1. Preface

1.1. Report Description

1.1.1. Purpose of the Report

1.1.2. Target Audience

1.1.3. USP and Key Offerings

1.2. Research Scope

1.3. Research Methodology

1.3.1. Phase I – Secondary Research

1.3.2. Phase II – Primary Research

1.3.3. Phase III – Expert Panel Review

1.3.4. Approach Adopted

1.3.4.1. Top-Down Approach

1.3.4.2. Bottom-Up Approach

1.3.5. Assumptions

1.4. Market Segmentation

2. Executive Summary

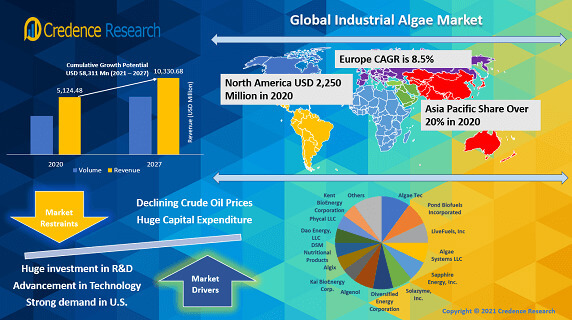

2.1. Market Snapshot: Global Industrial Algae Market

3. Market Dynamics & Factors Analysis

3.1. Introduction

3.1.1. Global Industrial Algae Market Value, 2015-2027, (US$ Bn)

3.2. Market Dynamics

3.2.1. Key Growth Trends

3.2.2. Major Industry Challenges

3.2.3. Key Growth Pockets

3.3. Attractive Investment Proposition,2020

3.3.1. Cultivation Technology

3.3.2. Application

3.3.3. End-user

3.3.4. Geography

3.4. Porter’s Five Forces Analysis

3.4.1. Threat of New Entrants

3.4.2. Bargaining Power of Buyers/Consumers

3.4.3. Bargaining Power of Suppliers

3.4.4. Threat of Substitute Cultivation Technologys

3.4.5. Intensity of Competitive Rivalry

3.5. Value Chain Analysis

4. Market Positioning of Key Players, 2020

4.1. Company market share of key players, 2020

4.2. Top 6 Players

4.3. Top 3 Players

4.4. Major Strategies Adopted by Key Players

5. COVID 19 Impact Analysis

5.1. Global Industrial Algae Market Pre Vs Post COVID 19, 2019 – 2027

5.2. Impact on Import & Export

5.3. Impact on Demand & Supply

6. North America

6.1. North America Industrial Algae Market, by Country, 2015-2027(US$ Bn)

6.1.1. U.S.

6.1.2. Canada

6.1.3. Mexico

6.2. North America Industrial Algae Market, by End-user, 2015-2027(US$ Bn)

6.2.1. Overview

6.2.2. Open Pond Cultivation Technology

6.2.3. Raceway Pond Cultivation Technology

6.2.4. Closed Photo Bioreactor Cultivation Technology

6.2.5. Closed Fermenter Systems Cultivation Technology

6.3. North America Industrial Algae Market, by Application, 2015-2027(US$ Bn)

6.3.1. Overview

6.3.2. Marine Sector

6.3.3. Aviation Sector

6.3.4. Road Transport

6.3.5. DHA Production (Protein Sales)

6.3.6. DHA Production (Pharmaceutical Applications)

6.3.7. Bioplastics

6.3.8. Others

7. Europe

7.1. Europe Industrial Algae Market, by Country, 2015-2027(US$ Bn)

7.1.1. UK

7.1.2. France

7.1.3. Germany

7.1.4. Italy

7.1.5. Russia

7.1.6. Spain

7.1.7. Belgium

7.1.8. Netherland

7.1.9. Austria

7.1.10. Sweden

7.1.11. Poland

7.1.12. Denmark

7.1.13. Switzerland

7.1.14. Rest of Europe

7.2. Europe Industrial Algae Market, by End-user, 2015-2027(US$ Bn)

7.2.1. Overview

7.2.2. Open Pond Cultivation Technology

7.2.3. Raceway Pond Cultivation Technology

7.2.4. Closed Photo Bioreactor Cultivation Technology

7.2.5. Closed Fermenter Systems Cultivation Technology

7.3. Europe Industrial Algae Market, by Application, 2015-2027(US$ Bn)

7.3.1. Overview

7.3.2. Marine Sector

7.3.3. Aviation Sector

7.3.4. Road Transport

7.3.5. DHA Production (Protein Sales)

7.3.6. DHA Production (Pharmaceutical Applications)

7.3.7. Bioplastics

7.3.8. Others

8. Asia Pacific

8.1. Asia Pacific Industrial Algae Market, by Country, 2015-2027(US$ Bn)

8.1.1. China

8.1.2. Japan

8.1.3. South Korea

8.1.4. India

8.1.5. Australia

8.1.6. New Zealand

8.1.7. Taiwan

8.1.8. Southeast Asia

8.1.9. Central Asia

8.1.10. Rest of Asia Pacific

8.2. Asia Pacific Industrial Algae Market, by End-user, 2015-2027(US$ Bn)

8.2.1. Overview

8.2.2. Open Pond Cultivation Technology

8.2.3. Raceway Pond Cultivation Technology

8.2.4. Closed Photo Bioreactor Cultivation Technology

8.2.5. Closed Fermenter Systems Cultivation Technology

8.3. Asia Pacific Industrial Algae Market, by Application, 2015-2027(US$ Bn)

8.3.1. Overview

8.3.2. Marine Sector

8.3.3. Aviation Sector

8.3.4. Road Transport

8.3.5. DHA Production (Protein Sales)

8.3.6. DHA Production (Pharmaceutical Applications)

8.3.7. Bioplastics

8.3.8. Others

9. Latin America

9.1. Latin America Industrial Algae Market, by Country, 2015-2027(US$ Bn)

9.1.1. Brazil

9.1.2. Argentina

9.1.3. Peru

9.1.4. Chile

9.1.5. Colombia

9.1.6. Rest of Latin America

9.2. Latin America Industrial Algae Market, by End-user, 2015-2027(US$ Bn)

9.2.1. Overview

9.2.2. Open Pond Cultivation Technology

9.2.3. Raceway Pond Cultivation Technology

9.2.4. Closed Photo Bioreactor Cultivation Technology

9.2.5. Closed Fermenter Systems Cultivation Technology

9.3. Latin America Industrial Algae Market, by Application, 2015-2027(US$ Bn)

9.3.1. Overview

9.3.2. Marine Sector

9.3.3. Aviation Sector

9.3.4. Road Transport

9.3.5. DHA Production (Protein Sales)

9.3.6. DHA Production (Pharmaceutical Applications)

9.3.7. Bioplastics

9.3.8. Others

10. Middle East

10.1. Middle East Industrial Algae Market, by Country, 2015-2027(US$ Bn)

10.1.1. UAE

10.1.2. KSA

10.1.3. Israel

10.1.4. Turkey

10.1.5. Iran

10.1.6. Rest of Middle East

10.2. Middle East Industrial Algae Market, by End-user, 2015-2027(US$ Bn)

10.2.1. Overview

10.2.2. Open Pond Cultivation Technology

10.2.3. Raceway Pond Cultivation Technology

10.2.4. Closed Photo Bioreactor Cultivation Technology

10.2.5. Closed Fermenter Systems Cultivation Technology

10.3. Middle East Industrial Algae Market, by Application, 2015-2027(US$ Bn)

10.3.1. Overview

10.3.2. Marine Sector

10.3.3. Aviation Sector

10.3.4. Road Transport

10.3.5. DHA Production (Protein Sales)

10.3.6. DHA Production (Pharmaceutical Applications)

10.3.7. Bioplastics

10.3.8. Others

11. Africa

11.1. Africa Industrial Algae Market, by Country, 2015-2027(US$ Bn)

11.1.1. South Africa

11.1.2. Egypt

11.1.3. Nigeria

11.1.4. Rest of Africa

11.2. Africa Industrial Algae Market, by End-user, 2015-2027(US$ Bn)

11.2.1. Overview

11.2.2. Open Pond Cultivation Technology

11.2.3. Raceway Pond Cultivation Technology

11.2.4. Closed Photo Bioreactor Cultivation Technology

