| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Automotive Smart Keys Market Size 2023 |

USD 766.52 Million |

| Japan Automotive Smart Keys Market, CAGR |

9.08% |

| Japan Automotive Smart Keys Market Size 2032 |

USD 1,677.08 Million |

Market Overview

Japan Automotive Smart Keys Market size was valued at USD 766.52 million in 2023 and is anticipated to reach USD 1,677.08 million by 2032, at a CAGR of 9.08% during the forecast period (2023-2032).

The Japan automotive smart keys market is driven by the increasing demand for advanced vehicle security systems, enhanced user convenience, and the rise of electric vehicles (EVs). As vehicle manufacturers focus on offering innovative, high-tech features, smart keys have become integral to modern car designs, providing functionalities like keyless entry, remote start, and proximity sensing. The growing need for seamless and secure vehicle access solutions fuels the adoption of smart keys. Additionally, the rising popularity of connected and autonomous vehicles further accelerates the market’s growth, as smart keys are often central to vehicle connectivity. Trends such as the integration of biometric authentication, like fingerprint or facial recognition, and the development of more sophisticated, durable, and energy-efficient smart key systems are also shaping the market. With technological advancements and changing consumer preferences, the market is expected to expand significantly in the coming years.

The geographical landscape of Japan’s automotive smart key market is driven by major automotive hubs like the Kanto, Kansai, and Chubu regions, which host a concentration of vehicle manufacturers, technology developers, and consumers seeking advanced vehicle access solutions. The Kanto Region, particularly Tokyo, remains the focal point for smart key adoption due to its dense urban population and high-tech infrastructure. Key players in the Japanese automotive smart key market include global and local giants such as Huf Hulsbeck & Furst GmbH & Co, Continental AG, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA, Hyundai Mobis, and Denso Corporation. These companies are at the forefront of innovation, developing cutting-edge smart key technologies that integrate security, convenience, and connectivity. Additionally, Toyota Motor Corporation and other local automakers continue to drive the market by incorporating smart key systems into their vehicles, meeting growing consumer demand for enhanced vehicle security and ease of access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan automotive smart key market was valued at USD 766.52 million in 2023 and is expected to reach USD 1,677.08 million by 2032, growing at a CAGR of 9.08% during the forecast period (2023-2032).

- The Global Automotive Smart Keys market was valued at USD 12,499.00 million in 2023 and is projected to reach USD 26,481.41 million by 2032, growing at a CAGR of 8.70% from 2023 to 2032.

- Increasing demand for keyless entry systems and advanced security features is driving the market’s growth.

- The adoption of Passive Keyless Entry (PKE) systems and biometric authentication is gaining momentum, enhancing convenience and safety.

- Consumer preference for luxury vehicles with integrated smart key solutions is a significant trend in the market.

- The presence of key players like Continental AG, ZF Friedrichshafen AG, and Denso Corporation is intensifying competition in the industry.

- High costs of implementation and concerns over cybersecurity remain significant market restraints.

- The Kanto and Kansai regions dominate the market, with a growing presence of automotive manufacturers and high-tech infrastructure in these areas.

