Market Overview:

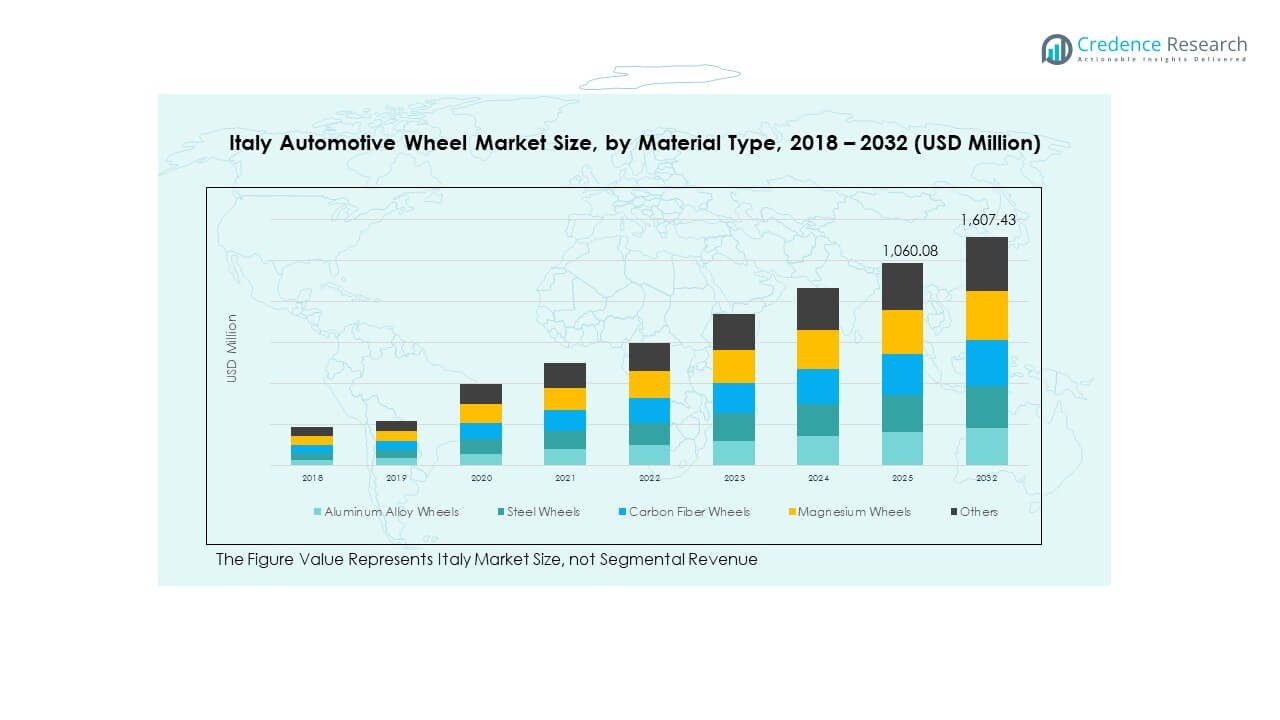

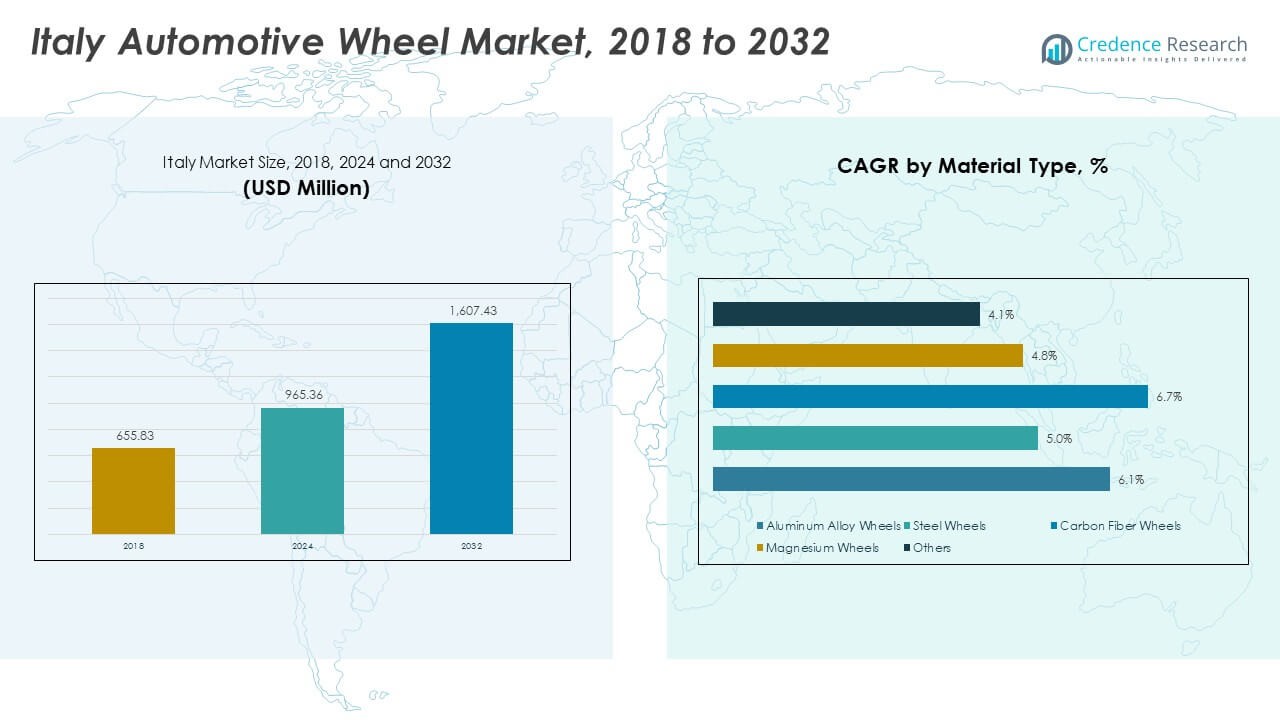

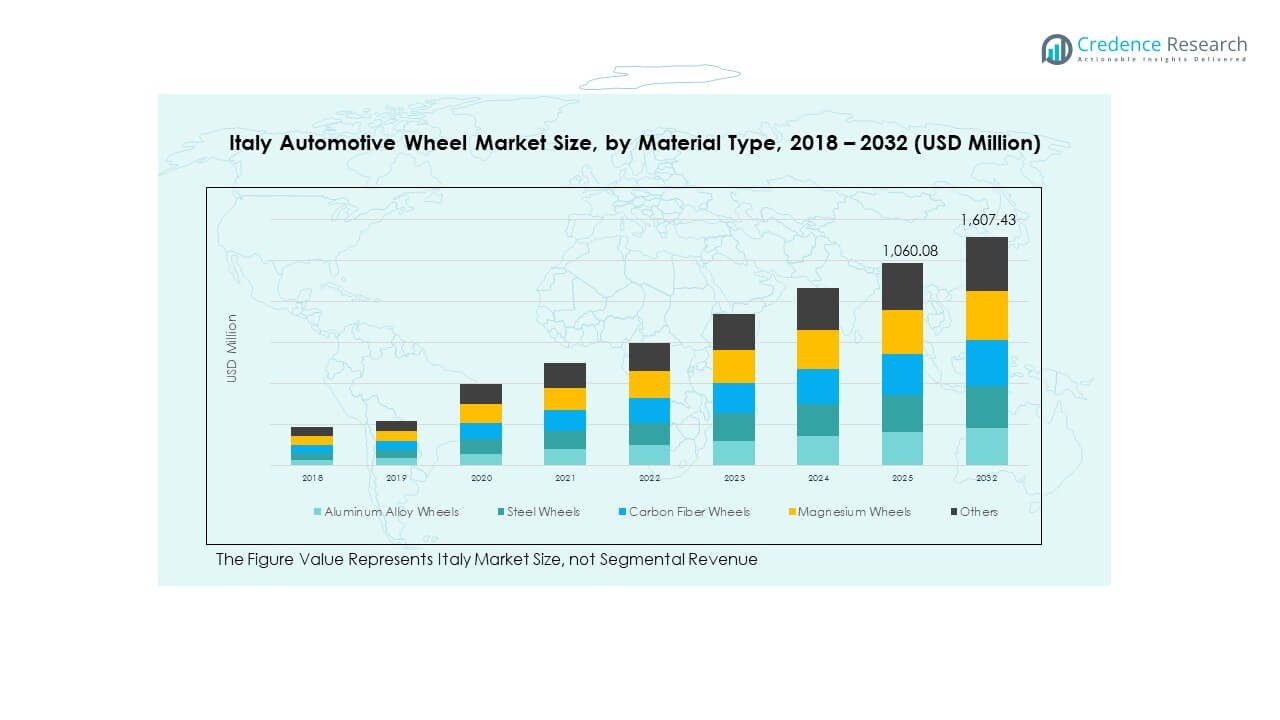

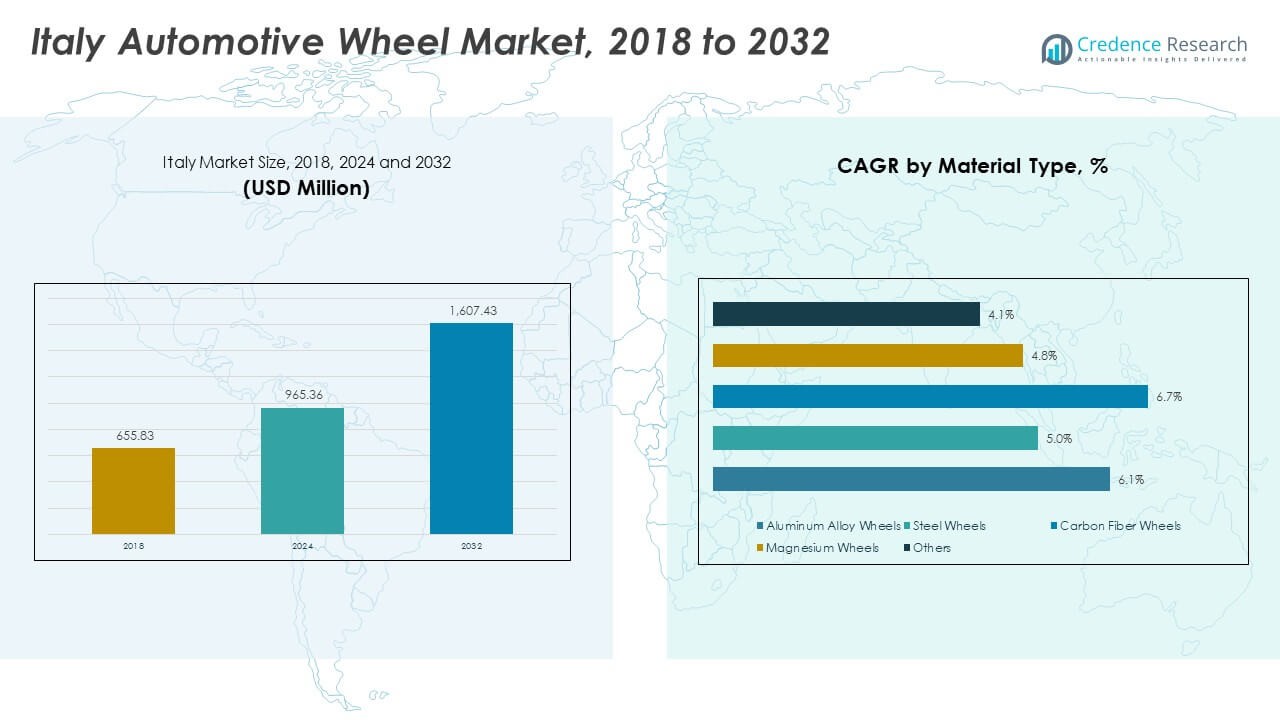

The Italy Automotive Wheel Market size was valued at USD 655.83 million in 2018 to USD 965.36 million in 2024 and is anticipated to reach USD 1,607.43 million by 2032, at a CAGR of 6.13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Automotive Wheel Market Size 2024 |

USD 965.36 Million |

| Italy Automotive Wheel Market, CAGR |

6.13% |

| Italy Automotive Wheel Market Size 2032 |

USD 1,607.43 Million |

Growing demand for lightweight mobility solutions drives strong interest in advanced wheel materials across Italy. Automakers focus on aluminum and hybrid alloy wheels to reduce vehicle weight and enhance handling performance. EV adoption strengthens demand for forged and flow-formed wheels that support battery load and improve energy efficiency. Rising consumer interest in personalized styling increases aftermarket sales. Premium vehicle brands also promote advanced wheel designs to improve ride quality and driving stability. Increasing production efficiency and continuous technological upgrades support wider market acceptance.