11.2.5. Closed Fermenter Systems Cultivation Technology

11.3. Africa Industrial Algae Market, by Application, 2015-2027(US$ Bn)

11.3.1. Overview

11.3.2. Marine Sector

11.3.3. Aviation Sector

11.3.4. Road Transport

11.3.5. DHA Production (Protein Sales)

11.3.6. DHA Production (Pharmaceutical Applications)

11.3.7. Bioplastics

11.3.8. Others

12. Global

12.1. Global Industrial Algae Market, by Cultivation Technology, 2015-2027(US$ Bn)

12.1.1. Overview

12.1.2. Open Pond Cultivation Technology

12.1.3. Raceway Pond Cultivation Technology

12.1.4. Closed Photo Bioreactor Cultivation Technology

12.1.5. Closed Fermenter Systems Cultivation Technology

12.2. Global Industrial Algae Market, by Application, 2015-2027(US$ Bn)

12.2.1. Overview

12.2.2. Marine Sector

12.2.3. Aviation Sector

12.2.4. Road Transport

12.2.5. DHA Production (Protein Sales)

12.2.6. DHA Production (Pharmaceutical Applications)

12.2.7. Bioplastics

12.2.8. Others

13. Company Profiles

13.1. Algae Tec

13.2. Pond Biofuels Incorporated

13.3. LiveFuels, Inc

13.4. Algae Systems LLC

13.5. Sapphire Energy, Inc.

13.6. Solazyme, Inc.

13.7. Diversified Energy Corporation

13.8. Algenol

13.9. Kai BioEnergy Corp.

13.10. Algix

13.11. DSM Nutritional Products

13.12. Dao Energy, LLC

13.13. Phycal LLC

13.14. Kent BioEnergy Corporation

13.15. Others

List of Figures

FIG. 1 Global Industrial Algae Market: Research Methodology

FIG. 2 Market Size Estimation – Top Down & Bottom up Approach

FIG. 3 Global Industrial Algae Market Segmentation

FIG. 4 Global Industrial Algae Market, by Cultivation Technology, 2019 (US$ Bn)

FIG. 5 Global Industrial Algae Market, by Application, 2019 (US$ Bn)

FIG. 6 Global Industrial Algae Market, by Geography, 2019 (US$ Bn)

FIG. 7 Attractive Investment Proposition, by Geography, 2019

FIG. 8 Global Market Positioning of Key Industrial Algae Market Manufacturers, 2019

FIG. 9 Global Industrial Algae Market Value Contribution, By Cultivation Technology, 2020 & 2027 (Value %)

FIG. 10 Global Industrial Algae Market, by Open Pond Cultivation Technology, Value, 2015-2027 (US$ Bn)

FIG. 11 Global Industrial Algae Market, by Raceway Pond Cultivation Technology, Value, 2015-2027 (US$ Bn)

FIG. 12 Global Industrial Algae Market, by Closed Photo Bioreactor Cultivation Technology, Value, 2015-2027 (US$ Bn)

FIG. 13 Global Industrial Algae Market, by Closed Fermenter Systems Cultivation Technology, Value, 2015-2027 (US$ Bn)

FIG. 14 Global Industrial Algae Market Value Contribution, By Application, 2020 & 2027 (Value %)

FIG. 15 Global Industrial Algae Market, by Marine Sector, Value, 2015-2027 (US$ Bn)

FIG. 16 Global Industrial Algae Market, by Aviation Sector, Value, 2015-2027 (US$ Bn)

FIG. 17 Global Industrial Algae Market, by Road Transport, Value, 2015-2027 (US$ Bn)

FIG. 18 Global Industrial Algae Market, by DHA Production (Protein Sales), Value, 2015-2027 (US$ Bn)