Report Scope

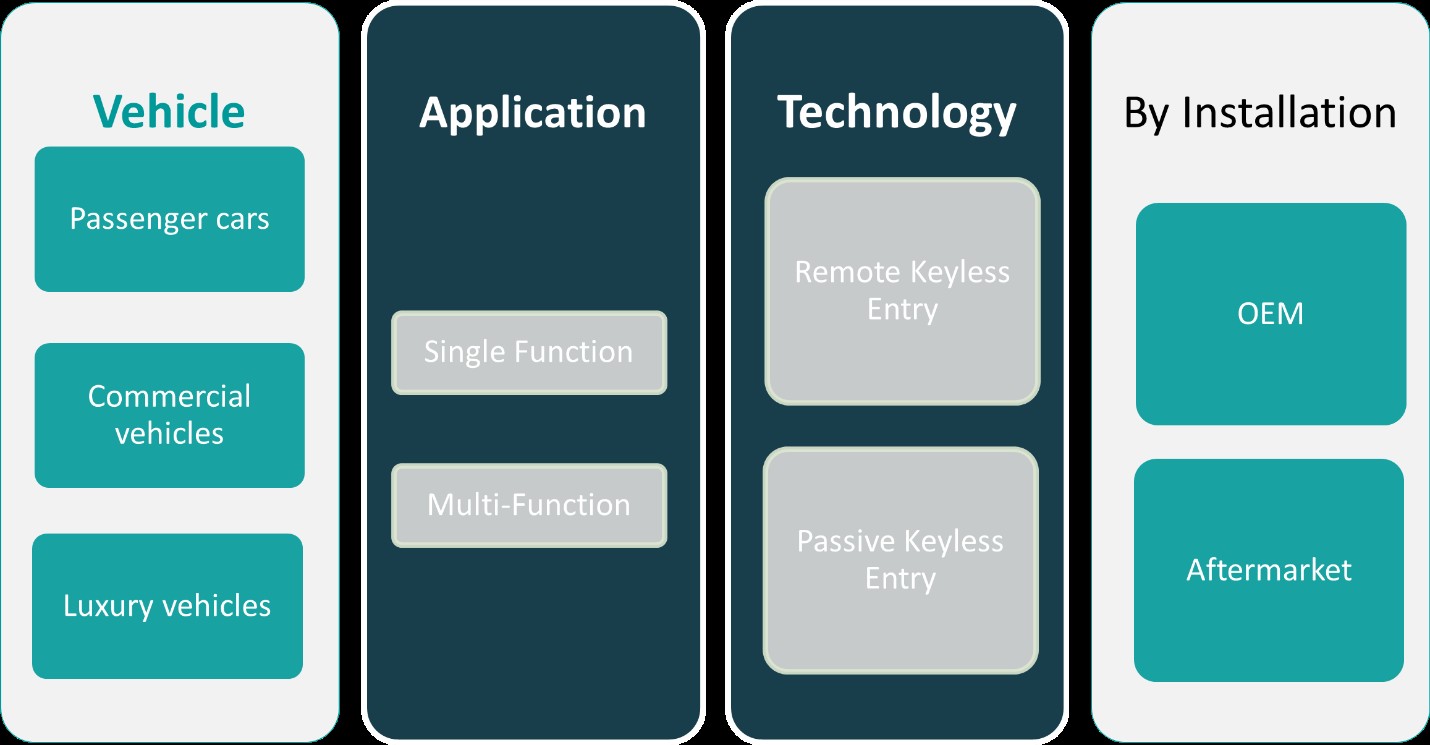

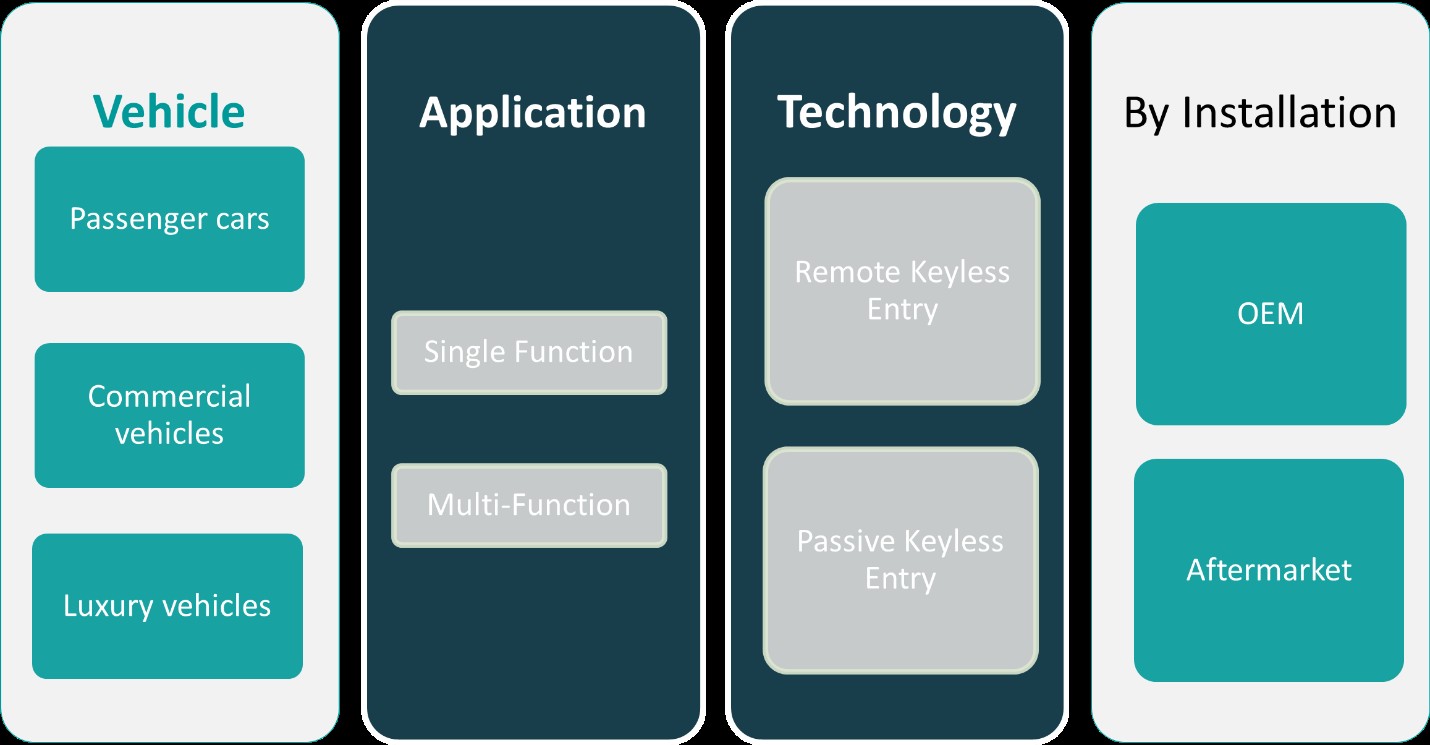

This report segments the Japan Automotive Smart Keys Market as follows:

Market Drivers

Rising Demand for Advanced Vehicle Security Systems

The growing need for enhanced security features in vehicles is one of the primary drivers for the Japan automotive smart key market. For instance, a report by the Japanese Ministry of Land, Infrastructure, Transport and Tourism highlights the effectiveness of encrypted communication and secure authentication protocols in reducing vehicle theft incidents. Traditional mechanical keys are increasingly seen as inadequate in providing sufficient protection against theft or unauthorized access. As a result, automotive manufacturers are incorporating advanced security systems, including smart keys, to meet consumer demands for safer vehicles. Smart keys offer features such as encrypted communication and secure authentication protocols, making them more difficult to hack or duplicate. This rise in consumer awareness regarding vehicle security is prompting manufacturers to adopt keyless entry and push-button start systems that provide both convenience and robust protection. Additionally, the Japanese market, which has a high emphasis on technological innovation, has witnessed a growing integration of automotive security solutions. These innovations are critical for enhancing the safety of vehicles in an era where cyber threats to vehicle systems are becoming more prevalent.

Technological Advancements in Automotive Systems

