Market Overview:

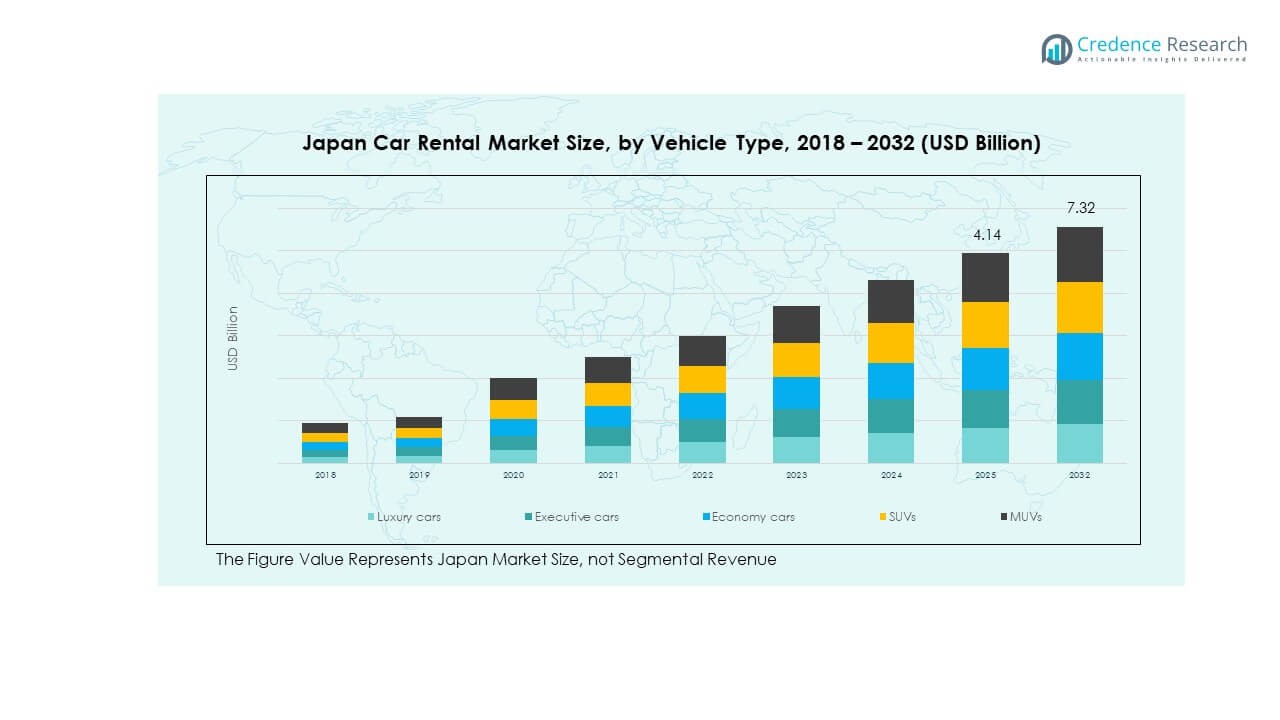

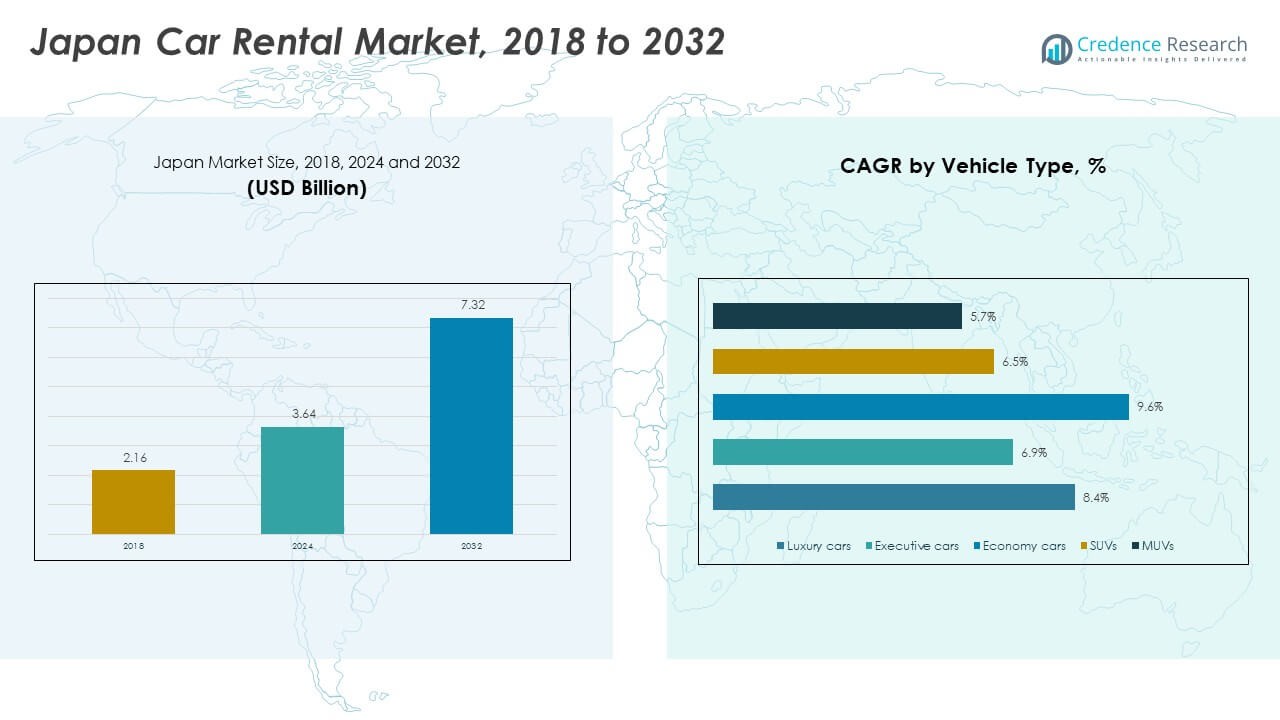

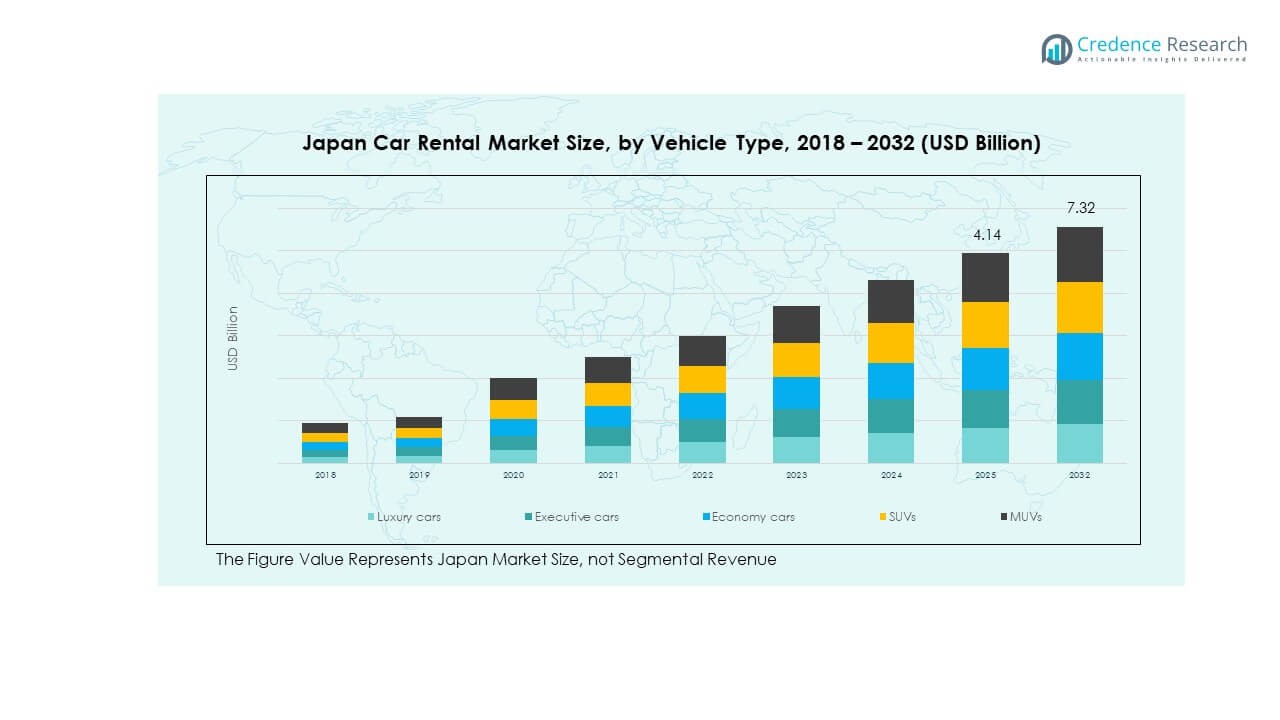

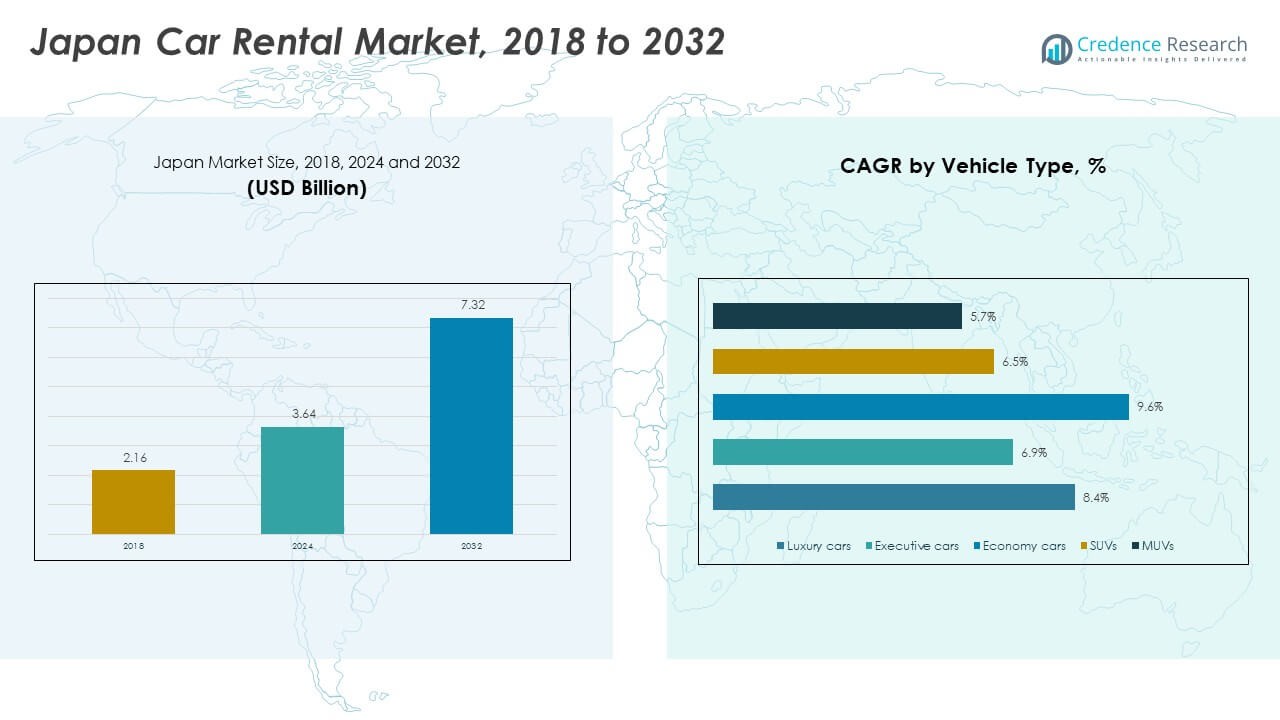

The Japan Car Rental Market size was valued at USD 2.16 Billion in 2018 to USD 3.64 Billion in 2024 and is anticipated to reach USD 7.32 Billion by 2032, at a CAGR of 8.49% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Car Rental Market Size 2024 |

USD 3.64 Billion |

| Japan Car Rental Market, CAGR |

8.49% |

| Japan Car Rental Market Size 2032 |

USD 7.32 Billion |

The market growth is driven by rising domestic tourism and business travel across Japan, which boosts demand for flexible mobility services. Urbanisation and improved road infrastructure encourage companies to expand rental fleets and offer innovative services such as short‑term and self‑drive rentals. Meanwhile, vehicle‑sharing trends and younger consumers’ preference for access over ownership stimulate change in how rental firms engage customers and diversify service portfolios.

Geographically, Japan remains the lead market in the Asia‑Pacific region owing to its high population density, mature transport networks and strong tourism sector. Emerging neighbouring markets such as South Korea and Southeast Asian nations are beginning to adopt car‑rental models more rapidly, aided by increasing disposable incomes and inbound tourism growth. These emerging regions are poised to further support rental demand as they replicate service innovations seen in Japan and build out regional vehicle‑sharing infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japan Car Rental Market was valued at USD 2.16 billion in 2018, expected to reach USD 3.64 billion in 2024, and grow to USD 7.32 billion by 2032, at a CAGR of 8.49% during the forecast period.

