Market Overview

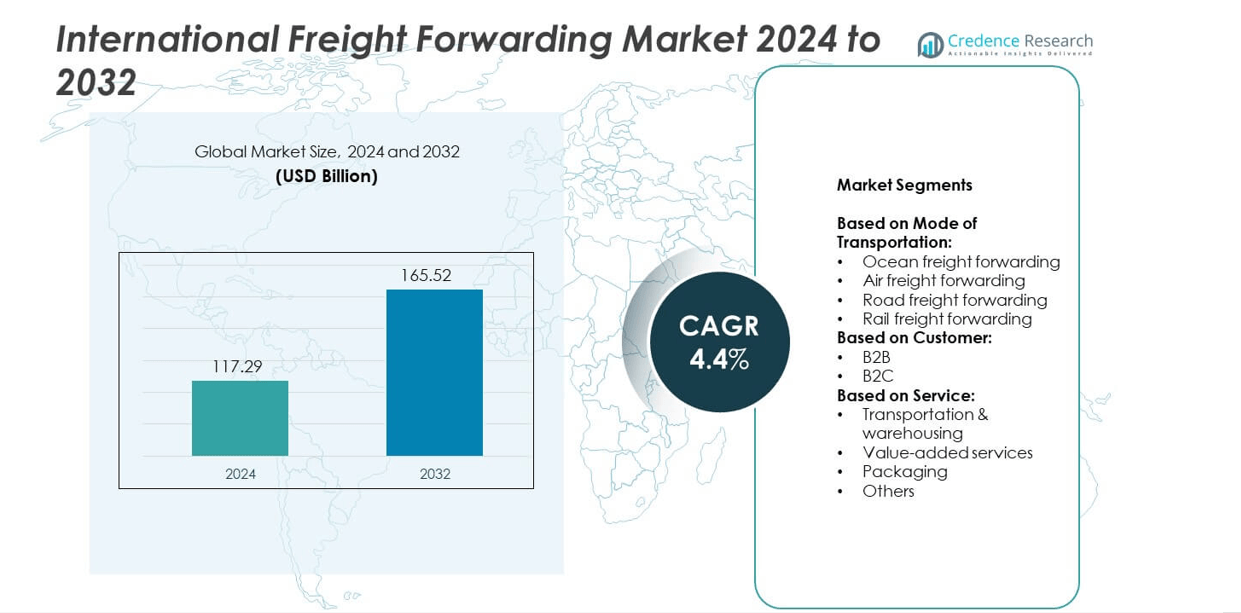

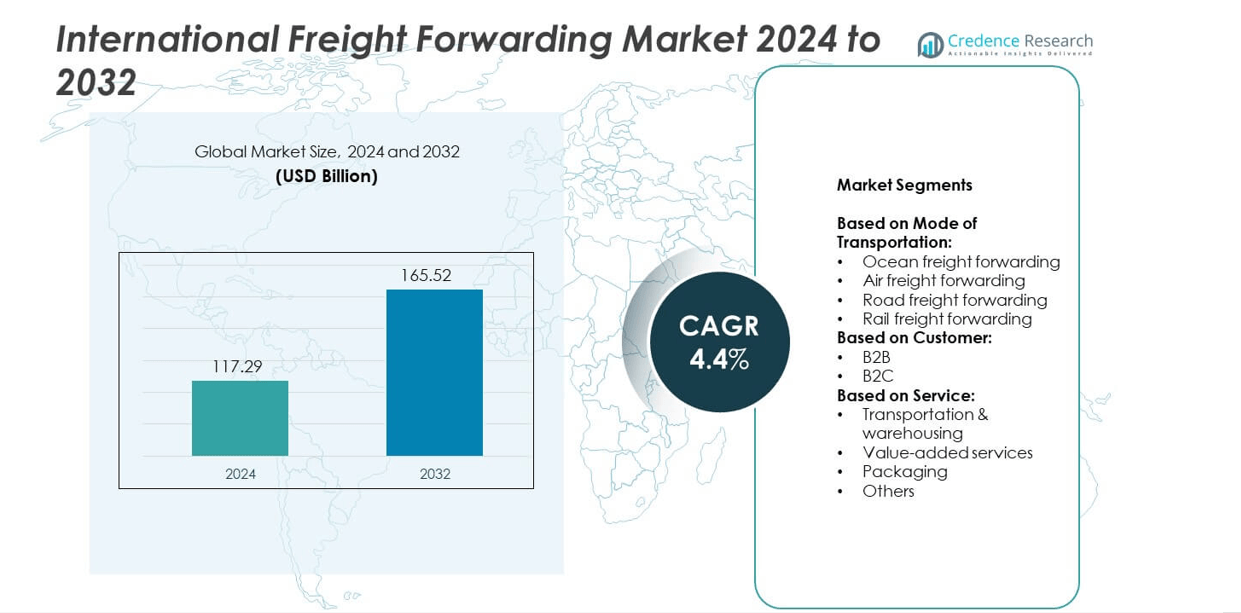

The International Freight Forwarding Market is projected to grow steadily from USD 117.29 Billion in 2024 to USD 165.52 Billion by 2032, registering a CAGR of 4.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| International Freight Forwarding Market Size 2024 |

USD 117.29 Billion |

| International Freight Forwarding Market, CAGR |

4.4% |

| International Freight Forwarding Market Size 2032 |

USD 165.52 Billion |

The International Freight Forwarding market grows due to rising global trade and increasing e-commerce demand. Companies adopt digital platforms, AI, and predictive analytics to optimize routes and improve shipment visibility. Multi-modal transportation solutions enhance efficiency across air, ocean, rail, and road networks. Expanding infrastructure in ports, highways, and logistics hubs supports faster deliveries. Demand for value-added services, such as customs clearance, packaging, and warehousing, strengthens market adoption. Sustainability initiatives and risk management strategies further drive forwarder investments and client confidence.

North America, Europe, and Asia Pacific dominate the International Freight Forwarding market with advanced infrastructure and high trade volumes. Companies focus on multi-modal transport and technology-driven solutions to improve efficiency across these regions. Key players such as DSV Global Transports and Logistics, DHL Global Forwarding, FedEx Corp., and Kuehne + Nagel International AG maintain extensive regional networks. It enables seamless cross-border shipments, faster deliveries, and reliable service. Emerging markets in Latin America and the Middle East also offer growth opportunities for forwarders expanding their global presence.

Market Insights

