| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Electric Vehicle (EV) Hub Motor Market Size 2024 |

USD 1,513.63 Million |

| Japan Electric Vehicle (EV) Hub Motor Market, CAGR |

12.14% |

| Japan Electric Vehicle (EV) Hub Motor Market Size 2032 |

USD 3,785.02 Million |

Market Overview

Japan Electric Vehicle (EV) Hub Motor Market size was valued at USD 1,513.63 million in 2024 and is anticipated to reach USD 3,785.02 million by 2032, at a CAGR of 12.14% during the forecast period (2024-2032).

The Japan Electric Vehicle (EV) Hub Motor market is driven by the rising adoption of electric vehicles, supported by government incentives and stringent emission regulations. Advancements in hub motor technology, including higher efficiency, lightweight designs, and improved power density, are enhancing vehicle performance and driving market expansion. The growing demand for compact and energy-efficient drivetrains, particularly in urban mobility solutions, further fuels market growth. Additionally, key trends include increased investments in research and development to enhance motor durability and optimize energy consumption. The integration of smart technologies, such as regenerative braking and connected vehicle systems, is also gaining traction, improving overall vehicle efficiency. The shift toward shared mobility and autonomous EVs is accelerating innovation in hub motor technology, ensuring higher adoption rates in the coming years. As Japan continues to focus on sustainable transportation, the EV hub motor market is set for significant growth throughout the forecast period.

Japan’s Electric Vehicle (EV) Hub Motor market is driven by regional advancements in EV adoption, infrastructure development, and government policies supporting sustainable transportation. Major regions like Kanto, Kansai, Chubu, and Kyushu play a crucial role in market expansion due to their strong automotive manufacturing bases and increasing investments in EV technology. Urban centers are witnessing rising demand for electric two-wheelers, passenger EVs, and light commercial vehicles, further fueling the need for efficient hub motors. Key players in the market include Tajima Motor Corporation, NTN Corporation, Yamaha Motor Co., Ltd., Nidec Corporation, Panasonic Corporation, Kyocera Corporation, Hitachi Automotive Systems, Furukawa Electric Co., Ltd., and Schaeffler Japan. These companies focus on technological advancements, product innovation, and strategic partnerships to enhance hub motor efficiency and durability. As Japan continues to advance its EV ecosystem, increasing collaborations between automakers and component manufacturers are expected to drive significant growth in the hub motor market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Electric Vehicle (EV) Hub Motor market was valued at USD 1,513.63 million in 2024 and is projected to reach USD 3,785.02 million by 2032, growing at a CAGR of 12.14% from 2024 to 2032.

- The market is expanding due to increasing EV adoption, government incentives, and advancements in hub motor technology, enhancing vehicle efficiency and performance.

- Growing demand for electric two-wheelers and last-mile delivery vehicles is driving the need for compact, lightweight, and high-efficiency hub motors.

- Companies are focusing on research and development, product innovations, and strategic collaborations to gain a competitive edge in the market.

- High initial costs, complex integration with existing vehicle architectures, and battery performance limitations pose challenges to market growth.

- Major regions such as Kanto, Kansai, Chubu, and Kyushu are driving demand due to strong EV infrastructure, government policies, and the presence of key manufacturers.

- Leading players include Tajima Motor Corporation, NTN Corporation, Yamaha Motor Co., Ltd., Nidec Corporation, Panasonic Corporation, and Kyocera Corporation.

Report Scope

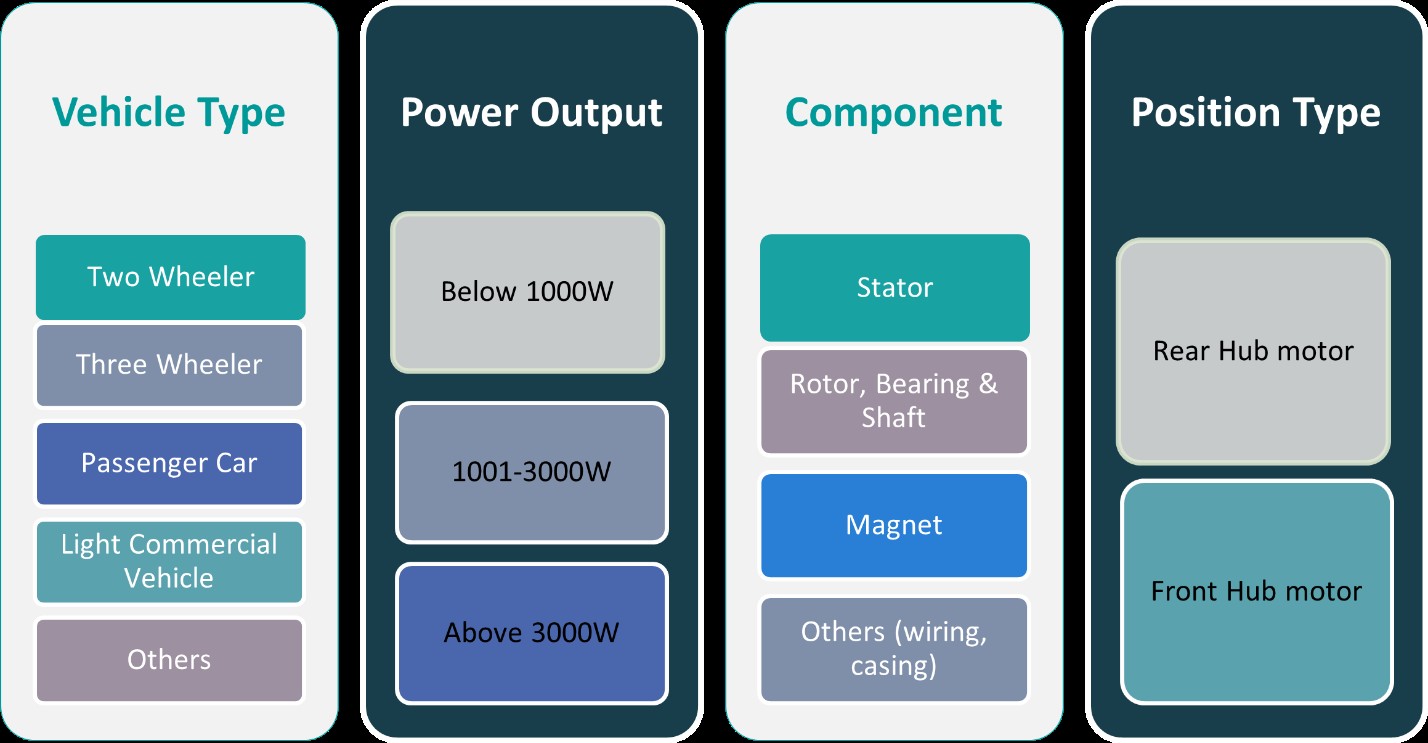

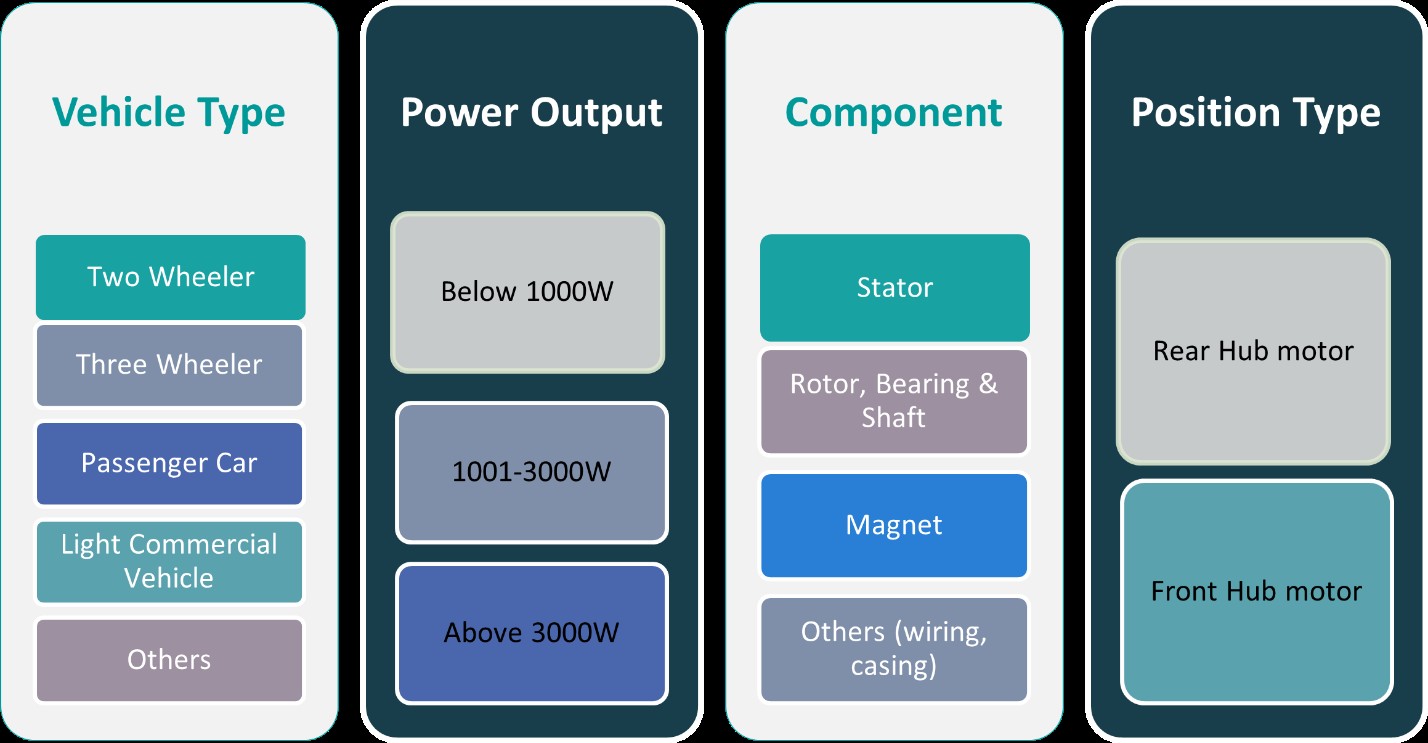

This report segments the Japan Electric Vehicle (EV) Hub Motor Market as follows:

Market Drivers

Rising Adoption of Electric Vehicles and Government Support

The increasing adoption of electric vehicles (EVs) in Japan is a key driver of the EV hub motor market. The Japanese government has implemented stringent emission regulations and policies to reduce carbon footprints, encouraging automakers and consumers to shift toward electric mobility. Incentives such as tax benefits, subsidies, and infrastructure development for EV charging stations are further accelerating this transition. Additionally, the growing environmental consciousness among consumers and the rising fuel prices are prompting a shift away from internal combustion engine vehicles. Automakers are responding by introducing new EV models with enhanced efficiency, further propelling the demand for hub motors. The government’s commitment to achieving carbon neutrality by 2050 also plays a crucial role in fostering market expansion, ensuring continuous investments in sustainable transportation solutions.

Advancements in Hub Motor Technology

Continuous advancements in hub motor technology are significantly driving the market’s growth. Manufacturers are focusing on enhancing motor efficiency, power density, and durability while reducing weight and energy losses. For example, innovations in motor cooling systems, such as advanced liquid cooling technologies, are improving the overall performance of EVs. Additionally, the integration of regenerative braking technology in hub motors is enhancing energy efficiency and extending vehicle range. The compact design of hub motors also enables better space utilization, leading to improved vehicle aesthetics and increased cabin space. These technological improvements are making hub motors a preferred choice for automakers looking to optimize the performance and efficiency of their EVs, contributing to their rising adoption across various vehicle segments.

Growing Demand for Compact and Energy-Efficient Drivetrains

The increasing preference for compact and lightweight drivetrains in electric vehicles is another major driver of the Japan EV hub motor market. Hub motors eliminate the need for complex transmission systems, resulting in a simplified drivetrain structure with fewer mechanical losses. For instance, consumer preferences for smaller, more efficient vehicles in urban areas are driving the adoption of compact mobility solutions. The demand for small, energy-efficient EVs is particularly strong in urban areas, where space constraints and the need for maneuverability drive the adoption of compact mobility solutions. Additionally, hub motors offer benefits such as enhanced vehicle stability and all-wheel drive capabilities, making them suitable for various EV applications, including passenger cars, electric two-wheelers, and last-mile delivery vehicles. As urbanization increases and smart city initiatives gain momentum, the demand for compact EVs with hub motors is expected to surge, further boosting market growth.

Expansion of Shared Mobility and Autonomous Vehicles

The rise of shared mobility services and the development of autonomous EVs are fueling the demand for hub motor technology. Ride-sharing companies and mobility service providers are increasingly adopting electric vehicles equipped with hub motors due to their lower operational costs and higher efficiency. For example, fleet operators are integrating hub motors into their vehicles to enhance operational efficiency and reduce maintenance expenses. Autonomous EVs, which require precise control and energy-efficient propulsion systems, also benefit from hub motors’ decentralized power distribution. Moreover, Japan’s investments in smart transportation infrastructure and vehicle connectivity solutions are promoting the use of advanced hub motor systems. The growing emphasis on sustainable urban mobility, coupled with the evolution of self-driving technology, is expected to drive the demand for hub motors, ensuring their widespread adoption in Japan’s EV ecosystem.

Expansion of Shared Mobility and Autonomous Vehicles

The rise of shared mobility services and the development of autonomous EVs are fueling the demand for hub motor technology. Ride-sharing companies and mobility service providers are increasingly adopting electric vehicles equipped with hub motors due to their lower operational costs and higher efficiency. Autonomous EVs, which require precise control and energy-efficient propulsion systems, also benefit from hub motors’ decentralized power distribution. Moreover, Japan’s investments in smart transportation infrastructure and vehicle connectivity solutions are promoting the use of advanced hub motor systems. The growing emphasis on sustainable urban mobility, coupled with the evolution of self-driving technology, is expected to drive the demand for hub motors, ensuring their widespread adoption in Japan’s EV ecosystem.

Market Trends

Increasing Integration of Smart Technologies

The integration of smart technologies in EV hub motors is a key trend shaping the Japanese market. Automakers are incorporating advanced control systems, sensor-based monitoring, and AI-driven diagnostics to enhance motor efficiency and performance. For instance, TMEIC Asia’s launch of the AI-based Smart Motor Sensor (TMASMS) demonstrates how predictive maintenance and real-time diagnostics are being integrated into motor systems to improve reliability and efficiency. The adoption of regenerative braking technology is improving energy recovery, extending battery life, and optimizing vehicle range. Additionally, the development of connected mobility solutions, including real-time performance monitoring and predictive maintenance, is enhancing the reliability of EV hub motors. These innovations are not only improving vehicle efficiency but also aligning with Japan’s vision for a technologically advanced and sustainable transportation ecosystem.

Rising Demand for Lightweight and High-Efficiency Motors

The push for energy efficiency and extended driving range has led to an increasing demand for lightweight and high-performance hub motors. Manufacturers are focusing on using advanced materials such as high-strength alloys and carbon composites to reduce motor weight without compromising durability. Additionally, improvements in power density and thermal management are enhancing motor efficiency, enabling EVs to achieve longer driving ranges with lower energy consumption. As Japanese automakers prioritize the development of compact and high-efficiency electric vehicles, the demand for lightweight hub motors is expected to grow, driving further innovation in motor design and performance optimization.

Growth of Urban Mobility and Last-Mile Delivery Solutions

The expansion of urban mobility solutions and last-mile delivery services is accelerating the adoption of EV hub motors. With increasing congestion in cities and the growing preference for eco-friendly transportation, there is a surge in demand for compact electric vehicles, including electric scooters, e-bikes, and small EVs. For instance, companies like Kakuyasu are electrifying their delivery fleets to reduce emissions and operational costs, leveraging the benefits of hub motors in urban logistics. Hub motors offer a space-saving design, improved maneuverability, and efficient power distribution, making them ideal for urban transport applications. Additionally, logistics companies are investing in electric last-mile delivery vehicles equipped with hub motors to reduce emissions and operational costs. This trend is expected to continue as e-commerce and urban logistics expand, further driving market growth.

Advancements in Autonomous and Shared Mobility Solutions

The rise of autonomous and shared mobility solutions is influencing the evolution of EV hub motor technology. Japan’s focus on smart cities and connected transportation is driving the adoption of self-driving electric vehicles, which require precise control and decentralized power distribution—features that hub motors efficiently provide. Additionally, shared mobility services, such as electric car-sharing and ride-hailing platforms, are increasingly adopting hub motor-driven EVs due to their low maintenance and enhanced energy efficiency. As autonomous vehicle development progresses and shared mobility services expand, the demand for hub motors in Japan’s EV market is set to rise, reinforcing their role in the future of sustainable transportation.

