Market Overview

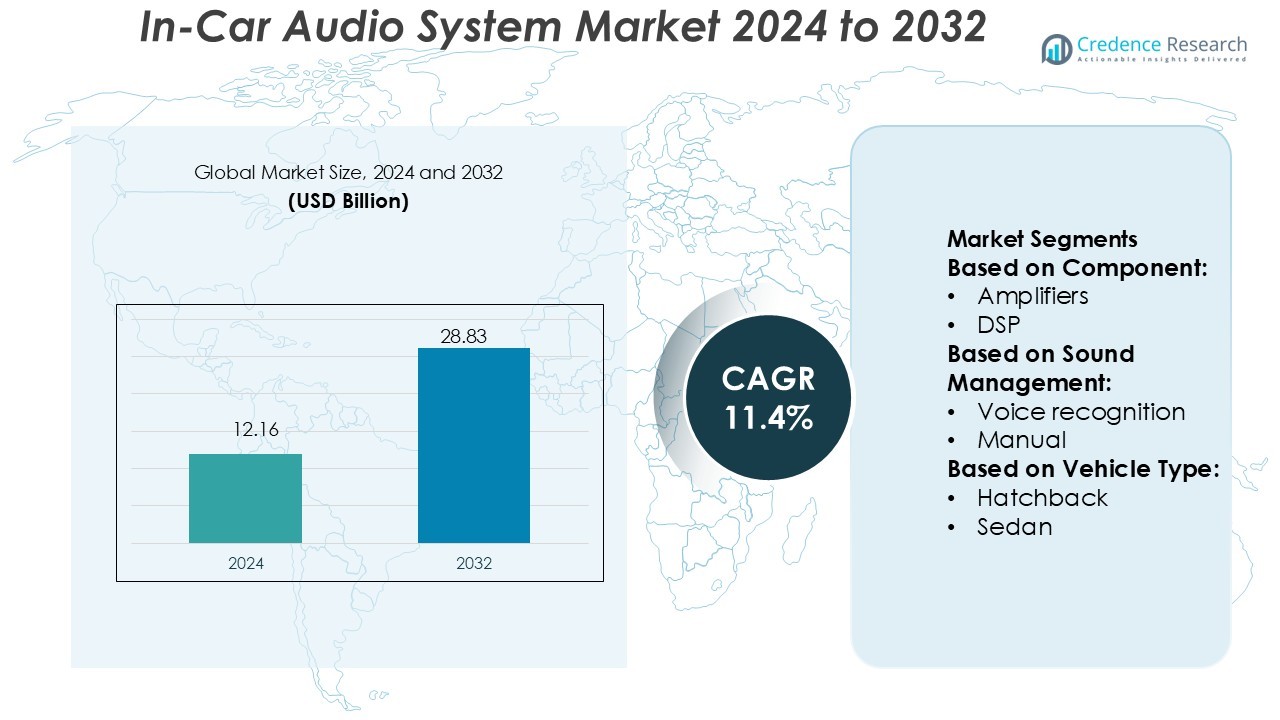

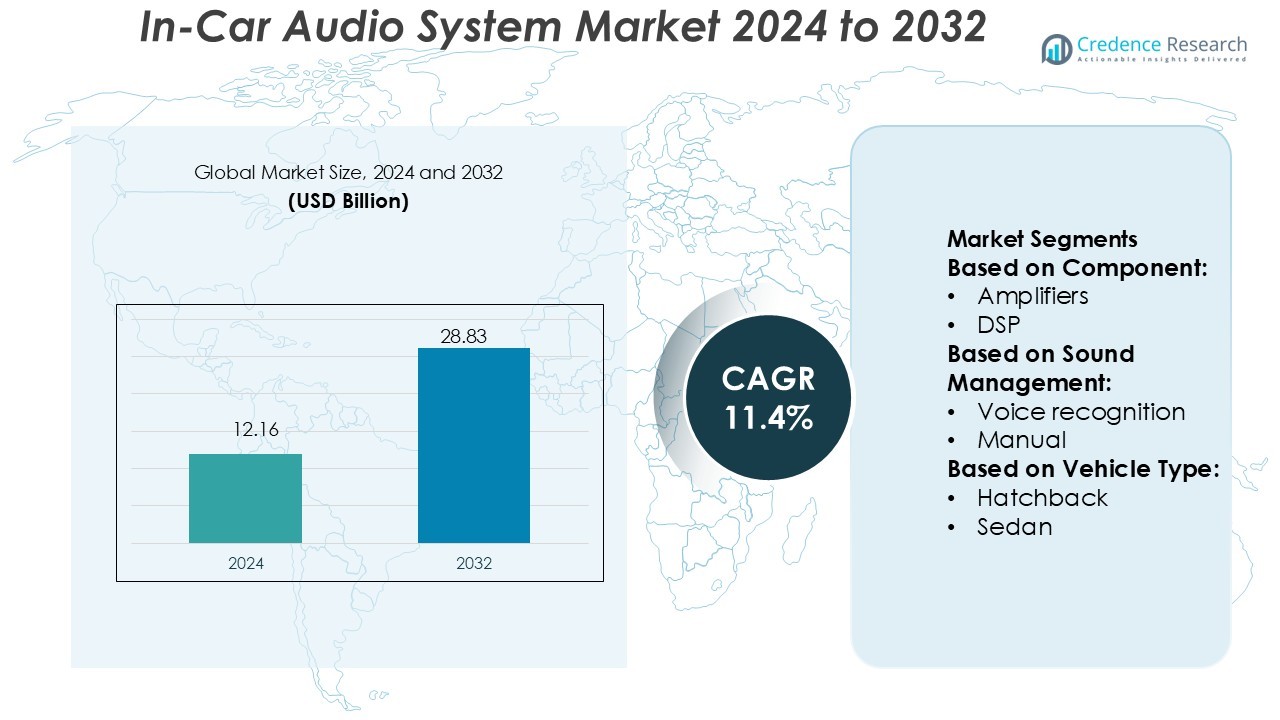

In-Car Audio System Market size was valued USD 12.16 billion in 2024 and is anticipated to reach USD 28.83 billion by 2032, at a CAGR of 11.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| In-Car Audio System Market Size 2024 |

USD 12.16 Billion |

| In-Car Audio System Market, CAGR |

11.4% |

| In-Car Audio System Market Size 2032 |

USD 28.83 Billion |

The In-Car Audio System Market features strong competition from companies offering multi-speaker setups, DSP software, amplifiers, and wireless connectivity solutions. Vendors provide branded surround sound, voice-controlled infotainment, and smartphone integration for sedans, SUVs, and electric vehicles. Players compete through OEM partnerships, product innovation, and lightweight acoustic materials that enhance energy efficiency. North America leads the global market with a 32% share, supported by high adoption of premium vehicles, connected car features, and luxury infotainment systems. Continuous upgrades in EV models, app-based controls, and noise-reduction technologies further strengthen the region’s leadership in advanced automotive audio solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market was valued at USD 12.16 billion in 2024 and will reach USD 28.83 billion by 2032 at a CAGR of 11.4%.

- Rising interest in premium audio, smartphone connectivity, and voice-controlled infotainment drives strong demand across sedans, SUVs, and EVs.

- Multi-speaker systems and DSP-based sound management remain dominant, while wireless streaming and app-based personalization create new growth opportunities.

- Strong competition focuses on branded surround sound, lightweight speaker materials, and OEM partnerships, while high costs of premium systems limit adoption in value segments.

- North America leads with 32% share as the largest region, Asia Pacific holds the fastest growth, and multi-speaker systems secure the top segment share due to higher installation in mid-range and luxury vehicles.

Market Segmentation Analysis:

By Component

Speakers lead the component segment with the highest market share due to strong demand for premium sound quality in modern vehicles. Within speakers, 2-way models dominate because they balance clarity, bass response, and affordability for mass-market deployments. Automakers integrate compact coaxial units to reduce space while improving audio dispersion. Rising adoption of connected infotainment systems and smartphone integration further supports speaker consumption. DSP units are gaining traction as buyers expect immersive sound tuning and noise cancellation. Microphones and tuners also grow as voice-enabled assistants, hands-free calling, and satellite radio become standard features in many mid-range cars.

- For instance, Burmester’s premium audio systems, such as the Burmester 3D Surround Sound System, are integrated into high-end vehicles like the Mercedes-Benz S-Class, where they feature 15 speakers designed to deliver a rich and immersive audio experience.