- The top three regional shares are the domestic mainland (70%), island and rural regions (20%), and international/inbound traveler segments (10%). Mainland Japan dominates due to high tourism and business travel, while rural regions benefit from seasonal tourism.

- The fastest-growing region is the island and rural areas, which are seeing increasing demand driven by regional tourism initiatives and limited public transportation options. Its share is expected to grow significantly over the next few years.

- The segment share distribution from the image shows that economy cars dominate, accounting for the largest market share, followed by SUVs. Luxury and executive cars occupy a smaller portion but show steady growth in demand.

- By 2032, economy cars will remain the dominant segment, with significant contributions from SUVs and MUVs. Luxury cars and executive cars represent a smaller share, reflecting consumer preference for cost-effective and versatile options.

Market Drivers:

Market Drivers:

Rising Demand for Convenient Mobility Solutions

The Japan Car Rental Market is experiencing significant growth driven by a surge in demand for convenient mobility options. As urbanisation progresses, residents and tourists are increasingly seeking flexible alternatives to traditional ownership. Short-term rentals are particularly popular among consumers who prefer not to commit to long-term contracts. Car rental companies are expanding their offerings to meet this demand, catering to customers who require easy access to vehicles for varying durations. This trend is particularly noticeable in densely populated cities, where personal car ownership is less practical.

- For instance, due to high demand in urban areas and for tourism in 2024, car rental companies in Japan, including major operators like Nippon Rent-A-Car and Times Car Rental, focused on accommodating a diverse range of customer needs with their rental services.

Growth in Tourism and Business Travel

Tourism is a major factor driving the growth of the Japan Car Rental Market. Japan’s rich cultural heritage, stunning landscapes, and modern cities make it a prime destination for tourists. Additionally, business travel to Japan has seen a steady increase, leading to greater demand for car rental services. These factors are encouraging rental companies to expand their fleets and offer competitive pricing to attract both domestic and international customers. As tourism continues to flourish, car rental services are becoming an integral part of the travel experience.

- For instance, robust global tourism recovery saw international visitor arrivals in Japan reach a record 36.9 million in 2024, surpassing pre-pandemic levels and highlighting the immense demand for in-destination travel solutions, including transportation. The global car rental market was valued at approximately USD 124 billion in 2024 and is projected to expand. Business travel also fuels growth, contributing to a global business travel market that is recovering to pre-pandemic levels.

Technological Innovations in the Rental Sector

Technological advancements play a significant role in shaping the Japan Car Rental Market. Companies are increasingly integrating digital tools to streamline the booking and vehicle rental process. Mobile apps and online booking systems make it easier for consumers to access rental services at any time. The introduction of contactless check-ins, digital keys, and GPS-equipped vehicles has enhanced convenience for customers. This tech-driven transformation enables rental businesses to provide faster, more efficient services while improving the overall customer experience.

Vehicle-Sharing and Sustainability Trends

In line with global sustainability trends, there is a growing emphasis on vehicle-sharing services within the Japan Car Rental Market. More consumers are shifting towards shared mobility options due to environmental concerns and the rising cost of car ownership. Rental companies are responding by offering flexible car-sharing services that allow users to rent vehicles for shorter periods, typically by the hour or day. This shift aligns with Japan’s commitment to sustainability and environmental protection, making car rentals more attractive to eco-conscious consumers.

Market Trends:

Market Trends:

Increasing Popularity of Self-Drive and Autonomous Rentals

The Japan Car Rental Market is witnessing a shift towards self-drive and autonomous vehicle rentals. Customers are seeking more independence, preferring to drive themselves rather than rely on chauffeurs or public transport. Car rental companies are responding by expanding their fleets to include self-drive options, allowing customers to choose the type of vehicle that best suits their needs. This trend is especially prevalent among younger consumers who value the freedom and convenience self-drive rentals provide.

- For instance, Waymo launched fully autonomous, driverless ride-hailing services in limited areas of the United States in the mid-2020s, marking a significant technological milestone in the transportation as a service The growing demand for self-drive and driverless options is particularly strong among younger consumers, who value the independence and flexibility these services offer, pushing companies to diversify their transportation models accordingly.

