Market Overview

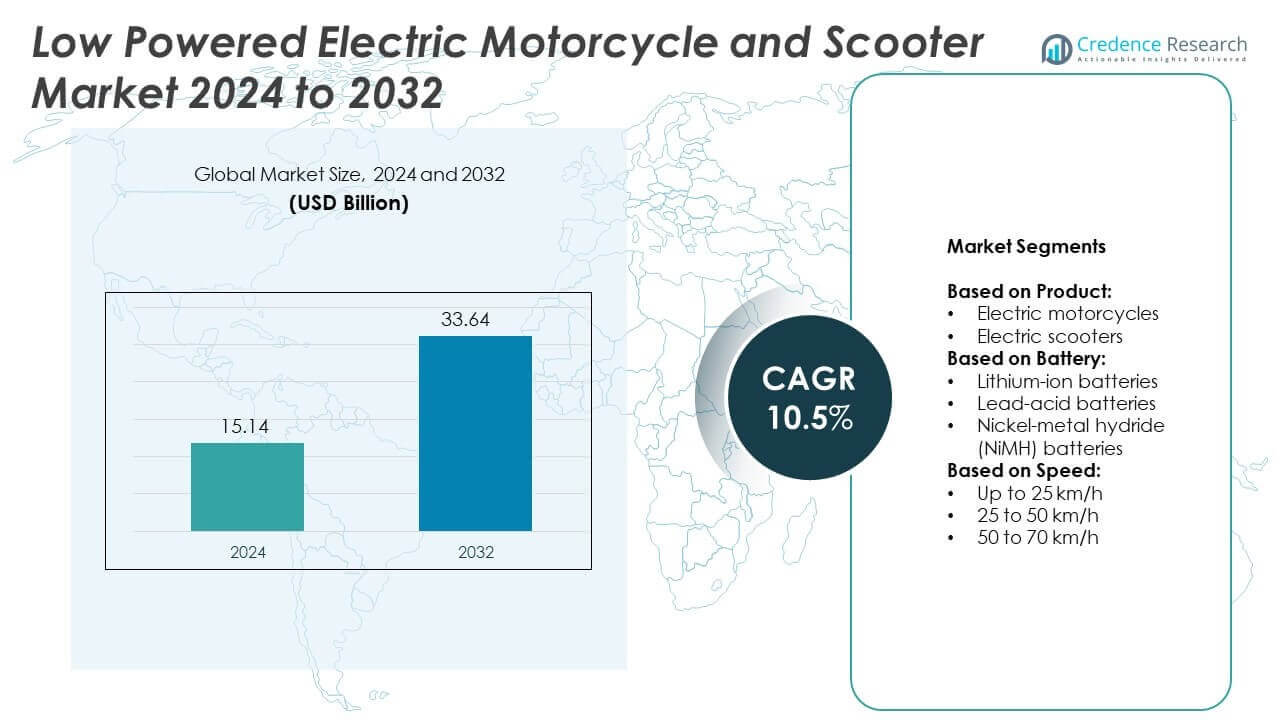

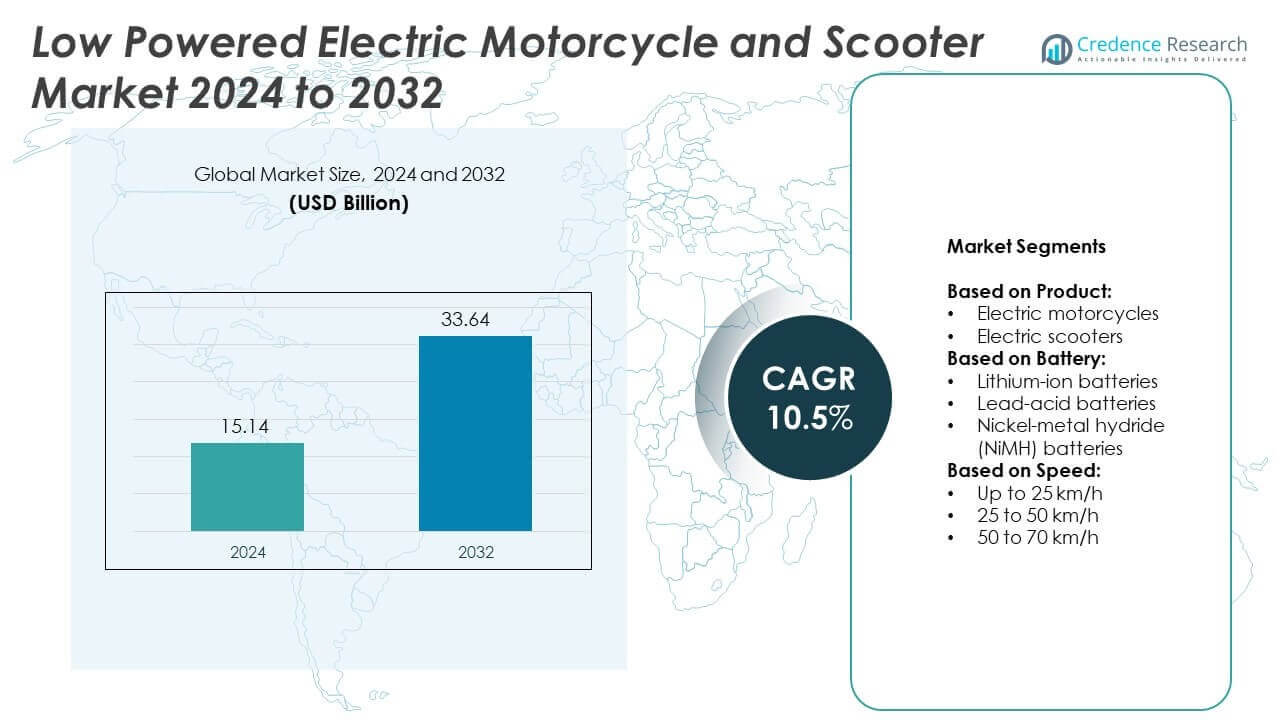

The Low Powered Electric Motorcycle and Scooter Market size was valued at USD 15.14 billion in 2024 and is projected to reach USD 33.64 billion by 2032, growing at a CAGR of 10.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Powered Electric Motorcycle and Scooter Market Size 2024 |

USD 15.14 Billion |

| Low Powered Electric Motorcycle and Scooter Market, CAGR |

10.5% |

| Low Powered Electric Motorcycle and Scooter Market Size 2032 |

USD 33.64 Billion |

The Low Powered Electric Motorcycle and Scooter market grows due to rising urban congestion, fuel cost sensitivity, and supportive government policies. Demand increases across delivery fleets and personal mobility segments driven by affordability and low maintenance. Advancements in lithium-ion batteries, lightweight materials, and connected features enhance user convenience. Urban consumers prefer compact, eco-friendly vehicles for short-distance travel. Manufacturers respond with modular designs, smart interfaces, and fast-charging options to meet evolving expectations in both developed and emerging markets.

Asia Pacific leads the Low Powered Electric Motorcycle and Scooter market due to strong manufacturing capabilities, urban density, and government incentives. China and India drive high sales through domestic production and targeted subsidies. Europe follows with strict emission rules and supportive infrastructure, while North America shows steady growth through delivery and commuting use cases. Latin America and Africa show rising interest supported by urbanization and fuel cost concerns. Key players include NIU Technologies, Yadea Group Holdings, Hero Electric Vehicles, and Ola Electric Mobility.

Market Insights

- The Low Powered Electric Motorcycle and Scooter market was valued at USD 15.14 billion in 2024 and is projected to reach USD 33.64 billion by 2032, growing at a CAGR of 10.5%.

- Rising urban traffic congestion, high fuel prices, and demand for affordable last-mile transport drive market expansion.

- Battery swapping, connected features, and lightweight, compact designs shape product innovation across key segments.

- Leading players focus on new model launches, strategic partnerships, and fleet-focused offerings to gain market share.

- Limited charging infrastructure in rural and semi-urban regions remains a key restraint, slowing wider adoption.

- Asia Pacific leads market growth due to high population density, strong manufacturing base, and policy support.

- Europe and North America see steady adoption, while Latin America and Africa show early but growing interest.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Urban Congestion and Demand for Cost-Effective Mobility Solutions

Urban centers face growing congestion and limited parking space. Consumers seek compact, affordable alternatives to conventional two-wheelers. The Low Powered Electric Motorcycle and Scooter market benefits from this shift, offering flexible and efficient urban transport. Rising fuel prices and maintenance costs of internal combustion engine vehicles drive adoption. Consumers prefer electric scooters for short commutes, delivery services, and daily errands. These vehicles offer lower total cost of ownership and quick return on investment.

- For instance, Yulu’s shared e‑bikes deliver up to 60 km per charge and allow battery swaps in about 1 minute via Yuma Energy stations

Government Incentives and Supportive Electric Mobility Policies Drive Market Growth

National and local governments introduce subsidies, tax exemptions, and rebates for electric vehicle purchases. Policy support encourages manufacturers to invest in low-powered EV models and infrastructure. The Low Powered Electric Motorcycle and Scooter market gains from regulatory frameworks that ban or restrict gasoline vehicles in city centers. Several regions mandate stricter emission standards, which favors clean mobility options. Public sector incentives reduce upfront cost barriers for individual and fleet buyers. Such policies improve market penetration across developing and developed economies.

- For instance, In Delhi the city’s EV infrastructure is continually expanding, with the government aiming for significant growth through public-private partnerships, a phased roll-out strategy, and encouraging battery-swapping solutions. In April 2025, it was announced that Delhi was set to have 48,000 charging points by 2026, comprising both government-operated and semi-private stations.

Growth in Last-Mile Delivery Services Creates Strong Use Cases for Low-Speed Electric Two-Wheelers

E-commerce and food delivery services rely on fast, economical transport solutions. Low-speed electric motorcycles and scooters reduce fuel costs and maintenance needs for logistics operators. The Low Powered Electric Motorcycle and Scooter market supports last-mile delivery with vehicles tailored for urban logistics. It enables faster deployment in congested areas with minimal noise or emissions. Fleets adopt swappable battery models to minimize downtime. Strong demand from gig economy and delivery platforms accelerates adoption across metro areas.

Improvements in Battery Technology and Charging Infrastructure Expand Market Scope

Technological advances enhance the range, durability, and affordability of electric two-wheeler batteries. Lithium-ion batteries now support longer distances and faster charging cycles. The Low Powered Electric Motorcycle and Scooter market benefits from expanded charging networks and portable solutions. It attracts first-time users concerned with range anxiety and ease of charging. Charging stations integrated in urban planning encourage wider use. Better battery management systems and modular platforms also increase consumer trust in electric mobility.

Market Trends

Expansion of Swappable Battery Models Across Urban and Fleet Applications

Battery swapping gains momentum in cities with high delivery density and limited home charging options. Companies deploy standardized battery stations that reduce downtime and extend fleet operations. The Low Powered Electric Motorcycle and Scooter market benefits from this model through partnerships with energy firms and mobility providers. It ensures continuous use without waiting for full charges. Riders can complete more trips per shift, improving earnings for delivery workers. Governments also support battery-as-a-service platforms to scale EV adoption in crowded cities.

- For instance, As of late 2024 and mid-2025, Zypp Electric operates a fleet of over 20,000 vehicles, including electric two-wheelers and three-wheelers. The company serves major clients such as Amazon and Uber, along with others like Zomato, Swiggy, and Blinkit. The fleet has experienced significant growth, with the company aiming for 50,000 vehicles by the end of FY25 (March 2025) and 125,000 by the end of FY26 (March 2026)

Integration of Smart Features Enhances User Experience and Operational Control

Manufacturers add connected features such as GPS, remote diagnostics, anti-theft alerts, and mobile apps. These tools allow users to monitor performance, track vehicles, and optimize routes. The Low Powered Electric Motorcycle and Scooter market sees demand for telematics and smart dashboards, especially in fleet operations. It strengthens operational control and user engagement. Cloud connectivity helps service providers manage maintenance cycles and charging routines. Over-the-air updates keep vehicles compatible with changing urban regulations.