- The International Freight Forwarding market was valued at USD 117.29 Billion in 2024 and is projected to reach USD 165.52 Billion by 2032, growing at a CAGR of 4.4%.

- Rising global trade volumes, e-commerce growth, and demand for faster cross-border deliveries drive market expansion.

- Adoption of digital platforms, AI, predictive analytics, and multi-modal transport solutions enhances operational efficiency and shipment visibility.

- Leading players such as DSV Global Transports and Logistics, DHL Global Forwarding, FedEx Corp., and Kuehne + Nagel compete through network expansion, technology investment, and value-added services.

- Complex regulatory frameworks, fluctuating transportation costs, and infrastructure gaps remain key challenges for forwarders worldwide.

- North America, Europe, and Asia Pacific lead the market with advanced logistics infrastructure, strong trade networks, and high adoption of technology-driven solutions.

- Emerging markets in Latin America, the Middle East, and Africa offer growth opportunities through regional hubs, expanding industrial activities, and investments in ports, railways, and highways.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Trade and E-Commerce Demand Driving Freight Forwarding Growth

The expansion of global trade significantly boosts demand for international logistics solutions. Companies increasingly require reliable freight forwarding to manage cross-border shipments efficiently. E-commerce growth fuels the need for faster and flexible delivery networks. Consumers expect timely delivery, pushing businesses to optimize supply chains. The International Freight Forwarding market benefits from integrated shipping solutions that reduce transit times. It enables companies to handle complex logistics with multiple carriers and transportation modes. Rising trade volumes directly increase revenue opportunities for forwarders.