Rise of Subscription-Based Rental Models

Another emerging trend in the Japan Car Rental Market is the rise of subscription-based rental models. These services allow customers to pay a monthly fee for access to a vehicle, with the flexibility to switch cars according to their needs. This model provides greater flexibility compared to traditional rentals, making it more attractive to those who may need a car for an extended period but do not want to commit to ownership. As the subscription model gains traction, it is expected to reshape the rental landscape in Japan.

- For instance, ORIX Auto Infrastructure Services India (a subsidiary of ORIX Corporation) has offered a long-term leasing/subscription service since at least 2020 through partnerships with major car manufacturers like Maruti Suzuki, Kia, Volkswagen, and Honda, providing access to a wide range of vehicles, including hybrid and electric options, catering to consumers who require long-term rentals without ownership.

Integration of Electric and Hybrid Vehicles

The Japan Car Rental Market is gradually incorporating electric and hybrid vehicles into rental fleets to meet the growing demand for environmentally friendly options. With increasing awareness about climate change and the need to reduce carbon emissions, both businesses and consumers are opting for more sustainable transport solutions. Rental companies are investing in EV infrastructure, including charging stations, to support this shift. The introduction of electric vehicles is expected to attract a new customer base and further contribute to the market’s growth.

Expansion of Ride-Hailing and Carpooling Services

Carpooling and ride-hailing services are gaining popularity in Japan, influencing the traditional car rental market. These services are appealing to those who do not need a car on a daily basis but still require one for occasional trips. By integrating rental services with ride-hailing platforms, companies can offer more flexible options to customers. This trend is helping rental companies expand their reach and cater to a broader audience, including those who may never have considered traditional car rentals.

Market Challenges Analysis:

Regulatory and Safety Concerns in Car Rental Services

One of the significant challenges facing the Japan Car Rental Market is the need to comply with stringent regulations and safety standards. Car rental companies must ensure that their vehicles meet government requirements for safety, emissions, and insurance coverage. Maintaining compliance can be costly and time-consuming, particularly as regulations evolve over time. For rental companies, the administrative burden of meeting these standards while maintaining a competitive edge is a key challenge. Staying updated with the latest regulations is essential to avoid penalties and ensure customer safety.

High Operational Costs and Fleet Maintenance

High operational costs, including vehicle maintenance, fuel, and insurance, are another challenge in the Japan Car Rental Market. Maintaining a large fleet of vehicles is expensive, and rental companies must balance fleet management with customer satisfaction. To remain profitable, they must ensure their vehicles are well-maintained and ready for customer use while controlling costs. Additionally, the need for constant investment in new vehicles to keep up with customer demands and technological trends adds pressure on companies, affecting their profitability and long-term growth.

Market Opportunities:

Expansion of Car Rental Services in Emerging Markets

There is a significant opportunity for the Japan Car Rental Market to expand into emerging markets. Many Southeast Asian countries and other parts of Asia are witnessing rapid urbanisation and an increase in tourism. As these markets grow, the demand for car rental services is expected to rise. Japan’s car rental companies have the opportunity to tap into these markets by leveraging their expertise and experience. By offering tailored services that meet local demands, they can establish a strong presence in these developing regions.

Collaboration with Tourism and Hospitality Industry

The Japan Car Rental Market can also benefit from stronger collaboration with the tourism and hospitality industries. Partnerships with hotels, travel agencies, and airlines could provide a steady stream of customers looking for seamless travel experiences. By offering package deals that include both accommodation and car rentals, companies can attract tourists seeking convenience. These collaborations could increase customer loyalty and help rental businesses maintain a competitive edge in a crowded market.

Market Segmentation Analysis:

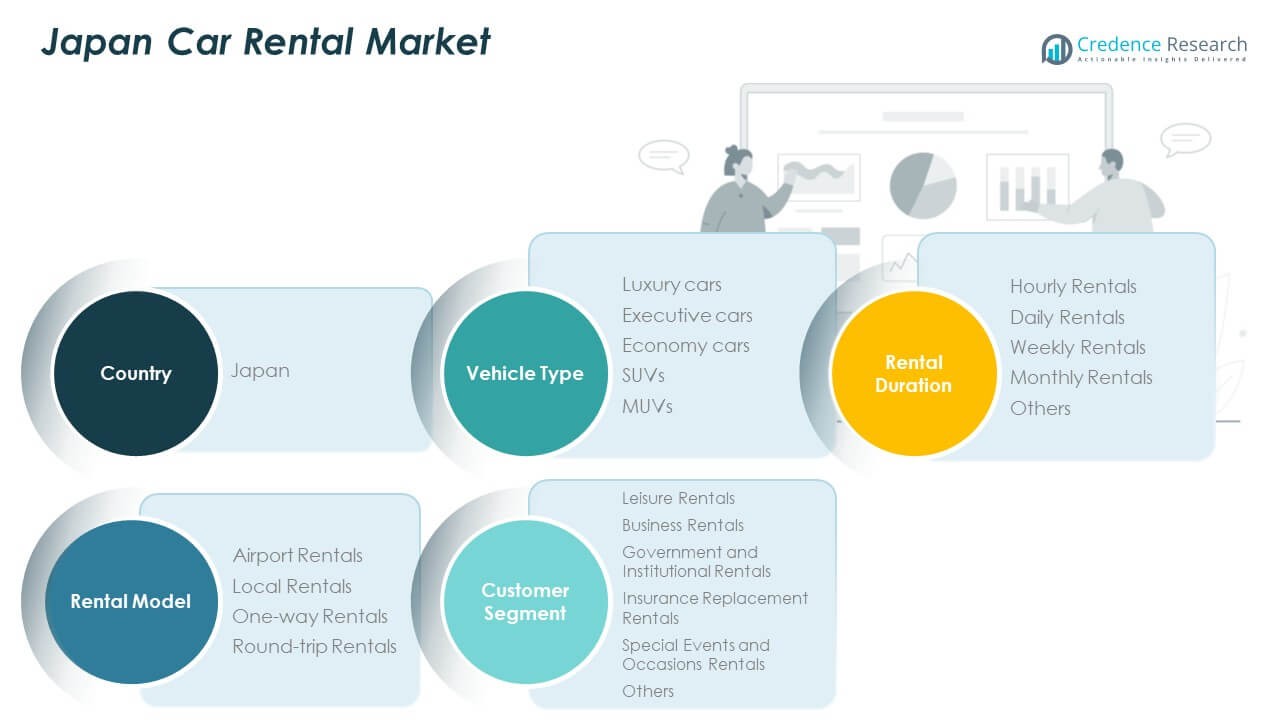

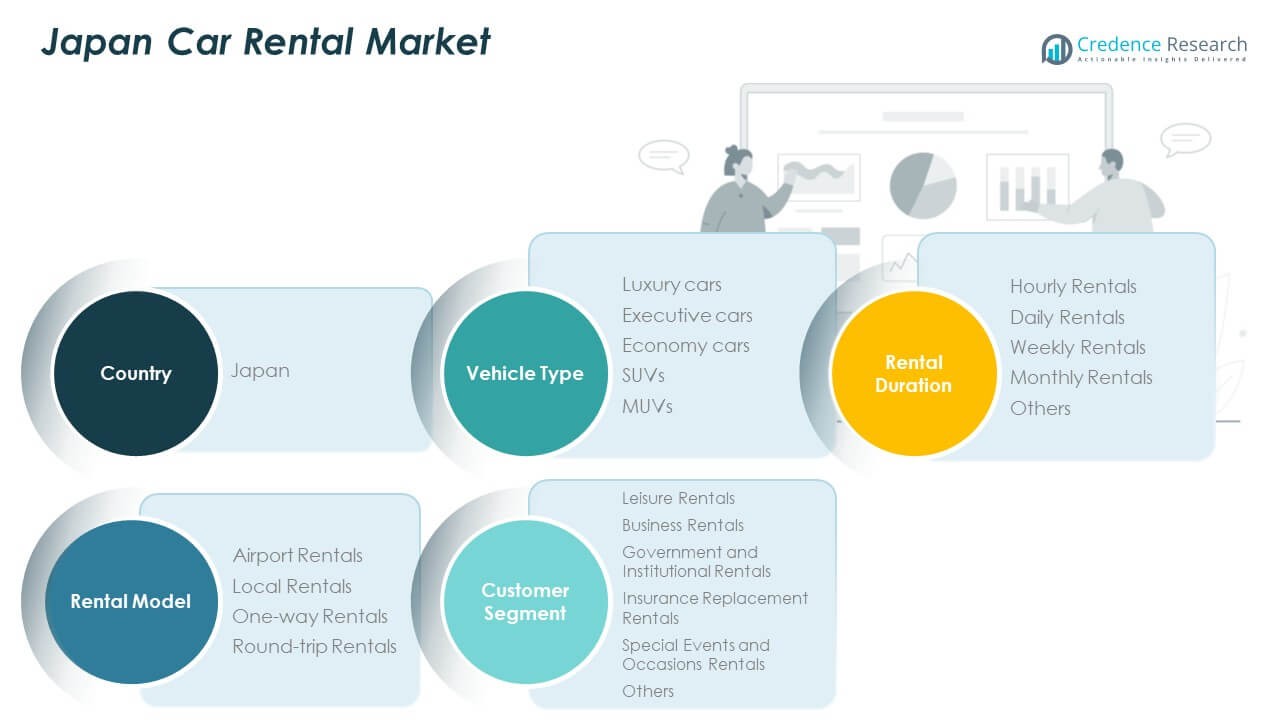

By Vehicle Type

The Japan Car Rental Market is segmented by vehicle type into luxury cars, executive cars, economy cars, SUVs, and MUVs. Luxury cars cater to high-end clients seeking comfort and style, while executive cars are popular among business professionals for their practicality and performance. Economy cars dominate the market, driven by their affordability for budget-conscious consumers. SUVs and MUVs appeal to those requiring more space for family or group travel. Each segment meets distinct consumer preferences, with the economy and SUV segments showing significant growth due to rising demand for versatile, cost-effective options.

- For instance, Rental companies offer the Lexus LS 500h, which features a 3.5-liter V6 hybrid engine producing 354 horsepower with a total system output of 264 kW. This is combined with a Multi Stage Hybrid System and an 84-cell lithium-ion battery with a nominal voltage of 310.8V and a system voltage of 650V. Executive cars are popular among business professionals for their practicality and performance.

By Rental Duration

In terms of rental duration, the Japan Car Rental Market is divided into hourly, daily, weekly, and monthly rentals, with additional options for other durations. Hourly rentals are suitable for short trips and specific needs like airport transfers. Daily rentals remain the most popular, offering flexibility for both tourists and business professionals. Weekly and monthly rentals are increasingly favored by those requiring longer-term solutions, such as long-term business stays or vacations. This segmentation caters to various customer needs, enhancing the accessibility of rental services across different travel durations.

- For instance, major operators like Toyota Rent a Car, which operates approximately 1,100 branches nationwide making it Japan’s largest rental company, offers a 24-hour rental rate starting from JPY 8,580 for a standard compact car as of November 2025.

By Rental Model

The market also segments by rental model, including airport, local, one-way, and round-trip rentals. Airport rentals dominate, driven by international and domestic travel. Local rentals serve customers who need vehicles for city-based travel. One-way rentals are growing, as travelers seek flexibility for drop-off at different locations, while round-trip rentals cater to those planning return journeys. This segmentation reflects the diverse travel patterns in the Japan Car Rental Market, providing flexible and efficient rental options.

By Customer Segment

Customer segmentation in the Japan Car Rental Market includes leisure rentals, business rentals, government and institutional rentals, insurance replacement rentals, and rentals for special events. Leisure rentals are highly popular among tourists, while business rentals cater to corporate travelers. Government and institutional rentals see steady demand for public sector needs. Insurance replacement rentals are essential for those requiring temporary vehicles after accidents. Rentals for special events provide unique options for occasions like weddings or conferences, driving further market expansion.

Segmentation:

By Vehicle Type:

- Luxury Cars

- Executive Cars

- Economy Cars

- SUVs

- MUVs

By Rental Duration:

- Hourly Rentals

- Daily Rentals

- Weekly Rentals

- Monthly Rentals

- Others

By Rental Model:

- Airport Rentals

- Local Rentals

- One-way Rentals

- Round-trip Rentals

By Customer Segment:

- Leisure Rentals

- Business Rentals

- Government and Institutional Rentals

- Insurance Replacement Rentals

- Special Events and Occasions Rentals

- Others

Regional Analysis:

Domestic Mainland Japan Region

The Japan Car Rental Market holds the largest regional share within the country, capturing approximately 70% of the national market. It maintains dominance due to high domestic tourist traffic and concentrated business hubs in Tokyo and Osaka. Urban density and efficient transport infrastructure support rental adoption in this region. Providers deploy fleets and technology in key metropolitan zones to meet demand. It forecasts stable growth driven by repeat domestic travellers. Competitive intensity remains high, and companies emphasise strong service levels to sustain market presence.

Island and Rural Regions (Hokkaido, Okinawa, Tohoku, Kyushu)

This region commands around 20% of the market share and records faster growth than the mainland due to rising travel and regional tourism initiatives. It offers rental firms untapped opportunities since ground transport options remain limited outside major cities. Seasonal tourism surges elevate demand, especially among foreign visitors seeking unique experiences. Providers tailor service offerings to remote and scenic locales and adjust pricing dynamically. The growth momentum is significant and firms that localise operations gain competitive edge.

