| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Autonomous Off-road Vehicles and Machinery Market Size 2023 |

USD 986.29 Million |

| South Korea Autonomous Off-road Vehicles and Machinery Market, CAGR |

13.4% |

| South Korea Autonomous Off-road Vehicles and Machinery Market Size 2032 |

USD 3,061.26 Million |

Market Overview:

South Korea Autonomous Off-road Vehicles and Machinery size was valued at USD 986.29 million in 2023 and is anticipated to reach USD 3,061.26 million by 2032, at a CAGR of 13.4% during the forecast period (2023-2032).

The acceleration of South Korea’s autonomous off-road vehicle market is propelled by several key factors. Technological advancements in artificial intelligence (AI), machine learning, and sensor technologies have enhanced the capabilities of autonomous machinery, enabling them to operate efficiently in challenging terrains. Additionally, the increasing emphasis on operational efficiency, safety, and sustainability in industries like agriculture and mining is driving the adoption of autonomous solutions. Government initiatives and investments in infrastructure to support automation further contribute to the market’s growth. Moreover, the rising labor shortages in key industries, such as agriculture, are encouraging businesses to seek autonomous solutions that can reduce reliance on human labor and increase operational efficiency. Finally, the growing push for sustainability and environmental considerations is further driving the market, as autonomous vehicles are seen as crucial in reducing emissions and improving fuel efficiency.

In the Asia Pacific region, South Korea stands out as a significant player in the autonomous off-road vehicle and machinery market. The country’s strong industrial base, coupled with a focus on technological innovation, positions it favorably for the adoption of autonomous solutions. While North America currently leads the global market, South Korea’s strategic investments and industrial advancements suggest a growing share in the regional market, particularly in sectors such as agriculture and mining. The government’s commitment to advancing smart farming techniques and the country’s aggressive push for innovation in its manufacturing sector provide a conducive environment for the market’s expansion. Furthermore, South Korea’s collaboration with key global players in the robotics and automation sector enhances its competitive positioning within the broader Asia Pacific region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market was valued at approximately USD 986 million in 2023 and is projected to reach over USD 3,061.26 million by 2032, growing at a compound annual growth rate (CAGR) of 13.4% during the forecast period.

- Global Autonomous Off-road Vehicles and Machinery size was valued at USD 23,300.00 million in 2023 and is anticipated to reach USD 68,887.09 million by 2032, at a CAGR of 12.80% during the forecast period (2023-2032).

- Advancements in artificial intelligence, machine learning, and sensor technologies have significantly enhanced the capabilities of autonomous machinery, enabling efficient operation in challenging terrains.

- Industries such as agriculture and mining are experiencing labor shortages, prompting the adoption of autonomous solutions to reduce reliance on human labor and maintain operational efficiency.

- The South Korean government is actively supporting automation through investments in infrastructure, research, and innovation, fostering the growth of autonomous technologies across various sectors.

- There is a growing emphasis on sustainability, with autonomous vehicles contributing to reduced emissions and improved fuel efficiency, aligning with environmental goals.

- South Korea stands out in the Asia Pacific region for its strong industrial base and focus on technological innovation, positioning it favorably for the adoption of autonomous solutions.

- Major players in the market include Hyundai Motor Group, GM Korea, Renault Samsung Motors, and KG Mobility, each contributing to the development and deployment of autonomous off-road machinery.

Market Drivers:

Technological Advancements in Automation and AI

The primary driver behind the growth of South Korea’s autonomous off-road vehicles and machinery market is the rapid development of automation technologies, including artificial intelligence (AI) and machine learning. These technologies are transforming the capabilities of off-road vehicles, enabling them to operate independently in various challenging environments. AI-powered systems improve the decision-making process in real-time, enhancing vehicle navigation, obstacle avoidance, and path planning. The integration of advanced sensors, such as LiDAR, radar, and GPS, further strengthens the precision and reliability of autonomous machinery. As these technologies become more refined, autonomous off-road vehicles are increasingly able to perform tasks more efficiently, safely, and with reduced human intervention. This shift is particularly beneficial in hazardous environments like construction sites, agricultural fields, and mining operations, where high-risk activities traditionally require human oversight.