- For instance, UPS Supply Chain Solutions leverages a global network to provide services in over 200 countries and territories. This network includes a combination of owned and leased facilities.

Technological Advancements Enhancing Operational Efficiency and Transparency

Digital platforms, AI-enabled route optimization, and real-time tracking improve freight management. Companies adopt advanced solutions to minimize delays and reduce operational costs. Automation in documentation and customs clearance accelerates shipments. The International Freight Forwarding market gains from software that coordinates multiple carriers and routes efficiently. It strengthens decision-making through predictive analytics and supply chain visibility. Cloud-based systems allow real-time collaboration across global offices. Technology adoption ensures higher reliability and customer satisfaction.

- For instance, in December 2019, DB Schenker opened a new 21,000 m² warehouse in Güstrow, Germany, providing dry and frost-free storage for the food and consumer goods sector. Additionally, DB Schenker announced a high-tech logistics center covering 55,000 m² near Prague in November 2022, with automated operations for a retail customer beginning in the summer of 2023.

Increasing Demand for Specialized and Value-Added Logistics Services

Shippers require tailored solutions, including packaging, warehousing, and cold-chain management. Freight forwarders provide end-to-end services to address industry-specific requirements. The International Freight Forwarding market expands with demand for secure and flexible storage options. It supports temperature-sensitive goods and high-value cargo. Companies leverage value-added services to reduce handling risks and improve delivery quality. Customized solutions also help meet regulatory and compliance standards. Enhanced service offerings strengthen client relationships and market competitiveness.

Regulatory Compliance and Strategic Trade Route Expansion Driving Market Adoption

Governments implement trade policies and customs regulations that affect logistics planning. Compliance with international standards ensures smooth cross-border shipments. The International Freight Forwarding market benefits from companies adapting to evolving regulations efficiently. It supports trade through optimized routes and partnership networks. Forwarders help businesses navigate tariffs, documentation, and local trade requirements. Expanding operations along strategic trade corridors improves market coverage. Regulatory expertise becomes a competitive advantage in global freight operations.

Market Trends

Adoption of Digital Freight Platforms and AI Solutions Transforming Logistics Operations

The International Freight Forwarding market experiences rapid transformation through digital platforms and AI technologies. Companies deploy software to manage shipments, track cargo, and optimize routing efficiently. Automation reduces manual errors and accelerates documentation processes. It enables predictive planning for delays and capacity shortages. Forwarders leverage real-time data to improve decision-making and supply chain visibility. Technology adoption enhances transparency for clients and strengthens operational reliability. The trend drives faster, more cost-effective cross-border logistics.

- For instance, CEVA Logistics provides customs brokerage consultancy services globally, through its existing network of agents. In February 2024, CEVA’s parent company, CMA CGM, completed the acquisition of Bolloré Logistics for €4.85 billion. The integration significantly strengthened CEVA’s air and ocean freight capabilities, particularly in the Asia-Pacific region.

Integration of Sustainable and Green Logistics Practices Across Supply Chains

Sustainability influences freight forwarding strategies through low-emission transportation and eco-friendly packaging. Companies adopt electric and hybrid vehicles for last-mile delivery. The International Freight Forwarding market benefits from initiatives that minimize carbon footprint while maintaining efficiency. It encourages use of energy-efficient warehouses and optimized shipping routes. Forwarders emphasize compliance with environmental regulations and corporate sustainability goals. Sustainable practices enhance brand reputation and attract environmentally conscious clients. Green logistics becomes a key differentiator in competitive markets.

- For instance, FedEx is implementing a phased rollout of electric vehicles in Europe as part of its global goal to achieve carbon-neutral operations by 2040. In early 2024, the company deployed 33 new Mercedes-Benz eSprinter vans in Spain for operations in Madrid and Barcelona.

