Market Overview:

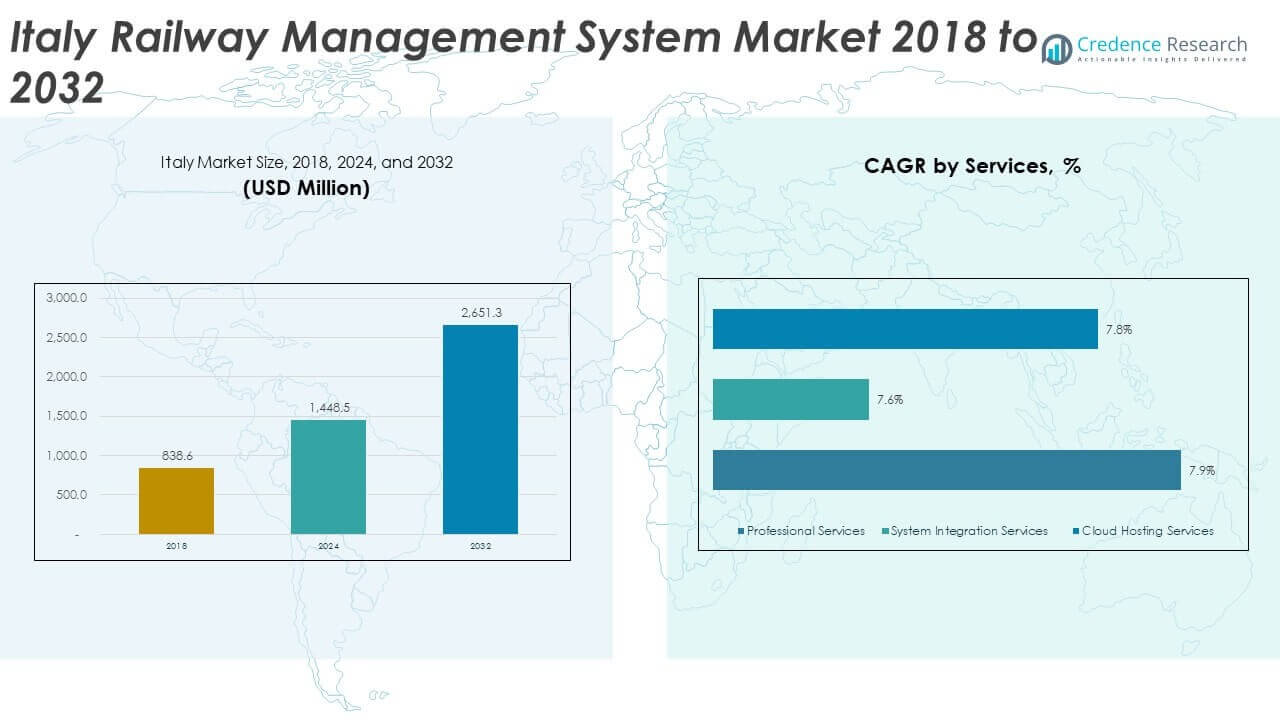

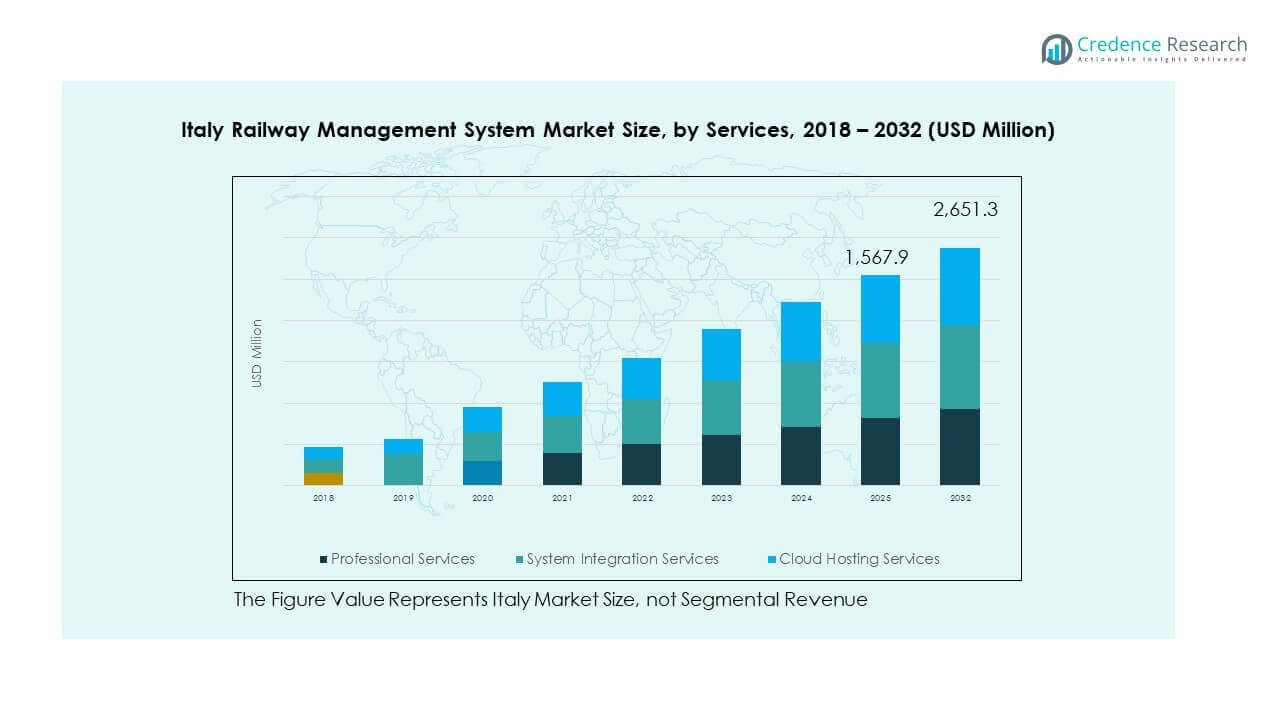

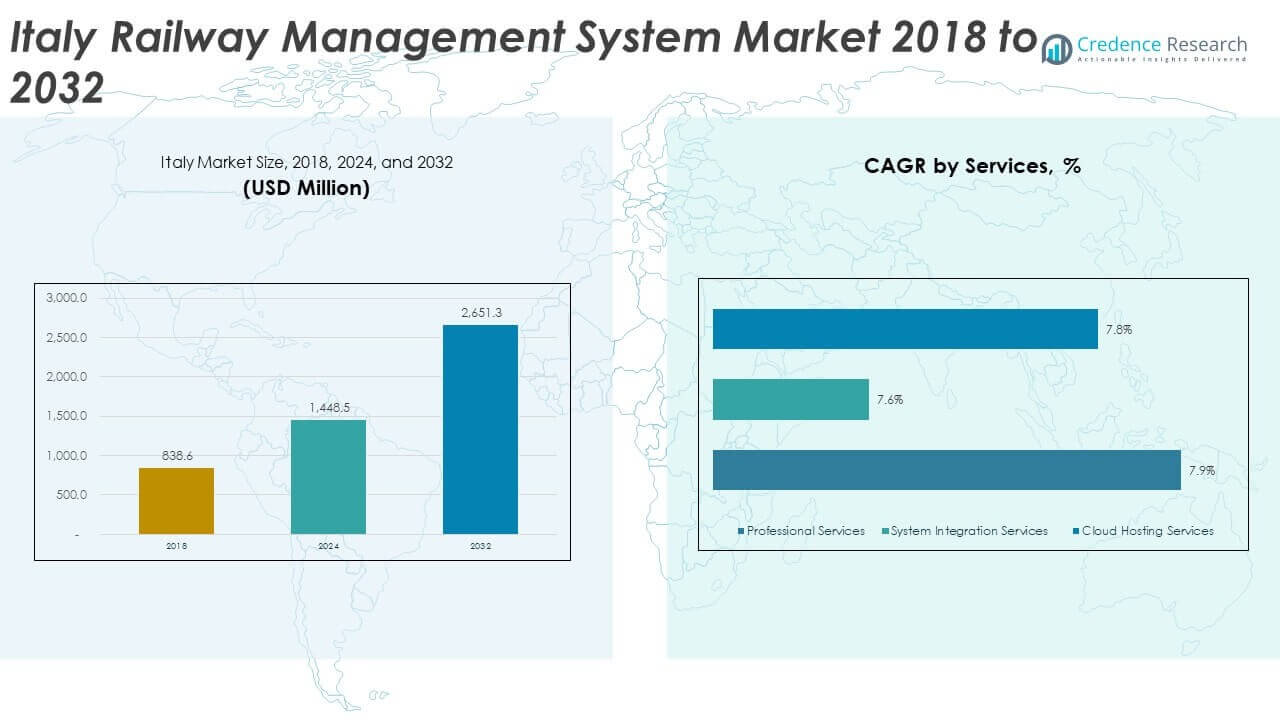

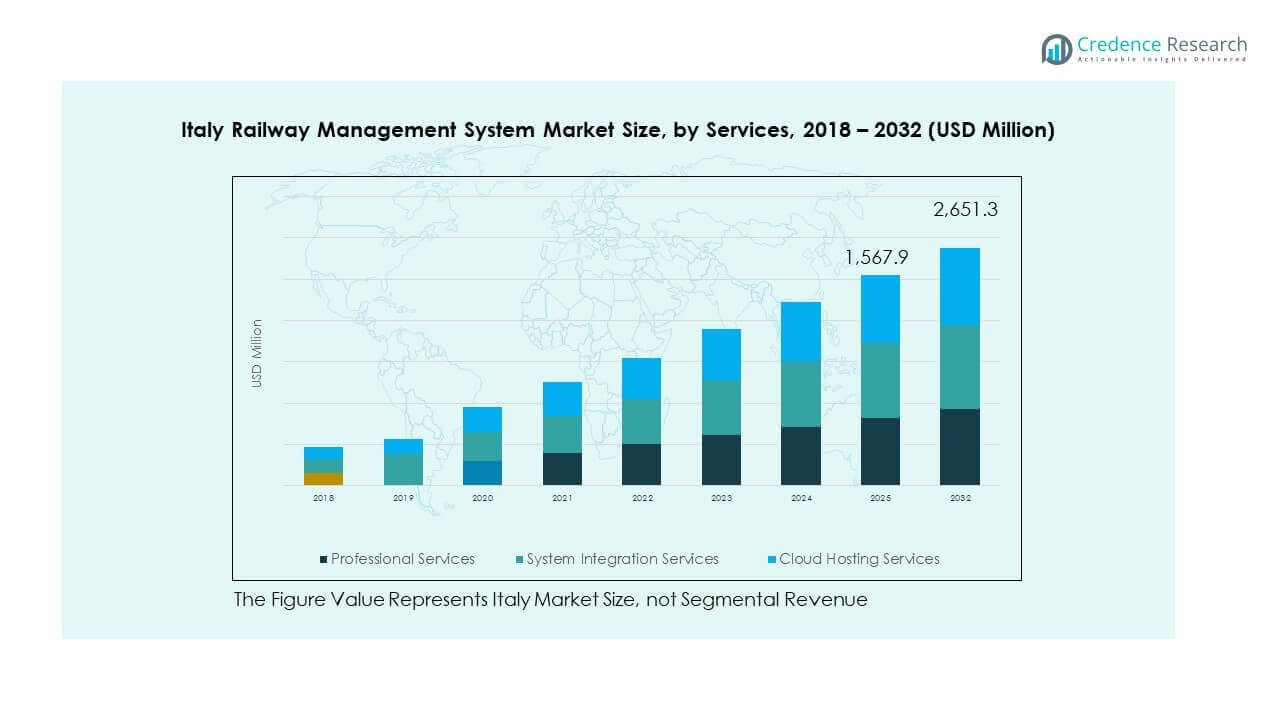

The Italy Railway Management System Market size was valued at USD 707.1 million in 2018 to USD 1,276.9 million in 2024 and is anticipated to reach USD 2,479.5 million by 2032, at a CAGR of 8.65% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Railway Management System Market Size 2024 |

USD 1,276.9 Billion |

| Italy Railway Management System Market, CAGR |

8.65% |

| Italy Railway Management System Market Size 2032 |

USD 2,479.5 Billion |

The market is driven by Italy’s ongoing focus on upgrading its railway infrastructure to meet growing passenger and freight demands. Increasing adoption of automation, digital monitoring, and signaling technologies is enhancing safety and punctuality across the network. Government initiatives supporting sustainability and reducing road congestion further encourage investments in railway management solutions. The integration of big data, IoT, and predictive analytics strengthens operational control and maintenance planning. Rising demand for high-speed rail services also boosts the adoption of modern management systems in the country.

