Market Overview:

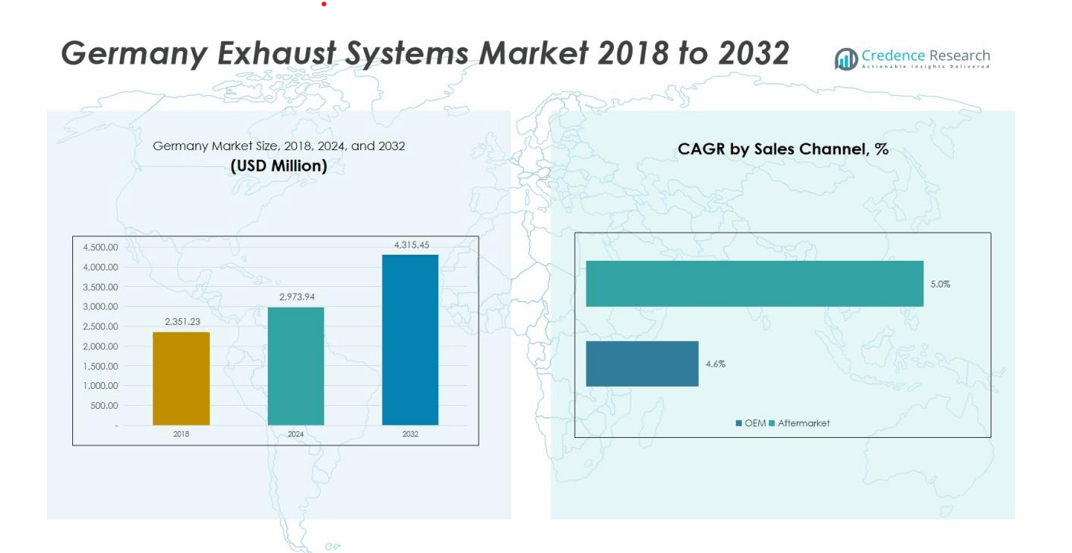

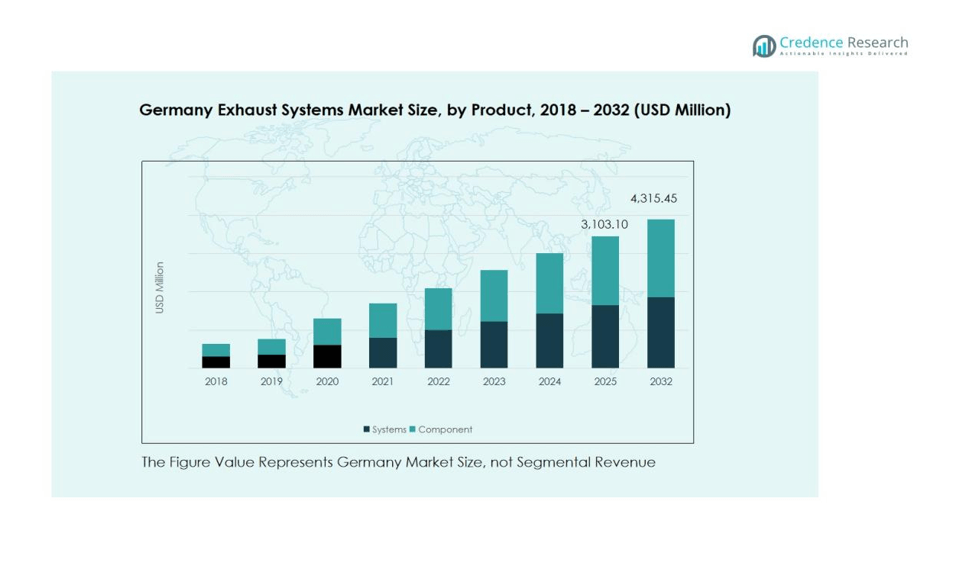

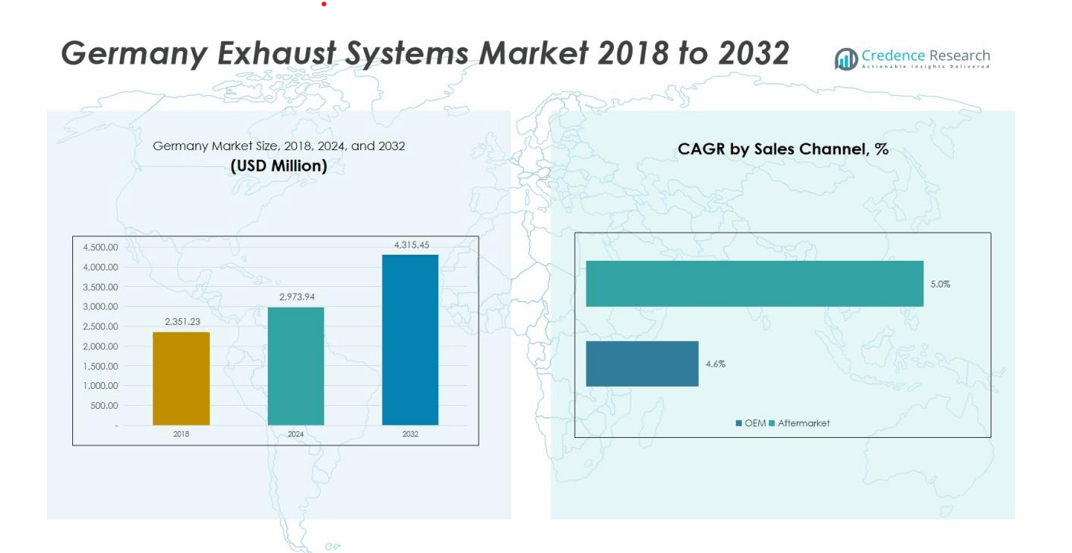

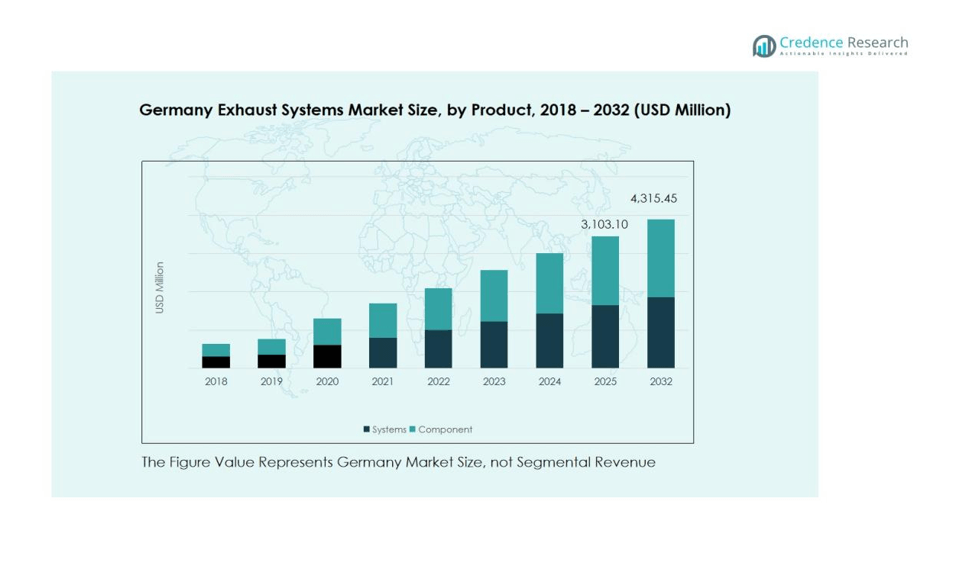

The Germany Exhaust Systems Market size was valued at USD 2,351.23 million in 2018 to USD 2,973.94 million in 2024 and is anticipated to reach USD 4,315.45 million by 2032, at a CAGR of 4.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Exhaust Systems Market Size 2024 |

USD 2,973.94 million |

| Germany Exhaust Systems Market, CAGR |

4.48% |

| Germany Exhaust Systems Market Size 2032 |

USD 4,315.45 million |

Stringent environmental regulations under Euro 6 and upcoming Euro 7 standards drive the adoption of cleaner and more efficient exhaust systems. German automakers are increasingly using lightweight materials such as stainless steel and titanium to improve performance and fuel efficiency. The rising demand for hybrid and plug-in hybrid vehicles also encourages integration of optimized catalytic converters, particulate filters, and mufflers to meet sustainability goals.

Regionally, southern and western Germany—particularly Bavaria, Baden-Württemberg, and North Rhine-Westphalia—lead production due to the concentration of major OEMs like BMW, Mercedes-Benz, and Volkswagen. These areas host advanced R&D and manufacturing hubs that contribute to both domestic and export demand. Eastern Germany is gradually emerging as a secondary growth zone, supported by new production facilities and government-backed green mobility initiatives.

Market Insights:

- The Germany Exhaust Systems Market was valued at USD 2,351.23 million in 2018, reached USD 2,973.94 million in 2024, and is projected to attain USD 4,315.45 million by 2032, registering a CAGR of 4.48% during the forecast period.

- Southern Germany holds 38% of the market share, followed by Western Germany at 33% and Central Germany at 17%, driven by the presence of major OEMs, advanced R&D hubs, and export-oriented manufacturing clusters.

- Eastern Germany represents the fastest-growing region with a 7% share, supported by new industrial investments, government-backed green mobility programs, and expansion of production facilities.

- By product type, catalytic converters account for 42% of the market due to stricter Euro 6 and Euro 7 emission standards, while mufflers contribute 28% driven by demand for noise control and performance enhancement.

- By vehicle type, passenger vehicles dominate with a 64% share, followed by commercial vehicles at 26%, supported by high automotive output and growing hybrid integration across fleets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Stringent Emission Norms and Environmental Compliance Driving Technological Advancements

The Germany Exhaust Systems Market is strongly driven by the nation’s adherence to Euro 6 and forthcoming Euro 7 emission standards. These regulations push automakers to develop advanced exhaust after-treatment systems that reduce nitrogen oxide and carbon emissions. Manufacturers are focusing on integrating selective catalytic reduction (SCR), diesel particulate filters (DPF), and gasoline particulate filters (GPF) to meet these benchmarks. Continuous innovation in sensor technology and thermal management further enhances exhaust efficiency and durability.

- For Instance, Bosch announced new diesel technology that significantly reduced nitrogen oxide (NOx) emissions. In real-world driving tests, an experimental vehicle equipped with this technology achieved an average of just 13 mg of NOx per kilometer, which was approximately one-tenth of the legal limit set to apply in Europe after 2020.

Rising Adoption of Hybrid and Plug-In Hybrid Vehicles Supporting System Integration

Germany’s growing hybrid and plug-in hybrid vehicle segment is boosting demand for customized exhaust solutions. These vehicles require systems that optimize both internal combustion performance and electric drive compatibility. The integration of lightweight materials, noise reduction technologies, and efficient catalytic converters strengthens system efficiency. OEMs and component suppliers are collaborating to design flexible architectures suited for multi-powertrain applications.

- For instance, in July 2024, Rheinmetall secured two major orders worth around €20 million for hybrid vehicle exhaust technologies, including advanced shut-off and exhaust gas recirculation valves designed for plug-in hybrids.

Strong Automotive Manufacturing Base Reinforcing Domestic and Export Demand

Germany’s status as Europe’s leading automotive manufacturing hub plays a major role in market expansion. Established OEMs such as Volkswagen, BMW, and Mercedes-Benz continuously invest in R&D to enhance emission control technologies. The extensive supply chain network and skilled workforce support high production output for domestic use and export. It benefits from advanced engineering capabilities and strong cooperation between manufacturers and technology providers.

Growing Focus on Lightweight and Sustainable Material Development

The push toward vehicle weight reduction and fuel efficiency encourages the use of stainless steel, titanium, and advanced composites in exhaust systems. These materials improve durability, reduce corrosion, and enhance overall thermal performance. Research initiatives across Germany promote the adoption of sustainable materials and recycling-friendly components. It strengthens environmental sustainability while aligning with the nation’s long-term carbon neutrality goals.

Market Trends:

Integration of Advanced Emission Control Technologies Enhancing System Efficiency

The Germany Exhaust Systems Market is witnessing a shift toward next-generation emission control technologies that enhance overall vehicle performance. Automakers are adopting advanced SCR systems, GPFs, and DPFs integrated with onboard diagnostics to ensure real-time emission monitoring. The growing emphasis on Euro 7 compliance encourages continuous improvements in exhaust flow design, catalyst coating, and filtration precision. Manufacturers are also leveraging smart sensors to regulate exhaust temperature and pressure, improving fuel efficiency and extending component lifespan. Increasing investments in R&D from both OEMs and suppliers are driving rapid innovation in compact, lightweight, and modular exhaust assemblies. It continues to benefit from strong collaboration between Germany’s automotive institutes and engineering firms focused on low-emission technologies.

- For instance, Purem by Eberspächer’s EHC Fractal Heater, launched in July 2023, enables reduction of over 90 percent of pollutants during the first two minutes of engine start-up.