Expansion of Multi-Modal Transport Solutions to Improve Flexibility and Coverage

Shippers demand seamless coordination across air, sea, road, and rail transport to reduce transit times. The International Freight Forwarding market gains traction through integrated multi-modal solutions. It provides flexibility for shipment prioritization and cost optimization. Forwarders develop partnerships with carriers to ensure smooth cargo transfers and connectivity. Companies benefit from reduced bottlenecks and enhanced reliability across global routes. Multi-modal approaches allow service customization for diverse industries. The trend supports scalable operations across high-volume trade corridors.

Rising Emphasis on Data-Driven Decision Making and Predictive Analytics

Freight companies increasingly rely on data to forecast demand, manage capacity, and optimize routes. The International Freight Forwarding market leverages analytics to reduce risks and improve performance. It identifies inefficiencies and recommends corrective measures promptly. Predictive tools enhance scheduling accuracy and inventory management. Companies integrate dashboards for real-time monitoring and reporting. Data-driven insights strengthen client trust and operational transparency. This trend supports strategic growth and competitive advantage in global logistics.

Market Challenges Analysis

Complex Regulatory Frameworks and Cross-Border Compliance Creating Operational Hurdles

The International Freight Forwarding market faces challenges due to varying customs regulations and trade policies across countries. Companies must ensure accurate documentation to avoid shipment delays or penalties. It requires continuous monitoring of tariffs, import-export restrictions, and local compliance standards. Forwarders often invest in specialized staff and software to navigate complex rules efficiently. Inconsistent enforcement across regions increases operational risks and costs. Delays caused by regulatory inspections can disrupt supply chains and affect client satisfaction. Companies must balance compliance requirements with timely delivery commitments to maintain competitiveness.

Volatility in Transportation Costs and Infrastructure Limitations Affecting Service Efficiency

Fluctuations in fuel prices, shipping rates, and labor costs impact profitability in the International Freight Forwarding market. Companies struggle to maintain consistent pricing while managing operational expenses. It also faces constraints due to limited port capacity, congested routes, and inadequate last-mile infrastructure in emerging markets. Unexpected disruptions, such as natural disasters or geopolitical tensions, can further delay shipments. Forwarders invest in risk management strategies and alternative routing to mitigate these challenges. Infrastructure gaps reduce overall efficiency and limit service scalability. Companies must optimize resources while ensuring reliable delivery for clients across regions.

Market Opportunities

Expansion into Emerging Markets and Untapped Trade Corridors Driving Growth Potential

The International Freight Forwarding market has significant opportunities in emerging economies with rising trade volumes. Companies can establish regional hubs to streamline shipments and reduce transit times. It enables access to new customer bases in sectors such as e-commerce, manufacturing, and pharmaceuticals. Forwarders benefit from growing infrastructure investments in ports, highways, and logistics parks. Strategic partnerships with local carriers strengthen network coverage and service reliability. Companies can capitalize on untapped trade corridors connecting Asia, Africa, and Latin America. This expansion supports long-term revenue growth and market diversification.

Adoption of Advanced Technologies and Data Analytics Enabling Service Differentiation

Digital transformation presents opportunities for the International Freight Forwarding market to enhance operational efficiency. Companies can implement AI, predictive analytics, and blockchain to improve shipment tracking and inventory management. It allows optimization of routes, cost reduction, and improved customer transparency. Forwarders can develop customized solutions tailored to industry-specific requirements, such as cold-chain logistics or high-value cargo handling. Investment in automation and digital platforms strengthens competitive positioning. Technology adoption also supports integration with global supply chains and real-time collaboration. These innovations drive service differentiation and higher client retention.

Market Segmentation Analysis:

By Mode of Transportation:

Ocean freight forwarding dominates the International Freight Forwarding market due to cost efficiency for large-volume shipments. Companies leverage sea transport for bulk goods and long-distance trade. It provides reliable transit options with global port connectivity and flexible scheduling. Air freight forwarding gains traction for high-value, time-sensitive cargo, offering faster delivery and enhanced security. It supports industries such as electronics, pharmaceuticals, and perishable goods. Road freight forwarding facilitates last-mile delivery and regional connectivity, ensuring shipments reach destinations promptly. Rail freight forwarding serves as a cost-effective, environmentally friendly option for long-haul domestic and continental transport, particularly in regions with strong rail infrastructure.