Labor Shortages and Operational Efficiency

Another key factor driving the demand for autonomous off-road vehicles in South Korea is the growing labor shortage in industries such as agriculture, mining, and construction. These sectors have faced difficulties in maintaining a consistent and skilled workforce due to demographic changes, urban migration, and aging populations. Autonomous vehicles present a viable solution by reducing dependence on human labor and ensuring continuous operations, particularly in areas where labor is either scarce or difficult to retain. By incorporating autonomous machinery, companies can reduce labor costs and improve operational efficiency, leading to cost savings and enhanced productivity. The ability of these vehicles to operate 24/7, even under harsh weather conditions, further increases their appeal in sectors that require round-the-clock productivity.

Government Initiatives and Investments

The South Korean government’s active role in supporting the automation and robotics sectors also plays a significant part in driving the market. Recognizing the potential of autonomous technology, the government has invested heavily in infrastructure development, research, and innovation to foster the growth of these technologies. For instance, in the autonomous vehicle sector, South Korea is investing 1.1 trillion won (about $999 million) to commercialize Level 4 autonomous vehicles by 2027, with Hyundai Mobis leading technology development. Initiatives such as smart farming and “Industry 4.0” encourage the adoption of autonomous systems across multiple industries. Moreover, government subsidies and funding for the development and deployment of autonomous machinery have reduced the financial barriers for companies considering these solutions. This policy support is crucial in accelerating the pace of adoption, particularly for small and medium-sized enterprises that might otherwise be hesitant to invest in advanced technologies.

Sustainability and Environmental Considerations

Sustainability concerns are becoming an increasingly important factor in the adoption of autonomous off-road vehicles in South Korea. With heightened awareness of environmental issues and the need to meet stringent regulations regarding emissions, industries are turning to autonomous machinery as a means to reduce their carbon footprints. For example, the government’s fuel efficiency and GHG standards for passenger cars require a fleet average of 70g CO₂/km or 33.1 km/L by 2030, with similar targets for light trucks. Autonomous vehicles are often more fuel-efficient than their traditional counterparts, contributing to lower energy consumption and fewer emissions. In sectors like agriculture, the use of autonomous machinery can also minimize the environmental impact of soil compaction and reduce the need for pesticides and fertilizers by allowing for more precise operations. As South Korea pushes forward with its green energy and environmental policies, autonomous vehicles that align with sustainability goals are becoming a more attractive option for industries seeking to improve their environmental performance and comply with evolving regulations.

Market Trends:

Integration of Advanced Sensors and Robotics

A notable trend in the South Korean autonomous off-road vehicles and machinery market is the increasing integration of advanced sensors and robotics. As these technologies continue to mature, autonomous vehicles are becoming more sophisticated, with enhanced capabilities to sense their environment and interact with it in real-time. For instance, Seoul Robotics supplies LiDAR sensors to major automotive and robotics firms, including Hyundai and Naver, enabling vehicles to operate reliably in complex and dynamic off-road environments. These developments have led to the emergence of more reliable and accurate autonomous systems that can operate safely in off-road settings, including construction sites and agricultural fields. Robotics technology is also evolving, contributing to the automation of tasks that were once considered too intricate or physically demanding for machines, further increasing the versatility and range of autonomous off-road vehicles.

Collaboration Between Tech Companies and Industry Leaders

Another prominent trend in South Korea’s autonomous off-road vehicle market is the growing collaboration between tech companies, autonomous vehicle manufacturers, and industry leaders. To accelerate innovation, companies in the automotive, robotics, and artificial intelligence sectors are forming strategic partnerships. For example, collaborations between South Korean manufacturers and global tech giants are enabling the exchange of knowledge and resources to drive the development of more advanced autonomous systems. These partnerships not only foster the rapid deployment of autonomous machinery in industries such as agriculture and construction but also enhance the overall technological ecosystem within the country. With such collaborations, South Korea is positioning itself as a leader in the autonomous vehicle space, creating a more robust and competitive market for off-road automation solutions.

Shift Towards Smart Agriculture and Precision Farming

The rise of smart agriculture and precision farming is significantly influencing the demand for autonomous off-road vehicles in South Korea. Farmers are increasingly adopting autonomous machinery to improve the efficiency of agricultural operations, such as planting, harvesting, and crop monitoring. By using autonomous vehicles equipped with advanced sensors and AI, farmers can optimize their use of resources, reduce waste, and improve crop yields. In addition, autonomous machinery can operate continuously, overcoming the challenges posed by labor shortages in rural areas. This trend is driven by the need for more sustainable farming practices and the desire to enhance productivity through data-driven, technology-enabled methods. South Korea’s government initiatives supporting smart farming are also contributing to this trend, as they provide subsidies and incentives for adopting such technologies.

Expansion of Autonomous Solutions in Construction and Mining

The construction and mining sectors in South Korea are increasingly embracing autonomous off-road vehicles and machinery, with an emphasis on automation to improve safety and efficiency. Autonomous construction vehicles, such as bulldozers and excavators, are being deployed to handle dangerous tasks, reducing human exposure to hazardous environments. Hyundai Motor Group, for example, is actively developing autonomous construction vehicles, such as bulldozers and excavators, which are deployed to perform hazardous tasks and reduce human exposure to dangerous environments. Similarly, in the mining industry, autonomous trucks and loaders are being used to transport materials in remote and challenging conditions, which helps reduce operational downtime and costs. The trend towards automation in these industries is supported by the need for more efficient resource management and the demand for reducing human risk in physically demanding tasks. This expansion is expected to continue as more companies realize the long-term benefits of adopting autonomous solutions in their operations.

Market Challenges Analysis:

High Initial Investment Costs

One of the key challenges faced by the South Korean autonomous off-road vehicles and machinery market is the high initial investment required for adoption. While autonomous technology offers long-term benefits in terms of efficiency and operational savings, the upfront costs of acquiring and deploying these systems can be significant. For small and medium-sized enterprises (SMEs) in industries like agriculture, construction, and mining, the financial burden of purchasing autonomous machinery, along with the necessary infrastructure, can be a major barrier. Despite government incentives and subsidies, many businesses remain cautious about the return on investment (ROI) in the short term, slowing the pace of widespread adoption.

Technological Limitations and Reliability

Another challenge is the technological limitations and reliability of autonomous off-road vehicles. While advancements in artificial intelligence, robotics, and sensor technologies have significantly improved the performance of autonomous vehicles, issues related to system malfunctions, sensor inaccuracies, and environmental conditions still pose risks. For example, rugged terrain and areas with limited GPS coverage can impede navigation and operational reliability. Continuous technology improvements and robust software updates are necessary to address these issues and ensure consistent performance in real-world conditions. Ensuring the reliability of autonomous systems in these challenging environments is crucial for market growth. Continuous improvements in technology and software are necessary to address these limitations and boost user confidence.

Regulatory and Safety Concerns

Regulatory hurdles and safety concerns are also key restraints in the autonomous off-road vehicle market. The adoption of autonomous machinery requires compliance with local and international safety standards, which can vary across industries. In South Korea, the regulatory framework for autonomous vehicles is still evolving, and companies may face delays or complications in gaining approval for autonomous systems in certain sectors. Moreover, safety concerns regarding the integration of autonomous vehicles into existing workflows and their interactions with human workers further complicate regulatory processes, slowing the adoption of these systems in the market.

Public Perception and Acceptance

Lastly, public perception and acceptance of autonomous off-road vehicles remain a challenge. Although the technology offers clear advantages in terms of efficiency and safety, many workers and industry stakeholders may be resistant to adopting autonomous machinery due to concerns about job displacement and safety risks. Overcoming these societal concerns and demonstrating the benefits of autonomy in enhancing safety and operational effectiveness will be essential for gaining broader acceptance in South Korea’s autonomous vehicle market.

Market Opportunities:

South Korea presents a compelling market opportunity for autonomous off-road vehicles and machinery, driven by substantial investments in technology and infrastructure development. The South Korean government has committed significant resources to advancing autonomous technologies, including the commercialization of Level 4 autonomous vehicles by 2027. This initiative is part of a broader strategy to enhance the nation’s autonomous driving capabilities and infrastructure. The government’s focus on smart farming and “Industry 4.0” encourages the adoption of autonomous systems across multiple industries. Moreover, the government’s commitment to advancing smart farming techniques and the country’s aggressive push for innovation in its manufacturing sector provide a conducive environment for the market’s expansion.

The convergence of technological advancements and strategic investments presents a robust market opportunity for autonomous off-road vehicles and machinery in South Korea. With applications spanning agriculture, construction, and mining, the demand for autonomous solutions is poised to increase, driven by the need for enhanced efficiency, safety, and sustainability. As global interest in autonomous technologies intensifies, South Korea’s proactive approach to research, development, and infrastructure development positions it favorably to capitalize on this expanding market. The integration of advanced sensors, artificial intelligence, and machine learning into off-road vehicles and machinery further enhances their capabilities, making them more adaptable and efficient in complex environments.

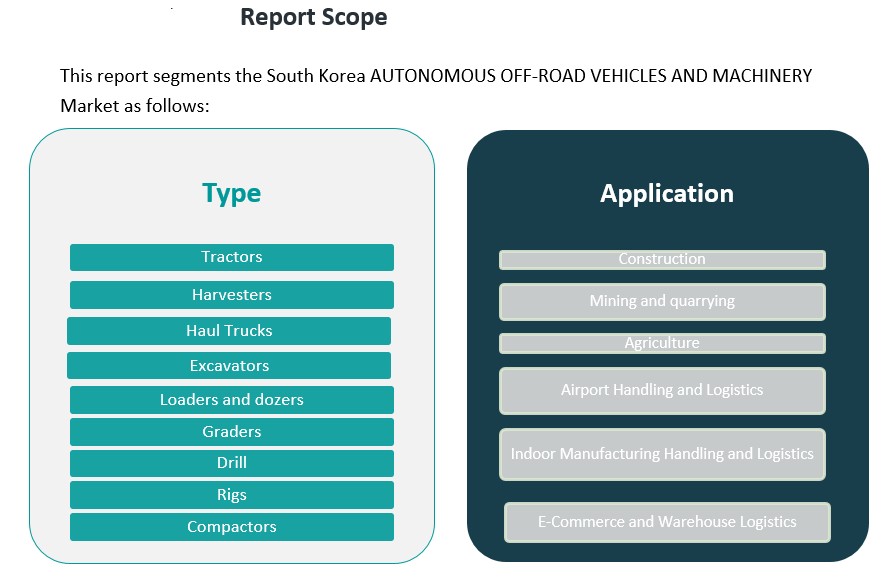

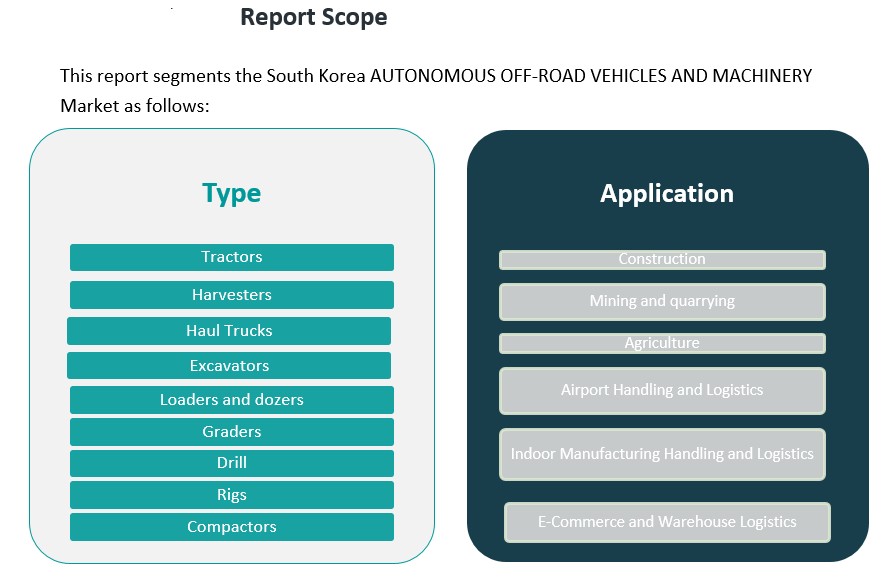

Market Segmentation Analysis:

By Type Segment

The South Korean market for autonomous off-road vehicles and machinery encompasses a diverse array of equipment tailored for various industrial applications. In agriculture, autonomous tractors and harvesters are enhancing precision and efficiency in tasks such as planting and harvesting. In construction, autonomous excavators, loaders, dozers, graders, and compactors are increasingly adopting autonomous technologies to improve safety and productivity on construction sites. In mining, autonomous haul trucks, drill rigs, and shovels are being equipped with autonomous systems to operate in hazardous mining environments, reducing human exposure to risks. Additionally, automated guided vehicles (AGVs), forklifts, and cranes are streamlining logistics operations by automating material transport and handling tasks.

By Application Segment

Autonomous off-road vehicles and machinery are deployed across various sectors, each benefiting from automation.In agriculture, autonomous farming equipment is enhancing crop management and yield optimization.In construction, automation in machinery is leading to more efficient project execution and improved safety standards.In mining and quarrying, autonomous mining equipment is improving operational efficiency and safety in challenging environments.In logistics, autonomous vehicles in warehouse and e-commerce logistics are optimizing material handling and inventory management processes.These applications highlight the broad applicability and growing adoption of autonomous technologies across various industries in South Korea.

Segmentation:

By Type Segment:

- Tractors

- Harvesters

- Haul Trucks

- Excavators

- Loaders and Dozers

- Graders

- Drill

- Rigs

- Compactors

By Application Segment:

- Construction

- Mining and Quarrying

- Agriculture

- Airport Handling and Logistics

- Indoor Manufacturing Handling and Logistics

- E-Commerce and Warehouse Logistics

Regional Analysis:

South Korea’s autonomous off-road vehicles and machinery market is experiencing dynamic regional development, influenced by technological advancements, infrastructure investments, and government initiatives.

Seoul Capital Area

The Seoul Capital Area, encompassing Seoul, Incheon, and Gyeonggi Province, leads in autonomous vehicle testing and infrastructure development. As of November 2023, this region accounted for the majority of the 635.75 km designated for autonomous vehicle testing nationwide. The concentration of research institutions, technology companies, and government agencies fosters innovation and facilitates the integration of autonomous technologies into off-road applications. Hyundai Motor Group, headquartered in this region, plays a pivotal role in advancing autonomous machinery development.

Yeongnam (Southeastern Region)

Yeongnam, comprising cities like Busan, Ulsan, and Daegu, is a significant hub for industrial activities, including shipbuilding, automotive manufacturing, and heavy industries. The region’s robust industrial base presents substantial opportunities for deploying autonomous off-road vehicles and machinery in construction, mining, and logistics sectors. The presence of established manufacturing facilities supports the adoption of automation technologies to enhance operational efficiency and safety.

Honam (Southwestern Region)

Honam, including Gwangju and the Jeolla provinces, is recognized for its agricultural activities and emerging technology sectors. The region benefits from government initiatives promoting smart farming and precision agriculture, creating a conducive environment for the adoption of autonomous agricultural machinery. Investments in infrastructure and technology are expected to drive the growth of autonomous off-road vehicles in this region, aligning with national objectives to modernize agriculture.

Hoseo (Central Region)

Hoseo, encompassing Daejeon and Chungcheong provinces, is a center for research and development, housing numerous institutions dedicated to science and technology. The region’s focus on innovation supports the advancement of autonomous technologies, including off-road vehicles and machinery. Collaborations between academia, industry, and government entities are fostering the development and deployment of autonomous systems in various sectors.

Other Regions

Other regions in South Korea are gradually adopting autonomous off-road vehicles and machinery, influenced by localized industrial needs and government support. While these areas may not yet match the technological infrastructure of the leading regions, ongoing investments and initiatives are paving the way for increased adoption of autonomous technologies across the country.

Key Player Analysis:

- Caterpillar Inc.

- Komatsu Ltd.

- Sandvik AB

- John Deere

- Liebherr Group

- Jungheinrich AG

- Daifuku Co. Ltd.

