Market Overview

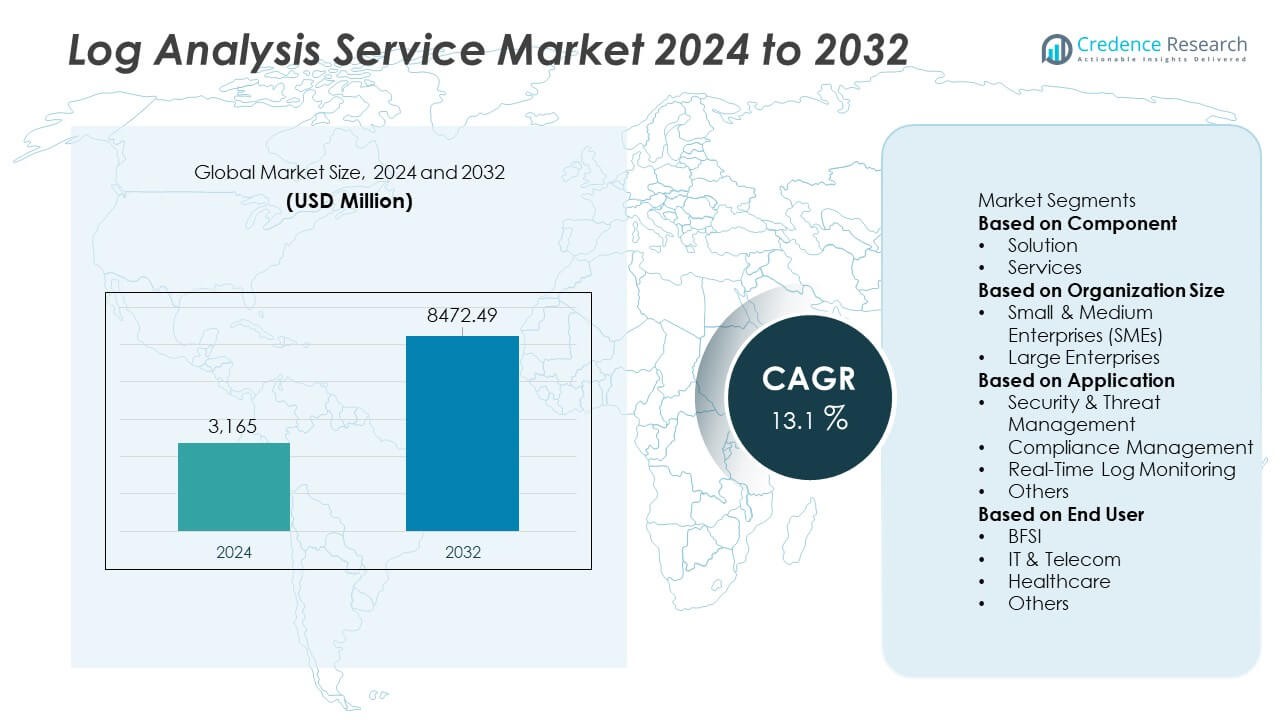

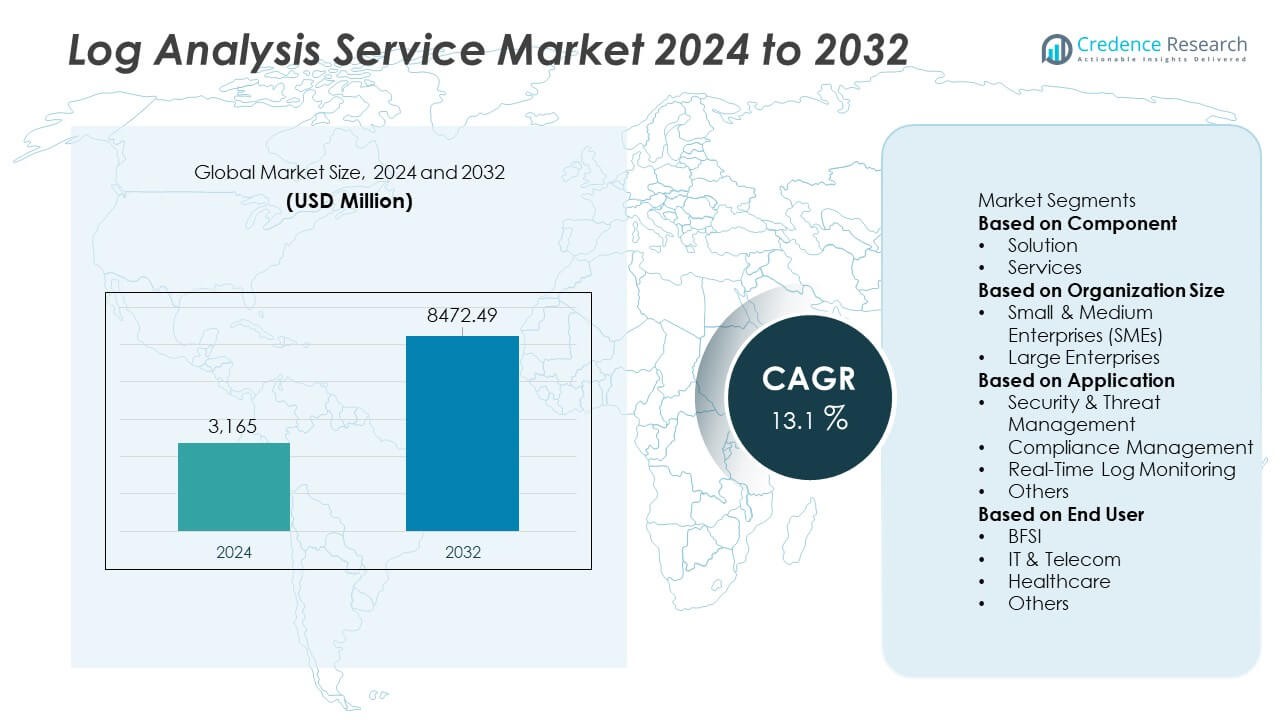

The Log Analysis Service Market was valued at USD 3,165 million in 2024 and is projected to reach USD 8,472.49 million by 2032, expanding at a CAGR of 13.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Log Analysis Service Market Size 2024 |

USD 3,165 Million |

| Log Analysis Service Market, CAGR |

13.1% |

| Log Analysis Service Market Size 2032 |

USD 8,472.49 Million |

The Log Analysis Service market is shaped by leading players such as Splunk, IBM, Microsoft, Elastic, SolarWinds, Datadog, Rapid7, Sumo Logic, LogRhythm, and ManageEngine, each advancing cloud-native analytics, automated threat detection, and real-time monitoring capabilities. These companies strengthen enterprise security by integrating AI-based correlation engines and unified observability features that improve incident response and compliance management. North America leads the global market with 39% share due to strong cloud adoption and high cybersecurity spending. Europe follows with 31% share, supported by strict data-governance frameworks, while Asia Pacific holds 24% share, driven by digital transformation, growing SME adoption, and rising cyber risk exposure across emerging economies.

Market Insights

- The Log Analysis Service market reached USD 3,165 million in 2024 and is projected to grow at a CAGR of 13.1% through 2032.

- Strong drivers include rising demand for automated threat detection, with the solution segment holding a 62% share due to high adoption of cloud-based log analytics platforms.

- Key trends include expansion of AI-enabled log correlation, real-time anomaly detection, and broader integration of observability tools across hybrid and multi-cloud environments.

- Competitive activity is shaped by major players investing in unified security analytics, automation, and SIEM enhancements, increasing differentiation through accuracy, scalability, and faster response capabilities.

- Regionally, North America leads with 39% share, Europe holds 31%, and Asia Pacific accounts for 24%, with SMEs accelerating adoption across all major markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

The solution segment dominated the market with a 63% share, driven by rising adoption of advanced log analytics platforms that support automated detection, anomaly scanning, and centralized log aggregation. Enterprises prefer integrated solutions for their ability to process high-volume, real-time log data across cloud, on-premises, and hybrid environments. Services also gained momentum as businesses sought consulting, implementation, and managed analytics support to streamline security operations. Growing cloud migration, rapid expansion of digital infrastructure, and increasing cyber risks continue to strengthen the demand for high-performance log analysis solutions across industries.

- For instance, Splunk continually optimizes its processing engine for efficiency and has demonstrated in lab environments the capability to ingest over 120,000 events per second (EPS) per indexer in specific optimized configurations, or achieve over 2.45 TB/day per indexer in performance tests.

By Organization Size

Large enterprises held the leading 58% share, supported by their complex IT environments, heavy data workloads, and strong focus on security and compliance management. These organizations deploy enterprise-grade log analysis tools to manage multi-cloud systems, detect advanced threats, and meet strict auditing requirements. SMEs demonstrated growing adoption as cloud-based platforms offered scalable, low-cost analytics capabilities suitable for limited budgets. The rising need for automated monitoring, faster incident response, and simplified operations drives adoption across both segments, with large enterprises maintaining dominance due to broader infrastructure demands.

- For instance, Microsoft processes more than 100 trillion signals from its services every day, using this vast threat intelligence to power security solutions like Microsoft Sentinel and Defender. This intelligence, combined with AI capabilities, is leveraged to improve threat detection, anticipate attacker movements, and automate responses.

By Application

Security and threat management accounted for the largest 49% share, driven by increasing cyberattacks, ransomware incidents, and the need for continuous monitoring across distributed IT systems. Organizations rely on log analytics to detect intrusions, identify suspicious patterns, and improve security posture. Real-time log monitoring also expanded as companies prioritized faster incident response and operational visibility. Compliance management remained essential for regulated sectors such as BFSI, healthcare, and government, where audit trails and governance standards are critical. The dominance of security-focused applications reflects growing enterprise emphasis on proactive risk management and system resilience.

Key Growth Drivers

Rising Cybersecurity Threats and Need for Continuous Monitoring

Growing cyberattacks, ransomware incidents, and insider threats increase demand for advanced log analysis services that provide real-time visibility across IT environments. Enterprises use centralized log monitoring to detect anomalies, block malicious activity, and strengthen incident response. Rising adoption of multi-cloud and hybrid infrastructures creates complex data trails, making automated log analytics essential for threat detection. Industries such as BFSI, healthcare, and government rely on log data to meet regulatory expectations and maintain secure operations. This focus on proactive security strongly accelerates market growth.

- For instance, CrowdStrike integrated log processing modules that analyze more than 1 trillion security events per day across global deployments.

Expansion of Cloud Adoption and Digital Transformation Initiatives

Rapid cloud migration and modernization of IT systems increase the volume of logs generated from applications, networks, and endpoints. Organizations adopt log analysis platforms to manage distributed data and ensure performance visibility across cloud-native environments. Serverless computing, microservices, and containerized workloads further amplify the need for scalable log analytics. Companies leverage these tools to optimize infrastructure, maintain uptime, and support digital transformation goals. Rising demand for cloud-based monitoring solutions drives continuous market expansion.

- For instance, self-managed Elasticsearch clusters have demonstrated the capability to handle ingestion pipelines of over 1 million writes per second in highly optimized, large-scale environments.

Growing Compliance Requirements Across Regulated Industries

Strict regulations such as GDPR, HIPAA, PCI DSS, and SOX increase the need for structured log management to ensure audit readiness and data governance. Enterprises depend on log analysis services to maintain accurate records, detect policy violations, and support compliance reporting. Automated log retention and integrity validation help organizations avoid penalties and strengthen governance frameworks. Sectors handling sensitive data—including finance, healthcare, and telecom—accelerate adoption to meet expanding regulatory obligations. Compliance-driven monitoring remains a major growth engine for the market.

Key Trends & Opportunities

Key Trends & Opportunities

Integration of AI and Machine Learning in Log Analytics

AI-driven log analysis enhances threat detection, reduces false positives, and accelerates correlation of complex data patterns. Machine learning models identify unusual behavior, provide predictive insights, and automate root-cause analysis. Vendors integrate AI to improve detection speed for both operational and security incidents. As zero-trust architectures expand, AI-powered analytics create strong opportunities for advanced security automation. This trend supports faster decision-making and greater accuracy in highly dynamic digital environments.

- For instance, Google Chronicle (now part of Google Security Operations) leverages Google’s speed, scale, and AI-powered protections to ingest and analyze massive volumes of security telemetry data at cloud scale, enabling sub-second search across petabytes of data.

Rising Demand for Cloud-Native and Real-Time Analytics Platforms

Organizations increasingly adopt cloud-native log analysis tools that support scalable ingestion, instant querying, and real-time monitoring across distributed systems. The rise of DevOps, microservices, and container orchestration drives need for continuous log visibility during deployment and operations. Real-time alerts and dashboards strengthen incident response and reduce downtime. Vendors offering multi-cloud compatibility, API-driven integration, and elastic storage gain strong opportunities. This trend aligns with the broader shift toward agile, performance-focused IT ecosystems.

- For instance, Sumo Logic improved its continuous intelligence engine to handle large-scale data analysis, with features such as real-time analytics, machine learning for anomaly detection, and the ability to process diverse data types (logs, metrics, and traces) to provide actionable insights for efficient troubleshooting and incident response.

Key Challenges

High Data Volume and Storage Costs for Large-Scale Log Management

Massive growth in log data from servers, networks, applications, and IoT devices creates storage and processing challenges. Organizations struggle to manage retention policies, index large datasets, and maintain cost-efficient infrastructure. High-volume ingestion increases operational overhead, especially for real-time analytics. Without optimized architectures, performance bottlenecks and rising storage costs limit scalability. These issues slow adoption for cost-sensitive enterprises and require vendors to offer more efficient data compression and tiered storage solutions.

Complexity of Integration Across Multi-Cloud and Hybrid Environments

Enterprises operate across fragmented infrastructures, making unified log collection and analysis difficult. Integrating data from legacy systems, cloud services, and third-party applications requires advanced connectors and security controls. Misaligned formats, inconsistent visibility, and lack of standardization hinder efficient monitoring. Organizations also face challenges in synchronizing logs for compliance and incident response. These integration gaps increase deployment complexity and slow adoption, especially among SMEs with limited technical resources.

Regional Analysis

North America

North America held 38% share, driven by strong adoption of cloud platforms, advanced cybersecurity frameworks, and widespread deployment of digital infrastructure. Enterprises in the U.S. and Canada rely heavily on log analysis services to manage rising cyberattacks, regulatory requirements, and distributed IT environments. High investment in AI-enabled security analytics and real-time monitoring tools further accelerates adoption. Leading technology vendors, robust data protection laws, and mature enterprise IT ecosystems strengthen market growth. The region continues to expand its use of automated log intelligence across sectors such as BFSI, healthcare, government, and telecom.

Europe

Europe accounted for 30% share, supported by stringent data protection regulations such as GDPR and growing demand for centralized log management solutions. Organizations prioritize log analytics to enhance compliance, detect anomalies, and secure critical data across hybrid and multi-cloud environments. Countries including Germany, the UK, and France lead adoption due to strong cybersecurity initiatives and increasing cloud migration. The rise in sophisticated cyber threats and rapid digital transformation across enterprises fuels market expansion. Europe’s regulated business environment ensures steady demand for secure, policy-driven log analysis tools.

Asia Pacific

Asia Pacific captured 24% share, driven by rapid digitalization, expanding cloud adoption, and increasing cybersecurity investments across developing economies. Countries such as China, India, Japan, and South Korea adopt log analysis services to manage rising cyber risks and support large-scale enterprise modernization. Growing SME participation and widespread use of mobile and IoT devices contribute to higher log volumes, increasing the need for real-time monitoring. Government initiatives promoting cybersecurity readiness and cloud infrastructure also support market expansion. Asia Pacific remains one of the fastest-growing regions due to its evolving digital ecosystem.

