Market Overview

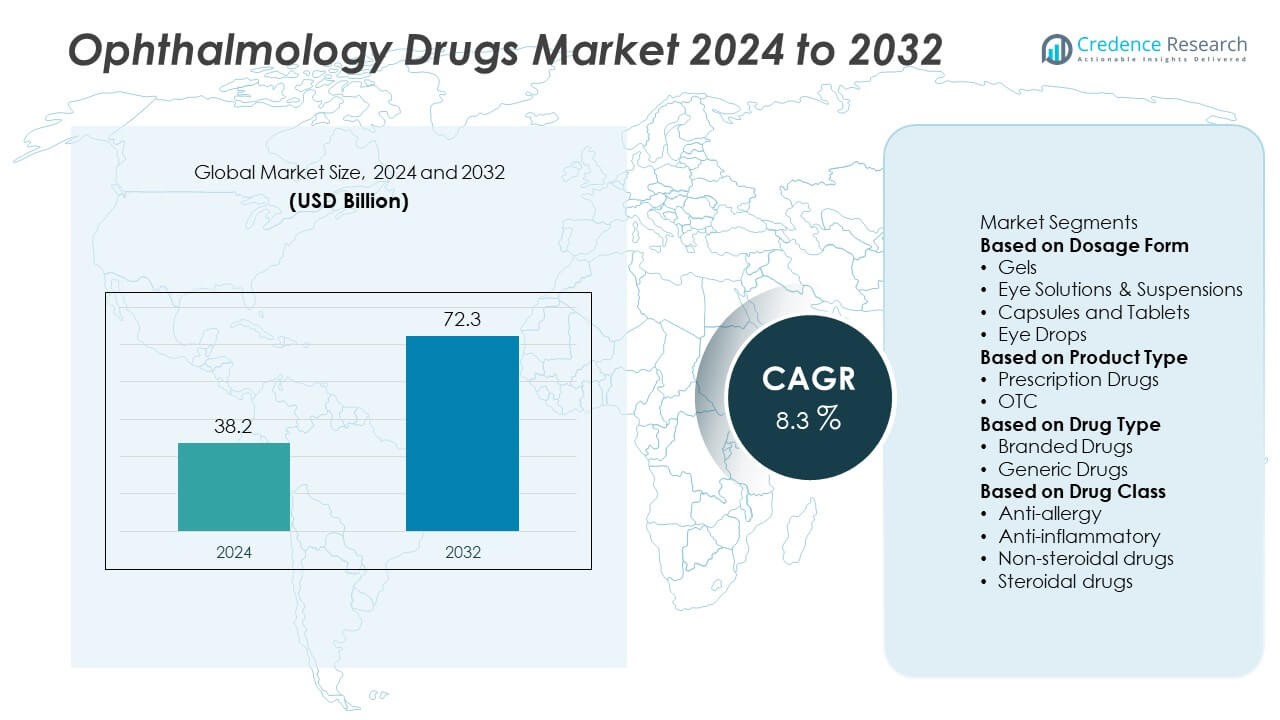

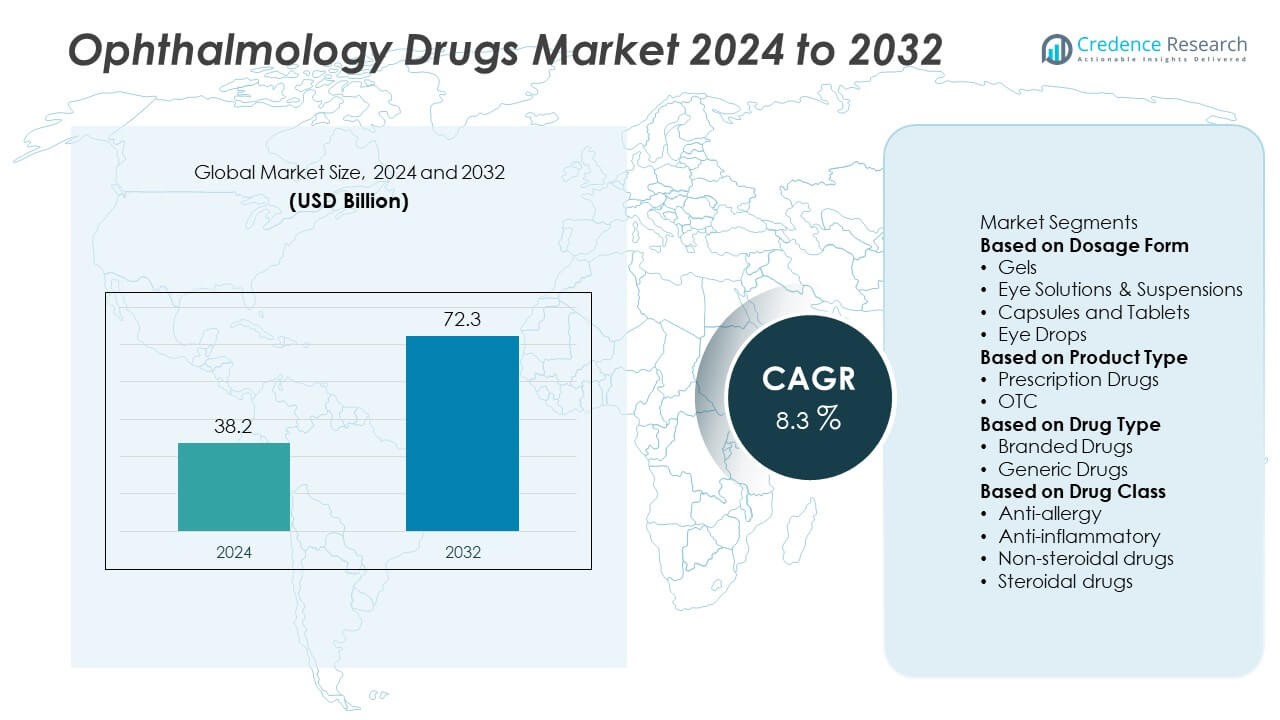

The Ophthalmology Drugs Market was valued at USD 38.2 billion in 2024 and is projected to reach USD 72.3 billion by 2032, expanding at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ophthalmology Drugs Market Size 2024 |

USD 38.2 Billion |

| Ophthalmology Drugs Market, CAGR |

8.3% |

| Ophthalmology Drugs Market Size 2032 |

USD 72.3 Billion |

The Ophthalmology Drugs Market grows with rising prevalence of glaucoma, diabetic retinopathy, and age-related macular degeneration, driving continuous demand for effective treatments. It benefits from innovation in biologics, biosimilars, and gene therapies that enhance outcomes and expand patient access.

The Ophthalmology Drugs Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with each region contributing through distinct factors. North America leads through advanced healthcare infrastructure, extensive clinical trials, and early adoption of biologics for retinal disorders. Europe emphasizes regulatory compliance and biosimilar adoption, supported by national healthcare systems that ensure patient access. Asia-Pacific expands rapidly, driven by rising cases of diabetic eye diseases and large-scale pharmaceutical manufacturing hubs in China, Japan, and India. Latin America and the Middle East & Africa experience gradual growth through healthcare modernization and increasing availability of prescription ophthalmic drugs. Key players shaping the market include Novartis AG, known for its strong portfolio of anti-VEGF therapies, Regeneron Pharmaceuticals, Inc., recognized for biologics in macular degeneration treatment, AbbVie, Inc. (Allergan), with its established glaucoma and dry eye drugs, and Bayer AG, contributing with advanced ophthalmology-focused research collaborations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Ophthalmology Drugs Market was valued at USD 38.2 billion in 2024 and is projected to reach USD 72.3 billion by 2032, expanding at a CAGR of 8.3% during the forecast period.

- Rising prevalence of glaucoma, diabetic retinopathy, and age-related macular degeneration fuels demand for advanced ophthalmic drugs across global markets.

- Strong trends emerge in biologics, biosimilars, gene therapies, and sustained-release formulations that improve treatment outcomes and patient adherence.

- The market remains competitive with leading companies such as Novartis AG, Regeneron Pharmaceuticals, AbbVie (Allergan), Bayer AG, and Pfizer focusing on innovation and partnerships.

- High treatment costs, strict regulatory processes, and limited accessibility in developing regions act as restraints to faster adoption.

- North America leads with advanced infrastructure and biologics adoption, Europe emphasizes biosimilars and compliance, and Asia-Pacific expands rapidly through growing diabetic populations and strong manufacturing bases.

- Opportunities arise from home healthcare demand, personalized medicine, and investments in digital health tools that enhance diagnosis and optimize treatment pathways.

Market Drivers

Rising Prevalence of Eye Disorders

The Ophthalmology Drugs Market grows with the increasing global burden of eye diseases such as glaucoma, diabetic retinopathy, and age-related macular degeneration. Rising cases of myopia and cataracts in aging populations strengthen drug demand across developed and emerging economies. It ensures a consistent need for advanced therapies that preserve vision and improve quality of life. Greater awareness of early diagnosis further fuels adoption of ophthalmic treatments. Screening programs and public health initiatives expand access to therapies in underserved regions. It highlights the strong link between disease prevalence and long-term market growth.

- For instance, Roche’s Susvimo implant demonstrated the ability to extend treatment intervals for wet AMD to 6 months in Phase III trials involving more than 1,000 patients, reducing the burden of frequent injections. Screening programs and public health initiatives expand access to therapies in underserved regions.

Innovation in Targeted Therapies and Biologics

The Ophthalmology Drugs Market benefits from rapid advances in biologics, gene therapies, and anti-VEGF treatments. Pharmaceutical companies invest in innovative formulations that target disease pathways more effectively. It improves patient outcomes while reducing treatment frequency and side effects. Biologics for conditions like wet AMD and retinal vein occlusion strengthen therapeutic pipelines. Growth in biosimilars also increases treatment availability in cost-sensitive markets. It demonstrates how innovation drives competitiveness and wider patient adoption in ophthalmology care.

Expanding Geriatric Population and Lifestyle Changes

The Ophthalmology Drugs Market gains momentum from demographic shifts and changing lifestyles. The global rise in elderly populations contributes to higher rates of chronic eye conditions requiring sustained drug use. It supports long-term demand across treatment classes, including glaucoma and dry eye therapies. Urban lifestyles, diabetes, and digital device exposure further raise risks of vision disorders. Increased health spending among older adults reinforces demand for advanced therapies. It ensures that demographic and lifestyle factors remain central to market expansion.

Strong Focus on Healthcare Infrastructure and Access

The Ophthalmology Drugs Market advances with growing investments in healthcare infrastructure and access programs. Governments and private stakeholders fund eye care centers and treatment initiatives to reduce preventable blindness. It strengthens patient access to drugs in both urban and rural regions. Insurance coverage and reimbursement support adoption of high-cost biologics in developed economies. Expanding clinical trial activity also brings innovative drugs closer to commercialization. It positions healthcare investment and accessibility as key drivers of ophthalmology drug demand worldwide.

- For instance, Novartis addresses avoidable blindness in underserved communities through its Avoidable Blindness Program (ABP), launched in 2021. The ABP operates in sub-Saharan Africa and Southeast Asia and focuses on strengthening healthcare systems and expanding access to affordable treatments for conditions like glaucoma and diabetic retinopathy.

Market Trends

Growing Role of Biologics and Biosimilars

The Ophthalmology Drugs Market shows a strong trend toward biologics and biosimilars. Anti-VEGF therapies dominate treatment for retinal disorders, while biosimilars enter the market to increase affordability. It supports wider adoption of effective drugs in both developed and emerging economies. Companies focus on extending product lifecycles through novel delivery methods. Long-acting formulations and sustained-release biologics reduce injection frequency, improving patient adherence. It highlights biologics as a central trend shaping ophthalmic care.

- For instance, Byooviz was the first FDA-approved Lucentis biosimilar in 2021, its US market launch in July 2022 saw modest initial uptake, due to market dynamics. Its price was 40% lower than Lucentis, making it a more affordable option, but it did not capture significant market share early on.

Advances in Gene and Cell Therapies

The Ophthalmology Drugs Market evolves with the development of gene and cell therapies. These treatments target inherited retinal diseases and degenerative conditions previously lacking effective solutions. It opens long-term opportunities for transformative therapies with durable effects. Several pipeline candidates progress through clinical trials, raising optimism for regulatory approvals. Pharmaceutical companies collaborate with biotech firms to accelerate commercialization. It demonstrates how breakthrough therapies reshape the treatment landscape for vision-threatening disorders.

- For instance, Spark Therapeutics’ Luxturna had treated only 103 patients outside the U.S. by an August 2021 data cutoff, per the multinational PERCEIVE study. Although a milestone for gene-based treatments, its use remains limited due to the rarity of the target disease.

Shift Toward Sustained-Release and Novel Drug Delivery

The Ophthalmology Drugs Market trends toward sustained-release implants and innovative delivery systems. Traditional eye drops and frequent injections face limitations in compliance and effectiveness. It drives research into biodegradable implants, nano-formulations, and refillable reservoirs. These approaches extend drug action and reduce treatment burden on patients. Advances in delivery technologies also improve precision and safety in drug administration. It emphasizes the growing importance of patient-friendly treatment modalities.

Rising Integration of Digital Health and Personalized Medicine

The Ophthalmology Drugs Market experiences growing integration of digital health tools and personalized care strategies. Remote monitoring, AI-based imaging, and predictive analytics support earlier diagnosis and treatment optimization. It enhances clinical decision-making and tailors drug use to individual patient needs. Precision medicine approaches also guide therapy choices based on genetic and lifestyle factors. Pharmaceutical companies invest in companion diagnostics to support targeted treatments. It reflects the trend of digital and personalized solutions transforming ophthalmology care.

Market Challenges Analysis

High Treatment Costs and Limited Accessibility

The Ophthalmology Drugs Market faces challenges from the high costs of advanced therapies such as biologics and gene treatments. Many patients in low- and middle-income countries lack access due to affordability issues. It restricts widespread adoption and creates inequalities in treatment availability. Healthcare systems struggle to balance rising demand with reimbursement limitations, especially for chronic conditions requiring long-term therapy. The financial burden of repeated injections or lifelong medication remains a significant obstacle. It underscores the difficulty of ensuring global access to innovative but expensive ophthalmology drugs.

Regulatory Complexity and Safety Concerns

The Ophthalmology Drugs Market also confronts challenges linked to stringent regulations and safety risks. New therapies must undergo extensive clinical trials and post-marketing surveillance, delaying time-to-market. It increases costs for pharmaceutical companies while slowing patient access to novel treatments. Safety issues, such as adverse events from invasive delivery methods, raise concerns among regulators and patients. Variability in global regulatory frameworks adds complexity for multinational drug approvals. It highlights the tension between innovation and compliance in advancing ophthalmology care.

Market Opportunities

Emerging Potential of Gene and Regenerative Therapies

The Ophthalmology Drugs Market presents opportunities through the advancement of gene and regenerative therapies. Innovative approaches target inherited retinal diseases, macular degeneration, and other vision-threatening conditions with limited existing solutions. It enables long-term benefits by addressing root causes rather than symptoms. Clinical success in trials for gene-based treatments creates strong potential for commercial breakthroughs. Pharmaceutical companies expand collaborations with biotechnology firms to accelerate development pipelines. It strengthens the market’s position as a hub for transformative therapies in eye care.

Growing Demand in Emerging Economies and Home Care Settings

The Ophthalmology Drugs Market gains opportunities from expanding healthcare access in emerging economies and rising demand for convenient treatment options. Rapid urbanization and increasing diabetes prevalence in regions such as Asia-Pacific and Latin America drive higher rates of diabetic retinopathy and glaucoma. It fuels consistent drug demand as governments invest in healthcare modernization. Rising preference for home care and self-administered therapies also supports innovation in user-friendly formulations. Companies that offer affordable and accessible treatments are well-positioned to capture these markets. It highlights emerging economies and home care solutions as key opportunity drivers for growth.

Market Segmentation Analysis:

By Dosage Form

The Ophthalmology Drugs Market is segmented by dosage form into eye drops, ointments, gels, and capsules or tablets. Eye drops dominate due to their ease of use and effectiveness in treating common conditions such as dry eye, glaucoma, and infections. It supports widespread adoption in both prescription and over-the-counter categories. Ointments and gels provide longer contact time with ocular tissues, offering benefits for severe infections or chronic conditions requiring sustained drug delivery. Oral capsules and tablets serve systemic treatment of vision-related complications, particularly in diabetic retinopathy and inflammatory eye diseases. It highlights how diverse dosage forms support accessibility and customization in ophthalmic care.

- For instance, In 2022, Novartis reported sales of approximately $487 million for Xiidra, an eye drop for dry eye disease. The company then finalized the sale of its “front of eye” ophthalmology assets, including Xiidra, to Bausch + Lomb in September 2023.

By Product Type

The Ophthalmology Drugs Market covers product types including prescription drugs, over-the-counter medications, and biosimilars. Prescription drugs hold the largest share due to strong reliance on anti-VEGF therapies, corticosteroids, and immunosuppressants for retinal disorders and glaucoma. It reinforces the role of physician-supervised treatment in managing complex conditions. Over-the-counter drugs, such as artificial tears and allergy eye drops, show steady growth with rising demand for self-care and convenience. Biosimilars emerge as a cost-effective alternative to branded biologics, expanding access in cost-sensitive regions. It reflects the balance between innovation and affordability across product categories.

By Drug Type

The Ophthalmology Drugs Market is segmented by drug type into anti-VEGF agents, corticosteroids, immunomodulators, anti-infectives, and others. Anti-VEGF drugs dominate as they remain the standard for age-related macular degeneration, diabetic macular edema, and retinal vein occlusion. It secures consistent demand supported by ongoing innovation in extended-release formulations. Corticosteroids address inflammation and post-surgical recovery, maintaining steady use across ophthalmic practices. Immunomodulators gain attention in treating chronic dry eye and autoimmune-related eye disorders. Anti-infectives serve critical roles in preventing or treating bacterial, viral, and fungal infections. It demonstrates a diverse therapeutic landscape where anti-VEGF agents lead, but supportive drug classes remain essential to comprehensive eye care.

- For instance, Regeneron and Bayer’s Eylea, a leading anti-VEGF therapy launched in the U.S. in 2011, has been supported by over 80 million global injections as of October 2024. In August 2023, the U.S. FDA approved Eylea HD, a higher-dose version offering the potential for less frequent injections.

Segments:

Based on Dosage Form

- Gels

- Eye Solutions & Suspensions

- Capsules and Tablets

- Eye Drops

Based on Product Type

Based on Drug Type

- Branded Drugs

- Generic Drugs

Based on Drug Class

- Anti-allergy

- Anti-inflammatory

- Non-steroidal drugs

- Steroidal drugs

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds around 35% share of the Ophthalmology Drugs Market, supported by advanced healthcare infrastructure and strong adoption of innovative therapies. The United States leads the region with significant demand for anti-VEGF drugs used in treating age-related macular degeneration, diabetic retinopathy, and retinal vein occlusion. It benefits from high healthcare spending, strong insurance coverage, and robust clinical trial activity driving drug approvals. Canada contributes through government-funded healthcare programs that expand access to ophthalmic treatments, while Mexico shows growth due to rising diabetes prevalence and improved access to specialty drugs. Pharmaceutical companies in the region, such as Regeneron and Pfizer, maintain strong positions by introducing advanced biologics and sustained-release formulations. It reinforces North America’s dominance in innovation, patient access, and high treatment uptake.

Europe

Europe accounts for about 28% share of the Ophthalmology Drugs Market, driven by high prevalence of chronic eye disorders and supportive healthcare systems. Germany, the UK, and France lead demand with large patient populations and access to advanced therapies. It reflects a well-regulated environment shaped by the European Medicines Agency, which ensures compliance and drug safety. Northern and Western Europe adopt biologics and biosimilars at higher rates, reducing treatment costs while maintaining quality. Southern and Eastern Europe show gradual adoption, supported by national programs targeting preventable blindness and diabetic eye disease. Pharmaceutical leaders, including Novartis and Roche, drive growth with anti-VEGF therapies and biosimilar development. It underscores Europe’s role as a hub for sustainable and regulated ophthalmic care.

Asia-Pacific

Asia-Pacific dominates the Ophthalmology Drugs Market with nearly 30% share, led by China, Japan, India, and South Korea. China drives rapid growth with its rising diabetic population and expanding access to eye care services. Japan and South Korea lead in advanced therapy adoption, supported by high investment in biotechnology and research. India shows steady growth, fueled by government initiatives addressing preventable blindness and expanding healthcare infrastructure. It benefits from a large patient base suffering from cataracts, glaucoma, and diabetic retinopathy. The region also attracts global pharmaceutical companies due to its manufacturing capacity and cost advantages. It positions Asia-Pacific as both the fastest-growing and highly competitive regional market.

