Market Overview:

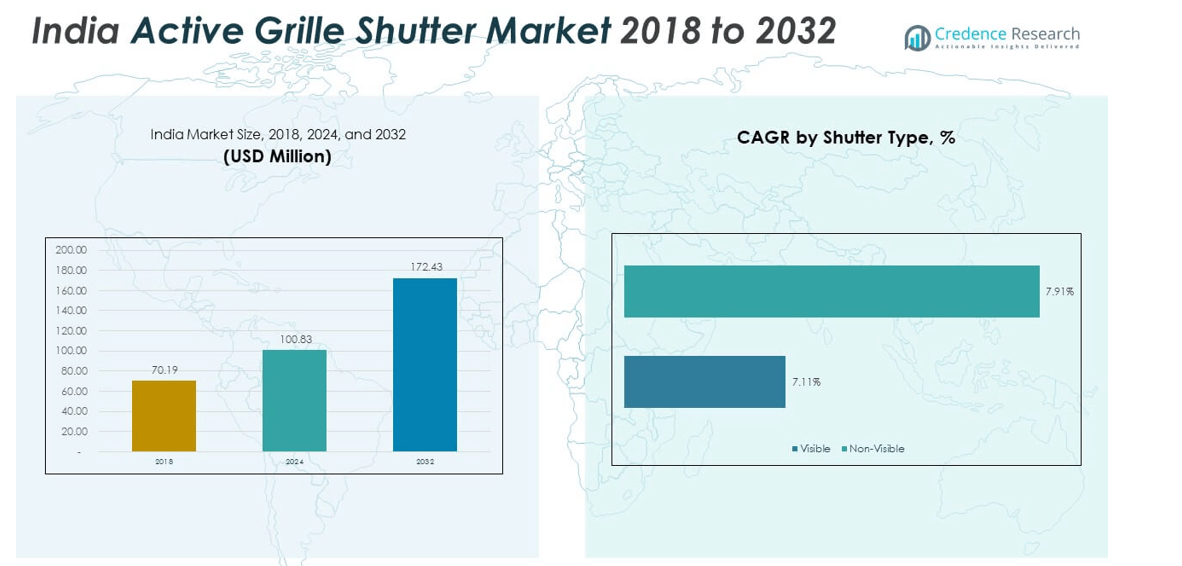

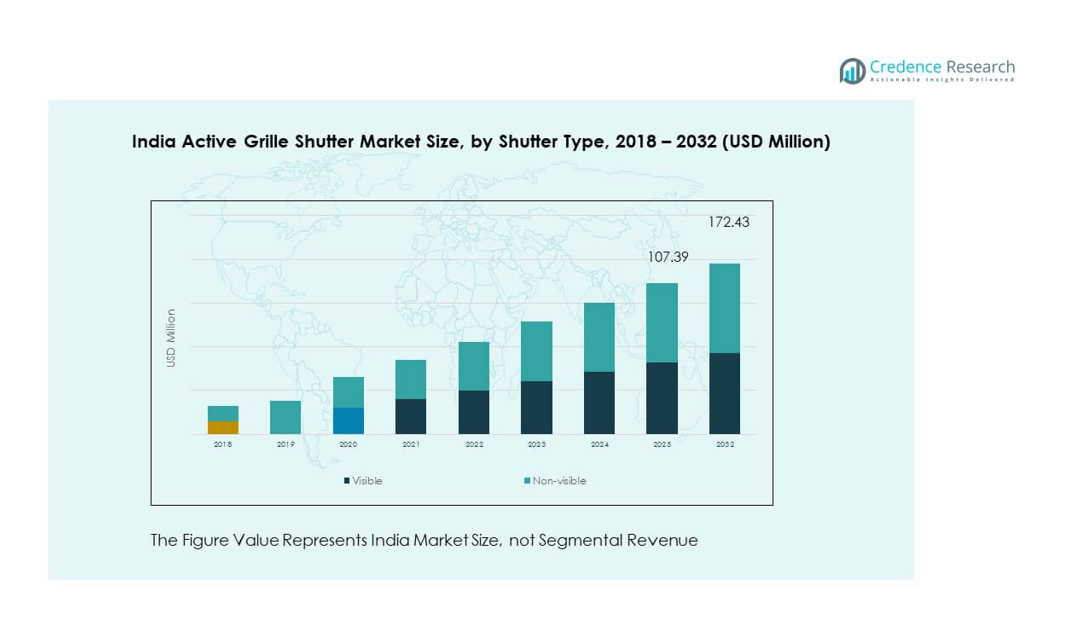

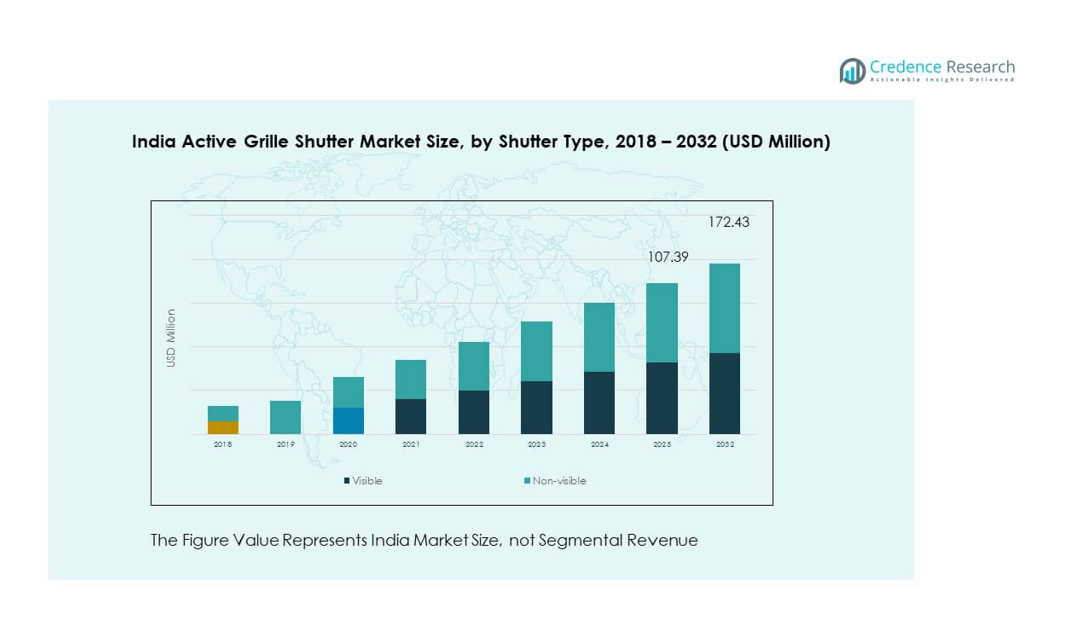

The India Active Grille Shutter Market size was valued at USD 70.19 million in 2018 to USD 100.83 million in 2024 and is anticipated to reach USD 172.43 million by 2032, at a CAGR of 7.0% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Active Grille Shutter Market Size 2024 |

USD 100.83 million |

| India Active Grille Shutter Market, CAGR |

7.0% |

| India Active Grille Shutter Market Size 2032 |

USD 172.43 million |

The market growth is driven by rising demand for fuel-efficient vehicles, regulatory pressure on emissions, and technological advancements in automotive aerodynamics. Automakers in India are integrating active grille shutter systems to enhance vehicle efficiency, improve thermal management, and reduce carbon footprints. Growing consumer preference for premium vehicles equipped with advanced energy-saving technologies is also accelerating adoption. Government policies supporting lower emissions and OEM strategies to align with global sustainability goals are further strengthening the market outlook.

