| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Glycine Based Amino Acid Surfactant Market Size 2024 |

USD 1,323.11 million |

| Glycine Based Amino Acid Surfactant Market, CAGR |

9.57% |

| Glycine Based Amino Acid Surfactant Market Size 2032 |

USD 2,893.74 million |

Market Overview:

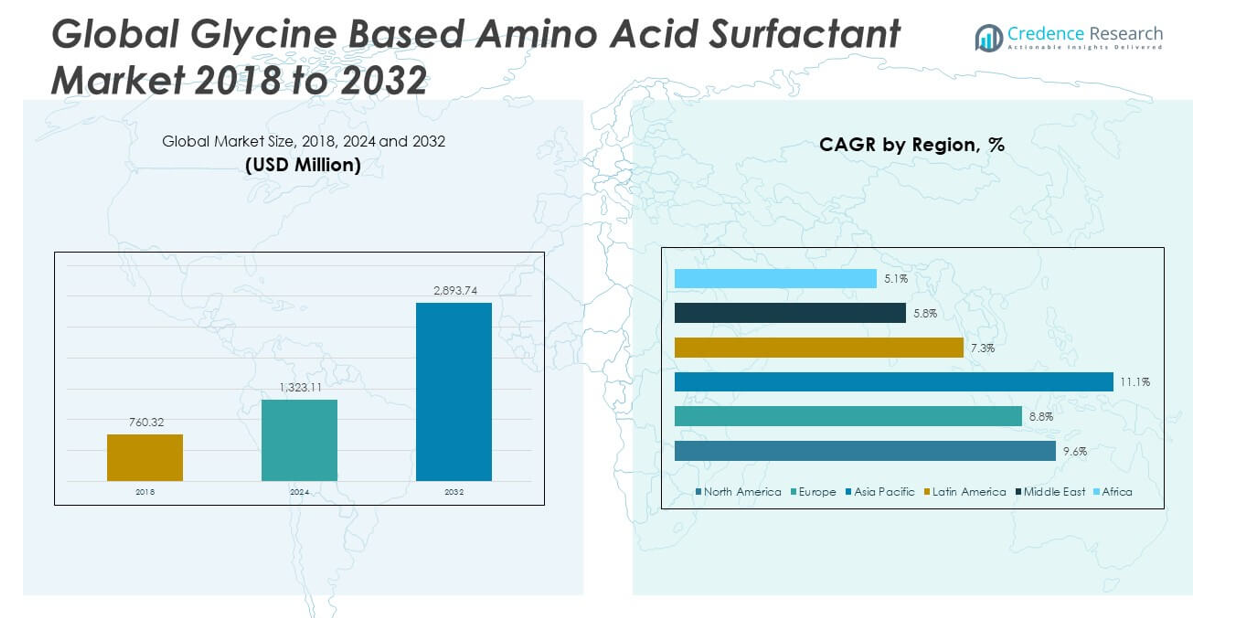

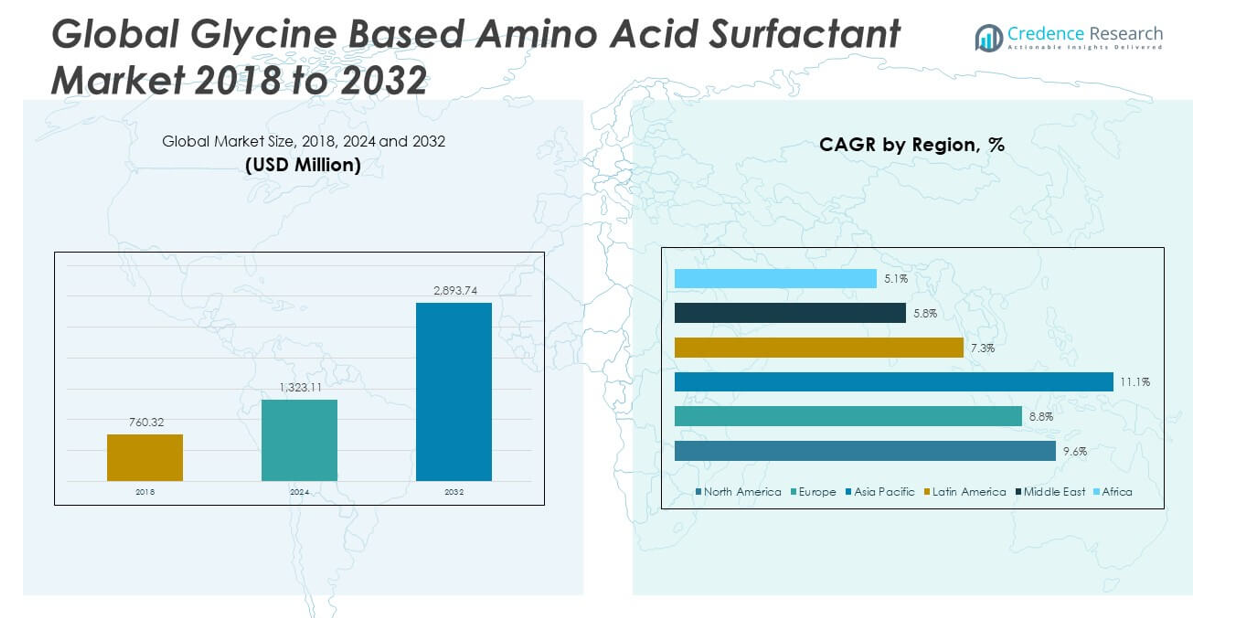

The Global Glycine Based Amino Acid Surfactant Market size was valued at USD 760.32 million in 2018 to USD 1,323.11 million in 2024 and is anticipated to reach USD 2,893.74 million by 2032, at a CAGR of 9.57% during the forecast period.

The market’s expansion is primarily driven by the rising consumer preference for sustainable and skin-friendly ingredients in personal care formulations. Glycine-based amino acid surfactants are favored for their mild cleansing properties and low irritation potential, making them suitable for sensitive skin and baby care products. As consumers become more informed about the harmful effects of conventional surfactants, demand for naturally derived and biodegradable alternatives has accelerated. Additionally, the prevalence of skin-related conditions such as dermatitis, eczema, and allergic reactions has prompted both manufacturers and dermatologists to recommend ultra-mild cleansing solutions, further boosting market demand. Regulatory bodies in North America, Europe, and parts of Asia-Pacific are also implementing stringent environmental policies to reduce chemical waste and pollution, thereby encouraging the adoption of bio-based surfactants. Despite these positive trends, high production costs and the complexity of sourcing raw materials pose challenges for market players.