Growing Transition Toward Lightweight, Sustainable, and Electrified Vehicle Platforms

Germany’s automotive industry is accelerating its transition toward lightweight and sustainable exhaust components to align with environmental goals. Manufacturers are integrating high-performance materials such as titanium, aluminized steel, and ceramic composites to achieve durability with reduced weight. The rapid adoption of hybrid and plug-in hybrid models demands quieter, thermally efficient exhaust systems tailored for variable powertrains. It is also influenced by the broader electrification trend, where manufacturers redesign systems to support partial combustion operation and energy recovery. Emerging innovations include active exhaust valves and 3D-printed metal components that offer design flexibility and improved heat management. The market reflects Germany’s engineering leadership in merging sustainability, efficiency, and performance within exhaust system manufacturing.

- For instance, Bosch inaugurated a €6 million metal additive manufacturing facility in March 2025 at its Nuremberg plant, capable of producing engine and e-axle components five times faster using twelve-laser 3D printing systems, which significantly reduces development timelines from years to days.

Market Challenges Analysis:

Rising Electrification and Decline in Internal Combustion Engine Production

The Germany Exhaust Systems Market faces challenges due to the country’s accelerated shift toward electric mobility. Government incentives and strict emission policies are driving manufacturers to reduce internal combustion engine output. This transition limits demand for conventional exhaust systems and redirects investments toward alternative propulsion technologies. It creates uncertainty for suppliers dependent on traditional vehicle segments. OEMs are revising long-term strategies to balance hybrid demand while preparing for full electrification. The gradual decline in ICE production poses structural challenges for maintaining steady revenue streams across the exhaust supply chain.

High Material Costs and Complex Manufacturing Processes

Increasing prices of stainless steel, titanium, and rare metals used in catalytic converters raise production costs. Exhaust system manufacturers must manage cost efficiency without compromising quality or compliance standards. Complex assembly processes involving precision welding, coating, and emissions testing further add to operational expenses. It faces pressure from OEMs seeking cost reductions and shorter development cycles. Supply chain disruptions and global material shortages intensify these cost challenges. Manufacturers are investing in automation and localized sourcing strategies to reduce production risks and maintain competitiveness within the evolving automotive landscape.

Market Opportunities:

Advancement in Hybrid and Plug-In Hybrid Exhaust Technologies

The Germany Exhaust Systems Market presents strong opportunities through the expansion of hybrid and plug-in hybrid vehicles. These vehicles require advanced exhaust designs that manage intermittent engine operation and maintain optimal thermal performance. Manufacturers are developing adaptive exhaust valves, active noise control systems, and integrated catalytic modules to improve efficiency. It benefits from Germany’s focus on hybrid innovation and R&D funding under national emission reduction programs. The growing consumer preference for low-emission vehicles supports continuous product upgrades. Collaborations between OEMs and material science companies are also opening pathways for innovative, lightweight exhaust solutions tailored for hybrid architectures.

Growing Demand for Sustainable and Lightweight Material Integration

Germany’s commitment to carbon neutrality promotes new opportunities in sustainable exhaust manufacturing. The use of recyclable metals, coated ceramics, and corrosion-resistant alloys is expanding across production lines. It encourages the development of eco-efficient systems that align with lifecycle emission reduction goals. The rising adoption of additive manufacturing and AI-driven design optimization allows greater flexibility in prototype development. These advancements reduce waste, improve material utilization, and shorten production timelines. The market continues to evolve through technological innovations that merge environmental performance with cost-effective manufacturing.

