Market Overview

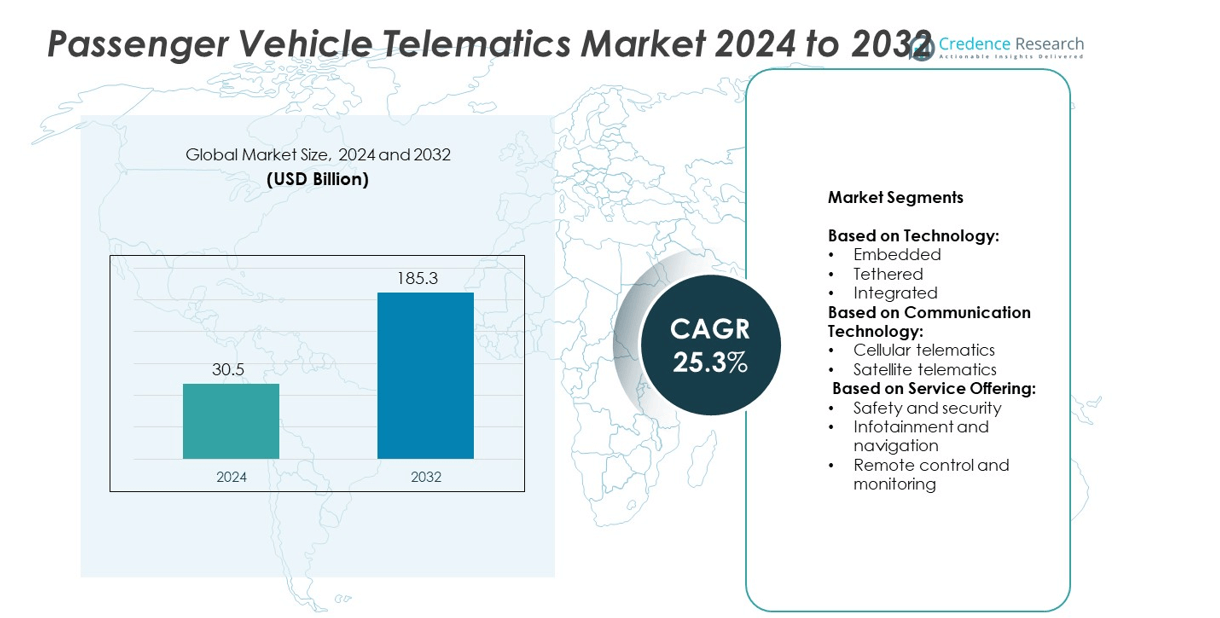

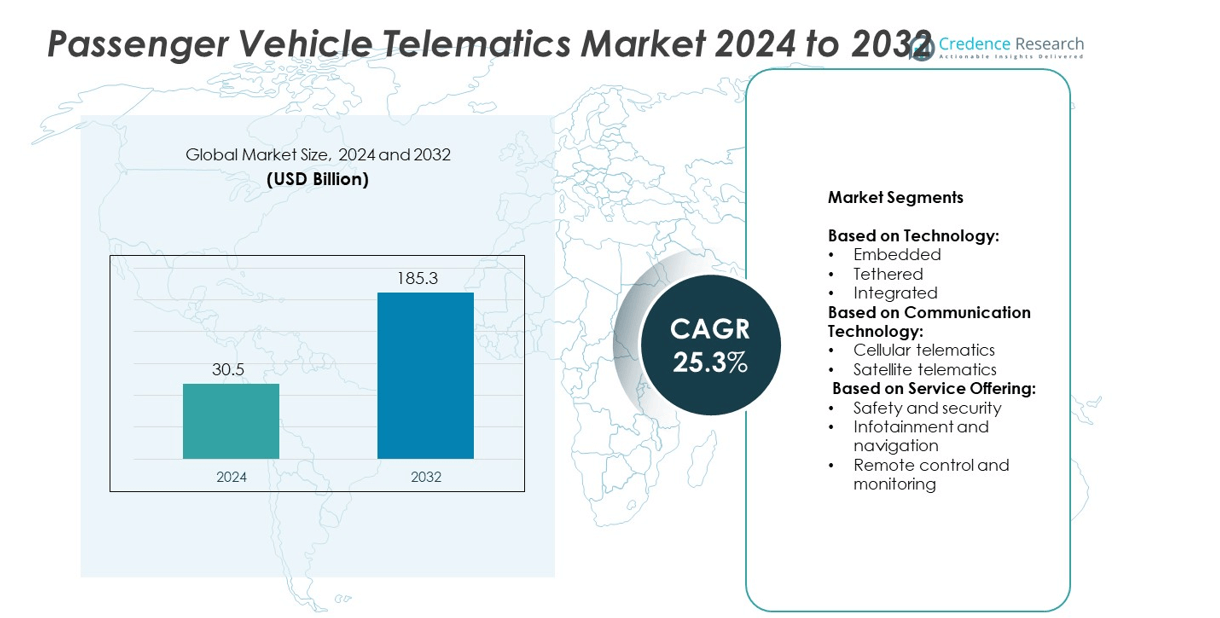

Passenger Vehicle Telematics Market size was valued at USD 30.5 billion in 2024 and is anticipated to reach USD 185.3 billion by 2032, at a CAGR of 25.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Passenger Vehicle Telematics Market Size 2024 |

USD 30.5 billion |

| Passenger Vehicle Telematics Market, CAGR |

25.3% |

| Passenger Vehicle Telematics Market Size 2032 |

USD 185.3 billion |

The Passenger Vehicle Telematics market grows rapidly due to rising demand for connected vehicle technologies and advanced safety features. Increasing integration of IoT, AI, and cloud-based platforms enhances real-time navigation, remote diagnostics, and vehicle monitoring. It benefits from regulatory mandates, growing EV adoption, and consumer preference for personalized driving experiences. Expansion of 5G networks further boosts seamless data transfer and communication. Automakers and technology providers focus on developing innovative telematics solutions, supporting the market’s strong growth trajectory globally.

The Passenger Vehicle Telematics market shows strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads due to high adoption of advanced connectivity solutions, while Asia-Pacific experiences rapid expansion driven by rising vehicle production and smart mobility initiatives. Europe focuses on sustainability and strict safety regulations, supporting innovation in telematics. Key players shaping the market include Verizon Connect, Continental AG, LG Electronics, and Octo Telematics, driving technological advancements and strategic partnerships.

Market Insights

- The Passenger Vehicle Telematics market was valued at USD 30.5 billion in 2024 and is projected to reach USD 185.3 billion by 2032, growing at a CAGR of 25.3% from 2025 to 2032.

- Rising demand for connected vehicle technologies and advanced safety solutions drives market growth globally.

- Key trends include increasing IoT integration, cloud-based telematics platforms, AI-driven analytics, and the expansion of 5G-enabled connectivity solutions.

- The market is highly competitive, with leading players focusing on innovation, partnerships, and expanding product portfolios to strengthen their presence.

- High implementation costs, integration complexities, and growing cybersecurity concerns act as major restraints, impacting adoption rates in certain regions.

- North America leads due to advanced connectivity infrastructure and regulatory support, while Asia-Pacific shows the fastest growth fueled by rising vehicle production and smart mobility initiatives.

- Europe focuses on strict safety standards and sustainability goals, while Latin America and the Middle East & Africa witness steady adoption supported by improving automotive infrastructure and growing demand for connected mobility services.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Connected Vehicle Solutions

The Passenger Vehicle Telematics market experiences strong growth due to rising demand for connected solutions. Consumers seek features like real-time navigation, vehicle tracking, and remote diagnostics. Automakers integrate telematics systems to enhance driving experiences and meet customer expectations. It supports safety, comfort, and efficiency through continuous data exchange between vehicles and networks. Government initiatives for intelligent transportation systems also accelerate adoption. The trend aligns with the increasing need for advanced in-car connectivity.

- For instance, GM’s OnStar service provides 24/7 vehicle assistance to over 20 million connected vehicles globally and has 22 million members subscribed to its services worldwide.

Increasing Focus on Vehicle Safety and Regulations

Government policies and safety regulations drive widespread use of telematics in passenger vehicles. Authorities encourage integration of systems like eCall, stolen vehicle tracking, and emergency response. It improves driver and passenger safety by providing immediate assistance during accidents. Insurance companies promote telematics-based policies to monitor driving behavior and reduce risks. The growing demand for compliance-ready solutions fuels innovations in tracking technologies. This shift supports higher safety standards across automotive markets.

- For instance, Tesla’s robotaxi pilot in Austin began in June 2025 with an initial invite-only fleet of approximately 10–20 Model Y vehicles. The fleet, which operates in a geofenced area, has since expanded, though the current number of vehicles is not officially confirmed. Each vehicle includes a human “safety monitor” in the passenger seat and is also monitored remotely.

Rising Integration of IoT and Advanced Technologies

The Passenger Vehicle Telematics market benefits from rapid advancements in IoT and AI-driven platforms. Automakers leverage connected devices for predictive maintenance, diagnostics, and enhanced infotainment services. It allows seamless data transfer between vehicles and cloud platforms, improving overall performance. Companies deploy advanced software to manage vehicle health and optimize efficiency. The expansion of 5G networks boosts faster communication and higher data accuracy. This integration enhances consumer satisfaction and accelerates system adoption.

Growing Consumer Demand for Personalized Experiences

Consumers increasingly prefer telematics solutions offering personalized driving insights and tailored infotainment options. It enables car owners to track fuel usage, receive maintenance alerts, and customize entertainment. Automakers develop user-centric platforms to strengthen brand loyalty and improve customer engagement. Cloud-based analytics enhance predictive services based on individual driving patterns. Subscription-based models for premium telematics services continue gaining traction among tech-savvy users. Rising demand for convenience and customization pushes market expansion globally.

Market Trends

Increasing Adoption of Advanced Connectivity Solutions

The Passenger Vehicle Telematics market shows a strong shift toward advanced connectivity features. Automakers integrate real-time navigation, over-the-air updates, and remote diagnostics to enhance user experience. It enables seamless communication between vehicles, devices, and external networks. Growing demand for intelligent transportation systems supports the development of connected vehicle technologies. Automakers collaborate with technology firms to deliver innovative in-car services. Rising consumer expectations for convenience and digital integration drive this trend forward.

- For instance, Toyota Connected demonstrates strong engagement with its connected service offerings, supporting a large number of customers across multiple products. For example, a report on Toyota Connected North America’s collaboration with Twilio noted that the platform scales to serve over 6 million Toyota and Lexus drivers.

Expansion of Cloud-Based Telematics Platforms

Cloud integration is transforming telematics systems by improving scalability and data processing efficiency. The Passenger Vehicle Telematics market benefits from cloud-enabled services that enhance predictive maintenance and performance monitoring. It allows secure storage and faster sharing of vehicle data for personalized services. Automakers and service providers adopt cloud ecosystems to manage large-scale connected fleets. Integration of cloud solutions reduces infrastructure costs and accelerates digital transformation. Rising demand for real-time insights strengthens the adoption of cloud-powered platforms.

- For instance, Mack Trucks has equipped over 200,000 Class 8 vehicles with its proprietary telematics gateway, supporting remote diagnostics and real-time fleet visibility.

Growth of Electric and Autonomous Vehicle Integration

The rising adoption of electric and autonomous vehicles drives significant advancements in telematics technologies. The Passenger Vehicle Telematics market focuses on developing solutions for energy optimization, battery monitoring, and autonomous navigation. It supports seamless vehicle-to-infrastructure and vehicle-to-vehicle communication for improved safety. Automakers invest in AI-powered platforms to enhance autonomous decision-making. Integration of advanced telematics ensures better range predictions and charging efficiency for EVs. The trend aligns with sustainability-focused automotive innovation and smarter mobility solutions.

Increasing Role of Artificial Intelligence and Big Data

AI and big data analytics are reshaping the future of telematics systems globally. The Passenger Vehicle Telematics market leverages AI to predict vehicle performance, enhance driver behavior analysis, and deliver personalized insights. It improves risk assessment and supports insurers in designing usage-based policies. Automakers use advanced analytics to study real-time data for better decision-making. Big data platforms enable faster integration of connected services and user-specific applications. This trend boosts innovation and improves operational efficiency across the industry.

Market Challenges Analysis

High Implementation Costs and Integration Complexities

The Passenger Vehicle Telematics market faces challenges due to high deployment costs and technical complexities. Automakers invest heavily in hardware, software, and network infrastructure to support advanced telematics systems. It becomes difficult for mid-range and budget vehicle manufacturers to offer premium connectivity solutions. Integration with multiple platforms and compatibility with existing vehicle architectures add further complications. Limited awareness among consumers regarding telematics benefits slows adoption in emerging markets. High costs and integration barriers continue to restrict wider implementation globally.

Data Privacy Concerns and Regulatory Compliance

Increasing data generation from connected vehicles raises significant concerns about privacy and cybersecurity. The Passenger Vehicle Telematics market struggles with strict data protection regulations across different regions. It requires secure frameworks to prevent unauthorized access and safeguard sensitive user information. Growing cyberattacks on connected systems add complexity to managing large-scale data streams. Automakers face challenges in ensuring compliance with regional and global data privacy standards. The need for robust security protocols impacts system development timelines and overall deployment strategies.

Market Opportunities

Rising Demand for Connected and Personalized Mobility Solutions

The Passenger Vehicle Telematics market presents strong opportunities due to growing demand for connected mobility experiences. Consumers prefer personalized infotainment, predictive maintenance, and real-time vehicle tracking features. It enables automakers to deliver advanced telematics services that enhance driving convenience and safety. Expanding adoption of subscription-based models creates recurring revenue streams for service providers. Growing interest in driver behavior analytics supports insurers in offering customized policies. Increasing urbanization and the need for smarter mobility drive greater integration of telematics technologies.

Expansion of Electric and Autonomous Vehicle Ecosystems

The growing shift toward electric and autonomous vehicles opens significant growth avenues for telematics providers. The Passenger Vehicle Telematics market benefits from solutions supporting energy optimization, charging management, and autonomous navigation. It enables seamless connectivity between vehicles, infrastructure, and cloud platforms for enhanced efficiency. Rising investments in AI-driven telematics strengthen autonomous decision-making capabilities. Global sustainability initiatives push automakers to integrate innovative connected technologies into EVs. The demand for advanced telematics in future mobility ecosystems drives innovation and long-term market expansion.

Market Segmentation Analysis:

By Technology:

The Passenger Vehicle Telematics market is segmented into embedded, tethered, and integrated solutions, each addressing specific connectivity needs. Embedded systems dominate due to increasing adoption by automakers seeking enhanced reliability and control over vehicle connectivity. It offers seamless integration with in-vehicle hardware, improving performance and security. Tethered telematics relies on smartphones for connectivity, making it cost-effective for budget-friendly vehicles. Integrated solutions combine the flexibility of mobile devices with in-built system capabilities, enabling advanced infotainment and navigation features. Rising demand for real-time updates and efficient connectivity supports the expansion of embedded and integrated solutions globally.

- For instance, Octo Telematics aggregates data from its 5.7 million connected users and has analyzed over 514,000 crashes and insurance events within its platform.

By Communication Technology:

The market is classified into cellular telematics and satellite telematics. Cellular telematics leads the segment due to widespread 4G and 5G network penetration, enabling faster data transmission and reliable services. It supports applications like predictive maintenance, emergency response, and remote vehicle management. Satellite telematics is gaining attention for providing connectivity in remote and rural locations where cellular coverage is limited. The rising integration of hybrid communication systems strengthens vehicle performance and expands accessibility. Increasing demand for uninterrupted connectivity drives innovation across both segments.

- For instance, Geotab’s telematics systems are installed in millions of vehicles, processing substantial data across diverse vehicle models, making it one of the largest connected fleets in the industry. Recent data from August 2025 indicates their fleet has grown to approximately 5 million connected vehicles, handling over 100 billion data points daily.

By Service Offering:

The service offering segment includes safety and security, infotainment and navigation, and remote control and monitoring. Safety and security solutions dominate due to growing regulatory mandates for emergency response systems and stolen vehicle tracking. It enhances driver and passenger protection by offering instant assistance during accidents or breakdowns. Infotainment and navigation services gain traction as consumers demand personalized entertainment and real-time traffic insights. Remote control and monitoring features enable users to manage vehicle functions through mobile applications, improving convenience and efficiency. Increasing preference for connected services accelerates innovation across these offerings, shaping the future of telematics integration.

Segments:

Based on Technology:

- Embedded

- Tethered

- Integrated

Based on Communication Technology:

- Cellular telematics

- Satellite telematics

Based on Service Offering:

- Safety and security

- Infotainment and navigation

- Remote control and monitoring

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The Passenger Vehicle Telematics market in North America holds a dominant position with a market share of 37% in 2024. The region leads due to strong demand for advanced connected car technologies and growing adoption of embedded telematics systems. Automakers focus on integrating real-time navigation, emergency response, and remote diagnostics to enhance customer experiences. It benefits from a robust infrastructure supporting 4G and 5G networks, enabling seamless connectivity across vehicles. Government regulations, such as mandates for eCall and driver assistance features, accelerate adoption in the United States and Canada. The presence of major players and technology providers, coupled with growing consumer preference for premium telematics services, drives consistent growth in the region.

Europe

Europe accounts for a significant share of the Passenger Vehicle Telematics market, holding 28% of the total revenue in 2024. The region focuses on strict automotive safety standards and sustainability goals, pushing manufacturers to deploy advanced telematics solutions. It benefits from growing demand for features like stolen vehicle tracking, predictive maintenance, and connected infotainment systems. Countries such as Germany, France, and the U.K. lead in adoption due to strong automotive manufacturing bases and supportive regulations. The increasing shift toward electric and autonomous vehicles boosts the integration of connected services. Strategic collaborations between automakers and technology firms further accelerate innovation and strengthen regional market competitiveness.