Regionally, the Asia-Pacific region dominates the global glycine-based amino acid surfactant market, accounting for the largest revenue share. This is largely due to the rapid growth of the personal care and cosmetics industry in countries such as China, India, Japan, and South Korea. The region benefits from a growing middle-class population, increasing disposable incomes, and heightened awareness of skincare and wellness. Moreover, the presence of large-scale manufacturing facilities and ongoing research and development efforts in the region contribute to market growth. North America holds a substantial share as well, with high consumer awareness of sustainable and premium skincare products. The region’s well-established regulatory framework and preference for eco-labeled products continue to support market expansion. Europe follows closely, driven by strict environmental regulations and strong demand for natural and organic personal care formulations. European consumers are particularly focused on ingredient transparency and environmental sustainability, making glycine-based surfactants a preferred choice.

Market Insights:

- The Global Glycine Based Amino Acid Surfactant Market grew from USD 760.32 million in 2018 to USD 1,323.11 million in 2024 and is projected to reach USD 2,893.74 million by 2032, at a CAGR of 9.57%.

- Growing consumer demand for mild, skin-friendly personal care products is driving the adoption of glycine-based surfactants in facial cleansers, shampoos, and baby care products.

- Regulatory bodies in major economies are enforcing strict environmental guidelines, encouraging the replacement of petrochemical surfactants with biodegradable alternatives.

