Market Overview:

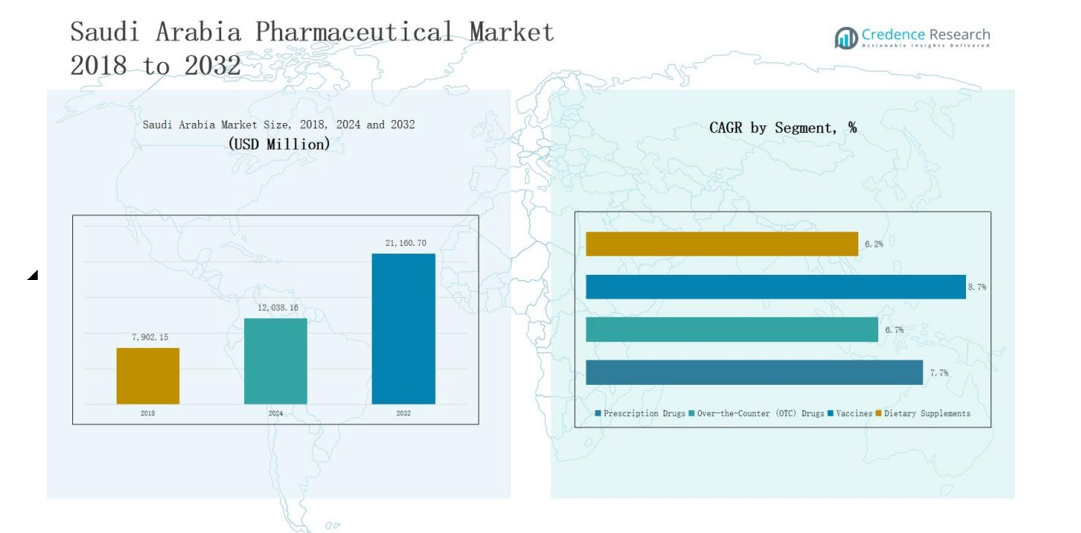

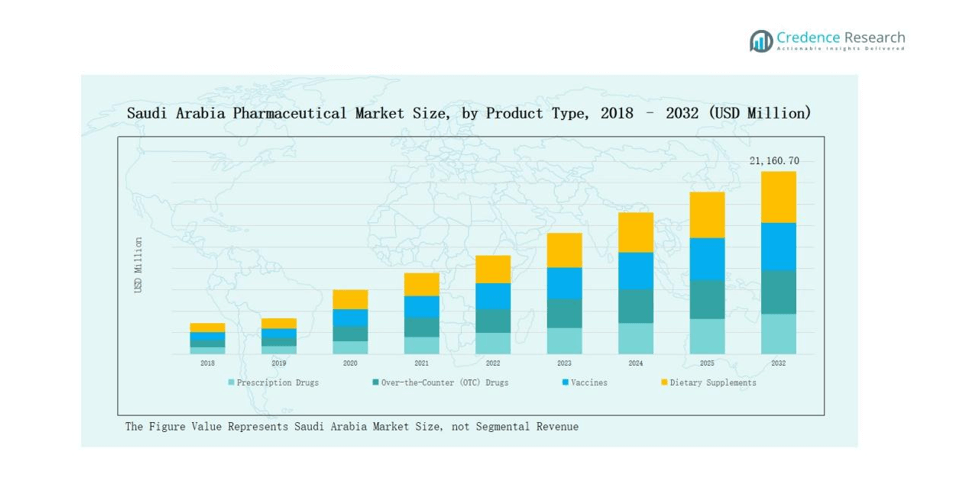

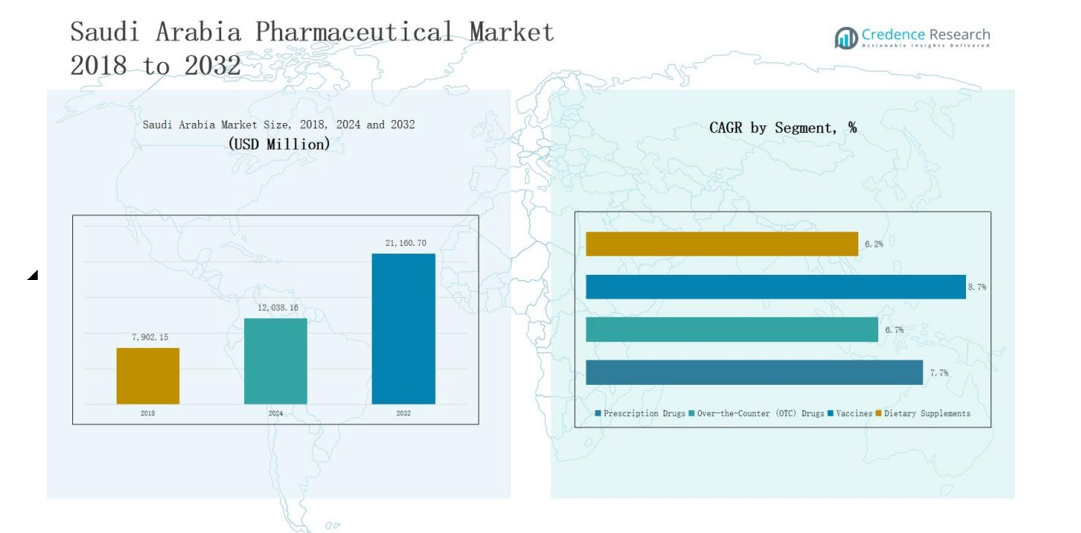

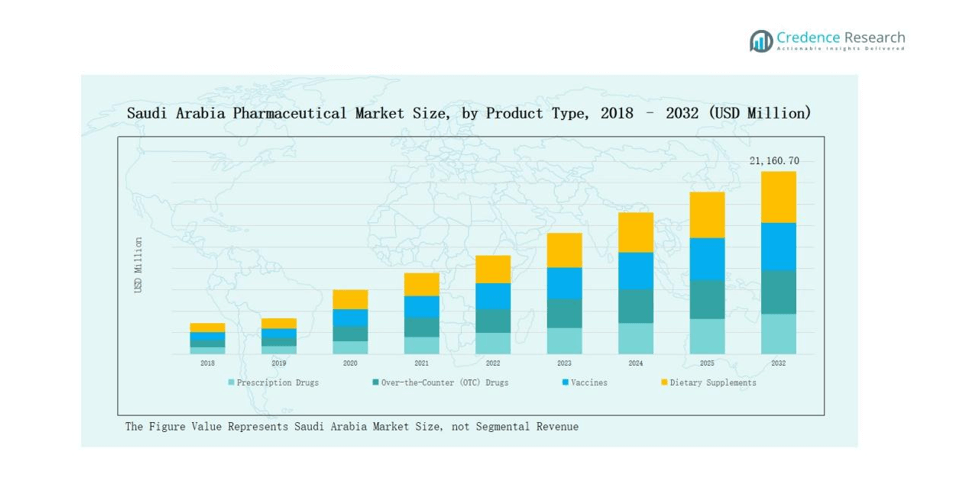

Saudi Arabia Pharmaceutical Market size was valued at USD 7,902.15 million in 2018 to USD 12,038.16 million in 2024 and is anticipated to reach USD 21,160.70 million by 2032, at a CAGR of 6.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saudi Arabia Pharmaceutical Market Size 2024 |

USD 12,038.16 million |

| Saudi Arabia Pharmaceutical Market, CAGR |

6.80% |

| Saudi Arabia Pharmaceutical Market Size 2032 |

USD 21,160.70 million |

The Saudi Arabia Pharmaceutical Market is shaped by a mix of strong domestic manufacturers and multinational corporations. Leading local players such as Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO), Tabuk Pharmaceuticals, Riyadh Pharma, and Al-Dawaa Pharmacies maintain a significant presence through generics, essential medicines, and extensive retail networks. Global leaders including Pfizer, Novartis, and GlaxoSmithKline (GSK) dominate advanced therapies, branded drugs, and specialty segments, leveraging innovation pipelines and strategic collaborations with regional firms. Among all regions, the Central Region emerged as the leader with 38% share in 2024, supported by Riyadh’s concentration of hospitals, research centers, and corporate headquarters that drive pharmaceutical demand. This combined competitive strength and regional dominance continue to underpin the market’s sustained growth trajectory.

