Market Overview:

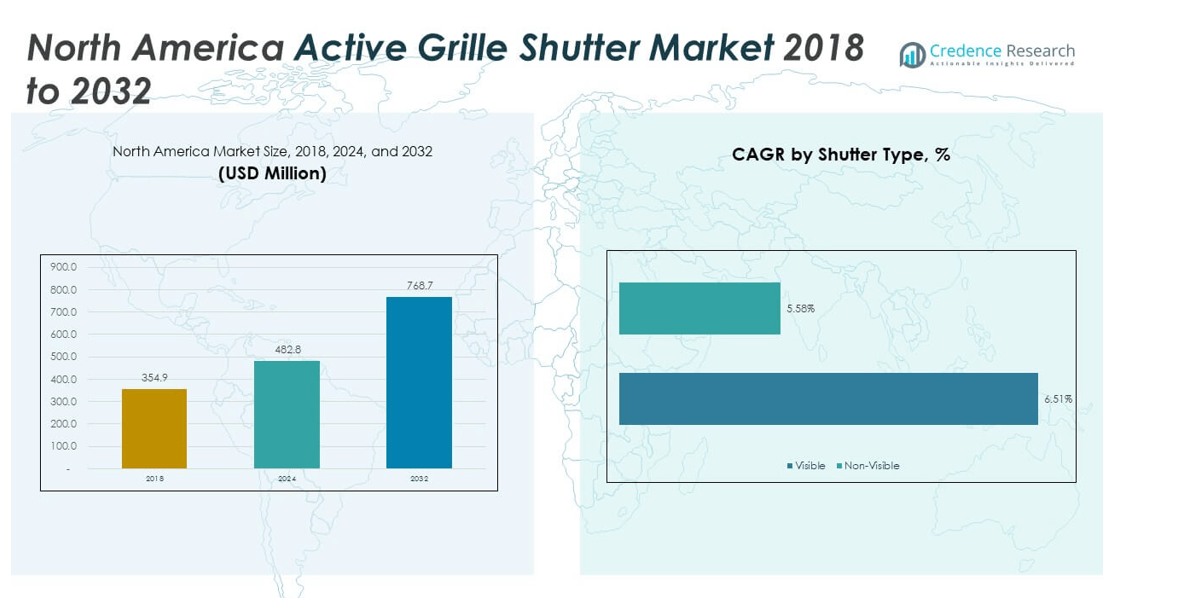

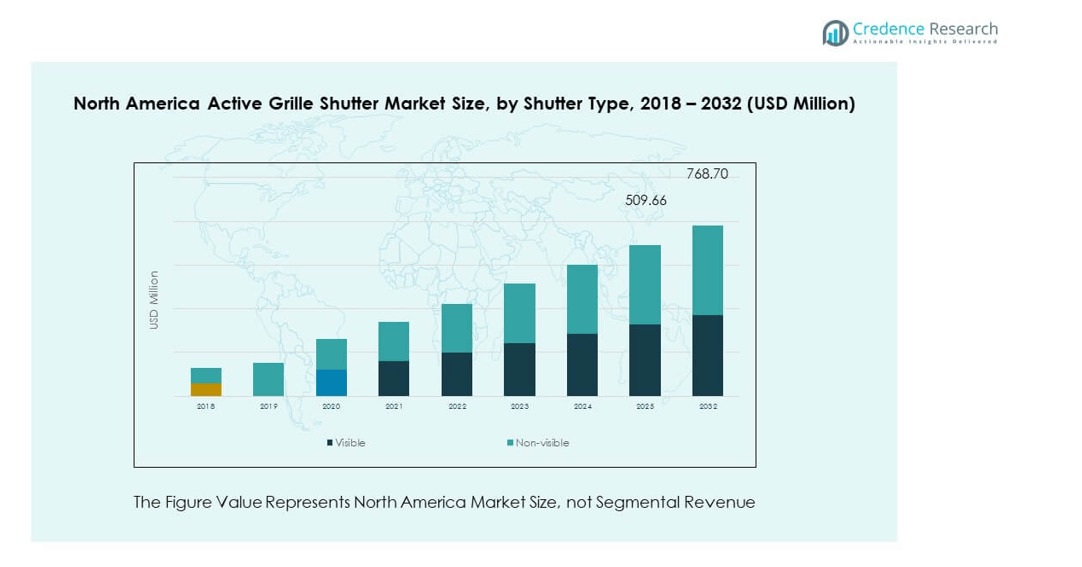

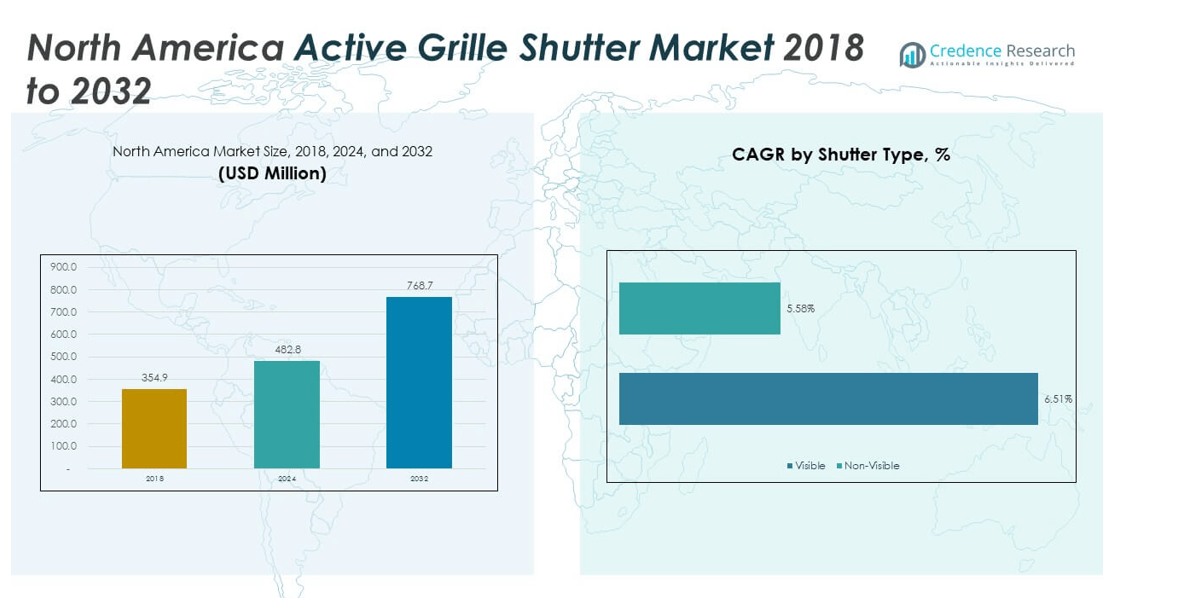

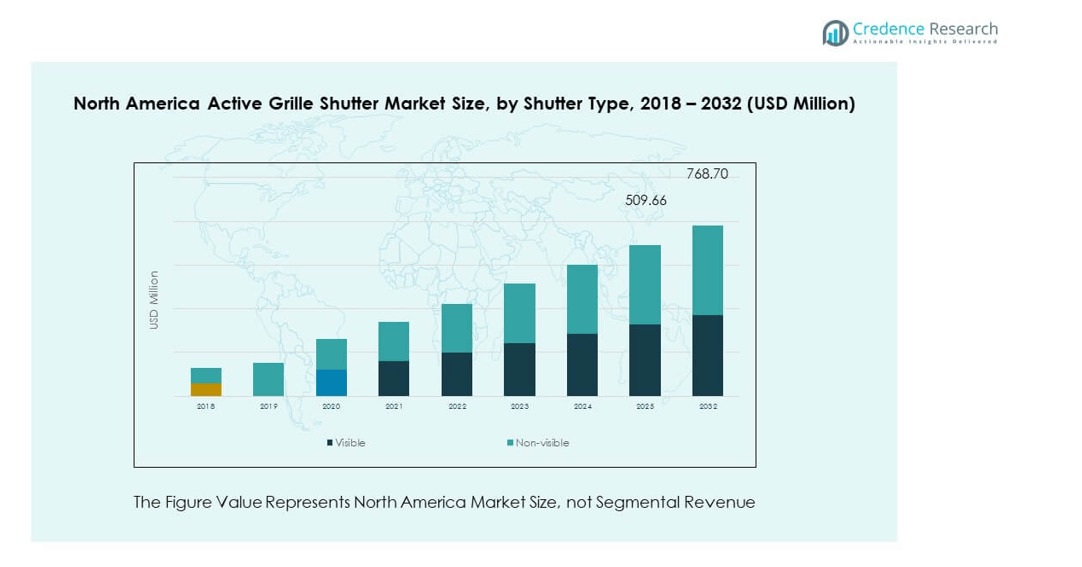

The North America Active Grille Shutter Market size was valued at USD 354.90 million in 2018 to USD 482.84 million in 2024 and is anticipated to reach USD 768.70 million by 2032, at a CAGR of 6.00% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Active Grille Shutter Market Size 2024 |

USD 482.84 million |

| North America Active Grille Shutter Market, CAGR |

6.00% |

| North America Active Grille Shutter Market Size 2032 |

USD 768.70 million |

The market is witnessing strong growth due to rising demand for fuel efficiency, stricter emission standards, and technological advancements in automotive design. Active grille shutters are increasingly adopted by manufacturers to optimize aerodynamics and reduce drag, contributing to lower fuel consumption and enhanced vehicle performance. Consumer preference for sustainable and efficient vehicles is also driving their adoption across both luxury and mass-market automotive segments, making them a vital component in modern vehicle design.