Regional adoption is strongest in industrialized automotive hubs across India, with states such as Maharashtra, Tamil Nadu, and Haryana leading due to established manufacturing ecosystems. These regions house global OEMs and suppliers investing in advanced technologies to cater to domestic and export markets. Emerging regions, including Gujarat and Karnataka, are also gaining traction with rising automotive clusters and infrastructure development. Expanding EV and hybrid vehicle production in these regions is expected to boost demand for active grille shutter systems.

Market Insights:

- The India Active Grille Shutter Market was valued at USD 70.19 million in 2018, reached USD 100.83 million in 2024, and is projected to hit USD 172.43 million by 2032, growing at a CAGR of 7.0%.

- Northern and Western India held 42% share in 2024 due to strong OEM presence, Southern India accounted for 36% with robust manufacturing clusters, while Eastern and Central India stood at 22% supported by emerging industrial hubs.

- Southern India represents the fastest-growing region, holding 36% share, driven by Tamil Nadu and Karnataka’s automotive production strength and supportive policies.

- Non-visible shutters dominated the market in 2024, contributing 62% share, as they are widely integrated into mass-market vehicles for aerodynamics and fuel efficiency.

- Visible shutters accounted for 38% share, supported by premium and luxury vehicles where design appeal and performance integration play a critical role.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Focus on Fuel Efficiency and Emission Reduction

The India Active Grille Shutter Market is strongly driven by rising demand for fuel efficiency in passenger and commercial vehicles. Consumers are increasingly choosing vehicles that offer better mileage and lower fuel costs. Automakers are also under pressure to reduce overall CO₂ emissions and comply with regulatory frameworks. Active grille shutters improve aerodynamics, which directly lowers fuel consumption in vehicles across segments. These systems also play a critical role in reducing drag during high-speed driving. The Indian government’s stricter emission standards are encouraging OEMs to adopt such energy-saving technologies. Vehicle manufacturers are aligning product launches with these requirements to maintain competitiveness. Rising consumer awareness regarding sustainability is reinforcing the adoption of such advanced automotive components.

- For example, Ford equips several EcoBoost models with Active Grille Shutter technology, which improves aerodynamics by reducing drag and supports better fuel efficiency. Official Ford materials confirm its role in lowering CO₂ emissions and enhancing engine thermal management.

Technological Advancements and Integration in Automotive Design

Technological innovation is accelerating the growth of this market, with automakers integrating smart and adaptive grille shutter systems into new models. These systems now include digital sensors that monitor engine conditions and optimize airflow automatically. Integration of lightweight composite materials reduces overall vehicle weight and improves performance. Thermal management has become a critical factor, especially in high-performance and premium cars. Advanced grille shutter systems allow faster engine warm-up, contributing to fuel efficiency and reduced emissions. Indian automakers are also collaborating with international suppliers to adopt global standards. The ability of these systems to blend seamlessly into vehicle aesthetics is boosting adoption. It is creating opportunities for suppliers specializing in adaptive and intelligent solutions.

- For instance, Mercedes-Benz integrates active grille shutters in its S-Class models to optimize aerodynamics, improve fuel efficiency, and support compliance with stringent emission norms, as confirmed in the company’s official product literature.

Growth in Premium Vehicle Segment and Consumer Preferences

Demand for premium and luxury vehicles is expanding, and these models often come equipped with advanced aerodynamic solutions. The India Active Grille Shutter Market is benefitting from the rising preference for vehicles that combine efficiency with performance. Consumers in urban centers are adopting cars with smart technologies that enhance both sustainability and comfort. Manufacturers are responding to this shift by integrating grille shutters into mid-range models as well. The inclusion of such technology in diverse price segments is broadening its reach. Rising disposable incomes and lifestyle changes are strengthening the preference for feature-rich automobiles. OEMs are highlighting grille shutter systems as part of their eco-friendly offerings. This trend is also helping manufacturers align with global consumer expectations.