Market Insights

- The Saudi Arabia Pharmaceutical Market grew from USD 7,902.15 million in 2018 to USD 12,038.16 million in 2024 and is forecasted to reach USD 21,160.70 million by 2032, reflecting steady expansion at a CAGR of 6.80%.

- Prescription drugs held 63% share in 2024, supported by chronic disease prevalence and government-backed healthcare reforms, while OTC drugs, vaccines, and dietary supplements captured 18%, 12%, and 7% respectively.

- Branded drugs led with 54% share in 2024, driven by physician preference and multinational innovation, whereas generics secured 36% and biosimilars gained 10% with increasing regulatory approvals.

- Oncology dominated with 29% share in 2024, followed by cardiology at 21% and diabetes at 17%, while neurology, respiratory, and other therapeutic areas accounted for the remaining 33% collectively.

- Regionally, the Central Region led with 38% share in 2024, followed by the Western Region at 27%, the Eastern Region at 22%, and the Southern Region at 13%, highlighting strong demand centers across the Kingdom.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product Type

Prescription drugs dominated the Saudi Arabia pharmaceutical market with 63% share in 2024. Growth is driven by rising chronic disease prevalence, government support for advanced therapies, and increasing patient reliance on prescribed medication. Over-the-counter (OTC) drugs held 18% share, supported by demand for self-care and minor illness treatment. Vaccines accounted for 12% share, reflecting national immunization initiatives, while dietary supplements captured 7% share, fueled by growing consumer interest in preventive healthcare and wellness.

- For instance, AstraZeneca’s Tagrisso (osimertinib) has been adopted within the Saudi National Cancer Control Program to improve survival rates in lung cancer patients.

By Drug Type

Branded drugs led the market with 54% share in 2024, supported by strong physician preference, established trust, and innovative formulations from multinational companies. Generic drugs followed with 36% share, driven by affordability and government encouragement to reduce healthcare costs. Biosimilars, though emerging, held 10% share, gaining traction through regulatory approvals and wider adoption for biologic treatments.

- For instance, Teva Pharmaceuticals offers one of the largest generic portfolios globally, including generic versions of widely used drugs like atorvastatin for cholesterol management.

By Application

Oncology was the largest application segment, contributing 29% share in 2024, supported by increasing cancer incidence and the introduction of advanced targeted therapies. Cardiology followed with 21% share, reflecting high demand for cardiovascular treatments in an aging population. Diabetes accounted for 17% share, driven by one of the world’s highest regional prevalence rates. Neurology captured 12% share, supported by growing cases of neurological disorders. Respiratory drugs held 9% share, boosted by asthma and COPD cases, while other therapeutic areas combined contributed 12% share.

Market Overview

Rising Burden of Chronic Diseases

The increasing prevalence of chronic conditions such as diabetes, cardiovascular disorders, and cancer is a key growth driver for Saudi Arabia’s pharmaceutical market. With one of the highest global diabetes rates and rising obesity-linked complications, demand for advanced and continuous treatment is expanding. The government’s Vision 2030 healthcare reforms further accelerate pharmaceutical demand by improving access to diagnostics, specialized therapies, and patient-centric care. These factors strengthen reliance on prescription medicines and encourage multinational companies to expand therapeutic portfolios tailored to chronic disease management.

- For instance, in September 2021, AstraZeneca signed a Memorandum of Understanding (MoU) with the Saudi Ministry of Investment and the Ministry of National Guard Health Affairs in Riyadh.

