Market Overview

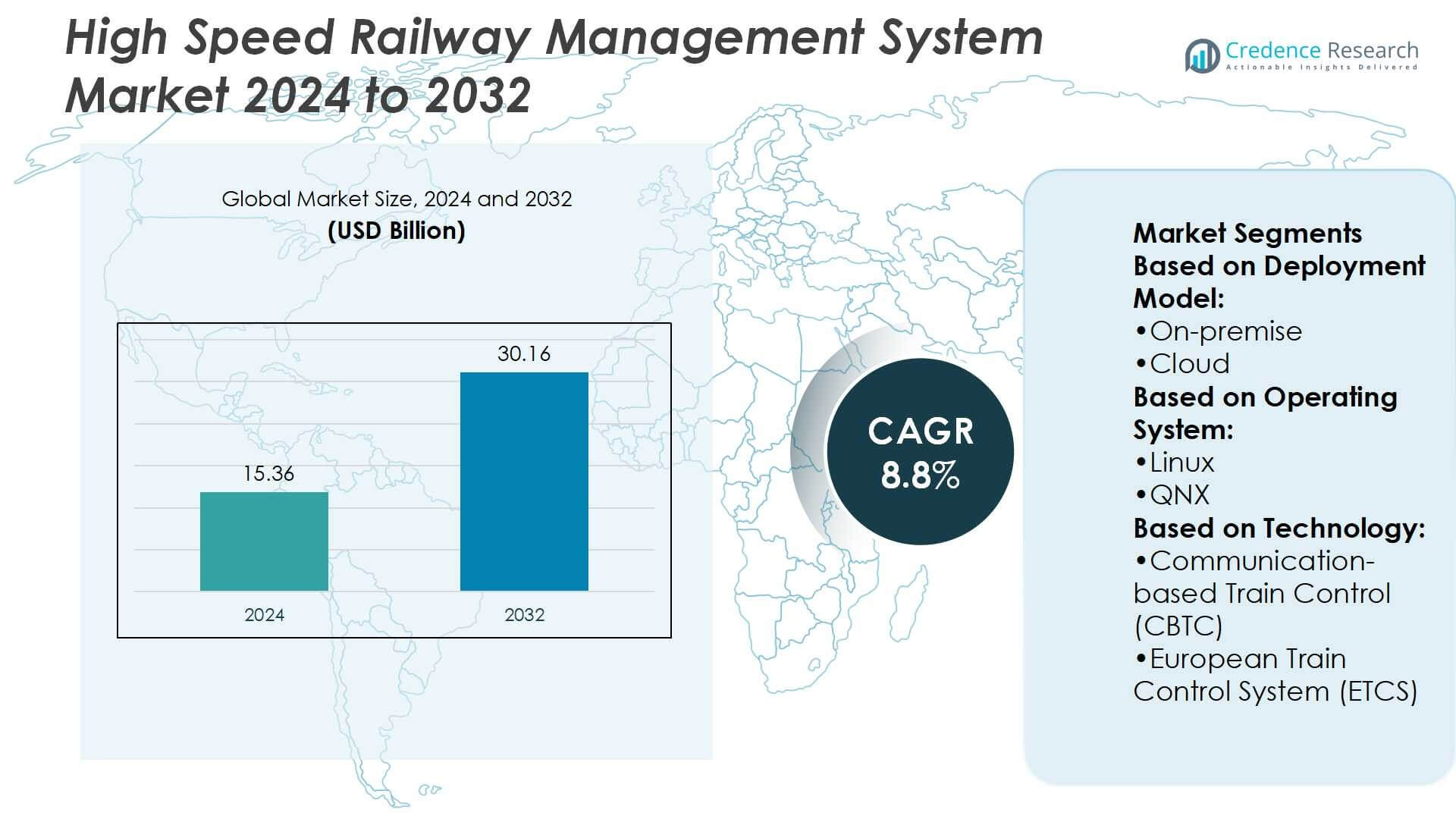

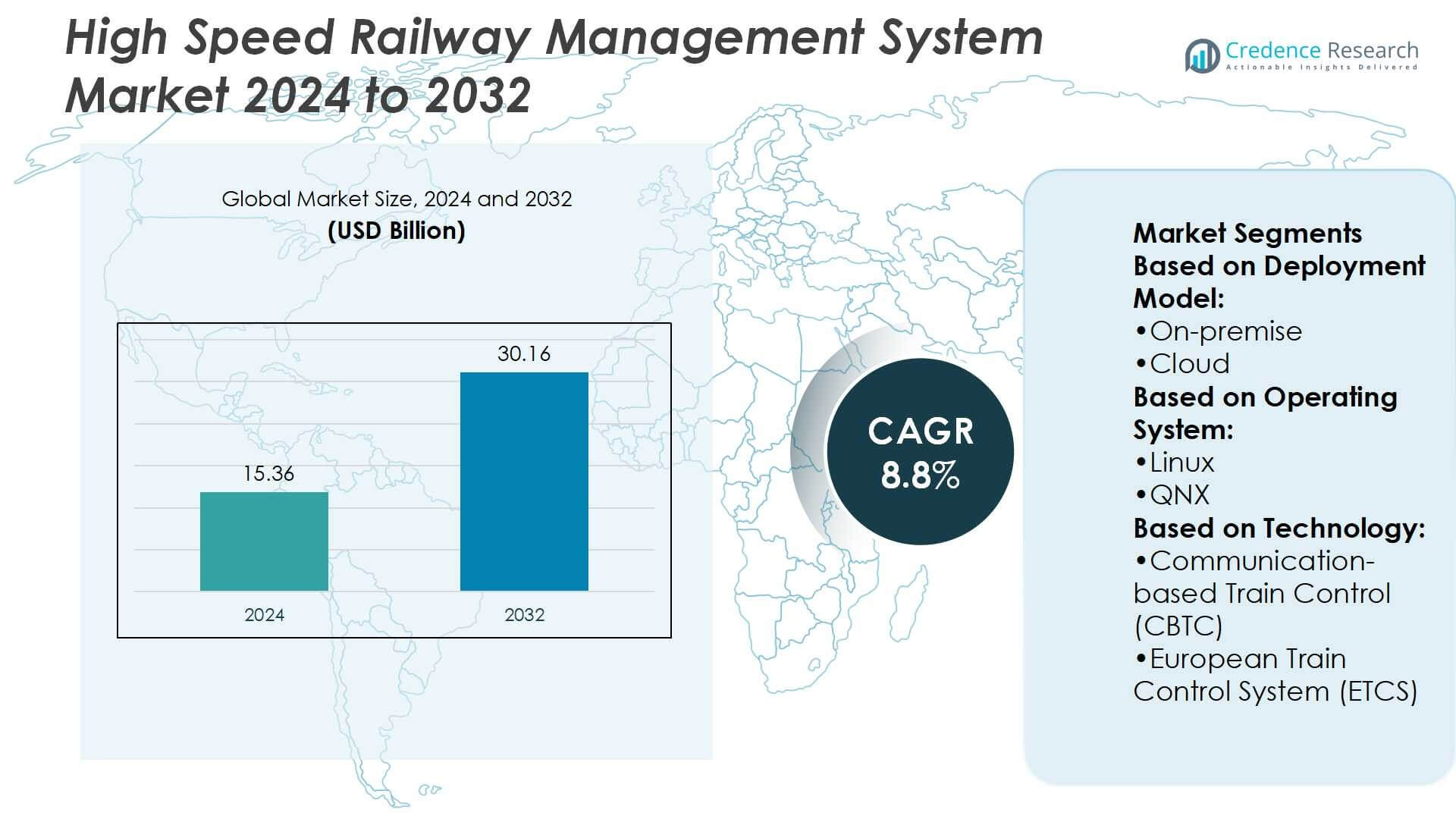

High Speed Railway Management System Market size was valued at USD 15.36 billion in 2024 and is anticipated to reach USD 30.16 billion by 2032, at a CAGR of 8.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Speed Railway Management System Market Size 2024 |

USD 15.36 billion |

| High Speed Railway Management System Market, CAGR |

8.8% |

| High Speed Railway Management System Market Size 2032 |

USD 30.16 billion |

The high-speed railway management system market grows through strong drivers and evolving trends shaping adoption. Rising investments in advanced rail infrastructure, demand for safe and efficient operations, and regulatory focus on safety compliance fuel system deployment. Digital transformation accelerates adoption of automation, predictive maintenance, and energy-efficient solutions. Integration of IoT, AI, and cloud platforms enhances real-time monitoring and data-driven decision-making. Trends also highlight increasing focus on cybersecurity, interoperability, and modular designs that reduce lifecycle costs. Expanding networks in Asia-Pacific and modernization programs in Europe and North America ensure sustained growth and innovation across the industry.

The high-speed railway management system market shows strong regional variation, with Asia-Pacific leading due to extensive infrastructure development, particularly in China and Japan. Europe follows with modernization initiatives and strict safety standards, while North America focuses on technological upgrades and efficiency. Emerging markets in Latin America and the Middle East show steady growth through new rail projects. Key players such as Alstom, Siemens, Hitachi, Huawei, CRRC, IBM, Cisco, ABB, Honeywell, and Thales compete through innovation, partnerships, and global expansion strategies.

Market Insights

- The High Speed Railway Management System Market was valued at USD 15.36 billion in 2024 and is projected to reach USD 30.16 billion by 2032, growing at a CAGR of 8.8%.

- Market growth is driven by rising investments in modern rail infrastructure and demand for safer, efficient operations.

- Trends highlight adoption of digital technologies like automation, predictive maintenance, and energy-efficient solutions.

- Integration of IoT, AI, and cloud platforms strengthens real-time monitoring and decision-making capabilities.

- Competitive dynamics involve players such as Alstom, Siemens, Hitachi, Huawei, CRRC, IBM, Cisco, ABB, Honeywell, and Thales.

- Market restraints include high implementation costs, cybersecurity risks, and interoperability challenges across regions.

- Asia-Pacific leads the market due to extensive infrastructure in China and Japan, followed by Europe with modernization efforts, while North America, Latin America, and the Middle East show steady adoption through new projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Efficient Transportation Infrastructure

The High Speed Railway Management System Market grows strongly due to the need for efficient, high-capacity transportation. Governments and operators invest in advanced rail networks to reduce road congestion and improve connectivity. It supports smooth operations by integrating scheduling, signaling, and safety systems. Growing urbanization and regional development accelerate adoption to meet rising passenger volumes. The system improves travel reliability, which strengthens public preference for rail travel. It aligns with broader goals of enhancing national and regional mobility frameworks.

- For instance, CRRC Corporation has supplied thousands of high-speed trainsets for China’s railway network, including the Fuxing series, which is capable of operating at speeds up to 350 km/h. This has enabled the deployment of advanced signaling and management systems across China’s high-speed rail network, which exceeded 40,000 km in 2021 and was on track to surpass 50,000 km.

Technological Advancements Driving Operational Excellence

Technological innovation drives the High Speed Railway Management System Market forward with intelligent monitoring, automation, and predictive maintenance. It enhances safety by providing real-time surveillance and automated fault detection. Integration with IoT and AI solutions increases efficiency and reduces operational costs. Energy-efficient solutions further support sustainability goals within the transport sector. The system facilitates seamless coordination between stations, trains, and control centers. High adoption of digital twin technology allows simulation of scenarios to optimize performance.

- For instance, Honeywell’s ground transportation solutions include the HGuide n580 inertial navigation system, which provides robust and continuous positioning, particularly in challenging environments like tunnels and urban canyons where GNSS signals may be denied or blocked.

Government Initiatives and Strategic Investments

Public funding and policy support play a vital role in advancing the High Speed Railway Management System Market. Governments prioritize sustainable mobility and allocate budgets for modernizing transport networks. It benefits from public-private partnerships that accelerate deployment across urban and intercity routes. Strategic investments ensure compliance with safety standards and enhance infrastructure resilience. Environmental goals also encourage rail adoption over carbon-heavy transport modes. Regional authorities focus on linking economic hubs through high-speed corridors.

Growing Emphasis on Passenger Safety and Experience

Rising passenger expectations for safety and comfort fuel the High Speed Railway Management System Market. The system ensures real-time monitoring of traffic, collision prevention, and emergency response mechanisms. It supports improved ticketing and passenger information systems, enhancing convenience and accessibility. Smart technologies allow predictive crowd management to improve travel experience. Operators rely on data analytics to tailor services and optimize scheduling. Strong focus on safety boosts trust and long-term adoption of high-speed rail solutions.