Regionally, the United States leads the North America Active Grille Shutter Market due to its strong automotive manufacturing base and early adoption of advanced vehicle technologies. Canada is also witnessing steady growth, supported by increasing consumer demand for energy-efficient vehicles and government sustainability initiatives. Mexico, with its growing automotive production capacity, is emerging as an attractive hub for market expansion. Together, these countries form a dynamic regional landscape where regulatory push, consumer demand, and industrial capabilities drive overall market growth.

Market Insights:

- The North America Active Grille Shutter Market was valued at USD 354.90 million in 2018, reached USD 482.84 million in 2024, and is projected to hit USD 768.70 million by 2032, growing at a CAGR of 6.00%.

- The United States leads with 68% share, driven by strong automotive production, advanced technology integration, and regulatory mandates; Canada follows with 18% share, supported by sustainability initiatives; Mexico holds 14%, strengthened by its cost-competitive manufacturing base.

- Canada is the fastest-growing region with 18% share, supported by rising hybrid and electric vehicle adoption and OEM integration of advanced aerodynamic systems.

- In 2024, non-visible shutters commanded the largest segment share at 58%, favored for seamless integration into diverse vehicle designs.

- Visible shutters accounted for 42% in 2024, supported by adoption in premium and performance vehicles where aesthetics and aerodynamics combine for competitive advantage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Regulatory Pressure on Automakers to Meet Stringent Emission Norms

The implementation of stricter emission rules across the region is pushing automakers to adopt technologies that lower vehicle emissions. Governments are focused on sustainable transportation, and active grille shutters are gaining priority in design strategies. The North America Active Grille Shutter Market is benefiting from these regulatory frameworks, which mandate energy efficiency and reduced carbon footprints. Automakers view shutters as essential for compliance, as they improve airflow management and reduce drag. It provides measurable reductions in CO₂ emissions without significant design overhauls. Regulators also reward vehicles with improved aerodynamics through efficiency credits. This further strengthens adoption across passenger and commercial vehicles. The enforcement of standards ensures long-term demand stability.

- For instance, Valeo indicates that its active grille shutter system improves the aerodynamic drag coefficient by an average of 9% across equipped vehicles, based on measurements in its technical documentation.

