Market Overview:

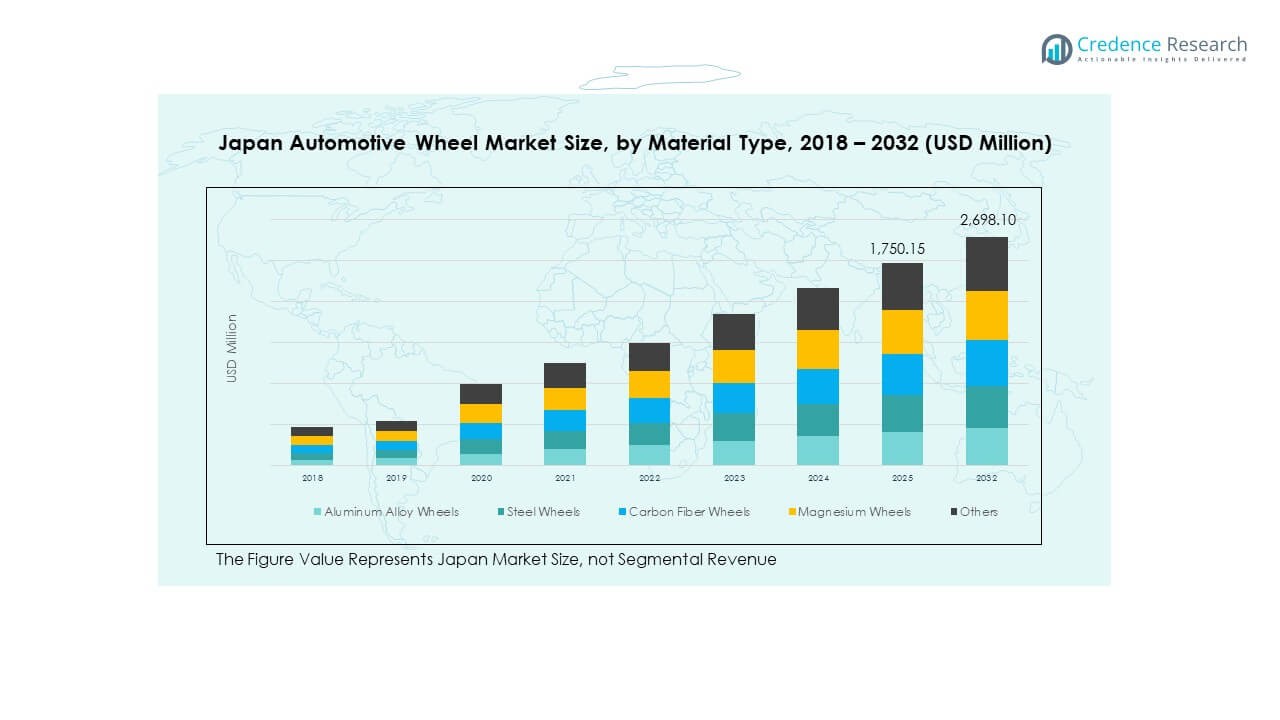

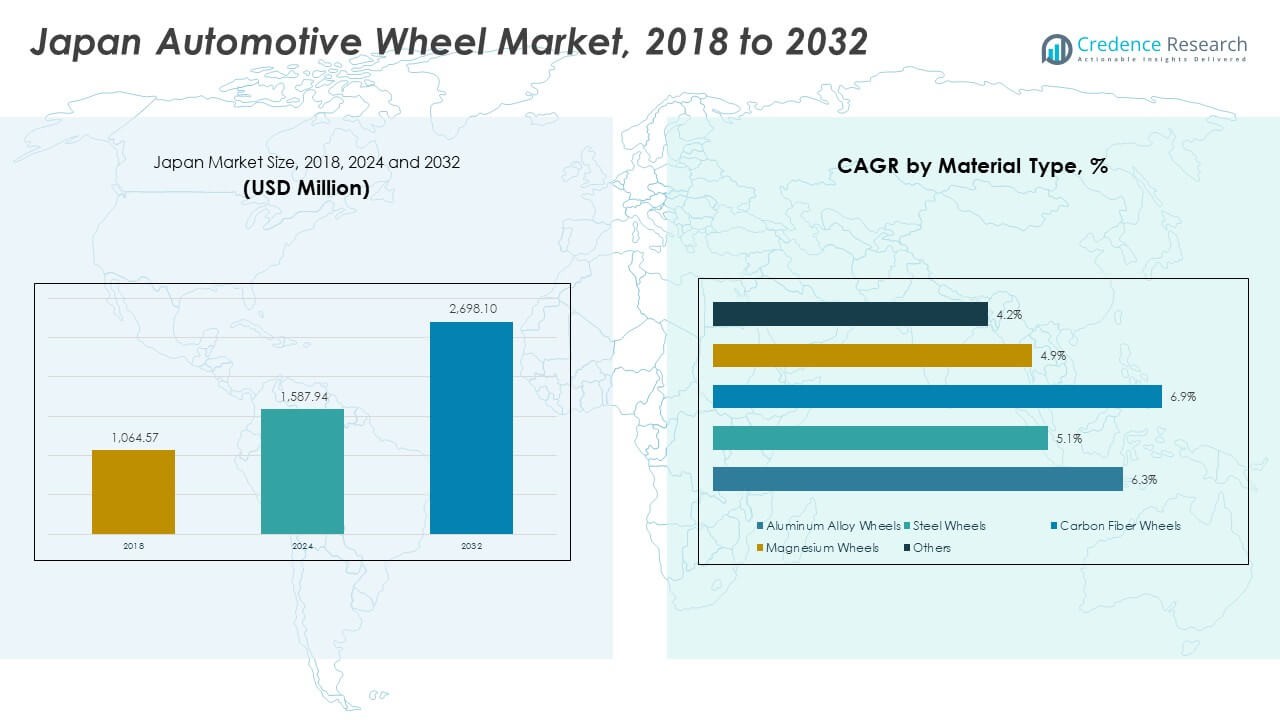

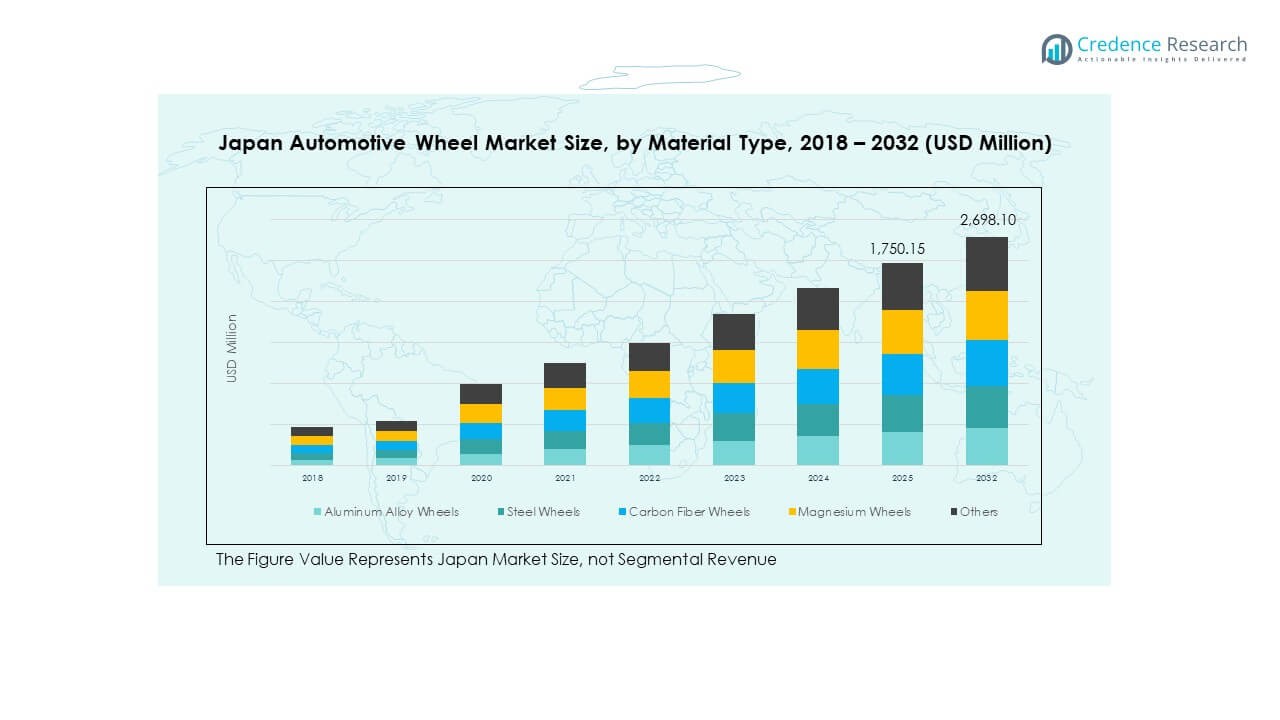