Regulatory Push and Automotive Manufacturing Ecosystem Growth

Regulations related to emissions and energy efficiency are shaping the automotive market in India. Government policies such as Bharat Stage VI norms have accelerated the integration of fuel-saving technologies. The India Active Grille Shutter Market is directly influenced by these initiatives, which encourage energy efficiency across the sector. India’s robust automotive manufacturing hubs, such as those in Tamil Nadu, Maharashtra, and Haryana, provide the right ecosystem for large-scale adoption. Collaboration with international players further supports knowledge transfer and local production. Increasing foreign investment in India’s automotive sector is expanding opportunities for grille shutter adoption. The growing focus on sustainable mobility also aligns with the integration of smart thermal management systems. Industry stakeholders view it as a necessary investment for long-term compliance and competitiveness.

Market Trends

Integration of Smart and Adaptive Shutter Technologies

The India Active Grille Shutter Market is witnessing growing adoption of smart and adaptive technologies that use sensors and AI. Automakers are now deploying shutters that adjust airflow based on driving conditions in real time. This integration enhances both performance and energy efficiency for vehicles across segments. Advanced systems allow up to ten airflow positions, offering precise control. The inclusion of AI-based predictive maintenance features is also becoming popular. Suppliers are highlighting these features to differentiate their solutions in the market. Growing R&D investments are accelerating this shift towards smarter systems. It reflects the industry’s focus on advanced engineering and innovation.

- For instance, Valeo India has implemented active grille shutter systems featuring integrated sensors and electronic control units, allowing up to ten distinct airflow positions to optimize aerodynamics and thermal management across vehicle models.

Adoption of Lightweight Materials and Composite Designs

Automakers and suppliers are increasingly using lightweight composites for grille shutter production. The India Active Grille Shutter Market is moving towards materials such as reinforced plastics and polycarbonate to reduce unit weight. Lighter components improve vehicle fuel efficiency without compromising durability. Manufacturers are also focusing on design integration, ensuring shutters complement vehicle styling. The shift towards recyclable materials aligns with sustainability goals and consumer preferences. Lightweight solutions are being developed for both premium and mid-range vehicle models. Suppliers are investing in advanced molding techniques to achieve higher strength and lower weight. It is also enabling cost efficiency in production and deployment.

Rising Demand in Electric and Hybrid Vehicles

Electric and hybrid vehicles are creating new demand for grille shutter systems. The India Active Grille Shutter Market benefits from the role of shutters in managing battery temperature and thermal stability. Shutters ensure optimal operating conditions for EV batteries, extending range and efficiency. Hybrid vehicles also rely on efficient cooling mechanisms, making grille shutters valuable. OEMs are integrating this technology into next-generation EV models targeted at urban buyers. The government’s push towards EV adoption is further expanding this trend. Suppliers are aligning product offerings with the unique needs of electrified vehicles. It is establishing grille shutters as a standard feature in future mobility solutions.

- For instance, Magna International’s active grille shutter system is designed to dynamically regulate airflow for improved aerodynamics, generating a plausible drag reduction of 7–15 counts (0.0007-0.0015 in drag coefficient) that aligns with industry standards.

Increasing OEM-Supplier Collaborations and Global Integration

Automakers in India are forming strong collaborations with global suppliers for advanced grille shutter systems. The India Active Grille Shutter Market is seeing growing integration of international expertise and local manufacturing capabilities. Partnerships are helping Indian OEMs access advanced thermal management technologies. Suppliers benefit by expanding their market presence in one of the world’s fastest-growing automotive hubs. Joint R&D programs are accelerating product development and innovation in India. These collaborations also support localization of production to reduce costs and improve scalability. OEMs are aligning their product pipelines with global emission reduction targets. It demonstrates the growing role of cross-border synergies in shaping this market.