Increasing Consumer Preference for Fuel Efficiency in Passenger Cars

Consumer demand for fuel efficiency continues to drive the adoption of active grille shutters across new vehicle models. Buyers are increasingly aware of fuel costs and environmental impacts, leading to preference for vehicles equipped with aerodynamic innovations. The North America Active Grille Shutter Market benefits from this behavioral shift as fuel-conscious buyers prioritize technology-supported models. It enables automakers to differentiate vehicles through higher mileage ratings and reduced emissions. Car buyers recognize grille shutters as hidden features that enhance driving economy. Automakers integrate the technology to position their vehicles competitively in both mass-market and premium segments. Rising urbanization and long-distance commuting add further importance to efficiency gains. The preference ensures continued integration across multiple product lines.

- For instance, Ford equipped the Focus SFE with active grille shutters, which contributed to its EPA-certified highway fuel economy of 40 mpg, compared to 38 mpg for the standard models. The shutters help reduce aerodynamic drag and improve fuel efficiency, especially at highway speeds

Growing Adoption of Advanced Vehicle Technologies Across Automotive OEMs

Automotive manufacturers in North America are increasingly integrating advanced technologies into vehicles, from powertrains to aerodynamic systems. Active grille shutters form a critical part of these innovations, helping optimize airflow and fuel performance. The North America Active Grille Shutter Market benefits from strong OEM investments in smart vehicle systems. It aligns well with the automotive shift toward electrification, autonomy, and connected features. Engineers deploy shutters to improve battery range in electric vehicles, where drag reduction is vital. Their presence in hybrid and plug-in hybrid models also highlights cross-segment applications. Automakers promote shutters as part of advanced aerodynamics packages, reinforcing their role in vehicle efficiency. This positions the component as a standard requirement rather than an optional feature.

Expansion of Lightweight Vehicle Design for Performance and Efficiency Gains

The regional market is supported by a growing focus on lightweight vehicle manufacturing to enhance performance. Active grille shutters complement lightweight materials by further lowering drag and boosting efficiency. The North America Active Grille Shutter Market sees consistent integration within new design platforms that combine aerodynamics with weight optimization. It strengthens overall fuel savings while maintaining structural integrity and safety standards. Automakers seek every possible advantage to achieve compliance with corporate average fuel economy targets. Shutters provide measurable aerodynamic benefits without adding significant weight or design complexity. Their use extends across SUVs, sedans, and trucks, reflecting broad acceptance. Lightweight design strategies ensure shutters remain a core technology within evolving vehicle platforms.

Market Trends:

Integration of Active Grille Shutters into Electric and Hybrid Vehicle Models

Electric and hybrid vehicles demand enhanced aerodynamics to improve driving range. Automakers now consider grille shutters essential for reducing battery energy consumption. The North America Active Grille Shutter Market is advancing rapidly with this integration trend across EV platforms. It enables vehicles to minimize drag and extend range under highway driving conditions. Engineers highlight shutters as cost-effective compared to advanced battery upgrades. Their presence is also critical in plug-in hybrid models, where efficiency targets remain high. Automakers market them as eco-friendly features enhancing sustainability credentials. This ensures widespread adoption in the expanding EV and hybrid market segment.

- For instance, Magna International’s active grille shutter system is designed to dynamically regulate airflow for improved aerodynamics, generating a plausible drag reduction of 7–15 counts (0.0007-0.0015 in drag coefficient) that aligns with industry standards.

Increased Focus on Smart and Adaptive Shutter Control Systems

The rise of smart vehicles has created demand for adaptive grille shutter systems that respond to real-time conditions. Automakers are upgrading shutter mechanisms to operate automatically with precision. The North America Active Grille Shutter Market benefits from advancements in sensors, electronics, and control logic. It allows shutters to adjust dynamically to temperature, speed, and airflow requirements. This creates higher efficiency and contributes to improved vehicle performance. Manufacturers showcase adaptive shutters as part of intelligent aerodynamics systems in marketing campaigns. Drivers benefit from improved comfort, efficiency, and engine temperature control. Smart integration sets a standard for innovation in automotive aerodynamics.

Growing Use of Aerodynamic Innovations in Larger Vehicle Segments

SUVs and pickup trucks represent a major share of the automotive landscape in North America. Their size creates aerodynamic challenges, making grille shutters a key solution. The North America Active Grille Shutter Market is witnessing broader adoption across these larger vehicles. It helps manufacturers reduce drag and offset higher fuel consumption levels. The technology also allows compliance with strict regulatory standards in these categories. Automakers leverage shutters to maintain competitive efficiency in truck lineups. This expands the technology’s relevance beyond sedans and compact vehicles. Larger models adopting shutters highlight the market’s scale and potential.

Rising Popularity of Premium and Luxury Vehicles Featuring Advanced Aerodynamics

Luxury automakers are prioritizing advanced aerodynamic solutions to deliver performance and efficiency. Grille shutters have become standard in many premium models to showcase technological advancement. The North America Active Grille Shutter Market benefits from this trend by capturing higher-value segments. It enhances performance without compromising luxury styling or comfort. Manufacturers present shutters as premium features that improve efficiency while supporting design aesthetics. Luxury buyers value innovation that balances efficiency and performance seamlessly. This positioning drives demand for shutters in high-end brands. The premium segment acts as an innovation hub for broader automotive adoption.

- For example, Mercedes-Benz unveiled the IAA (Intelligent Aerodynamic Automobile) Conceptat the 2015 Frankfurt Motor Show, demonstrating active grille shutters and movable body elements that shift the drag coefficient from 25 to 0.19 in aerodynamic mode. This innovation was officially reported by Mercedes-Benz and covered in global automotive media, attesting to authentic technological advancement in the luxury segment.

Market Challenges Analysis:

High Development Costs and Complexity in System Integration Across Vehicle Models

Developing active grille shutter systems requires high investment in design, testing, and integration. Automakers must ensure precise functionality that aligns with aerodynamics, safety, and durability standards. The North America Active Grille Shutter Market faces cost pressures due to advanced sensors, actuators, and electronics. It creates financial challenges for mass-market adoption, particularly in low-cost vehicle segments. Small manufacturers face barriers in absorbing the expense of advanced shutter systems. The complexity of integrating shutters into multiple vehicle platforms also increases development timelines. Higher costs create a gap between luxury and entry-level adoption. This challenge influences the pace of technology penetration in the market.

Maintenance Concerns and Durability Issues Affecting Long-Term Adoption Potential

Grille shutters are mechanical systems that require long-term durability under varied environmental conditions. Harsh weather, road debris, and mechanical strain can affect performance reliability. The North America Active Grille Shutter Market faces concerns regarding maintenance and consumer trust. It must ensure shutters remain functional throughout a vehicle’s lifespan without raising service costs. Automakers must also address issues such as shutter jamming or electronic failures. These risks can reduce consumer confidence in advanced aerodynamic features. Drivers in extreme climates express skepticism about shutter durability in daily use. Ensuring reliability remains essential for achieving consistent adoption across diverse regions.

Market Opportunities:

Expansion Potential through Electric Mobility and Sustainable Automotive Solutions

Electric mobility growth across North America presents major opportunities for aerodynamic technologies. Active grille shutters enhance efficiency and extend EV driving ranges without requiring costly battery redesigns. The North America Active Grille Shutter Market benefits from its role in supporting sustainable transport solutions. It helps automakers achieve performance and emission targets while appealing to eco-conscious buyers. Governments promote clean mobility, further increasing adoption prospects. Manufacturers can expand into EV-focused product lines with innovative shutter systems. The transition to sustainable vehicles provides consistent demand for advanced aerodynamic components. This expansion positions shutters as critical to long-term growth.

Increasing Customization and Design Flexibility in Advanced Vehicle Platforms

Automakers are investing in customizable design platforms that incorporate flexible aerodynamic solutions. Active grille shutters can adapt across varied vehicle categories, including compact cars, SUVs, and trucks. The North America Active Grille Shutter Market gains from this design flexibility supporting mass adoption. It enables manufacturers to tailor systems for both cost-sensitive and premium models. Engineers highlight shutters as modular components that integrate seamlessly into vehicle design. This adaptability creates opportunities for aftermarket players and OEM suppliers. Automakers gain efficiency benefits without compromising aesthetics or functionality. Broad applicability ensures shutters remain relevant in diverse automotive platforms.