- For instance, The Ather Rizta S, which comes with a 2.9 kWh battery, offers an ARAI/IDC certified range of 123 km. The Rizta Z is available with a 3.7 kWh battery that provides a certified range of 160 km. However, the actual “TrueRange” in real-world conditions is typically lower, estimated at around 100 km for the smaller battery and 125 km for the larger one, depending on riding style and other factors. The maximum speed for both models is 80 km/h.

Rise of Compact, Lightweight Designs for Dense Urban Environments

Consumers in large cities prefer lightweight models that offer ease of use, quick acceleration, and easy parking. Companies develop foldable or space-saving formats to appeal to short-distance commuters. The Low Powered Electric Motorcycle and Scooter market responds with compact designs suited for narrow streets and apartment living. It targets students, office workers, and gig economy riders needing practical transport. Reduced weight also improves energy efficiency and ride control. This trend supports higher vehicle utilization and broader demographic appeal.

OEM-Focused Vertical Integration Across EV Supply Chains

Brands now invest in in-house battery packs, electric drivetrains, and power electronics. Vertical integration helps reduce dependency on external suppliers and ensures product quality. The Low Powered Electric Motorcycle and Scooter market benefits from better pricing control and improved production timelines. It supports innovation in component design and energy efficiency. Several startups and legacy players now align R&D with supply chain strategy. This trend supports competitive differentiation and faster go-to-market timelines.

Market Challenges Analysis

Limited Charging Infrastructure Slows Mass Market Penetration in Semi-Urban and Rural Areas

Widespread adoption faces delays in regions lacking public charging points or grid stability. Semi-urban and rural areas often struggle with inconsistent power supply and poor EV infrastructure. The Low Powered Electric Motorcycle and Scooter market finds it harder to grow in such locations despite strong cost advantages. It depends on reliable access to charging to support regular use. Consumers hesitate to switch without visible, accessible stations near homes or workplaces. Infrastructure expansion remains uneven and focused mostly in metro cities, leaving key areas underserved.

Low Performance Perception and Limited Range Reduce Appeal for Certain Use Cases

Many consumers still associate electric two-wheelers with low top speed, weak acceleration, and short range. These perceptions discourage adoption in regions with longer commutes or varied terrain. The Low Powered Electric Motorcycle and Scooter market must address concerns over performance parity with petrol-powered models. It faces resistance from users needing high-speed travel or heavy-load capabilities. Fleet operators also evaluate payload capacity and range before switching. Until proven in diverse road conditions, the vehicles remain limited to light-duty urban mobility segments.

Market Opportunities

Emergence of Subscription and Mobility-as-a-Service Models Supports Broader Consumer Access

Subscription-based ownership and mobility-as-a-service (MaaS) models open new channels for EV adoption. Urban consumers prefer flexible access over full ownership, especially in high-density areas. The Low Powered Electric Motorcycle and Scooter market can tap into these models to attract students, gig workers, and tourists. It enables providers to scale faster without relying on individual purchases. Short-term rentals and app-based access lower entry barriers for first-time users. These models also help operators collect usage data to improve vehicle design and service efficiency.

Integration into Government and Institutional Fleets Creates Stable Long-Term Demand

Municipal bodies and public sector agencies look to electrify transport fleets for sustainability goals. Low-speed electric two-wheelers suit postal services, civic departments, and institutional campuses. The Low Powered Electric Motorcycle and Scooter market finds strong opportunities in these segments due to clear operational routes and fixed service zones. It allows manufacturers to secure large-volume contracts with predictable demand. Such partnerships reduce cost per unit through bulk production and shared servicing. Institutional buyers also push for local assembly and battery recycling, driving investment in domestic supply chains.