Market Trends

Integration of Digital Technologies and Smart Solutions

The High Speed Railway Management System Market shows a strong trend toward digital transformation with IoT, AI, and big data. It enables predictive maintenance, real-time fault detection, and seamless traffic management. Smart signaling and automation improve operational efficiency while reducing delays. Cloud-based platforms allow operators to centralize data and optimize scheduling. Cybersecurity solutions gain importance to protect sensitive transportation infrastructure. Digital adoption enhances system reliability and drives long-term modernization efforts.

- For instance, Hitachi Rail’s HMAX platform is fitted to over 2,000 trains and more than 200,000 asset-systems, processing real-time and batch data from sensors monitoring bogie and wheelset health, track vibration, overhead line condition, and train-vehicle subsystems to enable condition-based maintenance rather than fixed schedules.

Rising Focus on Sustainability and Energy Efficiency

Sustainability shapes the High Speed Railway Management System Market with advanced energy-efficient technologies. It supports electrification, regenerative braking, and lightweight materials for improved performance. Green initiatives promote rail transport as a cleaner alternative to road and air travel. Smart power management systems reduce energy waste during peak operations. Adoption of eco-friendly practices aligns with global climate goals and regulatory frameworks. Operators increasingly invest in systems that balance efficiency and environmental responsibility.

- For instance, Huawei’s dedicated communication network for the Jakarta–Bandung high-speed railway (spanning 142.3 kilometers) achieves up to 99.99% availability in its train-to-ground wireless transmissions, ensuring reliable and stable train control signal delivery for high-speed operations at 350 km/h.

Expansion of High-Speed Rail Networks Worldwide

The High Speed Railway Management System Market expands alongside new rail corridors across Asia, Europe, and the Middle East. It benefits from large-scale infrastructure projects connecting major urban and industrial hubs. Countries invest in cross-border collaborations to improve regional connectivity. Advanced management systems ensure smoother integration of long-distance and regional networks. Urbanization creates demand for faster mobility solutions, reinforcing the role of high-speed rail. Network expansion strengthens global competitiveness of modern rail operators.

Growing Emphasis on Passenger-Centric Innovations

Passenger experience becomes a central trend in the High Speed Railway Management System Market. It introduces smart ticketing, mobile applications, and digital passenger information systems. Real-time updates improve travel planning and enhance trust in rail services. AI-powered analytics allow operators to manage passenger flow and reduce congestion. Advanced safety features increase confidence among travelers. The focus on comfort, reliability, and seamless digital services drives greater adoption of high-speed rail travel.

Market Challenges Analysis

High Implementation Costs and Infrastructure Complexity

The High Speed Railway Management System Market faces challenges due to high implementation and maintenance costs. Building and modernizing railway infrastructure demands substantial capital investment, which limits adoption in cost-sensitive regions. It requires integration of advanced signaling, communication, and monitoring systems that increase financial burden. Long project timelines create further difficulties for governments and private operators. Complex coordination among multiple stakeholders slows down deployment. High costs and resource intensity restrict expansion, particularly in emerging economies.

Technical Limitations and Cybersecurity Risks

The High Speed Railway Management System Market also encounters risks linked to technology and security. It relies heavily on advanced digital platforms, which expose networks to cyberattacks. Protecting data integrity and ensuring system resilience remain critical concerns. Technical failures or integration errors can disrupt operations and compromise passenger safety. Standardization across regions remains limited, making interoperability a challenge for cross-border networks. Shortages of skilled professionals hinder effective system management. These issues create barriers to smooth and secure implementation of high-speed railway systems.

Market Opportunities

Expansion of Global High-Speed Rail Networks

The High Speed Railway Management System Market holds strong opportunities with the rapid expansion of rail infrastructure worldwide. Countries across Asia, Europe, and the Middle East continue to invest in large-scale high-speed corridors to connect major cities. It supports operational excellence through advanced signaling, scheduling, and monitoring technologies. Growing demand for cross-border connectivity creates prospects for systems that ensure interoperability. Rising urbanization and population density further strengthen the need for efficient high-speed solutions. Strategic investments in infrastructure open avenues for advanced management system providers.