Northern Italy leads automotive wheel consumption due to its strong manufacturing base and concentration of OEM assembly plants. The region benefits from established supply chains and high vehicle production activity. Central Italy shows rising demand supported by growing urban mobility, premium car ownership, and aftermarket expansion. Southern regions display emerging growth, driven by increasing vehicle replacement rates and expanding service networks. The nationwide shift toward EV platforms and advanced mobility solutions encourages manufacturers to invest in efficient wheel technologies that meet evolving performance needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Italy Automotive Wheel Market was valued at USD 655.83 million in 2018, reached USD 965.36 million in 2024, and is projected to hit USD 1,607.43 million by 2032, registering a CAGR of 6.13% during 2024–2032.

- North Italy leads with 58% share due to its strong automotive manufacturing base, Central Italy holds 27% supported by rising passenger car ownership, and South Italy captures 15% driven by increasing replacement demand and expanding service networks.

- South Italy is the fastest-growing region with a 15% share, supported by improved road infrastructure, rising customization trends, and growing acceptance of lightweight and corrosion-resistant wheels.

- Aluminum alloy wheels represent the largest segment at around 42%, driven by demand for lightweight structures and improved fuel efficiency.

- Steel wheels account for roughly 28%, supported by commercial vehicle usage and requirements for durability, heavy-load endurance, and cost-efficient operations.

Market Drivers

Market Drivers

Rising Demand for Lightweight Materials to Improve Efficiency Across Vehicle Categories

The Italy Automotive Wheel Market benefits from strong interest in lighter materials that improve mobility. Automakers shift toward aluminum and hybrid alloys to cut weight and support better driving stability. The trend helps brands meet strict emission norms without major drivetrain changes. It supports stronger acceleration and shorter braking distances during routine travel. EV makers depend on lightweight wheels to offset battery mass and extend driving range. Consumers value smoother handling across highways and city routes. OEMs raise investments in casting and forging upgrades to meet this shift. Aftermarket suppliers also scale product portfolios to serve demand for performance-oriented wheel options.

- For instance, Aftermarket suppliers also scale product portfolios to serve demand for performance-oriented wheel options. Enkei’s MAT process reduces wheel weight by up to 15% while maintaining structural rigidity.

Growing EV Adoption Driving Structural Advancements in Wheel Engineering

Rising EV registrations strengthen demand for advanced wheel designs across key Italian cities. EV models require wheels that handle heavy battery loads without reducing comfort. The Italy Automotive Wheel Market gains from wider adoption of forged and flow-formed wheels that deliver high strength. It encourages suppliers to incorporate heat-resistant alloys to support long road usage. Automakers focus on aerodynamics to boost energy efficiency during daily travel. EV buyers select wheels that balance strength and weight while supporting motor performance. The shift builds steady volume for premium wheel technologies nationwide. Strong policy support accelerates EV platform expansion across the region.

- For instance, Strong policy support accelerates EV platform expansion across the region. BBS’s forged FI-R wheel weighs only 7.8 kg in 19-inch format, supporting high load ratings for performance EVs.

Expansion of Premium and Luxury Vehicle Fleet Supporting High-Performance Wheel Demand

Premium vehicle sales lift demand for refined and advanced wheel structures in Italy. Luxury brands promote wheels with stronger load distribution and enhanced comfort levels. The Italy Automotive Wheel Market benefits from higher demand for precision machining and superior finishing. It drives OEMs to adopt multi-layer coatings that improve durability across seasonal conditions. Buyers choose larger wheel diameters that enhance aesthetics and driving feel. Premium car users show rising interest in customized wheel patterns that elevate brand appeal. Workshops upgrade fitting capabilities to match this trend. Strong focus on styling helps suppliers expand high-value wheel categories.

Shift Toward Vehicle Personalization Boosting Aftermarket Wheel Upgrades Nationwide

Vehicle customization trends push aftermarket suppliers to expand design-focused wheel lines. Younger buyers select wheels that offer strong visual appeal and improved agility. The Italy Automotive Wheel Market sees rising orders for colored rims, multi-spoke layouts, and sport-grade alloys. It encourages companies to invest in modular designs that suit different vehicle types. Performance users prefer wheels that deliver better traction across mixed terrains. Customization workshops strengthen installation services to meet repeat demand. Online channels raise visibility for specialized wheel options with quick delivery. Strong personalization culture drives steady upgrades across both urban and regional locations.