By Sound Management

Voice recognition holds the dominant share in sound management as automakers integrate AI-based assistants to enable hands-free control for calling, navigation, and entertainment. User preference for distraction-free interfaces boosts adoption across mid-range and premium car models. Touch-free audio adjustment reduces driver fatigue and supports road-safety regulations in many countries. Manual sound control remains relevant in entry-level vehicles due to cost sensitivity, but its share continues to decline. Over-the-air software upgrades and multilingual support further expand voice recognition usage across emerging markets.

- For instance, Alpine’s PXE‑0850X digital sound processor offers 6 low and/or high‑level inputs, and provides 12 RCA outputs. It supports 25 W RMS × 8 channels (4 Ω, <1% THD+N, 14.4 V).

By Vehicle Type

Passenger vehicles represent the leading segment, contributing the largest share, driven by high production volumes of hatchbacks, sedans, and SUVs. SUVs stand out with the highest adoption of premium multi-speaker layouts, subwoofers, and branded audio systems. Automakers partner with well-known sound brands to enhance cabin acoustics and attract tech-savvy customers. In commercial vehicles, LCVs show increasing installation of basic speakers and microphones to support telematics and fleet communication. HCVs adopt sound systems at a slower pace due to lower emphasis on cabin entertainment, keeping their share comparatively smaller.

Key Growth Drivers

- Integration of Connected and Smart Features

The market grows as automotive OEMs integrate smart infotainment and connected audio features. Bluetooth, Wi-Fi, voice control, and smartphone pairing improve in-car engagement and help brands differentiate. Automakers add seamless phone mirroring and driver assistance prompts through premium speakers and onboard DSP. Growth also comes from demand for navigation alerts, advanced sound staging, and personalized listening. These upgrades strengthen user comfort and safety, encouraging higher vehicle adoption. Rising consumer preference for media streaming and voice assistants accelerates system modernization across mass and premium cars.

- For instance, Sony’s media receiver model XAV‑AX8000 features a 22.7 cm (8.95‑inch) anti‑glare touchscreen mounted on a single‑DIN chassis, with a 3‑way adjustable mount allowing ±10° tilt, 40 mm–60 mm depth adjustment, and 60 mm height variation.

- Rising Demand for Premium Vehicles and Luxury Interiors

Premium vehicles lead to higher adoption of advanced sound systems with multi-channel speakers and sub-woofers. Luxury OEMs collaborate with audio specialists and launch branded solutions that enhance cabin acoustics. Customers prefer balanced sound, vibration control, and noise reduction inside the car cabin. High spending on vehicle personalization drives upgrades from standard sound units to premium audio packages. Electric vehicles also support this demand, as silent powertrains create better acoustic environments. These factors support steady installation of 3-way and 4-way speakers, amplifiers, and digital sound processing hardware.

- For instance, Harman Kardon’s system in the Jeep Grand Cherokee uses 19 speakers and is driven by an 825-watt, 11-channel high-voltage GreenEdge™ Class-D amplifier.

- Growth of Electric and Connected Car Architecture

EV and connected-car platforms use centralized computing and digital sound management. Automakers choose modern DSP solutions for battery safety alerts, navigation cues, sensor sounds, and entertainment. Software-defined audio profiles enhance cabin experience and improve road awareness. OTA upgrades and modular hardware enable automakers to add new audio features without redesigning the vehicle. Car brands push in-car entertainment as a key selling point when competing for tech-focused buyers. The trend strengthens adoption of embedded microphones, amplifiers, and smart speaker arrays.

Key Trends & Opportunities

- Voice Assistance and AI-Based Cabin Experience

AI-driven voice controls enable hands-free operation, reducing distraction and improving safety. Car buyers expect intuitive control for music, calls, navigation, and in-car apps. Microphone arrays and noise cancellation improve recognition accuracy, even at highway speeds. Automakers integrate cloud-based voice engines and predictive suggestions for playlists or routes. The trend creates demand for advanced DSP and microphone modules. Suppliers also gain opportunities by offering voice-first audio systems for EVs, autonomous shuttles, and connected fleets.

- For instance, NXP’s new SAF9xxx audio DSP family integrates a neural‑network engine and hardware accelerators to deliver gigahertz‑level DSP performance for automotive audio and radio applications.