Another significant driver of the Japan automotive smart keys market is the continuous advancement in automotive technology. For instance, a study by the Japan Automobile Manufacturers Association (JAMA) emphasizes the integration of features like remote start, vehicle tracking, and smartphone app connectivity in modern vehicles. With the increasing integration of electronics and connectivity in vehicles, smart keys have evolved from simple proximity-based systems to more sophisticated solutions that offer multi-functional capabilities. Features like remote start, keyless entry, push-to-start ignition, and vehicle tracking are now standard in many modern vehicles, all of which rely on the use of smart keys. Smart keys are also playing a pivotal role in the rise of autonomous and connected vehicles. As automakers work on integrating autonomous features, smart keys are evolving to support these systems by providing secure access to vehicles, ensuring that only authorized users can operate or control them.

Consumer Preference for Convenience and Enhanced User Experience

The increasing consumer preference for convenience is another key driver of the market. Today’s consumers seek features that simplify their everyday lives, and automotive smart keys offer just that. The ability to unlock or start a vehicle without removing the key from a pocket or bag provides a significant convenience boost for drivers. Furthermore, many smart keys can be programmed to remember individual driver preferences, such as seat position, climate control settings, and radio stations, enhancing the overall driving experience. This level of personalization and ease of use is becoming increasingly important, especially in a highly competitive automotive market. These features are particularly appealing to younger, tech-savvy consumers who prioritize a seamless, high-tech driving experience. The convenience factor is expected to drive the widespread adoption of smart keys in Japan’s automotive market.

