Market Overview

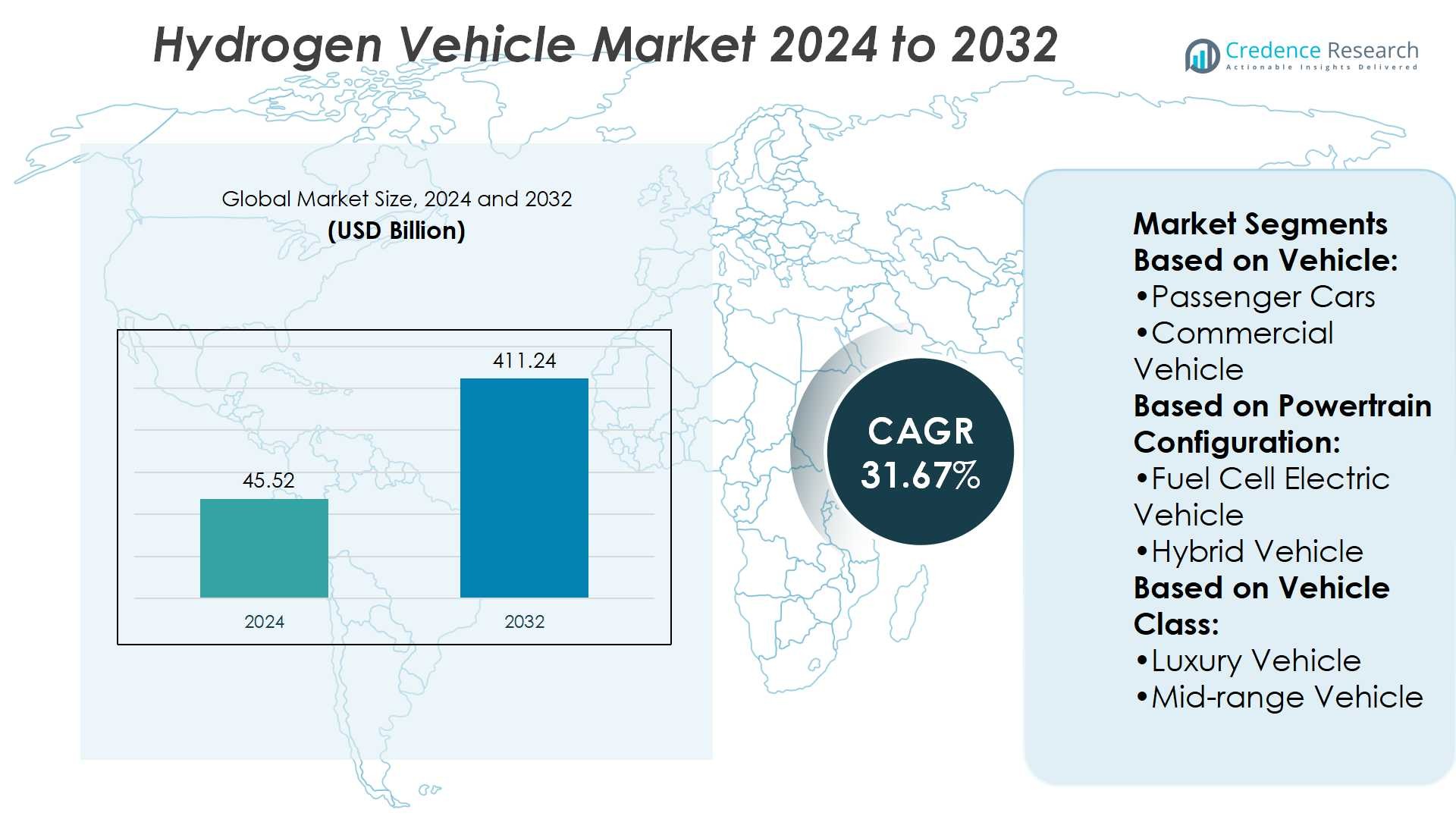

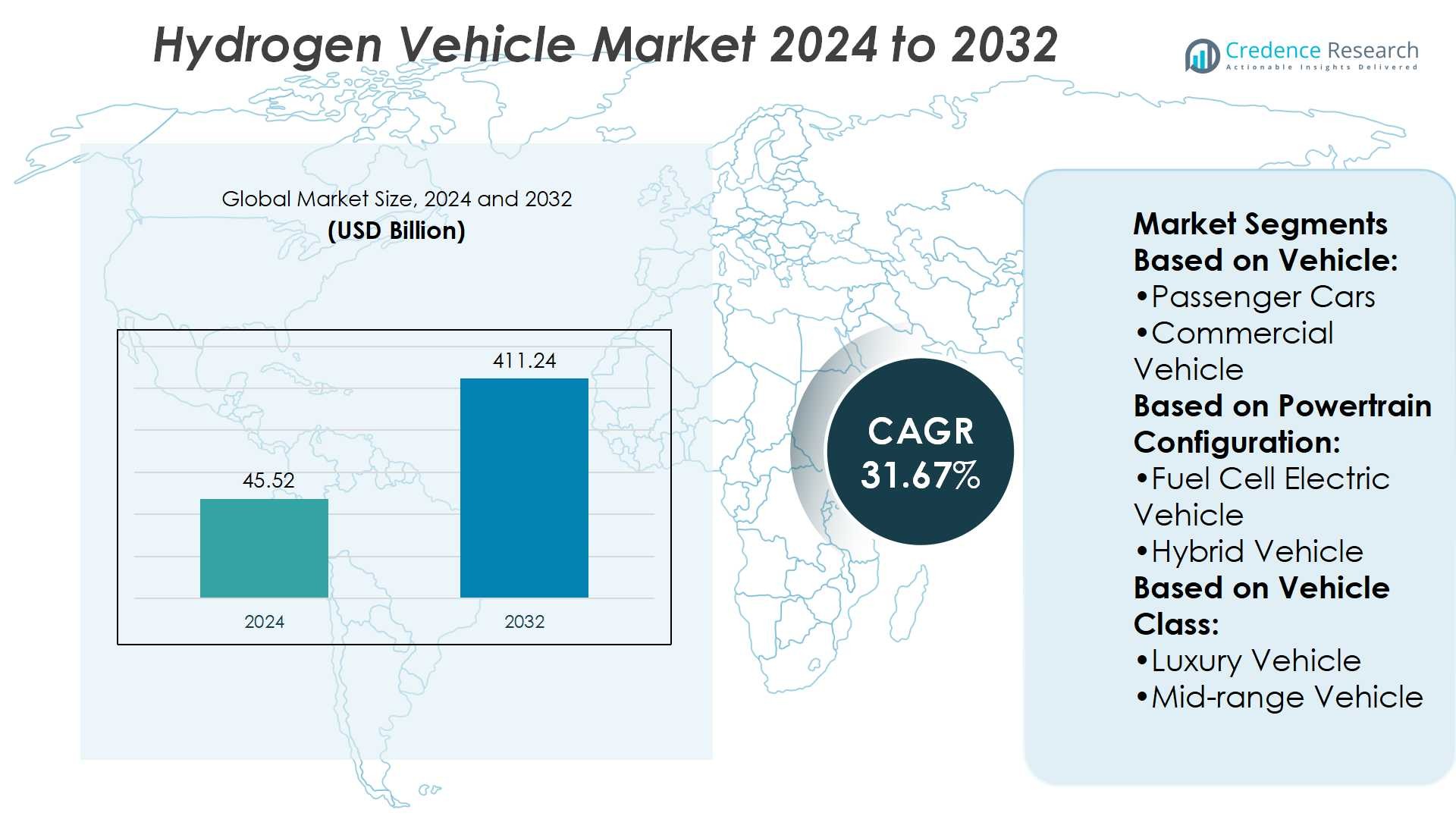

Hydrogen Vehicle Market size was valued at USD 45.52 billion in 2024 and is anticipated to reach USD 411.24 billion by 2032, at a CAGR of 31.67% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Hydrogen Vehicle Market Size 2024 |

USD 45.52 Billion |

| Hydrogen Vehicle Market, CAGR |

31.67% |

| Hydrogen Vehicle Market Size 2032 |

USD 411.24 Billion |

The Hydrogen Vehicle Market grows through strong drivers and evolving trends that reshape mobility. Rising demand for zero-emission transport, government incentives, and investments in refueling infrastructure support rapid adoption. It benefits from technological advancements in fuel cell efficiency, lightweight storage systems, and cost reduction initiatives. Partnerships between automakers, energy firms, and policymakers enhance deployment and supply chain stability. Growing fleet adoption in logistics, buses, and heavy-duty vehicles highlights hydrogen’s operational advantages. Expansion of renewable hydrogen production strengthens sustainability credentials. These combined drivers and trends position hydrogen vehicles as a critical component of global clean transportation strategies.