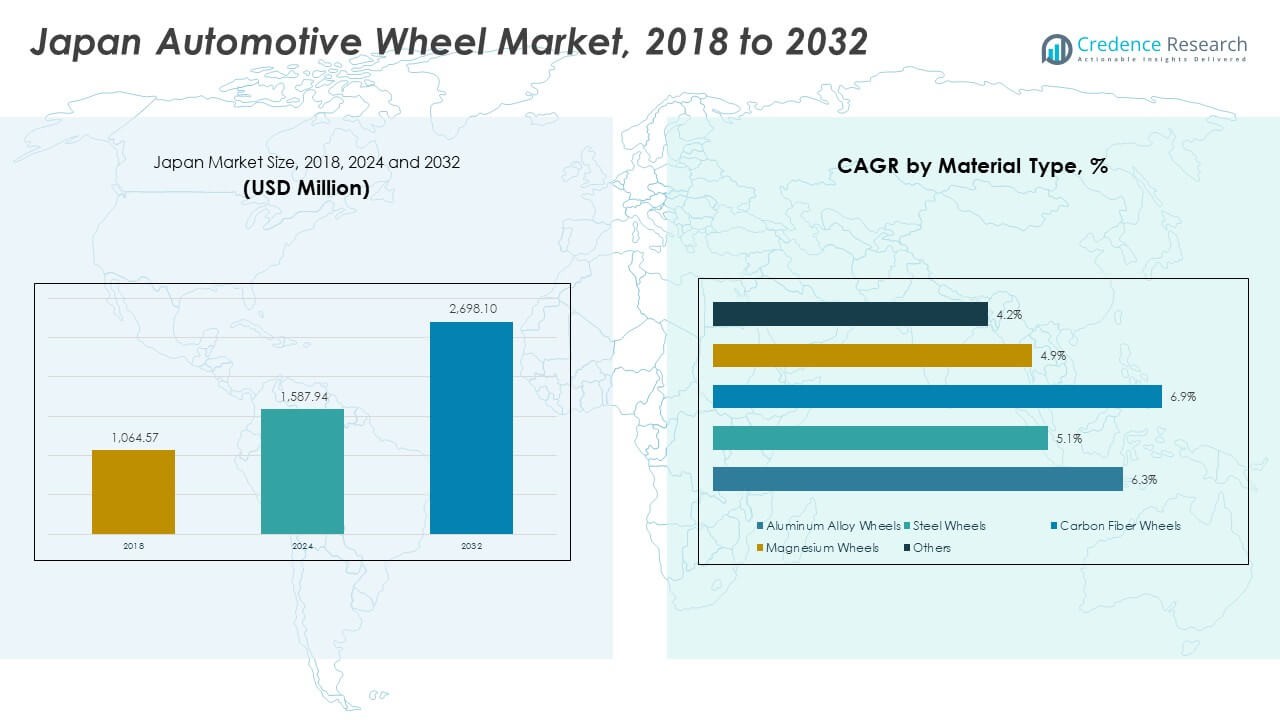

The Japan Automotive Wheel Market size was valued at USD 1,064.57 million in 2018 to USD 1,587.94 million in 2024 and is anticipated to reach USD 2,698.10 million by 2032, at a CAGR of 6.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Automotive Wheel Market Size 2024 |

