Market Overview

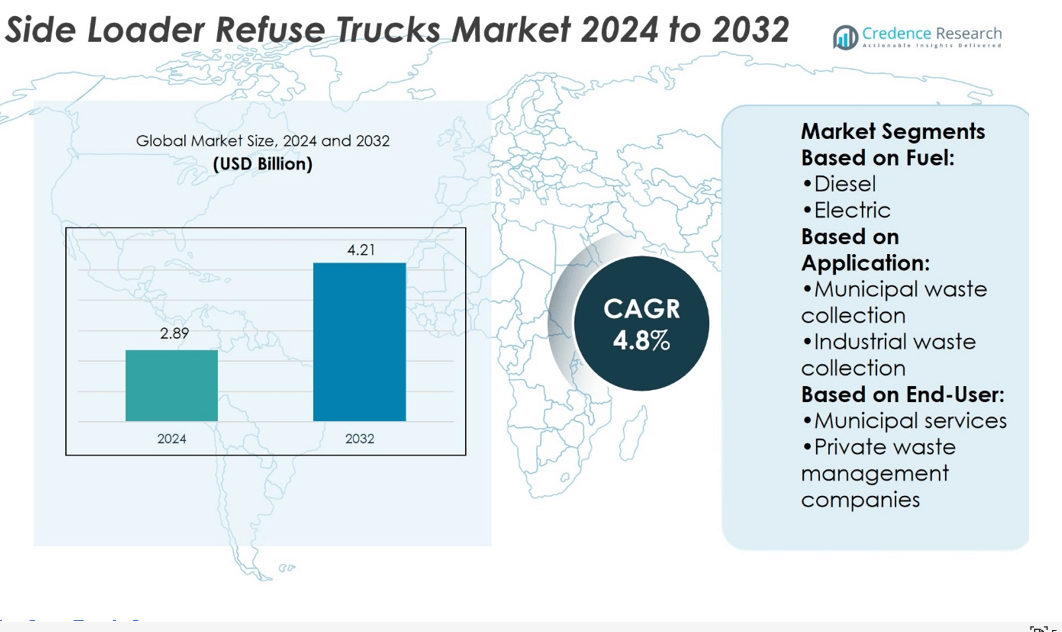

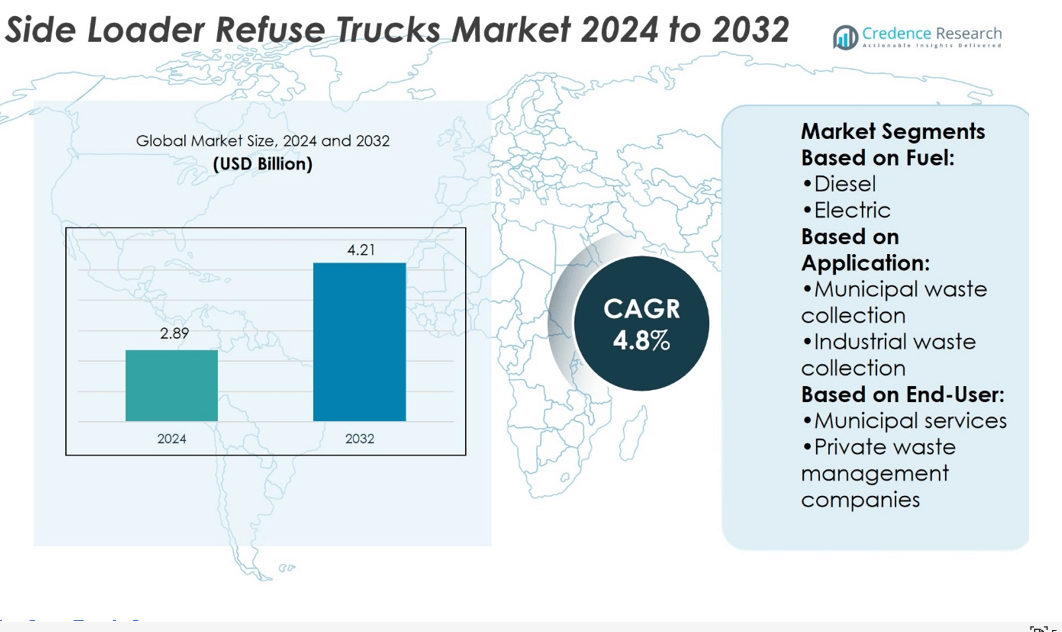

Side Loader Refuse Trucks Market size was valued at USD 2.89 billion in 2024 and is anticipated to reach USD 4.21 billion by 2032, at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Side Loader Refuse Trucks Market Size 2024 |