Adoption of Smart and Sustainable Technologies

The High Speed Railway Management System Market benefits from opportunities linked to digital and eco-friendly technologies. It enables adoption of AI-driven analytics, IoT-based monitoring, and cloud-integrated platforms to improve efficiency. Demand for smart ticketing, passenger information systems, and predictive maintenance tools enhances system value. Green initiatives promote sustainable railway operations, positioning high-speed systems as low-carbon transport alternatives. Operators seek energy-efficient solutions that align with climate goals and regulatory requirements. Integration of intelligent technologies and eco-friendly practices creates long-term growth opportunities for market players.

Market Segmentation Analysis:

By Deployment Model

The High Speed Railway Management System Market demonstrates clear differentiation across deployment models. On-premise solutions hold strong presence due to higher control, customization, and security. Many operators prefer them for critical infrastructure where reliability and data protection remain essential. Cloud-based models gain rapid traction with lower upfront costs, scalability, and seamless integration with digital platforms. It enables remote monitoring, predictive maintenance, and real-time analytics, making them attractive for modernization projects. Hybrid approaches emerge as a balanced option, offering cost efficiency while maintaining robust safety standards.

- For instance, Alstom’s Avelia Horizon high-speed trainsets deliver 8 megawatts of power, reach up to 350 km/h in design speed, and achieve over 30% lower maintenance costs through remote diagnostics. Depending on the comparison point, it also uses recyclable materials to reduce its carbon footprint by around 32-37% compared to previous generations, according to company information.

By Operating System

The High Speed Railway Management System Market records diverse adoption across operating systems. Linux holds a leading role with its flexibility, open-source framework, and enhanced security features. QNX remains important for real-time operations, particularly in safety-critical signaling and monitoring. VxWorks supports applications requiring high performance and fault tolerance. Other operating systems, though limited in use, serve niche needs driven by regional compliance or customization. It ensures operators select platforms that align with interoperability requirements and performance benchmarks. The mix of systems provides opportunities for innovation and integration.

- For instance, ABB’s Rolling Stock portfolio includes traction systems spanning from a few 100 kilowatts up to more than 7 megawatts, deployed in high-speed, intercity, and locomotive applications.

By Technology

The High Speed Railway Management System Market grows strongly with advancements in control technologies. Communication-based Train Control (CBTC) dominates with its ability to deliver real-time train-to-control center communication. It improves safety, reduces train headways, and raises network capacity on congested corridors. The European Train Control System (ETCS) gains prominence in Europe and beyond due to its role in standardizing cross-border networks. Automatic Train Operation (ATO) supports automation by reducing human error and improving operational efficiency. It works in combination with CBTC and ETCS to enable driverless train systems. Advanced control technologies position rail operators to manage future demand with higher efficiency.

Segments:

Based on Deployment Model:

Based on Operating System:

Based on Technology:

- Communication-based Train Control (CBTC)

- European Train Control System (ETCS)

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 20% share of the high-speed railway management system market. The United States and Canada are key contributors, with projects focused on modernizing existing rail networks and introducing new high-speed corridors. The region’s governments have allocated large budgets for infrastructure upgrades, particularly in rail signaling, communication, and traffic control systems. The growing need for safe and efficient transportation has increased demand for advanced management solutions. Efforts to reduce carbon emissions and promote public transport also support this adoption. The integration of digital monitoring and predictive maintenance technologies further strengthens the role of high-speed railway management systems in the region.

Europe

Europe holds 25% share of the global market. France, Germany, Spain, and Italy represent the largest high-speed rail networks in the region. The European Union strongly supports rail projects through investments and regulatory policies. Adoption of the European Train Control System (ETCS) and European Rail Traffic Management System (ERTMS) ensures interoperability across countries, driving steady demand. Europe also focuses on upgrading legacy systems to improve efficiency, reliability, and passenger safety. Sustainability goals, combined with rising passenger traffic, have reinforced the adoption of advanced railway management systems. Countries in Western and Central Europe remain leaders, while Eastern Europe shows gradual expansion through modernization projects.

