| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| North America Retail Pharmacy Market Size 2024 |

USD 541,858.52 Million |

| North America Retail Pharmacy Market, CAGR |

3.85% |

| North America Retail Pharmacy Market Size 2032 |

USD 732,810.86 Million |

Market Overview

The North America Retail Pharmacy Market is projected to grow from USD 541,858.52 million in 2024 to an estimated USD 732,810.86 million by 2032, with a compound annual growth rate (CAGR) of 3.85% from 2025 to 2032. This growth reflects a steady demand for retail pharmacy services and products, driven by a combination of factors including an aging population and increasing healthcare needs across the region

Several drivers are fueling the growth of the North American retail pharmacy market. These include the rising prevalence of chronic diseases, growing awareness of preventive healthcare, and the increasing adoption of over-the-counter medications. Additionally, advancements in digital health services, including online prescriptions and telepharmacy, are reshaping the industry, providing greater convenience to consumers and expanding market reach. The integration of digital tools, e-commerce platforms, and pharmacy automation also plays a key role in streamlining operations and enhancing service offerings.

Geographically, the North America Retail Pharmacy Market is primarily driven by the U.S. and Canada, with the U.S. accounting for the majority of the market share. This region is characterized by a well-established healthcare infrastructure, supportive government regulations, and a strong presence of leading pharmacy chains such as CVS Health, Walgreens, and Rite Aid. Additionally, the market benefits from ongoing innovations in drug delivery and patient care, with key players continuously expanding their product portfolios to cater to evolving consumer needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The North America Retail Pharmacy Market is projected to grow from USD 541,858.52 million in 2024 to USD 732,810.86 million by 2032, at a CAGR of 3.85% from 2025 to 2032.

- The Global Retail Pharmacy Market is expected to grow from USD 14,45,920.00 million in 2024 to USD 19,65,958.05 million by 2032, at a CAGR of 3.92% from 2025 to 2032.

- Key drivers of growth include the rising prevalence of chronic diseases, increasing consumer demand for over-the-counter medications, and the shift towards preventive healthcare services.

- Digital health advancements, such as online prescriptions, telepharmacy, and pharmacy automation, are reshaping the retail pharmacy landscape, improving service efficiency and expanding market reach.

- The U.S. dominates the North American retail pharmacy market, supported by its well-established healthcare infrastructure, strong pharmacy chains, and advanced digital health integration.

- Canada’s retail pharmacy market is experiencing steady growth, driven by a rising aging population, government healthcare policies, and expanding pharmacy service offerings, including wellness and vaccination programs.

- Market restraints include pricing pressures due to regulatory changes, rising competition from e-commerce pharmacies, and complex reimbursement structures affecting profit margins.

- The competitive landscape is marked by major players such as CVS Health, Walgreens Boots Alliance, and Rite Aid, who are expanding services and leveraging digital tools to stay competitive in a rapidly evolving market.

