Market Overview:

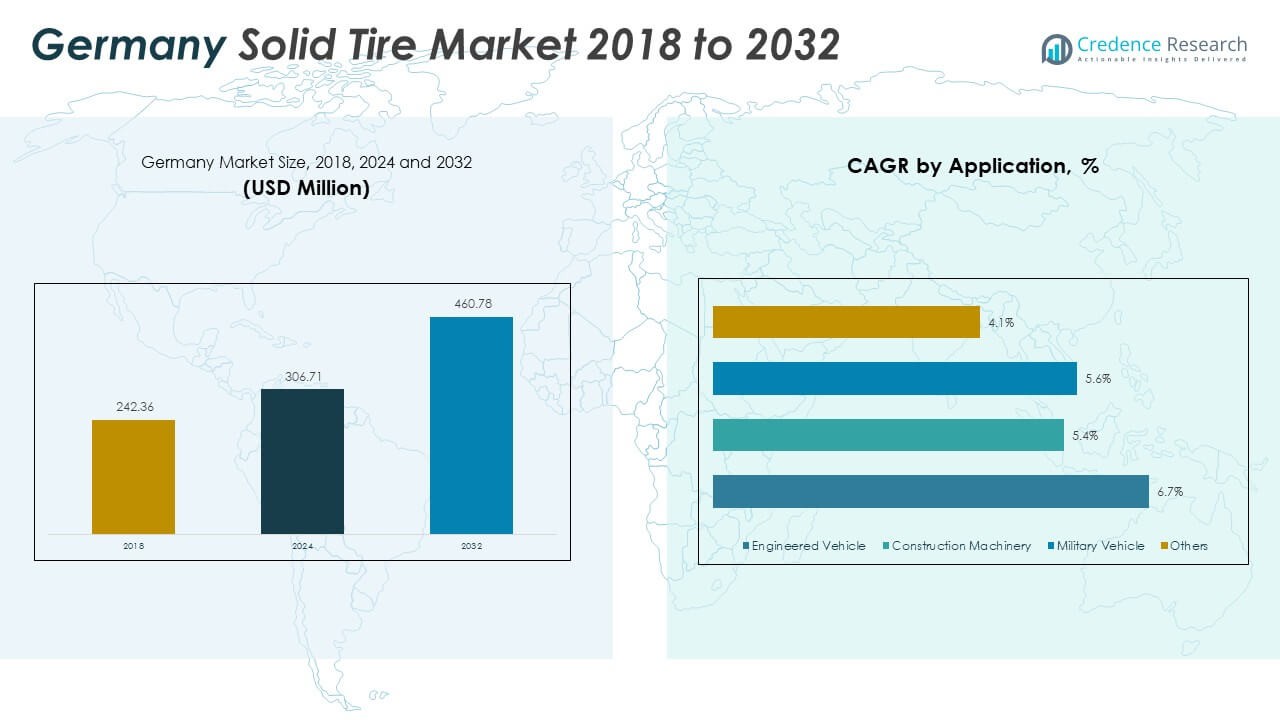

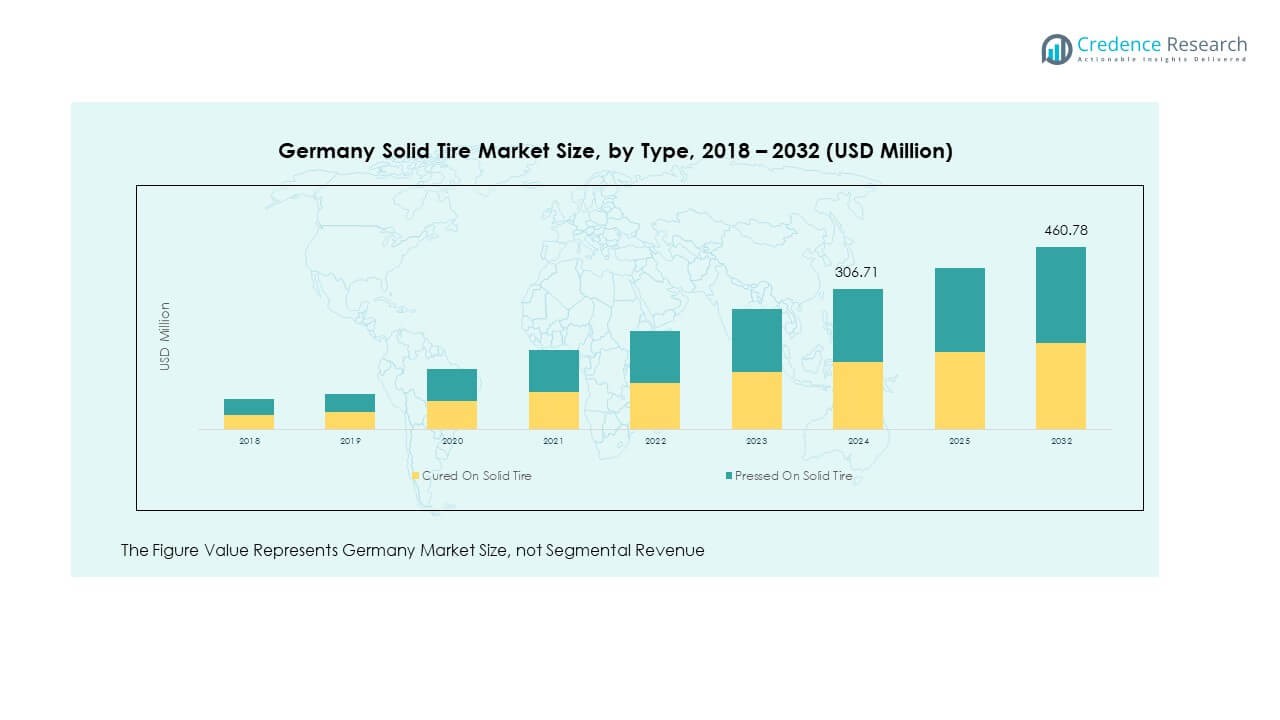

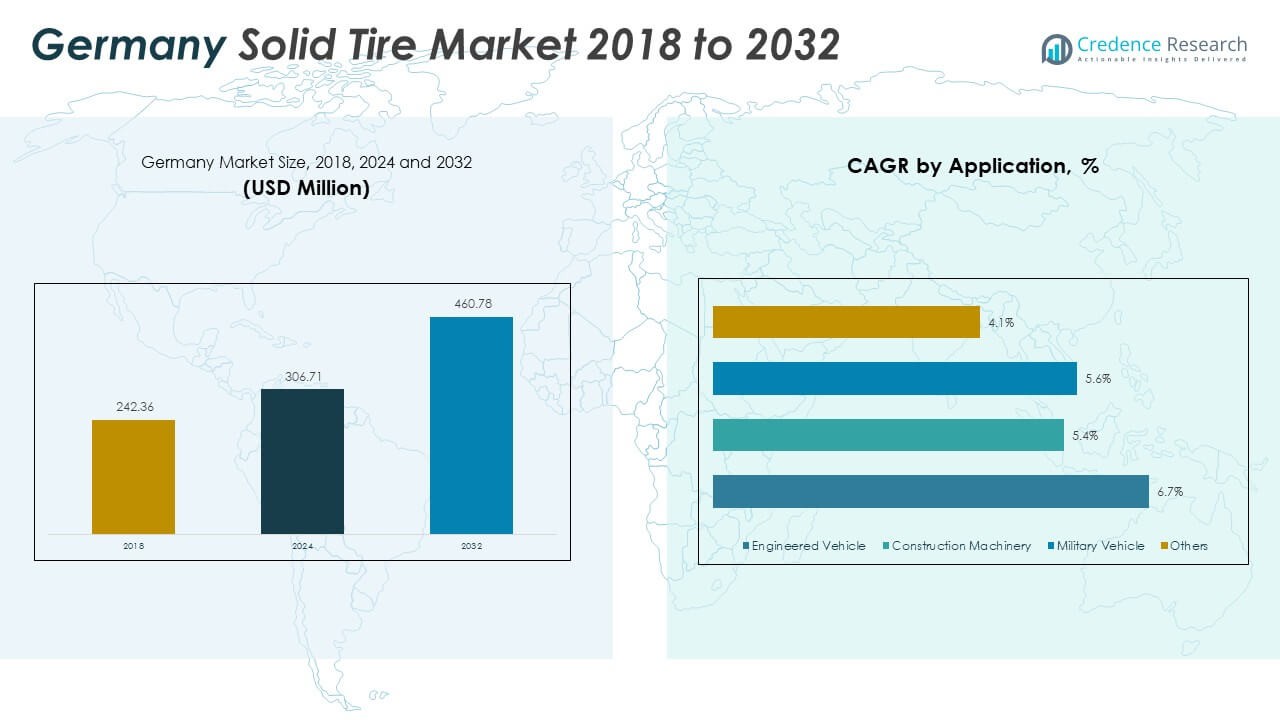