Latin America

Latin America held 5% share, supported by rising awareness of cybersecurity risks and increasing adoption of cloud-based monitoring tools. Enterprises in Brazil, Mexico, and Argentina implement log analysis services to manage security gaps and enhance operational visibility. Growth in digital banking, e-commerce, and mobile services generates large volumes of log data that require structured analytics. Economic challenges encourage organizations to adopt scalable, subscription-based solutions. While adoption is gradual, rising government cybersecurity programs and expanding IT modernization efforts continue to strengthen demand across the region.

Middle East & Africa

The Middle East & Africa region accounted for 3% share, driven by rising cybersecurity investments and expanding digital transformation initiatives across government, BFSI, and telecom sectors. Gulf countries adopt advanced log analysis solutions to support national cybersecurity strategies and secure critical infrastructure. African markets show increasing demand as enterprises modernize IT systems and combat growing cyber threats. Adoption of cloud platforms and managed security services enables wider use of log analytics. Despite limited technical resources in some areas, the region continues to advance its monitoring capabilities as digital ecosystems grow.

Market Segmentations:

By Component

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Application

- Security & Threat Management

- Compliance Management

- Real-Time Log Monitoring

- Others

By End User

- BFSI

- IT & Telecom

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights major players such as Splunk, IBM, Microsoft, Elastic, SolarWinds, Datadog, Rapid7, Sumo Logic, LogRhythm, and ManageEngine, all of which drive innovation and shape the Log Analysis Service market. These companies compete by enhancing their cloud-native log analytics platforms, improving threat detection capabilities, and integrating AI-driven correlation engines. Vendors focus on delivering scalable solutions that handle large data volumes across hybrid and multi-cloud environments. Partnerships with cybersecurity firms, cloud providers, and managed service companies strengthen market reach and accelerate product adoption. Continuous investments in automation, real-time monitoring, and machine learning help vendors address rising security threats and compliance needs. As enterprises demand faster insights, reduced false positives, and unified observability tools, competition intensifies among providers developing high-performance platforms that support modern IT operations, DevSecOps workflows, and advanced security analytics.

Key Player Analysis

- Splunk Inc.

- IBM Corporation

- Microsoft Corporation

- Elastic N.V.

- SolarWinds Corporation

- Datadog, Inc.

- Rapid7, Inc.

- Sumo Logic, Inc.

- LogRhythm, Inc.

- ManageEngine (Zoho Corporation)

Recent Developments

- In June 2025, Datadog, Inc. expanded its log-management offering with new long-term retention, search and data-residency capabilities.

- In May 2024, Sumo Logic also announced new AI and security-analytics capabilities for its log-analytics platform to support DevSecOps teams.

- In March 2024, Sumo Logic, Inc. announced its Flex Licensing plan for unlimited log data ingest (log analytics pricing plan).

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Organization Size, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI-driven log analytics will increase as enterprises prioritize automated threat detection.

- Cloud-native log analysis platforms will gain wider adoption across hybrid and multi-cloud environments.

- Real-time monitoring capabilities will expand as organizations strengthen incident response strategies.

- Integration of log analytics with SIEM and SOAR systems will grow to support unified security operations.

- SMEs will accelerate adoption due to simplified deployment models and lower subscription costs.

- Advanced correlation engines will enhance accuracy in detecting complex attacks and insider threats.

- Compliance-driven logging requirements will rise across regulated industries.

- Predictive analytics will become more common as companies analyze long-term patterns for risk forecasting.

- Edge log processing will expand to support distributed workloads and reduce latency.

- Vendors will focus on automation, scalability, and user-friendly visualization tools to improve market competitiveness.

Key Trends & Opportunities

Key Trends & Opportunities