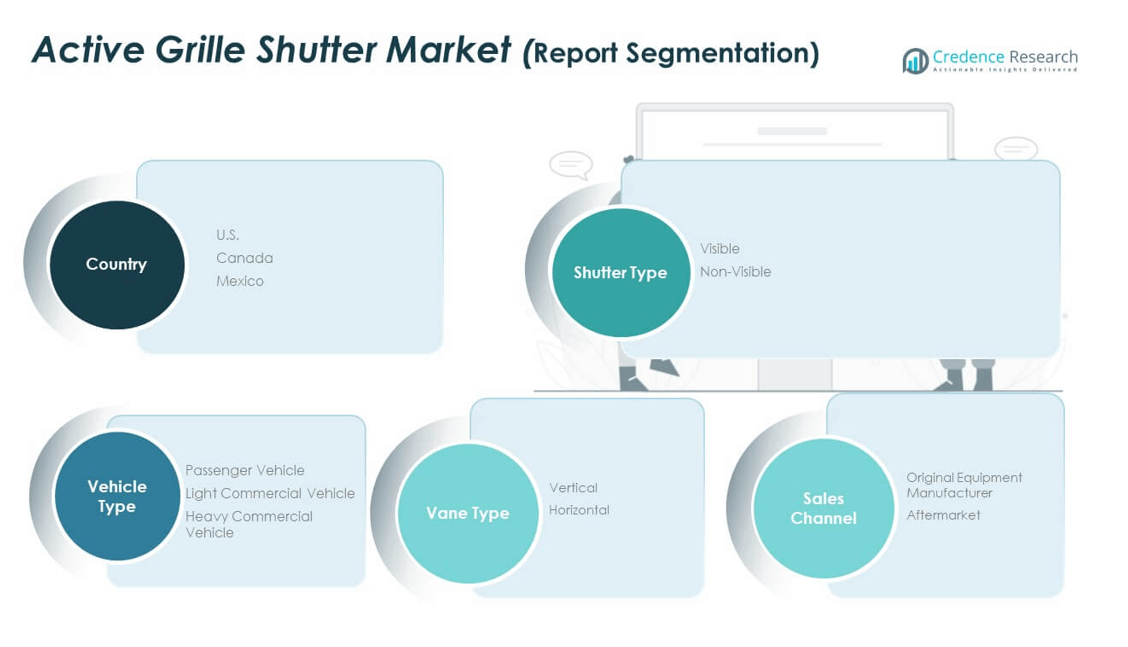

Market Segmentation Analysis:

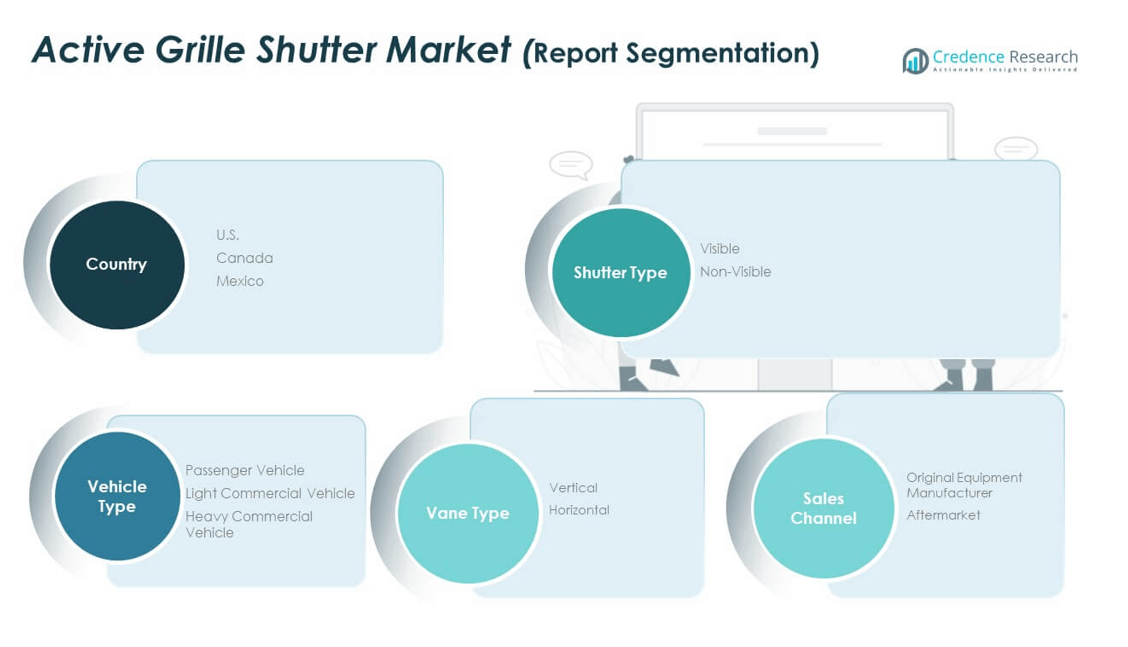

The North America Active Grille Shutter Market is segmented

By shutter type into visible and non-visible categories. Visible shutters are increasingly integrated into premium and performance vehicles, where aesthetics and aerodynamics must align. Non-visible shutters dominate broader applications due to their ability to deliver efficiency benefits without altering exterior styling. It supports automakers in achieving compliance with emission and efficiency standards while meeting diverse design requirements across vehicle platforms.

- For instance, the BMW 7 Series incorporates visible active grille shutters, which are designed for both premium aesthetics and aerodynamic optimization, as confirmed in BMW’s official literature and industry reviews.

By vehicle type, passenger vehicles account for a major share owing to higher production volumes and strong demand for fuel-efficient cars. Light commercial vehicles are witnessing steady adoption, driven by the need to balance operating costs with environmental regulations. Heavy commercial vehicles also present opportunities, with shutters reducing drag and improving long-distance fuel efficiency. The North America Active Grille Shutter Market benefits from integration across both personal and commercial mobility.

By vane type segmentation highlights vertical and horizontal configurations tailored to airflow requirements. Vertical vane systems are commonly used due to ease of integration and consistent airflow management. Horizontal vane systems are gaining traction in larger vehicles, where they deliver enhanced stability and thermal control. It allows manufacturers to optimize performance across different vehicle classes.

- For instance, General Motors integrates vertical vane systems in multiple passenger vehicle models for optimized airflow management, as explained in repair guides and GM’s technical documentation

By sales channel, OEMs dominate due to factory-installed shutter systems integrated into new vehicle designs. Aftermarket demand is also expanding, supported by consumers upgrading vehicles for efficiency and compliance. OEM-focused development ensures long-term stability, while aftermarket opportunities provide avenues for customization and replacement, reinforcing overall market growth.

Segmentation:

By Shutter Type

By Vehicle Type

- Passenger Vehicle

- Light Commercial Vehicle

- Heavy Commercial Vehicle

By Vane Type

By Sales Channel

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Region

Regional Analysis:

The United States holds the largest share of the North America Active Grille Shutter Market, accounting for 68% of regional revenue. Strong automotive production, high adoption of advanced vehicle technologies, and stringent fuel efficiency regulations drive this dominance. Automakers in the U.S. actively integrate grille shutters into passenger cars, SUVs, and light trucks to meet emission standards and enhance performance. It also benefits from robust investments in electric mobility, where aerodynamics directly influence range optimization. Premium and luxury car manufacturers further accelerate adoption by standardizing shutters in their models. Continuous innovation and large-scale manufacturing capacity position the U.S. as the leading growth engine in the regional market.

Canada represents 18% of the North America Active Grille Shutter Market, supported by growing consumer demand for energy-efficient vehicles and supportive government policies. The Canadian automotive industry emphasizes sustainability, with OEMs introducing new models featuring advanced aerodynamic systems. It is also influenced by rising adoption of hybrid and electric vehicles, which require optimized airflow management to achieve higher range efficiency. Cold weather conditions across Canada amplify the value of grille shutters, which help regulate engine temperature while improving fuel economy. Local suppliers collaborate with global OEMs to integrate cost-effective shutter solutions. This alignment ensures steady growth in the Canadian segment.

