| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Long Duration Energy Storage Market Size 2023 |

USD 310.99 Million |

| Germany Long Duration Energy Storage Market, CAGR |

15.9% |

| Germany Long Duration Energy Storage Market Size 2032 |

USD 1,178.27 Million |

Market Overview:

Germany Long Duration Energy Storage Market size was valued at USD 310.99 million in 2023 and is anticipated to reach USD 1,178.27 million by 2032, at a CAGR of 15.9% during the forecast period (2023-2032).

Several factors are propelling the demand for long-duration energy storage solutions in Germany. The country’s ambitious renewable energy targets, including the Energiewende initiative aiming for 100% renewable electricity by 2035, necessitate advanced storage technologies to manage the intermittent nature of solar and wind power. As Germany increases its reliance on renewable sources, the need for energy storage systems to balance supply and demand becomes more critical. Additionally, the German government has introduced favorable policies, such as exemptions from grid fees and electricity taxes for energy storage systems, enhancing their economic viability. These policies are expected to drive further investment in storage technologies and support the country’s renewable energy transition. Technological advancements and declining costs in battery storage systems further contribute to the market’s expansion. Moreover, the development of next-generation storage solutions, including solid-state batteries and hydrogen-based storage, offers promising opportunities to meet Germany’s growing energy storage demands.

Germany stands as a leader in Europe’s energy storage landscape, with significant developments in both residential and large-scale storage systems. In 2024, nearly 600,000 new stationary battery storage systems were installed, increasing the country’s storage capacity by 50% year-on-year. This growth reflects both the popularity of solar energy systems among German homeowners and the government’s initiatives to promote energy independence. These installations are predominantly linked to photovoltaic systems, reflecting the nation’s commitment to decentralized energy solutions. Furthermore, the integration of energy storage solutions into Germany’s electric grid plays a crucial role in enhancing grid stability and ensuring reliable power supply across the country. Moreover, Germany’s strategic location and robust infrastructure make it an attractive hub for energy storage investments, with ongoing projects and policy support reinforcing its position in the European market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Long Duration Energy Storage Market was valued at USD 310.99 million in 2023 and is expected to reach USD 1,178.27 million by 2032, growing at a CAGR of 15.9% during the forecast period.

- The global Long Duration Energy Storage (LDES) market was valued at USD 4,261.11 million in 2023 and is expected to grow at a CAGR of 13.2%, reaching USD 13,005.91 million by 2032.

- Germany’s goal of achieving 100% renewable electricity by 2035 through the Energiewende initiative is driving the demand for long-duration energy storage to balance intermittent renewable energy sources such as solar and wind.

- The German government supports the market with favorable policies, including exemptions from grid fees and electricity taxes, alongside financial incentives that make energy storage solutions more economically viable.

- Technological advancements in storage systems like flow batteries and hydrogen-based solutions are improving efficiency, scalability, and cost-effectiveness, making long-duration storage more accessible.

- The increasing frequency of extreme weather events and aging infrastructure underscore the need for long-duration energy storage to maintain grid stability and ensure energy security.

- Substantial investments in energy storage infrastructure from both the public and private sectors are accelerating the integration of energy storage with renewable energy systems.

- Germany’s strong position as a leader in Europe’s energy storage market is reinforced by ongoing projects, robust infrastructure, and supportive policies, making it a key player in the renewable energy and energy storage sectors.

Market Drivers:

Increasing Integration of Renewable Energy

Germany’s commitment to achieving a renewable energy transition is one of the primary drivers fueling the demand for long-duration energy storage (LDES) systems. The country’s Energiewende initiative targets 100% renewable electricity by 2035, a monumental goal that requires extensive infrastructure and technological advancements to ensure grid stability. With an increasing reliance on solar and wind power, which are inherently intermittent, the need for efficient and reliable energy storage systems becomes crucial. Long-duration energy storage plays a pivotal role in balancing the supply-demand curve by storing excess energy generated during peak production times and releasing it when energy generation falls short, ensuring a consistent power supply. This growing integration of renewables is propelling Germany’s need for LDES technologies that can store energy for longer durations, addressing the limitations of traditional short-term storage solutions.

