Market Overview:

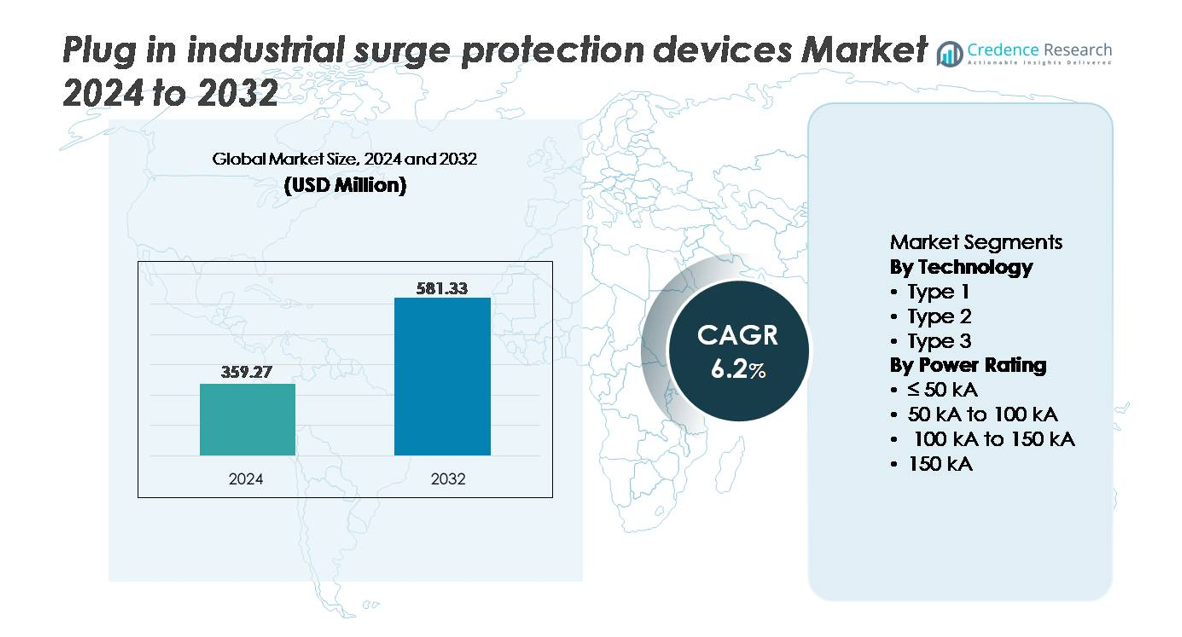

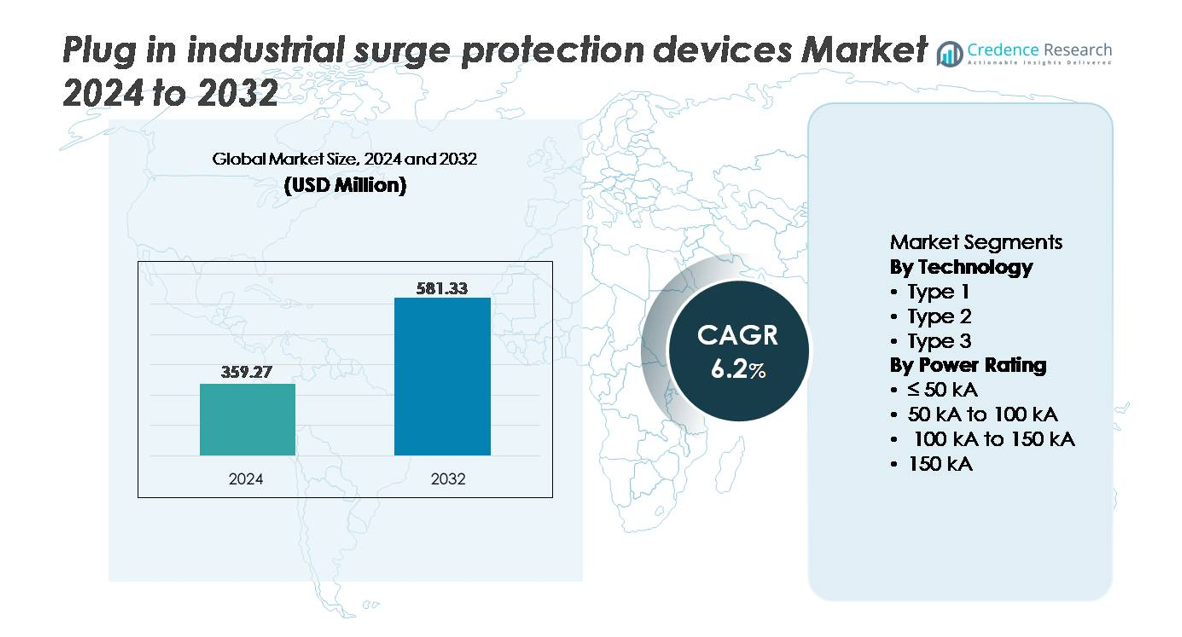

The global plug-in industrial surge protection devices market was valued at USD 359.27 million in 2024 and is projected to reach USD 581.33 million by 2032, advancing at a CAGR of 6.2% during the forecast period (2025-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plug-In Industrial Surge Protection Devices Market Size 2024 |

USD 359.27 million |

| Plug-In Industrial Surge Protection Devices Market , CAGR |

6.2% |

| Plug-In Industrial Surge Protection Devices Market Size 2032 |

USD 581.33 million |

Leading players in the plug-in industrial surge protection devices market include Honeywell International, JMV, Emerson Electric, Belkin, Eaton, Hubbell, ABB, Infineon Technologies, Havells, and General Electric, each contributing to advancements in surge protection reliability, diagnostics, and modular plug-in designs. These companies compete by strengthening product durability, integrating smart monitoring features, and expanding OEM and distribution networks across industrial sectors. North America leads the global market with approximately 32% share, supported by mature automation ecosystems, strong regulatory compliance, and high adoption of retrofit surge protection. Europe and Asia Pacific follow closely as rising electrification, grid developments, and industrial modernization accelerate adoption in diverse manufacturing and energy-intensive environments.

Market Insights:

- The global plug-in industrial surge protection devices market was valued at USD 359.27 million in 2024 and is projected to reach USD 581.33 million by 2032, expanding at a CAGR of 6.2%.

- Growing industrial automation, electrification of manufacturing lines, and integration of digitally controlled equipment drive demand for surge protection to reduce downtime and protect critical assets.

- Trends include adoption of modular plug-in SPDs, IoT-enabled monitoring, and retrofit-friendly solutions aligned with predictive maintenance and energy optimization initiatives.