Market Challenges Analysis

High Initial Costs and Complex Manufacturing Processes

The Japan Electric Vehicle (EV) Hub Motor market faces significant challenges due to the high initial costs and complex manufacturing processes associated with hub motor technology. The development of high-efficiency hub motors requires advanced materials, precision engineering, and sophisticated manufacturing techniques, leading to increased production costs. For instance, the use of high-performance magnets and advanced cooling systems in hub motors contributes to their high cost, as these components are essential for achieving optimal efficiency and reliability. Additionally, integrating hub motors into EV designs demands specialized components such as high-performance magnets, advanced cooling systems, and durable enclosures, further driving up costs. These factors make hub motors more expensive than traditional drivetrain systems, potentially limiting their adoption, especially in price-sensitive segments. Furthermore, the need for extensive research and development to enhance motor efficiency and reliability adds to the financial burden on manufacturers. The high upfront investment required for production and technology refinement poses a barrier for small and mid-sized companies looking to enter the market, slowing overall industry expansion.

Technical Limitations and Durability Concerns

Despite their advantages, hub motors face technical limitations and durability concerns that hinder their widespread adoption. One of the primary challenges is heat dissipation, as hub motors are located within the wheel assembly, making it difficult to manage thermal buildup during extended operation. Overheating can reduce motor efficiency and lifespan, leading to increased maintenance costs. Additionally, hub motors are exposed to harsh road conditions, including vibrations, water, and debris, which can accelerate wear and tear. Ensuring long-term durability while maintaining lightweight designs remains a critical challenge for manufacturers. Another limitation is the impact on unsprung weight, which can affect ride quality and handling, particularly in high-performance and larger EV models. Although ongoing advancements in materials and thermal management technologies aim to address these challenges, further innovation is required to enhance hub motor resilience and efficiency. Overcoming these technical hurdles is essential for ensuring the long-term viability and competitiveness of hub motors in Japan’s evolving EV landscape.

Market Opportunities

The Japan Electric Vehicle (EV) Hub Motor market presents significant opportunities driven by the country’s strong push toward sustainable mobility and technological advancements. As the Japanese government continues to implement policies supporting electric vehicle adoption, including tax incentives, subsidies, and investments in charging infrastructure, the demand for efficient drivetrain solutions like hub motors is expected to rise. The growing preference for compact and lightweight EVs, particularly in urban areas, creates opportunities for hub motor manufacturers to develop innovative, space-saving solutions that enhance vehicle performance. Additionally, as automakers increasingly focus on enhancing energy efficiency and extending driving range, advancements in hub motor technology, such as improved thermal management and power density, offer substantial growth potential. The rise of electric two-wheelers and last-mile delivery vehicles further expands the market, as hub motors provide an optimal solution for maneuverability and efficiency in congested city environments.

The increasing adoption of autonomous and shared mobility solutions in Japan also presents lucrative opportunities for the EV hub motor market. As self-driving and ride-sharing electric vehicles gain traction, the demand for efficient and low-maintenance propulsion systems is expected to surge. Hub motors, with their decentralized power distribution and simplified drivetrain architecture, align well with the needs of autonomous electric vehicles. Additionally, the rapid evolution of smart transportation infrastructure, including vehicle connectivity and intelligent mobility solutions, opens new avenues for hub motor integration. Collaborations between automotive manufacturers, technology firms, and mobility service providers could drive further innovation, enhancing the efficiency and performance of hub motors in Japan’s expanding EV ecosystem. With continued advancements and supportive government initiatives, the market is well-positioned for substantial growth in the coming years.

Market Segmentation Analysis:

By Vehicle Type:

The Japan Electric Vehicle (EV) Hub Motor market is segmented by vehicle type, including two-wheelers, three-wheelers, passenger cars, light commercial vehicles, and others. The two-wheeler segment holds a significant share due to the rising adoption of electric scooters and motorcycles for urban commuting and last-mile delivery services. The increasing demand for lightweight and energy-efficient vehicles, coupled with government initiatives promoting electric mobility, further supports market growth in this segment. Three-wheelers, primarily used for short-distance transportation and cargo delivery, are also witnessing a surge in hub motor adoption due to their cost-effective and low-maintenance benefits. Passenger cars are another key segment, driven by growing consumer interest in sustainable personal transportation and advancements in hub motor technology that enhance vehicle efficiency and performance. Meanwhile, the light commercial vehicle (LCV) segment is gaining traction as logistics and e-commerce companies increasingly invest in electric delivery vans with hub motors for improved maneuverability and operational efficiency. The “others” category includes niche applications such as electric buses and off-road vehicles, contributing to the market’s overall expansion.

By Power Output:

The EV hub motor market in Japan is also segmented by power output, categorized as below 1000W, 1001-3000W, and above 3000W. The below 1000W segment primarily caters to electric bicycles, scooters, and low-power two-wheelers, which are widely adopted for urban mobility due to their affordability and energy efficiency. The 1001-3000W segment includes medium-powered electric motorcycles, three-wheelers, and small passenger EVs, where demand is growing due to improvements in motor performance and battery efficiency. The above 3000W segment is gaining momentum in high-performance passenger cars and commercial EVs, where greater torque, speed, and durability are essential. As Japan continues to advance its EV infrastructure and technology, manufacturers are focusing on developing hub motors with optimized power output to cater to diverse vehicle categories. The increasing adoption of electric vehicles across all power ranges, coupled with ongoing R&D efforts to enhance motor efficiency, is expected to drive significant growth in the Japan EV hub motor market.

Segments:

Based on Vehicle Type:

- Two-Wheeler

- Three-Wheeler

- Passenger Car

- Light Commercial Vehicle

- Others

Based on Power Output:

- Below 1000W

- 1001-3000W

- Above 3000W

Based on Component:

- Stator

- Rotor, Bearing & Shaft

- Magnet

- Others (wiring, casing)

Based on Position Type:

- Rear Hub Motor

- Front Hub Motor

Based on the Geography:

- Kanto Region

- Kansai Region

- Chubu Region

- Kyushu Region

- Other Regions

Regional Analysis

Kanto Region

The Kanto region holds the largest share in the Japan Electric Vehicle (EV) Hub Motor market, accounting for approximately 35% of the total market. As the economic and technological hub of Japan, Kanto, which includes Tokyo, Yokohama, and Kawasaki, leads EV adoption due to high population density, strong government policies, and advanced infrastructure. The presence of major automakers, technology firms, and research institutions accelerates the development and deployment of hub motor technology. Additionally, the region’s extensive charging network and increasing demand for electric two-wheelers and passenger EVs contribute to its dominant market position. Urban mobility initiatives and growing consumer awareness of sustainable transportation further drive demand. With ongoing investments in smart city projects and EV infrastructure expansion, the Kanto region is expected to maintain its leadership in the EV hub motor market over the forecast period.

Kansai Region

The Kansai region, covering cities like Osaka, Kyoto, and Kobe, holds around 25% of the Japan EV hub motor market. The region’s growing emphasis on reducing carbon emissions and government incentives for electric vehicle adoption have fueled the demand for hub motor-driven EVs. Kansai’s industrial base, which includes automotive and electronics manufacturing, has played a crucial role in advancing hub motor technologies and improving their efficiency. The rising popularity of electric commercial vehicles, particularly for last-mile deliveries in urban centers, is also a key growth driver. Additionally, increasing investments in public transportation electrification, including electric buses and shared mobility services, contribute to the rising market share. As the region continues to develop its EV infrastructure and promote sustainable mobility, the adoption of hub motors in various vehicle segments is expected to expand significantly.

Chubu Region

The Chubu region, accounting for nearly 20% of the EV hub motor market, is emerging as a key growth area due to its strong automotive manufacturing presence. With cities like Nagoya serving as a major hub for Japan’s automobile industry, the region has seen increased investment in electric mobility and related technologies. The presence of leading automotive companies and component manufacturers has fostered innovation in hub motor design and performance. Additionally, rising government support for EV adoption and growing consumer interest in electric passenger cars and light commercial vehicles are driving market expansion. Chubu’s focus on smart manufacturing and sustainable transportation solutions is expected to further accelerate the demand for hub motors in the coming years.

Kyushu Region

Kyushu, with a market share of around 15%, is witnessing growing adoption of EV hub motors, driven by rising demand for electric two-wheelers and compact EVs. The region’s commitment to green energy and eco-friendly transportation initiatives has encouraged the shift toward electric mobility. Additionally, the presence of key battery and electronics manufacturers in Kyushu supports advancements in EV technology, including hub motors. The region’s focus on reducing emissions from urban transportation and increasing the deployment of electric taxis and shared EV services is also contributing to market growth. As local governments continue to promote EV infrastructure development and sustainability projects, the demand for hub motors in Kyushu is expected to grow steadily.

Key Player Analysis

- Tajima Motor Corporation

- NTN Corporation

- Yamaha Motor Co., Ltd.

- Nidec Corporation

- Panasonic Corporation

- Kyocera Corporation

- Hitachi Automotive Systems

- Furukawa Electric Co., Ltd.

- Schaeffler Japan

Competitive Analysis

The Japan Electric Vehicle (EV) Hub Motor market is highly competitive, with key players focusing on technological advancements, strategic partnerships, and product innovations to strengthen their market presence. Leading companies such as Tajima Motor Corporation, NTN Corporation, Yamaha Motor Co., Ltd., Nidec Corporation, Panasonic Corporation, Kyocera Corporation, Hitachi Automotive Systems, Furukawa Electric Co., Ltd., and Schaeffler Japan play a crucial role in shaping market dynamics. These players invest significantly in research and development to enhance motor efficiency, durability, and lightweight design, catering to the increasing demand for high-performance EVs. Market leaders are also expanding their global reach through mergers, acquisitions, and collaborations with automakers and battery manufacturers. Companies are focusing on improving power output, thermal management, and integration with advanced battery technologies to gain a competitive edge. Additionally, increasing government support for sustainable mobility is encouraging market players to innovate and develop cost-effective solutions. As competition intensifies, players are expected to focus on improving production capabilities and supply chain efficiencies to meet rising demand.

Recent Developments

- In May 2024, Bajaj Auto intended to introduce a mass-market electric scooter under the Chetak brand, increasing its retail presence three times over the next three to four months.

- In April 2024, VinFast, the electric vehicle arm of Vietnamese conglomerate Vingroup, will begin selling its VF DrgnFly electric bike in the U.S. The bike, a 750W rear hub motor, offers a smooth riding experience and a top speed of up to 45 km/h.

- In February 2024, Kabira Mobility, located in Verna, Goa, introduced two electric motorcycles in India, the KM3000 and KM4000, featuring an aluminium core hub motor powertrain, telescopic forks, monoshock, disc brakes, 17-inch wheels, and modular battery pack.

- In February 2024, BYD, auto manufacturing conglomerate based in Shenzhen, China, plans to establish an electric vehicle factory in Mexico, aiming to establish an export hub to the U.S., leveraging Mexico’s automaking sector’s close integration with the U.S.

- In October 2023, GEM Motor signed a strategic partnership agreement with Stilride to develop a specialized advanced electric drive. Stilride presented an electric scooter that will be available to Swedish customers in an exclusive limited series in spring 2024 and will be powered by an innovative GEM in-wheel drive G2.6.

Market Concentration & Characteristics

The Japan Electric Vehicle (EV) Hub Motor market exhibits a moderately high market concentration, with a few leading players dominating due to their technological expertise, strong manufacturing capabilities, and established industry presence. Companies such as Tajima Motor Corporation, NTN Corporation, Yamaha Motor Co., Ltd., Nidec Corporation, and Panasonic Corporation leverage their extensive research and development efforts to maintain a competitive edge. The market is characterized by continuous innovation, focusing on lightweight, high-efficiency motors with improved power output and thermal management. Additionally, strategic collaborations between motor manufacturers, automakers, and battery suppliers are shaping the industry landscape. The presence of stringent regulatory policies and government incentives for electric mobility further supports market growth. Despite high entry barriers due to capital-intensive manufacturing and advanced technology requirements, emerging players are entering the market through niche innovations. As demand for compact and energy-efficient EV hub motors rises, market competition is expected to intensify further.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Power Output, Component, Position Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan Electric Vehicle (EV) Hub Motor market will witness steady growth, driven by increasing EV adoption and government incentives.

- Advancements in motor efficiency, lightweight materials, and thermal management will enhance hub motor performance.

- Rising demand for electric two-wheelers and last-mile delivery vehicles will boost market expansion.

- Automakers and motor manufacturers will focus on strategic partnerships to accelerate innovation and production scalability.

- Integration of AI and smart control systems will improve hub motor efficiency and vehicle performance.

- Increasing investments in charging infrastructure and renewable energy will support long-term market growth.

- High initial costs and battery efficiency challenges will remain key obstacles for widespread adoption.

- Market players will focus on cost-effective production techniques to make hub motors more affordable.

- Government policies promoting zero-emission transportation will continue to drive industry advancements.

- Expansion of domestic and international supply chains will enhance market competitiveness and accessibility.