| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Distributed Acoustic Sensing Market Size 2024 |

USD 39.39 Million |

| Japan Distributed Acoustic Sensing Market, CAGR |

12.51% |

| Japan Distributed Acoustic Sensing Market Size 2032 |

USD 101.1 Million |

Market Overview:

The Japan Distributed Acoustic Sensing Market is projected to grow from USD 39.39 million in 2024 to an estimated USD 101.1 million by 2032, with a compound annual growth rate (CAGR) of 12.51%from 2024 to 2032.

Several factors are propelling the growth of the DAS market in Japan. The country’s emphasis on enhancing safety and security measures has led to increased investments in advanced monitoring systems. DAS technology offers continuous, high-resolution surveillance over extensive areas, making it invaluable for detecting and addressing events such as pipeline leaks and intrusions promptly. Additionally, the integration of DAS in infrastructure projects aids in real-time monitoring, ensuring structural integrity and operational efficiency. The oil and gas sector, in particular, benefits from DAS through improved pipeline monitoring and leak detection, enhancing safety and reducing operational costs. Furthermore, advancements in fiber optic sensing and data analytics are enhancing the performance and reliability of DAS systems, making them more appealing for widespread adoption.

In the Asia-Pacific region, Japan stands out due to its technological prowess and commitment to infrastructure development. The country’s focus on smart city initiatives and modernization of transportation networks provides ample opportunities for DAS applications. While China currently holds a significant share in the Asia-Pacific DAS market, Japan’s strategic investments in security and infrastructure projects are positioning it as a key player in the region. The increasing adoption of DAS in Japan’s oil and gas, transportation, and telecommunications sectors underscores its potential for substantial market growth in the coming years. As the country continues to invest in smart technologies and modernize its infrastructure, the adoption of DAS solutions is expected to accelerate, contributing significantly to the regional and global market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- Japan’s Distributed Acoustic Sensing (DAS) market is projected to grow from USD 39.39 million in 2024 to USD 101.1 million by 2032, registering a CAGR of 12.51%.

- The Global Distributed Acoustic Sensing Market is projected to grow from USD 639.45 million in 2024 to an estimated USD 1596.46 million by 2032, with a compound annual growth rate (CAGR) of 12.12% from 2024 to 2032.

- The country’s emphasis on enhancing safety and security measures has led to increased investments in advanced monitoring systems, driving the adoption of DAS technology.

- DAS offers continuous, high-resolution surveillance over extensive areas, making it invaluable for detecting and addressing events such as pipeline leaks and intrusions promptly.

- Integration of DAS in infrastructure projects aids in real-time monitoring, ensuring structural integrity and operational efficiency.

- The oil and gas sector benefits from DAS through improved pipeline monitoring and leak detection, enhancing safety and reducing operational costs.

- Advancements in fiber optic sensing and data analytics are enhancing the performance and reliability of DAS systems, making them more appealing for widespread adoption.

- Japan’s focus on smart city initiatives and modernization of transportation networks provides ample opportunities for DAS applications, positioning the country as a key player in the Asia-Pacific DAS market.

Market Drivers:

Infrastructure Modernization and Smart City Initiatives

Japan’s growing investment in infrastructure modernization and smart city development serves as a foundational driver for the adoption of distributed acoustic sensing (DAS) technologies. For instance, the Japanese government has allocated significant resources, such as 1.2 trillion yen for over 12 large-scale pilot projects, including IoT-enabled water systems and autonomous public transport. With the government’s emphasis on upgrading transportation networks, energy infrastructure, and urban facilities, there is a rising demand for advanced monitoring systems that ensure operational safety and efficiency. DAS systems, which utilize fiber optic cables to detect and interpret acoustic signals, offer a cost-effective and scalable solution for real-time infrastructure surveillance. Their ability to detect stress, strain, and potential failures along extensive physical assets positions them as a critical tool in Japan’s push for digital transformation in public infrastructure.