Report Scope

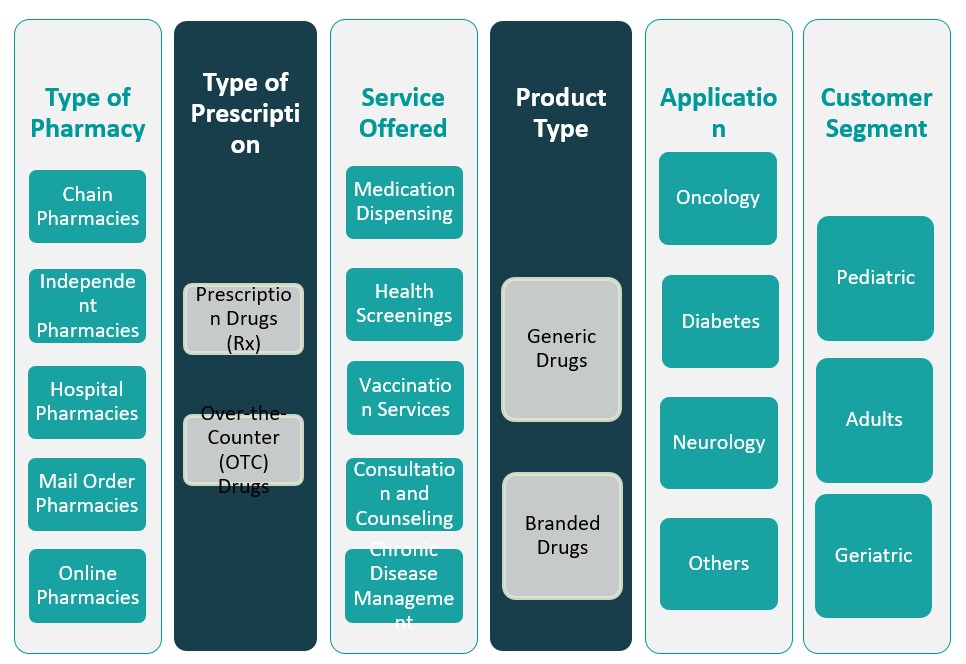

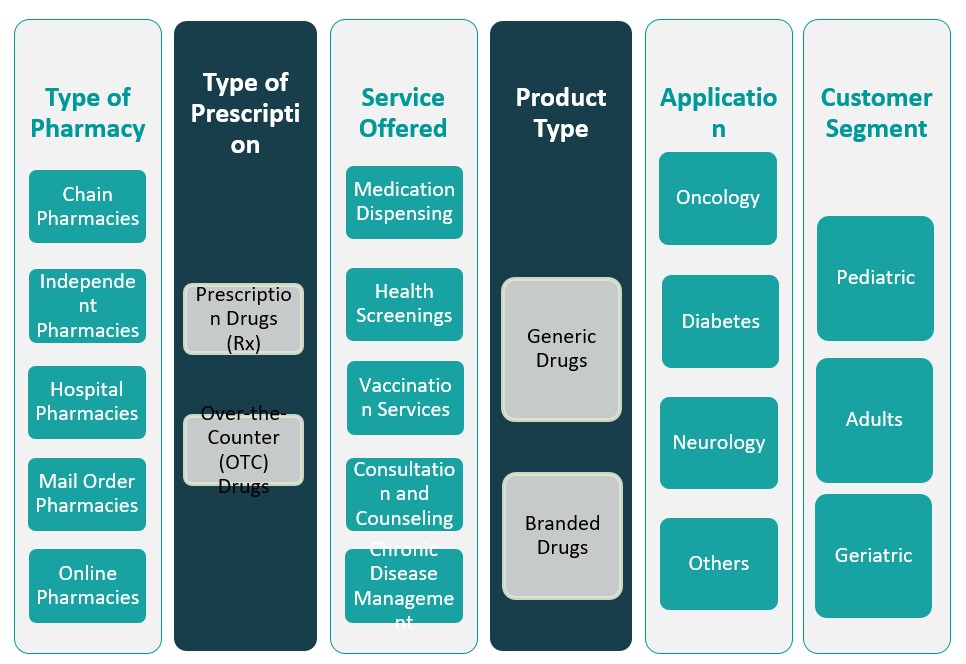

This report segments the North America Retail Pharmacy Market as follows:

Market Drivers

Rising Prevalence of Chronic Diseases and Aging Population

The increasing incidence of chronic conditions such as diabetes, hypertension, cardiovascular disorders, and respiratory diseases significantly fuels the demand for retail pharmacy services in North America. These long-term health conditions often require consistent medication, monitoring, and patient support, all of which drive recurring pharmacy visits and prescription refills. For instance, according to the Centers for Disease Control and Prevention (CDC), 6 in 10 adults in the U.S. have a chronic disease, and 4 in 10 have two or more chronic conditions, highlighting the need for ongoing pharmaceutical care. Furthermore, the aging population across the U.S. and Canada further amplifies this trend. As individuals age, they are more prone to chronic illnesses and polypharmacy, leading to a sustained rise in prescription drug usage. U.S. Census Bureau projects that the population aged 65 and over will surpass 80 million by 2040, emphasizing the growing demand for accessible healthcare solutions. This demographic shift places retail pharmacies in a crucial role in delivering accessible, cost-effective, and routine healthcare solutions, positioning them as essential service providers for ongoing patient management and wellness.

Expansion of E-commerce and Digital Pharmacy Services

The North America retail pharmacy market is witnessing a substantial transformation with the increasing integration of digital technologies and online platforms. The growth of e-commerce in the pharmaceutical sector, particularly post-COVID-19, has dramatically altered consumer behavior, with more patients opting for doorstep medication deliveries and remote consultations. For instance, Amazon Pharmacy has introduced features like prescription price comparison and home delivery, making medication access more convenient for millions of users. Telepharmacy services, electronic prescriptions (eRx), and mobile health apps are streamlining the entire medication management process while ensuring improved adherence and patient convenience. CVS Health reported a significant increase in digital engagement, with over 35 million users actively utilizing its mobile app for prescription management and health services. This digital shift not only boosts customer retention but also enables pharmacies to serve wider geographic regions without the need for physical expansion. The convenience, efficiency, and contactless delivery model of digital pharmacies are reshaping the retail pharmacy landscape, offering a compelling growth driver.

Increasing Focus on Preventive Healthcare and Wellness Products

Consumers in North America are increasingly inclined toward preventive healthcare, which includes nutritional supplements, vitamins, personal health monitoring tools, and over-the-counter (OTC) medications. This shift is influenced by growing health consciousness, awareness of lifestyle diseases, and rising healthcare costs that make preventive strategies more appealing. Retail pharmacies are capitalizing on this trend by diversifying their product offerings beyond prescription medications to include wellness and self-care products. Many retail chains are also incorporating health screenings, vaccination services, and wellness programs within their stores to align with evolving consumer expectations. This expanded scope transforms pharmacies from mere medication dispensers into holistic health hubs. The convergence of pharmaceutical care and wellness services not only strengthens customer loyalty but also creates additional revenue streams, enhancing the overall market potential.

Strong Presence of Key Players and Consolidation Trends

North America is home to some of the world’s most dominant retail pharmacy chains, including CVS Health, Walgreens Boots Alliance, Rite Aid, and Walmart Pharmacy. These companies leverage their extensive distribution networks, strong brand recognition, and strategic partnerships with healthcare providers and insurance firms to maintain a competitive edge. Their scale and reach allow for better pricing power, robust supply chain management, and consistent customer access. Furthermore, the market is experiencing a wave of consolidation, with major players acquiring smaller chains and independent pharmacies to expand their footprints. This consolidation improves operational efficiency, enhances service capabilities, and enables companies to invest in technology, data analytics, and personalized care initiatives. Additionally, partnerships with telehealth providers and pharmacy benefit managers (PBMs) further strengthen the position of retail pharmacies in the broader healthcare ecosystem. This robust competitive environment and strategic consolidation drive sustained market growth and innovation.

Market Trends

Integration of Telepharmacy and Digital Health Platforms

Retail pharmacies across North America are increasingly adopting telepharmacy and digital health platforms to enhance accessibility and patient engagement. For instance, during the COVID-19 pandemic, telepharmacy services in North America saw a 77% preference rate among patients for remote consultations over in-person visits, highlighting the growing reliance on digital healthcare solutions. Telepharmacy enables licensed pharmacists to provide remote consultations, prescription verifications, and patient counseling through digital channels. This improves access to pharmaceutical care in underserved and rural areas. Additionally, retail chains are integrating mobile apps and online portals that allow customers to schedule virtual consultations, manage prescriptions, receive medication reminders, and access health data. Reports indicate that telepharmacy services have reduced hospital admissions by improving medication adherence and patient monitoring. These platforms not only improve medication adherence but also reduce the burden on physical stores, lower operational costs, and increase customer convenience. As consumers demand more flexible and technology-driven healthcare solutions, the widespread adoption of telepharmacy and digital health tools continues to define the competitive landscape in the region.

Growth in Personalized Medicine and Pharmacogenomics Services

The North America retail pharmacy market is witnessing a significant shift toward personalized medicine, driven by advancements in pharmacogenomics and precision healthcare. For example, genetic testing costs have significantly decreased, making pharmacogenomics services more accessible to patients. Retail pharmacies are beginning to incorporate genetic screening and data analytics into their service offerings to tailor drug therapies based on individual patient profiles. This trend enhances treatment efficacy, reduces adverse drug reactions, and improves overall patient outcomes. Studies show that personalized medicine approaches have led to a 30% improvement in treatment response rates for chronic conditions. Pharmacies are also training their staff in pharmacogenomic interpretation and integrating these services with electronic health records (EHRs) for seamless care delivery. This personalized approach aligns with the broader healthcare movement toward value-based care. As genetic testing becomes more affordable and consumer demand for customized solutions grows, retail pharmacies are positioning themselves as critical access points for pharmacogenomics-driven medication management, offering a competitive advantage and boosting customer trust.

Expansion of In-Store Clinical Services and Health Hubs

Retail pharmacies in North America are evolving into full-fledged health hubs by expanding in-store clinical services beyond traditional medication dispensing. Pharmacies now offer immunizations, point-of-care diagnostics, chronic disease screenings, minor illness treatments, and wellness counseling. This shift responds to growing consumer demand for accessible, affordable, and convenient healthcare services. Major chains like CVS Health’s HealthHUBs and Walgreens Health Corners exemplify this trend, where dedicated areas within stores focus on preventive care and disease management. These retail-based clinics help reduce the burden on primary care providers and emergency rooms while improving patient access to timely interventions. By integrating pharmacists more deeply into the care continuum, retail pharmacies enhance their role in coordinated healthcare delivery. This expansion also generates new revenue streams and strengthens customer relationships, making pharmacies indispensable players in the outpatient care model. The rising demand for on-the-go healthcare solutions ensures continued investment in and expansion of these health-focused retail formats.

Adoption of AI and Automation in Pharmacy Operations

Artificial intelligence (AI) and automation are transforming pharmacy operations in North America, streamlining workflows and enhancing service quality. Retail pharmacies are implementing robotic dispensing systems, automated prescription refills, and AI-powered chatbots to improve accuracy, reduce wait times, and optimize labor efficiency. These technologies not only reduce the risk of human error but also free up pharmacists to focus on patient-centric services such as medication counseling and health screenings. AI tools are also being utilized for inventory management, demand forecasting, fraud detection, and personalized marketing. Leading pharmacy chains are integrating machine learning algorithms to analyze customer data and offer targeted health solutions or loyalty programs. Moreover, predictive analytics helps identify high-risk patients and tailor interventions accordingly. As digital transformation becomes a core strategic priority, the deployment of AI and automation in retail pharmacy operations continues to accelerate, ensuring better scalability, operational excellence, and patient satisfaction across the region.

Market Challenges

Intensifying Price Pressures and Reimbursement Challenges

Retail pharmacies in North America face significant price pressures driven by complex reimbursement structures, rising operational costs, and heightened competition. Pharmacy Benefit Managers (PBMs) and insurance companies exert considerable influence over pricing and reimbursement rates, often resulting in reduced margins for retail pharmacies. Additionally, the shift toward generic medications and government initiatives to control drug prices have further compressed profit margins. For instance, approximately 90% of prescriptions filled in the United States are for generic medications, which, while cost-effective for consumers, contribute to reduced revenue for pharmacies. Independent pharmacies, in particular, struggle to maintain profitability amid aggressive pricing strategies employed by larger chains and online pharmacies. Moreover, the growing popularity of discount drug programs and mail-order services increases downward pressure on retail pharmacy revenues. The administrative burden of navigating insurance claims, coupled with frequent reimbursement delays and clawbacks, adds operational complexity. As retail pharmacies attempt to deliver enhanced services such as telepharmacy, wellness programs, and in-store clinics, they must manage these added investments without guaranteed returns, making financial sustainability a persistent challenge.

Regulatory Compliance and Evolving Healthcare Policies

The North America retail pharmacy market operates within a stringent regulatory environment that demands constant adaptation to evolving healthcare policies and compliance requirements. Federal and state regulations govern nearly every aspect of pharmacy operations, including licensing, drug dispensing, data security, telehealth services, and patient privacy. Frequent changes to healthcare laws, such as shifts in Medicare and Medicaid reimbursements or new telepharmacy guidelines, create operational uncertainties and increase compliance costs. Pharmacies must also navigate the complexities of controlled substance regulations, especially with rising scrutiny related to opioid dispensing and substance abuse prevention. Furthermore, the increasing emphasis on electronic health records (EHR) integration and patient data protection under regulations like HIPAA adds to the technological and administrative burden. Non-compliance can lead to substantial penalties, reputational damage, and legal action. As the healthcare landscape continues to shift toward value-based care models, retail pharmacies must continuously upgrade their systems, train their staff, and invest in compliance infrastructure to stay aligned with regulatory expectations, posing a substantial operational challenge.

Market Opportunities

Expansion into Preventive Healthcare and Chronic Disease Management

Retail pharmacies in North America have a significant opportunity to expand their role in preventive healthcare and chronic disease management. With the rising prevalence of conditions such as diabetes, hypertension, and cardiovascular diseases, consumers increasingly seek accessible and affordable care solutions outside of traditional clinical settings. Pharmacies can capitalize on this trend by offering expanded services such as health screenings, immunizations, personalized medication therapy management (MTM), and wellness consultations. By integrating pharmacists more deeply into patient care teams and offering disease education programs, retail pharmacies can position themselves as primary touchpoints for ongoing patient engagement. This strategic expansion not only addresses growing healthcare demands but also enhances customer loyalty, drives foot traffic, and opens new revenue streams, strengthening the pharmacy’s role within the broader healthcare ecosystem.

Leveraging Digital Transformation and Omnichannel Strategies

The growing adoption of digital health solutions presents a powerful opportunity for North American retail pharmacies to transform their operations and enhance customer experiences. By investing in telepharmacy platforms, mobile health apps, e-prescription services, and online ordering systems, pharmacies can deliver greater convenience, personalized care, and broader service access. Omnichannel strategies that seamlessly integrate in-store and online experiences enable pharmacies to better meet evolving consumer expectations for flexibility and immediacy. Additionally, data analytics can be leveraged to offer targeted health promotions, loyalty programs, and preventive care initiatives. As consumers increasingly prioritize digital engagement in healthcare, retail pharmacies that embrace innovation and technology integration stand to gain a competitive advantage and secure sustainable long-term growth.

Market Segmentation Analysis

By Type of Pharmacy

The North America retail pharmacy market is segmented by type of pharmacy into chain pharmacies, independent pharmacies, hospital pharmacies, mail order pharmacies, and online pharmacies. Chain pharmacies dominate the market due to their widespread presence, strong brand recognition, and integrated healthcare services. Independent pharmacies, while facing challenges from larger chains, continue to serve niche and rural markets by offering personalized services. Hospital pharmacies are increasingly expanding their outpatient services, aligning with the trend toward integrated patient care. Mail order pharmacies have gained traction by offering convenience and cost savings, particularly for maintenance medications. Online pharmacies are experiencing rapid growth, driven by consumer demand for contactless delivery and telepharmacy services, a trend accelerated by digital health advancements.

By Type of Prescription

Based on the type of prescription, the market is divided into prescription drugs (Rx) and over-the-counter (OTC) drugs. Prescription drugs hold a significant market share due to the high burden of chronic diseases and the necessity for ongoing medication management. However, the OTC segment is witnessing faster growth, propelled by increased health awareness, self-medication practices, and consumer preference for preventive care solutions. Retail pharmacies are expanding their OTC product ranges to cater to this growing demand, enhancing profitability and customer engagement.

Segments

Based on Type of Pharmacy

- Chain Pharmacies

- Independent Pharmacies

- Hospital Pharmacies

- Mail Order Pharmacies

- Online Pharmacies

Based on Type of prescription

- Prescription Drugs (Rx)

- Over-the-Counter (OTC) Drugs

Based on Service offered

- Medication Dispensing

- Health Screenings

- Vaccination Services

- Consultation and Counseling

- Chronic Disease Management

Based on Product Type

- Generic Drugs

- Branded Drugs

Based on Application

- Oncology

- Diabetes

- Neurology

- Others

Based on Customer

- Paediatric

- Adults

- Geriatric

Based on Region

- United States

- Canada

- Mexico

Regional Analysis

United States (85.4%)

The North America Retail Pharmacy Market is dominated by the United States, which accounted for 85.4% of the total market share in 2024. The U.S. retail pharmacy sector benefits from a highly developed healthcare infrastructure, a large and aging population, and high healthcare spending per capita. Major pharmacy chains such as CVS Health, Walgreens Boots Alliance, and Walmart Pharmacy have a widespread network across the country, offering prescription medications, over-the-counter (OTC) products, vaccination services, and chronic disease management programs. Additionally, the U.S. has been at the forefront of digital transformation in pharmacy services, with rapid adoption of telepharmacy platforms, online medication ordering, and AI-based healthcare management tools. The high burden of chronic diseases like diabetes, cardiovascular disorders, and neurological conditions further drives steady demand for retail pharmacy services across urban and rural areas.

Canada (10.7%)

Canada holds a market share of 10.7% in the North America retail pharmacy landscape. The Canadian market is supported by a strong public healthcare system, increasing emphasis on preventive care, and rising incidence of chronic conditions. Retail pharmacy chains such as Shoppers Drug Mart and Rexall have expanded their services to include immunizations, health screenings, and patient counseling, aligning with government initiatives to shift non-urgent care away from hospitals. The growing trend of e-pharmacy adoption, especially post-pandemic, has opened new opportunities for Canadian pharmacies to enhance customer engagement through digital platforms. Additionally, Canada’s aging population continues to drive prescription drug sales, positioning retail pharmacies as critical components of the healthcare delivery system.

Key players

- CVS Health

- Walgreens Boots Alliance

- Walmart

- Kroger

- Rite Aid Corp.

Competitive Analysis

The North America retail pharmacy market is highly competitive, dominated by major players such as CVS Health, Walgreens Boots Alliance, Walmart, Kroger, and Rite Aid Corp. These companies leverage extensive retail networks, strong brand recognition, and diversified service offerings to maintain their market positions. CVS Health leads the market with its integrated healthcare model, combining pharmacy services with insurance and primary care initiatives. Walgreens continues to expand its digital health solutions and partnerships with healthcare providers to enhance customer engagement. Walmart capitalizes on its broad store footprint and competitive pricing strategies to strengthen its pharmacy business. Kroger emphasizes health and wellness initiatives through its in-store clinics and personalized healthcare programs. Rite Aid focuses on improving operational efficiency and expanding clinical services to regain market share. Intense competition drives continuous innovation, strategic acquisitions, and investments in digital transformation across the sector, positioning these companies for sustained growth and customer retention.

Recent Developments

- As of March 31, 2024, Apollo Pharmacy operated 6,030 stores across approximately 1,200 cities and towns in 22 states and 5 union territories. The company continues to expand its digital healthcare platform, offering services like online medicine delivery and virtual doctor consultations.

- In October 2024, Caring Pharmacy Retail Management Sdn Bhd, a 75%-owned unit of 7-Eleven Malaysia Holdings Bhd, announced acquisitions of equity interest and business assets in several pharmaceutical outlets for a combined cash consideration of RM48.86 million.

- In June 2024, the Australian Competition and Consumer Commission (ACCC) expressed concerns that the proposed acquisition of Chemist Warehouse by Sigma Healthcare could substantially lessen competition in pharmacy retailing, potentially leading to higher prices and reduced service quality.

- In January 2025, Watsons Philippines ended 2024 with 1,166 stores, expanding its community pharmacy format. The company opened more than 50 stores outside of Metro Manila.

Market Concentration and Characteristics

The North America Retail Pharmacy Market is moderately concentrated, with a few major players such as CVS Health, Walgreens Boots Alliance, Walmart, Kroger, and Rite Aid Corp. accounting for a significant share of the market. These companies dominate through extensive retail networks, diversified healthcare offerings, strong brand loyalty, and advanced digital integration. The market is characterized by a high level of service diversification, with pharmacies expanding beyond traditional medication dispensing to include vaccination services, health screenings, chronic disease management, and telepharmacy solutions. Rapid adoption of technology, growing focus on personalized healthcare, and strategic mergers and acquisitions further define the competitive landscape. Despite the dominance of large chains, independent pharmacies maintain a notable presence, especially in underserved and rural areas, offering personalized services to niche markets. The market’s evolution toward integrated, patient-centric care models and digital engagement continues to reshape its structure and growth trajectory.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmacy, Type of prescription, Service offered, Product Type, Application, Customer and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The North America retail pharmacy market will continue expanding as demand for chronic disease management and preventive healthcare services increases across the region. Pharmacies will play a more prominent role in delivering accessible and affordable healthcare solutions.

- Digital transformation will remain a major growth driver, with retail pharmacies investing in telepharmacy platforms, online medication delivery services, and AI-powered customer engagement tools to enhance service efficiency and patient convenience.

- Integration of pharmacies into broader healthcare ecosystems will strengthen, as collaborations with hospitals, insurance companies, and telehealth providers become critical for delivering comprehensive and coordinated patient care.

- Personalized medicine and pharmacogenomics will see greater adoption in retail settings, enabling pharmacists to offer customized medication therapies based on genetic profiles and improving patient outcomes.

- The expansion of in-store clinical services, including health screenings, vaccination programs, and wellness counseling, will redefine retail pharmacies as holistic health hubs rather than just medication dispensers.

- Price competition and reimbursement challenges will persist, pushing pharmacies to diversify revenue streams through wellness products, healthcare services, and strategic partnerships with pharmaceutical companies and technology providers.

- Pharmacies will increasingly focus on geriatric care, offering specialized medication management, vaccination drives, and chronic disease support programs to address the needs of an aging population.

- Sustainability initiatives will gain importance, with retail pharmacies adopting eco-friendly packaging, optimizing supply chain logistics, and participating in pharmaceutical waste reduction programs to align with environmental goals.

- Regulatory shifts related to drug pricing, telepharmacy practices, and patient data protection will drive pharmacies to enhance compliance infrastructure and invest in continuous staff training and technological upgrades.

- The competitive landscape will intensify, leading to further consolidation as large players acquire smaller chains and independents to expand their geographical reach, strengthen market presence, and achieve operational efficiencies.