USD 1,587.94 Million |

| Japan Automotive Wheel Market, CAGR |

6.38% |

| Japan Automotive Wheel Market Size 2032 |

USD 2,698.10 Million |

Rising preference for lightweight wheels drives strong adoption across OEMs and aftermarket buyers. Automakers select aluminum and hybrid alloy wheels to enhance fuel efficiency, braking response, and ride comfort. Growing focus on EV platforms accelerates the shift toward forged and flow-formed structures that reduce mass and improve heat dissipation. Local suppliers invest in new forming, machining, and coating technologies to meet strict safety, durability, and performance standards. Customization trends among younger drivers further boost premium wheel sales.

Japan leads the regional landscape due to its strong automotive production base and advanced material engineering capabilities. South Korea follows with rising export-oriented wheel manufacturing supported by expanding EV programs. China is emerging rapidly as large vehicle production volumes and rising aftermarket activity strengthen wheel demand. ASEAN markets show increasing potential as local assembly operations grow and governments promote cleaner mobility. The region maintains wide opportunities due to evolving consumer preferences and deeper investments in mobility innovation.

Market Insights:

Market Insights:

- The Japan Automotive Wheel Market increased from USD 1,064.57 million in 2018 to USD 1,587.94 million in 2024 and is projected to reach USD 2,698.10 million by 2032, supported by a steady 38% CAGR driven by strong demand for lightweight and advanced wheel materials.

- East Japan (42%), West Japan (35%), and Central/Northern Japan (23%) lead the market, supported by dense automotive clusters, advanced alloy processing, and strong aftermarket activity, which strengthen regional dominance.

- Central & Northern Japan stands out as the fastest-growing region with a 23% share, expanding through increasing aftermarket upgrades, colder-climate demand for corrosion-resistant wheels, and improving distribution networks.

- Aluminum alloy wheels hold the highest segment share at roughly 38%, driven by their strength, lower weight, and wide OEM adoption across passenger vehicles.

- Steel wheels account for around 22%, supported by commercial and off-highway applications that rely on durability and heavy-load capability.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Shift Toward Lightweight Alloy Wheels to Improve Efficiency and Vehicle Dynamics

The Japan Automotive Wheel Market gains momentum from rising demand for lightweight alloys. Automakers adopt aluminum and hybrid materials to cut vehicle weight. Lower mass improves fuel use and supports smoother handling. EV makers favor forged wheels for better thermal control. Buyers choose lighter wheels for stronger braking response. It supports improved acceleration and stable cornering. OEMs increase investment in advanced casting to meet strict norms. Aftermarket users push growth with rising personalization needs.

- For instance, RAYS’ forged Volk Racing TE37 wheels cut unsprung weight by nearly 20% versus cast options, based on RAYS engineering data.

Rapid Expansion of Electric Vehicle Platforms Supporting Advanced Wheel Technologies

Growing EV penetration propels demand for strong and light wheel systems. EV batteries add weight and push automakers to adopt reinforced alloys. Suppliers improve structural strength to handle high torque output. Heat-resistant rims gain wider use to protect braking systems. It drives new testing standards across domestic suppliers. Performance EV brands lead upgrades with bold designs. Automakers boost funding for fatigue-resistant materials. Local plants expand forging lines to meet long-term EV needs.

- For instance, Nissan’s Ariya incorporates an advanced regenerative braking system, including e-Pedal Step, which allows the driver to decelerate using only the accelerator pedal, maximizing energy efficiency and reducing brake wear.

Rising Consumer Interest in Customization and Aesthetic Wheel Enhancements

Personalization trends strengthen sales across premium alloys. Younger buyers prefer bold designs and multi-finish surfaces. It drives strong demand in urban aftermarket hubs. Machine-cut and diamond-cut rims trend across sports models. Car owners choose wider wheels for improved stance. Surface coatings evolve to resist corrosion and weather changes. Manufacturers release seasonal design editions. Custom fitments push workshops to expand service lines.

Growing Focus on Safety, Durability, and High-Precision Wheel Manufacturing

Safety rules push adoption of strong and tested wheel structures. Fatigue resistance guides new material choices in major plants. It increases demand for advanced metrology tools. Precision machining ensures accurate fitment across vehicle types. Brands refine testing methods to reduce field failures. Durable wheels support long-distance travel needs. OEMs adopt strict quality audits across regions. Strengthened compliance boosts supplier credibility.

Market Trends:

Increased Adoption of Flow-Formed Wheels for Performance and Weight Reduction Advantages

Flow-formed wheels gain wide acceptance across new vehicle lines. The method produces stronger barrels through mechanical shaping. It cuts weight while maintaining rigidity. It supports better fuel efficiency and improved agility. Performance car makers use the method for dynamic handling. Aftermarket brands launch deeper concave options. EV models adopt these wheels to balance battery load. Suppliers expand tooling to scale high-volume production.

- For instance, Subaru equipped the limited-edition 2018 STI Type RA models with lightweight, forged 19-inch BBS wheels to reduce unsprung weight and improve turn-in response. Similarly, the Canada-exclusive 2020 STI Kanrai Edition featured lightweight 19-inch BBS forged alloy wheels.

Growing Demand for Hybrid Material Combinations in Next-Generation Wheel Designs

Hybrid alloy structures grow popular across OEM lines. Brands blend aluminum with reinforced compounds. It meets strength targets without adding weight. It improves braking stability during long drives. The Japan Automotive Wheel Market benefits from advanced R&D. New blends extend lifespan and reduce corrosion. It supports diverse applications across SUVs and EVs. Suppliers release new hybrid variants for export needs.

- For instance, the Yokohama website indicates the use of advanced compounds and rigorous testing, and marketing materials for the Advan wheel series mention a hyper silver painted finish that provides “protection against rust and corrosion, ensuring longevity”.

Expansion of Smart Wheel Technologies Featuring Integrated Sensors and Monitoring Systems

Smart wheel technology gains traction in connected mobility. Embedded sensors monitor temperature and pressure. It boosts safety and supports predictive maintenance. Connected platforms improve real-time alerts. EV users adopt smart wheels for efficiency tracking. Tire-pressure data integrates with cockpit systems. Suppliers collaborate with electronics firms to enhance precision. Automation upgrades help scale sensor-enabled wheel units.

Rising Use of Eco-Friendly Coatings and Sustainable Production Processes in Wheel Manufacturing

Sustainable practices shape manufacturing decisions across Japan. Low-VOC coatings gain wider use across factories. It reduces emissions and improves worker safety. Recycled aluminum usage increases each year. Plants introduce energy-efficient furnaces to cut power needs. Water-based coatings replace older chemical methods. Brands promote green lines across marketing channels. Clean production supports corporate sustainability goals.

Market Challenges Analysis:

High Material Prices and Rising Production Costs Impacting OEM and Aftermarket Competitiveness

Material cost volatility creates pressure on manufacturers. Aluminum price swings affect long-term planning. It disrupts strategic sourcing decisions across suppliers. Energy costs increase pressure on forging units. Smaller plants face difficulty in adopting automation. OEMs negotiate aggressive prices that strain margins. Export shipments face currency uncertainties. These factors affect overall industry resilience in the Japan Automotive Wheel Market.

Supply Chain Disruptions and Workforce Shortages Slowing Technological Upgrades and Output

Supply chain gaps slow delivery timelines across regions. Imported alloy delays impact production cycles. Staffing shortages reduce output in key prefectures. It limits adoption of next-gen machining systems. Training gaps affect precision in advanced processes. Vendors struggle to maintain safety stock levels. Port delays increase freight lead times. These constraints overwhelm small and medium suppliers.

Market Opportunities:

Expansion of High-Performance Wheel Lines for EVs, Hybrids, and Advanced Passenger Vehicles

Growing EV adoption opens strong opportunity for advanced wheels. Lightweight forged units meet strict performance needs. It supports heat control during intense driving. Hybrid models adopt wide-rim designs for stability. Local firms explore new alloys for torque-intensive EVs. Performance divisions roll out track-grade wheels. Export programs expand opportunities in global EV clusters.