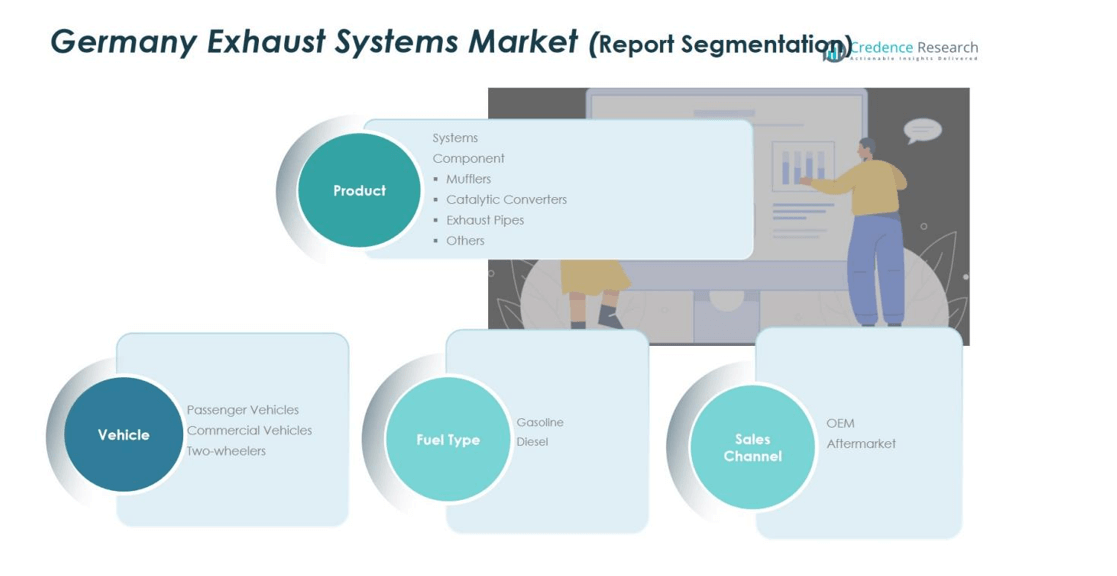

Market Segmentation Analysis:

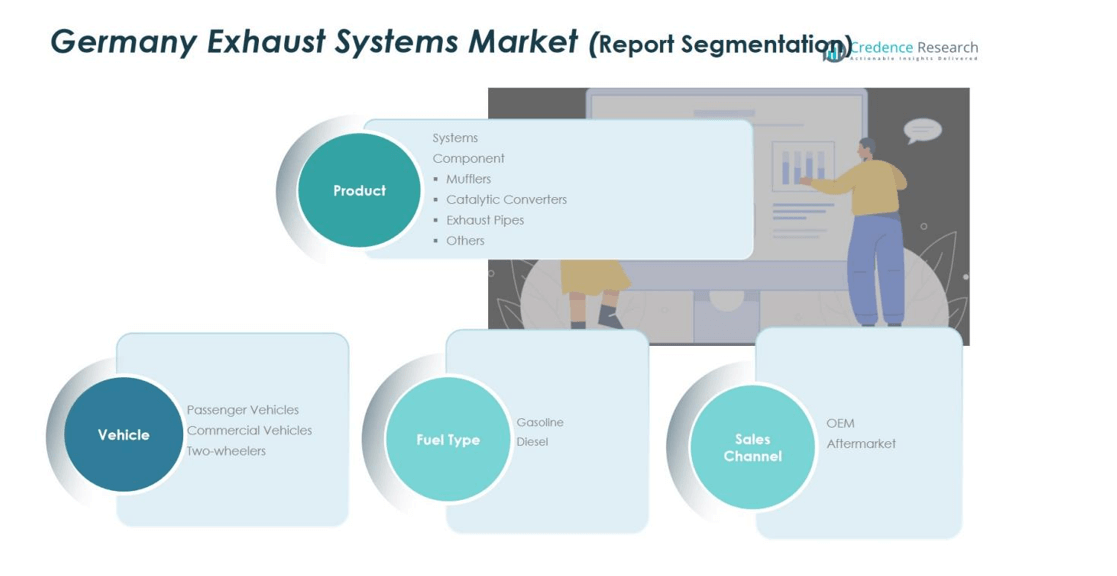

By Product Type

The Germany Exhaust Systems Market is segmented into systems and components, including mufflers, catalytic converters, exhaust pipes, and others. Catalytic converters hold the largest share due to strict emission standards that demand efficient pollutant reduction technologies. Mufflers and exhaust pipes continue to see strong demand driven by the need for noise control and performance optimization in both passenger and commercial vehicles. It benefits from the adoption of lightweight materials and corrosion-resistant alloys that extend product life and improve efficiency.

- For instance, Bosch’s double-injection SCR system, integrated into its latest Euro 6d engines, enables NOₓ emissions as low as 13 mg/km through dual AdBlue® dosing near and downstream of the engine within 10 seconds of start-up.

By Vehicle

Passenger vehicles dominate the market due to Germany’s large-scale automotive production and consumer preference for premium vehicles with advanced emission systems. Commercial vehicles contribute steadily, supported by logistics expansion and stricter emission regulations for heavy-duty fleets. Two-wheelers represent a smaller segment but show gradual growth through urban mobility programs and the rising demand for efficient scooters and motorcycles.

- For Instance, BMW’s 2025 7 Series integrates a selective catalytic reduction (SCR) system, which significantly decreases nitrogen oxide (NOx) emissions. While this technology addresses specific air pollutants, compliance with the EU’s fleet-wide average CO₂/km emission target for new passenger cars is achieved through a broader strategy that also includes hybrid and all-electric vehicles.