Geographically, Western Europe leads the market due to advanced infrastructure and long-standing investments in high-speed rail. Italy holds a prominent position with continuous modernization projects and integration of advanced control systems. Emerging opportunities are seen in Central and Eastern Europe, where countries are investing in electrification and digitalization to improve connectivity and reduce travel times. Global partnerships and EU-backed funding further accelerate adoption across these regions, making Europe a hub for railway innovation and advanced management technologies.

Market Insights:

- The Italy Railway Management System Market was valued at USD 707.1 million in 2018, reached USD 1,276.9 million in 2024, and is projected to hit USD 2,479.5 million by 2032, growing at a CAGR of 8.65%.

- Western Europe held the largest share with 42% in 2024, driven by advanced infrastructure and EU-backed projects, while Southern Europe, including Italy, accounted for 30% supported by intercity and freight demand, and Central and Eastern Europe captured 28% with modernization efforts.

- Asia-Pacific emerged as the fastest-growing region, with rising investment in digitalization and high-speed rail expansion fueling its share gains.

- System integration services dominated service segmentation in 2024, accounting for around 44% share due to strong demand for upgrading legacy networks.

- Cloud hosting services represented nearly 32% share in 2024, reflecting increasing adoption of scalable and cost-efficient digital platforms across Italy’s railway operators.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Government Investment in Railway Infrastructure Modernization:

The Italy Railway Management System Market benefits from sustained government investment in modernizing infrastructure. Authorities are prioritizing high-speed rail projects, electrification, and smart signaling upgrades. These investments aim to enhance safety, improve punctuality, and expand network capacity. The government also supports EU-backed funding programs that align with sustainability goals. With such initiatives, the railway network continues to adapt to rising passenger and freight demands. It creates opportunities for digital systems that optimize scheduling and operations. Ongoing infrastructure upgrades make the sector more efficient and reliable.

- For instance, Rete Ferroviaria Italiana (RFI) is expanding the European Rail Traffic Management System (ERTMS) to cover approximately 16,800 km of track by 2036, supported by €3 billion of EU Recovery Plan funding for advanced signaling and digital interlocking systems, accelerating interoperability and safety enhancements on both high-speed and conventional lines.

Growing Demand for High-Speed and Urban Rail Connectivity:

High-speed rail expansion drives strong adoption of advanced management systems. Italy’s busy intercity routes require technology that ensures punctuality and safe traffic flow. Urban transit networks also depend on efficient control platforms to handle daily congestion. Passenger expectations for shorter travel times encourage operators to upgrade systems. The Italy Railway Management System Market benefits from investments in automated traffic management. It enables efficient train scheduling and reduces network bottlenecks. Continuous demand for faster, seamless transport boosts long-term technology adoption across Italy.