Growth of Electric Vehicles (EVs) and Eco-friendly Solutions

The rise in electric vehicle (EV) adoption is also contributing to the growth of the automotive smart key market in Japan. As Japan remains one of the leading countries in the development and adoption of electric vehicles, the demand for advanced technologies in these vehicles is growing. Smart keys play an essential role in enhancing the overall EV experience by offering seamless, keyless entry and push-to-start functionalities, which are highly desirable in eco-friendly vehicles. Additionally, the shift toward EVs is often accompanied by a broader consumer interest in sustainable and innovative technologies. Smart key systems can support this trend by offering energy-efficient solutions that align with the environmentally conscious preferences of EV owners. Moreover, as EVs often feature high-tech systems for charging management, navigation, and energy optimization, the use of smart keys that integrate with these systems enhances the vehicle’s overall functionality.

Market Trends

Dominance of Passive Keyless Entry (PKE) Systems

One of the most prominent trends in the Japan automotive smart keys market is the widespread adoption of Passive Keyless Entry (PKE) systems. For instance, a report by the Japan Automobile Manufacturers Association (JAMA) highlights the increasing integration of PKE systems in vehicles by leading automakers like Toyota and Honda, emphasizing their role in enhancing security and convenience. Additionally, studies by the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) underline the adoption of Bluetooth Low Energy (BLE) technology in smart key systems, enabling smartphone apps to interact with vehicles for remote unlocking and ignition. The rise of such systems is reshaping how car owners interact with their vehicles, contributing significantly to the growth of the smart key market in Japan.

Integration of Biometric Authentication and Advanced Connectivity

Another key trend in the Japanese automotive smart key market is the integration of biometric authentication methods, such as fingerprint scanning and facial recognition. This trend is primarily driven by the growing need for enhanced security and personalized user experiences. Biometric technology ensures that only authorized users can access and operate the vehicle, making it virtually impossible for thieves to hack or duplicate the key. As automotive technology continues to evolve, smart keys are being integrated with advanced connectivity solutions, including mobile applications and Internet of Things (IoT) systems. This integration allows car owners to perform tasks such as remotely starting the engine, checking vehicle health, and adjusting settings like climate control and seat positioning. In addition, Artificial Intelligence (AI) is increasingly being used to learn user preferences and automatically adjust vehicle settings to provide a more personalized experience.

OEMs Leading Adoption with Advanced Features

The role of Original Equipment Manufacturers (OEMs) in shaping the future of the automotive smart key market in Japan is undeniable. Leading Japanese automakers, such as Toyota, Honda, and Lexus, are driving the adoption of advanced smart key features in their vehicles. These manufacturers are increasingly focused on enhancing the functionality and security of their vehicles to meet consumer expectations for convenience and high-tech solutions. For instance, Toyota’s introduction of smart key technology in their Lexus ES 300h models, which combines intelligent mobility features with eco-friendly technologies, highlights the growing trend of integrating advanced vehicle access solutions into mainstream vehicles. The preference for vehicles with cutting-edge technology among consumers is influencing OEMs to prioritize the inclusion of smart keys as a standard feature in their higher-end models, and increasingly in their mid-range offerings. The continued innovation from OEMs is setting a high benchmark for other players in the automotive industry, pushing the entire sector toward smarter, more secure solutions.

Growing Consumer Demand for Convenience and Security

Consumer demand for convenience and security is a powerful force driving the growth of the smart key market in Japan. As vehicle owners seek a more hassle-free experience, the desire for keyless entry systems has risen. Smart keys provide enhanced user convenience by allowing drivers to unlock and start their vehicles without having to physically insert a key. This feature is particularly appealing in daily commuting scenarios, where time-saving and ease of access are prioritized. At the same time, consumers are placing a higher value on security, and smart keys are increasingly being seen as a safer alternative to traditional keys. With advancements in encryption and secure communication between the smart key and the vehicle, these systems provide greater protection against hacking and unauthorized access. In addition, with the rise in vehicle thefts, especially in urban areas, the enhanced security features of smart keys provide vehicle owners with greater peace of mind. The dual appeal of convenience and security is making smart keys an indispensable feature for modern vehicles, significantly influencing market growth in Japan.

Market Challenges Analysis

Security Vulnerabilities and Cybersecurity Concerns

One of the key challenges facing the Japan automotive smart key market is the increasing risk of cybersecurity threats. For instance, a report by the European Union Agency for Cybersecurity (ENISA) highlights the prevalence of relay attacks and signal jamming incidents, emphasizing the need for enhanced encryption technologies and advanced authentication protocols to mitigate these risks. Although smart key manufacturers are continuously working to implement encryption technologies and advanced authentication protocols, the rapid pace of technological advancements means that new security threats are emerging regularly. In addition, the need for constant software updates and security patches adds to the complexity of maintaining the integrity of these systems. Automotive companies must invest heavily in cybersecurity measures to mitigate these risks and ensure that smart key systems are as secure as possible.

High Costs and Consumer Adoption Barriers

Another significant challenge is the high cost of manufacturing and integrating smart key systems into vehicles. For many automakers, the addition of advanced keyless entry, biometric authentication, and remote vehicle access capabilities can increase production costs, which may be passed on to consumers. While these systems provide significant convenience and security features, they are often seen as premium options, making them less accessible for cost-conscious buyers. Additionally, many consumers in Japan still rely on traditional key systems, which can be more familiar and perceived as less complicated. The shift to smart keys requires overcoming consumer hesitancy, especially among older generations or those unfamiliar with advanced technologies. Furthermore, the market is also challenged by the high costs of maintaining and replacing smart key systems, particularly in the event of a malfunction, which can further discourage widespread adoption. Overcoming these challenges will require automotive manufacturers to balance the benefits of smart keys with their affordability and usability for a broader range of consumers.

Market Opportunities

The Japan automotive smart key market presents significant opportunities driven by advancements in technology and evolving consumer preferences. One of the key opportunities lies in the growing demand for integrated, high-tech solutions within vehicles. As automakers increasingly focus on enhancing user experience through convenience and personalization, the integration of smart keys with features like biometric authentication, remote vehicle control, and smartphone connectivity is becoming more prevalent. This technological convergence offers an opportunity for smart key manufacturers to expand their product offerings, catering to consumers seeking seamless, secure, and personalized vehicle access. Additionally, as the Japanese automotive industry continues to innovate with autonomous vehicles and electric vehicles (EVs), the need for advanced keyless entry and secure access solutions will increase, creating a substantial market for next-generation smart keys that integrate with other smart systems in vehicles.

Another significant opportunity arises from the rising demand for enhanced security features in vehicles. With an increasing focus on protecting vehicles from theft, smart keys equipped with advanced encryption, encryption protocols, and biometrics offer substantial advantages over traditional key systems. These systems provide robust security, which is especially valuable in urban environments where vehicle theft rates are higher. Furthermore, government regulations and safety standards aimed at improving vehicle security and reducing theft may also push the adoption of smart keys, further expanding their market potential. As consumers become more aware of the importance of vehicle security, there is an opportunity for manufacturers to position smart keys as essential safety features in modern vehicles. With a growing consumer preference for both convenience and protection, the Japan automotive smart key market holds promising growth potential for innovative solutions and continued market expansion.

Market Segmentation Analysis:

By Vehicle:

The Japanese automotive smart key market is segmented by vehicle type into passenger cars, commercial vehicles, and luxury vehicles. Among these, passenger cars hold the largest market share, driven by the increasing adoption of smart key systems for enhancing user convenience and security. As consumer demand for high-tech features grows, automakers are increasingly integrating smart keys into their mid-range and economy models, offering features like keyless entry and push-to-start ignition. The growing popularity of electric vehicles (EVs) and hybrid models in Japan further accelerates the demand for smart key solutions, as these vehicles often require advanced access control systems. Commercial vehicles, though not as widely equipped with smart key systems as passenger cars, are expected to see growth due to the increasing need for fleet management solutions, including secure access and remote tracking capabilities. Luxury vehicles represent a premium segment, where smart keys are often standard. In this segment, multi-functional smart keys with features like biometric authentication, remote start, and personalized settings are highly sought after, reinforcing the market’s growth in the high-end automotive sector.