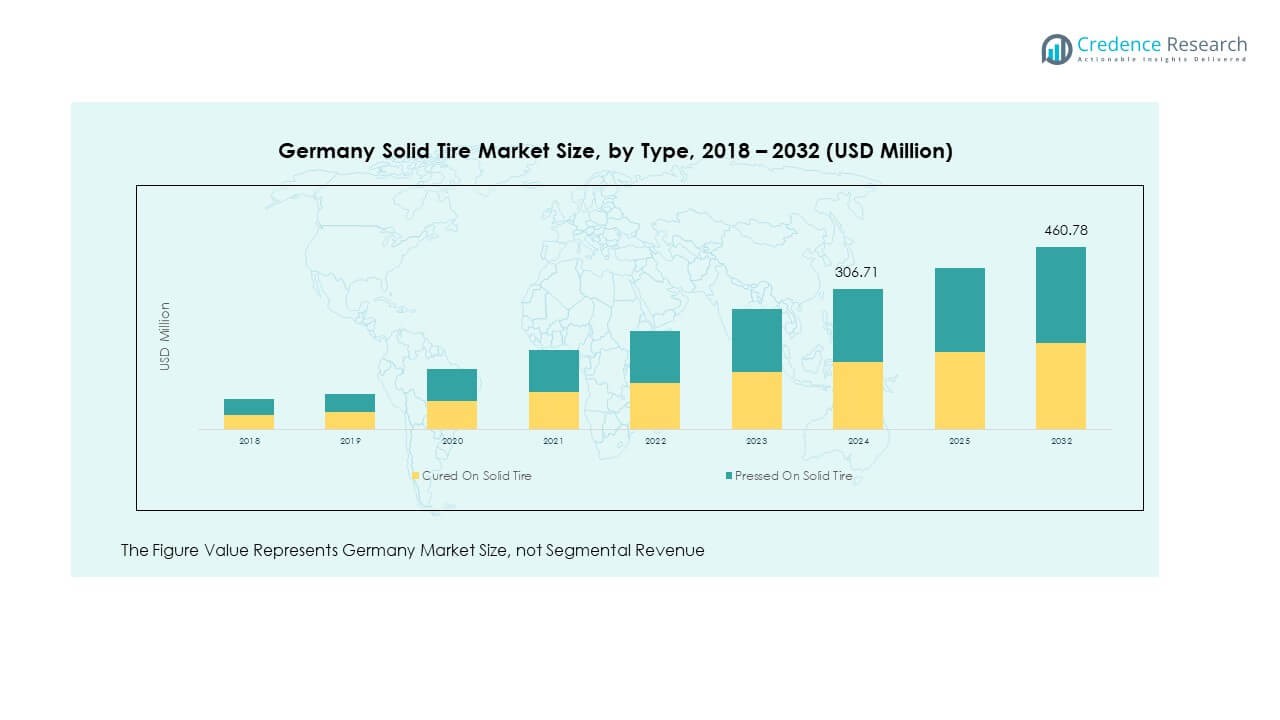

The Germany Solid Tire Market size was valued at USD 242.36 million in 2018, increased to USD 306.71 million in 2024, and is anticipated to reach USD 460.78 million by 2032, at a CAGR of 5.22% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Germany Solid Tire Market Size 2024 |