Market Challenges Analysis

High Initial Costs and Limited Consumer Awareness

The India Active Grille Shutter Market faces challenges related to high installation costs and limited consumer awareness. Advanced grille shutter systems increase vehicle costs, making them less attractive in price-sensitive segments. Consumers often prioritize affordability over advanced features in India’s mass-market automotive industry. Lack of widespread knowledge about efficiency benefits further limits acceptance among entry-level buyers. Automakers hesitate to integrate such systems into low-margin models due to cost pressures. The challenge is significant in rural and semi-urban regions where budget-conscious buyers dominate. Marketing efforts have yet to fully address the long-term savings associated with these systems. It continues to create barriers for large-scale market penetration.

Technical Integration and Supply Chain Limitations

Another challenge lies in technical integration and the readiness of supply chains in India. The India Active Grille Shutter Market requires advanced molding, sensor technologies, and automation that are not widely available locally. Dependence on imports for certain materials raises production costs. Integrating grille shutters into existing vehicle platforms also poses technical hurdles. Automakers must redesign components to ensure compatibility and seamless operation. Local suppliers often face challenges in scaling up to meet OEM demand for precision-engineered systems. The limited ecosystem delays widespread adoption, especially in low-cost segments. Strengthening supply chains and local capabilities will be critical for overcoming these barriers. It reflects the need for investments in advanced manufacturing and design integration.

Market Opportunities

Expansion of EV and Hybrid Vehicle Adoption

The India Active Grille Shutter Market is well-positioned to benefit from the rapid expansion of EV and hybrid vehicle adoption. Shutters play a crucial role in managing battery thermal performance and improving driving range. Government incentives for EV manufacturing and adoption are fueling demand for these solutions. Automakers are integrating grille shutters as standard features in upcoming EV models. Expanding consumer preference for clean mobility is opening new growth avenues. It also provides suppliers with opportunities to design specialized systems tailored for electrified platforms. The shift towards sustainable mobility ensures continued market opportunities for grille shutters. OEMs can leverage this trend to create competitive differentiation in their EV lineups.

Growing Role of Smart Manufacturing and Localization

Rising investment in India’s automotive sector is creating opportunities for localized grille shutter production. The India Active Grille Shutter Market can benefit from the government’s “Make in India” initiative, which promotes domestic manufacturing. Local production reduces costs and improves accessibility for OEMs across vehicle categories. Smart manufacturing techniques, including automation and precision molding, are enabling suppliers to meet global standards. Collaborations with international players are strengthening local capabilities and technology transfer. Emerging suppliers can position themselves as reliable partners for OEMs expanding in India. It is creating a favorable environment for scalable adoption of grille shutter systems. The growing focus on localization enhances both affordability and availability for the domestic market.

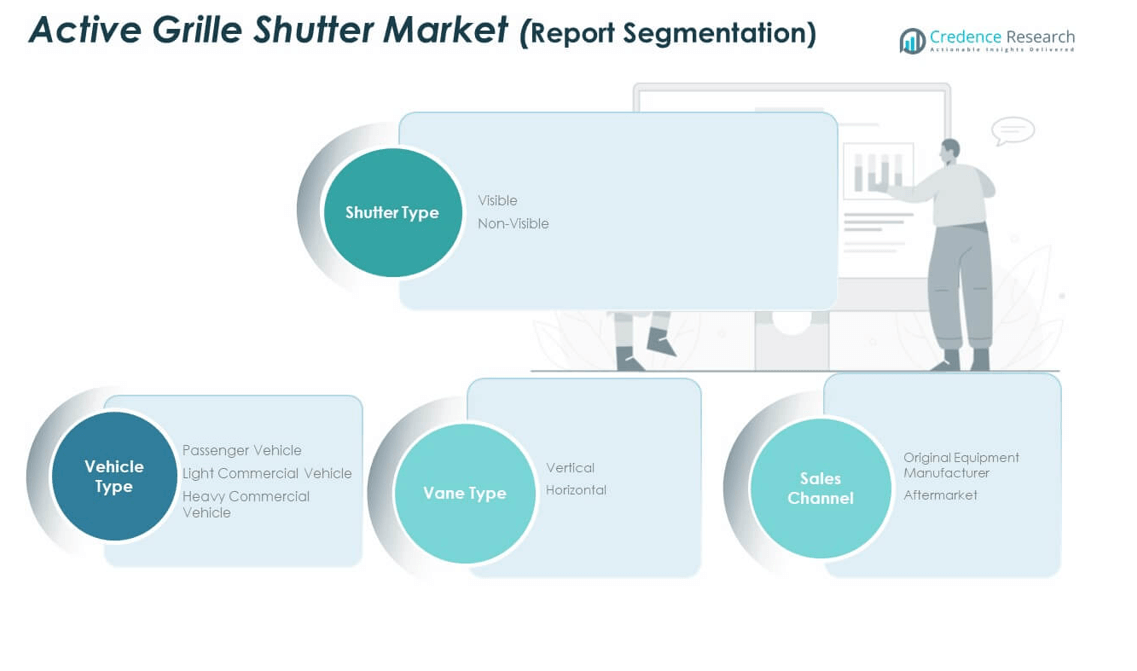

Market Segmentation Analysis:

The India Active Grille Shutter Market is segmented

By shutter type into visible and non-visible categories. Visible shutters are gaining traction in premium vehicles where aesthetics and design integration play a crucial role. Non-visible shutters dominate volume sales due to their functional focus on aerodynamics and thermal management in mainstream models. Both categories contribute significantly to improving fuel efficiency and meeting emission standards, creating strong demand across vehicle classes. It highlights the dual importance of design and performance within this market.

- For instance, the Chevrolet Malibu (General Motors) has used a visible active grille shutter system, mounted in the front grille, since at least the 2013 model year to enhance aerodynamics.

By vehicle type, passenger vehicles hold the largest share due to rising consumer preference for efficiency-driven models in urban areas. Light commercial vehicles are also adopting grille shutters to improve mileage and meet fleet emission targets. Heavy commercial vehicles show slower integration but present long-term opportunities as manufacturers align with sustainability goals. The segmental distribution reflects diverse adoption patterns across India’s automotive landscape. It underscores the growing role of grille shutters in both personal and commercial mobility.

By vane type is divided into vertical and horizontal designs. Vertical vanes are preferred in compact designs that support aerodynamics, while horizontal vanes dominate applications requiring wider airflow control. Each configuration caters to distinct engineering requirements in vehicle platforms. It supports OEM strategies to tailor solutions across product lines.

- For instance, General Motors integrates vertical vane systems in multiple passenger vehicle models for optimized airflow management, as explained in repair guides and GM’s technical documentation

By sales channel, OEMs account for the majority of demand, driven by integration into new vehicle models. The aftermarket is emerging, offering replacements and upgrades for efficiency-focused customers. It represents a growing opportunity for suppliers expanding service networks.

Segmentation:

By Shutter Type

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

By Vane Type

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

Regional Analysis:

Northern and Western India

Northern and Western India together account for 42% of the India Active Grille Shutter Market. This dominance is driven by the presence of established automotive hubs in Haryana, Delhi NCR, Maharashtra, and Gujarat. These regions host global OEMs, tier-1 suppliers, and R&D centers that accelerate adoption of advanced vehicle technologies. Strong infrastructure, skilled workforce, and investment-friendly policies make them leading contributors. Passenger vehicles and premium models manufactured in these clusters increasingly integrate grille shutter systems. It strengthens the role of Northern and Western India as primary demand centers for advanced automotive components.

Southern India

Southern India represents 36% of the India Active Grille Shutter Market, making it the second-largest regional contributor. Tamil Nadu and Karnataka are major automotive hubs with a concentration of production plants, export facilities, and supplier ecosystems. The strong presence of multinational OEMs drives high adoption rates in passenger and light commercial vehicles. State government policies supporting innovation and manufacturing expansion encourage integration of grille shutters in new models. Suppliers in this region are actively aligning with global emission and fuel efficiency norms. It reflects the strategic importance of Southern India in shaping future growth.

