Market Overview

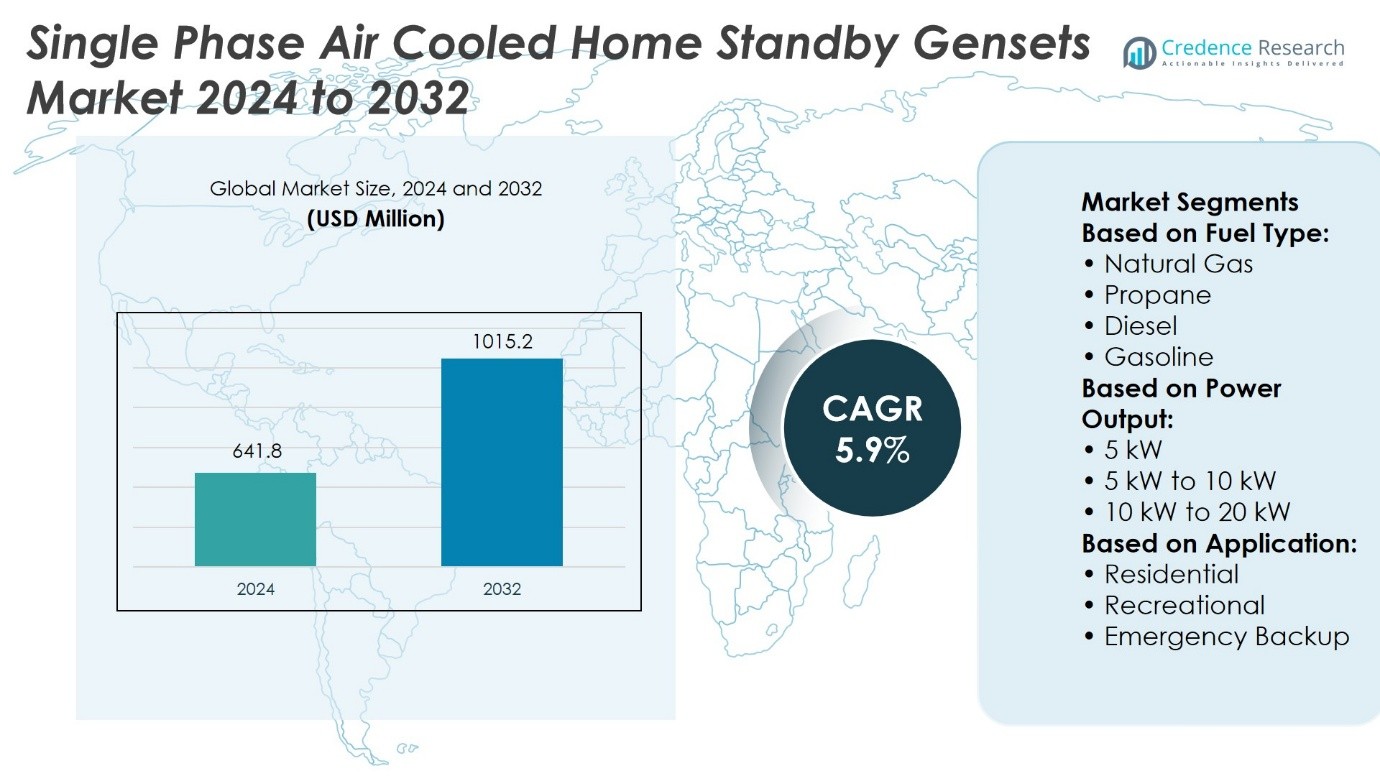

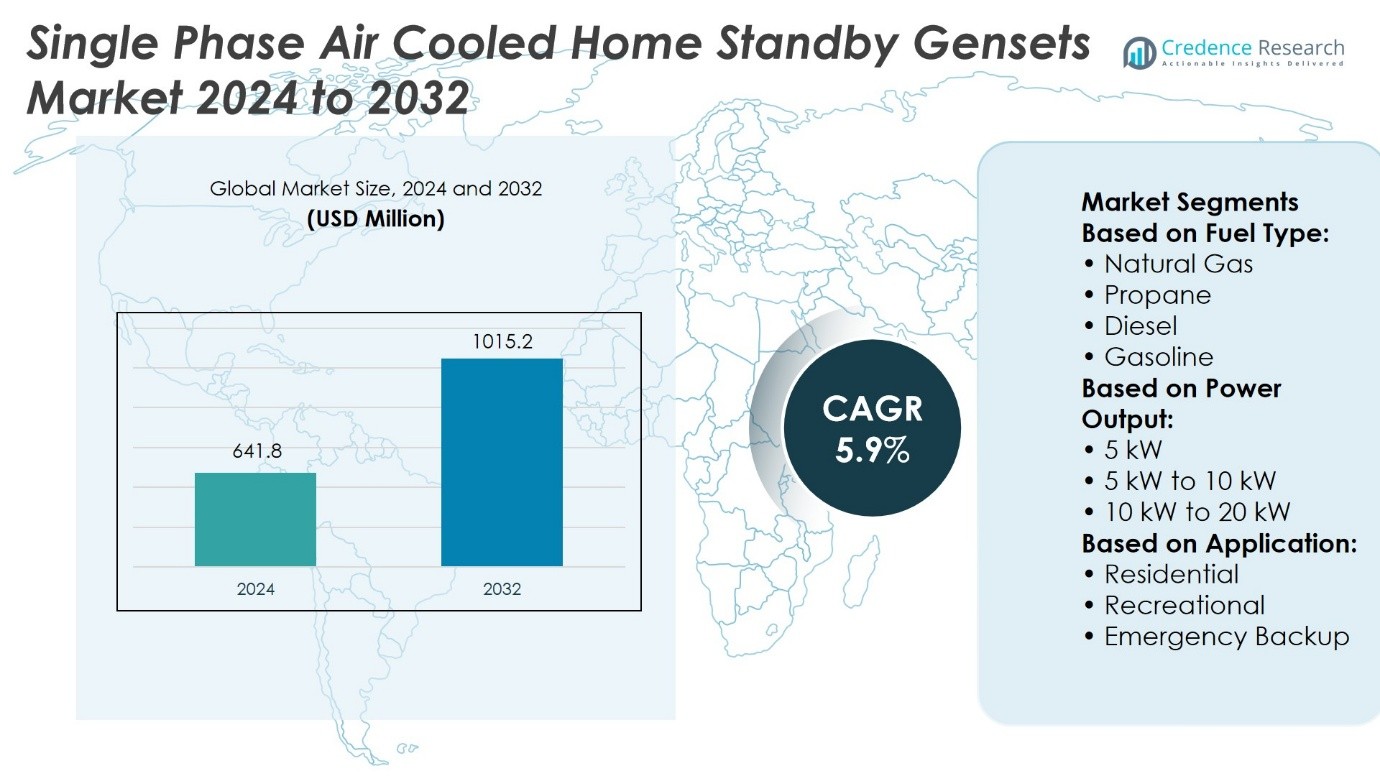

Single-Phase Air-Cooled Home Standby Gensets Market size was valued at USD 641.8 million in 2024 and is anticipated to reach USD 1015.2 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Single-Phase Air-Cooled Home Standby Gensets Market Size 2024 |

USD 641.8 Million |

| Single-Phase Air-Cooled Home Standby Gensets Market, CAGR |

5.9% |

| Single-Phase Air-Cooled Home Standby Gensets Market Size 2032 |

USD 1015.2 Million |

The Single-Phase Air-Cooled Home Standby Gensets Market grows through strong drivers such as rising residential demand for reliable backup power, frequent grid disruptions, and the need for energy security in storm-prone regions. Consumers value its cost-effectiveness, compact size, and suitability for household applications. The market also benefits from trends in smart home integration, where gensets feature digital monitoring, automated load management, and remote control. Manufacturers focus on improving fuel efficiency, reducing noise, and ensuring regulatory compliance. Expanding adoption in emerging economies and wider distribution networks further shape its evolution, making standby gensets an essential household energy solution.