- Wireless Audio and App-Based Personalization

Smartphones influence how users consume music, podcasts, and streaming apps. Drivers expect fast pairing, multi-device connectivity, and customizable listening profiles. Wireless audio removes the need for physical media and strengthens demand for Bluetooth-enabled speakers, amplifiers, and tuners. App-based tuning allows users to adjust bass, treble, and equalizers through a phone interface. Carmakers also push subscription-based infotainment bundles, unlocking new software revenue. This trend encourages suppliers to provide cloud-integrated audio platforms.

- For instance, Pioneer’s Pioneer DMH‑AP6650BT features a 9‑inch WSVGA (1024 × 600 pixel) capacitive touchscreen with built‑in Bluetooth®, Wi‑Fi® (5GHz) and supports both Wireless Apple CarPlay™ and Wireless Android Auto™.

- Partnerships with Branded Audio Manufacturers

Automotive OEMs collaborate with renowned audio brands to differentiate vehicle models. Co-branded systems improve marketing value and offer immersive cabin sound. Multi-speaker setups, sub-woofers, and 3D surround solutions enhance interior luxury. The trend lifts demand for high-quality components in sedans, SUVs, and EVs. Companies invest in lightweight materials and precision tuning to reduce energy use. These partnerships open revenue opportunities across mid-range and high-end vehicle lines.

Key Challenges

- High Cost of Premium and Multi-Speaker Configurations

Premium speakers, advanced amplifiers, sub-woofers, and DSP software increase vehicle production cost. The pricing challenge is higher for mass-market cars, where buyers are price-sensitive. OEMs must balance acoustic performance and affordability, especially in emerging markets. Integrating branded systems often adds to the final retail price, limiting penetration outside the luxury segment. Suppliers need cost-efficient materials and compact architecture to maintain margins. Budget vehicles continue to rely on basic speaker units, slowing adoption of premium audio upgrades.

- Complex Integration with Modern Vehicle Electronics

In-car audio systems must connect with infotainment, sensors, telematics, and ECU controls. Software-defined platforms and digital dashboards increase integration complexity. Any compatibility failure affects connectivity, noise control, or system reliability. Automakers must ensure tuning accuracy across multiple cabin sizes and body styles. EVs also create electromagnetic interference challenges that require shielding and advanced signal processing. Suppliers face longer development cycles and strict testing, which may delay product launches.

Regional Analysis

North America

North America holds the leading share of 32% in the In-Car Audio System Market, driven by high sales of premium vehicles, strong spending power, and widespread adoption of connected car features. U.S. and Canada buyers prefer Bluetooth-enabled infotainment, voice assistance, and branded acoustic solutions. Automakers collaborate with premium audio brands to enhance cabin comfort and sound clarity. The region also benefits from high penetration of EVs and luxury SUVs that adopt multi-speaker and DSP-based systems. Major OEMs invest in smart dashboards and smartphone integration, supporting continuous demand for multi-channel speakers, amplifiers, and wireless audio solutions.

Europe

Europe accounts for 28% market share supported by strong automotive manufacturing and strict safety regulations. Germany, France, and the U.K. lead demand for vehicles with noise-reducing cabin designs and integrated DSP functions. Electric vehicle adoption enhances the listening experience due to low cabin noise, encouraging buyers to upgrade to high-quality audio. Luxury brands launch branded systems using multi-speaker arrays and 3D acoustic tuning. Advancements in voice control, navigation-linked alerts, and smartphone pairing also boost sales. Carmakers focus on lightweight and energy-efficient speaker materials to meet fuel and emission rules, lifting demand for premium sound modules in sedans and SUVs.

Asia Pacific

Asia Pacific holds 30% share and stands as the fastest-growing region due to rising vehicle production in China, Japan, India, and South Korea. Mass-market cars increasingly include Bluetooth speakers, smartphone pairing, and touchscreen infotainment, driving steady volume demand. EV manufacturing growth in China supports high adoption of multi-speaker and DSP solutions. Rising disposable income encourages mid-range and premium car buyers to choose branded audio upgrades. Local suppliers benefit from low production costs, while global brands expand partnerships with OEMs. Government incentives for electric mobility and urban transportation growth add strong opportunities for advanced cabin audio systems.