The Hydrogen Vehicle Market shows strong geographical diversity, with Asia Pacific leading due to large-scale adoption in Japan, South Korea, and China. Europe follows with policy-driven growth, while North America advances through infrastructure investment and fleet trials. Latin America, the Middle East, and Africa remain early-stage but show emerging potential. Key players driving this market include Ballard Power Systems, BMW, Daimler AG, Honda, Hyundai, ITM Power, Linde plc, Nel Hydrogen, Nikola Corporation, and Plug Power Inc.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Hydrogen Vehicle Market size was USD 45.52 billion in 2024 and will reach USD 411.24 billion by 2032, at a CAGR of 31.67%.

- Rising demand for zero-emission transport and supportive government incentives drive strong adoption.

- Technological advancements in fuel cell efficiency and lightweight storage systems improve performance and reduce costs.

- Competitive landscape includes automakers, energy firms, and technology providers collaborating to scale production.

- High production costs and limited refueling infrastructure remain key restraints to broader adoption.

- Asia Pacific leads with Japan, South Korea, and China driving large-scale deployment, while Europe and North America show steady growth.

- Latin America, the Middle East, and Africa are early-stage markets with emerging potential for hydrogen mobility.

Market Drivers

Rising Demand for Zero-Emission Transportation

The Hydrogen Vehicle Market benefits from the increasing demand for zero-emission mobility. Governments implement stricter emission regulations, pushing manufacturers to explore cleaner alternatives. It offers a strong advantage by producing only water vapor during operation. This unique feature positions hydrogen vehicles as a credible replacement for combustion engines in heavy-duty transport. Public concern over climate change accelerates the interest in sustainable mobility solutions. Together, these factors strengthen the market’s growth trajectory.

- For instance, Plug Power operates hydrogen plants in Georgia, Tennessee, and Louisiana that jointly produce 40 tons of liquid hydrogen per day. For instance, its Woodbine, Georgia facility alone produced a record 300 metric tons of liquid hydrogen.

Expanding Infrastructure and Refueling Networks

The development of hydrogen refueling infrastructure supports the expansion of the Hydrogen Vehicle Market. National and regional governments invest in hydrogen corridors and station rollouts to increase accessibility. It enables faster adoption by addressing range anxiety and convenience concerns. Industry collaborations between automakers and energy companies enhance network availability. Expanding infrastructure not only improves user confidence but also attracts new investors. Strategic initiatives highlight the market’s growing ecosystem.

- For instance, BMW’s Leipzig plant operates five hydrogen refueling stations on-site and over 200 hydrogen-powered industrial trucks in its logistics fleet. This pilot setup tests real-world operations and rapid turnaround, enhancing infrastructure readiness.

Strong Investments in Research and Development

Continuous advancements in fuel cell technology drive the Hydrogen Vehicle Market forward. Automakers and technology companies allocate significant resources to improve efficiency and reduce costs. It results in lighter, more durable, and higher-performance systems for commercial and passenger vehicles. Enhanced stack durability increases vehicle lifespan, making adoption more attractive. Companies also focus on reducing platinum content in catalysts, lowering production expenses. This steady improvement cycle accelerates market readiness.

Growing Role in Heavy-Duty and Long-Distance Applications

The Hydrogen Vehicle Market gains traction in heavy-duty transport and long-haul mobility. Hydrogen vehicles offer quicker refueling compared to battery-electric options, providing operational efficiency. It gives fleet operators a practical solution for continuous operation without long downtimes. The higher energy density of hydrogen enables extended driving ranges, supporting logistics and freight. These advantages make hydrogen vehicles especially relevant for buses, trucks, and commercial fleets. Market opportunities expand as industries adopt hydrogen for reliable large-scale operations.