Government Policies and Regulatory Support

The German government has been proactive in introducing favorable policies to support the growth of the energy storage market, further driving demand for long-duration energy storage systems. For instance, in 2024, the government opened a public consultation on new frameworks to procure LDES, planning to require technologies that can provide up to 72-hour discharge duration with a minimum 1 MW power rating. Initiatives such as exemptions from grid fees and electricity taxes for energy storage systems are designed to reduce the economic burden on storage investments, making them more accessible and cost-effective for both residential and commercial users. Additionally, Germany’s energy policy framework includes subsidies and financial incentives to encourage the adoption of advanced energy storage solutions. These measures not only support the nation’s renewable energy targets but also foster an environment conducive to innovation and investment in energy storage technologies, providing a significant boost to the LDES market.

Technological Advancements and Cost Reduction

Ongoing technological advancements in energy storage technologies are another critical driver of the Germany long-duration energy storage market. Over the years, there have been substantial improvements in the efficiency, scalability, and performance of storage solutions such as flow batteries, compressed air energy storage, and advanced lithium-ion batteries. For instance, companies like VoltStorage are pioneering vanadium redox flow battery (VRFB) technology, supported by substantial government and European Investment Bank funding, to deliver long cycle life, scalability, and extended storage durations for renewable energy. These innovations have made LDES systems more viable and affordable, enabling large-scale deployment. The declining cost of energy storage solutions, driven by both technological progress and economies of scale, has made long-duration storage more economically attractive for utilities, businesses, and residential consumers. The trend of cost reduction is expected to continue, encouraging further adoption and deployment of LDES systems in Germany.

Rising Energy Security and Grid Stability Concerns

Energy security and grid stability concerns are also key drivers of the demand for long-duration energy storage solutions in Germany. The increasing frequency of extreme weather events and natural disasters, as well as the aging of the national energy grid, has highlighted the need for more resilient and robust energy infrastructure. Long-duration energy storage systems can enhance grid stability by providing a buffer against fluctuations in power supply and ensuring a constant energy flow during emergencies or power outages. Additionally, as Germany aims to reduce its reliance on fossil fuels and foreign energy imports, LDES systems play a critical role in energy independence by enabling local storage of renewable energy. This focus on energy security and grid stability is further boosting the adoption of long-duration energy storage solutions as a means to safeguard the future of Germany’s energy infrastructure.

Market Trends:

Emergence of Alternative Energy Storage Technologies

One of the key trends shaping the Germany long-duration energy storage (LDES) market is the increasing development and deployment of alternative storage technologies. While lithium-ion batteries have dominated the energy storage landscape for many years, new technologies such as flow batteries, compressed air energy storage (CAES), and pumped hydro storage are gaining traction in the country. These alternatives are particularly suited for long-duration applications, as they can provide stable, reliable storage solutions for extended periods. Flow batteries, for example, offer the advantage of long discharge durations and scalability, which aligns well with Germany’s energy storage requirements driven by the integration of renewable sources like solar and wind. As the market matures, these alternative energy storage technologies are expected to play an increasingly prominent role in the German energy storage ecosystem.

Rising Investment in Energy Storage Infrastructure

Germany’s increasing focus on energy storage infrastructure is another significant trend in the market. Both public and private investments in the development of storage technologies and related infrastructure are growing rapidly. The German government’s commitment to renewable energy, along with its introduction of incentive programs for energy storage, is fostering a favorable investment environment. Furthermore, German utilities and private investors are investing heavily in the deployment of energy storage systems to complement renewable energy integration. For instance, private sector commitment is exemplified by VPI, which announced an investment of up to €450 million to develop up to 500 MW of battery storage capacity across Germany, with most projects in wind-rich regions. This influx of capital is accelerating the pace of energy storage advancements and facilitating the development of large-scale LDES projects across the country. As investments continue to rise, Germany is positioning itself as a global leader in energy storage solutions.

Growing Role of Digitalization in Energy Storage Systems

The increasing use of digital technologies in energy storage systems is another emerging trend in the German market. Digitalization has enabled better management, optimization, and integration of energy storage systems with the grid, enhancing their overall performance. Advanced monitoring systems, artificial intelligence (AI), and data analytics are being employed to optimize the operation of long-duration energy storage systems, making them more efficient and cost-effective. These innovations are enabling utilities and energy operators to improve grid stability and predict energy storage demands more accurately. As digitalization continues to transform the energy storage sector, it is expected to drive improvements in the efficiency and scalability of LDES systems in Germany.