By Application:

In terms of application, the Japanese automotive smart key market is divided into single-function and multi-function systems. Single-function smart keys primarily focus on a single feature, such as keyless entry or push-to-start ignition. These systems are prevalent in lower-end and mid-range vehicles, offering basic convenience and security features to consumers at an affordable price point. The segment is experiencing steady growth, driven by cost-conscious consumers who prioritize simple functionality over advanced features. On the other hand, multi-function smart keys are gaining traction, particularly in luxury and high-end vehicles, due to their ability to support a variety of advanced functions. These may include biometric authentication, remote vehicle control, personalized driver settings, and vehicle tracking. As consumer preferences shift toward integrated and high-tech solutions, multi-function smart keys are becoming more desirable, providing automakers with the opportunity to differentiate their products and enhance user experience. This trend is expected to grow as the automotive industry increasingly focuses on connectivity and personalized, secure vehicle access solutions.

Segments:

Based on Vehicle:

- Passenger cars

- Commercial vehicles

- Luxury vehicles

Based on Application:

- Single Function

- Multi-Function

Based on Technology:

- Remote Keyless Entry

- Passive Keyless Entry

Based on Distribution Channel:

Based on the Geography:

- Kanto Region

- Kansai Region

- Chubu Region

- Kyushu Region

- Other Regions

Regional Analysis

Kanto Region

The Kanto Region, which includes major metropolitan areas such as Tokyo and Yokohama, holds the largest market share of Japan’s automotive smart key market. This region accounts for approximately 40% of the market share due to its dense population, high vehicle ownership rates, and strong technological adoption. Tokyo, being the capital, serves as a hub for innovation and early adoption of advanced technologies, including automotive smart keys. The region’s extensive infrastructure and the presence of leading automakers and suppliers contribute significantly to the high demand for smart key systems. Furthermore, the Kanto Region’s preference for premium vehicles and the rise in electric vehicle (EV) adoption are expected to further boost market growth. The concentration of luxury vehicles and cutting-edge technological solutions in this region makes it a key driver for the smart key market.

Kansai Region

The Kansai Region, including major cities like Osaka, Kyoto, and Kobe, holds a market share of approximately 25% in Japan’s automotive smart key market. As a prominent industrial and commercial area, Kansai boasts a high vehicle ownership rate, especially in urban centers where the demand for security and convenience features is high. The region is known for its manufacturing capabilities and the presence of large automotive companies, which play a crucial role in the widespread adoption of smart key systems. While not as large as Kanto, the Kansai Region continues to experience steady growth due to a growing preference for mid-range and luxury vehicles, coupled with increasing consumer demand for more secure and convenient vehicle access solutions.

Chubu Region

The Chubu Region, which includes cities like Nagoya, is responsible for approximately 20% of the market share in the Japanese automotive smart key market. Nagoya is a significant automotive manufacturing hub, housing some of the country’s largest vehicle producers, such as Toyota. The region benefits from strong industry support, particularly in the development and implementation of innovative automotive technologies. As a result, demand for smart key systems is growing in both consumer vehicles and commercial fleets. Chubu also sees a gradual rise in the adoption of smart keys in both luxury and commercial vehicles, driven by technological advancements and an increasing preference for integrated vehicle access solutions.

Kyushu Region

The Kyushu Region holds a smaller but still notable market share of around 10%. This region, known for its growing automotive and manufacturing sectors, has seen an uptick in the adoption of smart keys, particularly in the commercial vehicle segment. However, the region lags behind Kanto, Kansai, and Chubu in terms of overall market size due to lower vehicle ownership rates and less concentrated urban development. Despite this, Kyushu is gradually adopting advanced vehicle technologies as consumer preferences shift toward more secure and convenient solutions. The ongoing development of the region’s infrastructure and increased demand for EVs and connected vehicles are expected to drive future growth for the smart key market in this area.