- The market is witnessing increased usage of glycine-based surfactants due to rising cases of skin sensitivity and allergic conditions, prompting demand for non-irritating and hypoallergenic ingredients.

- Expanding interest in clean-label and organic personal care products is fostering innovation and increasing the incorporation of glycine-based surfactants in certified natural formulations.

- High production costs and complex synthesis processes limit mass-market adoption and keep the product line focused on premium and niche personal care categories.

- Asia-Pacific dominates the market, led by robust personal care industry growth in China, India, Japan, and South Korea, supported by growing disposable income and heightened skincare awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Mild and Skin-Friendly Ingredients in Personal Care Formulations

Consumer preference is shifting toward personal care products that offer gentle cleansing without compromising skin health. Glycine-based amino acid surfactants, known for their low irritation and mild foaming properties, have become the preferred choice in facial cleansers, shampoos, and baby care products. Consumers are increasingly aware of the harsh effects of sulfates and traditional surfactants, prompting a transition toward naturally derived alternatives. The Global Glycine-Based Amino Acid Surfactant Market benefits significantly from this shift, particularly in premium skincare segments. Brands are actively promoting skin-safe ingredients to align with dermatological trends and wellness-conscious lifestyles. This demand is also encouraging the development of multifunctional formulations that combine cleansing with hydration and skin barrier support.

- For instance, Galaxy Surfactants’ Galsoft SCG is available as a 30 percent aqueous solution, which is acidified and processed to yield high-purity cocoyl glycine for use in cold-dispersible pearlescent concentrates, demonstrating controlled pH adjustment (to 1.0 with sulfuric acid) and subsequent neutralization to skin-friendly pH levels (6–7) in finished products

Increased Regulatory Pressure on Petrochemical Surfactants Enhancing Natural Alternatives

Regulatory authorities across major economies are enforcing stricter guidelines to curb the environmental impact of synthetic and petroleum-based surfactants. These regulations are driving manufacturers to explore safer, biodegradable ingredients that comply with sustainability mandates. The Global Glycine-Based Amino Acid Surfactant Market is gaining traction among formulators seeking alternatives that meet both performance and compliance criteria. Many multinational brands are reformulating existing product lines to replace conventional surfactants with glycine derivatives. This trend is particularly evident in Europe and North America, where consumer expectations and regulatory standards are aligned in favor of eco-conscious products. The market is responding with a broader portfolio of glycine-based surfactant options tailored for diverse applications.

- For instance, Sunlight’s RhamnoClean-based formula is verified as safe even for baby dishes, offering superior cleaning without harsh chemicals.

Growing Incidence of Skin Sensitivity and Allergy Concerns Among Consumers

Rising cases of skin allergies, dermatitis, and sensitivity are creating a strong demand for dermatologically safe surfactants. Consumers are scrutinizing product labels and avoiding ingredients linked to irritation or allergic reactions. Glycine-based amino acid surfactants are non-toxic, pH balanced, and hypoallergenic, making them suitable for sensitive skin and therapeutic skincare products. The Global Glycine-Based Amino Acid Surfactant Market is expanding its footprint across both mainstream and specialized personal care categories. Dermatologists and skincare professionals are also recommending mild surfactants, contributing to their credibility and uptake. This health-conscious shift is reinforcing long-term demand for gentle cleansing agents in both developed and emerging regions.

Expansion of the Natural and Organic Personal Care Segment Driving Ingredient Innovation

The natural and organic personal care segment is experiencing robust growth, supported by consumers who prioritize clean-label products and botanical ingredients. Glycine-based surfactants align well with the natural product ethos due to their plant-derived origin and sustainable profile. The Global Glycine-Based Amino Acid Surfactant Market is benefiting from this surge in green consumerism, with many manufacturers incorporating these surfactants into organic-certified product lines. Ingredient suppliers are investing in innovation to improve purity, efficacy, and formulation flexibility. It is fostering partnerships between raw material providers and personal care brands to co-develop new product concepts. This innovation-led expansion is solidifying the role of glycine-based surfactants in the future of clean beauty.