Focus on Sustainability and Environmental Impact

Sustainability and environmental impact are increasingly influencing the direction of the Germany long-duration energy storage market. With a growing emphasis on achieving carbon-neutral energy systems, there is a strong focus on ensuring that energy storage technologies align with environmental goals. The use of sustainable materials in the production of storage systems, such as recyclable components and eco-friendly manufacturing processes, is gaining prominence. Additionally, Germany’s strict environmental regulations and commitment to reducing carbon emissions are driving the demand for energy storage solutions that support the decarbonization of the power sector. As the push for sustainability continues, energy storage technologies that offer lower environmental footprints, such as solid-state batteries and green hydrogen storage, are expected to see increasing adoption in Germany’s energy storage market.

Market Challenges Analysis:

High Initial Investment Costs

One of the primary restraints in the Germany long-duration energy storage (LDES) market is the high initial investment required for the deployment of energy storage systems. Although the costs of energy storage technologies, particularly lithium-ion batteries, have decreased over time, long-duration storage solutions such as flow batteries and compressed air energy storage remain relatively expensive compared to traditional short-term storage methods. For instance, in the case of compressed air energy storage (CAES), the capital expenditure is estimated at around $1,350 per kW, and a CAES facility requires a storage spread of 26c per kWh to achieve a 10% internal rate of return, with a round-trip efficiency of 63%. The high upfront costs associated with these technologies can be a barrier to widespread adoption, particularly for smaller energy operators or residential customers. While government incentives and subsidies can help offset some of these costs, the initial financial burden remains a significant challenge for the market.

Regulatory and Policy Uncertainty

Another challenge facing the Germany long-duration energy storage market is the potential for regulatory and policy uncertainty. Although Germany has strong governmental support for renewable energy and energy storage, future changes in energy policies, regulations, or incentives could introduce uncertainty for investors and developers in the LDES sector. Shifts in regulatory frameworks, such as changes to tax incentives or grid integration policies, could impact the economic viability and long-term profitability of energy storage projects. To mitigate this risk, it is essential for stakeholders to have clear, stable policies in place to encourage investment and innovation in energy storage technologies.

Technological Limitations and Maturity

While technological advancements in energy storage have made significant strides, many long-duration storage technologies are still in the early stages of development and commercialization. For example, some LDES solutions, such as flow batteries and hydrogen storage systems, are not yet as mature or widely proven as lithium-ion batteries. Issues related to efficiency, scalability, and the long-term performance of these technologies remain challenges. Until these technologies reach full maturity and reliability, widespread adoption may be limited, hindering the growth of the market.

Grid Integration and Infrastructure Constraints

The integration of long-duration energy storage systems into the existing grid infrastructure presents another challenge. Germany’s grid is heavily reliant on traditional energy systems, and the integration of LDES technologies requires significant upgrades to grid infrastructure. This includes ensuring that energy storage systems can interact seamlessly with renewable power sources and efficiently distribute stored energy when needed. The complexity and cost of upgrading grid infrastructure to accommodate LDES solutions can delay their widespread deployment.

Market Opportunities:

Germany’s transition to renewable energy presents significant opportunities for the long-duration energy storage (LDES) market. As the country strives to meet its ambitious renewable energy targets, particularly the Energiewende initiative, there is an increasing need for reliable energy storage systems to manage the intermittent nature of solar and wind power. Long-duration storage technologies, such as flow batteries and compressed air energy storage, offer substantial advantages in addressing this challenge by providing the ability to store energy for extended periods. The growing demand for grid stability, coupled with Germany’s commitment to carbon neutrality, presents a prime opportunity for LDES solutions to play a central role in supporting a sustainable and resilient energy infrastructure.

Moreover, Germany’s strong regulatory support for renewable energy and energy storage systems creates a favorable environment for market growth. Government incentives, including subsidies and tax exemptions for energy storage systems, provide a clear financial advantage for both residential and commercial users to invest in long-duration storage technologies. The increasing focus on digitalization within the energy sector also creates opportunities for LDES technologies that can be integrated into smart grids and optimized through advanced monitoring systems. As Germany continues to invest in renewable energy infrastructure and seeks to enhance energy independence, the long-duration energy storage market is poised to expand significantly, offering numerous opportunities for innovation, investment, and technological development.