Rising Demand for Premium Custom Wheels Across Urban Markets and Aftermarket Channels

Urban consumers drive strong interest in custom wheels. New finishes gain popularity across major cities. It increases demand for machining upgrades. Custom fitment studios grow across regional hubs. Seasonal design editions attract younger buyers. Digital catalogs improve purchase convenience. Aftermarket houses expand inventory to meet rising demand.

Market Segmentation Analysis:

Material Type Assessment

The Japan Automotive Wheel Market shows strong dominance of aluminum alloy wheels due to their light weight, strength, and clear efficiency benefits. OEMs prefer aluminum alloys to improve handling and reduce fuel use. Steel wheels retain demand in cost-sensitive segments that prioritize durability. Carbon fiber wheels gain traction in performance models because they offer high rigidity and reduced rotational mass. Magnesium wheels appeal to niche sports segments where buyers value speed and precision. It supports expanded product lines across premium and mainstream categories, while the “Others” segment covers emerging hybrid materials.

- For instance, BBS carbon fiber wheels can weigh approximately 8 kg less per set (four wheels total) than comparable aluminum designs in automotive applications, translating to about 2 kg of weight savings per wheel.

Vehicle Type Assessment

Passenger vehicles lead demand due to high production volumes and strong consumer interest in alloy upgrades. The segment adopts new materials faster because OEMs focus on comfort, efficiency, and styling. Commercial vehicles rely on robust steel wheels for load-bearing needs and extended duty cycles. Off-highway vehicles require reinforced structures suited for construction and agricultural terrain. It pushes suppliers to invest in high-strength blends and impact-resistant designs. Each vehicle class drives distinct performance, safety, and durability standards.

- For instance, Toyota confirms that Corolla models use aluminum wheels to reduce unsprung mass and strengthen steering feedback.

End-User Assessment

OEM demand remains dominant due to strict fitment standards, quality requirements, and strong integration with vehicle design cycles. It encourages suppliers to upgrade forging, casting, and coating technologies. The aftermarket segment grows through rising customization trends and replacement needs. Buyers prefer premium finishes, wider profiles, and performance-focused wheel sets. Urban markets show higher adoption of style-driven alloys, expanding opportunities for aftermarket brands.

Segmentation:

Material Type Segments

- Aluminum Alloy Wheels

- Steel Wheels

- Carbon Fiber Wheels

- Magnesium Wheels

- Others

Vehicle Type Segments

- Passenger Vehicles

- Commercial Vehicles

- Off-Highway Vehicles

End-User Segments

- OEM (Original Equipment Manufacturer)

- Aftermarket

Regional Analysis:

East Japan Market Strength

East Japan holds the largest share of the Japan Automotive Wheel Market at 42%, driven by strong vehicle production, dense urban mobility needs, and a high concentration of OEM facilities. The region supports fast adoption of lightweight alloys and forged wheels due to advanced manufacturing clusters. It benefits from strong consumer demand for customization and premium finishes. Tokyo and Kanagawa lead aftermarket upgrades through large dealer networks. Local suppliers invest in modern machining and coating units to meet rising EV requirements. The region maintains stable growth due to steady passenger vehicle sales and expanding EV adoption.

West Japan Competitive Footprint

West Japan accounts for 35% of the national share, supported by major automotive plants and metal-processing industries across Osaka, Hyogo, and Hiroshima. The region favors high-strength aluminum and hybrid alloy wheels for both OEM and commercial vehicle applications. It supports strong export-driven production due to the presence of established wheel manufacturers. Premium performance brands in West Japan create demand for advanced forging and precision casting technologies. It gains momentum from strategic industry collaborations and material innovation programs. Local consumers show consistent interest in multi-finish and high-durability wheel designs.

Central & Northern Japan Emerging Growth Zones

Central and Northern Japan together represent 23% of the market share, driven by expanding vehicle parks and growing aftermarket activity. Hokkaido and Tohoku create demand for corrosion-resistant wheels due to colder climates and rougher driving surfaces. Central Japan benefits from its proximity to major industrial hubs, supporting supply chain efficiency for OEM and aftermarket channels. It experiences rising adoption of steel and hybrid wheels across commercial and off-highway vehicles. Local workshops expand services to support customization and wheel replacement cycles. The region strengthens long-term potential through gradual EV penetration and improving distribution networks.