Key Player Analysis

- Huf Hulsbeck & Furst GmbH & Co

- Continental AG

- ZF Friedrichshafen AG

- HELLA GmbH & Co. KGaA

- Hyundai Mobis

- Silca Group

- Tokai Rika Co

- Denso Corporation

- ALPHA Corporation

- Valeo SA

- Robert Bosch GmbH

- Toyota Motor Corporation

Competitive Analysis

The Japan automotive smart key market is highly competitive, with several key players leading the innovation and development of advanced keyless entry and security solutions. Leading companies such as Huf Hulsbeck & Furst GmbH & Co, Continental AG, ZF Friedrichshafen AG, HELLA GmbH & Co. KGaA, Hyundai Mobis, Silca Group, Tokai Rika Co, Denso Corporation, ALPHA Corporation, Valeo SA, Robert Bosch GmbH, and Toyota Motor Corporation are at the forefront of this market. These companies focus on developing cutting-edge technologies such as Passive Keyless Entry (PKE), biometric authentication, and integrated connectivity for vehicles. These advancements cater to growing consumer demand for enhanced convenience, security, and personalized experiences. Companies in the market invest heavily in research and development to introduce cutting-edge technologies that address emerging needs, such as vehicle tracking, remote access, and driver personalization features. In addition to technological innovation, competition is fueled by the push towards integrating smart key systems into a broader range of vehicles, including luxury, commercial, and electric vehicles (EVs). As consumer preferences shift towards vehicles with higher security and more sophisticated technology, manufacturers are enhancing their product portfolios to provide smart key solutions that meet these demands. The market is also influenced by the increasing focus on connected vehicles and smart mobility, which presents new opportunities for keyless entry systems to become an integral part of the broader automotive ecosystem. With the expansion of smart vehicle features and growing security concerns, the competition among companies is expected to intensify.

Recent Developments

- In January 2025, Honda Lock, now owned by MinebeaMitsumi, expanded its product line to include advanced keyless entry systems with mobile connectivity and IoT features, aligning with the automotive industry’s trend towards electrification and automation.

- In December 2024, Hyundai Mobis announced plans to expand its card-type smart key to major Hyundai models like the Santa Fe and Tucson. This key uses UWB for enhanced functionality and wireless charging capabilities.

- In April 2024, Continental developed a smart device-based access solution for Mercedes-Benz E-Class cars. This system utilizes ultra-wideband (UWB) technology, transceivers, and intelligent software to enhance security and convenience for luxury vehicles.

- In December 2023, Huf introduced a groundbreaking smart key that combines UWB, BLE, and NFC technologies in compliance with Car Connectivity Consortium (CCC) standards. This innovation enhances anti-theft security and convenience while allowing integration with “Phone as a Key” systems.

Market Concentration & Characteristics

The Japan automotive smart key market exhibits moderate to high concentration, with a few dominant players holding a significant share while several smaller companies focus on niche innovations. The market is characterized by intense competition among global and local manufacturers, driven by the continuous demand for advanced security, convenience, and connectivity features in vehicles. As smart key technologies evolve, key players are focusing on integrating biometric authentication, passive keyless entry (PKE), and mobile connectivity to cater to the growing preference for seamless vehicle access solutions. The market is also marked by the rising adoption of electric vehicles (EVs), which further boosts the demand for innovative smart key systems. Given the high level of technological expertise required for developing secure and user-friendly systems, companies in this market must invest heavily in research and development. Additionally, strategic partnerships and collaborations among automotive manufacturers and smart key solution providers are common, driving the growth and diversification of the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Application, Technology, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan automotive smart key market is expected to continue growing at a steady pace, driven by rising demand for convenience and security features in vehicles.

- The integration of biometric authentication and advanced encryption technologies will become more prevalent, offering enhanced security to vehicle owners.

- Increased adoption of electric vehicles (EVs) will drive the need for smarter, more integrated key solutions that offer remote access and vehicle monitoring.

- The development of smart keys with multi-functional capabilities, such as remote start, personalized settings, and vehicle tracking, will be a major trend in the coming years.

- Growth in connected car technologies will push for seamless integration between smart keys and broader vehicle ecosystems, offering a more personalized user experience.

- The increasing popularity of luxury vehicles and high-tech features will further fuel the adoption of advanced smart key solutions in premium models.

- Competition in the market will intensify as automotive manufacturers look to differentiate their offerings with superior smart key technology.

- Rising concerns over vehicle theft and the need for stronger security will drive demand for more secure and tamper-resistant smart key systems.

- Partnerships between automakers and technology companies will accelerate the development and deployment of next-generation smart key solutions.

- Consumer preferences for hassle-free, keyless entry systems will continue to shape the market, encouraging manufacturers to innovate and provide more user-friendly features.