FIG. 19 Global Industrial Algae Market, by DHA Production (Pharmaceutical Applications), Value, 2015-2027 (US$ Bn)

FIG. 20 Global Industrial Algae Market, by Bioplastics, Value, 2015-2027 (US$ Bn)

FIG. 21 U.S. Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 22 Rest of North America Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 23 U.K. Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 24 Germany Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 25 France Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 26 Italy Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 27 Spain Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 28 Russia Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 29 BENELUX Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 30 Poland Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 31 Austria Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 32 Rest of Europe Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 33 Japan Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 34 China Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 35 India Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 36 South Korea Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 37 Australia Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 38 Southeast Asia Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 39 Rest of Asia Pacific Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 40 Middle East & Africa Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 41 South Africa Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 42 Nigeria Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 43 Egypt Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 44 GCC Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 45 Israel Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 46 Latin America Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 47 Mechanicalzil Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 48 Argentina Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 49 Colombia Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 50 Peru Industrial Algae Market, 2015-2027 (US$ Bn)

FIG. 51 Chile Industrial Algae Market, 2015-2027 (US$ Bn)

List of Tables

TABLE 1 Market Snapshot: Global Beauty Devices (Industrial Algae) Market

TABLE 2 Global Industrial Algae Market, by Cultivation Technology, 2015-2027 (US$ Bn)

TABLE 3 Global Industrial Algae Market, by Application, 2015-2027 (US$ Bn)

TABLE 4 Global Industrial Algae Market, by Geography, 2015-2027 (US$ Bn)

TABLE 5 North America Industrial Algae Market, by Cultivation Technology, 2015-2027 (US$ Bn)

TABLE 6 North America Industrial Algae Market, by Application, 2015-2027 (US$ Bn)

TABLE 7 North America Industrial Algae Market, by Country, 2015-2027 (US$ Bn)

TABLE 8 Europe Industrial Algae Market, by Cultivation Technology, 2015-2027 (US$ Bn)

TABLE 9 Europe Industrial Algae Market, by Application, 2015-2027 (US$ Bn)

TABLE 10 Europe Industrial Algae Market, by Country/Region, 2015-2027 (US$ Bn)

TABLE 11 Asia Pacific Industrial Algae Market, by Cultivation Technology, 2015-2027 (US$ Bn)

TABLE 12 Asia Pacific Industrial Algae Market, by Application, 2015-2027 (US$ Bn)

TABLE 13 Asia Pacific Industrial Algae Market, by Country/Region, 2015-2027 (US$ Bn)

TABLE 14 Latin America Industrial Algae Market, by Cultivation Technology, 2015-2027 (US$ Bn)

TABLE 15 Latin America Industrial Algae Market, by Application, 2015-2027 (US$ Bn)

TABLE 16 Latin America Industrial Algae Market, by Country/Region, 2015-2027 (US$ Bn)

TABLE 17 Middle East Industrial Algae Market, by Cultivation Technology, 2015-2027 (US$ Bn)

TABLE 18 Middle East Industrial Algae Market, by Application, 2015-2027 (US$ Bn)

TABLE 19 Middle East Industrial Algae Market, by Country/Region, 2015-2027 (US$ Bn)

TABLE 20 Africa Industrial Algae Market, by Cultivation Technology, 2015-2027 (US$ Bn)

TABLE 21 Africa Industrial Algae Market, by Application, 2015-2027 (US$ Bn)

TABLE 22 Africa Industrial Algae Market, by Country/Region, 2015-2027 (US$ Bn)

TABLE 23 Algae Tec: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 24 LiveFuels, Inc: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 25 Algae Systems LLC: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 26 Sapphire Energy, Inc.: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 27 Solazyme, Inc.: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 28 Diversified Energy Corporation: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 29 Algenol: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 30 Kai BioEnergy Corp.: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 31 Algix: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 32 DSM Nutritional Products: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 33 Dao Energy, LLC: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 34 Phycal LLC: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments

TABLE 35 Kent BioEnergy Corporation: Company Snapshot (Company Overview; Cultivation Technology Portfolio; Financial Information; Key Developments