Enhanced Security Requirements in Critical Infrastructure

Security concerns surrounding critical infrastructure, such as oil and gas pipelines, railways, and power grids, are significantly influencing the DAS market in Japan. The increasing sophistication of threats, including potential sabotage or unauthorized intrusions, has prompted both government agencies and private operators to deploy robust perimeter and asset monitoring systems. For example, DAS systems have been successfully used to detect vibrations and disturbances over long distances, providing actionable intelligence to mitigate risks. This real-time intelligence aids in proactive threat response, minimizing risks and improving resilience against external attacks or internal failures. As national security becomes a higher priority, the use of DAS is expected to become integral to Japan’s critical infrastructure protection strategies.

Technological Advancements and Integration with IoT and AI

Advancements in fiber optic technology, combined with the proliferation of Internet of Things (IoT) and artificial intelligence (AI), are significantly boosting the performance and appeal of DAS systems in Japan. Modern DAS platforms are increasingly capable of processing complex acoustic signals, thanks to machine learning algorithms that enhance pattern recognition and predictive analysis. This allows for the early detection of anomalies and potential failures in applications ranging from seismic activity monitoring to pipeline integrity assessments. The convergence of DAS with smart sensor networks and real-time analytics is enabling automated, data-driven decision-making, which aligns well with Japan’s vision for a highly connected, intelligent infrastructure ecosystem.

Growing Adoption in the Oil, Gas, and Utility Sectors

The oil and gas industry in Japan is embracing distributed acoustic sensing for its ability to optimize operations and ensure environmental compliance. DAS is widely used in upstream and midstream activities for real-time well monitoring, pipeline surveillance, and leak detection. Its deployment reduces the need for manual inspections and helps companies maintain compliance with increasingly stringent safety and environmental regulations. Beyond oil and gas, utility companies are also leveraging DAS for monitoring power transmission lines, water networks, and other linear assets. As the energy and utilities sectors pursue automation and digitalization, DAS emerges as a vital tool to enhance operational oversight and reduce maintenance costs across extensive infrastructure networks.

Market Trends:

Rising Deployment in Transportation and Rail Monitoring

Distributed Acoustic Sensing (DAS) technology is increasingly being integrated into Japan’s transportation and rail infrastructure monitoring systems. For instance, DAS enables real-time detection of rail defects, unauthorized track access, and train movement irregularities, which are critical for ensuring operational safety and efficiency. This technology is particularly beneficial for Japan’s extensive railway network, which includes aging infrastructure requiring constant surveillance. Railway operators have started deploying DAS systems to modernize their operations, leveraging its ability to monitor long distances without active power sources at sensing points. Such advancements align with Japan’s focus on enhancing railway safety and operational efficiency.

Increased Utilization in Seismic and Environmental Monitoring

Given Japan’s vulnerability to seismic activity, there is an increasing trend of leveraging DAS for geophysical and environmental monitoring. Researchers and government agencies are exploring the use of fiber-optic sensing networks to detect ground vibrations, which can serve as early indicators of seismic events. For example, the Earthquake Research Institute at the University of Tokyo has implemented DAS measurements using spare fibers from seafloor cable systems to record seismic events, including microearthquakes and teleseismic occurrences. DAS systems, when integrated with existing fiber-optic cable infrastructure, can capture a wide range of vibrational frequencies, allowing for high-resolution seismic data collection. This trend aligns with Japan’s national focus on disaster preparedness and resilience. In addition to earthquake monitoring, DAS is being tested for applications such as landslide detection and volcanic activity monitoring in geologically active zones.

Expansion of Urban Fiber Networks Enhancing DAS Integration

Japan’s continuous expansion of fiber-optic communication networks in urban areas is facilitating the broader implementation of distributed acoustic sensing solutions. Telecom operators and city planners are increasingly exploring how existing fiber infrastructure can serve dual purposes—both as data transmission lines and sensing tools. This trend reduces the cost of DAS deployment by eliminating the need for dedicated sensor installation. As urban regions become more digitally connected, DAS is finding use in monitoring construction sites, underground utilities, and traffic patterns. The convergence of DAS with fiber communication networks supports the country’s ambitions toward building smart cities with real-time situational awareness.