Latin America

Latin America contributes 5% share as automotive sales recover in Brazil, Mexico, and Argentina. The market focuses on compact cars and SUVs, where infotainment systems with basic speakers and Bluetooth connectivity remain popular. Consumers prioritize affordable upgrade options rather than full premium setups. However, rising smartphone usage boosts demand for wireless streaming and hands-free control. Regional OEMs add touchscreen units and app-based functions to attract younger buyers. Growth remains moderate due to inflation and cost-sensitive buying behavior, but premium installations expand slowly in urban centers through partnerships with global audio brands.

Middle East & Africa

Middle East & Africa hold 5% share supported by rising demand for SUVs, pickup trucks, and luxury imports. Countries like UAE and Saudi Arabia favor advanced infotainment with navigation, multi-speaker systems, and branded acoustic enhancements. Warm climates demand robust hardware with heat-resistant components, supporting premium material use. However, mass-market vehicles still rely on low-cost 2-way speaker units, limiting wide premium adoption. Increasing EV projects and tourism-driven automotive rentals create new opportunities for improved in-car audio quality. Partnerships with international OEMs help expand adoption of DSP-enabled speakers and voice-controlled infotainment units.

Market Segmentations:

By Component:

By Sound Management:

By Vehicle Type:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the In-Car Audio System Market players such as Premium Sound Solutions, Panasonic, Alpine Electronics, Sony, Harman, JVCKenwood, NXP Semiconductors, Pioneer, Bose, and Clarion Co. The In-Car Audio System Market remains strong, driven by rapid innovation, OEM collaborations, and rising demand for premium sound quality. Leading suppliers focus on advanced speaker arrays, digital sound processing, and noise-cancellation features to enhance cabin acoustics. Many vendors partner directly with automakers to co-engineer branded audio systems for SUVs, sedans, and electric vehicles. The shift toward wireless connectivity and app-based controls drives investments in Bluetooth modules, smart amplifiers, and cloud-linked infotainment platforms. Companies also expand their product portfolios with lightweight and energy-efficient components to meet fuel-efficiency and EV battery standards. Competition increases further as suppliers target mid-range and entry-level vehicles with affordable premium-grade speaker solutions.

Key Player Analysis

Recent Developments

- In July 2024, Allen & Heath, in collaboration with Harrison Audio, unveiled Harrison LiveTrax, a cutting-edge software tailored for multitrack recording and virtual soundchecks. Seamlessly integrating with Allen & Heath’s mixers, the software captures scene changes as timeline markers, facilitating effortless virtual soundchecks and timecode automation.

- In May 2024, Dolby Laboratories forged a partnership with VIZIO, focusing on embedding Dolby Atmos technology into VIZIO’s newly launched soundbar lineup for 2024. This collaboration builds on Dolby Vision’s recent integration into VIZIO’s entire 4K TV spectrum, promising audiences a richer visual and auditory journey.

- In March 2024, Pioneer Corporation announced it had signed an agreement with LEXUS for its Premium Sound System to be factory-installed in the 2024 LEXUS GX SUVs launched in Japan. The company also received a Special Chief Engineer (CE) Award from Toyota for designing a technologically advanced sound system for the GX.

- In February 2024, Alps Alpine North America announced an all-in-one sound system upgrade for Tesla vehicles that features a 1200W Peak power output, plug-and-play installation, and requires no custom alterations. This system is designed for Tesla owners and can be installed by those with basic DIY skills, though professional installation is also an option.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Sound Management, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow for voice-controlled infotainment and hands-free audio functions.

- Electric vehicles will boost adoption of multi-speaker and DSP-based systems.

- Wireless streaming and app-based personalization will replace traditional audio controls.

- AI-driven noise cancellation will improve cabin comfort during urban and highway travel.

- Automakers will expand partnerships with branded audio manufacturers for premium sound.

- Lightweight speaker materials will support fuel efficiency and EV battery performance.

- OTA software updates will enable new sound features without hardware changes.

- Affordable premium systems will enter mid-range vehicle segments to attract new buyers.

- Smart microphone arrays will improve voice recognition and reduce road noise.

- 3D surround sound and spatial audio effects will become common in luxury and connected cars.