The Single-Phase Air-Cooled Home Standby Gensets Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, with North America leading adoption due to frequent outages and advanced infrastructure. Europe emphasizes regulatory compliance, while Asia-Pacific records rapid growth from urbanization and unstable grids. Latin America and MEA provide emerging opportunities through residential electrification. Key players shaping the market include Generac Power Systems, Briggs & Stratton, Kohler, Cummins, Caterpillar, Eaton, Kirloskar, HIMOINSA, Champion Power Equipment, and Ashok Leyland.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Single-Phase Air-Cooled Home Standby Gensets Market size was valued at USD 641.8 million in 2024 and is projected to reach USD 1015.2 million by 2032, at a CAGR of 5.9%.

- Strong drivers include rising residential demand for reliable backup power, frequent grid failures, and the need for energy security in storm-prone regions.

- Key trends highlight smart home integration, digital monitoring, automated load management, and remote operation features.

- Competitive analysis shows leading players focusing on fuel efficiency, noise reduction, emission compliance, and strong service networks.

- Market restraints include high installation costs, regulatory challenges, and fuel availability issues in certain regions.

- Regional analysis shows North America leading adoption, Europe focusing on regulatory standards, Asia-Pacific witnessing fastest growth, and Latin America with Middle East & Africa offering emerging opportunities.

- Major players influencing the market include Generac Power Systems, Briggs & Stratton, Kohler, Cummins, Caterpillar, Eaton, Kirloskar, HIMOINSA, Champion Power Equipment, and Ashok Leyland.

Market Drivers

Rising Dependence on Reliable Backup Power in Residential Sector

The Single-Phase Air-Cooled Home Standby Gensets Market grows on heightened consumer demand for uninterrupted power supply during outages. Homeowners seek dependable systems that maintain essential appliances, security devices, and medical equipment during grid failures. Increasing frequency of weather-related disruptions reinforces adoption across suburban and semi-urban households. It provides a cost-effective alternative compared to three-phase units, making it practical for small to medium homes. Rising urbanization and greater reliance on electrical devices strengthen consumer preference. The shift toward energy resilience continues to accelerate the need for standby power solutions.

- For instance, Kohler expanded its home standby generator line in 2023 with models delivering up to 20 kW single-phase output, incorporating PowerBoost™ technology that handles up to load instantly without voltage drop, ensuring uninterrupted operation of HVAC systems and critical household circuits.

Expansion of Smart Home Integration and Automated Control Features

The Single-Phase Air-Cooled Home Standby Gensets Market benefits from integration with smart home technologies that enable remote monitoring and automatic start functions. Manufacturers design units with digital controllers and Wi-Fi connectivity, improving ease of use for households. It allows homeowners to track performance metrics and fuel levels in real time through mobile applications. Advanced load management capabilities ensure efficient distribution of power across appliances. Rising consumer preference for automated and connected solutions supports wider market acceptance. This alignment with modern home technologies makes standby gensets more appealing to tech-savvy consumers.

- For instance, Eaton’s EWFSW15 Wi-Fi smart decorator switch—integrated into smart home ecosystems—operates at 120 V/AC, supports 15 A (1/2 HP motor loads), and requires no hub for installation.

Government Support for Energy Security and Infrastructure Preparedness

The Single-Phase Air-Cooled Home Standby Gensets Market receives support from policies encouraging household-level preparedness for grid instability. Governments promote backup power adoption to reduce dependency on centralized infrastructure during emergencies. It aligns with programs that emphasize disaster readiness and protection of residential communities. Energy agencies recommend gensets for regions prone to severe storms, hurricanes, or long-duration blackouts. Policy-driven awareness campaigns improve consumer understanding of benefits. Incentives and supportive guidelines further enhance household adoption rates.

Competitive Product Innovation and Cost-Effective Manufacturing Practices

The Single-Phase Air-Cooled Home Standby Gensets Market advances through innovation in compact design, noise reduction, and fuel efficiency. Manufacturers introduce models with simplified installation processes and longer service intervals, improving consumer convenience. It enables households to adopt reliable standby systems without major space or maintenance constraints. Lower production costs achieved through modular assembly contribute to affordability. Enhanced distribution networks ensure product availability across developed and emerging markets. Ongoing innovation sustains the competitive edge and fosters consistent market expansion.