Market Trends

Growing Use of Advanced Forging Technologies to Improve Wheel Strength and Stability

The Italy Automotive Wheel Market experiences rapid adoption of forging techniques that boost wheel resilience. Strong interest in structural precision drives investments in high-pressure forming systems. It leads to wheels that withstand high loads across varied road conditions. Automakers focus on forged wheels to enhance steering response during long highway travel. Workshops adopt CNC machining to deliver consistent quality standards. Buyers choose forged wheels for greater impact resistance during daily use. The trend expands the premium alloy segment across major Italian cities. Strong brand competition accelerates product enhancements in forged categories.

- For instance, Strong brand competition accelerates product enhancements in forged categories, OZ Racing’s HLT (High Light Technology) process reduces rotational mass, improving strength-to-weight performance.

Rising Integration of Smart Wheel Sensors for Tire Monitoring and Driver Safety

Digital features reshape wheel innovation across Italy and elevate demand for sensor-ready designs. The Italy Automotive Wheel Market advances with integration of embedded sensors that track pressure and temperature. It helps drivers maintain road safety and reduce tire wear. Automakers upgrade wheel platforms to support real-time monitoring tools. Growing interest in connected mobility raises the adoption rate for smart wheel systems. Fleets benefit from better maintenance planning supported by instant alerts. Consumers value greater control over safety functions during long-distance travel. The shift supports rising collaboration between wheel suppliers and electronics manufacturers.

- For instance, Consumers value greater control over safety functions during long-distance travel. The shift supports rising collaboration between wheel suppliers and electronics manufacturers. Continental’s intelligent TPMS sensors track pressure and temperature with data accuracy of ±1.5 psi and ±2°C, improving monitoring reliability.

Increasing Popularity of Large-Diameter Wheels Across Passenger and Performance Cars

Large-diameter wheels gain traction due to styling appeal and better handling characteristics. The Italy Automotive Wheel Market records stronger demand for 18–20-inch wheel sets across premium cars. It enables vehicle owners to achieve improved grip and sharper cornering. Automakers promote larger wheels to support modern body profiles and design lines. Buyers view larger wheels as a key styling element in new car purchases. The trend fuels investments in advanced rim manufacturing with lightweight alloys. Workshops expand balancing equipment to manage larger rim formats. Wider acceptance of sporty looks strengthens high-diameter wheel categories.

Sustained Growth in Eco-Friendly Wheel Coatings and Recyclable Alloy Development

Sustainability goals influence wheel production models across Italy and reshape material choices. The Italy Automotive Wheel Market moves toward low-VOC coatings that reduce environmental impact. It encourages suppliers to adopt powder-based finishes with stronger corrosion resistance. Automakers focus on recyclable alloys to support circular manufacturing programs. Buyers show rising interest in sustainable products with long service life. Workshops adopt eco-friendly cleaning and finishing processes to reduce waste. Green standards influence supplier selection for OEM partnerships. Strong push for sustainability reshapes material innovation across the value chain.

Market Challenges Analysis

High Raw Material Costs and Volatile Supply Chains Limiting Production Flexibility

Rising prices of aluminum and specialty alloys challenge suppliers across the Italy Automotive Wheel Market. It forces manufacturers to adjust procurement strategies during supply fluctuations. Volatile commodity markets limit planning for long production cycles. It increases cost pressure on OEMs that rely on lightweight wheel designs. Import delays create bottlenecks during peak demand periods. Suppliers struggle to maintain stable margins under shifting cost structures. Production schedules slow when material shortages emerge across the region. Strong competition pushes companies to manage costs more efficiently.

Technical Complexities and Strict Performance Norms Increasing Production Burden

Strict durability requirements place heavy strain on wheel manufacturing lines in Italy. The Italy Automotive Wheel Market must meet structural tests that ensure high load capacity. It raises the need for advanced forging, heat treatment, and quality inspection tools. Workshops face difficulty in maintaining precision during machining procedures. It increases investment needs for equipment upgrades and skilled labor training. OEMs demand tighter tolerances that elevate production challenges. Failures during testing phases delay product approvals. Rising complexity limits fast scale-up opportunities for smaller suppliers.