Market Trends:

Widespread Adoption of Clean Label and Transparent Ingredient Practices

Consumers are demanding transparency in ingredient sourcing and formulation practices. Brands are responding by offering clean label products that exclude harsh chemicals, sulfates, and artificial additives. Glycine-based amino acid surfactants meet these expectations due to their natural origin, mild nature, and proven skin compatibility. The Global Glycine-Based Amino Acid Surfactant Market is benefiting from this transparency trend, which continues to influence both product development and marketing strategies. Retailers and e-commerce platforms are also highlighting ingredient clarity, giving clean-label formulations a competitive edge. This shift is encouraging personal care manufacturers to standardize labeling and certification practices to build consumer trust.

- Amisoft LS-11, for example, achieves a mildness score of 35.8 (NR50, ppm) compared to sodium lauryl sulfate’s 3.4, demonstrating superior skin compatibility2. These surfactants are used in personal care products such as shampoos, shower gels, and face washes, and are produced to USP, EP, and JP standards, with an assay of 98.5 to 101.0% purity.

Increased Use in Baby Care and Dermatologist-Recommended Products

The demand for ultra-mild, dermatologically approved formulations is accelerating the inclusion of glycine-based surfactants in baby care and clinical skincare. These products require surfactants that maintain the skin’s natural pH and avoid irritation. It supports these needs by offering excellent cleansing performance while preserving the skin barrier. The Global Glycine-Based Amino Acid Surfactant Market is seeing higher demand from brands specializing in hypoallergenic and pediatric-friendly products. This trend is especially prominent in North America and Europe, where parents are more inclined to choose fragrance-free and allergen-free options. Product safety endorsements from dermatologists further reinforce this preference.

Shift Toward Sulfate-Free and Eco-Friendly Hair Care Products

The hair care industry is undergoing a transformation with increasing demand for sulfate-free shampoos and conditioners. Consumers seek products that cleanse effectively without stripping natural oils or causing scalp irritation. Glycine-based surfactants offer a gentle alternative, enabling brands to deliver performance with fewer side effects. The Global Glycine-Based Amino Acid Surfactant Market is gaining from this trend, as sulfate-free claims continue to influence purchasing decisions. Hair care companies are reformulating products to include mild surfactants and plant-based actives. This trend is expanding across premium, mass-market, and professional salon segments.

For instance, Croda’s Arlasilk EFA, derived from sunflower oil, acts as a surfactant and counter-irritant, providing mildness and compatibility with a variety of surfactants in rinse-off and leave-on skin care products. The company’s product portfolio also includes high-purity vegetable oils, emollient esters, and amphoteric surfactants, with recommended topical usage levels ranging from 0.5 to 10% depending on the application.

Growing Integration in Solid and Waterless Personal Care Formats

Sustainability concerns are prompting a shift toward solid bars, powders, and waterless beauty formats that reduce packaging waste and carbon footprint. Glycine-based surfactants are compatible with these formats due to their stable structure and formulation flexibility. The Global Glycine-Based Amino Acid Surfactant Market is seeing increased adoption in eco-conscious packaging and minimalist skincare routines. It supports the clean beauty movement by enabling concentrated, low-water content formulations. Brands are using this trend to differentiate their offerings and appeal to environmentally aware consumers. Innovation in this space is likely to continue shaping future product development strategies.

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes Limit Mass Adoption

The production of glycine-based amino acid surfactants involves specialized synthesis techniques and costly raw materials, which increases overall manufacturing expenses. These surfactants require precise formulation processes to maintain purity, stability, and efficacy, often leading to higher unit costs than conventional surfactants. Small- and medium-sized manufacturers may find it challenging to absorb these costs, especially in price-sensitive markets. The Global Glycine Based Amino Acid Surfactant Market faces limitations in scaling due to these financial and technical barriers. It remains largely concentrated in premium and niche personal care segments, where consumers are more willing to pay for sustainability and skin-friendly properties. Wider adoption across mainstream and mass-market products will depend on advancements in cost optimization and production efficiency.