- For instance, the Naples-Bari high-speed rail line, currently under construction and slated for completion around 2028, will cut travel time across 145 kilometers from four hours to approximately two hours. It is incorporating the European Rail Traffic Management System (ERTMS) signaling for high safety and interoperability. Separately, urban operator Trenord in Lombardy has been using Oracle Cloud Infrastructure for its ticketing platform since 2017 to improve operational efficiency and low-latency service delivery across its network.

Integration of Advanced Digital Solutions Across Operations:

Operators are adopting IoT, predictive analytics, and digital monitoring for network management. These solutions help in real-time tracking, automated diagnostics, and preventive maintenance planning. The Italy Railway Management System Market supports integration of smart technologies for better control. It improves efficiency while lowering risks of operational delays. Digital platforms also enhance communication between control centers and rolling stock. Growing reliance on analytics enables informed decision-making in complex railway networks. Such integration establishes a foundation for future adoption of AI-driven solutions.

Focus on Passenger Safety and Enhanced Customer Experience:

Passenger safety remains a central driver for adopting modern railway management systems. Italy’s operators implement signaling upgrades and automatic control systems to prevent collisions. Improved safety standards build trust among passengers and encourage higher ridership. The Italy Railway Management System Market aligns with global safety regulations and EU compliance. It helps operators ensure seamless passenger experience by reducing delays. Digital ticketing and real-time information also improve customer satisfaction. Focus on safety and convenience motivates continued adoption of advanced management platforms.

Market Trends:

Rising Adoption of Cloud-Based Railway Management Platforms:

Railway operators are increasingly shifting to cloud-based platforms for centralized management. These solutions reduce infrastructure costs and improve scalability for future expansions. The Italy Railway Management System Market integrates cloud technology to streamline communication. It allows operators to store, analyze, and share data efficiently across networks. Cloud platforms also strengthen disaster recovery and backup systems. Rising demand for remote monitoring encourages wider cloud adoption. This trend creates flexible and cost-efficient railway management frameworks across the country.

- For instance, Trenord, one of Italy’s largest regional railway operators, has used Oracle Cloud Infrastructure for its ticketing systems since 2017, enabling secure, scalable, and high-performing operations that support millions of commuters across the Lombardy region.

Use of Artificial Intelligence and Predictive Analytics in Rail Systems:

Artificial intelligence is transforming predictive maintenance and scheduling processes. Operators use algorithms to detect faults before they disrupt services. The Italy Railway Management System Market adopts AI-powered platforms to enhance network reliability. It enables faster response to technical issues and lowers maintenance costs. Predictive analytics support smarter allocation of resources and reduce downtime. AI also strengthens passenger flow management at crowded stations. This trend highlights the industry’s focus on automation and improved decision-making.

Expansion of Smart Ticketing and Contactless Travel Technologies:

Digitalization is reshaping the passenger experience through smart ticketing platforms. Contactless travel solutions reduce queues and improve boarding efficiency in busy stations. The Italy Railway Management System Market benefits from growing adoption of mobile applications. It allows passengers to access real-time travel updates and seamless payment options. Smart ticketing also integrates with loyalty programs to attract frequent travelers. Operators leverage data from digital tickets to optimize route planning. This trend ensures a modern, customer-focused travel environment.

Sustainability and Green Mobility Initiatives in Railway Operations:

Rail operators are aligning strategies with sustainability and energy efficiency goals. The Italy Railway Management System Market incorporates eco-friendly technologies to cut emissions. It promotes electrification, energy-efficient signaling, and low-carbon infrastructure. Sustainable systems reduce reliance on fossil fuels and support environmental regulations. Operators are adopting smart energy management to optimize electricity use. Green mobility trends also strengthen Italy’s leadership in sustainable transport. Such initiatives reflect a long-term commitment to cleaner and efficient rail operations.

Market Challenges Analysis:

High Initial Costs and Long Payback Periods for System Implementation:

The Italy Railway Management System Market faces significant barriers due to high setup costs. Deploying advanced management systems requires large capital investment in hardware, software, and training. Smaller operators find it difficult to justify such expenses within limited budgets. It creates long payback periods that delay wider adoption. Integration with existing infrastructure further increases costs. Financial constraints limit flexibility for adopting cutting-edge digital platforms. These challenges make scalability a concern for operators focusing on profitability. Balancing modernization with financial viability remains a major industry challenge.

Complex Integration and Resistance to Technology Adoption Across Networks:

System integration with older infrastructure poses a considerable challenge for operators. The Italy Railway Management System Market struggles with compatibility issues across legacy systems. It demands specialized expertise to connect digital platforms with conventional signaling. Resistance to change among workforce and operators slows down adoption. Technical failures during integration risk disrupting essential services. Lack of standardized protocols complicates collaboration across regions. Limited awareness of benefits further reduces adoption speed. Overcoming such challenges requires clear strategies for training, modernization, and change management.

Market Opportunities:

Expansion of High-Speed Rail and Cross-Border Connectivity Projects:

Italy’s expansion of high-speed and cross-border rail projects creates strong opportunities. The Italy Railway Management System Market supports advanced systems needed for international standards. It allows seamless integration of networks across European corridors. Cross-border initiatives strengthen connectivity and trade efficiency. Adoption of advanced control systems ensures safe, punctual services across extended routes. Demand for standardized systems also supports global partnerships. This expansion makes Italy an attractive hub for modern rail technologies.

Adoption of Digital Mobility Services and Passenger-Centric Innovations:

Rising demand for digital mobility services boosts opportunities for innovation. The Italy Railway Management System Market aligns with customer-focused solutions like real-time updates and app-based ticketing. It creates space for AI-driven platforms that improve passenger flow. Integration of digital services enhances travel experience and customer loyalty. Operators can also monetize value-added services through mobility ecosystems. Growing preference for convenience accelerates demand for such innovations. This focus on passenger needs presents lasting growth opportunities in Italy’s rail sector.

Market Segmentation Analysis:

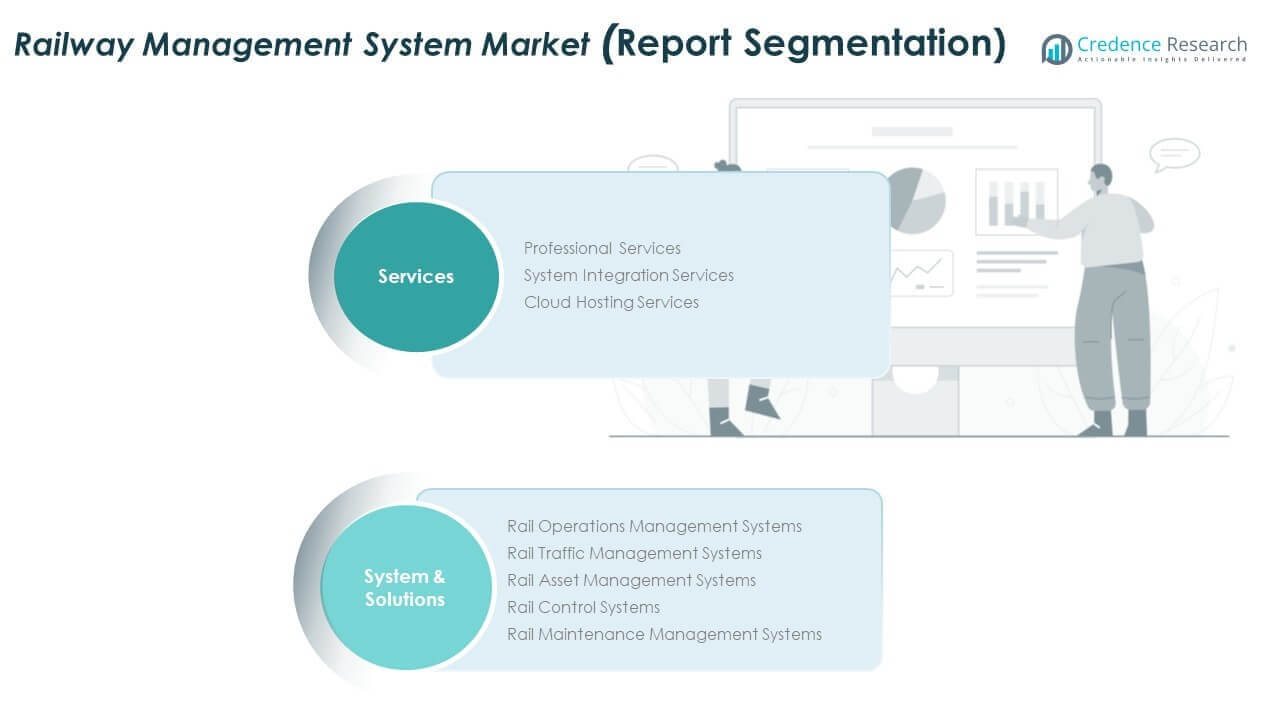

By Services

The Italy Railway Management System Market is supported by strong demand across service categories. Professional services form a critical foundation, offering consultancy, training, and technical support to operators modernizing infrastructure. System integration services hold significant importance as rail networks adopt advanced platforms that must align with legacy systems. Integration ensures smooth operations, reliable communication, and optimized control across complex networks. Cloud hosting services are gaining traction, driven by the need for scalable, cost-effective, and secure data solutions. It allows operators to centralize operations, strengthen real-time monitoring, and improve disaster recovery frameworks.

- For instance, AlmavivA, a leading system integrator in Italy, actively supports digital transformation through developing infrastructure monitoring digital twins, using cloud and AI technologies to coordinate over 16,000 km of rail infrastructure, improving predictive maintenance and operational efficiency nationwide.

By System & Solution

System and solution segments represent key revenue drivers in the Italy Railway Management System Market. Rail operations management systems lead adoption due to their role in scheduling and traffic coordination. Rail traffic management systems support growing passenger demand by enhancing punctuality and flow control. Rail asset management systems optimize maintenance cycles, reducing downtime and extending equipment life. Rail control systems remain vital for signaling upgrades and ensuring passenger safety. Rail maintenance management systems are expanding with predictive tools that improve efficiency and lower operational risks. It highlights the sector’s focus on digital resilience and sustainable railway growth.

- For instance, Alstom manages some of Italy’s high-speed trains and urban transit solutions, delivering integrated rail systems that include advanced traffic management, asset optimization, and signaling technologies that have been deployed to handle dense traffic and reduce delays.

Segmentation:

By Services

- Professional Services

- System Integration Services

- Cloud Hosting Services

By System & Solution

- Rail Operations Management Systems

- Rail Traffic Management Systems

- Rail Asset Management Systems

- Rail Control Systems

- Rail Maintenance Management Systems

Regional Analysis:

Western Europe – Leading Regional Contributor

Western Europe dominates the Italy Railway Management System Market with over 42% share, supported by advanced infrastructure and heavy investment in rail modernization. Italy’s strong high-speed network and integration with cross-border corridors strengthen its leadership. Operators in this region prioritize digital signaling, automated control, and sustainable energy systems to meet passenger and freight demands. EU-backed projects provide consistent funding for high-speed rail and smart mobility solutions. It benefits from established players that supply advanced management platforms and safety-focused technologies. Continuous adoption of AI-driven systems consolidates Western Europe’s position as a market leader.

Central and Eastern Europe – Emerging Adoption Hub

Central and Eastern Europe account for around 28% share, reflecting growing investment in electrification and digitalization. Countries in this region are upgrading legacy networks to improve safety and reduce travel times. The Italy Railway Management System Market benefits indirectly through partnerships and knowledge sharing across EU initiatives. Operators adopt modern asset management and traffic control solutions to enhance operational efficiency. Rising government focus on connectivity projects increases adoption of advanced management systems. It reflects the region’s transition from traditional infrastructure toward digitally integrated rail networks.

Global and Cross-Border Influence – Supporting Growth

Southern Europe, including Italy, contributes nearly 30% share, driven by growing intercity passenger demand and freight modernization. Italy’s strong focus on rail control, maintenance, and asset optimization boosts system adoption. Cross-border connectivity with France, Switzerland, and Austria strengthens the role of Italy in the broader European framework. The Italy Railway Management System Market benefits from global technology providers introducing scalable, cloud-based, and predictive maintenance solutions. Operators align with EU sustainability goals, ensuring efficient resource utilization. It demonstrates how regional collaboration fuels both domestic and international railway modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Italy Railway Management System Market is highly competitive, with global and domestic companies focusing on modernization and digital transformation. Leading players such as FS Italiane, Hitachi, Siemens, Alstom, and Ansaldo STS hold strong positions through technology-driven portfolios and long-term contracts. It is characterized by investments in automation, predictive analytics, and smart mobility platforms that improve operational efficiency and safety. Companies emphasize strategic partnerships, system integration, and cloud-based services to meet evolving demand. Local firms complement international players by offering niche solutions and tailored services. Competitive intensity remains high, as operators seek innovation to align with EU sustainability and connectivity goals.

Recent Developments:

- In early 2025, FS Italiane delivered 61 new regional trains with an investment of approximately EUR 500 million as part of its 2025-2029 Strategic Plan, aiming to have 1,061 next-generation trains in service by 2027, significantly renewing 80% of the regional fleet across Italy.

- In September 2025, Hitachi Rail officially opened its $100 million lighthouse digital factory in Maryland, U.S., capable of producing up to 20 railcars per month with advanced digital technology including AI and smart manufacturing. Though this facility is primarily for North American customers, it reflects Hitachi’s ongoing global investment in rail technology, including the railway management system sector.

- Alstom announced a €63 million investment plan in Italy from 2024 to 2026 to expand production and maintenance facilities for regional and high-speed trains, including hydrogen train testing and production line enhancements, supporting over 14,000 jobs in Italy and focusing on sustainable, environmentally friendly solutions.

- Progress Rail, a Caterpillar company, acquired Italy-based ECM S.p.A., a leading rail signal provider, continuing innovation and production in railway signaling infrastructure in Italy, strengthening Progress Rail’s presence in this vital supply segment.

- Adria Fer s.r.l., through its subsidiary Adriafer Rail Services, launched a new rail service in February 2025 linking Parma, Italy with Hupac terminal in Brwinów, Poland, enhancing intermodal freight transportation between Italy and Poland.

Report Coverage:

The research report offers an in-depth analysis based on services and system & solution segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- High-speed rail projects will continue to drive technology upgrades across Italy’s networks.

- Cloud-based platforms will expand adoption for cost-effective and scalable management solutions.

- AI and predictive analytics will enhance asset management and reduce operational downtime.

- Passenger-centric innovations such as real-time updates will strengthen customer loyalty.

- Cross-border connectivity projects will increase demand for standardized management platforms.

- Green mobility initiatives will encourage investments in energy-efficient rail operations.

- Regional partnerships will foster system integration and modernization at scale.

- Professional and integration services will remain crucial for upgrading legacy systems.

- Predictive maintenance solutions will gain traction for improving safety and reliability.

- Global technology leaders will expand influence through mergers, collaborations, and strategic contracts.