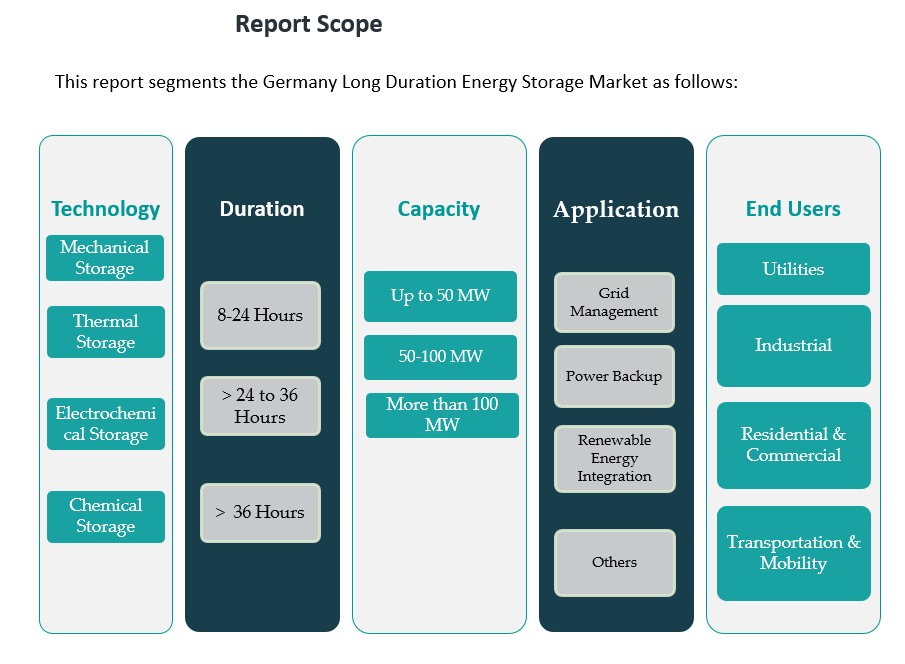

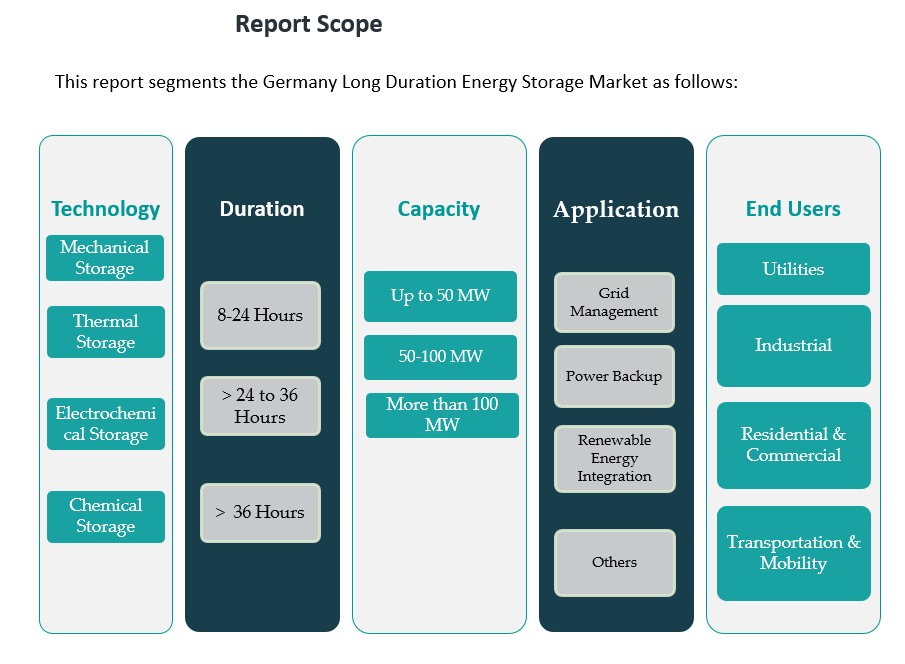

Market Segmentation Analysis:

The Germany long-duration energy storage (LDES) market is segmented across several dimensions, offering insights into the diverse technological solutions, application areas, and customer types driving its growth.

By Technology

The LDES market in Germany is primarily driven by four key technology segments: mechanical storage, thermal storage, electrochemical storage, and chemical storage. Mechanical storage, which includes solutions like pumped hydro and compressed air, dominates the market due to its scalability and long-term viability. Electrochemical storage, particularly flow batteries, is also gaining traction due to its flexibility and ability to handle long-duration applications. Thermal storage systems, which store energy in the form of heat, and chemical storage solutions, such as hydrogen, offer promising potential as Germany focuses on decarbonizing its energy grid.