Latin America

Latin America represents around 5% share of the Ophthalmology Drugs Market, with Brazil and Mexico as the largest contributors. Brazil benefits from a strong public health system and rising investments in diabetic retinopathy screening and treatment programs. Mexico shows demand growth due to a large diabetic population and rising access to ophthalmic care. Argentina and Chile contribute modestly, driven by private healthcare expansion and improved availability of prescription drugs. It faces challenges such as uneven distribution of healthcare resources and affordability constraints. Despite these barriers, multinational companies continue to expand partnerships to strengthen market presence in the region. It reflects Latin America’s gradual but steady role in global ophthalmology drug adoption.

Middle East & Africa

The Middle East & Africa account for approximately 2% share of the Ophthalmology Drugs Market, supported by rising investments in healthcare modernization and ophthalmology centers. Gulf countries such as Saudi Arabia and the UAE lead with higher adoption of advanced biologics and expansion of specialized eye hospitals. Africa shows growing demand, particularly in South Africa and Nigeria, where prevalence of glaucoma and cataracts remains high. It faces constraints from limited infrastructure, high treatment costs, and uneven drug access across rural regions. International aid programs and public-private partnerships are helping expand access to affordable treatments. It highlights the region’s emerging but still developing role in the global ophthalmology drug landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pfizer, Inc.

- Coherus BioSciences, Inc.

- AbbVie, Inc. (Allergan)

- Bayer AG

- Regeneron Pharmaceuticals, Inc.

- Novartis AG

- Santen Pharmaceutical Co., Ltd.

- Merck & Co., Inc.

- Bausch Health Companies, Inc.

- Alcon

Competitive Analysis

The competitive landscape of the Ophthalmology Drugs Market features leading players such as Alcon, Novartis AG, Bausch Health Companies, Inc., Merck & Co., Inc., Regeneron Pharmaceuticals, Inc., Coherus BioSciences, Inc., AbbVie, Inc. (Allergan), Pfizer, Inc., Bayer AG, and Santen Pharmaceutical Co., Ltd. These companies compete by focusing on innovation in biologics, biosimilars, gene therapies, and sustained-release formulations that improve patient adherence and therapeutic outcomes. Market leaders invest heavily in research and development to advance anti-VEGF therapies, immunomodulators, and novel drug delivery systems. Strategic collaborations, licensing agreements, and acquisitions strengthen their global reach and diversify product pipelines. The emphasis on biosimilars helps address cost barriers and expand access in emerging economies. Companies also pursue digital health integration, pairing ophthalmic drugs with AI-based diagnostics and remote monitoring solutions to optimize treatment. Intense competition drives continuous advancements, positioning these players to meet growing global demand for effective therapies against glaucoma, macular degeneration, and diabetic retinopathy.

Recent Developments

- In June 2025, the FDA approved prednisolone acetate ophthalmic suspension 1%, a self-administered eye drop for treating steroid-responsive ocular inflammation. Amneal Pharmaceuticals plans a launch in the third quarter of 2025.

- In April 2025, the FDA issued a complete response letter for Regeneron’s supplemental application to extend aflibercept 8 mg dosing intervals up to 24 weeks.

- In March 2025, the FDA approved Revakinagene taroretcel (Encelto), an intravitreal gene therapy for macular telangiectasia type 2. The treatment improved near vision significantly within 30 minutes and maintained its effect for 8–10 hours.

- In December 2024, the FDA approved a generic version of latanoprost (from Gland Pharma Limited), a widely used prostaglandin analogue for open-angle glaucoma.

Report Coverage

The research report offers an in-depth analysis based on Dosage Form, Product Type, Drug Type, Drug Class and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Innovative gene therapies and regenerative treatments will extend vision restoration options.

- Expanded use of sustained-release implants and long-acting injectables will reduce treatment visits.

- Biologic biosimilars will increase access by offering cost-effective alternatives to branded drugs.

- Digital health tools like AI-powered imaging and remote monitoring will refine diagnostics and therapy optimization.

- Personalized medicine approaches will tailor drug selection based on genetic and lifestyle factors.

- Home administration of ophthalmic treatments will grow with patient-centric design enhancements.

- Emerging markets will drive growth through increased healthcare investments and aging populations.

- Combination therapies targeting multiple ocular pathways will gain traction for complex diseases.

- Strategic collaborations between pharma and tech firms will speed delivery of advanced treatment platforms.

- Regulatory support for real-world evidence will accelerate approvals for novel ophthalmic therapies.