Asia Pacific

Asia Pacific dominates with 45% share, making it the largest regional market. China leads globally with its massive high-speed rail network, which exceeds 40,000 kilometers and continues to expand. Japan also remains an innovator, with Shinkansen lines driving early adoption of advanced control systems. India and South Korea are investing heavily in new projects to expand connectivity and ease congestion. Governments in the region prioritize efficient passenger management, predictive maintenance, and digital signaling technologies. Rapid urbanization, rising population, and strong public funding accelerate market growth. Asia Pacific is also the fastest-growing region, supported by continuous infrastructure investments and high passenger demand for faster travel.

Latin America

Latin America represents 5% share of the market. High-speed rail projects remain limited in the region, but growing interest is evident. Brazil and Argentina are exploring high-speed connections to improve urban and intercity mobility. Most investments are still at the planning or pilot stage, which keeps the regional share relatively small. However, modernization of existing rail lines and government focus on sustainable transport may gradually increase adoption. Latin America’s market is expected to progress steadily, supported by urban growth and the need for efficient long-distance connectivity.

Middle East & Africa

The Middle East & Africa account for 5% share of the high-speed railway management system market. Saudi Arabia’s Haramain High-Speed Railway is a landmark project, linking Mecca and Medina. The UAE has invested in Etihad Rail, which is expanding across the region. Governments in MEA are prioritizing large infrastructure projects to diversify economies and improve connectivity. Adoption of smart signaling, advanced traffic management, and safety systems is rising in these projects. Africa is still at an early stage, with South Africa showing interest in modernization. Overall, MEA remains a smaller market but shows strong growth potential with ongoing and planned rail initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The High Speed Railway Management System Market players such as CRRC Corporation, Cisco Systems, Honeywell International, Thales Group, Hitachi, Huawei Technologies, IBM Corporation, Alstom, Siemens, ABB Group. The high-speed railway management system market shows intense competition driven by technological innovation and regional expansion. Companies focus on delivering advanced signalling, predictive maintenance, and integrated control platforms that ensure safety and operational efficiency. Strong emphasis is placed on interoperability, cybersecurity, and lifecycle cost management as rail networks adopt digital solutions. The market also reflects a shift toward IoT, AI, and cloud-based platforms to enable real-time monitoring and data-driven decision-making. Regional differences in regulation and infrastructure maturity create opportunities for firms that can adapt their systems to diverse standards and operational needs.

Recent Developments

- In October 2024, Hitachi Rail was selected to implement a Mobility-as-a-Service (MaaS) solution for Etihad Rail, which is responsible for developing and operating the UAE’s National Railway Network. This initiative will cover a 900-kilometer railway stretching from Ghuweifat, near the Saudi border, to Fujairah, providing an integrated digital platform aimed at enhancing passenger mobility.

- In September 2024, Indra entered into a collaboration with Lithuanian Railways to develop a pioneering digital signalling interlocking system. The primary goal is to create a digital interlocking device that adheres to open standards and is compatible with the European ERTMS Level-2 signalling system.

- In July 2024, the ETR 400 high-speed trains, specifically the Frecciarossa 1000 model, are currently undergoing testing at the Velim test centre in the Czech Republic. This testing involves a second unit from a new batch ordered by Trenitalia, the Italian State Railways subsidiary.

- In November 2023, Hyundai Rotem officially launched the KTCS-2 (Korean Train Control System 2) along the 180-kilometer Jeolla Line in South Korea. This system represents a significant advancement in train management and safety, utilizing LTE-R wireless technology for real-time communication.

Report Coverage

The research report offers an in-depth analysis based on Deployment Model, Operating System, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as countries invest in high-speed rail infrastructure.

- Digital signalling systems will become standard for ensuring safety and efficiency.

- Cloud-based platforms will gain adoption for flexible and scalable system management.

- Artificial intelligence will drive predictive maintenance and reduce downtime.

- Cybersecurity solutions will strengthen to protect critical railway networks.

- IoT integration will enable real-time monitoring of trains and infrastructure.

- Governments will push for regulatory compliance and international interoperability standards.

- Partnerships between technology firms and rail operators will increase for system integration.

- Energy-efficient systems will gain traction to align with sustainability goals.

- Emerging economies will drive demand as they expand modern rail networks.