USD 306.71 Million |

| Germany Solid Tire Market, CAGR |

5.22% |

| Germany Solid Tire Market Size 2032 |

USD 460.78 Million |

The market in Germany is gaining strength from rising demand in industrial and logistics applications. Strong growth in warehousing, e-commerce, and manufacturing sectors is driving higher adoption of solid tires, known for their durability and low maintenance compared to pneumatic alternatives. German companies are also investing in automation and material-handling equipment, which further accelerates the need for resilient and reliable tires to ensure operational efficiency. The construction sector contributes additional momentum as heavy-duty solid tires are increasingly preferred for stability and long service life.

Geographically, Germany holds a central role in the European tire market due to its advanced industrial base and strong automotive ecosystem. The western and southern regions, with dense manufacturing and logistics hubs, lead in adoption. Emerging areas in eastern Germany are witnessing rising growth supported by infrastructure modernization and expanding warehousing activity. Neighboring countries such as France and Poland also strengthen demand, given their trade and industrial links with Germany, reinforcing the country’s strategic role in the regional solid tire landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Germany Solid Tire Market was valued at USD 242.36 million in 2018, reached USD 306.71 million in 2024, and is projected to hit USD 460.78 million by 2032, growing at a CAGR of 5.22%.

- Western Germany holds the largest share with 38%, driven by strong logistics hubs and automotive clusters. Southern Germany follows with 27%, supported by industrial and construction activities, while Northern Germany accounts for 21%, benefiting from ports and trade infrastructure.

- Eastern Germany is the fastest-growing region with a 14% share, supported by infrastructure modernization, new warehousing investments, and government-backed industrial development programs.

- Pressed-On Solid Tires dominate the market with 63% share in 2024, reflecting their extensive use in forklifts and material-handling vehicles.

- Cured-On Solid Tires represent 37% share in 2024, gaining traction for construction equipment and specialized heavy-duty applications.

Market Drivers:

Rising Adoption of Solid Tires in Material Handling and Industrial Applications:

The Germany Solid Tire Market is driven by rapid expansion in material-handling and industrial applications. Forklifts, warehouse trucks, and heavy-duty transport vehicles rely heavily on solid tires due to their puncture resistance and low downtime. Growing demand from logistics hubs in major cities strengthens market expansion. It benefits from strong e-commerce penetration, which requires efficient warehouse operations. Solid tires provide stability on uneven floors and withstand long operational cycles, supporting their adoption. It ensures cost efficiency for businesses by reducing frequent replacements. Industrial safety regulations in Germany also push companies toward reliable tire solutions.

- For instance, Continental AG, a leading manufacturer headquartered in Hanover, supplies solid forklift tires known for enhanced puncture resistance, significantly reducing downtime for warehouses like DHL’s logistics hubs in Hamburg and Frankfurt. Continental’s recent launch of their SC 15 solid tire model integrates reinforced polymer compounds, enhancing load capacity tailored specifically for heavy-duty material handling equipment widely used in German industrial zones.

Growth in the Construction Sector and Infrastructure Development:

Germany’s robust construction sector is fueling demand for heavy-duty solid tires. Solid tires are increasingly chosen for construction equipment, such as skid steers and loaders, because they perform well under tough conditions. Rising public infrastructure investments in roads, bridges, and commercial projects strengthen the sector’s role. Urban expansion in cities like Berlin and Munich creates continuous equipment demand. It provides construction firms with durability, which reduces maintenance costs. The government’s commitment to sustainable building practices further supports adoption of sturdy tire solutions. Contractors prefer solid tires for their extended service life and reliability.

Strong Influence of Automotive and Manufacturing Ecosystem:

The automotive and manufacturing ecosystem in Germany plays a pivotal role in the market’s growth. Global automotive leaders headquartered in Germany create consistent demand for industrial-grade tires. Automated manufacturing lines rely on equipment supported by durable solid tires. It ensures smooth production cycles by reducing interruptions due to tire damage. Export-focused industries drive additional requirements for high-performance logistics systems. Strong supplier networks and innovation hubs across Germany add momentum to growth. Focus on operational efficiency enhances the attractiveness of solid tires in manufacturing. The country’s industrial culture directly aligns with the benefits offered by solid tires.

Emphasis on Sustainability and Environmental Benefits of Solid Tires:

Sustainability goals are influencing tire choices across multiple industries in Germany. Solid tires, due to their extended lifespan, reduce waste compared to pneumatic alternatives. It lowers the environmental footprint of companies focusing on greener operations. German industries are under pressure to adopt eco-friendly practices, and tires are part of this trend. Recycling initiatives and circular economy policies support the use of long-lasting solid tire models. Businesses are increasingly investing in solutions that balance performance with sustainability. Reduced fuel consumption through stable handling further adds to their environmental benefits. Solid tires align well with Germany’s climate action policies.

Market Trends:

Rising Integration of Automation and Advanced Machinery in Logistics:

Automation is transforming warehouses and logistics operations across Germany. The Germany Solid Tire Market benefits from the adoption of autonomous vehicles and robotics. These machines require durable tire solutions to function efficiently under continuous workloads. It creates demand for solid tires with advanced engineering for precision handling. Growing investments in smart warehouses increase reliance on automation-friendly tire models. Logistics companies view tire performance as critical for maintaining efficiency. Technological collaborations are emerging to improve tire performance in automated environments. The trend supports higher-value tire products designed for long-term durability.

- For instance, Continental AG develops intelligent tire technologies, such as its C.A.R.E™ system, which uses integrated sensors for real-time monitoring and self-adjustment for autonomous vehicle fleets like robotaxis. Meanwhile, the BMW Group is a leader in automated logistics, and has been deploying automated transport vehicles within its manufacturing facilities, including at its plant in Leipzig, to optimize material flow and efficiency.

Increasing Preference for Customization and Specialized Tire Solutions:

Industries in Germany are demanding more specialized and customized solid tire models. Companies seek tires tailored to unique operational conditions such as heavy load or high speed. The Germany Solid Tire Market is responding with options offering diverse tread patterns and compounds. It allows businesses to optimize equipment efficiency for specific tasks. Demand for tires suited for harsh indoor and outdoor surfaces is growing. Specialized designs enhance traction, stability, and safety across varied applications. Tire manufacturers are focusing on flexible production to cater to niche requirements. Customization is emerging as a key competitive differentiator in the German market.

- For instance, the bicycle company Specialized has an R&D and tire manufacturing facility in Lage, Germany, which produces specialized, custom-built tires for professional racing applications, not solid industrial ones. This factory primarily focuses on innovating tire development for its sponsored athletes and high-end consumer products, with a very small annual production capacity.

Adoption of Smart Technologies and Tire Monitoring Systems:

Technological innovation is shaping how industries manage tire performance. Smart tire monitoring systems are being integrated with solid tires to enhance operational oversight. The Germany Solid Tire Market benefits as industries adopt predictive maintenance strategies. It reduces unplanned downtime by providing real-time condition data. Embedded sensors and digital platforms are being developed to monitor pressure, wear, and temperature. This trend aligns with Germany’s focus on Industry 4.0 practices. Data-driven tire management enhances productivity and lowers long-term costs. Tire manufacturers are collaborating with digital solution providers to expand their smart product lines.

Shift Toward Premium and High-Performance Tire Segments:

A noticeable trend is the move toward premium solid tires designed for high-performance demands. Industries are willing to invest in tires that provide superior safety, stability, and efficiency. The Germany Solid Tire Market is witnessing growing acceptance of premium-priced models. It reflects the priority given to durability and long-term value over cost savings. Premium tires offer advanced compounds for longer lifespan and better traction. Their role in supporting productivity and reducing risk is highly valued in German industries. Businesses view premium tires as an investment in operational efficiency. The trend is strengthening manufacturer focus on high-margin product portfolios.

Market Challenges Analysis:

High Upfront Costs and Competitive Pressure from Alternatives:

The Germany Solid Tire Market faces challenges due to the high initial cost of solid tires. Businesses often compare upfront expenses with pneumatic alternatives, slowing adoption among smaller firms. It becomes a barrier for price-sensitive buyers in logistics and construction sectors. Competitive pricing pressure from global tire manufacturers also limits margins for local suppliers. The availability of cheaper imports further complicates the market environment. Decision-makers may delay replacement cycles to control costs, reducing demand frequency. Economic slowdowns create additional constraints on investments in premium solid tires. These cost-related hurdles slow the pace of market penetration.

Technical Limitations and Adoption Barriers in Emerging Applications:

Solid tires, while durable, still face limitations in specific high-speed or precision-driven operations. The Germany Solid Tire Market struggles with acceptance in certain advanced automation setups. It creates hesitation among industries requiring extreme flexibility and performance. Limited awareness of newer high-performance solid tire models restricts adoption. Training requirements for operators further act as a challenge. Small and mid-sized companies remain cautious about investing in advanced tire solutions. Rising complexity in regulations also adds compliance costs for manufacturers. These technical and operational hurdles challenge seamless adoption across all industrial segments.

Market Opportunities:

Expansion of E-Commerce and Warehousing Driving Demand:

The expansion of e-commerce is reshaping logistics requirements in Germany. Warehouses are increasing their reliance on material-handling equipment fitted with solid tires. The Germany Solid Tire Market stands to gain from these expanding networks. It benefits from rising consumer demand for faster deliveries, requiring reliable equipment. Growth in cold storage and specialized warehousing further boosts adoption. Retail and third-party logistics providers prefer solid tires for their low maintenance needs. E-commerce growth offers continuous long-term opportunities for tire manufacturers.

Technological Advancements and Focus on Value-Added Solutions:

Technological progress is creating opportunities for innovation in tire design and performance. The Germany Solid Tire Market is witnessing demand for tires with embedded smart sensors and improved compounds. It allows industries to optimize lifecycle management while cutting costs. Tire makers focusing on premium designs and digital solutions can expand their share. Growing preference for sustainability opens pathways for eco-friendly product development. Collaborations between tire manufacturers and technology providers create value-added offerings. These advancements strengthen competitiveness and capture emerging demand opportunities.

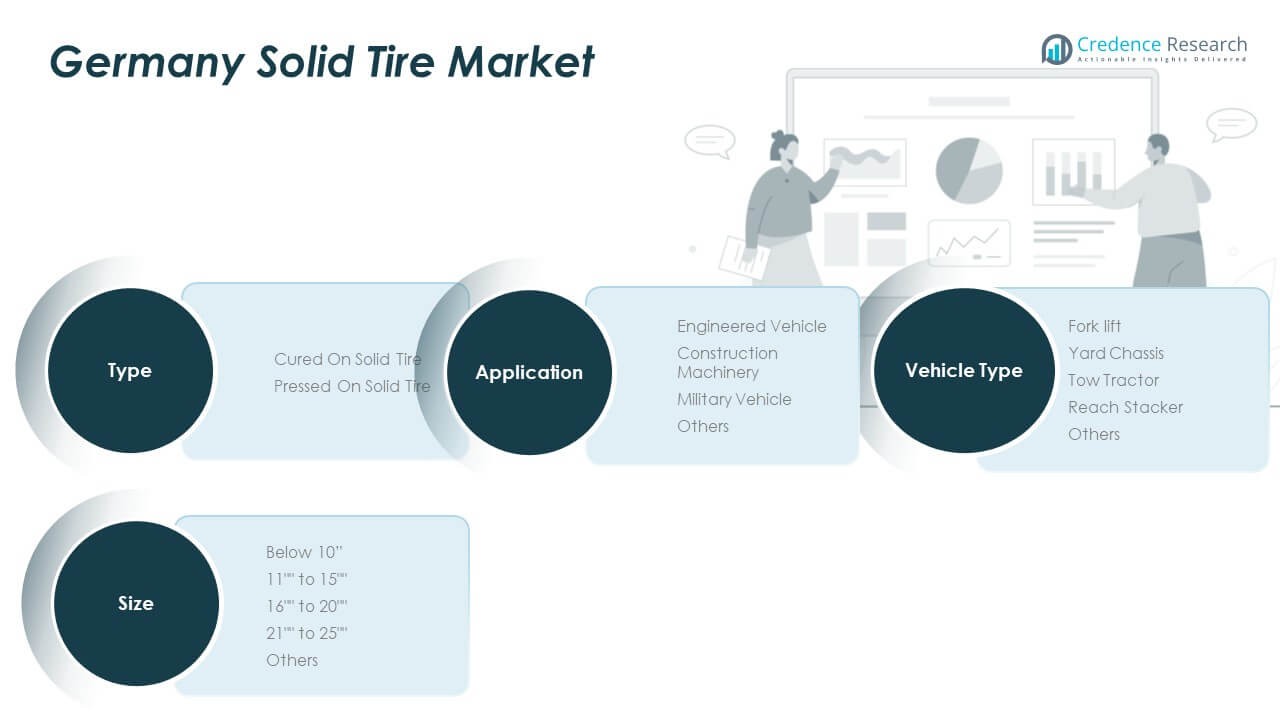

Market Segmentation Analysis:

By Type

The Germany Solid Tire Market is segmented into cured on solid tires and pressed on solid tires. Cured on solid tires hold steady adoption in heavy-duty vehicles for their durability, while pressed on solid tires dominate forklifts and warehouse equipment due to easy installation and low maintenance. It continues to see balanced growth across both categories.

- For instance, industry sources report that pressed-on solid tires are commonly preferred in smooth-floor warehouse operations due to their superior stability and longer service life for heavy-duty applications, while resilient solid tires remain popular for mixed indoor/outdoor use requiring more ride comfort and versatility on uneven surfaces.

By Application

Engineered vehicles represent the leading share, supported by logistics and industrial operations across Germany. Construction machinery follows with strong demand, driven by infrastructure projects requiring high-load capacity tires. Military vehicles and other specialized segments contribute niche demand, reflecting the country’s defense and specialized transport needs. It sustains growth across diverse operational environments.

- For instance, Continental AG supplies solid tires for engineered vehicles widely used in logistics centers, while Zeppelin Baumaschinen addresses construction equipment demands. Specialized manufacturers provide tires meeting strict standards for military applications in Germany.

By Size

Solid tires in the range of 11” to 15” and 16” to 20” command the largest shares, favored in forklifts and mid-sized machinery. Smaller sizes below 10” serve compact equipment, while larger segments such as 21” to 25” support heavy construction vehicles. It highlights the adaptability of solid tires across varied operational scales.

By Vehicle Type

Forklifts lead the market, with extensive use in warehousing and material-handling facilities across Germany’s logistics hubs. Yard chassis and tow tractors contribute steady demand in ports and distribution centers, while reach stackers gain traction in specialized lifting operations. Other vehicles, including industrial trolleys, provide consistent but smaller contributions. It reflects a well-rounded distribution of demand across industrial, logistics, and construction ecosystems.

Segmentation:

By Type

- Cured On Solid Tire

- Pressed On Solid Tire

By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

By Size

- Below 10”

- 11” to 15”

- 16” to 20”

- 21” to 25”

- Others

By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

Regional Analysis:

Western Germany – Dominant Market Hub

Western Germany holds the largest share of the Germany Solid Tire Market, accounting for nearly 38% in 2024. Strong logistics hubs in cities like Cologne and Frankfurt drive higher adoption of solid tires for forklifts and yard equipment. The presence of major automotive clusters in Stuttgart and surrounding regions further strengthens demand. It benefits from advanced industrial bases that require reliable material-handling solutions. Growth in warehousing facilities linked to e-commerce expansion adds to market traction. Western Germany remains the central growth driver supported by well-established infrastructure.

