, ready-to-drink (RTD) caffeinated products like energy drinks and iced coffees supports market expansion.

- The market is highly competitive, with major players such as Nestlé, PepsiCo, Red Bull, and Monster Energy leading the sector.

- Regulatory concerns regarding caffeine consumption, especially among children and young adults, pose potential restraints for the market.

- Regionally, Berlin, Munich, Hamburg, and Bremen exhibit distinct preferences, with Berlin showing the highest consumption of innovative, health-focused beverages.

Report Scope

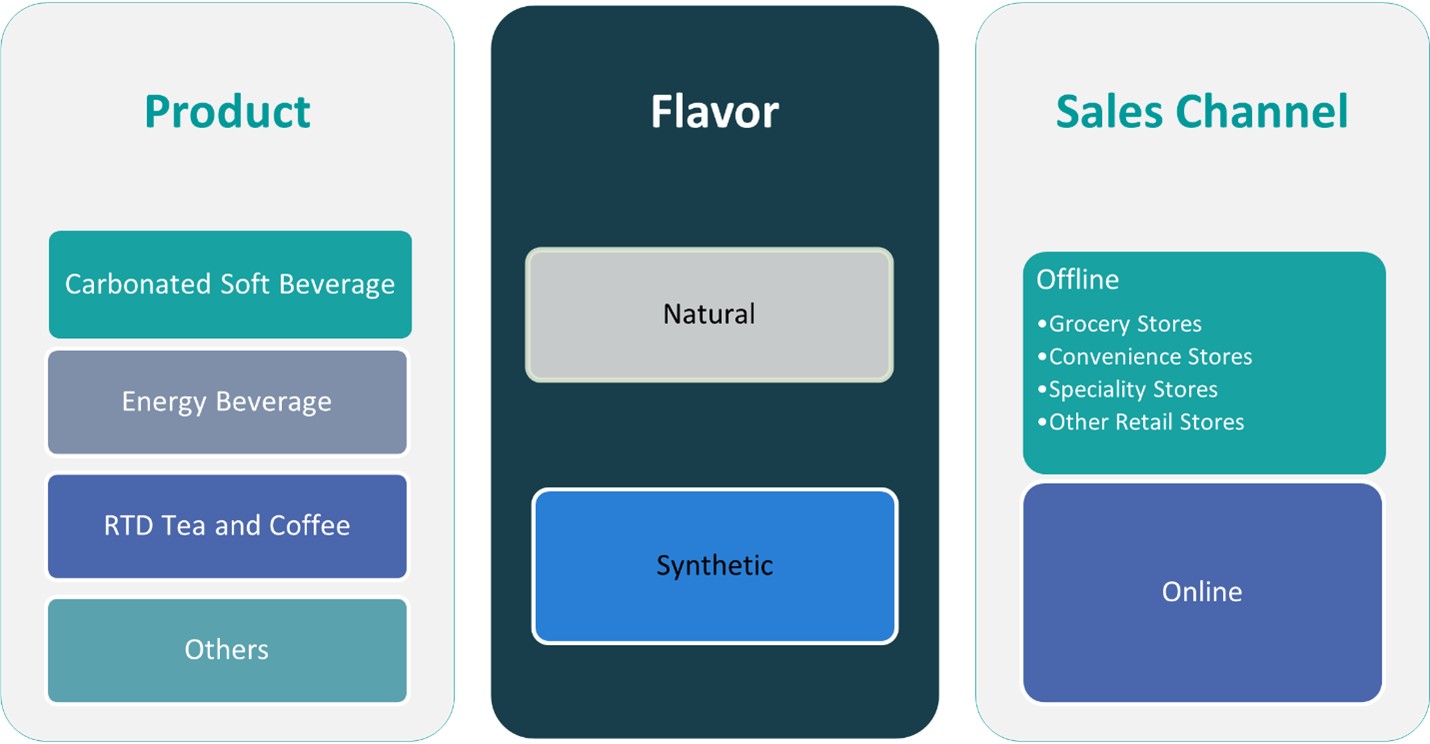

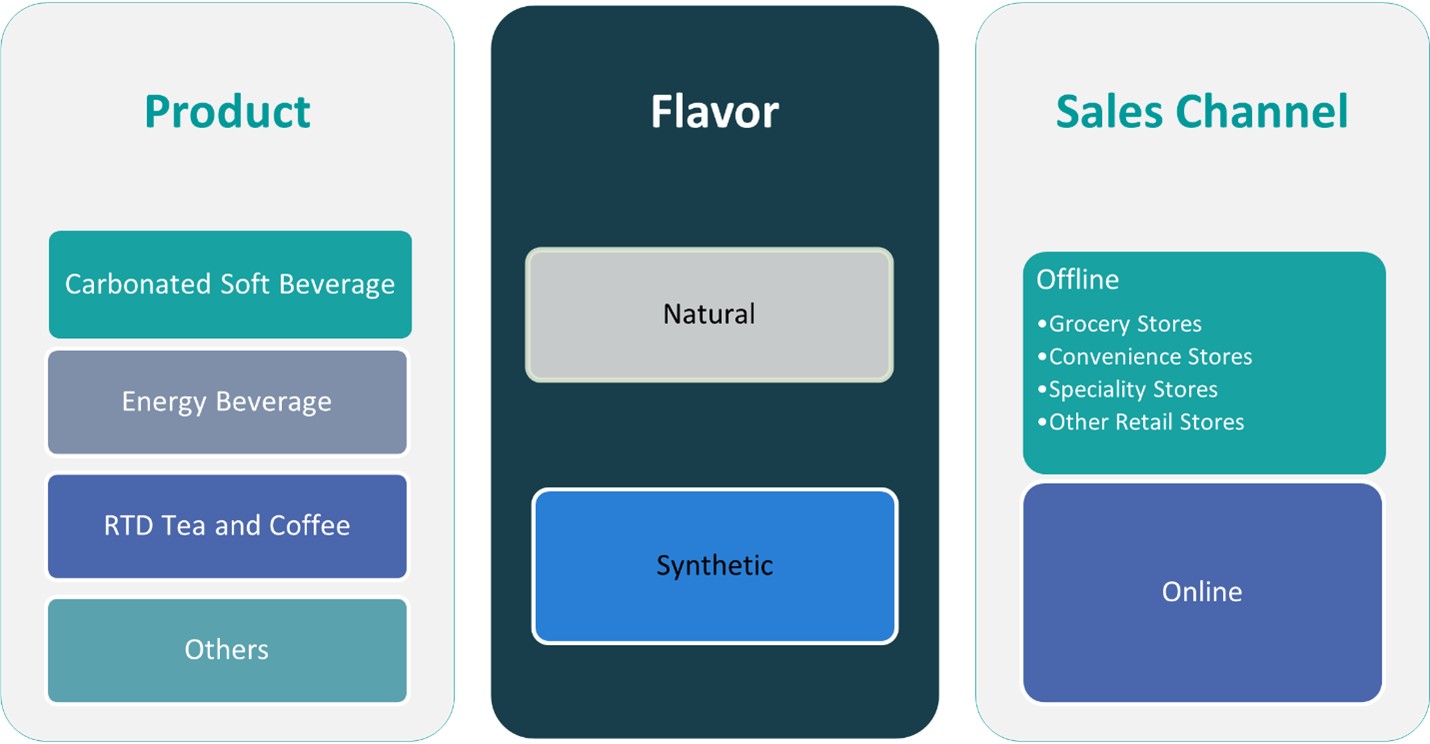

This report segments the Germany Caffeinated Beverage Market as follows:

Market Drivers

Growing Consumer Demand for Energy-Boosting Products

The Germany Caffeinated Beverage market is primarily driven by a growing consumer demand for energy-boosting products, particularly energy drinks and ready-to-drink coffees. As the need for mental alertness and physical stamina rises, especially among busy professionals, students, and athletes, caffeinated beverages offer a convenient solution. For instance, Germany is one of the largest consumers of energy drinks in Europe, with demand driven by younger demographics and active lifestyles. Energy drinks, which are known for their ability to provide a quick energy surge, are particularly favored by younger demographics who have an active lifestyle. With an increasing number of consumers seeking quick and efficient ways to stay energized throughout the day, caffeinated beverages are becoming an essential part of the modern diet, contributing significantly to market growth.

Health and Wellness Trends

In recent years, there has been a noticeable shift towards healthier options within the Germany Caffeinated Beverage market. Consumers are becoming more health-conscious and are actively seeking low-sugar, sugar-free, and organic alternatives to traditional caffeinated drinks. For instance, Germany’s caffeine market is witnessing a shift toward natural and organic caffeine sources, driven by consumer demand for healthier alternatives. This health and wellness trend is particularly evident in the rise of natural, plant-based energy drinks, which emphasize functional ingredients such as vitamins, minerals, and electrolytes. These products cater to the demand for beverages that not only provide a caffeine boost but also contribute to overall well-being. The market is responding by innovating and introducing a wider range of healthier beverage options that align with modern consumer preferences, further expanding the market.

Increasing On-the-Go Consumption

The fast-paced lifestyle prevalent in Germany has driven the demand for on-the-go, convenient beverage options. As people seek convenience in their daily routines, ready-to-drink caffeinated beverages provide an easy and accessible solution. Busy professionals, commuters, and students are increasingly turning to bottled energy drinks and canned coffees as quick alternatives to traditional brewed beverages. The rise in retail distribution networks, particularly through supermarkets, convenience stores, and online platforms, makes caffeinated beverages more accessible to a broader consumer base. This shift towards on-the-go consumption not only boosts sales but also encourages product innovations tailored to convenience, such as single-serve bottles and compact packaging, further driving market growth.

Expanding Product Innovations and Functional Ingredients

The continuous innovation in product offerings and the inclusion of functional ingredients are key drivers of the Germany Caffeinated Beverage market. Manufacturers are increasingly focusing on creating beverages with added benefits, such as improved hydration, enhanced mental focus, and increased stamina. The introduction of drinks enriched with amino acids, adaptogens, and plant-based ingredients appeals to health-conscious consumers who are looking for more than just caffeine. Additionally, the market has seen a rise in beverages that cater to specific consumer needs, such as those targeting athletes, weight management, or stress relief. With these innovations, companies are tapping into niche segments, broadening their consumer base, and contributing to the growth of the market. As consumers continue to seek products that align with their lifestyle and health goals, product innovation will remain a crucial factor in driving demand for caffeinated beverages in Germany.

Market Trends

Rise of Health-Conscious Caffeinated Beverages

A significant trend in the Germany Caffeinated Beverage market is the shift towards healthier alternatives. With growing awareness of health and wellness, consumers are increasingly seeking beverages that align with their desire for low-sugar, sugar-free, and organic options. There is a noticeable rise in demand for energy drinks and coffees that offer functional benefits, such as improved hydration, mental clarity, and overall well-being. For instance, the German market is seeing a rise in functional beverages that combine caffeine with additional health benefits, such as stress relief and weight management. Products containing natural ingredients, like plant-based caffeine from guarana or green tea, and fortified with vitamins, minerals, and electrolytes, are gaining traction. This trend is particularly strong among consumers who are looking for a balance between energy boosts and nutritional value, pushing brands to innovate and offer healthier, better-for-you caffeinated options.

Increasing Popularity of Ready-to-Drink (RTD) Beverages

The convenience factor plays a significant role in the growing popularity of ready-to-drink (RTD) caffeinated beverages in Germany. As consumers increasingly prioritize convenience in their busy lives, there is a marked shift towards pre-packaged, on-the-go drinks, such as energy drinks, iced coffees, and cold brews. The demand for these products has been further supported by the growth of retail distribution channels, including supermarkets, convenience stores, and online platforms. RTD beverages cater to consumers looking for quick, portable caffeine fixes without the need for preparation, fitting seamlessly into the fast-paced lifestyle of modern German consumers. This shift towards on-the-go consumption is expected to continue driving market expansion, with more brands introducing RTD options to meet consumer needs.

Expansion of E-commerce and Digital Channels

The expansion of e-commerce and digital sales channels is another prominent trend influencing the Germany Caffeinated Beverage market. With the increasing reliance on online shopping, many consumers are turning to digital platforms to purchase their favorite caffeinated drinks. This shift has been accelerated by the convenience of home delivery services and the availability of a wider product range. For instance, brands are distributing products through various points of sale such as hypermarkets, supermarkets, cafes, restaurants, hotels, malls, convenience stores, and gas station stores. E-commerce platforms offer consumers easy access to niche or specialized caffeinated beverages that may not be available in physical stores. Additionally, online platforms allow brands to reach a broader audience, including those in remote areas or those seeking personalized shopping experiences. As more brands strengthen their online presence, e-commerce will continue to be a critical channel for market growth and consumer engagement.

Product Diversification and Innovation

In response to evolving consumer preferences, product diversification and innovation have become central trends within the Germany Caffeinated Beverage market. Brands are exploring new ways to differentiate their products by introducing a variety of flavors, caffeine blends, and functional ingredients. For example, the integration of adaptogens, amino acids, and herbal extracts into caffeinated beverages is becoming increasingly popular, offering benefits beyond just an energy boost. Additionally, there is a growing trend towards the inclusion of plant-based or vegan ingredients, catering to the increasing number of consumers adopting vegetarian or vegan diets. This diversification is helping brands appeal to a wider range of consumers, from health-conscious individuals to those seeking specialized, functional beverages.

Market Challenges Analysis

Health Concerns and Regulatory Challenges

One of the key challenges facing the Germany Caffeinated Beverage market is growing health concerns surrounding the consumption of caffeinated products. With increasing awareness of the potential negative effects of excessive caffeine intake, including insomnia, anxiety, and increased heart rate, there is a rising demand for beverages with lower caffeine content or alternative energy-boosting ingredients. This shift in consumer preferences is placing pressure on manufacturers to reformulate their products to meet health-conscious demands while still providing the desired energy effects. For instance, Germany’s caffeine market is subject to regulations governing its use in food, beverages, pharmaceuticals, and dietary supplements, prioritizing consumer safety and public health. Furthermore, the German government, along with the European Union, has imposed stringent regulations on the marketing and sale of caffeinated products, especially those targeting children and adolescents. This includes restrictions on caffeine levels in beverages marketed to younger consumers and requirements for clear labeling on caffeine content. Navigating these regulatory challenges while maintaining consumer satisfaction presents a significant hurdle for brands in the caffeinated beverage sector.

Intense Market Competition and Price Sensitivity

The German Caffeinated Beverage market is also highly competitive, with numerous local and international brands vying for market share. This intense competition results in price sensitivity among consumers, particularly in the energy drink segment, where price plays a key role in purchasing decisions. As a result, brands face the challenge of balancing product quality and innovation with competitive pricing to attract and retain customers. Additionally, the presence of private-label products from major retailers further intensifies the competition, often offering similar products at lower prices. This pressure to reduce costs while maintaining product differentiation and quality can be challenging for companies, particularly smaller or emerging brands. Moreover, with changing consumer tastes and trends, brands must continuously innovate and adapt to stay relevant, requiring ongoing investments in research and development, which can further strain profitability.

Market Opportunities

The Germany Caffeinated Beverage market presents several key opportunities driven by shifting consumer preferences and emerging trends. One of the most notable opportunities lies in the increasing demand for healthier and functional beverages. As consumers become more health-conscious, there is a growing preference for low-sugar, sugar-free, and organic caffeinated drinks. Brands that can innovate to offer beverages with added health benefits, such as vitamins, electrolytes, and adaptogens, are well-positioned to capture this evolving market. The rise of plant-based and vegan products also creates opportunities for brands to cater to a broader demographic, including environmentally and health-conscious consumers. This trend, along with the demand for more sustainable packaging solutions, allows companies to differentiate themselves and tap into the expanding market for better-for-you caffeinated options.

Another significant opportunity lies in the increasing popularity of ready-to-drink (RTD) caffeinated beverages, driven by the growing trend of on-the-go consumption. Busy lifestyles and the desire for convenience have made RTD drinks, including energy drinks and iced coffees, more popular among German consumers. With an expanding retail presence and increasing online shopping, there is ample room for growth in this segment. Brands that offer convenient, portable, and easily accessible caffeinated beverages are likely to see increased consumer adoption. Moreover, the expansion of e-commerce channels and digital marketing strategies presents an opportunity for brands to reach wider and more diverse audiences, particularly through online platforms. These channels not only enable brands to cater to convenience-seeking consumers but also allow for more targeted and personalized marketing, driving further market growth.

Market Segmentation Analysis:

By Product:

The Germany Caffeinated Beverage market is segmented into four key product categories: carbonated soft beverages, energy beverages, ready-to-drink (RTD) tea and coffee, and others. Among these, energy beverages are experiencing the highest growth, driven by increasing consumer demand for quick, convenient energy boosts. These beverages are particularly popular among younger consumers and those with busy lifestyles, as they provide a rapid energy surge. Carbonated soft beverages also maintain a strong market presence, with consumers often choosing them for their refreshing taste and the caffeine kick they offer. RTD tea and coffee are emerging as significant contenders, catering to the demand for healthier, ready-to-consume alternatives. These drinks offer a more balanced caffeine content compared to energy drinks, making them popular among health-conscious consumers. The “Others” segment includes niche products like caffeinated waters and functional beverages, which are expanding in response to growing consumer interest in innovative caffeinated options.

By Flavor:

Flavor is a crucial factor in consumer decision-making within the Germany Caffeinated Beverage market, with products typically categorized into natural and synthetic flavors. Natural flavors are gaining significant traction due to the increasing preference for health-conscious and clean-label products. Beverages made with natural ingredients, such as fruit extracts, plant-based caffeine, and organic flavors, align with the rising demand for transparent, healthier alternatives. As consumers become more mindful of ingredient sourcing and product quality, natural-flavored caffeinated drinks are being favored. On the other hand, synthetic flavors still dominate many mainstream energy drinks and carbonated soft beverages, offering bold and consistent tastes at a lower cost. While synthetic flavors remain popular among price-sensitive consumers, the market is increasingly shifting towards natural options, driven by growing awareness of the benefits of clean-label and additive-free products. This shift presents an opportunity for brands to innovate and differentiate themselves with natural flavor offerings.

Segments:

Based on Product:

- Carbonated Soft Beverage

- Energy Beverage

- RTD Tea and Coffee

- Others

Based on Flavor:

Based on Sales Channel:

- Offline

- Grocery Stores

- Convenience Stores

- Speciality Stores

- Other Retail Stores

- Online

Based on the Geography:

- Berlin

- Munich

- Hamburg

- Bremen

Regional Analysis

Berlin

Berlin leads the market, holding the largest share at approximately 30%. The capital city’s large and diverse population, along with its vibrant social and cultural scene, drives high demand for caffeinated beverages. Berlin is known for its trend-driven consumer base, with a strong preference for innovative, health-conscious, and functional beverages. This region also benefits from its status as a hub for young professionals, students, and tourists, contributing to the high consumption of energy drinks, ready-to-drink coffees, and health-oriented caffeinated options.

Munich

Munich, with its affluent and health-conscious population, accounts for around 25% of the Germany Caffeinated Beverage market. The city’s consumers are particularly inclined toward premium, organic, and low-sugar caffeinated products. Munich’s market is driven by a preference for higher-quality beverages, with a growing demand for ready-to-drink (RTD) tea and coffee, as well as functional energy drinks that focus on wellness benefits. The city’s strong economic position and the presence of a large corporate sector also fuel demand for convenient, on-the-go caffeinated options, particularly among busy professionals.

Hamburg

Hamburg, holding a market share of approximately 20%, is another key region in Germany’s caffeinated beverage sector. Known for its bustling port and diverse population, Hamburg’s consumers have a diverse range of preferences, with energy drinks and carbonated soft beverages being particularly popular. The city’s younger demographic, combined with a thriving tourism industry, contributes to the robust demand for both traditional and innovative caffeinated beverages. Hamburg’s position as a major commercial and cultural center also promotes the consumption of both mainstream and niche caffeinated products, with a growing shift towards healthier options.