Commercialization of Advanced DAS Platforms for Industrial Use

The commercial availability of advanced DAS platforms tailored for industrial applications is also shaping market trends in Japan. These platforms offer improved spatial resolution, extended sensing ranges, and enhanced compatibility with industrial control systems. Industries such as chemical processing, power generation, and marine infrastructure are showing increasing interest in DAS due to its ability to detect operational anomalies and enable predictive maintenance. As Japanese manufacturers seek to maintain global competitiveness through automation and quality assurance, the demand for reliable, non-intrusive monitoring systems like DAS continues to grow. This trend reflects a broader shift toward condition-based monitoring in industrial environments.

Market Challenges Analysis:

High Initial Deployment Costs

One of the primary restraints in the growth of the Distributed Acoustic Sensing (DAS) market in Japan is the high initial cost associated with system deployment. Although DAS leverages existing fiber optic infrastructure in some applications, the integration of specialized interrogator units, advanced software platforms, and tailored system configurations increases the overall capital expenditure. For example, in the Minami-Aga pilot CCUS project, the integration of DAS technology required specialized equipment such as interrogators and optical receivers, alongside tailored configurations for seismic monitoring, which substantially increased capital expenditure. For sectors with budget constraints, especially small and mid-sized enterprises, this cost becomes a significant barrier to adoption. Moreover, the return on investment may not be immediately evident, which further delays the decision-making process for full-scale deployment.

Complexity of System Integration

The complexity involved in integrating DAS technology with existing operational systems presents a significant challenge for market expansion in Japan. DAS solutions require a high level of customization to align with the specific monitoring requirements of industries such as oil and gas, transportation, or utilities. Achieving accurate interpretation of acoustic data demands specialized technical expertise and calibration processes. In many cases, companies lack the in-house capabilities to manage these technical complexities, necessitating reliance on external experts, which adds to operational costs and delays implementation timelines.

Limited Standardization and Interoperability

The lack of industry-wide standards for DAS technology and data formats limits interoperability across platforms and vendors. This poses a challenge for widespread adoption in Japan, where organizations prioritize long-term system compatibility and scalability. Without standardized protocols, integrating DAS with broader industrial monitoring systems or smart city frameworks becomes more cumbersome, requiring custom solutions that increase both cost and deployment time. Additionally, the absence of universal benchmarks complicates performance comparisons between systems, making it difficult for end-users to make informed procurement decisions.

Data Management and Analysis Challenges

DAS systems generate vast volumes of complex acoustic data that require advanced analytical tools and machine learning algorithms to extract meaningful insights. For many Japanese industries transitioning into data-driven operations, managing this influx of information presents a challenge. The need for specialized personnel and high-performance computing resources adds an additional layer of complexity, potentially limiting DAS adoption among organizations with limited digital infrastructure.

Market Opportunities:

The Japan Distributed Acoustic Sensing market presents significant opportunities driven by the country’s ongoing digital transformation and infrastructure modernization initiatives. As Japan continues to invest in smart city development, there is a growing need for intelligent monitoring systems that can deliver real-time, high-resolution data across vast linear assets. DAS technology, which utilizes fiber optic cables for distributed sensing, aligns perfectly with this need. Its ability to detect vibrations, monitor environmental conditions, and track infrastructure integrity creates valuable use cases across transportation, urban planning, and civil engineering. The presence of an extensive and reliable fiber-optic network across Japan further enhances the potential for scalable and cost-effective DAS integration without the need for laying new physical infrastructure.

Additionally, the energy transition and increasing focus on sustainability provide further avenues for DAS adoption in Japan. As industries and utility providers strive to improve operational efficiency and reduce environmental risk, distributed acoustic sensing offers a non-intrusive, real-time monitoring solution for pipelines, power grids, and critical facilities. The growing interest in renewable energy sources, such as offshore wind and geothermal energy, can also benefit from DAS applications for structural and seismic monitoring. Moreover, advancements in data analytics, artificial intelligence, and edge computing are enhancing the performance and interpretability of DAS data, enabling more industries to unlock its value. As digital technologies become more embedded in Japan’s industrial and civic infrastructure, the DAS market is positioned to grow as a key enabler of proactive monitoring and intelligent decision-making.