Market Trends

Rising Integration of Hydrogen Vehicles in Public and Commercial Fleets

The Hydrogen Vehicle Market shows a clear trend toward public transit and commercial adoption. Cities deploy hydrogen buses to cut emissions and meet sustainability targets. It offers long range and fast refueling, making it suitable for high-frequency routes. Logistics firms explore hydrogen trucks for long-haul operations, reducing dependence on diesel. Global pilot projects validate performance in real-world environments, boosting confidence. The shift toward fleet integration strengthens long-term market acceptance.

- For instance, Nel supplies electrolysers producing ~400 kg/day hydrogen in offshore trials—enough to power about ten buses.This refers to a 1.25 MW electrolyser deployed in the North Sea’s PosHYdon pilot, generating ~400 kg of hydrogen daily, supporting about 10 urban buses.

Growing Partnerships Across Automotive and Energy Sectors

Collaboration between automakers, energy providers, and governments is shaping the Hydrogen Vehicle Market. Partnerships focus on co-developing refueling infrastructure and advancing fuel cell technology. It ensures consistent investment and coordinated progress across the supply chain. Joint ventures aim to cut production costs and improve vehicle affordability. Cross-industry cooperation also accelerates regulatory approvals and standardization. This growing ecosystem marks a strategic trend that supports wider adoption.

- For instance, Hyundai operated its FCEV coach bus UNIVERSE up to 2,080 m altitude on 24% gradients in NEOM. This high-altitude trial confirmed vehicle reliability in steep, mountainous terrain.

Technological Innovations in Fuel Cell and Storage Systems

Technological advancement is a defining trend in the Hydrogen Vehicle Market. Companies work on lightweight tanks, higher-pressure storage, and durable fuel cell stacks. It enhances efficiency, reduces maintenance needs, and extends driving range. New materials and designs decrease reliance on rare metals, lowering costs. Breakthroughs in modular systems enable flexibility for both passenger cars and heavy-duty vehicles. Continuous innovation keeps the market competitive against battery-electric alternatives.

Expansion of Hydrogen Production from Renewable Sources

The Hydrogen Vehicle Market benefits from the expansion of renewable hydrogen production. Governments and companies invest in green hydrogen projects powered by wind, solar, and hydropower. It reduces the carbon footprint of hydrogen vehicles, strengthening their environmental value. Large-scale electrolyzer installations improve availability and reduce reliance on fossil-based hydrogen. Renewable sourcing aligns with global decarbonization goals and energy transition strategies. This trend reinforces hydrogen vehicles as a long-term sustainable mobility option.

Market Challenges Analysis

High Costs and Limited Infrastructure Development

The Hydrogen Vehicle Market faces challenges from high production costs and limited refueling networks. Fuel cell systems require expensive materials and complex manufacturing processes, keeping vehicle prices elevated. It restricts affordability for mass consumers and slows adoption. Infrastructure remains underdeveloped, with a low number of hydrogen stations compared to traditional fuels. The uneven distribution of refueling points limits convenience for users in many regions. High capital requirements for station deployment further delay expansion. These factors together hinder market scalability.

Technical Barriers and Competitive Pressure from Alternatives

Technical hurdles create another set of challenges for the Hydrogen Vehicle Market. Fuel cell durability, efficiency, and hydrogen storage safety require continuous improvement. It raises concerns for long-term reliability, particularly in demanding applications. Battery-electric vehicles gain stronger momentum due to broader charging infrastructure and declining battery costs. Their faster adoption pace creates competitive pressure for hydrogen vehicles. Public perception also remains cautious, with limited awareness of hydrogen’s safety and benefits. Addressing these barriers is essential to unlock broader market growth.

Market Opportunities

Expanding Role in Heavy-Duty and Long-Distance Transportation

The Hydrogen Vehicle Market holds strong opportunities in heavy-duty and long-distance segments. Hydrogen vehicles provide extended driving ranges and fast refueling, making them suitable for logistics, buses, and freight transport. It addresses operational needs where battery-electric vehicles face limitations. Fleet operators value the efficiency and minimal downtime hydrogen offers for continuous use. Governments promote hydrogen adoption through subsidies, creating a favorable environment for large-scale deployment. Rising demand for sustainable freight solutions strengthens the case for hydrogen integration. This creates a clear growth path for commercial mobility.