USD 2.89 billion |

| Side Loader Refuse Trucks Market, CAGR |

4.8% |

| Side Loader Refuse Trucks Market Size 2032 |

USD 4.21 billion |

The Side Loader Refuse Trucks Market grows through strong drivers and evolving trends shaped by urbanization, sustainability goals, and technological innovation. Rising municipal waste volumes push adoption of automated trucks that reduce labor needs and improve efficiency. Regulatory pressure on emissions accelerates demand for electric, hybrid, and CNG-powered models. Telematics and IoT integration enhance fleet performance, route optimization, and predictive maintenance. Operators also prioritize safety and ergonomics, influencing design improvements. Growing investments in smart city projects and public-private partnerships further strengthen opportunities, while automation and eco-friendly technologies define long-term growth directions for the global side loader refuse trucks industry.

North America leads the Side Loader Refuse Trucks Market with strong adoption supported by advanced infrastructure, while Asia Pacific shows the fastest growth driven by urbanization and government initiatives. Europe maintains significant share with strict emission regulations and sustainable fleet investments. Latin America and Middle East & Africa record smaller yet expanding adoption through urban projects. Key players shaping the market include Bridgeport Manufacturing, Mack Trucks, Dennis Eagle, Amrep, Peterbilt, Labrie Trucks, Heil, McNeilus Truck, New Way Refuse Trucks, and Autocar.

Market Insights

- Side Loader Refuse Trucks Market was valued at USD 2.89 billion in 2024 and will reach USD 4.21 billion by 2032 at a CAGR of 4.8%.

- Urbanization and rising municipal waste volumes drive adoption of automated trucks that improve efficiency.

- Sustainability goals and emission rules push demand for electric, hybrid, and CNG-powered side loader models.

- Competition focuses on innovation, with players investing in automation, telematics, and ergonomic designs.

- High initial costs and infrastructure limitations act as restraints, slowing adoption in developing regions.

- North America leads with strong infrastructure, Asia Pacific grows fastest with government support, Europe expands through sustainability mandates, while Latin America and Middle East & Africa record gradual growth.

- Key companies such as Bridgeport Manufacturing, Mack Trucks, Dennis Eagle, Amrep, Peterbilt, Labrie Trucks, Heil, McNeilus Truck, New Way Refuse Trucks, and Autocar shape the competitive landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Efficient Waste Collection in Urban Areas

Rapid urbanization drives municipalities to adopt advanced waste collection solutions. The Side Loader Refuse Trucks Market benefits from the need for streamlined, space-efficient operations in crowded cities. Side loaders reduce manual labor by allowing automated or semi-automated loading of bins. It helps municipalities meet waste management targets while improving safety for operators. Cities facing limited budgets also focus on cost efficiency, favoring vehicles with higher productivity. Expanding urban populations continue to generate higher volumes of waste, reinforcing demand for these trucks.

- For instance, Mack Trucks has surpassed a milestone of 200,000 Class 8 trucks built with its proprietary telematics gateway since 2014. This confirms the active truck figure cited.

Shift Toward Automation and Technological Integration

Automation plays a central role in boosting adoption of side loader refuse trucks. These vehicles integrate robotic arms and sensor-based guidance to increase collection speed. The Side Loader Refuse Trucks Market grows with municipalities investing in technologies that minimize manual intervention. It reduces accident risk and enhances route optimization, enabling smoother operations. Advanced telematics and IoT features also support predictive maintenance and fleet management. Truck manufacturers develop models that combine automation with fuel efficiency, making them attractive to operators.

- For instance, Dennis Eagle introduced the Olympus Midi in April 2025 for narrow urban streets. It offers 9.8 m³, 10.8 m³, and 11.8 m³ body capacities. The vehicle’s 3.25 m wheelbase and 2,350 mm width boost maneuverability in tight spaces.

Emphasis on Sustainability and Environmental Regulations

Governments enforce stricter emission norms, encouraging investment in sustainable waste collection vehicles. The Side Loader Refuse Trucks Market responds with electric and hybrid variants that meet compliance standards. It supports cities in lowering carbon footprints while maintaining operational efficiency. Waste management firms prefer vehicles that align with sustainability goals and reduce lifecycle costs. Development of energy-efficient hydraulic systems further improves environmental performance. Green initiatives across regions continue to accelerate adoption of eco-friendly refuse trucks.