Market Segmentation Analysis:

By Product:

Electric scooters lead due to their strong uptake in urban commuting and delivery services. They offer better maneuverability, compact design, and lower operating cost than electric motorcycles. The Low Powered Electric Motorcycle and Scooter market sees growing demand for scooters across students, gig workers, and office commuters. Electric motorcycles, while still evolving, gain popularity in suburban areas and among younger riders seeking sportier designs. They deliver higher torque and better performance for medium-range travel. Both segments benefit from increased availability of models in different price brackets.

- For instance, Battery Smart handles approximately 125,000 swaps daily, which translates to about 3.75 million swaps per month (assuming 30 days per month), using its network of over 1,500 partner-led stations spread across more than 35 cities.

By Battery:

Lithium-ion batteries dominate due to their lightweight, longer lifespan, and fast-charging capability. They support improved range and power density, which are key to daily usability. The Low Powered Electric Motorcycle and Scooter market shifts rapidly toward lithium-ion chemistry, especially in private ownership and commercial fleets. Lead-acid batteries remain active in price-sensitive regions due to their lower upfront cost but face replacement issues and shorter life. Nickel-metal hydride (NiMH) batteries hold a niche position with better temperature tolerance but lack the scalability and energy density of lithium-ion. Most OEMs continue to phase out lead-acid and NiMH in favor of next-generation lithium-based solutions.

- For instance, The Hero Electric Atria LX has a kerb weight of 69 kg. It is equipped with a 250W BLDC motor that enables a top speed of 25 km/h, which means it does not require a driving license or registration. The scooter also includes features such as cruise control and a 1.54 kWh lithium-ion battery, which provides a claimed range of 85 km on a single charge.

By Speed:

The 25 to 50 km/h segment leads due to its balance of safety, performance, and licensing ease. This range fits well with urban mobility regulations and supports varied user needs. The Low Powered Electric Motorcycle and Scooter market benefits from high adoption in this category by delivery platforms and everyday riders. The up to 25 km/h category appeals to senior citizens and entry-level users who value simplicity over speed. Vehicles in the 50 to 70 km/h range target users needing faster commutes or suburban coverage, though licensing and insurance requirements limit access in some regions. All three segments serve distinct user types, helping the market cater to both mass and niche demands.

Segments:

Based on Product:

- Electric motorcycles

- Electric scooters

Based on Battery:

- Lithium-ion batteries

- Lead-acid batteries

- Nickel-metal hydride (NiMH) batteries

Based on Speed:

- Up to 25 km/h

- 25 to 50 km/h

- 50 to 70 km/h

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America captured 10% of the global Low Powered Electric Motorcycle and Scooter market in 2024. The region sees stable growth driven by rising environmental awareness, high gasoline prices, and federal tax incentives. Urban centers such as Los Angeles, New York, and Toronto encourage electric two-wheeler use through congestion zone benefits and infrastructure plans. The region supports pilot programs for electric scooter fleets, especially among delivery and mobility startups. However, outside major cities, public charging networks remain sparse, limiting adoption in suburban and rural zones. Manufacturers focus on premium models with smart features, targeting professionals, students, and logistics operators. The presence of tech-integrated, safe, and durable designs strengthens market position in the region.

Europe

Europe held 15% of the global Low Powered Electric Motorcycle and Scooter market in 2024, backed by progressive policy frameworks and urban mobility reforms. Countries like Germany, France, the Netherlands, and Italy lead the regional demand with strong regulatory pushes for clean transportation. The growing implementation of zero-emission zones in key cities accelerates the switch to low-powered electric two-wheelers. Public transport integration, dedicated scooter lanes, and electric charging hubs improve operational convenience for daily users. Fleet operators, including postal services and food delivery platforms, adopt low-speed EVs to comply with emission standards and reduce operational costs. European manufacturers focus on quality, modularity, and compliance with local and EU safety norms to retain competitive edge in a tech-savvy consumer market.