- Competitive intensity increases as key players enhance surge handling capacity, strengthen compliance certifications, and expand distribution in industrial aftermarket service channels.

- North America leads with 32% market share, followed by Asia Pacific at 29% and Europe at 27%, while the 50 kA-100 kA power rating segment holds the largest share, driven by demand in mid-to-high load industrial environments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

In the technology category, Type 2 surge protection devices represent the dominant sub-segment, accounting for the largest market share due to their suitability for industrial panels, distribution boards, and critical machinery protection across manufacturing facilities. They are widely preferred because they balance high surge handling capability with ease of installation in existing electrical architectures, making them ideal for commercial and industrial retrofits. Type 1 devices continue to gain traction in grid-connected and utility infrastructure, while Type 3 variants serve complementary plug-level protection for sensitive electronics in secondary environments.

- For instance, The Siemens SIPROTEC 7VK87 protection relay is a modular breaker management device used in utility-grade networks which adheres to the robust surge withstand requirements for substation equipment (e.g., IEC 60255 standards for impulse voltage).

By Power Rating

Based on power rating, the 50 kA to 100 kA sub-segment leads the market share, driven by demand for mid-capacity surge protection that aligns with operational standards in automated manufacturing units, warehousing, and power-dependent industrial environments. These devices provide sufficient protection for most three-phase and heavy-equipment applications without exceeding budgetary constraints. Higher-rated devices above 100 kA support mission-critical facilities such as data centers and energy-intensive production lines, while the ≤ 50 kA segment is primarily utilized in auxiliary systems, control rooms, and non-critical industrial auxiliaries.