Government Healthcare Investments and Reforms

Saudi Arabia’s strong investment in healthcare infrastructure under Vision 2030 plays a central role in market expansion. The government allocates substantial budgets to modernize hospitals, expand pharmaceutical distribution, and integrate advanced medical technologies. Regulatory bodies also accelerate drug approvals, encouraging faster access to innovative medicines. Furthermore, policies promoting local manufacturing and partnerships with global pharmaceutical leaders are increasing domestic production capacity. This combination of investments, policy support, and industry collaborations positions the country as a regional hub for pharmaceutical innovation and growth.

Expanding Local Manufacturing and Generic Adoption

The growing focus on local production of generics is driving cost efficiency and supply security in Saudi Arabia’s pharmaceutical sector. Domestic companies, supported by government incentives, are scaling up facilities to reduce reliance on imports and improve drug availability. Generics, known for affordability, are gaining wider acceptance among physicians and patients, particularly in managing chronic diseases. Increased manufacturing capabilities also open avenues for exporting regionally. This shift not only supports healthcare affordability but also strengthens the Kingdom’s pharmaceutical self-sufficiency in line with Vision 2030 goals.

- For instance, Jamjoom Pharma, headquartered in Jeddah, has increased local production of generic ophthalmology and dermatology drugs, which are now widely prescribed in government hospitals.

Key Trends & Opportunities

Digital Transformation and E-Pharmacies

Digital healthcare is rapidly transforming the Saudi pharmaceutical landscape. Online pharmacies and telemedicine platforms are expanding, offering convenient access to medicines and consultations. Consumers increasingly prefer e-pharmacies for prescription refills, OTC drugs, and dietary supplements due to convenience and home delivery. Government endorsement of digital healthcare systems under Vision 2030 further enhances trust in online distribution. This trend presents significant opportunities for pharmaceutical firms to invest in digital platforms, strengthen customer engagement, and capture growing demand for technology-driven healthcare solutions in the Kingdom.

- For instance, Al Nahdi Medical Company, a leading retail pharmacy chain in Saudi Arabia, has expanded its NahdiCare Clinics and digital pharmacy services, enabling patients to consult doctors virtually and order chronic medication refills directly via its online platform.

Rising Demand for Specialty and Biologic Drugs

The increasing adoption of specialty and biologic drugs represents a major opportunity in the Saudi market. High incidence of oncology, autoimmune, and neurological disorders is driving demand for innovative biologics and targeted therapies. Regulatory support for biosimilars further complements market expansion by offering cost-effective alternatives to high-priced biologics. Multinational firms are entering partnerships with Saudi companies to enhance access to advanced therapies. With healthcare reforms encouraging innovation, specialty drugs and biosimilars are set to gain a stronger foothold, improving patient outcomes and expanding revenue opportunities.

- For instance, Saudi Food and Drug Authority (SFDA) approvals of biosimilars like Amgen’s adalimumab biosimilar (Amgevita) have given patients with autoimmune disorders affordable treatment options.

Key Challenges

Pricing Pressure and Cost Containment Policies

Despite market growth, pricing pressure remains a critical challenge in Saudi Arabia’s pharmaceutical sector. The government actively regulates drug prices to maintain affordability and reduce healthcare spending. While beneficial for patients, these policies limit profit margins for manufacturers and distributors. Generic competition further intensifies pricing challenges, especially for multinational companies that depend on branded medicines. The focus on cost containment makes it essential for companies to balance innovation with affordability, often requiring partnerships or local manufacturing strategies to sustain long-term profitability.

Supply Chain and Import Dependency

A significant challenge for Saudi Arabia is its dependency on imports for many pharmaceutical products, particularly advanced biologics and specialty drugs. Global supply chain disruptions, such as those witnessed during the pandemic, highlight the risks of reliance on external suppliers. Delays in shipments and shortages can hinder patient access to critical medicines. Although local manufacturing is expanding, it is not yet sufficient to meet the entire demand. Addressing these vulnerabilities requires accelerated investment in domestic production and regional supply chain diversification.

Regulatory and Market Entry Barriers

Strict regulatory requirements and lengthy approval processes can act as barriers for pharmaceutical companies entering the Saudi market. While reforms are improving transparency, compliance with complex regulations remains time-consuming and resource-intensive. Multinational firms often face challenges aligning global practices with local standards, delaying product launches. Furthermore, competition from well-established domestic firms adds to the difficulty of market penetration. Overcoming these hurdles requires strategic partnerships, investment in regulatory expertise, and alignment with national healthcare priorities to ensure successful market entry and sustained growth.

Regional Analysis

Central Region

The Central Region accounted for 38% share of the Saudi Arabia Pharmaceutical Market in 2024, supported by the dominance of Riyadh as the capital and medical hub. Major hospitals, research centers, and corporate headquarters strengthen pharmaceutical consumption in this area. It benefits from government-driven healthcare reforms and strong investment in hospital infrastructure. The presence of multinational pharmaceutical firms and local players ensures widespread drug availability. Retail and hospital pharmacies remain the primary distribution channels. Demand for oncology and cardiology drugs is particularly strong in this region.

Western Region

The Western Region held 27% share of the Saudi Arabia Pharmaceutical Market in 2024. The cities of Jeddah and Makkah play a crucial role due to large populations and high medical tourism. Seasonal healthcare demand rises with millions of pilgrims traveling to the area each year, supporting increased pharmaceutical consumption. Hospitals and retail pharmacies remain vital in fulfilling demand. This region also records strong sales of OTC drugs and vaccines, driven by preventive healthcare practices. Pharmaceutical distributors continue to expand networks to cater to both residents and visiting populations.

Eastern Region

The Eastern Region contributed 22% share of the Saudi Arabia Pharmaceutical Market in 2024. Its significance comes from a concentration of expatriates and industrial hubs, which require advanced healthcare facilities. The region’s hospitals and clinics are highly equipped, driving demand for branded and specialty drugs. Chronic diseases such as diabetes and cardiovascular disorders remain key therapeutic focus areas. Retail and online pharmacies show steady growth as consumers increasingly seek convenient access to medicines. The region benefits from government-backed investment in healthcare to support its growing population.

Southern Region

The Southern Region represented 13% share of the Saudi Arabia Pharmaceutical Market in 2024. Pharmaceutical growth here is relatively moderate compared to other regions due to smaller urban populations and fewer large-scale hospitals. However, the government continues to invest in strengthening healthcare accessibility in rural and semi-urban areas. OTC drugs and dietary supplements see higher traction, as preventive health awareness spreads. Local pharmacies and hospital networks are expanding to improve drug penetration. It remains an emerging growth area with potential for further investment in infrastructure and distribution.

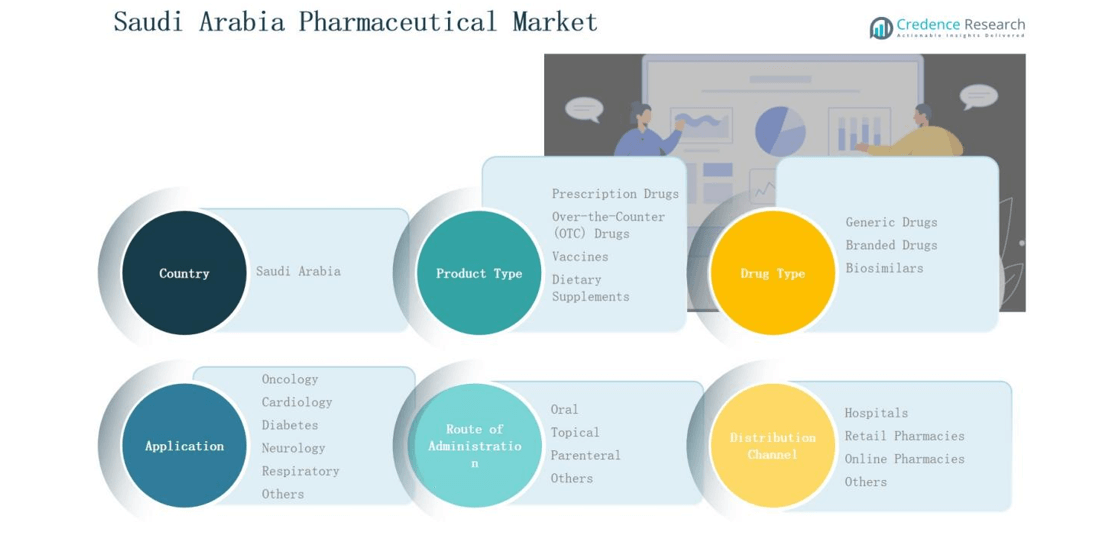

Market Segmentations:

By Product Type

- Prescription Drugs

- Over-the-Counter (OTC) Drugs

- Vaccines

- Dietary Supplements

By Drug Type

- Generic Drugs

- Branded Drugs

- Biosimilars

By Application

- Oncology

- Cardiology

- Diabetes

- Neurology

- Respiratory

- Others

By Route of Administration

- Oral

- Topical

- Parenteral

- Others

By Distribution Channel

- Hospitals

- Retail Pharmacies

- Online Pharmacies

- Others

By Region

- Central region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape

The Saudi Arabia Pharmaceutical Market is highly competitive, with a mix of domestic firms and multinational corporations shaping industry dynamics. Local leaders such as SPIMACO, Tabuk Pharmaceuticals, and Riyadh Pharma maintain strong positions by producing generics and essential drugs aligned with national healthcare priorities. Multinational players including Pfizer, Novartis, and GSK dominate branded and specialty drug categories, leveraging global innovation pipelines and strategic partnerships. Al-Dawaa Pharmacies adds strength on the retail side, operating one of the largest pharmacy networks in the Kingdom. Companies compete through expansion of product portfolios, collaborations with government agencies, and investments in manufacturing to reduce import dependency. Growing interest in biosimilars and specialty therapies further intensifies competition, pushing firms to balance affordability with innovation. The market’s regulatory environment also encourages local–global partnerships, ensuring technology transfer and advanced product availability. Collectively, this diverse competitive base sustains growth and drives continuous advancement in the Kingdom’s pharmaceutical sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Saudi Pharmaceutical Industries and Medical Appliances Corporation (SPIMACO)

- Al-Dawaa Pharmacies

- Tabuk Pharmaceuticals

- Pfizer

- Riyadh Pharma

- Novartis

- GSK (GlaxoSmithKline)

Recent Developments

- In August 2025, Agios’ PYRUKYND® (mitapivat) received approval in Saudi Arabia for treating adult patients with thalassemia, expanding access to innovative rare disease therapies.

- In May 2025, Saudi Arabia’s Public Investment Fund (Lifera) partnered with Novo Nordisk to localize the production of insulin and GLP-1 medications, boosting domestic manufacturing capabilities.

- In December 2024, Bio-Thera Solutions partnered with Tabuk Pharmaceuticals to exclusively manufacture, distribute, and market the ustekinumab biosimilar BAT2206 in Saudi Arabia.

- In June 2025, King Faisal Specialist Hospital & Research Centre (KFSHRC) and Germfree Laboratories announced the establishment of the first Advanced Therapy Medicinal Product (ATMP) Manufacturing Campus in Riyadh.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Drug Type, Application, Route of Administartion, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for chronic disease therapies will continue to drive prescription drug growth.

- Government reforms will expand local pharmaceutical manufacturing capacity across key regions.

- Adoption of generics will rise as cost efficiency remains a priority in healthcare policy.

- Specialty and biologic drugs will gain traction with increasing cancer and autoimmune cases.

- Digital healthcare platforms will strengthen online pharmacy penetration and patient accessibility.

- Partnerships between global firms and local companies will expand innovation and technology transfer.

- Preventive healthcare will boost demand for vaccines and dietary supplements across demographics.

- Regulatory frameworks will become more transparent, supporting faster drug approvals and market entry.

- Distribution networks will strengthen with hospital and retail pharmacies expanding into underserved areas.

- Investments in research and clinical trials will position the Kingdom as a regional pharmaceutical hub.