Asia Pacific

Asia Pacific accounted for the largest share of 55% in the Low Powered Electric Motorcycle and Scooter market in 2024. China, India, Vietnam, and Indonesia dominate regional demand due to population density, lower vehicle costs, and widespread government incentives. China remains the global hub for manufacturing and deploying electric scooters, supported by high-volume production and strong public-private partnerships. In India, state and national subsidies under FAME-II and similar schemes promote sales in both urban and semi-urban areas. Gig economy platforms like Meituan and Swiggy use these vehicles extensively for last-mile deliveries. Asia Pacific also benefits from advances in battery technology, localized vehicle designs, and broad dealer networks. Domestic OEMs continue to lead with scalable models that meet the region’s cost and utility expectations.

Latin America, Middle East, and Africa

Latin America, Middle East, and Africa collectively held 10% of the global Low Powered Electric Motorcycle and Scooter market in 2024. Demand is rising in urban centers across Brazil, South Africa, the UAE, and Mexico where traffic congestion and fuel cost pressures push consumers toward electric alternatives. Governments have started introducing incentive programs and import duty reductions to improve accessibility. In Latin America, delivery services and short-range personal travel support slow but consistent adoption. In the Middle East and Africa, limited infrastructure and high upfront costs remain barriers, but emerging policies and fleet trials show positive signals. Regional interest continues to grow as more OEMs explore local partnerships and assembly strategies to lower production and service costs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

-

- Hero Electric Vehicles

- TVS Motor Company

- Gogoro

- KTM AG

- Yadea Group Holdings

- Ather Energy

- Honda Motor

- Ola Electric Mobility

- Bajaj Auto

Competitive Analysis

The Low Powered Electric Motorcycle and Scooter market features strong competition among key players such as NIU Technologies, Hero Electric Vehicles, TVS Motor Company, Gogoro, KTM AG, Yadea Group Holdings, Ather Energy, Honda Motor, Ola Electric Mobility, and Bajaj Auto. These companies focus on product innovation, regional expansion, and strategic partnerships to strengthen market position. Players invest in advanced battery technologies, lightweight materials, and connected features to meet diverse consumer needs. Manufacturers target both individual and fleet buyers with tailored offerings across urban, semi-urban, and delivery segments. Companies actively explore battery swapping, mobile integration, and app-based diagnostics to enhance user experience. Competitive pricing and financing plans remain essential in emerging markets to attract first-time EV users. OEMs also focus on expanding dealership networks, after-sales support, and localized production to boost accessibility and reduce cost barriers. Leading players continuously launch models with improved range, compact designs, and faster charging to stay ahead. Collaboration with energy providers and mobility platforms helps scale infrastructure and create recurring demand. Competitive intensity will remain high as new startups and traditional two-wheeler brands enter the segment, aiming to capture growing interest in sustainable, cost-effective urban mobility solutions.

Recent Developments

- In January 2025, Ather Energy Launched the 2025 Ather 450 range including 450 X, 450 S, and 450 Apex with new features like Multi-Mode Traction Control, MagicTwist throttle, and software AtherStack 6.0 with Google Maps, Alexa, and WhatsApp notifications on the dashboard.

- In November 2024, Honda Motor launched two electric motorcycle concepts “EV Fun Concept” and “EV Urban Concept” at EICMA 2024, with a planned 2025 release for the sports model “EV Fun.

- In January 2023, Hero Electric formed a long-term alliance with Maxwell Energy Systems (India) for advanced battery management systems to supply over 1 million units within three years.

Report Coverage

The research report offers an in-depth analysis based on Product, Battery, Speed and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as urban areas adopt sustainable and compact transport options.

- Government incentives and EV-friendly regulations will continue to drive adoption across key regions.

- Battery technology will improve with longer range, faster charging, and extended life cycles.

- Shared mobility platforms and subscription services will create new use cases and revenue models.

- OEMs will focus on lightweight, foldable, and IoT-enabled models for urban commuters.

- Low-speed electric vehicles will see higher uptake in last-mile delivery and logistics fleets.

- Asia Pacific will maintain its lead, while Latin America and Africa will grow through local assembly.

- Battery swapping infrastructure will scale, reducing downtime and improving fleet utilization.

- Consumers will prefer models with app integration, remote diagnostics, and anti-theft features.

- The market will attract more investments from traditional two-wheeler brands and tech startups.