Market Trends

Increasing Adoption of Compact and Space-Efficient Designs

The Single-Phase Air-Cooled Home Standby Gensets Market shows a clear shift toward compact models tailored for residential use. Consumers prefer systems that require minimal installation space and blend with home environments. It supports demand from suburban households where available outdoor area is limited. Manufacturers focus on lightweight enclosures and simplified layouts without compromising performance. Improved portability enhances consumer convenience and broadens appeal across varied housing types. Compact design innovations strengthen the role of gensets in modern residential settings.

- For instance, Generac Power Systems introduced its Guardian Series 10 kW air-cooled standby generator with a footprint of just 48 × 25 inches and a weight of 338 kg, making it 20% smaller than earlier models while still delivering full-rated power output.

Rising Focus on Fuel Efficiency and Environmental Compliance

The Single-Phase Air-Cooled Home Standby Gensets Market trends toward models that balance reliable output with reduced fuel consumption. Manufacturers adopt advanced combustion systems and improved cooling technologies to meet strict emission norms. It ensures compliance with regional air quality standards while maintaining dependable power supply. Consumers prioritize generators that minimize operating costs and environmental impact. Product lines increasingly highlight eco-friendly certifications to enhance brand competitiveness. The emphasis on sustainable performance positions gensets as responsible household energy solutions.

- For instance, Caterpillar’s D125 GC standby genset—powered by a C7.1 four-cycle diesel engine—consumes 21.9 liters of fuel per hour at 50% rated load, 30.3 liters per hour at 75% load, and 37.8 liters per hour at full load while operating with its cooling fan engaged.

Integration of Digital Monitoring and Smart Control Systems

The Single-Phase Air-Cooled Home Standby Gensets Market incorporates advanced control features that improve user experience. Smart panels and wireless connectivity enable homeowners to oversee generator operation from remote locations. It allows monitoring of runtime, maintenance schedules, and performance metrics through mobile applications. Manufacturers design systems with automated load transfer switches for seamless power restoration. Rising consumer preference for connected devices strengthens demand for digitally enabled gensets. This integration aligns with broader smart home technology adoption across residential markets.

Expansion of Distribution Networks and After-Sales Services

The Single-Phase Air-Cooled Home Standby Gensets Market benefits from improved accessibility through expanded retail and service networks. Manufacturers invest in dealership partnerships and e-commerce platforms to reach a wider customer base. It ensures timely availability of products in both developed and emerging regions. Service offerings such as extended warranties and maintenance packages improve customer confidence. Reliable after-sales support strengthens brand loyalty and market competitiveness. Expanded distribution channels reinforce consistent adoption of home standby gensets worldwide.

Market Challenges Analysis

High Installation Costs and Limited Consumer Awareness

The Single-Phase Air-Cooled Home Standby Gensets Market faces constraints from the upfront expense of equipment and installation. Many households hesitate to invest due to the need for professional setup, fuel connections, and compliance with safety codes. It creates a cost barrier for middle-income consumers, particularly in emerging regions. Limited awareness of long-term benefits further restricts adoption, with some homeowners relying on portable alternatives. Marketing efforts and educational programs remain uneven across geographies, reducing penetration. The combination of high entry costs and low awareness continues to challenge growth potential.

Regulatory Pressures and Fluctuating Fuel Availability

The Single-Phase Air-Cooled Home Standby Gensets Market encounters challenges linked to emission regulations and fuel supply volatility. Governments enforce strict standards on noise and exhaust emissions, requiring costly technological upgrades by manufacturers. It increases production expenses and lengthens development cycles. Fuel availability presents another challenge, with regions dependent on inconsistent supply of natural gas or propane. Rising fuel costs impact consumer willingness to operate gensets during frequent outages. Regulatory constraints combined with supply uncertainties create significant hurdles for sustained market expansion.

Market Opportunities

Rising Demand for Residential Energy Resilience and Safety

The Single-Phase Air-Cooled Home Standby Gensets Market holds strong opportunity in households that prioritize energy security during frequent power disruptions. Growing reliance on home medical devices, digital equipment, and climate control systems increases the need for reliable backup. It offers an efficient solution for families seeking uninterrupted comfort and safety. Expansion of suburban housing in regions prone to storms and outages supports wider adoption. Demand is further reinforced by consumer preference for systems that require minimal maintenance while ensuring consistent performance. The focus on residential resilience positions gensets as a critical household investment.

Technological Advancements and Expansion into Emerging Economies

The Single-Phase Air-Cooled Home Standby Gensets Market benefits from innovation in fuel efficiency, automation, and noise reduction technologies. Manufacturers introduce models with smart connectivity and advanced load management, appealing to modern households. It creates opportunities for differentiation in a competitive landscape. Emerging economies with unstable grid infrastructure present strong prospects, as consumers seek affordable backup power. Rising urbanization and increasing disposable incomes in Asia and Africa broaden the customer base. Enhanced product features combined with geographic expansion open significant growth pathways for market participants.

Market Segmentation Analysis:

By Fuel Type

The Single-Phase Air-Cooled Home Standby Gensets Market segments by fuel type into natural gas, propane, diesel, and gasoline. Natural gas units dominate due to stable supply through municipal pipelines and lower maintenance requirements. Propane gensets follow closely, preferred in rural regions where gas connections remain limited. It provides clean combustion and longer shelf life, supporting consistent residential adoption. Diesel units hold niche demand in areas with limited access to other fuels, offering high reliability during long outages. Gasoline gensets remain less common for standby use, but they appeal to households seeking low initial cost and simple refueling.

- For instance, Generac’s Guardian Series 22 kW natural gas standby generator records a fuel consumption of 6.9 m³/hr at half load and 12.9 m³/hr at full load while meeting U.S. EPA emission standards.

By Power Output

Power output segments include less than 5 kW, 5 kW to 10 kW, 10 kW to 20 kW, and above 20 kW. Less than 5 kW units address small households and recreational users, offering backup for essential appliances. The 5 kW to 10 kW category holds strong traction, balancing affordability with capacity to run multiple household systems. It supports typical residential needs including lighting, refrigeration, and climate control. The 10 kW to 20 kW segment appeals to larger homes, delivering capacity for extended power outages with higher load coverage. Above 20 kW units remain limited but serve premium homes requiring complete household backup. Manufacturers continue to diversify output ranges to address household variations.

- For instance, Kirloskar’s iGreen 15 kVA single-phase air-cooled genset for homes delivers a rated output of 12 kW with fuel consumption of 3.8 liters per hour at 75% load, equipped with a remote monitoring system for urban households.

By Application

Applications divide into residential, recreational, and emergency backup. The residential segment leads adoption, driven by rising demand for uninterrupted household power supply in storm-prone and urbanizing regions. Recreational applications include use in cabins, off-grid homes, and leisure properties where stable energy access is valued. It expands adoption beyond conventional household settings and strengthens market appeal. Emergency backup applications remain critical, addressing households that depend on medical equipment or operate in regions with fragile grid infrastructure. Each application underscores the role of gensets in reinforcing safety, convenience, and energy independence.

Segments:

Based on Fuel Type:

- Natural Gas

- Propane

- Diesel

- Gasoline

Based on Power Output:

- 5 kW

- 5 kW to 10 kW

- 10 kW to 20 kW

Based on Application:

- Residential

- Recreational

- Emergency Backup

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds the largest share in the Single-Phase Air-Cooled Home Standby Gensets Market, accounting for about 38% of the global market. Strong demand comes from frequent storms, grid failures, and the high need for home energy security. It benefits from advanced dealer networks, strong after-sales services, and innovation in smart, quiet, and fuel-efficient genset designs. The United States dominates regional adoption, followed by Canada.

Europe

Europe represents about 27% of the market share, with steady growth supported by strict emission norms and preference for eco-friendly genset models. It sees consistent demand in colder countries where winter outages are common. Regulatory compliance drives technological improvements in efficiency and cleaner operation. Germany, the UK, and Nordic countries account for major adoption.

Asia-Pacific

Asia-Pacific holds around 25% share and records the fastest growth. Rising urbanization, unstable grids, and higher power needs in India, China, and Southeast Asia fuel adoption. It attracts consumers with affordable and compact units suitable for dense housing areas. Local partnerships, government focus on energy resilience, and e-commerce channels expand accessibility.

Latin America

Latin America contributes nearly 6% of the Single-Phase Air-Cooled Home Standby Gensets Market. Brazil and Mexico lead adoption, supported by increasing residential energy demand and unstable grid supply. It shows rising interest in compact gensets for households and small properties. Manufacturers target the region with affordable models and regional distributor networks.

Middle East & Africa

The Middle East & Africa account for about 4% of global share. Frequent outages in parts of Africa and high reliance on backup power in Gulf countries support demand. It highlights opportunities for propane and diesel-based gensets suited to local fuel availability. South Africa, Saudi Arabia, and the UAE are key growth hubs. Service partnerships and financing programs help increase consumer adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Single-Phase Air-Cooled Home Standby Gensets Market features include Ashok Leyland, Briggs & Stratton, Caterpillar, Champion Power Equipment, Cummins, Eaton, Generac Power Systems, HIMOINSA, Kirloskar, and Kohler. The Single-Phase Air-Cooled Home Standby Gensets Market reflects a highly competitive environment shaped by continuous innovation and expanding consumer expectations. Companies focus on developing gensets with improved fuel efficiency, quieter operation, and advanced automation features to meet residential needs. Emphasis on smart connectivity and remote monitoring strengthens product appeal in modern households. The market also experiences competition around cost-effectiveness, as manufacturers streamline production and distribution to deliver affordable solutions without compromising reliability. Service networks and maintenance support play a crucial role in building customer trust and long-term loyalty. Global and regional players alike prioritize regulatory compliance, particularly in emission standards, while targeting growth opportunities in both developed and emerging economies. This combination of technological advancement, service quality, and geographic expansion drives the intensity of competition across the market.

Recent Developments

- In May 2024, Briggs & Stratton Energy Solutions expanded its 26 kW PowerProtect Home Standby Generator by making it more powerful than ever before. It has 65.6 kVA of motor starting capability and the new model delivers 68% more starting power than its leading competitor, ensuring smooth operation of large appliances such as air conditioners and refrigerators.

- In January 2024, Champion Power Equipment introduced its 22 kW home standby generator, engineered for exceptional reliability and continuous power during storms and outages. This advanced system features automatic operation, including a seamless Automatic Transfer Switch (ATS) for smooth power transitions.

- In January 2023, Generac Power Systems joined forces with ecobee smart thermostats to improve their home standby generators by adding cellular and Wi-Fi functionalities. With this partnership, now homeowners can easily manage their generators and propane tanks in the case of an outage.

Market Concentration & Characteristics

The Single-Phase Air-Cooled Home Standby Gensets Market shows moderate concentration with a mix of global leaders and regional manufacturers competing across developed and emerging economies. It is characterized by steady technological innovation, strong distribution networks, and a focus on residential reliability. Leading companies differentiate through advancements in fuel efficiency, digital monitoring, and low-noise operation, while regional players emphasize affordability and service accessibility. It reflects high consumer preference for compact and easy-to-install systems that ensure consistent backup during power outages. Competitive intensity is reinforced by regulatory compliance pressures, with manufacturers aligning products to meet emission and safety standards. It continues to expand through growing demand for energy resilience, creating a balanced structure where established brands dominate premium segments while local producers address cost-sensitive markets.

Report Coverage

The research report offers an in-depth analysis based on Fuel Type, Power Output, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Single-Phase Air-Cooled Home Standby Gensets Market will see higher adoption in residential households due to increasing power outages.

- Demand will rise for compact and fuel-efficient models suited to urban and suburban housing.

- Smart connectivity and remote monitoring features will become standard offerings in new genset models.

- Regulatory pressure on noise and emission levels will push manufacturers toward cleaner technologies.

- Expanding service networks and maintenance support will strengthen customer trust and retention.

- Emerging economies will drive growth with rising urbanization and unstable grid infrastructure.

- Manufacturers will focus on modular designs that simplify installation and reduce operating costs.

- E-commerce and digital sales channels will expand product availability and consumer reach.

- Partnerships with utility providers and distributors will support wider market penetration.

- Innovation in dual-fuel and fuel-flexible gensets will enhance adaptability across diverse regions.