International & Inbound Traveller Segment

The outbound‑inbound mix segment accounts for roughly 10% of the regional share but presents high opportunity intensity. It includes arrivals at airports and port cities and ties to global travel trends. It benefits from increased international arrivals and demand for rental options suited for non‑Japanese drivers. Rental firms expand multi‑lingual services and integrate digital platforms to capture this segment. It monitors policy and visa‑flow changes closely to adapt operations and capture growth.

Key Player Analysis:

- Toyota Rent a Car

- Nippon Rent-A-Car

- Orix Rent-A-Car

- Nissan Rent-A-Car

- Times Car Rental

- Budget Japan

- ABC Rent-A-Car

- JR Rent-A-Car

- Nippon Travel Agency

- JR East Rent-A-Car

Competitive Analysis:

The Japan Car Rental Market is highly competitive, with both domestic and international players vying for market share. Key players include Toyota Rent a Car, Nippon Rent-A-Car, and Orix Rent-A-Car, all of which maintain extensive fleets and strong brand recognition. These companies focus on service differentiation through technology, offering mobile apps for booking, contactless rentals, and personalized customer experiences. With increasing demand from tourists and business travelers, the competition is intensifying, pushing companies to expand their service offerings and improve customer service. It remains critical for companies to invest in fleet diversification, including electric and hybrid vehicles, to align with evolving consumer preferences and sustainability trends.

Recent Developments:

- In November 2025, Nippon Travel Agency (NTA) announced a groundbreaking partnership with Innovative Space Carrier (ISC) to commercialize space travel business. NTA and ISC signed a new business partnership contract after jointly studying “space travel for everyone” since September 2024. Under the agreement, they are building a system for selling, operation, and experience design for commercialization of space travel. NTA plans to accept space travel applications for SPACE Tour 2.0 (next-generation point-to-point high-speed transportation on Earth) and SPACE Tour 3.0 (orbital stays) within fiscal year 2026, which starts April 1, 2026. While this partnership is not directly related to car rental operations, it demonstrates NTA’s expansion into innovative mobility and travel services beyond traditional offerings.

- In October 2025, Nissan Motor Corporation showcased its commitment to the Japanese market at the Japan Mobility Show 2025 by unveiling several new and refreshed vehicles as part of its Re:Nissan recovery plan. The company displayed the all-new fourth-generation Elgrand, scheduled for launch in summer 2026, along with the all-new LEAF developed specifically for the Japan market, and confirmed the introduction of the flagship Patrol SUV to Japan in fiscal year 2027. These product announcements demonstrate Nissan’s strategy to refresh core models, expand into new segments, and introduce signature “heartbeat” vehicles that resonate emotionally with customers and embody the brand’s innovation and heritage.

- In September 2025, Toyota launched Toyota Invention Partners Co., Ltd. (TIP), a new strategic investment subsidiary with 100 billion yen (approximately 670 million USD) in capital. This subsidiary, which began operations on October 1, 2025, focuses on accelerating collaborations between Toyota, Woven by Toyota, Toyota Group companies, and external partners as part of Toyota’s transformation into a mobility company. Unlike conventional funds with fixed periods, TIP takes a long-term investment view and will primarily invest in early-stage startups in Japan and other companies that share Toyota’s vision of “Inventing our path forward, together.” The establishment of TIP represents Toyota’s commitment to building business collaborations by investing in partners across various sectors beyond just automotive.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on vehicle types, rental durations, rental models, and customer segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for eco-friendly rental vehicles will continue to rise, driven by environmental awareness.

- Companies will focus on expanding their digital offerings, including mobile apps and online booking systems.

- Fleet diversification, including electric and hybrid vehicles, will become more prominent to meet customer preferences.

- The growth of business and leisure travel will further drive car rental demand.

- Strategic partnerships and collaborations between rental firms and tourism agencies will increase.

- New business models like subscription-based rentals will gain more popularity.

- Rising infrastructure development in regional markets will improve access to rental services.

- Advances in AI and automation will streamline operations and improve customer experiences.

- Price optimization models based on demand forecasting will enhance rental service profitability.

- The shift towards self-drive and autonomous vehicle rentals will redefine customer engagement in the market.

Market Drivers:

Market Drivers: Market Trends:

Market Trends: