| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Off the Road Tire Market Size 2023 |

USD 1,200.37 Million |

| Germany Off the Road Tire Market, CAGR |

5.07% |

| Germany Off the Road Tire Market Size 2032 |

USD 1,875.17 Million |

Market Overview:

Germany Off-the-Road Tire Market size was valued at USD 1,200.37 million in 2023 and is anticipated to reach USD 1,875.17 million by 2032, at a CAGR of 5.07% during the forecast period (2023-2032).

The growth of the German OTR tire market is primarily driven by the robust demand from key industries such as mining, construction, and agriculture. These sectors require specialized tires for heavy-duty machinery operating in challenging terrains. Technological advancements in tire design and materials have led to the development of tires that offer enhanced durability, fuel efficiency, and environmental performance. Additionally, the increasing adoption of electric vehicles (EVs) and the growing emphasis on sustainability are influencing tire manufacturers to innovate and produce eco-friendly OTR tire solutions. The rise in construction and infrastructure projects, especially in urban development and renewable energy sectors, also significantly contributes to the demand for durable and high-performance OTR tires. Moreover, the increasing global focus on reducing carbon emissions is leading to a push for environmentally friendly tire solutions, thus driving further growth.

Germany’s OTR tire market benefits from the country’s strategic position within Europe and its strong industrial base. The South-West region, particularly Baden-Württemberg, holds the largest tire market share in Germany due to the high concentration of vehicle manufacturing industries, including renowned automobile giants like Mercedes-Benz and Porsche. This region’s dominance in vehicle manufacturing translates into a significant demand for high-quality tires, including OTR tires, supporting the overall market growth. Additionally, Germany’s role as a global leader in innovation and its strong focus on technological advancements in the automotive and industrial sectors further solidify its position as a key market for OTR tires. The increasing emphasis on infrastructure development and expansion of renewable energy projects within Germany is also expected to continue driving demand for OTR tires in the coming years.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Off the Road (OTR) tire market was valued at USD 1,200.37 million in 2023 and is projected to reach USD 1,875.17 million by 2032, growing at a CAGR of 5.07% during the forecast period.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Key drivers of market growth include strong demand from sectors such as mining, construction, and agriculture, where heavy-duty machinery requires durable OTR tires for rough terrain operations.

- Technological advancements in tire design, including better durability, fuel efficiency, and the use of smart sensors for real-time monitoring, are contributing significantly to market expansion.

- The growing emphasis on sustainability has led to an increase in the development of eco-friendly OTR tire solutions, aligning with environmental regulations and consumer demand.

- The expansion of infrastructure projects and the rise in renewable energy initiatives in Germany are further fueling the demand for specialized, high-performance OTR tires.

- Germany’s OTR tire market is geographically concentrated in Western Germany, with the region accounting for about 40% of the market share due to its strong industrial base and high machinery usage.

- The primary challenge faced by the market is high production costs, especially for advanced, eco-friendly tires, which may limit accessibility for smaller companies or price-sensitive operators.

Market Drivers:

Demand from Key Industries

The growth of the Germany off-the-road (OTR) tire market is largely driven by the high demand from critical industries such as construction, mining, and agriculture. These sectors rely heavily on specialized machinery such as bulldozers, dump trucks, and excavators, all of which require durable OTR tires to operate efficiently on rugged terrains. In particular, Germany’s ongoing infrastructure projects, including urbanization, transportation, and renewable energy developments, are fueling the need for robust OTR tires. The agricultural sector’s increasing mechanization, coupled with the shift towards more advanced machinery like high-powered tractors and harvesters, further propels the demand for OTR tires. These tires are essential for ensuring smooth operations in environments that are difficult and require tires capable of handling heavy loads and rough surfaces.

Technological Advancements

Technological advancements in tire design and manufacturing play a significant role in driving the growth of the OTR tire market in Germany. Tire manufacturers are continuously innovating to produce products that offer better durability, performance, and fuel efficiency. Innovations in tread patterns, rubber compounds, and tire construction have enhanced the resilience of OTR tires, making them more suitable for high-performance machinery. For instance, in August 2024, Bridgestone Corporation announced a USD 166.89 million strategic investment at its Kitakyushu Plant to boost mining and construction vehicle tire production, with a focus on supporting global customers and sustainability goals. Additionally, advancements in smart tire technology, such as the incorporation of sensors for real-time monitoring, have greatly contributed to the growth of the market. These sensors track tire pressure, temperature, and wear, allowing operators to take proactive measures that prevent downtime and reduce maintenance costs. As these technologies become more accessible, demand for advanced OTR tires in Germany’s industrial sectors continues to rise.

Sustainability Trends

The growing emphasis on sustainability in industrial practices is another key driver of the German OTR tire market. As part of broader efforts to reduce environmental impact, industries are increasingly adopting eco-friendly and energy-efficient solutions. OTR tire manufacturers are responding to this trend by producing tires that not only meet performance standards but also align with sustainability goals. For instance, Nokian Tyres GmbH’s partnership with RuLa-BRW to use innovative retreading materials further demonstrates the industry’s commitment to extending tire life and reducing environmental impact. These environmentally friendly tires are made using recycled materials, reduced rolling resistance, and longer-lasting designs, which minimize waste and fuel consumption. Additionally, Germany’s stringent environmental regulations, especially those aimed at reducing carbon emissions, are encouraging the adoption of greener solutions. This shift towards sustainable practices, coupled with growing consumer and regulatory pressure, continues to drive innovation and demand for eco-friendly OTR tire options.

Expansion of Mining and Construction Sectors

Germany’s mining and construction sectors are also significant contributors to the expansion of the OTR tire market. The mining industry, while smaller in comparison to other European nations, requires specialized equipment for extracting raw materials such as coal, limestone, and metals. Heavy-duty machinery used in mining operations requires OTR tires that can withstand challenging environments and long operating hours. Furthermore, the growth of the construction industry, fueled by urbanization, infrastructure development, and renewable energy projects, further amplifies the need for OTR tires. The demand for large-scale machinery in these sectors has been increasing, as construction companies look to enhance productivity and efficiency. As a result, the demand for durable and high-performance OTR tires continues to rise, supporting the market’s long-term growth.

Market Trends:

Technological Integration in Tire Manufacturing

One of the prominent trends in the Germany off-the-road (OTR) tire market is the increasing integration of advanced technologies in tire manufacturing. Manufacturers are incorporating digital technologies, such as automated manufacturing systems and artificial intelligence (AI), to enhance the precision and efficiency of tire production. For instance, companies like NEXEN TIRE are leveraging explainable artificial intelligence (XAI) and 3D printing to streamline tire development, enabling virtual tire modeling, faster prototyping, and greater design precision. AI is being used to optimize tire designs by analyzing performance data and simulating different operating conditions. Additionally, the use of 3D printing in tire production is gaining momentum, enabling the development of prototype designs and rapid testing before large-scale manufacturing. This trend is not only improving tire quality but also reducing production costs and lead times. The continuous evolution of manufacturing technologies in Germany reflects the industry’s commitment to maintaining a competitive edge in the global market.

Rise of Electric and Hybrid Construction Equipment

The rise of electric and hybrid construction machinery is a key trend influencing the Germany OTR tire market. For instance, Giti Tire’s European Research & Development Centre in Hannover has engineered the GT Radial SportActive 2 EV tire, specifically designed for heavy and powerful electric vehicles. As industries move toward cleaner, more sustainable machinery, there has been a significant shift toward electric and hybrid vehicles in construction and mining operations. These vehicles, which rely on advanced battery technologies, require specialized OTR tires designed to accommodate different weight distribution and load requirements. Manufacturers are responding to this trend by developing tires that are optimized for electric machinery, which typically has different torque and performance characteristics compared to conventional internal combustion engine-powered machinery. This shift to hybrid and electric equipment in Germany is expected to continue, driving the demand for specialized tires that meet the unique needs of these vehicles.

Focus on Tire Longevity and Cost Efficiency

Another trend shaping the Germany OTR tire market is a heightened focus on tire longevity and cost efficiency. Industries are increasingly seeking ways to lower their total cost of ownership (TCO) by investing in longer-lasting OTR tires. Tire manufacturers are developing tires with advanced wear-resistant materials, better tread patterns, and enhanced durability to reduce the frequency of replacements and improve the overall efficiency of operations. In sectors such as mining and construction, where machinery downtime is costly, the emphasis on long-lasting tires is growing. Additionally, as operational costs remain a critical consideration, companies are favoring OTR tire solutions that offer the best balance between initial cost and long-term performance.

Increased Demand for Eco-Friendly Tires

The demand for eco-friendly tires is also on the rise in the Germany OTR tire market, driven by both environmental concerns and regulatory pressures. As Germany continues to implement stricter environmental regulations aimed at reducing carbon emissions, tire manufacturers are increasingly focusing on producing tires with lower rolling resistance and made from sustainable materials. These eco-friendly tires help reduce fuel consumption and lower emissions, aligning with the country’s sustainability goals. Furthermore, there is growing consumer and industry interest in the recycling and reuse of tires, prompting manufacturers to design products with end-of-life recyclability in mind. This trend toward eco-friendly solutions is expected to gain momentum as industries continue to focus on reducing their environmental impact.

Market Challenges Analysis:

High Production Costs

A key restraint in the Germany off-the-road (OTR) tire market is the high production costs associated with manufacturing advanced tires. The development of specialized tires, particularly those incorporating new technologies such as wear-resistant materials and eco-friendly components, requires substantial investment in research and development. Additionally, the use of advanced manufacturing techniques such as AI and automation adds to the overall cost structure. These high production costs can result in elevated tire prices, which may limit their affordability for smaller companies or operators with tight budgets. This can slow down the adoption of premium OTR tire solutions, especially in price-sensitive markets.

Raw Material Supply Chain Issues

Another challenge faced by the Germany OTR tire market is the volatility in raw material prices. The cost of key materials such as rubber, steel, and synthetic polymers can fluctuate significantly due to supply chain disruptions, geopolitical factors, and changes in global demand. For instance, any disruption in the supply of natural rubber from countries like Thailand or Indonesia can affect production timelines and tire costs. Such price fluctuations create uncertainty for tire manufacturers, impacting their ability to maintain consistent pricing strategies and supply chains. These challenges can ultimately affect the profitability of manufacturers and the overall stability of the OTR tire market.

Regulatory Compliance and Environmental Concerns

The increasing focus on environmental regulations and sustainability also presents a challenge for the German OTR tire market. Tire manufacturers are under pressure to meet stringent environmental standards, including reducing carbon emissions, recycling materials, and minimizing waste. For instance, under Germany’s End-of-Life Vehicle Regulation (AltfahrzeugV), manufacturers are required to accept old tires free of charge and ensure proper recycling, with violations leading to fines ranging from €100 to €25,000. Complying with these regulations requires significant investments in innovation and production processes. Additionally, the disposal of used tires remains a concern, as improper disposal can have adverse environmental effects. This need for continuous adaptation to regulatory requirements adds an ongoing challenge for manufacturers looking to balance cost efficiency and environmental sustainability.

Market Opportunities:

The Germany off-the-road (OTR) tire market presents significant opportunities driven by the growing demand for specialized tires in the construction, mining, and agricultural sectors. As Germany continues to invest in infrastructure development, including urbanization and renewable energy projects, the need for durable and high-performance OTR tires will increase. These sectors require machinery capable of withstanding harsh conditions, and the demand for innovative tire solutions that enhance operational efficiency and reduce downtime is on the rise. Manufacturers have the opportunity to capitalize on this trend by offering advanced tires that improve performance, reduce maintenance costs, and provide better fuel efficiency.

Additionally, the rising adoption of electric and hybrid construction machinery represents a valuable opportunity for growth in the OTR tire market. With the shift towards more sustainable machinery, there is an increasing demand for OTR tires designed to meet the unique performance characteristics of electric and hybrid vehicles. Tire manufacturers can seize this opportunity by developing specialized products that cater to the growing fleet of electric construction and mining equipment. By incorporating advanced technologies and sustainable materials, manufacturers can tap into the expanding market of environmentally-conscious companies looking for energy-efficient solutions. As the German OTR tire market evolves, these opportunities offer considerable potential for growth and innovation in the coming years.

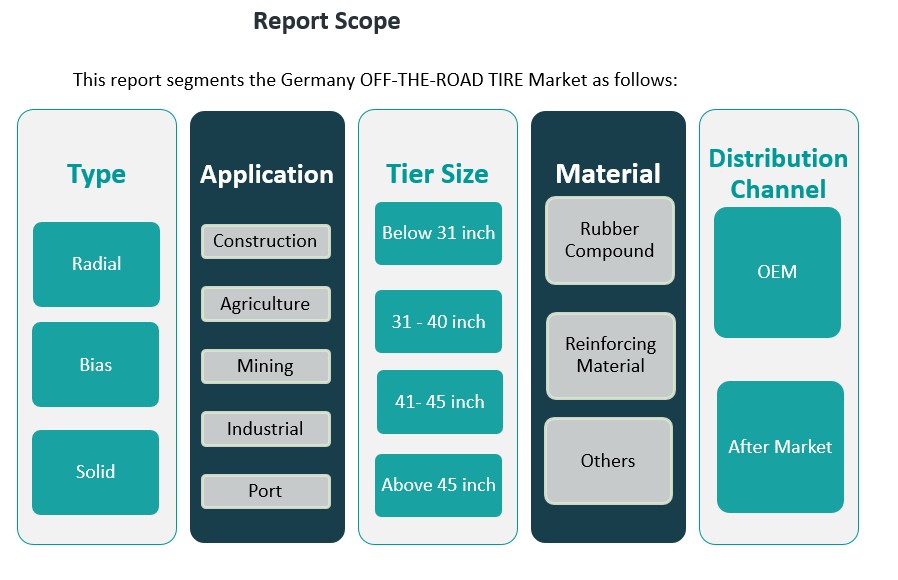

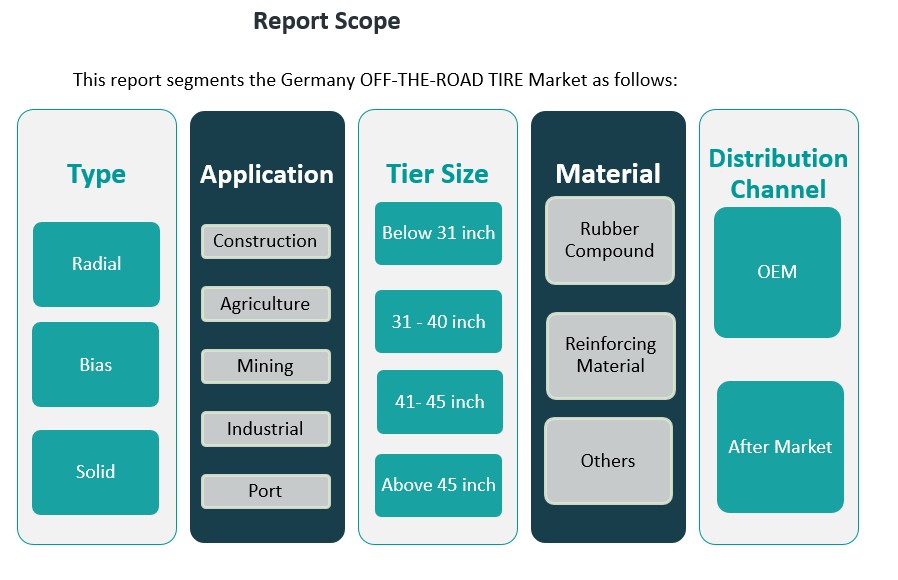

Market Segmentation Analysis:

The Germany off-the-road (OTR) tire market is segmented across various dimensions, including type, application, tire size, material, and distribution channel.

By Type Segment: The market is divided into radial, bias, and solid tires. Radial tires dominate due to their durability, fuel efficiency, and high performance on rough terrains, making them ideal for construction and mining equipment. Bias tires are primarily used for applications where high load capacity and cost-efficiency are more critical. Solid tires are gaining traction in industrial and port applications due to their robustness and resistance to punctures, offering longer life cycles and reduced maintenance costs.

By Application Segment: The key applications of OTR tires in Germany include construction, agriculture, mining, industrial, and port operations. The construction sector holds a significant share due to ongoing infrastructure development projects. The mining and agricultural sectors also drive demand for specialized tires, as these industries require machinery that can operate in rugged, uneven conditions.

By Tire Size Segment: OTR tires in Germany are available in various sizes, including below 31 inches, 31-40 inches, 41-45 inches, and above 45 inches. Larger tires (41 inches and above) are commonly used in heavy-duty mining and construction equipment due to their superior load-bearing capabilities.

By Material Segment: The key materials used in OTR tire production include rubber compounds, reinforcing materials like steel and fabric, and other components. Rubber compounds are the primary material due to their ability to withstand tough conditions and provide optimal traction.

By Distribution Channel Segment: The market is divided into OEM and aftermarket segments. OEM tires are typically sold with new machinery, while the aftermarket segment caters to replacement tires and tire maintenance, contributing significantly to market growth.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The Germany Off-the-Road (OTR) tire market is a key segment within Europe, characterized by steady growth driven by industrial and infrastructure development, as well as advancements in tire technology. The regional market benefits from Germany’s status as an industrial hub, with substantial demand across various sectors including construction, agriculture, and mining. The market is forecasted to grow steadily due to the ongoing mechanization of agriculture and the continued rise in construction and mining activities, which require heavy-duty vehicles equipped with specialized tires.

Western Germany is the largest market for OTR tires, primarily due to its strong manufacturing and industrial base. This region accounts for approximately 40% of the total market share, driven by heavy machinery usage in automotive production, infrastructure projects, and mining. Key cities like Cologne, Düsseldorf, and Frankfurt play a central role in the demand for robust tires that can withstand harsh operating conditions. Moreover, the presence of major OEM manufacturers and a well-developed aftermarket sector further reinforces the market in this region.

Southern Germany, including Bavaria and Baden-Württemberg, holds a significant share of about 25%. This region is known for its industrial sectors, particularly automotive manufacturing, which requires specialized OTR tires for heavy machinery. In addition, the agricultural sector in Southern Germany has seen increased mechanization, contributing to a rise in demand for agricultural OTR tires. The strong emphasis on innovation and sustainability in tire technology also drives market growth here, with manufacturers focusing on eco-friendly and high-performance tires for both construction and agricultural use.

Eastern Germany accounts for approximately 15% of the market share, benefiting from a growing focus on mining activities in regions like Saxony and Brandenburg. Although smaller compared to other regions, this area is seeing increased investments in infrastructure and mining, contributing to a steady demand for OTR tires suited for rough terrains and heavy equipment.

Northern Germany, including cities like Hamburg and Bremen, holds around 10% of the market share. This region’s demand for OTR tires is largely influenced by its port operations and logistics sector, requiring durable tires for heavy vehicles used in transportation and port handling.

Central Germany completes the regional distribution with around 10% of the market share, driven by regional construction projects and local agricultural needs.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Continental AG

- BFGoodrich

Competitive Analysis:

The Germany off-the-road (OTR) tire market is highly competitive, with a blend of global and regional players driving innovation and capturing market share. Key international manufacturers such as Michelin, Bridgestone, Continental, and Goodyear dominate the market with their advanced tire technologies, offering high-performance solutions tailored for construction, mining, and agricultural sectors. These companies focus on product differentiation, incorporating durable materials, eco-friendly solutions, and smart tire technologies to meet the evolving demands of machinery in rugged environments. Regional players, such as German-based brands, also hold a significant portion of the market by catering to specific local requirements, emphasizing cost-effective and high-quality tire solutions for small- and medium-sized businesses. With the ongoing demand for sustainable solutions and technological advancements, competition is increasingly centered around innovation, tire longevity, and cost-efficiency. Manufacturers are also adopting strategic partnerships, mergers, and acquisitions to strengthen their positions in this competitive landscape.

Recent Developments:

- In December 2023, Nokian Tyres GmbH announced a partnership with the German retreader RuLa-BRW to introduce Nokian’s innovative Noktop retreading material into the German market. This collaboration enables RuLa-BRW to utilize Noktop material in its pre-cure retreading process and distribute the resulting tires across Germany, supporting the growing demand for sustainable tire solutions in the off-the-road (OTR) segment.

- In February 2025, The Goodyear Tire & Rubber Company completed the divestiture of its global Off-The-Road (OTR) tire business to The Yokohama Rubber Company for approximately $905 million in an all-cash transaction. This move is a significant milestone in Goodyear’s transformation plan, streamlining its portfolio and allowing the company to focus on its core products and services.

Market Concentration & Characteristics:

The Germany off-the-road (OTR) tire market is moderately concentrated, with a few global leaders dominating the competitive landscape, alongside regional players. Leading international manufacturers, including Michelin, Bridgestone, Continental, and Goodyear, hold a significant market share due to their well-established brands, extensive distribution networks, and advanced technological offerings. These companies dominate the market through innovation, high-quality products, and strong relationships with OEMs and aftermarket distributors. Regional players in Germany, while smaller in scale, cater to specific needs within the agricultural, construction, and mining sectors. They differentiate by offering cost-effective solutions, tailored tire designs, and personalized customer service. The market is characterized by a high degree of technological focus, with manufacturers continually improving tire durability, fuel efficiency, and sustainability. As sustainability and eco-friendly solutions become more prominent, the market is also witnessing increasing innovation in tire materials and production processes to meet stringent environmental standards.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Germany OTR tire market will continue to grow due to ongoing infrastructure and construction projects.

- Increased agricultural mechanization will drive demand for specialized tires tailored to farming machinery.

- The shift toward electric and hybrid construction equipment will create opportunities for innovative tire solutions.

- Advancements in tire technology will focus on enhancing fuel efficiency and minimizing maintenance costs.

- Eco-friendly tire production will become a key focus, driven by sustainability regulations and consumer demand.

- Demand for high-performance tires in mining operations will rise as global mineral extraction activities expand.

- Smart tire technology, such as real-time monitoring and predictive analytics, will be integrated into OTR tire solutions.

- Regional expansion and urbanization will lead to higher tire demand in smaller, rapidly developing regions.

- The replacement tire segment will experience steady growth as machinery fleets expand and require ongoing maintenance.

- Strategic partnerships, mergers, and acquisitions will increase among global and regional players to enhance market position.