By Fuel Type

Gasoline-powered vehicles account for a major share, supported by continued adoption of hybrid and plug-in hybrid engines requiring optimized exhaust designs. Diesel vehicle demand has declined due to tightening emission norms but remains significant in commercial transport applications. It continues to evolve through technological advancements in after-treatment systems aimed at reducing nitrogen oxide emissions and improving overall fuel efficiency across both fuel types.

Segmentations:

By Product Type Segment

Systems

Component

- Mufflers

- Catalytic Converters

- Exhaust Pipes

- Others

By Vehicle Segment

- Passenger Vehicles

- Commercial Vehicles

- Two-wheelers

By Fuel Type Segment

By Sales Channel Segment

Regional Analysis:

Southern and Western Regions Leading Automotive Manufacturing and Innovation

The Germany Exhaust Systems Market is primarily driven by strong manufacturing activity in southern and western regions such as Bavaria, Baden-Württemberg, and North Rhine-Westphalia. These regions host major automotive OEMs, including BMW, Mercedes-Benz, and Volkswagen, along with an extensive network of component suppliers. It benefits from advanced production capabilities, research institutions, and skilled labor that support innovation in exhaust design and emission control technologies. Strong export orientation from these areas reinforces Germany’s role as a leading European hub for automotive component manufacturing. Continuous investment in lightweight materials and energy-efficient production processes strengthens the regional market performance.

Eastern Germany Emerging as a Growth-Oriented Manufacturing Hub

Eastern Germany is witnessing increasing investment in automotive and component manufacturing facilities. The expansion of industrial zones and favorable government incentives encourage OEMs and suppliers to establish new production lines. It supports regional diversification and reduces dependency on traditional western manufacturing clusters. Growing adoption of automation, robotics, and digital manufacturing tools enhances operational efficiency across new plants. Rising collaboration between local universities and technology centers also promotes research into emission reduction materials and hybrid-compatible exhaust systems.

Northern and Central Regions Supporting Export and Supply Chain Connectivity

Northern and central Germany play a strategic role in logistics, distribution, and export activities for exhaust system components. Ports such as Hamburg facilitate large-scale exports to European and international markets. It gains strength from established transportation infrastructure and supply chain integration with leading OEMs. Central Germany’s proximity to key automotive corridors supports just-in-time delivery systems and aftermarket distribution networks. The presence of specialized suppliers in these regions further enhances the reliability and competitiveness of Germany’s exhaust system exports.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Germany Exhaust Systems Market features a competitive environment driven by strong technological expertise and established manufacturing capabilities. Key companies include RTA Technik GmbH, Futaba Industrial Co., Ltd., MagnaFlow, ATJ Automotive GmbH, Eberspächer, The Axces Group, and BOSAL. These players compete on innovation, product quality, and compliance with stringent emission regulations. It emphasizes continuous development of lightweight, corrosion-resistant, and high-performance exhaust solutions to meet Euro 7 standards. Local manufacturers benefit from close partnerships with OEMs and R&D institutions, enhancing their ability to deliver customized systems. Strategic investments in automation, modular designs, and hybrid-compatible exhaust architectures strengthen competitiveness within domestic and export markets.

Recent Developments:

- In September 2025, Futaba Industrial released its Earnings Results Presentation for the first three months of the fiscal year ending March 31, 2025 (112th term).

- In September 2025, Purem by Eberspächer developed Direct Air Capture Technology designed to remove CO₂ from the atmosphere, expanding the company’s expertise beyond traditional exhaust systems.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Vehicle, Fuel Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Germany Exhaust Systems Market will continue to evolve with growing emphasis on low-emission and lightweight technologies.

- Adoption of Euro 7 emission norms will accelerate development of advanced catalytic converters and filtration systems.

- Hybrid and plug-in hybrid vehicles will remain key growth drivers, requiring adaptable exhaust solutions for dual powertrains.

- Manufacturers will focus on integrating smart sensors for real-time emission monitoring and predictive maintenance.

- Increased use of stainless steel, titanium, and composite materials will enhance system durability and fuel efficiency.

- Automation and additive manufacturing will streamline production processes and reduce material waste.

- Collaborations between OEMs, suppliers, and research institutions will strengthen innovation capacity and technical precision.

- Expansion of hydrogen and synthetic fuel technologies will create new opportunities for specialized exhaust system designs.

- Aftermarket demand will remain stable due to maintenance and replacement needs in aging vehicle fleets.

- It will maintain steady growth supported by technological advancement, sustainability goals, and continued global automotive leadership.