Eastern and Central India

Eastern and Central India together hold 22% of the India Active Grille Shutter Market. Adoption in these regions remains slower due to limited automotive manufacturing bases. However, expanding industrial infrastructure and government efforts to attract investments are gradually improving growth prospects. Demand is led by light commercial and passenger vehicles catering to regional logistics and urban mobility. Suppliers are exploring opportunities to establish assembly units closer to these markets. It indicates a growing potential for grille shutter adoption as infrastructure and industrial clusters develop further.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Röchling SE & Co. KG

- Valeo

- Magna International Inc.

- OPmobility SE

- Padmini VNA Mechatronics Ltd

- Standard Motor Products, Inc.

- Techniplas LLC

- Motion Controls International

- Yacenter Electric Co., Ltd.

- Keboda

- Starlite

- Zhejiang Success Auto Parts Co., Ltd.

Competitive Analysis:

The India Active Grille Shutter Market features strong competition among global and domestic players focusing on technological innovation and cost efficiency. Leading companies such as Röchling SE & Co. KG, Valeo, Magna International Inc., and OPmobility SE hold significant positions through their advanced product portfolios and established OEM partnerships. Domestic players like Padmini VNA Mechatronics Ltd are strengthening their role by offering localized solutions tailored for the Indian market. Competition is also shaped by suppliers investing in lightweight materials, adaptive control systems, and integration with vehicle electronics. It highlights the importance of innovation and strategic collaborations in maintaining market leadership. Market rivalry is intensifying with OEMs demanding cost-effective yet efficient grille shutter solutions for passenger and commercial vehicles. Companies are expanding their manufacturing footprint in India to benefit from localization initiatives and reduce supply chain costs. Several players are pursuing mergers, acquisitions, and partnerships to enhance capabilities and gain market access. The India Active Grille Shutter Market reflects a landscape where global expertise merges with local adaptability.

Recent Developments:

- In June 2025, OPmobility SE was awarded a fast-track contract by an Indian automotive manufacturer for the development and production of a full bumper and grille for a light-duty truck model, delivered from prototype to series-ready in under 15 months.

- In November 2024, Continental Automotive Systems Inc. released a new line of Active Grille Shutters for key Ford and Chrysler models. The launch covers popular vehicles like the Chrysler 200, Ford Focus, Escape, Mustang, Explorer, F-150, Fusion, and Lincoln MKZ. Designed to reduce aerodynamic drag and regulate engine cooling, these shutters remain closed during the engine warm-up phase to warm up quickly, then open at lower speeds for cooling and close again at higher speeds to lower drag.

Report Coverage:

The research report offers an in-depth analysis based on shutter type, vehicle type, vane type, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The India Active Grille Shutter Market will expand steadily, driven by stricter emission standards across the automotive industry.

- OEM integration in passenger vehicles will remain the key driver, with adoption rising in both premium and mid-range segments.

- Light commercial vehicles will contribute more demand as fleet owners focus on efficiency and regulatory compliance.

- Heavy commercial vehicles will adopt grille shutters gradually, supported by sustainability and long-term cost benefits.

- Smart and adaptive grille shutters equipped with sensor-based systems will achieve stronger acceptance, enhancing aerodynamics and performance.

- Growth in electric and hybrid vehicle production in India will open fresh opportunities, with shutters essential for battery thermal management.

- Expansion of local manufacturing will reduce production costs, improve accessibility, and support integration in mass-market models.

- Collaborations between domestic firms and international players will accelerate technology transfer, innovation, and product localization.

- The aftermarket will strengthen, with growing demand for replacements and performance upgrades across vehicle categories.

- Competitive intensity will increase, with companies prioritizing R&D investments, product innovation, and strategic partnerships to secure leadership positions.