By Duration

The market is segmented based on storage duration, with technologies supporting durations of 8–24 hours, 24–36 hours, and over 36 hours. The 8–24 hour duration segment is currently the largest, driven by the need to balance energy supply during daily fluctuations in renewable energy generation. However, longer-duration storage solutions (24-36 hours and beyond) are gaining attention as Germany aims for grid stability during extended periods of low renewable generation, such as winter months.

By Capacity

Capacity segmentation includes solutions that provide storage up to 50 MW, between 50-100 MW, and more than 100 MW. Solutions up to 50 MW are commonly deployed in residential and commercial applications, while larger systems are typically used for utility-scale projects that manage broader grid stability and renewable energy integration.

By Application

Key applications include grid management, power backup, renewable energy integration, and others such as microgrid stabilization. Renewable energy integration is a growing segment as Germany increasingly relies on solar and wind energy, necessitating robust storage systems to manage intermittent production.

By End User

The end-user market consists of utilities, industrial sectors, residential and commercial customers, and transportation and mobility. Utilities remain the largest customer segment due to their central role in grid stability, though the residential and commercial sector is growing, driven by increasing energy independence trends.

Segmentation:

By Technology

- Mechanical Storage

- Thermal Storage

- Electrochemical Storage

- Chemical Storage

By Duration

- 8–24 Hours

- 24–36 Hours

- 36 Hours

By Capacity

- Up to 50 MW

- 50-100 MW

- More than 100 MW

By Application

- Grid Management

- Power Backup

- Renewable Energy Integration

- Others

By End User

- Utilities

- Industrial

- Residential & Commercial

- Transportation & Mobility

Regional Analysis:

Germany is a key player in the European long-duration energy storage (LDES) market, with significant developments occurring across multiple regions within the country. The market is influenced by Germany’s ambitious energy transition goals, extensive renewable energy deployment, and proactive government policies aimed at decarbonizing the power sector. The country’s regional distribution of LDES projects reflects varying levels of infrastructure, energy needs, and governmental support, with the highest concentration of installations located in regions with strong renewable energy capacities.

Southern Germany: Bavaria and Baden-Württemberg

Southern Germany, particularly the states of Bavaria and Baden-Württemberg, leads the market in LDES adoption. These regions have made significant strides in renewable energy integration, particularly solar and wind power. As a result, they are also seeing substantial investments in energy storage systems to manage the fluctuations of renewable generation. Southern Germany accounts for approximately 30% of the total market share for LDES in the country, with a focus on large-scale storage systems integrated with renewable energy sources. Furthermore, the presence of major utilities and innovative energy storage companies in this region has driven market expansion.

Western Germany: North Rhine-Westphalia and Hesse

In Western Germany, regions like North Rhine-Westphalia and Hesse are pivotal in the development of energy storage solutions. These areas are home to numerous industrial hubs, making energy security a key priority. As such, there is a growing demand for LDES systems that provide grid stability and support industrial operations. The market share in this region is approximately 25%, and projects typically focus on medium to large-scale storage applications, addressing both industrial and grid management needs. The regional shift towards integrating LDES systems with smart grids and industrial facilities further accelerates the adoption of storage technologies in this area.

Northern Germany: Schleswig-Holstein and Lower Saxony

Northern Germany, including Schleswig-Holstein and Lower Saxony, is a key region for wind energy production. The high proportion of renewable energy generation in this region necessitates effective storage solutions to manage the intermittent supply from wind power. Long-duration energy storage systems are essential to ensure that excess energy produced during high wind periods is stored for later use. Northern Germany holds around 20% of the LDES market share, with a growing emphasis on integrating LDES solutions into the grid to stabilize energy supply and support energy transition efforts.

Eastern Germany: Brandenburg and Saxony

Eastern Germany, with regions like Brandenburg and Saxony, is also witnessing steady growth in the LDES market. Although these regions have historically relied on coal for power generation, recent shifts toward renewable energy, particularly wind and solar, have led to increased demand for energy storage. The LDES market in this region is growing at a slower pace compared to others, accounting for roughly 15% of the total market share. However, with continued investments in renewable energy infrastructure and the country’s push toward carbon neutrality, the region is expected to see significant expansion in the coming years.

Central Germany: Thuringia and Saxony-Anhalt

Central Germany, particularly Thuringia and Saxony-Anhalt, has a smaller but growing presence in the LDES market. This region is focused on smaller-scale storage projects and serves as an important area for regional energy distribution. With approximately 10% of the total market share, Central Germany is gradually adopting long-duration storage solutions to meet the increasing demand for grid stabilization and renewable energy integration.