Southern Germany – Industrial and Construction Stronghold

Southern Germany contributes around 27% of the market share, led by Munich, Bavaria, and Baden-Württemberg. Heavy industrial activities and a robust construction sector sustain consistent demand for solid tires in this region. It reflects reliance on construction machinery and engineered vehicles for ongoing infrastructure projects. Premium tire adoption is also higher in this part due to the concentration of high-value industries. Growth in urban development and commercial projects further stimulates solid tire consumption. Southern Germany represents a stronghold for mid-to-large size categories of solid tires.

Northern and Eastern Germany – Trade-Driven and Emerging Growth Regions

Northern and Eastern Germany together account for the remaining share, with Northern Germany commanding 21% and Eastern Germany about 14% in 2024. Northern Germany benefits from strong trade flows through Hamburg and Bremen ports, supporting yard chassis and tow tractor applications. It leverages its maritime infrastructure to maintain consistent growth in solid tire demand. Eastern Germany, though smaller in share, records the fastest growth due to infrastructure modernization and rising warehousing activity. It reflects opportunities in construction and logistics supported by government-backed development programs. Together, these regions reinforce the nationwide growth of the solid tire market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Bridgestone

- MICHELIN

- Goodyear

- Continental

- ZC Rubber

- Sumitomo Rubber

- Pirelli

- Sailun Jinyu Group

- Cooper Tire

- Hankook

- Yokohama

- Kumho Tire

- Linglong Tire

Competitive Analysis:

The Germany Solid Tire Market features strong competition among global tire giants and regional manufacturers. Key players such as Bridgestone, Michelin, Continental, and Goodyear maintain a dominant presence with extensive product portfolios and wide distribution networks. Asian manufacturers like ZC Rubber, Kumho Tire, and Linglong Tire are expanding footprints by offering cost-effective alternatives. It faces intense rivalry due to innovation-driven differentiation, where premium players emphasize advanced compounds and eco-friendly designs. Partnerships with OEMs and industrial clients remain central to securing long-term contracts. Competitive intensity is reinforced by sustained investments in R&D, strategic acquisitions, and regional expansions, highlighting the market’s dynamic structure.

Recent Developments:

- In July 2025, Michelin introduced the X Multi Z2 all-position tire designed for food logistics, urban delivery, and transit operations. This tire provides 20 percent more mileage and 17 percent lower rolling resistance than its predecessor, thanks to Michelin’s Regenion technology and Powercoil casing technology, making it highly durable and cost-effective for demanding fleet operations in regions including Germany.

- In March 2025, Bridgestone unveiled two new tires featuring its next-generation ENLITEN technology, including the Bridgestone R273 Ecopia regional tire tailored for steer positions and the Duravis M705 for mixed fleet vehicles used in pickup and last-mile delivery. These tires enhance performance and sustainability by improving wear resistance and using more renewable materials, underscoring Bridgestone’s commitment to sustainable innovations in commercial truck tires.

- In January 2025, Continental released a new fuel-efficient trailer retread called ContiTread HT. This product features enhanced shoulder design and tread compound to deliver up to 20 percent improved rolling resistance, reducing fuel consumption and operational costs for fleets. It also meets SmartWay regulations for environmental sustainability, reinforcing Continental’s focus on innovation and cost efficiency.

Report Coverage:

The research report offers an in-depth analysis based on type, application, size, and vehicle type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for forklifts in warehouses will continue driving adoption of solid tires.

- Construction sector expansion will sustain demand for heavy-duty cured-on tire categories.

- Eco-friendly and recyclable tire designs will gain traction in line with German regulations.

- Integration of smart sensors will support predictive maintenance and fleet optimization.

- Demand for premium tires will grow among industries prioritizing durability and efficiency.

- Eastern Germany will emerge as a high-growth region with strong infrastructure projects.

- Local manufacturers will expand market presence by targeting niche applications.

- Partnerships with logistics and construction firms will strengthen distribution channels.

- Product customization will become a key differentiator in meeting diverse industrial needs.

- Continued investment in R&D will enhance compound performance and extend tire life cycles.