Bremen

Bremen, while a smaller market, holds a 15% share of the total German caffeinated beverage market. The region’s more conservative consumer base tends to favor traditional carbonated soft drinks and energy beverages. However, the demand for health-focused beverages, such as RTD coffee and tea, has been gradually increasing. Bremen’s market is also influenced by a strong local manufacturing presence and a growing awareness of wellness trends. The region’s relatively smaller, yet dedicated consumer base, continues to embrace caffeinated beverages, with an increasing shift towards convenience and health-conscious choices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nestlé

- Dr Pepper Snapple Group

- Monster Energy Company

- PepsiCo

- Red Bull GmbH

Competitive Analysis

The Germany Caffeinated Beverage market is highly competitive, with leading players such as Nestlé, Dr Pepper Snapple Group, Monster Energy Company, PepsiCo, and Red Bull GmbH dominating the landscape. Nestlé continues to focus on innovation in healthier and functional caffeinated beverages, capitalizing on its strong distribution network and global presence. The trend towards functional and low-sugar beverages has prompted manufacturers to develop products with added vitamins, electrolytes, and plant-based ingredients, catering to the rising demand for healthier alternatives. Additionally, brands are emphasizing sustainability by introducing eco-friendly packaging and reducing the environmental impact of their operations. In the energy drink segment, the competition remains fierce, with brands seeking to differentiate themselves through bold flavors, unique ingredients, and marketing strategies targeting younger demographics. The ready-to-drink (RTD) coffee and tea segments are also becoming more competitive, with players offering premium options and focusing on convenience for on-the-go consumers. As market preferences evolve, the ability to innovate and adapt to trends such as natural ingredients, clean labels, and functional benefits will be crucial for maintaining market share. Effective distribution strategies and brand differentiation will be key in this competitive landscape.

Recent Developments

- In March 2025, PepsiCo expanded its Pepsi MAX Caffeine Free line with a new 500ml bottle in the UK, responding to rising demand for caffeine-free and sugar-free colas among younger consumers.

- In February 2025, Coca-Cola introduced Simply Pop, a prebiotic, fruit juice-enriched soda targeting the “better-for-you” market segment, competing with brands like Poppi and Olipop.

- In January 2025, Nestlé implemented a new global organizational structure for its Waters & Premium Beverages division, operating as a standalone business.

- In June 2024, the Starbucks Corporation, one of the renowned brands in caffeinated beverages industry launched new range of Caramel Vanilla Swirl Iced Coffee, handcrafted energy drinks and few other products. Starbucks Tripleshot Energy drink, recently launched offering is characterized by 65mg of caffeine content, protein, B vitamins. The products is provided in three flavor choices including dark caramel, bold mocha, and rich vanilla.

- In February 2024, Dunkin’, one of the applauded brands in food & beverages industry introduced SPARKD’ Energy by Dunkin’, iced beverages equipped with minerals, vitamins and some amount of caffeine. The flavors include berry burst entailing strawberry and raspberry, and peach sunshine featuring lychee and juicy peach flavors.

Market Concentration & Characteristics

The Germany Caffeinated Beverage market is moderately concentrated, with a few dominant players holding a significant share, while smaller and emerging brands continue to compete by offering niche products. Major companies have established strong brand recognition, extensive distribution networks, and significant marketing resources, which contribute to their market leadership. However, the market also sees a growing presence of local and independent brands, particularly in the segments of functional and health-oriented beverages. Consumers are increasingly drawn to unique offerings, such as organic, low-sugar, and plant-based caffeinated drinks, creating opportunities for innovation. The market is characterized by a trend toward premiumization, with a focus on quality, natural ingredients, and sustainability. Companies are investing in research and development to introduce new flavors and healthier formulations, aligning with consumer preferences for more functional, low-calorie, and natural options. Overall, the market is dynamic, with increasing competition and a shift towards healthier, on-the-go beverage options.

Report Coverage

The research report offers an in-depth analysis based on Product, Flavor, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for healthier, low-sugar, and functional caffeinated beverages is expected to grow significantly.

- Consumer preferences will continue to shift towards organic, plant-based, and clean-label products.

- The ready-to-drink (RTD) segment, including coffee and tea, will experience strong growth due to the convenience factor.

- Increased awareness of the negative effects of excessive caffeine consumption may drive demand for moderate caffeine products.

- There will be a rising emphasis on sustainable packaging and eco-friendly production practices.

- Innovation in flavors and formulations will remain a key factor for brand differentiation in the market.

- Health-focused energy drinks, with added benefits like vitamins and electrolytes, will become more popular.

- E-commerce platforms will play a bigger role in the distribution of caffeinated beverages, offering more direct access to consumers.

- Growth in the demand for functional beverages will lead to more investment in research and development for new product lines.

- The market will likely see further diversification, with more brands entering niche segments, such as caffeine-infused waters and teas.