Market Segmentation Analysis:

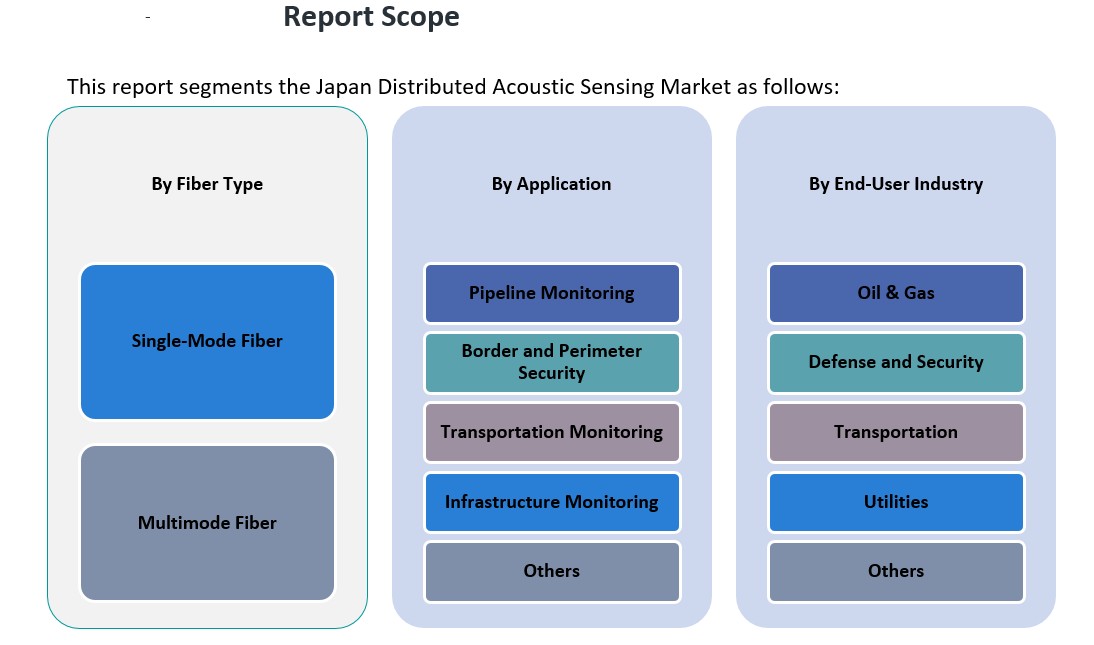

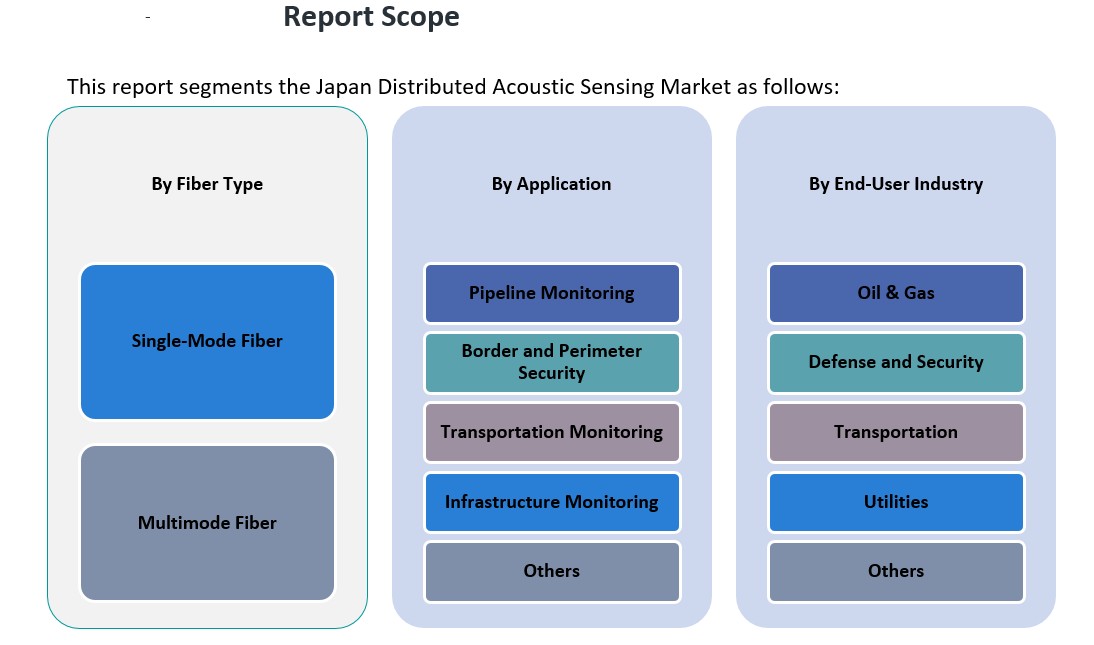

The Japan Distributed Acoustic Sensing (DAS) market is segmented by fiber type, application, and end-user industry.

By fiber types, single-mode fiber holds a dominant share due to its ability to transmit signals over long distances with minimal attenuation, making it ideal for large-scale industrial and infrastructure monitoring. Multimode fiber, while less prevalent, finds applications in confined environments requiring high bandwidth over shorter ranges. The growing demand for precise and continuous monitoring across vast networks reinforces the preference for single-mode fiber in Japan’s evolving smart infrastructure landscape.

By application, pipeline monitoring represents a significant segment, driven by Japan’s need to ensure safety and efficiency across its aging oil, gas, and water infrastructure. Transportation monitoring is gaining momentum, particularly with increased adoption of DAS for railway and road network surveillance. Border and perimeter security applications are also expanding as Japan strengthens its national security infrastructure. Infrastructure monitoring, including bridges, tunnels, and high-rise structures, is becoming increasingly important amid urban redevelopment projects. The ‘Others’ category includes emerging uses such as seismic detection and industrial asset monitoring, which are gradually gaining traction.

By end-user industry, oil and gas remains the leading segment, leveraging DAS for leak detection and well surveillance. The defense and security sector actively adopts DAS for real-time threat detection and intrusion monitoring. Transportation and utilities are also significant contributors, utilizing DAS for operational oversight and infrastructure integrity. The ‘Others’ category includes research institutions and disaster management agencies, indicating diverse potential for DAS in Japan’s high-tech and safety-conscious environment.

Segmentation:

By Fiber Type:

- Single-Mode Fiber

- Multimode Fiber

By Application:

- Pipeline Monitoring

- Transportation Monitoring

- Border and Perimeter Security

- Infrastructure Monitoring

- Others

By End-User Industry:

- Oil & Gas

- Defense and Security

- Transportation

- Utilities

- Others

Regional Analysis:

Japan plays a significant role in the Asia-Pacific Distributed Acoustic Sensing (DAS) market, contributing nearly 14% of the region’s total market share. As one of the most technologically advanced nations, Japan is steadily increasing its investments in DAS technologies across various critical sectors such as transportation, utilities, and energy. The demand for real-time monitoring, predictive maintenance, and infrastructure safety has led to the widespread implementation of DAS in major urban centers and industrial zones.

Within Japan, the Kanto region—home to Tokyo and the country’s most extensive urban infrastructure—accounts for the largest share of DAS deployments, representing approximately 37% of the national market. This is due to the region’s focus on smart city development, rail network monitoring, and utility infrastructure modernization. Kanto’s dense population and concentration of corporate and government institutions drive the integration of advanced monitoring solutions, positioning it as the core region for DAS adoption.

The Kansai region, including Osaka, Kyoto, and Kobe, holds around 25% of the domestic DAS market. Known for its industrial base and logistical importance, Kansai is witnessing increasing application of DAS technology in energy distribution networks and perimeter security systems. The Chubu region, which includes Nagoya and serves as a hub for manufacturing and automotive industries, accounts for nearly 18% of the market. DAS is being used here for monitoring industrial assets and ensuring operational continuity in key facilities.

Other regions such as Kyushu, Tohoku, and Hokkaido collectively represent the remaining 20% of the market. These areas are progressively exploring DAS applications, particularly in disaster risk monitoring, border surveillance, and remote infrastructure oversight. As nationwide infrastructure resilience becomes a greater priority, demand for DAS across regional and rural areas is expected to grow steadily. Japan’s balanced regional adoption reflects both its centralized urban needs and expanding regional infrastructure initiatives.

Key Player Analysis:

- AP Sensing GmbH

- Bandweaver Technologies

- Silixa Ltd.

- Omnisens SA

- Fotech Solutions Ltd.