Market Opportunities

Expansion of EV Platforms Creating Strong Demand for Advanced Lightweight Wheels Across Italy

The Italy Automotive Wheel Market gains new opportunities from growing EV models that require efficient wheel designs. It encourages suppliers to adopt forged and flow-formed technologies for better load handling. Automakers seek wheels that reduce resistance and support longer driving range. Urban EV adoption pushes demand for corrosion-resistant coatings suitable for varied climates. The trend opens avenues for specialized wheel categories with aerodynamic advantages. Rising fleet electrification supports B2B sales for optimized wheel sets. Strong regulatory support accelerates development of innovative wheel products.

Growing Aftermarket Customization Culture Enabling Product Diversification and Niche Wheel Segments

Aftermarket demand grows quickly as buyers seek unique styling options and performance enhancements. The Italy Automotive Wheel Market benefits from interest in colored finishes, multi-spoke rims, and sport-grade alloys. It helps suppliers expand designs that match regional aesthetic preferences. Workshops scale personalized services that attract young buyers across major cities. The rise of digital retail improves visibility for niche wheel models. It boosts competition among brands offering modular and high-impact designs. Strong demand for customization opens new revenue channels nationwide.

Market Segmentation Analysis:

By Material Type

The Italy Automotive Wheel Market shows strong preference for aluminum alloy wheels due to their lighter weight and balanced performance profile. It gains traction from wider OEM adoption and improved fuel efficiency targets. Steel wheels maintain steady demand in budget vehicles where durability and low cost matter. Carbon fiber wheels attract premium buyers seeking superior strength and high-speed stability. Magnesium wheels gain interest among performance users who prioritize reduced rotational mass. Other materials serve niche requirements where customization and design flexibility drive purchases.

- For instance, Carbon fiber wheels attract premium buyers seeking superior strength and high-speed stability. Carbon Revolution’s single-piece carbon fiber wheels reduce unsprung mass by up to 45% compared to aluminum equivalents.

By Vehicle Type

The Italy Automotive Wheel Market expands across passenger vehicles, commercial vehicles, and off-highway equipment. Passenger vehicles generate the highest demand due to strong urban usage and rising compact car sales. It benefits from buyers seeking alloy-based wheels for better handling. Commercial vehicles prefer steel wheels that support heavy loads and frequent travel cycles. Off-highway vehicles use reinforced wheel structures that handle rough terrain and high-impact activities. Each category drives focused production strategies across domestic suppliers.

- For instance, Commercial vehicles prefer steel wheels that support heavy loads and frequent travel cycles. Accuride’s steel commercial wheels meet fatigue test cycles exceeding 2 million revolutions.

By End-User

The Italy Automotive Wheel Market splits demand between OEM and aftermarket buyers. OEM demand remains strong due to rising vehicle production and increasing installation of lightweight alloys. It supports consistent supply chain activity across leading manufacturers. The aftermarket grows rapidly with higher interest in personalization and performance upgrades. Vehicle owners replace factory wheels with sport-oriented, larger-diameter, or custom-finish options. Aftermarket channels benefit from online retail growth and broader design availability.

Segmentation:

By Material Type

- Aluminum Alloy Wheels

- Steel Wheels

- Carbon Fiber Wheels

- Magnesium Wheels

- Others

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Off-Highway Vehicles

By End-User

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Country (Italy Market Breakdown)

- Country-wise Volume Share

- Country-wise Revenue Share

- Volume by Material Type

- Revenue by Material Type

- Volume by Vehicle Type

- Revenue by Vehicle Type

- Volume by End-User

- Revenue by End-User

Regional Analysis:

North Italy – Manufacturing Core With Strongest Market Share

The Italy Automotive Wheel Market records its highest share in North Italy, holding nearly 58% of national demand. The region leads due to its dense automotive manufacturing belt and established supplier ecosystem. It benefits from high OEM activity supported by global brands and advanced machining hubs. Strong adoption of aluminum alloys and performance wheels drives steady growth among vehicle owners. The northern region supports large-scale aftermarket activity through specialized tuning workshops. Rising EV registrations strengthen demand for forged and lightweight wheel types across major cities.