Expansion of Municipal and Private Sector Waste Management Contracts

Rising outsourcing of waste collection to private operators boosts market demand. Municipalities issue long-term contracts that require reliable, high-capacity trucks. The Side Loader Refuse Trucks Market benefits from the need for fleet upgrades in response to these contracts. It enables operators to improve service delivery and comply with contractual performance benchmarks. Large-scale residential and commercial projects also create steady demand for side loaders. Growth in public-private partnerships ensures continuous investment in waste management fleets.

Market Trends

Growing Adoption of Automated Collection Systems

Automation trends dominate the waste management industry with rising preference for smart trucks. The Side Loader Refuse Trucks Market advances through integration of robotic arms, automatic bin lifters, and sensor-based operations. It supports faster collection cycles while reducing physical strain on workers. Automated systems improve precision in handling varied container sizes, enhancing service efficiency. Municipalities and private operators favor automation for consistent performance in high-density urban areas. The shift toward mechanization sets a strong direction for future fleet investments.

- For instance, Amrep advertises that its automated side loaders can handle between 800 and 1,200 homes per route, depending on route density and landfill proximity. The figure of “up to 1,200 homes per route” is directly supported by this information.

Increasing Penetration of Electric and Hybrid Models

Sustainability goals push manufacturers to introduce eco-friendly refuse truck models. The Side Loader Refuse Trucks Market evolves with growing adoption of electric and hybrid variants. It aligns with regulatory requirements and helps operators reduce operational emissions. Battery technology improvements extend range and allow reliable deployment in municipal routes. Hybrid models also balance fuel efficiency and performance, lowering long-term costs. Urban governments encourage procurement of such vehicles through incentive programs and clean fleet policies.

- For instance, Peterbilt’s Model 520EV delivers 670 hp, supports a GCWR of 66,000 lbs, and handles up to 1,100 bin pickups (≈80–120 miles) on a single charge. It also charges fully in about 3 hours, featuring regenerative braking for added efficiency.

Integration of Telematics and Digital Fleet Management Tools

Digitalization transforms waste collection by enabling data-driven decision-making. The Side Loader Refuse Trucks Market incorporates telematics, GPS tracking, and real-time monitoring tools. It allows fleet operators to optimize routing, reduce idle time, and improve fuel efficiency. Predictive maintenance supported by IoT integration reduces downtime and service interruptions. Digital tools also provide municipalities with performance analytics for contract management. Growing reliance on connected technologies ensures smarter operations and higher customer satisfaction.

Focus on Ergonomic and Safety Enhancements

Operator safety and comfort remain critical factors influencing product innovation. The Side Loader Refuse Trucks Market emphasizes design improvements such as advanced cabin ergonomics and visibility systems. It reduces fatigue and enhances operational safety in urban environments. Automated loading arms further minimize direct worker contact with waste, lowering health risks. Truck makers also integrate advanced braking systems and stability features to prevent accidents. Safety-focused design trends continue to strengthen adoption across both municipal and private sectors.

Market Challenges Analysis

High Initial Costs and Maintenance Burden

The Side Loader Refuse Trucks Market faces challenges due to high acquisition and maintenance costs. Advanced automation systems, telematics, and eco-friendly powertrains raise upfront expenses for operators. It limits adoption among smaller municipalities and private contractors with budget restrictions. Ongoing maintenance of hydraulic systems, robotic arms, and digital sensors further increases operating costs. Spare parts and skilled technicians are also expensive, impacting long-term profitability. The cost barrier slows fleet modernization in emerging economies where funding is limited.

Infrastructure Limitations and Regulatory Compliance

Deployment of side loader refuse trucks is restricted by inadequate infrastructure in many regions. Narrow roads, irregular bin placement, and limited charging stations hinder efficient use of these vehicles. The Side Loader Refuse Trucks Market also struggles with evolving emission and safety regulations that vary across countries. It forces manufacturers to design multiple variants, increasing production complexity and costs. Operators face compliance challenges while transitioning fleets to meet stricter sustainability standards. Infrastructure gaps combined with regulatory uncertainty continue to constrain market expansion.

Market Opportunities

Expansion of Smart Waste Management Initiatives

Smart city projects and digital waste management programs create strong opportunities for advanced vehicles. The Side Loader Refuse Trucks Market gains traction from demand for trucks equipped with automation, sensors, and telematics. It supports municipalities in achieving efficiency targets while improving service reliability. Integration with data-driven platforms allows real-time monitoring, route optimization, and predictive maintenance. Public-private partnerships in waste management further accelerate fleet upgrades with smart capabilities. Growth of urban populations ensures steady demand for high-performance side loaders.

Rising Demand for Eco-Friendly and Electric Variants

Global sustainability commitments open pathways for electric and hybrid refuse trucks. The Side Loader Refuse Trucks Market benefits from government incentives and clean fleet policies encouraging adoption. It enables operators to reduce emissions, meet strict regulations, and align with carbon reduction goals. Battery technology improvements increase operational range, making electric side loaders more viable for urban routes. Hybrid solutions provide balance between fuel efficiency and performance, appealing to cost-sensitive buyers. Expansion of charging infrastructure strengthens prospects for wider deployment in developed and emerging markets.

Market Segmentation Analysis:

By Fuel

The Side Loader Refuse Trucks Market segments by fuel into diesel, electric, CNG, hybrid, and others. Diesel trucks maintain a dominant position due to established infrastructure and proven reliability in long routes. It remains a preferred option in regions where alternative fuel access is limited. Electric trucks gain strong traction as municipalities adopt zero-emission fleets supported by incentives and stricter emission norms. CNG-powered models find steady demand in countries with natural gas infrastructure, offering lower emissions and cost savings. Hybrid trucks bridge efficiency and sustainability, appealing to operators seeking transitional options. Other fuels, including biofuels and LNG, serve niche applications and support localized green initiatives.

- For instance, Curbtender’s PowerPak ASL achieves a high compaction rating of 1,000 pounds per cubic yard, with pack cycles completed in 16–20 seconds. Its 2,000-pound-capacity Power Arm lifts standard 300-gallon containers and includes a 5-year structural warranty.

By Application

Application-based segmentation covers municipal, industrial, commercial, and construction and demolition waste collection. Municipal waste collection accounts for the largest share due to urbanization and rising population density. The Side Loader Refuse Trucks Market benefits from large city contracts that require automated, high-capacity trucks. It supports municipalities in achieving efficient daily waste collection while meeting environmental goals. Industrial waste collection demands robust models capable of handling heavy and hazardous loads. Commercial waste collection emphasizes efficiency and flexibility in servicing retail, hospitality, and office facilities. Trucks designed for construction and demolition waste focus on durability and high-volume handling.

- For instance, Dennis Eagle’s purpose-built ProView chassis supports municipal and specialized fleets. It offers a best-in-class turning circle as small as 66.7 feet (curb-to-curb), aiding tight urban navigation.The low-entry cab has an 18.4‑inch ground-to-step height, flat walkthrough floor, and panoramic windows—ideal for crew safety and better driver visibility.

By End User

End users include municipal services, private waste management companies, specialized waste handlers, and others. Municipal services dominate adoption with strong investments in automated fleets and sustainability-driven procurement. It helps governments meet regulatory compliance while improving collection efficiency. Private waste management companies expand their fleets to secure long-term contracts from both public and commercial clients. Specialized waste handlers adopt side loaders for sectors such as healthcare and hazardous waste, where safety and precision are critical. Other users, including institutional facilities and large residential complexes, invest in side loaders for in-house waste management. The diversity of end users broadens the market’s long-term growth outlook.

Segments:

Based on Fuel:

Based on Application:

- Municipal waste collection

- Industrial waste collection

Based on End-User:

- Municipal services

- Private waste management companies

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America leads the Side Loader Refuse Trucks Market with about 35% of the global share. The U.S. dominates, driven by strong municipal budgets, modern waste infrastructure, and early adoption of automation. Cities such as New York, Los Angeles, and Chicago invest heavily in automated side loaders to improve efficiency and reduce labor costs. Canada follows a similar path, focusing on sustainable fleet modernization through electric and hybrid variants. Waste management companies across the region also benefit from supportive policies and incentive programs aimed at cutting emissions. The presence of established manufacturers and consistent fleet upgrades keeps North America a stable and mature market with strong growth potential.

Europe

Europe holds nearly 20% of the Side Loader Refuse Trucks Market, supported by strict environmental regulations and recycling mandates. Countries such as Germany, the UK, and France lead in adopting electric and CNG-powered refuse trucks to meet EU carbon targets. Municipalities in urban centers face pressure to manage high waste volumes while lowering emissions, creating steady demand for automated side loaders. Manufacturers also focus on ergonomic designs and advanced safety features to align with European worker safety standards. Continuous investment in sustainable fleets ensures long-term opportunities. Government funding and recycling targets accelerate adoption of both electric and hybrid side loader models across the continent.

Asia Pacific

Asia Pacific accounts for about 30% of the Side Loader Refuse Trucks Market and represents the fastest-growing region. Rapid urbanization in China, India, and Southeast Asia drives demand for efficient and automated waste collection. Rising populations in large cities create high daily waste volumes that require modern fleet solutions. Governments and private waste companies invest in side loaders to manage dense residential areas where manual collection is less practical. China invests in smart waste management projects under its urban modernization initiatives, while India focuses on fleet expansion through programs like Swachh Bharat. Growing interest in electric refuse trucks also reflects regional goals to curb urban pollution. Asia Pacific’s rapid economic growth and infrastructure development position it as a key market for future expansion.

Latin America

Latin America contributes around 10% to the Side Loader Refuse Trucks Market. Mexico and Brazil dominate the regional share due to rising urbanization and municipal waste collection needs. Cities such as São Paulo and Mexico City face mounting pressure to modernize waste fleets with automated side loaders. Public-private partnerships expand adoption, with contractors investing in fleets to meet service contracts. Regional governments encourage modernization but face budget constraints, which slows wider adoption. Demand focuses mainly on diesel and CNG trucks, though interest in electric fleets is gradually emerging. Latin America shows steady growth potential as waste collection infrastructure improves and service coverage expands.

Middle East & Africa

The Middle East & Africa hold a smaller share of about 5%, but rising urban development projects create opportunities. Gulf countries, including Saudi Arabia and the UAE, invest in modern side loader fleets as part of smart city and sustainability programs. These fleets help improve collection efficiency in fast-growing urban centers such as Dubai and Riyadh. In contrast, adoption across Africa remains limited due to infrastructure gaps, high vehicle costs, and limited access to advanced fuel technologies. Still, growing urban populations and waste management reforms in South Africa, Nigeria, and Egypt provide growth opportunities. Regional demand remains niche but is set to expand with government-backed sustainability initiatives and international investment in waste infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bridgeport Manufacturing

- Mack Trucks

- Dennis Eagle

- Amrep

- Peterbilt

- Labrie Trucks

- Heil

- McNeilus Truck

- New Way Refuse Trucks

- Autocar

Competitive Analysis

The Side Loader Refuse Trucks Market players include Bridgeport Manufacturing, Mack Trucks, Dennis Eagle, Amrep, Peterbilt, Labrie Trucks, Heil, McNeilus Truck, New Way Refuse Trucks, and Autocar. The Side Loader Refuse Trucks Market is highly competitive, with manufacturers focusing on technology integration, sustainability, and fleet efficiency to strengthen their positions. Companies emphasize automation, advanced hydraulic systems, and ergonomic designs to improve performance and operator safety. Growing demand for electric and hybrid models pushes innovation in low-emission solutions that align with global sustainability goals. Digital fleet management, telematics, and predictive maintenance tools further enhance competitiveness by reducing downtime and operating costs. Municipal contracts and public-private partnerships play a critical role, as operators seek reliable and cost-effective solutions. The market continues to evolve through product diversification, regional expansion, and continuous investment in research and development.

Recent Developments

- In Jun 2025, GFL Environmental Services acquired OSI, marking one of its first major deals since the company’s spin-off. This acquisition strengthens GFL’s market position and signals a renewed growth strategy post-restructuring.

- In January 2025, Amrep announced a new official dealer partnership with MTech With this agreement, MTech located in Cleveland, Ohio, will cover the Amrep front-end loaders, automated side loaders, and rear-loader refuse truck products for the entire Ohio, Michigan and Western Pennsylvania region.

- In September 2024, Casella Waste Systems announced the acquisition of Royal Carting and Welsh Sanitation, expanding its footprint in the Northeastern U.S. The move is expected to enhance operational efficiency and customer reach in key regional markets.

- In May 2024, Peterbilt will exhibit its extensive vehicle lineup for the refuse industry, including all-electric and natural gas engine-equipped models its new fleet of natural gas-powered garbage trucks in collaboration with Peterbilt Motors Company.

Report Coverage

The research report offers an in-depth analysis based on Fuel, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see steady demand driven by urban waste management needs.

- Electric and hybrid trucks will gain more adoption with stricter emission rules.

- Automation will remain central, with robotic arms and sensors improving efficiency.

- Telematics and IoT tools will expand for smarter fleet management and monitoring.

- Municipal contracts will drive steady fleet upgrades across developed regions.

- Developing countries will increase investments in modern waste collection fleets.

- Safety and ergonomic features will become standard in new product designs.

- CNG and alternative fuels will serve as transitional options alongside electrification.

- Private operators will expand their fleets through public-private partnerships.

- Sustainability initiatives will continue to shape innovation and product development.