Limited Awareness in Emerging Markets and Low Penetration in Industrial Applications

Consumer awareness regarding the benefits of glycine-based surfactants is still limited in many developing regions. Low brand visibility, lack of education on ingredient safety, and limited product availability restrict market growth outside urban and developed areas. The Global Glycine Based Amino Acid Surfactant Market has yet to establish a strong presence in industrial applications such as institutional cleaning and large-scale detergents, where cost and performance take priority over gentleness. It must overcome skepticism around performance parity with synthetic alternatives to expand into broader end-use sectors. Market participants need to invest in outreach, education, and targeted marketing to unlock growth potential in underpenetrated regions. Regulatory support and collaboration with local distributors can also improve accessibility and consumer trust in these markets.

Market Opportunities:

Expansion in Natural Cosmetics and Personal Care Product Lines Creates New Demand

Consumer demand for sustainable, plant-derived, and skin-friendly ingredients is pushing brands to expand their natural product portfolios. Glycine-based amino acid surfactants align with this trend and provide an ideal base for clean-label formulations. The Global Glycine Based Amino Acid Surfactant Market stands to benefit from growing investments in organic skincare, sulfate-free hair care, and hypoallergenic personal care lines. It can support innovation across multiple segments, including facial cleansers, baby care, and body washes. Brands that emphasize ingredient transparency and dermatological safety will find strong alignment with these surfactants. Rising popularity of vegan and cruelty-free products also opens further opportunity.

Partnerships with Contract Manufacturers and Niche Brands Support Market Penetration

Emerging personal care brands and contract manufacturing organizations offer entry points into new markets with agile product development. Companies in the Global Glycine Based Amino Acid Surfactant Market can leverage these collaborations to scale production, introduce region-specific formulations, and test consumer response. It allows faster time to market without heavy capital investment. Growth in e-commerce and direct-to-consumer channels further enables smaller players to reach targeted demographics. These partnerships can accelerate adoption in both developed and developing economies. Expanding awareness and availability through strategic alliances will support long-term market visibility and customer engagement.

Market Segmentation Analysis:

The Global Glycine Based Amino Acid Surfactant Market demonstrates significant segmentation based on type and application, shaping product development and consumer targeting.

By type, Sodium Cocoyl Glycinate holds the dominant market share due to its widespread use in premium personal care products. It offers excellent foaming, mild cleansing, and compatibility with sensitive skin, making it a preferred choice for facial and baby care formulations. Potassium Cocoyl Glycinate, though less prevalent, is gaining traction for its moisturizing properties and suitability in formulations requiring low pH, especially in high-end skincare applications.

- For instance, Ajinomoto’s Amisoft® SCG (Sodium Cocoyl Glycinate) is widely used in premium facial cleansers and baby shampoos due to its excellent foaming ability and skin mildness.

By application, the Shower Gel segment accounts for a major portion of the market due to its mass-market appeal and frequent consumer usage. The Facial Cleanser segment follows closely, benefiting from consumer demand for non-irritating, dermatologically safe solutions. The Shampoo segment also reflects steady growth with rising awareness about scalp sensitivity and hair health. The Others category, which includes hand washes and baby care products, is gradually expanding with new product launches catering to eco-conscious consumers. The Global Glycine Based Amino Acid Surfactant Market continues to evolve as brands align their offerings with consumer preferences for clean-label and biodegradable formulations.

- For applications, Amisoft SCG is a key ingredient in the formulation of shower gels such as Shiseido’s Senka Perfect Whip, which reports annual sales exceeding 30 million units globally, driven by consumer preference for mild, non-irritating cleansing.