- OptaSense (QinetiQ Group)

- Schlumberger Limited

- Baker Hughes Company

- OFS Fitel LLC

- Hifi Engineering Inc.

Competitive Analysis:

The Japan Distributed Acoustic Sensing (DAS) market features a competitive landscape comprising both global leaders and specialized regional players. Prominent international companies such as Halliburton, Baker Hughes, Schlumberger, and Silixa have established a presence in Japan, offering advanced DAS solutions tailored for sectors like oil and gas, transportation, and infrastructure monitoring. These firms leverage their global expertise and technological innovations to meet the specific demands of the Japanese market. In addition to these global entities, regional companies contribute to the market by providing customized solutions that address local requirements. The competitive dynamics are further influenced by strategic partnerships, research and development initiatives, and a focus on integrating DAS technology with emerging fields such as artificial intelligence and the Internet of Things. This integration enhances the functionality and applicability of DAS systems across various industries. As the demand for real-time monitoring and infrastructure safety continues to grow, companies that offer innovative, scalable, and cost-effective DAS solutions are well-positioned to strengthen their market presence in Japan.

Recent Developments:

- In March 2023, Optex Group, a Japan-based manufacturer of industrial process instruments, launched its Echopoint distributed acoustic sensors. These sensors utilize advanced fiber optic sensing technology to enhance intrusion detection in high-security areas. The product offers features such as ±6 meter detection accuracy over distances of up to 100 kilometers, sophisticated classification algorithms for differentiating intrusion types, flexible installation options, customizable sensitivity settings through intelligent software zoning, and robust resistance to electromagnetic interference and lightning strikes.

- In September 2023, researchers from the University of New Mexicoand Sandia National Laboratories developed a novel method to monitor local sea ice in Alaska using Distributed Acoustic Sensing (DAS) technology. By leveraging a telecommunications fiber optic cable combined with machine learning algorithms, the team analyzed ground vibrations caused by ocean waves to detect sea ice coverage and strength.

- In December 2023, Luna Innovations Inc. acquired Silixa Ltd., a UK-based leader in distributed fiber optic sensing solutions. This strategic acquisition enhanced Luna’s capabilities in distributed acoustic sensing (DAS), distributed temperature sensing (DTS), and distributed strain sensing (DSS), enabling improved performance for applications in energy, natural environments, mining, and defense.

Market Concentration & Characteristics:

The Japan Distributed Acoustic Sensing (DAS) market exhibits a moderately concentrated structure, characterized by the presence of both global industry leaders and specialized regional players. Major international companies, including Halliburton, Baker Hughes, Schlumberger, and Silixa, have established a significant presence in Japan, offering advanced DAS solutions tailored to sectors such as oil and gas, transportation, and infrastructure monitoring. These firms leverage their global expertise and technological innovations to meet the specific demands of the Japanese market. In addition to these global entities, regional companies contribute to the market by providing customized solutions that address local requirements. The competitive dynamics are further influenced by strategic partnerships, research and development initiatives, and a focus on integrating DAS technology with emerging fields such as artificial intelligence and the Internet of Things. This integration enhances the functionality and applicability of DAS systems across various industries. As the demand for real-time monitoring and infrastructure safety continues to grow, companies that offer innovative, scalable, and cost-effective DAS solutions are well-positioned to strengthen their market presence in Japan.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Fiber Type, Application and End-User Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Japan will witness increased DAS adoption in smart city projects to enhance real-time infrastructure monitoring.

- Integration of DAS with AI and IoT will improve predictive analytics and operational efficiency across industries.

- Expansion of fiber-optic networks will support broader and more cost-effective DAS deployments.

- The oil and gas sector will continue leveraging DAS for enhanced pipeline surveillance and environmental safety.

- Transportation authorities will scale up DAS use for proactive rail and road condition monitoring.

- Government investment in disaster resilience will drive DAS adoption for seismic and geohazard detection.

- Demand from defense and border security agencies will grow for real-time perimeter monitoring solutions.

- Utilities will integrate DAS into energy and water infrastructure for continuous asset condition monitoring.

- Local technology firms may emerge with tailored DAS solutions, increasing market competitiveness.

- Japan’s role in regional innovation will position it as a key adopter and influencer in the Asia-Pacific DAS market.