Growth Potential through Renewable Hydrogen and Global Collaboration

The Hydrogen Vehicle Market benefits from the expansion of renewable hydrogen production. Green hydrogen projects powered by solar, wind, and hydropower enhance sustainability and reduce lifecycle emissions. It positions hydrogen vehicles as a critical tool in decarbonization strategies. International partnerships between automakers, energy firms, and policymakers accelerate infrastructure rollout and technology adoption. Strong government support, tax incentives, and research funding improve industry readiness. Developing economies present further opportunities as they expand clean energy investments. Together, these factors create a promising landscape for hydrogen vehicles worldwide.

Market Segmentation Analysis:

By Vehicle

The Hydrogen Vehicle Market divides into passenger cars and commercial vehicles, each showing distinct growth patterns. Passenger cars attract early adopters interested in sustainable mobility, supported by government incentives and growing urban awareness. It offers convenience with shorter refueling times compared to electric charging, improving daily usability. Commercial vehicles, including buses, trucks, and logistics fleets, represent the largest potential due to long-range capabilities. Companies seek hydrogen-powered options to reduce emissions in freight and public transit sectors. Strong adoption in this category highlights hydrogen’s role in industrial-scale mobility solutions.

- For instance, Ballard’s FCmove®-XD module delivers 120 kW in a 0.36 kW/L volumetric power density, runs over 30,000 hours, and achieves >98% uptime in service. This engine, used in heavy-duty trucks and buses, achieves industry-leading power density at 0.36 kW per liter, sustains over 30,000 operational hours.

By Powertrain Configuration

Segmentation by powertrain includes fuel cell electric vehicles (FCEVs) and hybrid hydrogen vehicles. FCEVs dominate due to their zero tailpipe emissions and ability to achieve ranges comparable to combustion engines. It provides efficient performance while ensuring sustainability goals are met across major markets. Hybrid hydrogen vehicles integrate fuel cells with secondary power sources, offering greater flexibility and efficiency. This segment appeals to regions where hydrogen infrastructure remains limited, extending operational reach. Advancements in powertrain durability and cost reduction continue to strengthen adoption rates across both categories.

- For instance, Nikola’s Tre FCEV pairs a 200 kW fuel-cell module with 70 kg H₂ and a 164 kWh battery, delivering up to 500 miles and refuels in under 20 minutes.

- The fuel cell powertrain combines a 200 kW module, uses 70 kg hydrogen storage, integrates a 164 kWh battery, achieves a range of approximately 500 miles per refuel, and supports fueling in less than 20 minutes.

By Vehicle Class

Vehicle class segmentation highlights adoption across luxury, mid-range, and economy categories. Luxury vehicles lead the segment, driven by premium features and strong focus on sustainability branding. It enables manufacturers to showcase advanced fuel cell systems while targeting high-income consumers. Mid-range vehicles gain traction as infrastructure improves, offering a balance of affordability and range. Economy vehicles remain limited due to high production costs, though future cost reductions may enable expansion. The distribution across classes shows how hydrogen adoption starts at premium levels and gradually scales down.

Segments:

Based on Vehicle:

- Passenger Cars

- Commercial Vehicle

Based on Powertrain Configuration:

- Fuel Cell Electric Vehicle

- Hybrid Vehicle

Based on Vehicle Class:

- Luxury Vehicle

- Mid-range Vehicle

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 18% of the Hydrogen Vehicle Market in 2023. The United States leads with strong government incentives, clean energy funding, and hydrogen corridor projects. It benefits from public-private partnerships that expand fueling infrastructure and support fleet adoption. Canada contributes with hydrogen bus and truck programs in major cities. Refueling networks grow steadily, but infrastructure density remains lower than Asia. Automakers focus on heavy-duty transport, where hydrogen shows greater advantage. This regional share is expected to rise as investments accelerate.

Europe

Europe accounts for 22% of the Hydrogen Vehicle Market in 2023. Germany, France, and the UK dominate demand due to clean transport policies and investment in hydrogen refueling. It benefits from the European Union’s Hydrogen Strategy, which funds large-scale mobility projects. Fuel cell buses and delivery fleets expand rapidly across urban centers. Regional governments prioritize decarbonization goals, boosting adoption in both passenger and commercial vehicles. Collaboration between automakers and energy firms strengthens the supply chain. Europe’s regulatory environment ensures stable growth.

Asia Pacific

Asia Pacific dominates with 51% share of the Hydrogen Vehicle Market in 2023. Japan, South Korea, and China drive growth with large-scale adoption programs and long-term hydrogen roadmaps. It has the most developed refueling networks, with thousands of hydrogen stations under construction or planned. Automakers like Toyota and Hyundai introduce new models and scale production. China pushes heavy-duty hydrogen trucks for logistics and industrial use. Regional governments invest heavily in green hydrogen to support sustainability. Asia Pacific maintains the clear leadership position worldwide.

Latin America

Latin America represents 5% of the Hydrogen Vehicle Market in 2023. Chile leads with national strategies and pilot projects that focus on renewable hydrogen. It positions itself as a regional hub for hydrogen production, supported by solar and wind capacity. Brazil shows interest in fuel cell buses for urban transport. It remains at a small scale but demonstrates strong long-term potential. Infrastructure limitations and high costs delay broader adoption. Market growth depends on international partnerships and government incentives.

Middle East & Africa

The Middle East & Africa together hold 4% of the Hydrogen Vehicle Market in 2023. Gulf nations invest in hydrogen mobility to diversify energy and reduce emissions. It includes pilot programs for hydrogen buses and trucks linked with green hydrogen projects. South Africa explores hydrogen mobility with support from local mining companies. Limited infrastructure keeps adoption at an early stage. Governments view hydrogen as a way to strengthen clean transport and attract investment. Growth remains gradual but strategic.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Hydrogen Vehicle Market features players include Ballard Power Systems, BMW, Daimler AG (Mercedes-Benz), Honda Motor Co., Ltd, Hyundai Motor Company, ITM Power, Linde plc, Nel Hydrogen, Nikola Corporation, and Plug Power Inc. The Hydrogen Vehicle Market shows increasing competition driven by innovation, partnerships, and infrastructure development. Companies invest in advanced fuel cell technology, hydrogen production, and refueling networks to gain a competitive edge. It benefits from supportive policies and sustainability targets that accelerate adoption across passenger and commercial segments. Firms prioritize reducing costs, improving fuel cell durability, and expanding supply chains to strengthen their market position. Strategic alliances between automotive and energy sectors foster large-scale deployment and enhance reliability. The competitive landscape continues to evolve as participants scale production and broaden applications in heavy-duty and long-distance transport.

Recent Developments

- In October 2024, Hyundai unveiled its INITIUM hydrogen fuel cell electric vehicle (FCEV) concept, showcasing its new design language, “Art of Steel.” The concept previews a new production FCEV set to launch in the first half of 2025.

- In May 2024, Symbio unveiled a hydrogen-powered, regional-haul Class 8 truck engineered and assembled by the company in California. This truck is equipped with advanced EV-specific tires from Michelin, promising enhanced fuel efficiency and reduced wear.

- In May 2024, Volvo Trucks announced its development of hydrogen-powered trucks with combustion engines, with on-road testing scheduled to commence in 2026 and a commercial launch planned for the end of the decade. Utilizing green hydrogen, Volvo seeks to further its net zero ambitions and assist customers in reaching their decarbonization goals.

- In March 2024, Mannok announced a strategic partnership with Hydrogen Vehicle Systems (HVS) to initiate a pioneering trial of hydrogen fuel cell trucks. As the UK’s first hydrogen fuel cell truck OEM, HVS will collaborate with Mannok to integrate hydrogen fuel cell HGVs into their fleet.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Powertrain Configuration, Vehicle Class and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Hydrogen Vehicle Market will expand with stronger adoption in heavy-duty transport fleets.

- Infrastructure growth will improve refueling convenience and support higher consumer confidence.

- Green hydrogen production will strengthen sustainability and reduce lifecycle emissions.

- Automakers will launch more fuel cell models across passenger and commercial categories.

- Cost reduction in fuel cell systems will improve affordability and drive wider adoption.

- International collaborations will accelerate infrastructure rollout and technology development.

- Governments will increase incentives and policy support for zero-emission vehicles.

- Fleet operators will prioritize hydrogen vehicles for long-range and continuous operations.

- Advances in storage and fuel cell durability will extend vehicle lifespan and efficiency.

- The market will see stronger integration with renewable energy projects worldwide.