Key Player Analysis:

- MAN Energy Solutions

- CMBlu Energy AG

- VoltStorage

- HydroSTORE

- Linde Engineering

- Sonnen (A subsidiary of Shell)

- Voltabox

- Zinc8 Energy Solutions

- RWE

- Electrochaea

- GreenHydrogen

- Fraunhofer UMSICHT

- STORNETIC

Competitive Analysis:

The Germany long-duration energy storage (LDES) market is highly competitive, with several key players leading the charge in the development and deployment of advanced storage technologies. Prominent companies in the market include global energy storage giants such as Siemens Energy, which is actively involved in the development of flow batteries and hydrogen storage solutions. Additionally, companies like AWE (Advanced Energy Storage) and Schaeffler are contributing to the market’s expansion by offering innovative energy storage systems tailored to Germany’s energy transition goals. These players focus on both utility-scale and residential applications, with an emphasis on integrating energy storage with renewable energy sources. The competitive landscape is also shaped by emerging startups, particularly those focusing on novel technologies such as solid-state batteries and compressed air energy storage. As government incentives and regulatory support for energy storage continue, new entrants are expected to accelerate innovation, making the market increasingly dynamic and diverse. Collaboration between industry leaders and research institutions will further drive technological advancements.

Recent Developments:

- In February 2025, BW ESS, a global energy storage owner-operator based in Zurich, and Munich-based developer MIRAI Power announced a significant partnership to co-develop up to 1GW of large-scale battery energy storage projects in Southern Germany. This collaboration aims to address the growing need for grid flexibility as Germany integrates more renewable energy and faces challenges such as negative pricing and curtailment risks. Both companies bring complementary strengths: MIRAI Power’s expertise in European battery storage development and BW ESS’s international experience and supply chain capabilities.

- In March 2025, TotalEnergies launched 221 MW of new battery energy storage systems in Germany, developed by Kyon Energy. This move marks a major milestone in TotalEnergies’ expansion of its integrated power operations in Germany, where the company is already active in renewable energy production, trading, and electricity aggregation. The new storage capacity will enhance the resilience of the German power system by reducing congestion and adding flexibility, supporting the rapid growth of renewables.

- In September 2024, the German government initiated a public consultation on new frameworks to procure long-duration energy storage (LDES) as part of its proposed Power Plant Safety Act (Kraftwerkssicherheitsgesetz). The Ministry for the Economy and Climate Change (BMWK) is planning to procure 12.5 GW of new power plants and 500 MW of LDES, with a focus on technologies capable of providing up to 72-hour discharge durations at a minimum 1MW power rating.

Market Concentration & Characteristics:

The Germany long-duration energy storage (LDES) market is moderately concentrated, with a mix of established energy giants and emerging players contributing to its growth. Major players such as Siemens Energy, ABB, and General Electric dominate the market, leveraging their extensive experience in energy systems to develop and deploy advanced LDES technologies. These companies typically focus on large-scale storage solutions integrated with renewable energy systems for grid stabilization and power backup. However, the market also sees increasing participation from smaller, innovative companies specializing in cutting-edge storage solutions such as flow batteries, compressed air energy storage, and hydrogen-based systems. This mix of established companies and startups fosters a competitive environment that drives technological advancements and reduces costs. The market is characterized by ongoing investments in research and development, regulatory support from the government, and an increasing focus on sustainability, making it dynamic and conducive to innovation in energy storage technologies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Technology, Duration, Capacity, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Germany’s long-duration energy storage market will continue to expand as the country works towards its renewable energy goals, particularly under the Energiewende initiative.

- Increasing government incentives and favorable policies will drive further investments in energy storage solutions across residential, commercial, and industrial sectors.

- Technological advancements in storage systems such as flow batteries and compressed air storage will enhance the efficiency and scalability of long-duration solutions.

- The rise of decentralized energy systems will create greater demand for residential and small-scale energy storage solutions.

- Germany’s commitment to carbon neutrality will accelerate the adoption of energy storage technologies in both the public and private sectors.

- Market growth will be driven by the increasing need for grid stabilization as more renewable energy sources are integrated into the national grid.

- The decline in storage system costs, coupled with improved economies of scale, will make long-duration storage more economically viable.

- The integration of energy storage with smart grid technologies will improve energy management and efficiency in both urban and rural areas.

- Partnerships between energy storage providers, utilities, and technology developers will foster innovation and enhance market competitiveness.

- As Germany continues to focus on energy independence, long-duration energy storage will become a critical component of its national energy strategy.