Market Overview

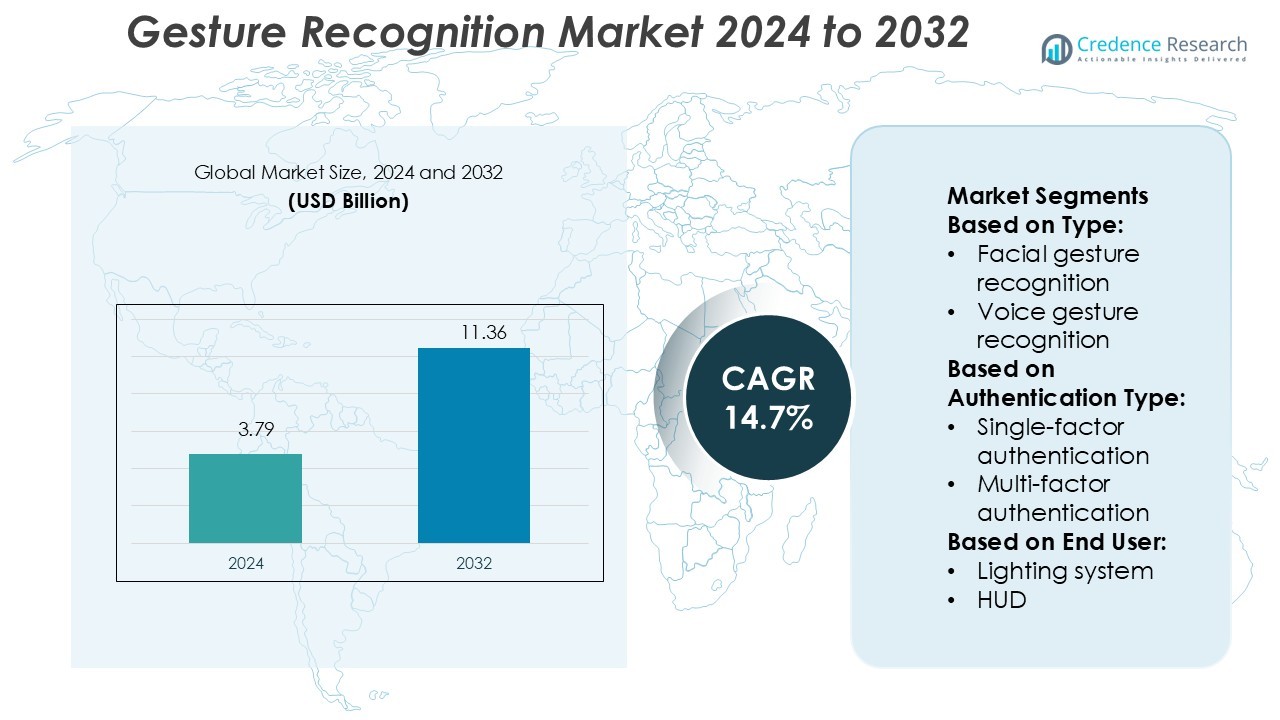

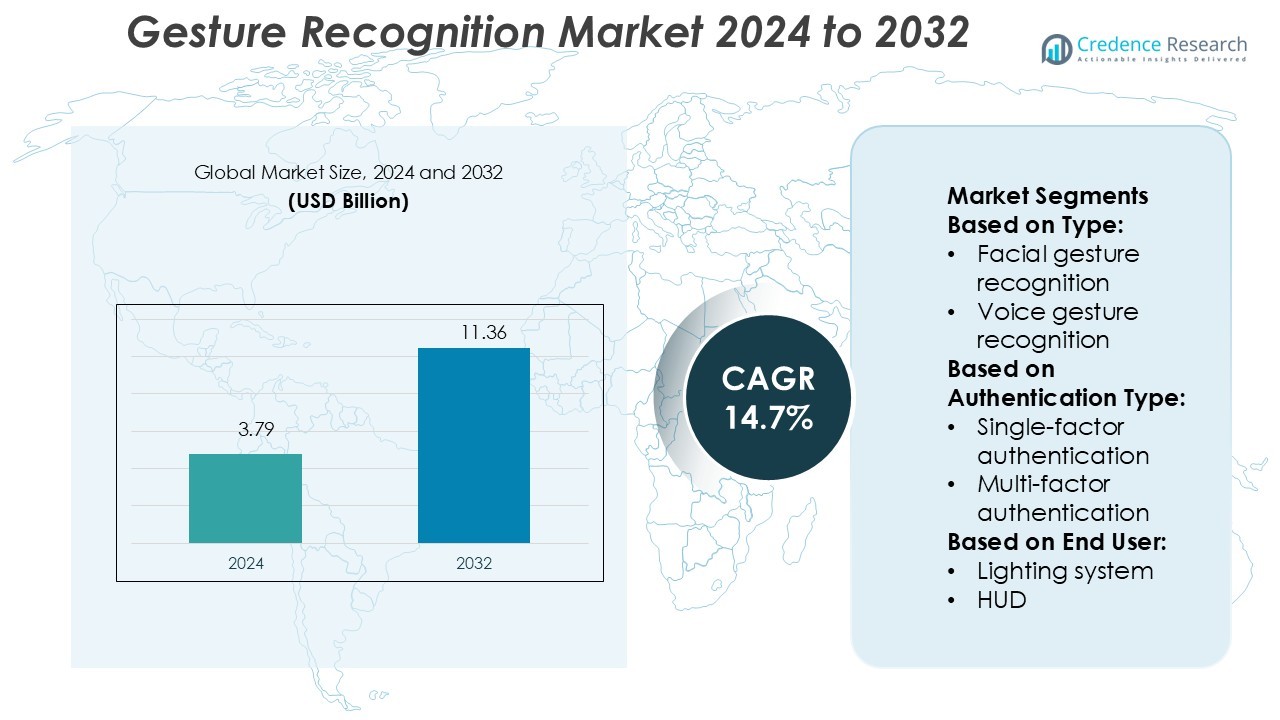

Gesture Recognition Market was valued USD 3.79 billion in 2024 and is anticipated to reach USD 11.36 billion by 2032, at a CAGR of 14.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gesture Recognition Market Size 2024 |

USD 3.79 Million |

| Gesture Recognition Market, CAGR |

14.7% |

| Gesture Recognition Market Size 2032 |

USD 11.36 Million |

The Gesture Recognition Market is driven by strong competition and continuous technological innovation. Leading companies are advancing AI algorithms, sensor technologies, and 3D vision systems to improve accuracy and performance across industries. North America holds the dominant position with a 36.4% market share, supported by robust demand in consumer electronics, automotive, and IoT applications. The region’s strong R&D ecosystem and rapid digital adoption strengthen its leadership. Strategic collaborations, product diversification, and expanding application areas are shaping the competitive landscape. As gesture interfaces become more intuitive and cost-effective, their global adoption is expected to accelerate further.Top of Form

Market Insights

- Gesture Recognition Market was valued at USD 3.79 billion in 2024 and is projected to reach USD 11.36 billion by 2032, registering a CAGR of 14.7% during the forecast period.

- Rising demand for touchless control in consumer electronics and automotive systems is driving growth, with hand/finger gesture recognition holding a 37.6% segment share.

- Increasing AI integration and 3D sensing technology adoption are shaping market trends, making gesture interfaces more accurate and cost-effective.

- High implementation costs and technical complexity remain key restraints, particularly in price-sensitive regions and industrial applications.

- North America leads the market with a 36.4% share, followed by Europe and Asia Pacific, supported by strong R&D activity, rapid digitalization, and growing IoT adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Hand/finger gesture recognition dominates the Gesture Recognition Market with a 37.6% share. This segment leads due to its wide use in consumer electronics, automotive interfaces, and gaming. Touchless control through hand and finger movements enhances user experience and device interaction speed. Advancements in 3D sensing and infrared cameras boost accuracy and response time. Facial and voice gesture recognition also see strong adoption in security and authentication systems, supported by AI-driven emotion detection and voice processing technologies.

- For instance, Alphabet’s Google ATAP team developed the Project Soli radar sensor which was integrated into the Pixel 4 smartphone as a single packaged RFIC of 5.0 mm × 6.5 mm including the antenna.

By Authentication Type

Single-factor authentication holds the largest share of 59.3% in the Gesture Recognition Market. This dominance is due to its lower cost, easy integration, and faster processing, especially in consumer devices like smartphones and smart TVs. Many automotive and lighting systems rely on single-factor gesture input for quick access. However, the adoption of multi-factor authentication is growing rapidly, driven by rising cybersecurity needs and advanced sensor fusion, enhancing protection in biometric access and enterprise systems.

- For instance, NXP’s Trimension UWB Radar portfolio offers a single-chip solution that combines radar and ranging functionality operating in the 6-8 GHz band—enabling gesture recognition and motion detection, such as sensing respiration-level movement.

By End User

Consumer electronics is the leading end user, accounting for 44.7% of the Gesture Recognition Market. Smartphones dominate this segment, followed by laptops and tablets, due to increasing demand for touchless control and advanced user interfaces. Features like air gestures, face unlock, and voice control drive mass adoption. The automotive sector is also growing fast, with gesture-enabled HUDs and biometric access improving driver safety and comfort. Rising integration in lighting systems and security solutions adds further momentum.

Key Growth Drivers

Rising Adoption in Consumer Electronics

Gesture recognition is rapidly expanding in smartphones, laptops, and tablets, driving significant market growth. Touchless control through gestures improves user experience, boosts accessibility, and enables faster device interaction. OEMs are integrating 3D sensing cameras, LiDAR, and AI-based gesture tracking to enhance functionality. This technology reduces reliance on physical input methods, which aligns with the growing demand for intuitive interfaces. The continuous upgrade of smart devices worldwide strengthens market penetration and accelerates product innovation.

- For instance, eyeSight’s “singlecue Gen 2” home-gesture solution supported wave, pinch, and “shush” gestures. The system used a camera to recognize and interpret hand movements from a distance in consumer devices.

Advancements in AI and Sensor Technology

AI-driven algorithms and advanced sensors are making gesture recognition more accurate and responsive. Infrared sensors, time-of-flight cameras, and computer vision improve detection and reduce latency. These innovations enable better real-time tracking for applications in AR/VR, gaming, and automotive systems. Integration of AI enhances recognition in complex environments, making the technology more reliable. This technological progress is attracting strong investment from electronics and automotive industries, boosting global deployment.

- For instance, Apple’s monocular-camera method achieved up to 97 % average recognition accuracy from a single demonstration of a bespoke gesture, across a set of 20 gestures collected from 21 participants.

Growing Integration in Automotive Systems

Gesture recognition is becoming a core feature in next-generation automotive designs. It allows drivers to control infotainment, HUDs, and climate systems without physical contact. Leading OEMs are integrating gesture interfaces to enhance safety and reduce driver distraction. This hands-free interaction aligns with advanced driver-assistance systems (ADAS) and connected car trends. Growing demand for premium vehicles and autonomous driving technologies further supports market expansion in this segment.

Key Trends & Opportunities

Expansion of AR/VR and Metaverse Applications

The rapid growth of AR/VR and metaverse platforms creates strong opportunities for gesture recognition technology. Accurate hand tracking enhances user immersion and control in virtual spaces. Major tech companies are investing in advanced gesture sensors to support gaming, education, and collaboration applications. This expansion opens new revenue streams beyond traditional electronics and automotive markets, driving broader ecosystem adoption.

- For instance, HoloLens 2 achieved fingertip tracking errors in the range of 2 mm to 4 mm, and joint-angle errors of about 5° compared to a professional motion-capture system.

Integration with IoT and Smart Home Devices

Gesture recognition is increasingly integrated into IoT ecosystems and smart home products. Touchless control in lighting, entertainment systems, and home appliances improves user convenience and hygiene. The rise of connected devices and voice-assist integration enhances compatibility and scalability. These developments support cross-device interaction and enable smart environments, creating new growth opportunities for technology providers.

- For instance, Intel’s RealSense D400 Series depth camera from its Vision Processor D4 architecture offers a minimum depth capture distance of 45 cm (17.7″) at full resolution for the D415 model, with a depth-accuracy specification of <2 % at 2.0 m distance.

Rising Demand for Biometric Security

Growing security concerns are driving gesture-based biometric solutions. Combining gesture recognition with facial or voice authentication strengthens access control systems. This trend is gaining traction in enterprise environments, healthcare, and high-security facilities. Advanced AI models support more secure, multi-modal authentication methods, creating long-term market potential.

Key Challenges

High Implementation Costs and Complexity

Advanced gesture recognition systems require sophisticated sensors, AI algorithms, and processing hardware. This raises development and integration costs, especially for automotive and industrial applications. Smaller manufacturers often struggle to adopt the technology due to high upfront investment. The complexity of integrating hardware and software also slows down deployment in cost-sensitive markets.

Accuracy and Reliability Issues in Real-World Conditions

Gesture recognition performance can decline under poor lighting, background noise, or complex motion. Environmental variations affect sensor precision, leading to false recognition or delayed response. These issues limit adoption in critical applications like automotive safety and industrial automation. Continuous R&D investment is essential to overcome these technical barriers and ensure consistent performance.

Regional Analysis

North America

North America leads the Gesture Recognition Market with a 36.4% share. The region benefits from strong adoption in consumer electronics, automotive systems, and smart home devices. Major tech companies are investing in AI-driven gesture interfaces, enhancing product functionality and user experience. Automotive OEMs integrate gesture control in infotainment and safety systems, driven by high premium vehicle demand. Widespread 5G and IoT infrastructure supports large-scale deployments. The U.S. dominates regional revenue, backed by leading players and robust R&D activity. Rising integration across industrial and healthcare applications further strengthens the market position.

Europe

Europe accounts for 27.8% of the Gesture Recognition Market. The region’s strong automotive industry plays a major role in driving growth, especially in Germany, France, and the U.K. Automakers are adopting gesture control to enhance driver assistance and in-cabin interaction. Government regulations supporting vehicle safety and green mobility further boost adoption. The consumer electronics sector also contributes significantly, with rising demand for touchless interfaces in smart homes. Europe’s focus on AI innovation and sustainable manufacturing strengthens market competitiveness. Leading OEMs and sensor companies in the region drive steady technological advancements.

Asia Pacific

Asia Pacific holds a 25.6% share of the Gesture Recognition Market and is the fastest-growing region. China, Japan, and South Korea lead due to their strong electronics manufacturing base. High smartphone penetration and rapid smart home adoption boost demand for gesture-enabled devices. Automakers in the region are also integrating gesture control in electric and connected vehicles. Investments in AI and sensor technologies further accelerate market expansion. The presence of global and regional players enhances production capacity, driving economies of scale. Rising disposable income and urbanization fuel long-term market growth.

Latin America

Latin America captures a 6.1% share of the Gesture Recognition Market. Brazil and Mexico are key contributors, driven by growing demand for advanced consumer electronics and connected vehicles. The adoption of gesture control in smart homes and entertainment systems is rising steadily. Regional governments are supporting digital transformation, encouraging new technology investments. However, limited infrastructure and higher device costs slow wider penetration. As technology prices fall and awareness grows, the region is expected to experience steady market expansion in the coming years.

Middle East & Africa

The Middle East & Africa region holds a 4.1% share of the Gesture Recognition Market. GCC countries are leading adoption, supported by smart city initiatives and growing investment in digital infrastructure. Consumer electronics and automotive segments are witnessing increased deployment of gesture control technologies. Healthcare and hospitality sectors are also exploring touchless interfaces to improve service delivery. However, adoption remains limited in several African countries due to cost constraints and lack of infrastructure. Strategic partnerships with global technology providers are expected to accelerate growth over the forecast period.

Market Segmentations:

By Type:

- Facial gesture recognition

- Voice gesture recognition

By Authentication Type:

- Single-factor authentication

- Multi-factor authentication

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Gesture Recognition Market is shaped by key players such as Cognitec Systems GmbH, Alphabet Inc., NXP Semiconductors, eyeSight Technologies Ltd, Apple Inc., Microsoft Corporation, Intel Corporation, Microchip Industry Incorporated, Infineon Technologies AG, and Omnivision Technologies, Inc. The Gesture Recognition Market is marked by intense competition, rapid innovation, and increasing technological convergence. Companies are focusing on integrating AI algorithms, 3D sensing, and computer vision to enhance accuracy and real-time response. Product development strategies emphasize touchless control, advanced biometric authentication, and seamless interaction across devices. Strategic collaborations with automotive, consumer electronics, and IoT solution providers are expanding application reach. Firms are also investing in miniaturized, low-power sensors to support broader use cases. Continuous R&D, patent development, and ecosystem partnerships strengthen competitive positioning, allowing market players to meet rising global demand for intelligent human-machine interfaces.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cognitec Systems GmbH

- Alphabet Inc.

- NXP Semiconductors

- eyeSight Technologies Ltd

- Apple Inc.

- Microsoft Corporation

- Intel Corporation

- Microchip Industry Incorporated

- Infineon Technologies AG

- Omnivision Technologies, Inc.

Recent Developments

- In September 2024, Doublepoint, the pioneering startup known for its award-winning gesture detection technology, announced the launch of WowMouse Presenter, a groundbreaking app that turns your Wear OS Smartwatch into a gesture-controlled remote for PowerPoint and Google Slides presentations.

- In March 2024, OmniVision launched the OV50K40 image sensor, incorporating TheiaCel technology for enhanced high dynamic range (HDR) capabilities. This sensor, featuring 50 megapixels, is designed for high-end smartphones and offers improved low-light performance.

- In November 2023, NXP Semiconductors has unveiled the Trimension NCJ29D6, a next-generation automotive Ultra-Wideband (UWB) single-chip solution that uniquely combines secure ranging and short-range radar capabilities. This innovative chip enables multiple automotive applications-including secure car access, child presence detection, intrusion alerts, and gesture recognition-using a single system, helping automakers reduce costs and complexity.

- In May 2023, Infineon Technologies AG announced its acquisition of the Stockholm-based startup Imagimob AB, a prominent provider of machine learning solutions for edge devices. This acquisition enhanced Infineon’s position in delivering world-class Machine Learning (ML) solutions and significantly strengthened its AI offerings.

Report Coverage

The research report offers an in-depth analysis based on Type, Authentication Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for touchless interfaces will continue to rise across consumer electronics and automotive systems.

- Advancements in AI and deep learning will enhance gesture accuracy and speed.

- Integration with AR/VR platforms will expand application areas in gaming, education, and collaboration.

- Gesture control will become a key feature in autonomous and connected vehicles.

- Growth in smart home and IoT ecosystems will drive large-scale adoption.

- Miniaturized, low-power sensors will enable cost-effective product integration.

- Gesture-based biometric authentication will strengthen security applications across industries.

- Collaboration between hardware and software providers will accelerate innovation.

- Emerging markets will adopt gesture technologies faster due to affordable smart devices.

- Continuous R&D will lead to more adaptive and intuitive human-machine interaction.