Segmentation:

By Type:

- Sodium Cocoyl Glycinate

- Potassium Cocoyl Glycinate

By Application:

- Shower Gel

- Facial Cleanser

- Shampoo

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Glycine Based Amino Acid Surfactant Market size was valued at USD 317.79 million in 2018 to USD 547.01 million in 2024 and is anticipated to reach USD 1,199.83 million by 2032, at a CAGR of 9.60% during the forecast period. North America holds the largest share in the Global Glycine Based Amino Acid Surfactant Market, driven by strong demand for premium personal care and skincare products. It benefits from high consumer awareness regarding ingredient safety, sustainability, and regulatory compliance. Major brands are reformulating products using glycine-based surfactants to meet clean-label and hypoallergenic standards. Dermatologists frequently recommend sulfate-free and mild cleansers, reinforcing the credibility of such ingredients. The region is home to a significant number of product innovations and eco-conscious startups. Strong retail and e-commerce infrastructure also supports wider market penetration.

The Europe Glycine Based Amino Acid Surfactant Market size was valued at USD 221.66 million in 2018 to USD 372.20 million in 2024 and is anticipated to reach USD 767.72 million by 2032, at a CAGR of 8.80% during the forecast period. Europe represents a mature market with a robust demand for bio-based and dermatologically safe surfactants. Consumers in the region prioritize environmental impact, ethical sourcing, and product transparency. The Global Glycine Based Amino Acid Surfactant Market gains momentum here through strong regulatory frameworks that limit the use of synthetic chemicals. It is also supported by the rising popularity of vegan and cruelty-free personal care lines. Established personal care brands across Germany, France, and the UK are expanding their sulfate-free portfolios. Retailers are aligning with sustainability goals, boosting shelf space for glycine-based formulations.

The Asia Pacific Glycine Based Amino Acid Surfactant Market size was valued at USD 170.98 million in 2018 to USD 318.89 million in 2024 and is anticipated to reach USD 777.43 million by 2032, at a CAGR of 11.10% during the forecast period. Asia Pacific is the fastest-growing regional market, driven by rapid urbanization, rising disposable incomes, and evolving skincare habits. Consumers across China, India, Japan, and South Korea are increasingly seeking gentle, high-performance personal care products. The Global Glycine Based Amino Acid Surfactant Market is expanding here through local manufacturing, wider product accessibility, and growth in natural beauty brands. It is also supported by government initiatives promoting sustainable chemicals. Domestic brands are adopting clean-label strategies, fueling demand for natural surfactants. The region’s high population base and digital commerce penetration further accelerate market growth.

The Latin America Glycine Based Amino Acid Surfactant Market size was valued at USD 27.08 million in 2018 to USD 46.35 million in 2024 and is anticipated to reach USD 85.85 million by 2032, at a CAGR of 7.30% during the forecast period. Latin America is emerging as a growth market with increasing awareness of skin sensitivity and clean beauty trends. Consumers are gradually transitioning to sulfate-free and skin-safe formulations. The Global Glycine Based Amino Acid Surfactant Market finds opportunities in Brazil and Mexico, where personal care industries are expanding and organic labels are gaining visibility. It is benefitting from an increase in local cosmetic brands promoting natural ingredients. Challenges include price sensitivity and uneven product availability across rural areas. However, urban growth and social media-driven education are creating steady demand.

The Middle East Glycine Based Amino Acid Surfactant Market size was valued at USD 14.58 million in 2018 to USD 22.18 million in 2024 and is anticipated to reach USD 36.94 million by 2032, at a CAGR of 5.80% during the forecast period. The Middle East market is developing steadily, led by premium skincare demand in Gulf countries. Consumers prefer gentle and luxury products that perform well in hot, arid climates. The Global Glycine Based Amino Acid Surfactant Market is building presence through niche brands and premium offerings in UAE and Saudi Arabia. It faces challenges in scalability due to pricing and limited raw material availability. Import-driven product variety supports current demand. Growth is expected through partnerships with regional distributors and retail chains.