Central Italy – Growing Consumer Base With Expanding Mid-Size Market Share

Central Italy holds around 27% of the Italy Automotive Wheel Market, supported by a balanced mix of urban mobility and premium vehicle ownership. It benefits from steady demand for alloy wheels aligned with rising passenger car usage. The region shows growing interest in sport-oriented and design-focused wheel upgrades. It supports a diverse aftermarket network that caters to customization and performance needs. Strong tourism and rental fleet renewal create repeat orders for durable wheel formats. The central region expands wheel replacement cycles as households shift toward compact and hybrid vehicles.

South Italy – Emerging Market With Rising Adoption of Modern Wheel Technologies

South Italy contributes nearly 15% of the Italy Automotive Wheel Market, marking it as an emerging yet fast-improving region. The region sees growing demand for steel and hybrid alloy wheels among budget and utility-focused segments. It benefits from rising vehicle replacement rates supported by expanding service centers. Urban clusters show increasing interest in aesthetic wheel upgrades driven by younger buyers. Improving road infrastructure pushes interest in stronger wheel materials suitable for mixed driving conditions. It gains momentum as more dealers introduce lightweight, corrosion-resistant wheel categories tailored for regional climates.

Key Player Analysis:

- OZ Racing

- Fondmetal

- Momo

- Speedline Corse

- Abarth (OEM Wheels)

- Tecnomagnesio

- ANTEROS (Italy)

- RMF Wheels

- AEZ Italy

- Ronal Italy

Competitive Analysis:

The Italy Automotive Wheel Market maintains a competitive landscape shaped by strong domestic manufacturers and established European suppliers. It benefits from companies that focus on lightweight materials, precision casting, and forged wheel technologies. Leading brands compete through design innovation, advanced coating systems, and expanded aftermarket offerings. It shows high product differentiation driven by performance needs and aesthetic preferences. OEM partnerships strengthen long-term revenue streams for top suppliers. Aftermarket players rely on customization and rapid distribution networks. Competitive intensity remains strong due to rising EV wheel demand and growing adoption of premium alloys across key regions.

Recent Developments:

- In September 2025, OZ Racing announced the Ultraleggera Day event scheduled for September 6, 2025, at their headquarters in San Martino di Lupari, Italy. This special event celebrates the 20th anniversary of their iconic Ultraleggera wheel and includes factory tours, exclusive access to the OZ Wheel Museum, and community engagement activities, highlighting the brand’s commitment to their enthusiast community.

- In September 2025, the RONAL GROUP launched the R73 wheel, a modern multi-spoke performance wheel with dynamic design inspired by rally racing. The R73 features delicate, precisely manufactured spokes providing maximum rigidity with reduced weight, resulting in improved handling and driving dynamics. The wheel is available in sizes 7.5×18, 8.0×18, 8.5×19, and 9.5×19 inches with four finishes: Bronze-matt, Jetblack-matt, Rallye-white, and Tremolite metallic matt.

- In May 2025, at Autopromotec 2025 in Bologna, Antera unveiled the world premiere of the A123 wheel model. This groundbreaking product represents the first three-spoke wheel produced through low-pressure casting with advanced cooling mold technology—a production technique never before used in the industry. The A123 achieves a 25% reduction in rim width and 1-kg weight reduction per wheel while maintaining resistance and safety. Available in 20-inch (x9.0) and 22-inch (x9.5/10.5/11.5) sizes with Piano Black Diamond, Piano Black, and Silver Ice finishes, this launch marked a significant milestone in Antera’s renaissance under G.M.P. Group ownership.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Material Type (Aluminum Alloy Wheels, Steel Wheels, Carbon Fiber Wheels, Magnesium Wheels, Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles, Off-Highway Vehicles), and By End-User (OEM and Aftermarket). It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising EV penetration will drive strong demand for lightweight wheels with higher load capacity.

- OEMs will expand forged and flow-formed wheel adoption to meet efficiency and durability targets.

- Aftermarket customization will gain share from younger buyers seeking premium styling upgrades.

- Demand for corrosion-resistant coatings will strengthen due to varied road conditions across regions.

- Wheel suppliers will invest in automation and precision machining to improve production quality.

- Larger wheel diameters will grow in popularity across passenger and crossover vehicles.

- Partnerships between wheel manufacturers and EV makers will expand to support specialized wheel designs.

- Sustainability goals will push producers to adopt recyclable alloys and low-VOC coatings.

- Digital retail will boost aftermarket visibility and accelerate custom wheel purchases.

- Regional supply chain optimization will improve delivery timelines and enhance market responsiveness.

Market Drivers

Market Drivers