| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium Polymer Battery Market Size 2024 |

USD 17,740.57 Million |

| Lithium Polymer Battery Market, CAGR |

8.83% |

| Lithium Polymer Battery Market Size 2032 |

USD 36,623.81 Million |

Market Overview:

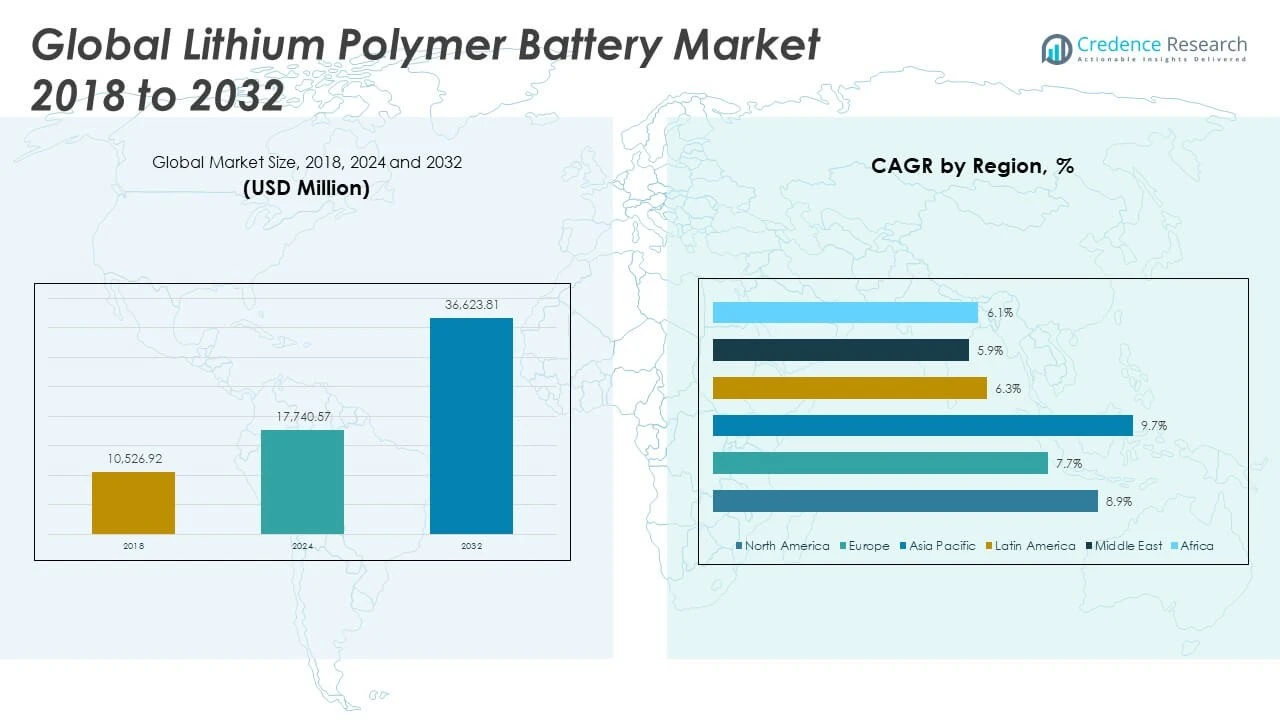

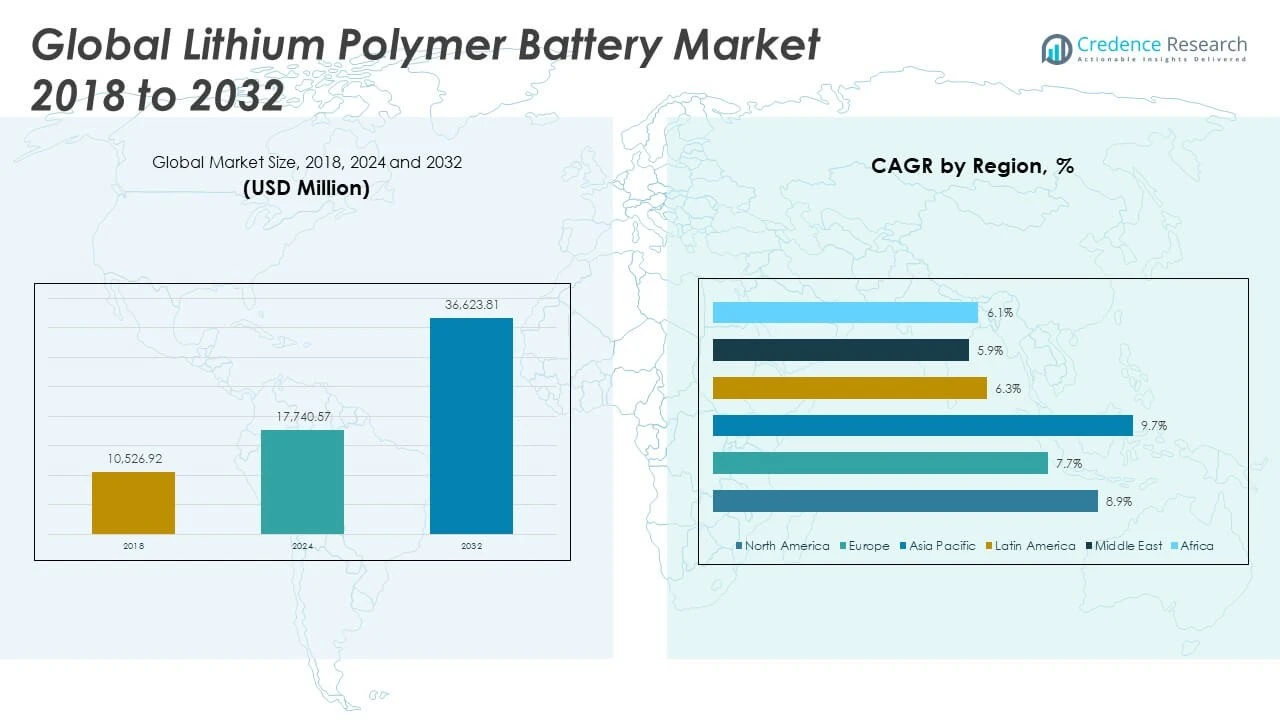

The Global Lithium Polymer Battery Market size was valued at USD 10,526.92 million in 2018 to USD 17,740.57 million in 2024 and is anticipated to reach USD 36,623.81 million by 2032, at a CAGR of 8.83% during the forecast period.

Several factors are propelling the growth of the lithium polymer battery market. The rapid expansion of the electric vehicle industry is a primary driver, as LiPo batteries offer high energy density and lightweight characteristics essential for enhancing vehicle performance and range. Additionally, the proliferation of portable consumer electronics, including smartphones, tablets, and wearable devices, is fueling demand for compact and efficient energy storage solutions. The increasing integration of renewable energy sources into power grids necessitates efficient energy storage systems, further boosting the market. Technological advancements leading to improved battery performance, safety, and cost-effectiveness are also contributing to market growth.

Regionally, the Asia-Pacific (APAC) region dominates the global lithium polymer battery market, with countries like China, Japan, South Korea, and India leading in both production and consumption. The presence of major battery manufacturers, coupled with high demand from the automotive and electronics industries, underpins this dominance. North America and Europe are also significant markets, driven by strong adoption of electric vehicles and supportive regulatory frameworks promoting clean energy. In North America, the United States leads in technological innovation and investment in battery manufacturing. Europe’s focus on reducing carbon emissions and transitioning to sustainable energy sources is fostering market growth. Emerging economies in Latin America, the Middle East, and Africa are expected to witness increased adoption of LiPo batteries, driven by growing industrialization and infrastructure development.

Market Insights:

- The Global Lithium Polymer Battery Market was valued at USD 17,740.57 million in 2024 and is projected to reach USD 36,623.81 million by 2032, growing at a CAGR of 8.83%.

- The growing adoption of electric vehicles worldwide drives demand for lightweight, high-energy-density lithium polymer batteries.

- Consumer electronics such as smartphones, tablets, and wearables significantly contribute to market growth due to their need for compact and efficient power sources.

- Technological innovations in battery design, such as solid-state electrolytes and nanomaterials, improve safety, durability, and cost-effectiveness.

- High manufacturing costs and complex processes challenge smaller players and limit broader adoption in cost-sensitive regions.

- Asia Pacific dominates the market with major manufacturers in China, Japan, and South Korea, while North America and Europe follow with strong policy support and innovation.

- Safety concerns in high-stress applications like aerospace and automotive create entry barriers, requiring advanced thermal management systems and regulatory compliance.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Demand for Lightweight and High-Energy-Density Batteries in Consumer Electronics

The growing penetration of smartphones, tablets, laptops, wearables, and other portable electronics continues to drive demand for compact, lightweight, and high-performance batteries. Lithium polymer batteries provide significant advantages over traditional battery chemistries, including higher energy density, flexible form factors, and reduced weight. These attributes make them ideal for modern consumer electronics, where size, portability, and extended battery life are critical. Manufacturers increasingly adopt lithium polymer batteries to meet consumer expectations for slimmer designs and longer usage cycles. The rapid evolution of smart devices, coupled with rising global smartphone usage, ensures sustained market growth. The Global Lithium Polymer Battery Market benefits directly from the surging sales of portable gadgets across both developed and developing economies.

For instance, Amperex Technology Limited (ATL), a major supplier for leading consumer electronics brands, provides small-form LiPo batteries for mobile phones and wearables, emphasizing lightweight construction and flexible shapes to fit increasingly compact devices.

Accelerated Adoption of Electric Vehicles and Hybrid Electric Vehicles

The automotive sector is undergoing a significant transformation with the global shift toward electric mobility. Lithium polymer batteries are gaining traction in this industry due to their superior energy-to-weight ratio and safer design compared to conventional lithium-ion batteries. They contribute to reduced vehicle weight and enhanced driving range, two key performance metrics in electric vehicles (EVs). Governments across various regions offer incentives, tax benefits, and regulatory support to encourage EV adoption, which in turn fuels battery demand. Automakers continue to invest in battery innovation and partnerships with battery suppliers to scale production and reduce costs. The transition from internal combustion engines to electric propulsion continues to expand the application scope of lithium polymer batteries in passenger cars, buses, and commercial fleets.

For example, LG Chem produced 106.8 GWh of batteries in 2023, supplying major automakers such as General Motors, Hyundai, and Volkswagen for use in electric vehicles (EVs).

Surging Investments in Renewable Energy Storage Solutions

The increasing deployment of solar and wind energy systems has created a strong need for efficient energy storage technologies. Lithium polymer batteries play a critical role in supporting renewable energy infrastructure by offering stable storage, load balancing, and grid reliability. Their ability to deliver high power output and withstand frequent charge-discharge cycles makes them suitable for off-grid and backup power systems. Residential and commercial users are investing in energy storage solutions to manage power outages, reduce electricity bills, and increase energy independence. Energy storage projects, supported by government subsidies and declining battery costs, are rapidly scaling across key markets. It creates a favorable environment for the Global Lithium Polymer Battery Market to expand into stationary storage applications.

Technological Advancements Enhancing Battery Safety, Efficiency, and Affordability

Ongoing research and development efforts are advancing lithium polymer battery technology, making it more reliable, efficient, and cost-effective. Innovations such as solid-state electrolytes, advanced thermal management systems, and nanomaterial integration have improved battery safety and energy density. These advancements address common concerns like overheating, short circuits, and limited lifespan. Companies are focusing on scalable manufacturing processes to reduce per-unit costs and enhance product availability. Strategic collaborations between battery manufacturers, tech companies, and research institutions are accelerating innovation cycles. It strengthens the competitive edge of lithium polymer batteries in various sectors and enhances their adoption across diverse applications.

Market Trends:

Emergence of Flexible and Ultra-Thin Battery Designs for Wearables and IoT Devices

Demand for innovative and compact power solutions is pushing manufacturers to develop flexible and ultra-thin lithium polymer batteries. These batteries support design freedom in wearable technologies, fitness trackers, smart textiles, and medical monitoring devices. The ability to mold batteries into different shapes and sizes without compromising capacity offers a critical advantage in miniaturized electronics. Brands in the consumer tech space are integrating these advanced batteries to create sleeker, lighter, and more efficient products. Research into stretchable battery technologies further expands use cases in next-generation smart devices. The Global Lithium Polymer Battery Market is witnessing growing traction from sectors that prioritize compactness and adaptability in energy storage.

For example, Motoma Power has mass-produced a rechargeable lithium polymer battery cell that is just 0.9 mm thick, specifically targeting applications requiring minimal thickness, such as smart cards and mini phones.

Rapid Expansion of Battery Manufacturing Capacity Across Asia-Pacific

Leading battery producers in China, South Korea, and Japan are scaling up manufacturing capabilities to meet surging global demand. New gigafactories and advanced production lines are being established to enhance capacity, lower costs, and secure supply chains. Governments are supporting domestic battery manufacturing with subsidies, land grants, and policy frameworks to ensure long-term competitiveness. Companies are investing in vertical integration to gain control over raw materials, production, and end-user delivery. This regional manufacturing momentum reinforces Asia-Pacific’s position as a global hub for lithium polymer battery production. It enables faster delivery cycles and strengthens the region’s contribution to the Global Lithium Polymer Battery Market.

Integration of Smart Battery Management Systems for Enhanced Safety and Performance

Smart battery management systems (BMS) are becoming a standard feature in lithium polymer battery applications. These systems monitor real-time metrics such as temperature, voltage, current, and state of charge, ensuring optimal battery performance and user safety. The integration of IoT-enabled BMS technologies allows remote diagnostics and predictive maintenance, especially in industrial and automotive settings. Manufacturers are embedding advanced software and sensor technologies to detect faults and prevent hazards such as thermal runaway. Smart BMS capabilities are particularly valued in electric vehicles and energy storage systems, where precision control is critical. It enhances the appeal of lithium polymer batteries in high-demand environments and supports the growth of the Global Lithium Polymer Battery Market.

Shift Toward Sustainable and Recyclable Battery Materials

Environmental concerns and regulatory mandates are prompting a shift toward greener battery chemistries and recyclable materials. Manufacturers are exploring the use of solid-state electrolytes, biodegradable components, and less hazardous elements to reduce environmental impact. Recycling initiatives for lithium polymer batteries are gaining momentum to recover valuable metals and minimize waste. Lifecycle assessments and environmental certifications are becoming important metrics for battery procurement. Companies are collaborating with recycling firms and research institutions to develop closed-loop systems. It aligns with global sustainability goals and positions the Global Lithium Polymer Battery Market for long-term ecological responsibility.

For instance, companies like LOHUM are leading the way in lithium-ion battery recycling, aiming for a 100% circular supply chain and producing sustainable battery raw materials through recycling, repurposing, and low-carbon refining.

Market Challenges Analysis:

High Manufacturing Costs and Complex Production Processes Limit Profit Margins

The production of lithium polymer batteries involves complex fabrication processes, including electrode coating, electrolyte filling, and cell packaging, which require high-precision equipment and skilled labor. These intricate steps elevate overall manufacturing costs compared to other battery types, affecting profitability, especially for smaller manufacturers. Raw material sourcing, particularly for lithium, cobalt, and nickel, presents another challenge due to fluctuating prices and limited availability. This cost pressure impacts pricing strategies and deters wider adoption in price-sensitive markets. Scaling up production while maintaining quality and safety adds further financial strain. The Global Lithium Polymer Battery Market must overcome these cost barriers to ensure broader market accessibility and sustained growth.

Thermal Stability and Safety Concerns Restrict Broader Adoption in Certain Applications

Lithium polymer batteries are more vulnerable to thermal runaway and overheating if not properly managed, which raises safety concerns in high-stress applications. Without robust battery management systems, the risk of swelling, leakage, or combustion becomes significant under extreme operating conditions. These issues are especially critical in sectors such as automotive and aerospace, where battery reliability directly affects safety and performance. Strict regulatory requirements and certification standards create additional hurdles for market entry. Manufacturers must invest heavily in thermal management technologies and rigorous testing protocols to ensure compliance. It limits the speed at which the Global Lithium Polymer Battery Market can penetrate certain high-risk or highly regulated sectors.

For example, UL 2580 and UN 38.3 certifications require extensive cycle testing and abuse tolerance validation, which can add up to 9–12 months to product development timelines.

Market Opportunities:

The growing interest in electric aviation, urban air mobility, and commercial drone applications is opening new frontiers for lithium polymer battery adoption. These sectors demand lightweight, high-density energy solutions that can support extended flight durations and rapid power discharge. Lithium polymer batteries meet these performance benchmarks, making them ideal for next-generation aerial platforms. Startups and aerospace firms are actively testing battery-powered aircraft prototypes, supported by rising investments and regulatory interest in low-emission aviation. The Global Lithium Polymer Battery Market can capitalize on this momentum by aligning product development with aerospace safety and efficiency standards. It creates a promising opportunity to establish a strong foothold in emerging high-tech verticals.

Governments across major economies are offering subsidies, tax credits, and funding support to encourage battery storage adoption in grid-scale and residential renewable energy systems. Policies promoting net-zero targets and clean energy transitions are accelerating investments in solar-plus-storage and wind storage installations. Lithium polymer batteries, with their high energy efficiency and space-saving design, fit well within compact energy storage infrastructures. The Global Lithium Polymer Battery Market can benefit from this policy-driven momentum by collaborating with renewable energy providers and utility operators. It provides a pathway to diversify applications beyond mobility and electronics, broadening long-term market potential.

Market Segmentation Analysis:

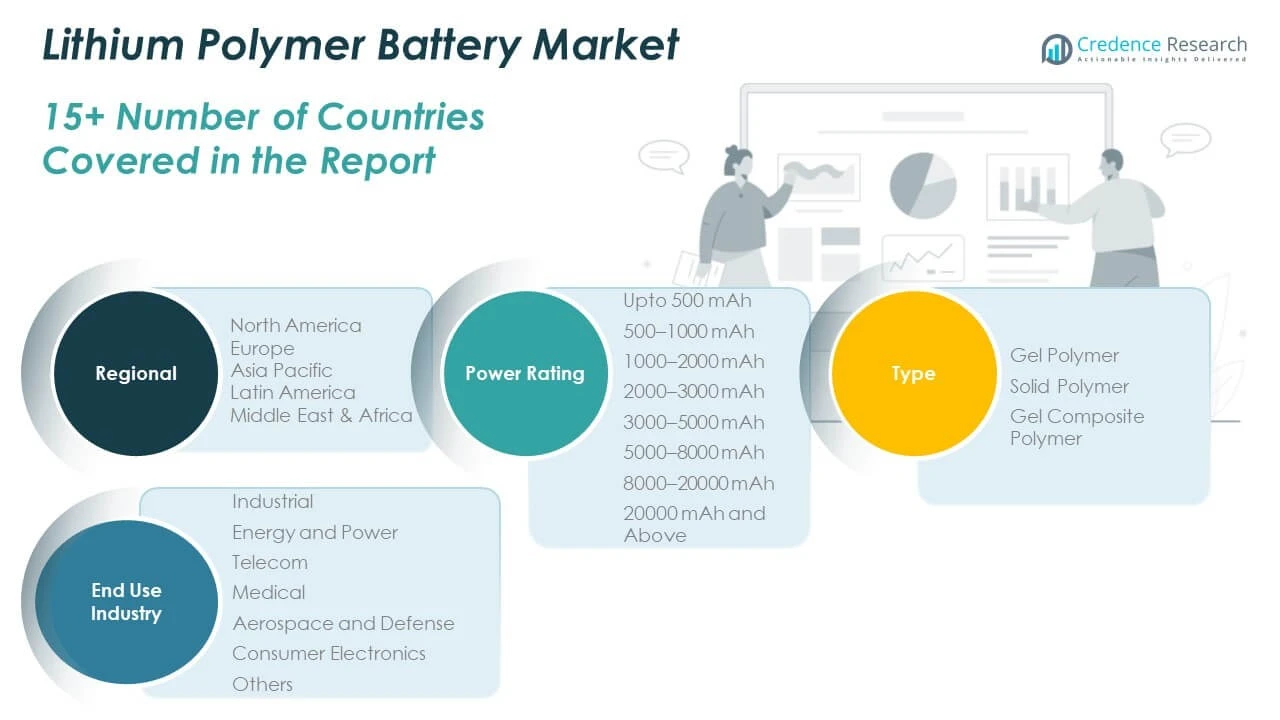

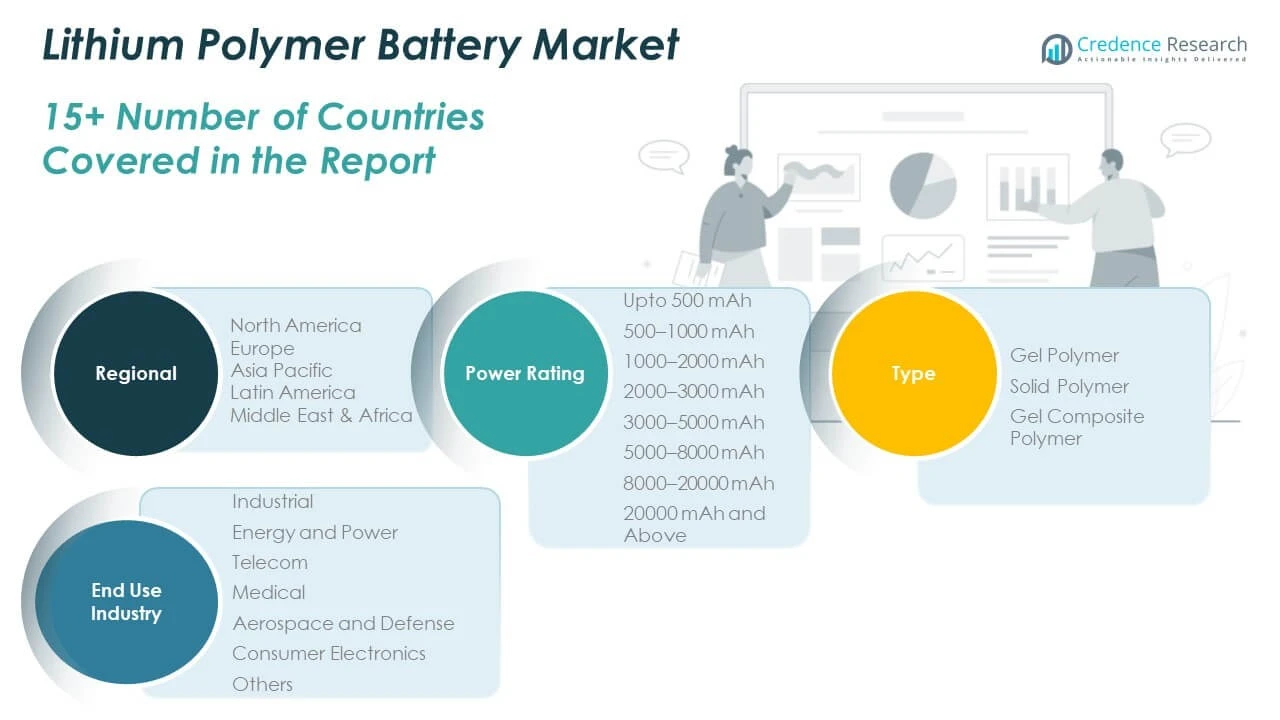

The Global Lithium Polymer Battery Market is segmented by power rating, type, and end use industry.

By power rating, the market includes eight categories: upto 500 mAh, 500–1000 mAh, 1000–2000 mAh, 2000–3000 mAh, 3000–5000 mAh, 5000–8000 mAh, 8000–20000 mAh, and 20000 mAh and above. Batteries with ratings between 1000–5000 mAh dominate due to high demand in smartphones, tablets, and other portable electronics. Segments above 8000 mAh are gaining traction in electric vehicles and industrial equipment.

By type, the market is classified into gel polymer, solid polymer, and gel composite polymer batteries. Gel polymer batteries hold a significant share owing to their commercial availability, flexibility, and stable performance. Solid polymer batteries are expected to grow steadily, supported by ongoing innovations in solid-state technology and safety enhancements.

By end use industry, the market is divided into industrial, energy and power, telecom, medical, aerospace and defense, consumer electronics, and others. Consumer electronics lead the market, driven by the surge in mobile device usage. Energy and power, along with medical and aerospace sectors, are expanding their battery adoption due to reliability and form factor benefits. The Global Lithium Polymer Battery Market benefits from these diversified applications, reinforcing its presence across key industrial domains.

Segmentation:

By Power Rating Segment

- Upto 500 mAh

- 500–1000 mAh

- 1000–2000 mAh

- 2000–3000 mAh

- 3000–5000 mAh

- 5000–8000 mAh

- 8000–20000 mAh

- 20000 mAh and Above

By Type Segment

- Gel Polymer

- Solid Polymer

- Gel Composite Polymer

By End Use Industry Segment

- Industrial

- Energy and Power

- Telecom

- Medical

- Aerospace and Defense

- Consumer Electronics

- Others

By Region and Country Analysis

North America

- United States

- Canada

- Mexico

Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Argentina

- Rest of Latin America

Middle East

- GCC Countries

- Israel

- Turkey

- Rest of Middle East

Africa

- South Africa

- Egypt

- Rest of Africa

Regional Analysis:

North America

The North America Global Lithium Polymer Battery Market size was valued at USD 3,120.71 million in 2018 to USD 5,178.74 million in 2024 and is anticipated to reach USD 10,734.99 million by 2032, at a CAGR of 8.90% during the forecast period. The region benefits from strong demand in consumer electronics, electric vehicles, and energy storage systems. The United States leads regional growth due to ongoing technological advancements and federal support for clean energy and mobility solutions. Major players in battery production and EV manufacturing continue to invest in expanding domestic capacity. It also benefits from the presence of tech-driven industries that require compact and efficient battery solutions. North America accounted for a significant market share and is expected to maintain a competitive position through infrastructure development and R&D.

Europe

The Europe Global Lithium Polymer Battery Market size was valued at USD 2,265.75 million in 2018 to USD 3,636.93 million in 2024 and is anticipated to reach USD 6,922.14 million by 2032, at a CAGR of 7.70% during the forecast period. The region is driving market growth through aggressive decarbonization targets and stringent emission norms, especially in the automotive sector. Countries like Germany, France, and the UK are accelerating electric vehicle deployment and battery manufacturing initiatives. It sees rising battery integration in renewable energy storage and smart grid applications. Collaborations between OEMs and battery suppliers continue to support technological innovation. Europe’s share of the Global Lithium Polymer Battery Market is reinforced by its push for sustainable mobility and energy independence.

Asia Pacific

The Asia Pacific Global Lithium Polymer Battery Market size was valued at USD 4,372.25 million in 2018 to USD 7,654.61 million in 2024 and is anticipated to reach USD 16,814.54 million by 2032, at a CAGR of 9.70% during the forecast period. The region dominates global production and consumption, driven by high demand from China, Japan, South Korea, and India. Strong manufacturing ecosystems, government incentives, and cost-effective labor contribute to regional leadership. It supports growth across electric vehicles, consumer electronics, and industrial automation. Major battery manufacturers operate large-scale facilities and export to other global markets. Asia Pacific holds the largest market share and remains the central hub for innovation and supply chain expansion.

Latin America

The Latin America Global Lithium Polymer Battery Market size was valued at USD 340.44 million in 2018 to USD 563.31 million in 2024 and is anticipated to reach USD 966.60 million by 2032, at a CAGR of 6.30% during the forecast period. The region is gradually adopting lithium polymer batteries for use in telecommunications, automotive, and backup power applications. Brazil leads demand due to rising energy storage investments and EV infrastructure development. It benefits from improving regulatory frameworks and regional cooperation on energy projects. Market penetration remains moderate but is expected to accelerate with foreign investment and industrial growth. Latin America is a developing market with growing potential across multiple end-use segments.

Middle East

The Middle East Global Lithium Polymer Battery Market size was valued at USD 242.12 million in 2018 to USD 365.34 million in 2024 and is anticipated to reach USD 607.72 million by 2032, at a CAGR of 5.90% during the forecast period. The region is witnessing increased demand for advanced battery systems in telecom towers, smart cities, and solar power installations. GCC countries are investing in clean energy diversification, supporting adoption in off-grid and hybrid systems. It shows progress in industrial sectors where reliability and compact power sources are essential. Battery imports and joint ventures with global suppliers drive regional supply chains. The Middle East market share is growing steadily amid strategic energy transformation goals.

Africa

The Africa Global Lithium Polymer Battery Market size was valued at USD 185.65 million in 2018 to USD 341.63 million in 2024 and is anticipated to reach USD 577.82 million by 2032, at a CAGR of 6.10% during the forecast period. The region is gradually deploying lithium polymer batteries in rural electrification, telecom, and solar home systems. South Africa leads adoption due to rising urbanization and energy infrastructure upgrades. It faces challenges related to affordability and limited manufacturing capabilities but benefits from international aid and partnerships. Demand is expanding in mobile communications and healthcare sectors that require off-grid power solutions. Africa holds a small but growing share of the Global Lithium Polymer Battery Market with long-term potential.

Key Player Analysis:

- LiPol Battery Co. Ltd

- LG Energy Solution, Ltd.

- Samsung SDI Co., Ltd.

- Amperex Technology Limited (ATL)

- EVE Energy Co., Ltd.

- EnerSys

- Saft (a subsidiary of TotalEnergies)

- Panasonic Corporation

- BYD Co. Ltd.

- Sunwoda Electronic Co., Ltd.

Competitive Analysis:

The Global Lithium Polymer Battery Market features a competitive landscape marked by technological innovation, capacity expansion, and strategic partnerships. Leading players such as LG Energy Solution, Samsung SDI, Panasonic, and BYD Co. Ltd. dominate the market through large-scale production and diverse application portfolios. Companies like Amperex Technology Limited (ATL) and EVE Energy focus on high-energy-density solutions tailored for consumer electronics and electric vehicles. Saft and EnerSys strengthen their position through specialized energy storage systems and industrial applications. It continues to witness increased investment in R&D, aimed at improving battery safety, cycle life, and performance. Emerging players such as LiPol Battery Co. Ltd and Sunwoda Electronic Co., Ltd. are gaining traction through customization and flexible manufacturing capabilities. The Global Lithium Polymer Battery Market remains dynamic, with competition intensifying around innovation, efficiency, and sustainability. Strategic collaborations and expansion into emerging markets will shape the next phase of competitive growth.

Recent Developments:

At InterBattery Europe 2025, Samsung SDI introduced the U8A1, a new battery optimized for high-powered uninterruptible power supply (UPS) systems in AI data centers, offering industry-leading power output and space efficiency. The company also showcased the SBB 1.5, a containerized energy storage solution featuring advanced fire safety technology. In March 2025, Samsung SDI announced a $1.38 billion capital increase to fund strategic projects, including a joint venture with General Motors for a new U.S. battery plant and the expansion of solid-state battery production in Korea and Hungary.

In May 2025, EnerSys announced a $750 million agreement to acquire the Alpha Technologies Group of Companies. This acquisition will create the only fully integrated DC power solutions provider for broadband, telecom, and energy storage systems, expanding EnerSys’ market reach and product portfolio.

In January 2025, EVE Energy Co., Ltd. agreed to acquire the remaining 1.10% stake in Hubei EVE Power Co., Ltd. for approximately CNY 580 million, making Hubei EVE Power a wholly owned subsidiary.

Market Concentration & Characteristics:

The Global Lithium Polymer Battery Market exhibits moderate to high market concentration, with a few dominant players controlling significant market share. Companies like LG Energy Solution, Samsung SDI, and Panasonic maintain leadership through advanced technologies, economies of scale, and established supply chains. It features strong vertical integration, with several manufacturers managing end-to-end production from raw materials to finished products. The market is characterized by high entry barriers due to capital-intensive manufacturing, strict quality standards, and complex safety regulations. Innovation cycles are fast, driven by demand for lighter, safer, and more efficient batteries. The market also reflects a growing shift toward sustainability and customization, particularly in consumer electronics, EVs, and energy storage systems. Strategic alliances, regional expansions, and focus on R&D continue to shape market dynamics.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on power rating, type, and end use industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for lithium polymer batteries will rise with expanding electric vehicle adoption and supporting government policies.

- Technological innovations will enhance battery safety, energy density, and lifecycle performance.

- Growth in wearable devices and IoT applications will create new opportunities for ultra-thin and flexible battery formats.

- The shift toward renewable energy will increase reliance on battery storage solutions for grid and residential systems.

- Asia Pacific will maintain its lead due to strong manufacturing capabilities and high domestic consumption.

- Battery recycling and circular economy practices will gain importance amid raw material supply concerns.

- Strategic mergers and partnerships will accelerate global production capacity and innovation pipelines.

- Customized battery solutions will see greater demand in aerospace, defense, and medical sectors.

- Declining unit costs through economies of scale will make lithium polymer batteries more competitive across industries.

- Regulatory focus on low-emission technologies will sustain long-term investment in battery research and infrastructure.