The Africa Glycine Based Amino Acid Surfactant Market size was valued at USD 8.24 million in 2018 to USD 16.48 million in 2024 and is anticipated to reach USD 25.97 million by 2032, at a CAGR of 5.10% during the forecast period. Africa remains a nascent market with limited awareness and lower penetration of advanced personal care products. Growth is driven by increasing hygiene standards and urban consumer segments seeking quality skincare. The Global Glycine Based Amino Acid Surfactant Market is gradually entering through imported products and online platforms. It must overcome barriers related to affordability, supply chain gaps, and regulatory inconsistencies. Local formulation units and targeted awareness campaigns may unlock future potential. Rising interest in plant-based solutions aligns with the growing global clean beauty movement.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Ajinomoto Co., Inc.

- Sino Lion (USA) Ltd.

- Changsha Puji Co., Ltd.

- Tinci Materials Technology Co., Ltd.

- Croda International Plc

- Clariant AG

- Galaxy Surfactants Ltd.

- Miwon Commercial Co., Ltd.

- Zhangjiagang Great Chemicals Co., Ltd.

- Innospec Inc.

Competitive Analysis:

The Global Glycine Based Amino Acid Surfactant Market features a competitive landscape led by a mix of multinational corporations and specialized ingredient manufacturers. Key players focus on innovation, sustainability, and expanding product portfolios to meet rising demand for mild and eco-friendly formulations. It is shaped by strategic partnerships, product launches, and technological advancements in green chemistry. Companies are investing in R&D to improve cost-efficiency and performance, aiming to replace traditional surfactants in personal care and cosmetic applications. Regional players are also entering the market with clean-label positioning and tailored solutions. Price competition remains moderate due to the premium nature of glycine-based surfactants. Growth strategies center on strengthening distribution networks, increasing consumer awareness, and responding to evolving regulatory standards.

Recent Developments:

- In April 2025, Ajinomoto Co., Inc. announced the sale of its entire equity stake in Ajinomoto Althea, Inc., a US-based contract development and manufacturing organization (CDMO), to Packaging Coordinators Inc. (PCI). The transaction, completed on May 1, 2025, reflects Ajinomoto’s strategy to accelerate value enhancement in its biopharma services and focus on its core business areas.

- In May 2023, Croda International Plc announced two new partnership agreements aimed at advancing sustainability in the pharmaceutical industry. The first is an exclusive license agreement with Amyris for the supply of biotechnology-derived, pharmaceutical-grade squalene, and the second is a partnership with BSI to develop sustainable QS-21 vaccine adjuvants. These moves align with Croda’s commitment to sustainable ingredient sourcing and innovation in bio-based surfactants.

Market Concentration & Characteristics:

The Global Glycine Based Amino Acid Surfactant Market exhibits moderate market concentration with a few dominant players controlling significant shares, particularly in North America, Europe, and Asia Pacific. It is characterized by a focus on premium product segments, sustainability, and ingredient transparency. The market favors suppliers that offer high-purity, bio-based formulations backed by dermatological testing and regulatory compliance. Innovation in green chemistry and demand for sulfate-free solutions define its competitive edge. Entry barriers include high production costs, limited raw material suppliers, and complex manufacturing processes. It continues to evolve through product diversification and expansion into emerging personal care formats. It continues to evolve through product diversification and expansion into emerging personal care formats. Manufacturers that align with clean beauty trends and invest in scalable, cost-effective technologies are well-positioned to gain long-term market share.

Report Coverage:

The research report offers an in-depth analysis based on type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising consumer preference for natural and skin-friendly ingredients will continue to drive market demand.

- Expansion of sulfate-free and clean-label personal care products will create new application opportunities.

- Technological advancements in green chemistry will help reduce production costs and improve scalability.

- Growing awareness in emerging markets will support wider product adoption beyond premium segments.

- Strategic collaborations with cosmetic brands and contract manufacturers will strengthen market presence.

- Increased regulatory support for biodegradable and non-toxic ingredients will favor market growth.

- E-commerce and direct-to-consumer channels will accelerate product accessibility and brand visibility.

- Product innovation in baby care, facial cleansers, and sensitive-skin solutions will fuel diversification.

- Rising competition may encourage pricing optimization and formulation efficiency across regions.

- Sustained investment in R&D and ingredient transparency will shape long-term industry leadership.