- For instance, ABB’s “OVR T2 3N 40–275s P QS” Type 2 surge protector is engineered with a declared maximum surge current handling capability of 40 kA (8/20 µs) per pole(and a nominal discharge current of 20 kA per pole) and includes a QuickSafe (QS) disconnector mechanism, ensuring protection continuity during thermal runaway scenarios

Key Growth Drivers:

Rapid Expansion of Industrial Automation and Electrical Infrastructure

The accelerating adoption of industrial automation, robotics, and digitally controlled machinery significantly increases dependency on uninterrupted and clean power supply. Programmable logic controllers, sensor-driven lines, automated conveyors, and industrial IoT networks expose production floors to voltage transients and surge-related failures. Plug-in surge protection devices support scalable protection across distributed control systems without requiring extensive rewiring. Expansion of renewable integration, EV charging infrastructure, and energy-efficient retrofits further add electrical complexity and surge vulnerability. As manufacturers pursue predictive maintenance and uptime reliability, plug-in SPDs become essential protection components, supporting asset preservation, operational continuity, and reducing unexpected equipment downtime costs.

- For instance, Siemens’ SENTRON PAC320 0power monitoring device performs measurements at a sampling rate of 64 samples per cycle. It provides basic power quality parameters like Total Harmonic Distortion (THD). This data is typically logged as average values over a configurable period(e.g., 15 minutes), which can be exported to supervisory software like SENTRON powermanager for further analysis, supporting energy management and helping to identify potential issues for preventive maintenance cycles.

Regulatory Mandates and Compliance with Electrical Safety Standards

Stringent global and national regulatory frameworks reinforce the adoption of surge protection devices across industrial environments. Safety norms such as UL, IEC, and region-specific grid protection requirements ensure manufacturers and end users incorporate surge mitigation to safeguard equipment, workforce, and operational assets. Insurance compliance and facility audit requirements also influence installation decisions, particularly in high-risk sites such as oil and gas, chemical processing, and large warehousing. Frequent updates to electrical codes encourage replacement cycles and retrofit deployments. Mandatory surge protection in new-build commercial and industrial developments further supports market expansion, especially where governments promote resilient infrastructure, workplace safety, and energy transition.

- For instance, Germany’s DIN VDE 0100-443 and 0100-534 regulations require mandatory installation of SPDs in new and extensively renovated structures with external lightning exposure, especially when line communication systems operate at overvoltage category II or higher, compelling compliance across industrial automation and renewable energy integration projects.

Growth of Aftermarket Retrofits and Maintenance-Centric Deployments

Aging electrical layouts in manufacturing units and utilities create significant demand for aftermarket surge protection solutions that are easily deployable without full system overhauls. Plug-in SPDs cater to decentralized systems where multiple machines, sub-panels, and auxiliary connections require localized safeguard. As facilities upgrade from legacy analog systems to digitally connected operations, surge vulnerabilities increase due to sensitive microelectronics. Rising awareness of cost impacts associated with downtime, equipment repair, and data loss fuels recurring investments in plug-level protection. OEM service contracts, lifecycle-based replacements, and performance degradation from harsh industrial environments stimulate sustainable aftermarket revenue streams.

Key Trends & Opportunities:

Modular, Retrofit-Friendly SPD Designs Supporting Scalable Protection

A prominent trend shaping the market is the adoption of modular surge protection devices that enable phased upgrades aligned with equipment expansion and infrastructure modernization. Plug-in SPDs allow users to expand protection as load density increases rather than investing in full-capacity systems upfront. This is particularly valuable to leasing-based workspaces, multi-tenant manufacturing hubs, and rapidly evolving logistics and warehousing footprints. Manufacturers offering compact, easily interchangeable modules tailored to different power ratings and surge capacities gain competitive advantage as users prioritize lifecycle optimization and flexibility in asset allocation.