- KION Group

- NAVYA

- EasyMile

- Hyundai Motor Company

Competitive Analysis:

The South Korea Autonomous Off-road Vehicles and Machinery market is characterized by the presence of both established global players and emerging local firms, creating a highly competitive landscape. Leading companies like Hyundai, Doosan Infracore, and Samsung Heavy Industries are pioneering advancements in autonomous off-road machinery. These companies leverage strong technological capabilities in robotics, AI, and sensor integration, which enable improved operational efficiency and safety in construction, mining, and agricultural applications. Additionally, local firms such as LG Electronics are focusing on enhancing vehicle autonomy and connectivity features, further intensifying competition. These companies are engaging in strategic partnerships and R&D investments to develop cutting-edge autonomous solutions tailored to the specific needs of off-road industries. The competitive rivalry is heightened by innovations in electric and hybrid technology, which are expected to play a significant role in reducing operational costs and environmental impact, thereby influencing the market dynamics moving forward.

Recent Developments:

- In March 2025, Hyundai Motor Company announced a major partnership with Avride, an autonomous driving technology startup, to jointly develop driverless robotaxis based on the Hyundai IONIQ 5 platform. This collaboration aims to expand Avride’s fleet to up to 100 autonomous IONIQ 5 vehicles within 2025, leveraging Hyundai’s electric vehicle technology and Avride’s autonomous driving systems.

- In January 2025, John Deere unveiled several new autonomous machines and technologies at CES 2025, specifically targeting agriculture, construction, and commercial landscaping sectors. These advancements include the second-generation autonomy kit, which leverages advanced computer vision, AI, and cameras to enable machines such as the Autonomous 9RX Tractor for large-scale agriculture, the Autonomous 5ML Orchard Tractor for air blast spraying, the 460 P-Tier Autonomous Articulated Dump Truck for quarry operations, and an Autonomous Battery Electric Mower for commercial landscaping.

Market Concentration & Characteristics:

The South Korean autonomous off-road vehicles and machinery market is characterized by a moderate level of concentration, with several key players leading the development and deployment of autonomous technologies. Hyundai Motor Group, through its subsidiary Hyundai Mobis, is at the forefront, focusing on the commercialization of Level 4 autonomous vehicles by 2027. This initiative is supported by significant government investments, including approximately 1.1 trillion won (about $999 million), aimed at advancing autonomous driving capabilities and infrastructure. Other notable companies in the sector include GM Korea, Renault Samsung Motors, and KG Mobility, each contributing to the development of autonomous off-road machinery tailored for applications in agriculture, construction, and mining. These companies are investing in research and development to enhance the capabilities of autonomous systems, focusing on improving safety, efficiency, and adaptability to various off-road environments. The market is also witnessing the emergence of specialized technology firms, such as Seoul Robotics, which provide advanced sensor solutions to support autonomous operations in complex terrains . Collectively, these developments indicate a competitive yet collaborative market landscape, where established automotive manufacturers and innovative technology firms are working together to drive the adoption of autonomous off-road vehicles and machinery in South Korea.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type and Application It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is projected to experience substantial growth, with a notable compound annual growth rate (CAGR) anticipated over the next decade.

- Advancements in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of autonomous machinery, enabling more precise and efficient operations.

- Government initiatives, including regulatory support and infrastructure development, are fostering an environment conducive to the adoption of autonomous technologies.

- The integration of autonomous systems in agriculture is streamlining operations, improving yield predictions, and reducing labor costs.

- In construction and mining, autonomous machinery is enhancing safety by performing hazardous tasks and improving operational efficiency.

- The logistics sector is benefiting from autonomous vehicles that optimize material handling and transportation, leading to cost savings and increased productivity.

- Collaborations between automotive manufacturers and technology firms are accelerating the development and deployment of autonomous off-road vehicles.

- The emphasis on sustainability is driving the adoption of electric-powered autonomous machinery, aligning with environmental goals.

- Investments in research and development are leading to innovations that address challenges such as terrain adaptability and energy efficiency.

- As technology matures, the market is expected to expand into new applications, including disaster response and environmental monitoring.