Asia-Pacific

Asia-Pacific represents the fastest-growing region in the Passenger Vehicle Telematics market, capturing a 25% market share in 2024. Rapid urbanization, rising disposable incomes, and growing demand for connected mobility solutions drive expansion across China, India, Japan, and South Korea. It benefits from the large-scale deployment of 5G infrastructure, supporting advanced telematics services and vehicle-to-everything (V2X) communication. Governments in countries like China and India promote intelligent transportation systems and safety-focused regulations, fostering wider telematics adoption. Automakers in the region invest heavily in integrated and embedded platforms to meet rising consumer expectations. Increasing EV adoption and demand for AI-driven navigation systems further support strong regional growth.

Latin America

Latin America accounts for 6% of the Passenger Vehicle Telematics market share in 2024. The region experiences growing interest in connected mobility solutions, supported by expanding automotive production in Brazil, Mexico, and Argentina. It faces challenges related to infrastructure limitations but benefits from increasing demand for safety and infotainment services. Automakers are gradually introducing embedded telematics platforms to enhance vehicle efficiency and improve customer engagement. Rising adoption of smartphone-based tethered solutions offers cost-effective alternatives for mid-range vehicles. As consumer awareness grows, the demand for real-time navigation, predictive maintenance, and emergency assistance is expected to strengthen further.

Middle East & Africa

The Middle East & Africa region holds a market share of 4% in 2024, showing steady growth driven by rising automotive sales and improving connectivity infrastructure. Gulf Cooperation Council (GCC) countries dominate adoption due to increasing investments in smart mobility and premium vehicle technologies. It benefits from higher demand for security-driven telematics features, including tracking and emergency response systems. In Africa, growing automotive imports and expanding mobile network coverage foster gradual adoption of tethered and integrated telematics solutions. Government initiatives promoting digital transformation in transportation further support market expansion. Increasing interest in luxury vehicles with advanced connectivity features accelerates growth prospects in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Verizon Connect

- Continental AG

- Agero Inc

- LG Electronics

- Geotab Inc

- Octo Telematics

- MiX Telematics

- Qualcomm Incorporated

- OnStar Corporation

- Fleet Complete

Competitive Analysis

The Passenger Vehicle Telematics market is highly competitive, with leading players including Verizon Connect, Continental AG, Agero Inc, LG Electronics, Geotab Inc, Octo Telematics, MiX Telematics, Qualcomm Incorporated, OnStar Corporation, and Fleet Complete. These companies focus on technological advancements, strategic collaborations, and expanding product portfolios to strengthen their market presence. It drives innovation by integrating AI, IoT, and cloud-based solutions into telematics platforms. Players invest heavily in developing advanced safety, infotainment, and remote monitoring features to meet evolving consumer demands. Strong emphasis on data analytics and predictive maintenance capabilities helps enhance operational efficiency and customer experience. Competitive strategies involve partnerships with automakers, telecom providers, and fleet operators to deliver seamless connectivity solutions. Growing adoption of electric and autonomous vehicles creates new opportunities, pushing companies to enhance vehicle-to-everything communication and intelligent mobility services. Continuous innovation, regional expansion, and focus on subscription-based telematics models allow players to capture a larger customer base while sustaining profitability in a rapidly evolving market landscape.

Recent Developments

- In March 2025, OCTO announced a strategic partnership with DallBogg to support its expansion in the Italian market

- In January 2025, Verizon Connect launched its Extended View Cameras and Driver Vehicle Inspection Report (DVIR) to enhance fleet safety, visibility, compliance, and operational efficiency

- In February 2024, MiX Telematics received shareholder approval for a proposed business combination with Powerfleet, expected to close in early April 2024

Report Coverage

The research report offers an in-depth analysis based on Technology, Communication Technology, Service Offering and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Smart city initiatives will integrate telematics into traffic control, parking, and urban mobility systems.

- In‑vehicle connectivity will expand through cloud and 5G adoption, improving real‑time data sharing.

- Artificial intelligence and advanced analytics will enhance predictive maintenance and driver safety insights.

- Telematics will play a critical role in electric and autonomous vehicles by enabling advanced energy and communication systems.

- Embedded telematics adoption by original equipment manufacturers will rise, ensuring seamless integration and better performance.

- Asia-Pacific will witness the fastest growth due to regulatory mandates, rising vehicle sales, and enhanced telecom infrastructure.

- Demand for fleet management and logistics optimization will drive stronger telematics adoption among commercial operators.

- Increasing data privacy and cybersecurity concerns will lead to stricter regulations and advanced protection protocols.

- Subscription-based telematics services will become a key revenue model, offering continuous upgrades and personalized features.

- Growth in connected vehicle cloud infrastructure will enable scalable and flexible telematics deployment in modern vehicles.