Key Player Analysis:

- Enkei Corporation

- Topy Industries

- Rays Co., Ltd.

- Kosei Aluminium

- OZ Racing Japan

- SSR Wheels (Sumitomo Rubber)

- BBS Japan

- Advanti Racing

- MHT Wheels

- Weds Co., Ltd.

Competitive Analysis:

The Japan Automotive Wheel Market features strong competition driven by advanced manufacturing capabilities, material innovation, and expanding EV-focused product lines. Leading companies invest in forged, flow-formed, and hybrid alloy wheels to improve strength, weight reduction, and durability. It encourages suppliers to enhance automation and adopt high-precision casting. Domestic brands compete on quality and design, while premium performance wheel makers strengthen visibility across sports and luxury segments. Aftermarket players expand portfolios to match rising customization trends. OEM partnerships support long-term supply contracts and stabilize production cycles. The competitive field remains dynamic due to evolving safety standards and rapid technological upgrades.

Recent Developments:

- In February 2025, Rays returned as an official sponsor of Global Time Attack (GTA) for the 2025 season, reinforcing its commitment to the motorsports community and time attack racing. The partnership highlights Rays’ decades of racing heritage and technical excellence in performance wheel manufacturing. Additionally, in December 2024, Rays introduced the VOLK RACING 21A spec-PW for 2025, featuring the new Pressed Double Black color finish that adds a darker, more refined atmosphere compared to standard models. The company also launched new wheel models throughout 2024-2025, including updates to their product data books showcasing their expanding portfolio.

- In December 2024, Weds Co., Ltd. announced its participation in the SUPER GT 2025 SERIES under the team name TGR TEAM WedsSport BANDOH, competing in the GT500 class with the TOYOTA GR Supra GT500. This marks the team s 15th season in the GT500 class since stepping up in 2011, with drivers Yuji Kunimoto and Sena Sakaguchi entering their fourth season together. In December 2024, Weds released new 2025 model wheels across multiple brands, including the WedsSport SA series featuring the SA-01R successor to the SA-10R with a 5 twin-spoke design optimized for street use. The company also introduced new models from Kranze (Versam in 16 and 17-inch sizes), MAVERICK 2P-TYPE models (1705S and 1613M), and various Leonis lineup updates. In April 2024, Weds announced a personal sponsorship contract with Formula DRIFT driver Kazuya Taguchi, who continues using WedsSport TC105X wheels for his seventh consecutive year.

- In September 2024, SSR launched the SP1 DEVIDE Trail truck and SUV wheels, representing the latest addition to the company’s esteemed wheel lineup. These wheels were specifically engineered for versatility and durability, designed to handle rigorous off-road driving while maintaining aesthetic appeal. The SP1 Trail wheels feature a 6×139.7 bolt pattern fitting various trucks and SUVs, available in four color choices and two offset options (+0 or -10), with an MSRP of $490 per wheel. For 2025, SSR introduced new model lineups including the Type-C FORGED series with EXECUTOR CV06/CV06S and EXECUTOR EX07/EX07S models, as well as Professor SP7 and Professor MESH wheels.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Vehicle Type, and End-User segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for lightweight and forged wheels will grow due to rising EV and hybrid adoption.

- OEMs will expand investments in precision machining to meet strict durability requirements.

- Aftermarket customization will gain traction across urban regions with stronger disposable income.

- Smart wheel technologies with embedded sensors will reach wider acceptance.

- Material innovations will support stronger, corrosion-resistant constructions for varied terrains.

- Performance-focused designs will expand as sports and luxury vehicle sales increase.

- Regional production clusters will upgrade automation to improve output efficiency.

- Exports of premium alloy wheels will rise with strong demand in Asia and Europe.

- Sustainability goals will strengthen the use of recycled aluminum and low-VOC coatings.

- Investment in EV-compatible wheel platforms will guide long-term competitive strategies.

Market Insights:

Market Insights: