Market Overview

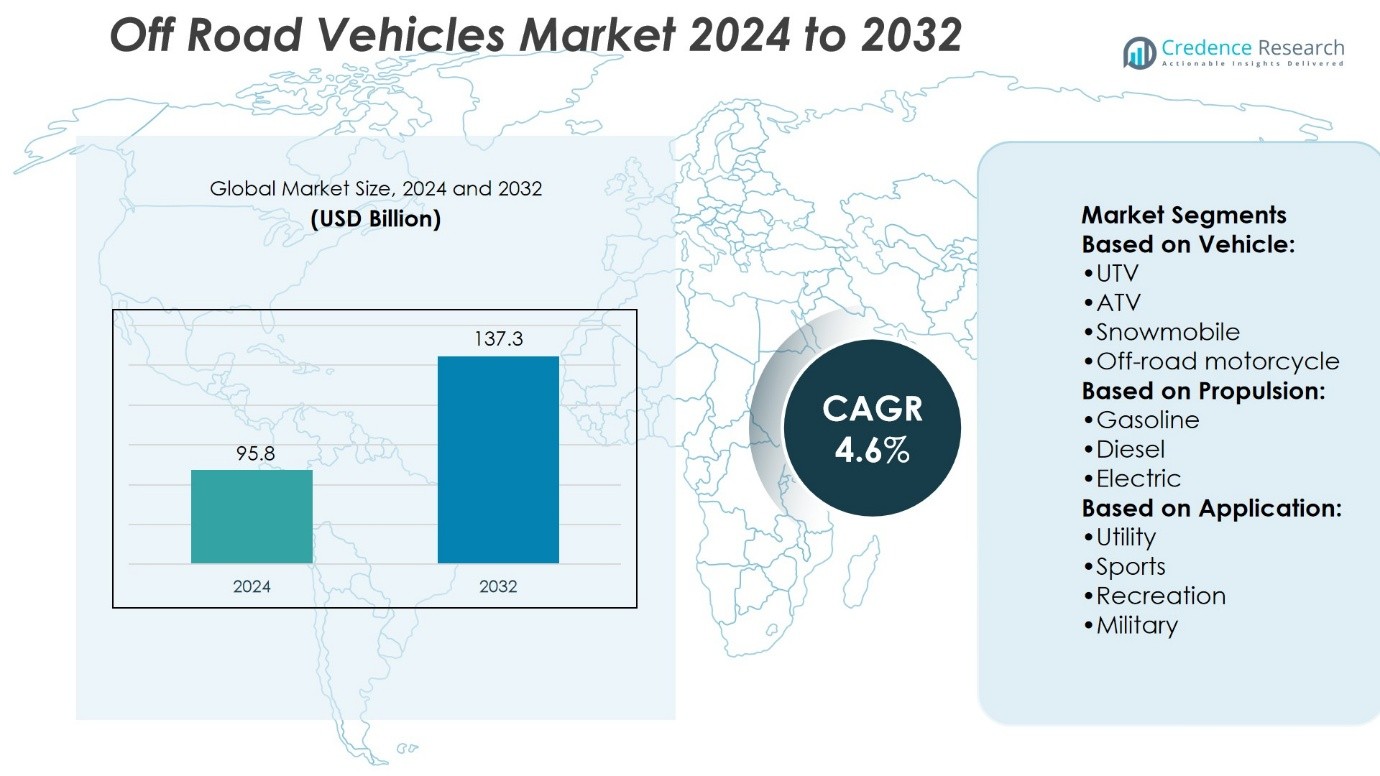

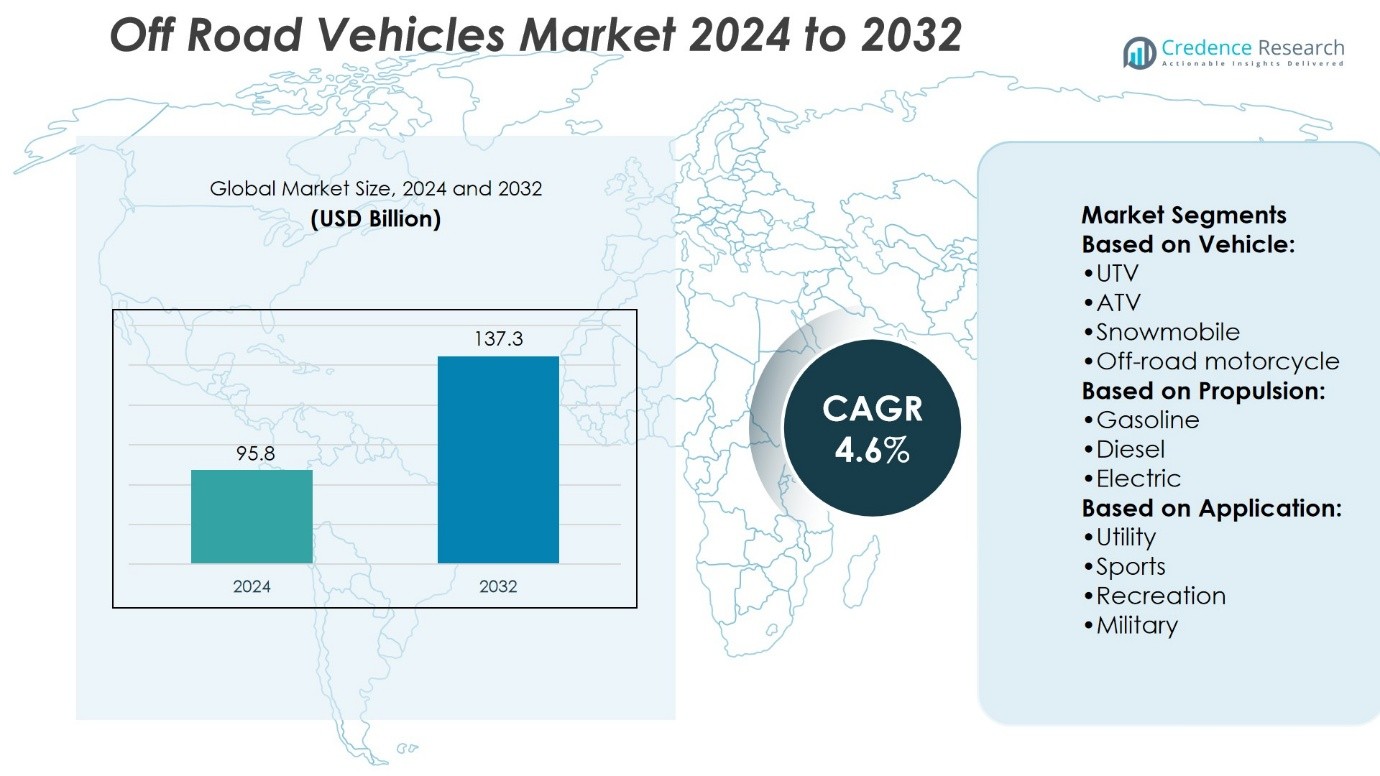

Off-Road Vehicles Market size was valued at USD 95.8 billion in 2024 and is anticipated to reach USD 137.3 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Off-Road Vehicles Market Size 2024 |

USD 95.8 Billion |

| Off-Road Vehicles Market, CAGR |

4.6% |

| Off-Road Vehicles Market Size 2032 |

USD 137.3 Billion |

The Off-Road Vehicles Market is driven by rising demand for recreational activities, expanding applications in agriculture, construction, and defense, and growing consumer interest in adventure tourism. It benefits from technological advancements such as advanced suspension systems, fuel-efficient engines, and connectivity features that improve safety and performance. The market also shows a strong trend toward electrification, with hybrid and electric models gaining attention amid sustainability goals. Customization and aftermarket services strengthen consumer engagement, while digital sales platforms and financing options improve accessibility. These drivers and trends collectively shape a dynamic industry with broad opportunities for growth.

The Off-Road Vehicles Market demonstrates strong geographical presence, with North America leading due to high recreational demand, Europe showing steady growth through sustainability-focused innovations, and Asia-Pacific emerging as the fastest-growing region supported by agriculture and adventure tourism. Latin America and the Middle East & Africa hold smaller but steady shares driven by utility and niche applications. Key players shaping the market include Polaris, Yamaha, Honda, BRP, Arctic Cat, Kawasaki, KTM, KYMCO, Hisun, and Zero Motorcycles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Off-Road Vehicles Market size was valued at USD 95.8 billion in 2024 and is projected to reach USD 137.3 billion by 2032, growing at a CAGR of 4.6%.

- Rising demand for recreational activities and expansion into agriculture, construction, and defense drive strong adoption.

- Technological advancements in suspension, fuel efficiency, and smart connectivity enhance performance and safety.

- Electrification emerges as a major trend, with hybrid and electric models gaining traction under sustainability goals.

- Competition intensifies with global players focusing on innovation, customization, and digital sales channels.

- High ownership costs, safety risks, and strict regulatory standards act as restraints for wider adoption.

- North America leads market share, Europe shows steady eco-focused growth, Asia-Pacific records fastest expansion, while Latin America and Middle East & Africa reflect smaller yet consistent opportunities.

Market Drivers

Rising Consumer Interest in Adventure and Recreational Activities

The growing enthusiasm for outdoor sports and recreational travel drives consistent demand for the Off-Road Vehicles Market. Consumers engage in activities such as trail riding, desert safaris, hunting, and camping, which require specialized vehicles. It caters to diverse user groups, including young enthusiasts and families seeking leisure activities. Expanding tourism and off-road adventure parks increase accessibility and visibility of such vehicles. Lifestyle changes emphasizing active and outdoor-oriented experiences push steady sales. Demand intensifies in regions with natural terrains suitable for off-road driving.

- For instance, the total number of global UTV (side-by-side) units sold in 2023 was significantly higher than the 210,000 figure that was cited. Market research reports show a much larger market, with sales driven by demand across recreational, agricultural, and commercial sectors.

Technological Advancements Enhancing Vehicle Performance

Continuous innovation in design and engineering supports growth within the market. Manufacturers introduce advanced suspension systems, fuel-efficient engines, and durable drivetrains to improve reliability. It integrates features such as electronic stability control, adaptive traction, and GPS-enabled navigation for safer off-road performance. Lightweight materials improve efficiency without compromising strength. Hybrid and electric models enter the market, aligning with sustainability targets. These innovations attract new buyers who value both performance and environmental responsibility.

- For instance, Toyota introduced its Multi-Terrain Select system in the Land Cruiser 300 series in 2021, which optimizes traction across six driving modes, while Tesla reported a drivetrain efficiency of 92% in its 2023 Model S Plaid.

Expanding Utility in Commercial and Military Applications

The adoption of off-road vehicles extends beyond recreation into commercial and defense applications. Construction firms, mining operators, and agriculture businesses deploy these vehicles for demanding terrain conditions. It provides essential mobility for military operations requiring durability and adaptability. Utility-focused models are designed with load-bearing and towing capabilities to serve professional needs. Emergency and rescue services also rely on these vehicles for accessing remote areas. Rising infrastructure projects and defense modernization programs support long-term demand.

Strong Distribution Networks and Rising Customization Demand

Expanding dealer networks, financing options, and digital sales platforms improve market penetration. It strengthens customer accessibility through online configurators and direct sales channels. Buyers increasingly seek personalized options, including engine modifications, aesthetic upgrades, and safety enhancements. Customization trends create added revenue streams for manufacturers and aftermarket service providers. Growth in social media and digital communities further accelerates awareness and peer-driven purchases. This evolving consumer preference for tailored vehicles sustains steady momentum in the market.

Market Trends

Shift Toward Electrification and Sustainable Models

The Off-Road Vehicles Market experiences a steady transition toward electric and hybrid models. Consumers demand eco-friendly options as environmental awareness increases. It encourages manufacturers to invest in battery efficiency, lightweight materials, and charging infrastructure. Electric ATVs and UTVs are entering trails and recreational zones, offering quieter and emission-free rides. Governments support this shift with policies and incentives that favor sustainable mobility. This trend reshapes product portfolios and influences long-term innovation strategies.

- For instance, Polaris launched its RANGER XP Kinetic in 2022 with a 110-horsepower electric motor and a towing capacity of 1,134 kilograms, showing how electrification enhances both performance and sustainability.

Integration of Smart Features and Connectivity

The market embraces digitalization through advanced connectivity and smart technologies. It incorporates GPS navigation, real-time performance monitoring, and mobile app integration into new models. Features such as driver assistance, automated controls, and AI-based diagnostics improve safety and convenience. Consumers value personalized ride data that enhances performance insights. Connectivity also supports fleet management for commercial users in agriculture and construction. This trend elevates user experience and widens adoption across both recreational and utility segments.

- For instance, KTM offers its Ride-by-Wire electronic throttle system on several motorcycles, including models produced in 2023. The system provides customizable riding modes and automatically adjusts traction control based on real-time sensor inputs, enhancing throttle control and safety. KTM has detailed this technology and its benefits in official documentation.

Growing Popularity of Customization and Lifestyle-Oriented Design

Rising consumer preference for personalized experiences drives strong demand for customized vehicles. The Off-Road Vehicles Market adapts by offering modifications in suspension, lighting, seating, and safety gear. It aligns with lifestyle branding, where vehicles reflect personal identity and adventure spirit. Manufacturers collaborate with aftermarket specialists to expand options for enthusiasts. Social media platforms showcase custom builds, influencing younger demographics to invest in tailored models. This trend creates fresh revenue opportunities and strengthens brand loyalty.

Expansion into Adventure Tourism and Commercial Applications

Adventure tourism growth and professional utility needs fuel wider usage of off-road vehicles. It supports operators in desert safaris, mountain expeditions, and recreational parks. Commercial adoption expands across sectors such as construction, mining, and forestry, where mobility in difficult terrain is critical. Partnerships between tourism providers and vehicle manufacturers promote immersive off-road experiences. Events, rallies, and sporting competitions further enhance visibility and appeal. This trend positions off-road vehicles as both lifestyle products and functional assets.

Market Challenges Analysis

High Ownership Costs and Regulatory Constraints

The Off-Road Vehicles Market faces challenges linked to high acquisition, maintenance, and insurance costs. Premium pricing of advanced models limits adoption among price-sensitive consumers. It requires significant spending on spare parts, specialized servicing, and aftermarket upgrades, creating long-term ownership concerns. Stringent safety and emission regulations increase production costs for manufacturers. Complex certification processes delay product launches and reduce flexibility for smaller brands. Market penetration in developing regions slows due to financial barriers and regulatory hurdles.

Safety Risks and Environmental Concerns

Frequent accidents, rollover incidents, and terrain-related hazards create a perception of safety risks that affect consumer confidence. It demands continuous investment in protective features and driver training programs. Off-road activities also raise environmental concerns, including habitat disruption and soil degradation. Growing pressure from environmental groups and policymakers restricts access to certain trails and recreational zones. Manufacturers struggle to balance performance with sustainability requirements. These factors collectively limit growth potential and demand careful strategic response.

Market Opportunities

Expansion of Electrification and Green Mobility Solutions

The Off-Road Vehicles Market holds strong opportunities through the rise of electric and hybrid vehicle models. Consumers increasingly prefer eco-friendly options that reduce emissions and operating noise. It encourages manufacturers to invest in advanced battery technologies, renewable charging infrastructure, and lightweight composite materials. Partnerships with energy providers can expand charging networks in remote areas, enabling wider adoption. Governments continue to support sustainable transportation with incentives and subsidies, creating favorable conditions for manufacturers. The growth of electric off-road models positions the industry to attract new consumer segments and meet future environmental regulations.

Growth of Adventure Tourism and Specialized Commercial Use

Adventure tourism expansion and demand for professional utility create promising prospects for manufacturers. The market benefits from rising interest in off-road activities such as desert safaris, mountain exploration, and outdoor sports. It enables tourism operators to form collaborations with vehicle brands, offering immersive travel experiences that attract high-value customers. Commercial sectors including agriculture, construction, and mining require reliable mobility solutions in challenging terrains, providing steady demand for utility-focused models. Development of multi-purpose vehicles tailored for both recreational and professional use enhances revenue streams. These opportunities strengthen the industry’s global footprint and broaden customer engagement.

Market Segmentation Analysis:

By Vehicle

The Off-Road Vehicles Market demonstrates strong diversity across vehicle categories including UTVs, ATVs, snowmobiles, and off-road motorcycles. Utility Terrain Vehicles (UTVs) lead in popularity due to their load-bearing capacity, safety features, and adaptability across agriculture, construction, and recreational activities. It finds steady demand from professional users requiring multipurpose solutions. All-Terrain Vehicles (ATVs) maintain a significant share, particularly among sports and recreational enthusiasts, because of their compact size and maneuverability. Snowmobiles dominate demand in colder regions where mobility across snow-covered landscapes is essential. Off-road motorcycles attract a younger demographic interested in competitive racing, trail riding, and adventure sports.

- For instance, Yamaha implemented a Tri-Mode On-Command 4WD system in its 2023 Grizzly 700 ATV. This system allows the driver to switch between 2WD, 4WD, and differential lock modes with the push of a button. The system is known for its seamless and instantaneous engagement, but no specific switching time has been publicly verified by Yamaha.

By Propulsion

Propulsion-based segmentation highlights the transition from conventional fuel engines to alternative options. Gasoline-powered vehicles dominate due to widespread availability and established fueling infrastructure. Diesel variants retain relevance in utility applications where higher torque and endurance are critical. It shows growing momentum in electric models as manufacturers prioritize sustainability, low maintenance, and quieter operation. Advancements in battery efficiency and renewable charging solutions enhance adoption prospects. The rise of hybrid models further bridges consumer preferences between traditional and electric propulsion.

- For instance, the Arcimoto FUV uses two electric motors that produce a combined 57 kW (77 hp). The vehicle is equipped with a 20-kWh lithium-ion battery pack, though a smaller 12 kWh battery was an available option.

By Application

Application-based analysis underlines the versatile use cases of off-road vehicles. Utility applications hold a substantial share, with adoption in sectors such as agriculture, forestry, mining, and construction. It serves as a critical mobility solution in challenging terrains, driving consistent demand from commercial users. Sports applications gain attention through competitive events, racing leagues, and recreational parks. Recreational usage expands globally as consumers seek adventure tourism and outdoor leisure activities. Military applications remain strategically important, with defense organizations investing in durable and adaptable vehicles for tactical mobility and logistical support.

Segments:

Based on Vehicle:

- UTV

- ATV

- Snowmobile

- Off-road motorcycle

Based on Propulsion:

Based on Application:

- Utility

- Sports

- Recreation

- Military

Based on the Geography:

o U.S.

o Canada

o Mexico

o UK

o France

o Germany

o Italy

o Spain

o Russia

o Belgium

o Netherlands

o Austria

o Sweden

o Poland

o Denmark

o Switzerland

o Rest of Europe

o China

o Japan

o South Korea

o India

o Australia

o Thailand

o Indonesia

o Vietnam

o Malaysia

o Philippines

o Taiwan

o Rest of Asia Pacific

o Brazil

o Argentina

o Peru

o Chile

o Colombia

o Rest of Latin America

o UAE

o KSA

o Israel

o Turkey

o Iran

o Rest of Middle East

o Egypt

o Nigeria

o Algeria

o Morocco

o Rest of Africa

Regional Analysis

North America

North America dominates the Off-Road Vehicles Market with around 65% share. The U.S. and Canada lead demand due to a strong culture of trail riding, hunting, camping, and motorsports. It benefits from advanced infrastructure, well-established dealerships, and strong aftermarket networks. UTVs and ATVs are widely used for both farming and recreation, supporting steady growth. Sports events, rallies, and outdoor tourism further boost visibility. High disposable income and consumer interest in customization also keep demand strong. North America remains the key revenue hub for global players.

Europe

Europe contributes about 15–20% of the market. Countries like Germany, France, and Nordic nations show high adoption due to forestry, farming, and winter sports. Snowmobiles are especially popular in Nordic countries, while compact ATVs see demand in rural areas. It places a strong focus on sustainability, creating opportunities for hybrid and electric models. Stricter emission rules encourage innovation in cleaner technologies. Off-road tourism in the Alps and other rural destinations adds further demand. Europe remains steady, with growth driven by eco-friendly innovation and lifestyle appeal.

Asia-Pacific

Asia-Pacific holds roughly 15% market share but shows the fastest growth. China and India are leading markets, with off-road vehicles widely used in agriculture, rural mobility, and tourism. Rising disposable incomes and urbanization expand recreational purchases among younger consumers. Off-road motorcycles, UTVs, and ATVs are in high demand for both leisure and utility purposes. Governments are promoting adventure tourism, which further supports adoption. It also shows rising interest in electric models, especially in China. Asia-Pacific is expected to close the gap with mature markets in the coming years.

Latin America

Latin America contributes less than 10% to the global market. Brazil and Mexico lead regional demand, supported by agriculture, mining, and outdoor recreation. ATVs and UTVs are popular for farm use and eco-tourism activities. It benefits from diverse terrains such as rainforests, mountains, and deserts, which create unique demand. Adventure sports and outdoor tourism are slowly expanding, creating growth opportunities. Infrastructure challenges and lower purchasing power limit mass adoption. Still, the region offers steady opportunities for utility-focused models.

Middle East & Africa

The Middle East & Africa also account for less than 10% of the market. Demand comes mainly from desert terrains, oil and gas exploration, construction projects, and defense applications. Gulf countries use off-road vehicles for desert safaris and luxury tourism, supporting niche demand. It also provides utility applications for agriculture and mining across Africa. Limited infrastructure and economic uncertainty restrict large-scale growth. However, specialized demand for rugged, durable vehicles remains consistent. Manufacturers see opportunities in fleet sales and tourism partnerships.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Off-Road Vehicles Market players such as Arctic Cat, BRP, Hisun, Honda, Kawasaki, KTM, KYMCO, Polaris, Yamaha, and Zero Motorcycles. The Off-Road Vehicles Market is defined by continuous innovation, regional expansion, and strong brand positioning. Companies focus on expanding product portfolios across ATVs, UTVs, motorcycles, and snowmobiles to serve both recreational and utility applications. The market places emphasis on electrification, with growing investments in hybrid and electric models that align with sustainability goals. Advanced safety features, smart connectivity, and customization options are increasingly integrated to enhance user experience and build loyalty. Strong dealer networks and aftersales services remain critical to maintaining competitiveness, while digital platforms support direct engagement with consumers. Competition is further shaped by the balance between premium offerings for enthusiasts and affordable models for emerging markets. This creates a dynamic environment where innovation, compliance with regulatory standards, and responsiveness to consumer lifestyle trends determine long-term success.

Recent Developments

- In October 2024, Kawasaki launches new Kawasaki commercial brand. The brand will feature a new line of KT model UTVs designed to meet the needs of government and fleet customers. Its KT model UTVs will be built with the distinct demands of the difficult work environments of government services and fleet operations.

- In August 2023, Honda announced a trio of new ATV models in the United States. Additionally, introducing two of its most popular miniMOTO models, the Monkey and the Super Cub C125.

- In May 2023, Polaris introduced the Xpedition UTV, crafted for outdoor enthusiasts who prioritize comfort in all weather conditions. The Xpedition ADV boasts a fully enclosed cabin, including the cargo area. The two-seat model offers 36 inches of covered cargo space.

- In February 2023, BRP announced its all-new mid-cc Can-Am Outlander ATV recreational and utility models. It is designed and built with the emphasis of improving the rider experience at every touchpoint for both work and play.

Report Coverage

The research report offers an in-depth analysis based on Vehicle, Propulsion, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising demand from recreational and utility applications.

- Electric and hybrid off-road vehicles will gain stronger adoption across key regions.

- Manufacturers will invest more in lightweight materials and advanced safety technologies.

- Adventure tourism will drive higher demand for ATVs, UTVs, and off-road motorcycles.

- Customization and aftermarket services will create new revenue opportunities.

- Military and defense sectors will continue to integrate advanced off-road mobility solutions.

- Digital connectivity and smart features will become standard in new vehicle models.

- Asia-Pacific will emerge as the fastest-growing regional market.

- Stricter emission regulations will accelerate innovation in sustainable propulsion systems.

- Strong dealer networks and online platforms will enhance consumer accessibility worldwide.