- For instance, Phoenix Contact’s “VAL-MS” modular SPD system features replaceable plug-in modules with surge handling capability of 40 kA (8/20 μs) per module, allowing maintenance teams to replace individual cartridges without powering down entire distribution panels.

Integration of IoT-Enabled Diagnostic and Remote Monitoring Capabilities

The increasing incorporation of smart sensors, thermal indicators, and real-time monitoring capabilities within surge protection systems presents new opportunities for value-added solutions. IoT-enabled SPDs allow remote diagnostic assessments, surge event tracking, predictive fault identification, and automated maintenance scheduling. This trend is catalyzed by the growing importance of data-driven reliability management in smart factories and energy-intensive production facilities. Service model transformation, where manufacturers offer monitoring subscriptions and digital dashboards, strengthens long-term customer engagement, reduces operational risk, and supports modernization of maintenance ecosystems across industrial sectors.

- For instance, Certain high-speed ABB Ability™ Condition Monitoring interfaces and data loggers are capable of collecting device-level performance data at high sampling rates, sometimes up to 1,000 data points per second (1 kHz) for dynamic measurements like vibration, enabling detailed trend forecasting and advanced preventive maintenance planning across distributed industrial assets.

Key Challenges:

Low Awareness in Emerging Industrial Economies and Cost-Sensitive Sectors

Despite performance and safety benefits, market penetration faces resistance in cost-sensitive regions where surge protection is perceived as an optional rather than essential safeguard. Small and medium-size manufacturers often prioritize immediate capital expenditures over preventive electrical safety investments, underestimating long-term risk exposure. Lack of technical awareness regarding surge-related failures, hidden downtime expenses, and protection lifecycle management limits adoption in developing markets. Education campaigns, regulatory enforcement, and insurance-driven compliance are required to overcome adoption barriers and shift spending focus from reactive repairs to proactive protection.

Performance Variability and Lack of Harmonized Global Standardization

The market faces challenges associated with inconsistent performance benchmarks, certification requirements, and interoperability concerns across regions. Surge protection device ratings, test methodologies, and labeling criteria vary across regulatory frameworks, creating user confusion and procurement complexities, especially for multinational enterprises. Inadequate standardization also enables substandard or counterfeit products to enter the market, exposing buyers to reliability risks. Manufacturers must continuously invest in certification, testing, and compliance documentation to maintain credibility. Greater standard harmonization and cross-border approvals remain essential to ensuring market confidence, product compatibility, and long-term investment justification.

Regional Analysis:

North America

North America holds approximately 32% market share and remains the leading region for plug-in industrial surge protection devices, supported by strong adoption of automation, advanced manufacturing, and regulatory enforcement under UL and ANSI standards. High dependence on digitally controlled equipment and renewable-grid integration drives surge protection deployment across utility, automotive, aerospace, and logistics facilities. The United States leads demand due to retrofit-driven upgrades in industrial hubs, while Canada is expanding through energy modernization and commercial electrification. Continued investment in smart factories and EV charging networks reinforces the region’s preference for plug-in SPDs with remote diagnostics and predictive maintenance capabilities.

Europe

Europe accounts for around 27% market share, driven by strict safety requirements, energy transition policies, and infrastructure modernization across Germany, France, and the UK. Industrial surge protection adoption is further supported by EU carbon reduction mandates and the expansion of electrification in transportation and industrial automation. Strong manufacturing bases in automotive, chemicals, and machinery encourage advanced power protection systems for sensitive equipment. Replacement cycles are influenced by updates to IEC compliance frameworks. Plug-in SPDs benefit from the region’s preference for standardized, modular designs that align with sustainability-focused digital infrastructure and lifecycle-driven procurement models.

Asia Pacific

Asia Pacific commands nearly 29% market share and represents the fastest-evolving region, fueled by large-scale industrialization, smart city development, and grid capacity expansion across China, India, Japan, and Southeast Asia. Surge protection demand accelerates as factories integrate robotics, high-load machinery, and AI-driven production intelligence. Growing renewable and distributed energy adoption increases transient exposure, prompting protection upgrades in utilities and manufacturing clusters. Cost-efficient plug-in SPDs gain rapid traction in retrofits. Government initiatives supporting industrial corridors and semiconductor production further amplify the need for power quality management in digitally enabled and export-oriented industries.

Latin America

Latin America contributes about 7% market share, driven by increasing investments in oil and gas, mining, and industrial warehousing across Brazil, Mexico, and Chile. Modernization of outdated electrical systems encourages adoption of plug-in surge protection solutions that reduce operational risks without major capital expenditure. Demand is supported by the rise of automated packaging, food processing, and logistics industries. However, budget constraints and lower awareness limit adoption among SMEs. As multinational manufacturers expand regional footprints and power reliability concerns persist, the market shows emerging opportunities for mid-range and easily deployable surge protection devices.

Middle East & Africa

The Middle East & Africa region holds approximately 5% market share, with growth accelerated by industrial diversification, utility grid reinforcement, and large-scale infrastructure developments in the UAE, Saudi Arabia, and South Africa. High temperatures, unstable power distribution, and rapid construction cycles increase reliance on surge protection for industrial equipment. Oil, gas, and desalination plants require robust electrical safeguards to minimize downtime, driving plug-in SPD demand. Limited standardization and cost sensitivity challenge adoption; however, energy transition projects and industrial automation investments are expected to strengthen long-term market growth across strategic economic clusters.

Market Segmentations:

By Technology

By Power Rating

- ≤ 50 kA

- 50 kA to 100 kA

- 100 kA to 150 kA

- 150 kA

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the plug-in industrial surge protection devices market reflects strong participation from global electrical component manufacturers, semiconductor companies, and specialized industrial safety solution providers. Major players compete through advancements in surge handling capacity, modular architectures, thermal disconnect mechanisms, and diagnostic-enabled intelligent devices. Strategic priorities focus on expanding retrofit-friendly product lines, enhancing durability for harsh industrial environments, and integrating IoT-based monitoring for predictive maintenance. Partnerships with automation OEMs, distributors, and facility service providers extend market reach, while compliance with IEC and UL standards remains fundamental for credibility. Continuous innovation in compact form factors and high-kA-rated devices differentiates leading brands, while emerging regional manufacturers drive price competitiveness. Investments in R&D, certification testing, and localized production support market expansion across high-growth industrial clusters and developing electrification markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Recent Developments:

- In October 2024, Hubbell expanded its surge protection lineup by updating the “SpikeShield™” series of surge protective devices (SPDs), offering additional models designed to protect both line-side and load-side installations for residential, hospitality, and institutional buildings.

- In May 2024, Phoenix Contact strategically strengthened its North American presence by establishing Phoenix Contact Production S.A. de C.V. in Mexico. This top-notch facility is expected to facilitate an investment of about USD 55 million and covers an area of 20,000 square meters. Furthermore, with an estimated increase in the local economy, the facility will create around 700 jobs by 2032, which in turn will strengthen the company’s manufacturing capabilities.

- In February 2024, ABB acquired SEAM Group, expanding its electrification portfolio in renewable energy, electrical safety, and asset management advisory services. This acquisition complements the growing marketplace for asset modernization and optimization. Following this acquisition, ABB can provide clients with more efficient, safe and sustainable operational solutions around the world.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Power rating and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing adoption of predictive maintenance will accelerate integration of intelligent surge protection systems.

- Industrial automation growth will sustain long-term demand for high-capacity plug-in SPDs.

- Retrofit-friendly modular devices will gain preference in cost-sensitive and evolving infrastructure environments.

- Integration with IoT platforms will enable real-time diagnostics and remote monitoring capabilities.

- Sustainability and energy efficiency requirements will influence next-generation SPD materials and designs.

- Electrification of transportation and logistics facilities will create new deployment opportunities.

- Stringent regulatory standards will shape product innovation and certification-driven competition.

- Emerging markets will contribute significantly as industrial expansion accelerates.

- OEM partnerships will strengthen as manufacturers embed surge protection within equipment.

- Increased reliance on digital controls will make surge protection a standard component in industrial ecosystems.