- For instance, Hellmann Worldwide Logistics is actively expanding its rail freight network, with ongoing plans for new block train services and routes in Europe and between Europe and Asia. The company’s financial results for the 2024 fiscal year, which were reported in May 2025, showed a global revenue of €3.8 billion. During 2024, Hellmann also handled approximately 20 million shipments worldwide. The revenue from the company’s combined road and rail transport segment increased by 6.2% in 2024.

By Customer:

B2B customers form the largest segment in the International Freight Forwarding market due to the complexity and volume of corporate shipments. Companies rely on forwarders for integrated logistics, route optimization, and compliance management. It enables seamless movement of raw materials and finished products across global supply chains. B2C customers drive growth through e-commerce and direct-to-consumer deliveries, requiring faster turnaround and tracking transparency. It allows businesses to meet increasing consumer expectations for timely and secure delivery. Forwarders adapt their services to balance cost, speed, and customer experience for both segments.

- For instance, According to the Pitney Bowes Parcel Shipping Index, Amazon Logistics delivered 5.9 billion parcels in the U.S. in 2023, which represented a 15.7% increase over the previous year. A Wall Street Journal report noted that internal Amazon projections predicted approximately 5.9 billion deliveries in the U.S. in 2023

By Service:

Transportation and warehousing represent the core service segment, providing storage, inventory management, and shipment coordination. The International Freight Forwarding market benefits from centralized facilities that streamline cross-border logistics. It ensures consistent service quality and reduces delays in multi-modal transport. Value-added services, including customs clearance, documentation, and insurance, enhance client convenience and compliance. Packaging services address safe handling of fragile or sensitive goods, supporting risk reduction during transit. Other specialized services, such as temperature-controlled logistics and hazardous material handling, offer additional growth opportunities. It allows forwarders to differentiate their offerings and strengthen client relationships across industries.

Segments:

Based on Mode of Transportation:

- Ocean freight forwarding

- Air freight forwarding

- Road freight forwarding

- Rail freight forwarding

Based on Customer:

Based on Service:

- Transportation & warehousing

- Value-added services

- Packaging

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a significant market share in the International Freight Forwarding market, accounting for 27% of global revenue. The region benefits from advanced logistics infrastructure, well-developed ports, and extensive road and rail networks. Companies leverage technological adoption, including AI, predictive analytics, and digital freight platforms, to optimize operations. It supports high-volume trade in sectors such as automotive, electronics, and pharmaceuticals. The presence of major logistics providers and integrated supply chain solutions strengthens regional competitiveness. Strong cross-border trade with Mexico and Canada drives consistent demand. North American forwarders invest in sustainable practices and value-added services to maintain client satisfaction and operational efficiency.

Europe

Europe represents a major segment in the International Freight Forwarding market, contributing 25% to global revenue. The region relies on well-connected ports, rail corridors, and highway networks to facilitate cross-border trade within the EU and beyond. Companies adopt multi-modal transportation strategies to reduce transit times and enhance flexibility. It supports shipments across industries including manufacturing, chemicals, and consumer goods. Strict regulatory compliance, environmental standards, and customs management remain key operational considerations. European forwarders focus on digital transformation and predictive analytics to improve supply chain visibility. The growing e-commerce sector further drives demand for fast and reliable logistics solutions across Europe.

Asia Pacific

Asia Pacific accounts for 30% of the International Freight Forwarding market, making it the largest regional contributor. Rapid industrialization, expanding manufacturing hubs, and rising trade volumes drive market growth. It benefits from significant investments in ports, rail, and road infrastructure across China, India, Japan, and Southeast Asia. Companies in the region leverage air freight and ocean freight to meet high demand for electronics, automotive, and consumer products. Forwarders implement advanced tracking systems and automated operations to manage complex supply chains. Expanding e-commerce and cross-border trade further accelerate market adoption. The region also emphasizes multi-modal integration to optimize cost and delivery efficiency.

Latin America

Latin America contributes 8% to the International Freight Forwarding market. The region experiences growth due to expanding trade with North America and Europe and rising industrial activities in Brazil, Mexico, and Argentina. It faces challenges from infrastructure gaps and regulatory complexity, prompting companies to adopt specialized logistics solutions. It supports transportation of commodities, industrial equipment, and consumer goods efficiently through a mix of road, rail, and air transport. Forwarders focus on building regional networks and partnerships to improve service reliability. Demand for digital platforms and real-time tracking solutions increases competitiveness. Latin American companies aim to optimize cross-border operations to strengthen market presence.

Middle East & Africa

Middle East & Africa represents 10% of the International Freight Forwarding market. The region benefits from strategic trade routes, port developments, and investment in logistics hubs, especially in the UAE, Saudi Arabia, and South Africa. It supports high-value goods, energy equipment, and industrial machinery transport across international corridors. Companies adopt air and ocean freight solutions to meet diverse client needs. It emphasizes compliance with regional trade regulations and customs procedures. Forwarders implement technology-driven systems for shipment tracking, documentation, and warehouse management. The region’s growing e-commerce and industrial activities provide opportunities for service expansion and enhanced market reach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

DSV Global Transports and Logistics, Nippon Express Co., Ltd., Hellmann Worldwide Logistics, CEVA Logistics, FedEx Corp., DB Schenker, Bollore Logistics, Kuehne + Nagel International AG, DHL Global Forwarding, Expeditors International. The International Freight Forwarding market is highly competitive, driven by the need for global connectivity and efficient logistics solutions. Leading players focus on expanding their service networks across multiple regions to strengthen market presence. Companies invest in technology adoption, including AI-based route optimization, predictive analytics, and digital freight platforms, to enhance operational efficiency and client satisfaction. It allows forwarders to provide real-time tracking, risk management, and seamless multi-modal transport solutions. Strategic partnerships and acquisitions help companies increase geographic coverage and service capabilities. Forwarders differentiate through specialized services such as temperature-controlled logistics, hazardous material handling, and value-added customs support. Sustainability initiatives, including low-emission transport and eco-friendly warehousing, are increasingly shaping competitive positioning. Firms focus on e-commerce logistics and time-sensitive shipments to capture high-growth segments. Service reliability, pricing strategies, and regulatory compliance remain critical factors in maintaining customer loyalty. Companies continuously optimize their global supply chains to manage costs, improve delivery speed, and meet the evolving demands of B2B and B2C clients. The market remains dynamic, with innovation and operational excellence as key drivers of competitive advantage.

Recent Developments

- In July 2025, CEVA launched a sustainable road transport pilot project using biofuel-powered “Duo Trailers” to reduce CO2 emissions.

- In 2024, The Bolloré Group and the CMA CGM Group announced the completion of the sale of Bolloré Logistics.

- In 2024, Kuehne+Nagel and the Wacker Neuson Group opened a new contract logistics center in Rhineland-Palatinate, Germany, which included automation and a fleet of autonomous robots

Report Coverage

The research report offers an in-depth analysis based on Mode of Transportation, Customer, Service and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The International Freight Forwarding market will grow steadily due to rising global trade.

- Companies will increasingly adopt digital platforms and AI for shipment tracking and route optimization.

- Multi-modal transportation solutions will expand to improve flexibility and reduce delivery times.

- Demand for e-commerce logistics will drive faster and more reliable cross-border services.

- Forwarders will invest in sustainable and green logistics practices to reduce carbon footprint.

- Value-added services, including customs clearance and packaging, will see higher adoption.

- Emerging markets will offer new growth opportunities through regional hubs and trade corridors.

- Predictive analytics and data-driven decision-making will enhance operational efficiency.

- Infrastructure development in ports, rail, and highways will support market expansion.

- Companies will focus on risk management and compliance to navigate regulatory complexities.