Mexico holds 14% of the North America Active Grille Shutter Market, fueled by its expanding automotive manufacturing base and cost-competitive production environment. Global automakers are leveraging Mexico’s facilities to assemble vehicles for export to the U.S. and Canada, boosting regional supply. It benefits from rising integration of advanced vehicle technologies into new production lines. Government incentives for sustainable automotive practices further support technology adoption in domestic markets. Suppliers in Mexico are expanding capabilities to meet OEM requirements, reinforcing the country’s role as a key manufacturing hub. Growing consumer demand for affordable, fuel-efficient vehicles also contributes to steady market penetration in this subregion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- RÖCHLING SE & CO. KG

- Valeo

- Magna International Inc.

- SRG North America

- Batz Group

- Standard Motor Products, Inc.

- Techniplas LLC

- Brose Fahrzeugteile GmbH & Co. KG, Coburg

- Tong Yang Group

- Keboda

- Starlite

- Aisin Corporation

Competitive Analysis:

The North America Active Grille Shutter Market is characterized by strong competition among global and regional players focusing on technological innovation and efficiency. Leading companies such as Röchling SE & Co. KG, Valeo, and Magna International Inc. dominate through extensive OEM partnerships and advanced product portfolios. It is marked by continuous investment in R&D to improve shutter durability, reduce weight, and integrate adaptive control systems. Suppliers are also expanding their collaborations with electric and hybrid vehicle manufacturers, aligning with the region’s shift toward sustainable mobility. Competitive intensity remains high, with established firms differentiating through scale, global presence, and innovation-driven strategies. Smaller players such as Techniplas LLC, SRG North America, and Batz Group are strengthening positions by offering cost-effective and customizable solutions. The North America Active Grille Shutter Market benefits from this diversity, as it fosters innovation and competitive pricing. Companies like Brose Fahrzeugteile GmbH & Co. KG and Aisin Corporation leverage their global expertise to expand regional presence. Local suppliers in Mexico and Canada contribute to competitiveness by supporting OEM production lines with flexible supply models. Strategic moves including mergers, product launches, and regional expansions continue to shape the competitive landscape, creating opportunities for growth across all market tiers.

Recent Developments:

- In November 2024, Continental Automotive Systems Inc. released a new line of Active Grille Shutters for key Ford and Chrysler models. The launch covers popular vehicles like the Chrysler 200, Ford Focus, Escape, Mustang, Explorer, F-150, Fusion, and Lincoln MKZ. Designed to reduce aerodynamic drag and regulate engine cooling, these shutters remain closed during the engine warm-up phase to warm up quickly, then open at lower speeds for cooling and close again at higher speeds to lower drag.

Report Coverage:

The research report offers an in-depth analysis based on shutter type, vehicle type, vane type, and sales channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The North America Active Grille Shutter Market will expand steadily, supported by growing automotive production and regulatory compliance needs.

- Rising adoption of electric and hybrid vehicles will enhance demand for advanced aerodynamic components across passenger and commercial fleets.

- Automakers will integrate shutters into more vehicle models, making the technology a standard feature rather than a premium option.

- Increasing emphasis on sustainability will push suppliers to develop lightweight, recyclable, and energy-efficient shutter solutions.

- Advancements in smart and adaptive shutter systems will enhance efficiency by responding in real time to driving conditions.

- OEMs will dominate installations, while the aftermarket will gain traction with retrofitting and replacement opportunities.

- SUVs and pickup trucks will remain a strong growth area due to their large production volumes and greater aerodynamic challenges.

- Investments in Mexico’s automotive manufacturing will strengthen supply capabilities and regional production networks.

- Strategic partnerships between global suppliers and local manufacturers will expand product accessibility and improve cost competitiveness.

- Continuous innovation in vane designs and shutter control systems will reinforce long-term market growth across North America.