| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| South Korea Toy Market Size 2024 |

USD 10,247.93 Million |

| South Korea Toy Market, CAGR |

5.04% |

| South Korea Toy Market Size 2032 |

USD 15,191.70 Million |

Market Overview

South Korea Toy Market size was valued at USD 10,247.93 million in 2024 and is anticipated to reach USD 15,191.70 million by 2032, at a CAGR of 5.04% during the forecast period (2024-2032).

The South Korean toy market is driven by increasing disposable income, changing consumer preferences, and a growing focus on educational and interactive toys. Parents are increasingly seeking toys that offer developmental benefits, promoting cognitive skills and creativity. The rise of digital and smart toys, incorporating technology such as augmented reality (AR) and artificial intelligence (AI), has also contributed to market growth. Additionally, the popularity of licensed toys, especially those based on global franchises like cartoons, movies, and video games, has further fueled demand. The shift toward online shopping, influenced by convenience and a tech-savvy consumer base, is reshaping retail dynamics. Increasing urbanization, along with a rising number of dual-income households, has further stimulated the demand for high-quality, innovative toys. These factors, combined with a robust e-commerce platform, are expected to drive the market’s growth, enhancing the overall consumer experience and expanding market opportunities.

The South Korean toy market is primarily concentrated in key urban regions, including the Seoul Metropolitan area, Gyeonggi Province, Busan, and Ulsan. These regions drive the demand for various toy types, with Seoul being the largest market due to its economic affluence and high consumer spending. Gyeonggi Province, surrounding Seoul, benefits from its proximity, while Busan and Ulsan are important for outdoor and sports toy demand, aligned with active lifestyles. Daegu, though smaller in market size, still contributes steadily to the overall demand for educational and traditional toys. Leading players in the South Korean toy market include global giants like Hasbro, Spin Master, VTech Electronics, and Playmobil, as well as local brands such as Toybox. These companies compete by offering a mix of traditional, educational, and innovative smart toys, often capitalizing on technological advancements and local consumer preferences for quality and safety in toys.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The South Korean toy market was valued at USD 10,247.93 million in 2024 and is projected to reach USD 15,191.70 million by 2032, growing at a CAGR of 5.04% during the forecast period.

- Increased disposable income and a growing emphasis on educational toys are driving the market’s growth.

- Rising demand for interactive, tech-enabled toys, such as those incorporating AI and AR, is reshaping the landscape.

- The toy market is highly competitive, with key players like Hasbro, Spin Master, and VTech Electronics competing alongside local brands.

- Regulatory challenges related to toy safety standards and growing concerns about plastic pollution may act as restraints on the market.

- The Seoul Metropolitan area dominates the market, followed by Gyeonggi Province, which benefits from its proximity to the capital.

- Other regions like Busan and Ulsan show strong demand for outdoor and sports toys, catering to active lifestyles.

Report Scope

This report segments the South Korea Market as follows:

Market Drivers

Increasing Disposable Income and Changing Lifestyles

One of the primary drivers of the South Korean toy market is the increasing disposable income of households. As the country continues to experience economic growth and urbanization, families are seeing higher levels of income, which in turn fuels the demand for a wide range of toys. Parents, particularly from dual-income households, have more financial freedom to invest in high-quality, innovative toys for their children. Additionally, the rising number of nuclear families and smaller household sizes has led to an increased focus on providing children with premium and educational toys. This growing purchasing power is enabling families to seek toys that are not only entertaining but also offer developmental benefits, driving the demand for toys that promote creativity, cognitive skills, and motor functions.

Shift Toward Educational and Developmental Toys

There is a notable shift in consumer preferences in South Korea towards educational and developmental toys. Parents are becoming more aware of the significant role toys play in their children’s learning and growth. For instance, South Korea’s Ministry of Education has introduced initiatives to promote early childhood education, encouraging the use of STEM toys in schools and learning centers. As a result, there is a rising demand for toys that can stimulate a child’s intellectual, emotional, and physical development. Products that encourage learning through play, such as puzzles, building blocks, STEM (Science, Technology, Engineering, and Mathematics) toys, and interactive games, are becoming increasingly popular. This trend is further supported by the government and educational institutions, which emphasize early childhood education and learning outside of formal school settings. Educational toys are seen as a way to provide children with an advantage, making them a key driver of market growth.

Technological Advancements and Smart Toys

The integration of technology into toys is another significant driver of the South Korean toy market. As consumers become more tech-savvy, the demand for toys that incorporate digital elements, such as augmented reality (AR), artificial intelligence (AI), and interactive features, has surged. For instance, South Korea’s strong internet infrastructure and government-backed programs like the “Smart Korea” initiative have facilitated the adoption of smart toys. Smart toys, which respond to voice commands, interact with children, or offer personalized experiences, are gaining popularity. These toys engage children in a more immersive and dynamic way compared to traditional, non-interactive options. For example, smart robots, educational tablets, and video games that teach coding or problem-solving are increasingly being embraced by tech-oriented parents. The growing interest in digital play is further propelled by the country’s strong infrastructure and high levels of internet connectivity, making it easier for children to access and engage with these advanced toys.

Influence of Licensing and Pop Culture

Licensed toys, especially those based on global franchises, play a significant role in driving demand in South Korea’s toy market. Characters and themes from popular movies, television shows, video games, and cartoons, such as those from Disney, Marvel, and Pokémon, hold immense appeal for children. These licensed toys often come with a sense of cultural relevance and nostalgia, drawing both young audiences and parents who are familiar with the franchises. The strong presence of pop culture and media content in South Korea ensures that licensed toys remain in high demand. Additionally, the rise of international streaming platforms, such as Netflix and YouTube, has amplified the visibility of global entertainment properties, further driving consumer interest in related toys. The licensing trend has not only expanded the variety of toys available in the market but has also increased their appeal, contributing significantly to market growth.

Market Trends

Rising Popularity of STEM and Educational Toys

One of the key trends in the South Korean toy market is the increasing demand for STEM (Science, Technology, Engineering, and Mathematics) and educational toys. With a strong cultural emphasis on academic achievement and early childhood education, parents are prioritizing toys that can enhance their children’s learning experiences. For instance, a survey conducted by the Toy Association revealed that 94% of parents believe toys play a significant role in their child’s development, with a strong preference for STEM toys that foster problem-solving and critical thinking. Products such as building sets, coding toys, and interactive kits that teach science or math concepts are highly sought after. As educational toys continue to be integrated into children’s playtime, the focus has shifted from mere entertainment to creating value in terms of skills development, making this trend a significant influence on market growth.

E-commerce and Online Retail Growth

Another key trend in South Korea’s toy market is the significant shift toward online shopping. With the rise of e-commerce platforms, consumers are increasingly purchasing toys online rather than in traditional brick-and-mortar stores. For instance, a study by the Competition Commission of India emphasized how e-commerce platforms have transformed consumer access to toys, offering personalized recommendations and detailed product descriptions. This trend is driven by the convenience, variety, and ease of access that online shopping offers, as well as the availability of detailed product information, reviews, and delivery services. Major e-commerce platforms like Coupang, Gmarket, and Naver Shopping have become key players in the toy retail space, making it easier for consumers to find both local and international toy brands. Additionally, online retailers are offering personalized recommendations based on consumer behavior, which has further accelerated the trend toward digital shopping for toys in South Korea.

Integration of Smart and Interactive Technology

The incorporation of smart technology into toys is another prominent trend shaping the South Korean market. With children becoming increasingly tech-savvy, there is a growing preference for interactive toys that use artificial intelligence (AI), augmented reality (AR), and voice recognition to enhance play. These smart toys offer personalized experiences, adapting to a child’s learning level and preferences. For instance, interactive robots that teach coding, voice-responsive toys, and digital games are becoming more popular. This trend is driven by South Korea’s strong digital infrastructure and high levels of internet connectivity, making tech-integrated toys both accessible and appealing to tech-oriented families. As these toys become more sophisticated, they promise to offer a more engaging, immersive, and educational experience for young children.

Sustainability and Eco-friendly Toys

Sustainability is increasingly becoming an important consideration for consumers in the South Korean toy market. As awareness of environmental issues grows, many parents are seeking eco-friendly alternatives to traditional plastic toys. There is a rising demand for toys made from sustainable materials such as wood, organic fabrics, and recycled plastics. Eco-friendly and non-toxic products are seen as safer for children and better for the planet. This trend aligns with broader global movements toward sustainability, and toy manufacturers are responding by incorporating environmentally responsible practices in production and packaging. As consumers continue to prioritize sustainability, eco-friendly toys are expected to become an even more significant part of the South Korean toy market in the coming years.

Market Challenges Analysis

Intense Competition and Price Sensitivity

One of the key challenges facing the South Korean toy market is the intense competition among both domestic and international brands. With a growing number of local and global toy manufacturers entering the market, it has become increasingly difficult for individual companies to stand out. International giants such as Mattel and Hasbro face competition from local brands that are offering similar products at competitive prices. This price sensitivity can put pressure on profit margins and force brands to engage in price wars, often resulting in reduced overall profitability. Furthermore, the preference for high-quality, durable toys in the South Korean market means that manufacturers need to continuously innovate and invest in better materials, production techniques, and designs, which can further strain financial resources.

Regulatory Challenges and Safety Standards

Another significant challenge in the South Korean toy market is navigating the complex regulatory landscape, particularly regarding safety standards and product certifications. South Korea has stringent safety regulations for children’s toys, which include strict testing for harmful chemicals, age-appropriate designs, and compliance with international standards. For instance, South Korea’s Ministry of Trade, Industry, and Energy has implemented stringent safety regulations for toys, requiring rigorous testing for harmful chemicals and compliance with international standards. Toy manufacturers must meet these rigorous requirements, which can result in increased production costs and delays in time-to-market. Moreover, global concerns about plastic pollution and toxicity have pushed authorities to introduce even stricter environmental and safety policies, adding to the complexity. Companies that fail to meet these evolving standards risk damaging their reputation and facing legal consequences, making it crucial for toy manufacturers to remain vigilant and adapt to regulatory changes.

Market Opportunities

The South Korean toy market presents significant opportunities for growth, particularly through the increasing demand for educational and developmental toys. As parents prioritize learning and cognitive development, there is a rising interest in toys that offer both entertainment and educational value. Products focused on STEM education, such as science kits, coding toys, and building sets, are gaining traction. Additionally, toys that promote creativity and problem-solving skills, such as art supplies and puzzles, align with the growing emphasis on enhancing children’s intellectual abilities. As South Korea continues to value early childhood education, manufacturers have the opportunity to capitalize on this trend by developing innovative, skill-building toys that appeal to both parents and children.

Another promising opportunity lies in the integration of technology into toys. With South Korea’s high digital penetration and tech-savvy population, there is a growing appetite for interactive and smart toys that incorporate artificial intelligence (AI), augmented reality (AR), and voice recognition features. These tech-enabled toys offer a personalized experience, engaging children in a dynamic way while also promoting learning. Manufacturers can seize this opportunity by creating toys that integrate cutting-edge technology with educational content. Furthermore, the expansion of e-commerce platforms presents a chance for toy companies to reach a broader consumer base, both domestically and internationally. Online retail growth offers convenience and accessibility for South Korean consumers, allowing toy brands to enhance their presence and improve sales through digital channels. By aligning product offerings with these technological advancements and leveraging the growing e-commerce ecosystem, toy manufacturers can tap into the market’s vast potential.

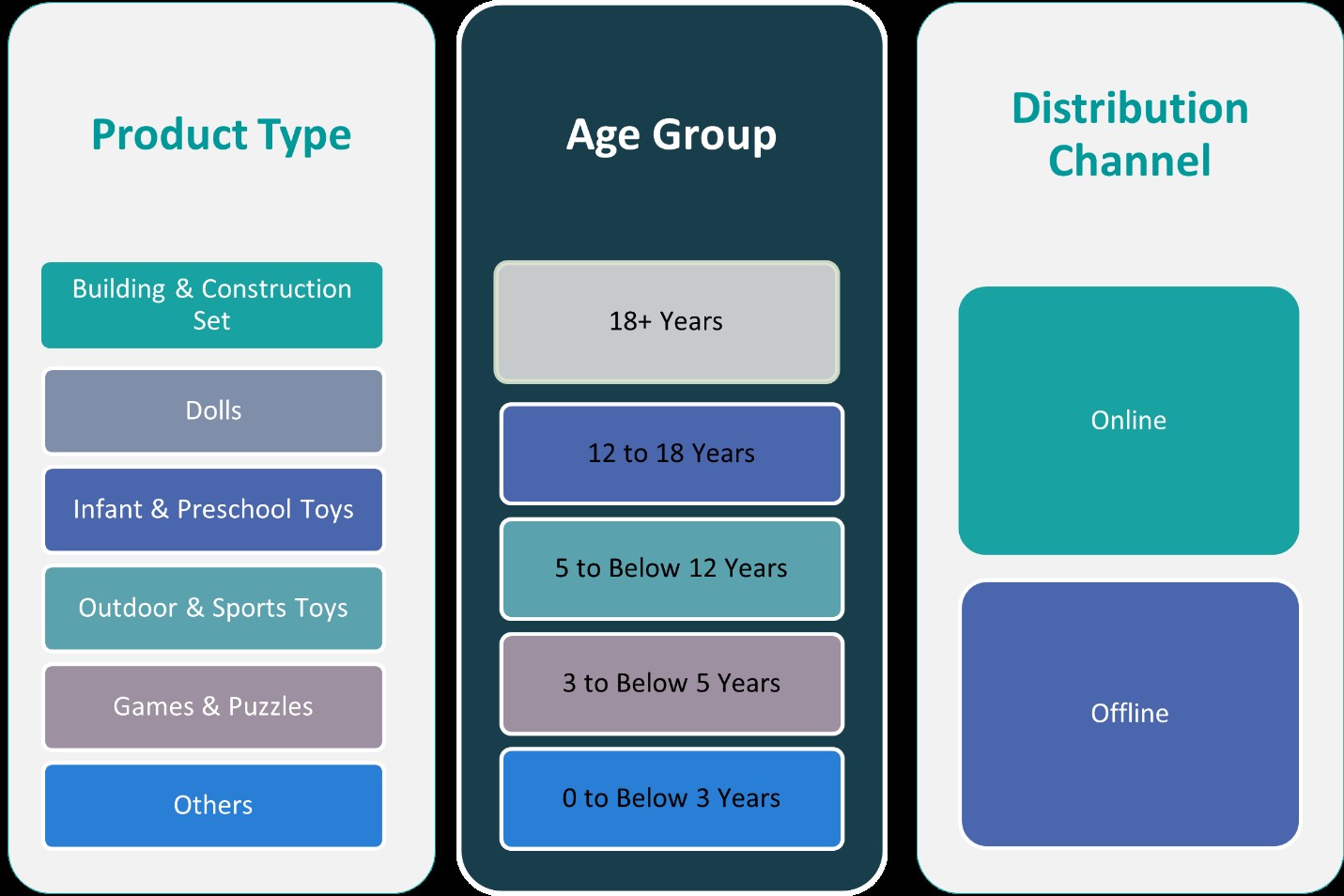

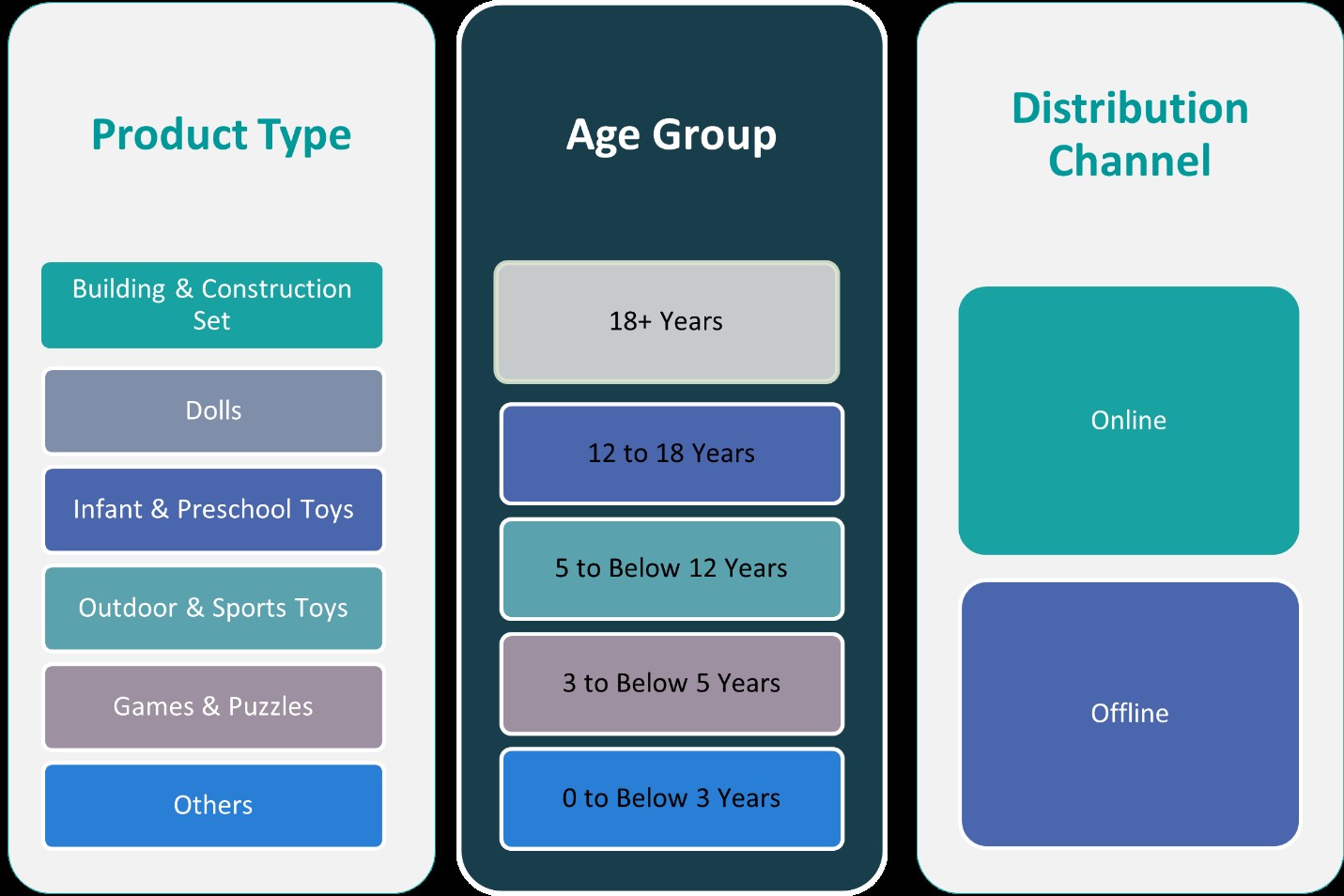

Market Segmentation Analysis:

By Product Type:

The South Korean toy market is divided into several key product types, each catering to different consumer preferences. Building & construction sets are particularly popular among children who enjoy creating structures and enhancing their problem-solving skills. These products are favored in the 5 to below 12 years age group, where creativity and cognitive development are emphasized. Dolls, on the other hand, remain a staple in the market, especially for younger children. They appeal to a broad demographic, with a strong preference among children aged 3 to below 5 years, as they support imaginative play and social development. Infant & preschool toys, focusing on sensory stimulation and motor skill development, are also essential, with high demand from the 0 to below 3 years age group. Outdoor & sports toys are popular across various age groups, promoting physical activity and social interaction. Games & puzzles are widely sought after across all age groups, enhancing critical thinking, coordination, and engagement. These diverse product segments ensure broad market appeal, with each offering unique value based on developmental needs.

By Age Group:

In the South Korean toy market, the age group segment plays a crucial role in determining product demand. The 0 to below 3 years category primarily drives the demand for infant and preschool toys that promote sensory development, motor skills, and early learning experiences. As children grow, the 3 to below 5 years age group seeks toys that encourage imaginative play, such as dolls, action figures, and basic building sets. For children aged 5 to below 12 years, there is a strong demand for toys that foster cognitive and creative development, including building sets, games, puzzles, and sports toys. The 12 to 18 years age group is more interested in games and collectibles, with a growing preference for tech-enabled toys, digital games, and sports equipment. Finally, the 18+ years category represents a niche market focused on collectibles, gaming merchandise, and hobby-based toys, often linked to popular franchises. This segmentation allows manufacturers to tailor their offerings based on the developmental stages and interests of children and adults alike, creating opportunities for targeted product development and marketing.

Segments:

Based on Product Type:

- Building & Construction Set

- Dolls

- Infant & Preschool Toys

- Outdoor & Sports Toys

- Games & Puzzles

Based on Age Group:

- 18+ Years

- 12 to 18 Years

- 5 to Below 12 Years

- 3 to Below 5 Years

- 0 to Below 3 Years

Based on Distribution Channel:

Based on the Geography:

- Seoul Metropolitan Region

- Gyeonggi Province

- Busan and Ulsan Regions

- Daegu Region

Regional Analysis

Seoul Metropolitan Region

The Seoul Metropolitan Region dominates the toy market, accounting for approximately 45% of the market share. As the capital and largest metropolitan area in South Korea, Seoul is the primary hub for consumer spending, including toys. The region’s high population density, urbanization, and concentration of affluent households contribute to its market leadership. Seoul’s large consumer base, combined with its proximity to major retail outlets, e-commerce platforms, and toy manufacturers, creates a thriving market for both traditional and innovative toys. The region also boasts strong demand for educational, smart, and interactive toys, driven by tech-savvy parents and a growing emphasis on early childhood education.

Gyeonggi Province

Gyeonggi Province, which surrounds Seoul, holds around 30% of the market share and is the second-largest contributor to the toy market. As a region that benefits from its proximity to Seoul, Gyeonggi Province experiences high levels of economic activity and urbanization. Many households in Gyeonggi are also part of the middle-to-high-income demographic, which supports the demand for a wide range of toys, from educational products to premium tech-enabled toys. The region’s large residential areas and a growing number of dual-income households further increase the demand for toys that combine both entertainment and developmental benefits. Additionally, Gyeonggi’s proximity to the capital’s retail infrastructure facilitates strong distribution channels for toy manufacturers.

Busan and Ulsan regions

The Busan and Ulsan regions collectively represent around 15% of the toy market share in South Korea. As key industrial and port cities, these regions have a strong economic foundation, but their toy market is slightly smaller compared to Seoul and Gyeonggi. However, the demand for toys remains robust, particularly for outdoor and sports toys, which align with the active lifestyles of families in these coastal cities. Additionally, the cultural importance of family-oriented leisure activities contributes to consistent demand for toys that support physical play and social interaction. The market in this region is increasingly characterized by a preference for both traditional toys and digital/interactive toys.

Daegu

Daegu, representing about 10% of the toy market share, is another notable region, though it is relatively smaller in comparison to the aforementioned areas. Daegu is known for its more conservative and traditional consumer base, where the demand for toys tends to be centered around classic, educational, and practical options. Building and construction sets, dolls, and educational toys are highly popular, particularly in the 0 to 5 years age group. Although Daegu’s market is smaller, it shows steady growth due to the region’s emphasis on family-oriented values and education. Additionally, as the region’s infrastructure continues to improve, the accessibility of toys and e-commerce options will likely drive further growth.

Key Player Analysis

- Hasbro, Inc.

- Toybox

- Spin Master

- VTech Electronics

- Playmobil

Competitive Analysis

The South Korean toy market is highly competitive, with both global and local players vying for market share. Leading international brands such as Hasbro, Spin Master, VTech Electronics, and Playmobil dominate the market by offering a diverse range of products that cater to different consumer preferences. The demand for toys is fueled by a combination of factors, including increasing disposable income, a shift toward educational and developmental toys, and the rise of tech-enabled products. As the market grows, companies are focusing on innovation to cater to evolving consumer preferences, such as interactive, digital, and smart toys. The popularity of STEM-based toys, which combine learning with entertainment, continues to rise, particularly among parents who prioritize educational value. Additionally, there is a growing interest in sustainability, prompting manufacturers to explore eco-friendly alternatives to traditional plastic toys. The market dynamics are also influenced by consumer trends, such as the increasing use of online platforms for purchasing toys, making it easier for companies to reach a broader audience. Regional differences within South Korea also shape toy demand, with urban centers showing higher demand for innovative toys, while more suburban or rural areas may favor traditional and educational toys. The South Korean market is rapidly evolving, driven by both local consumer behavior and global toy industry trends.

Recent Developments

- In March 2025, Spin Master announced the renewal of its global master toy licensee agreement with DreamWorks Animation for Gabby’s Dollhouse.

- In March 2025, MGA Entertainment’s Little Tikes brand announced a partnership with BBC Studios to launch a line of Bluey-inspired toys, including the Bluey Grannies Car Coupe, Bluey Bushland Adventures Splash Pad, Bluey Beach Day Sand Box, and Bluey Beach Water Table.

- In March 2025, the LEGO Group announced a new multi-year partnership with The Pokémon Company International to bring LEGO Pokémon sets starting in 2026.

- In March 2025, Hasbro participated in the North American International Toy Fair, showcasing new products and collaborations, including a PLAY-DOH Barbie line and Marvel’s Iron Man toys.

- In March 2025, Mattel renewed its multi-year global licensing agreement with Disney for Toy Story, planning new products for the franchise’s 30th anniversary and Toy Story 5.

Market Concentration & Characteristics

The South Korean toy market is moderately concentrated, with both domestic and international players competing for market share. While large global companies dominate in terms of product diversity and brand recognition, local manufacturers also play a significant role in catering to regional preferences and offering competitive pricing. The market is characterized by a mix of traditional and innovative toy offerings, with growing demand for educational toys, STEM products, and tech-enabled toys, such as those incorporating AI and AR features. Consumers in South Korea are highly discerning, often seeking products that combine entertainment with developmental benefits for children. The market also reflects a strong inclination toward safety, quality, and sustainability, prompting manufacturers to adopt environmentally friendly practices. E-commerce platforms have further influenced market dynamics, making it easier for companies to reach a broad consumer base. The industry’s competitiveness continues to drive innovation, creating a constantly evolving landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The South Korean toy market is expected to continue its steady growth, driven by increasing disposable income and evolving consumer preferences.

- Demand for educational and STEM-focused toys will rise, as parents increasingly prioritize learning and developmental benefits.

- The integration of technology in toys, including AI, AR, and interactive features, will become more prevalent, enhancing play experiences.

- The shift towards eco-friendly and sustainable toys will grow as consumers become more environmentally conscious.

- Online shopping will continue to dominate, with e-commerce platforms providing easy access to a wide range of toy products.

- The rise of digital toys and video games will expand, with a growing emphasis on educational content and interactive gameplay.

- Competitive pressures will encourage innovation, pushing brands to create unique and tech-driven products to meet consumer demand.

- The market will see increasing regional variations in toy preferences, with specific product types gaining popularity in different areas.

- Licensing and partnerships with popular media franchises will remain a significant driver of sales, particularly among younger age groups.

- South Korea’s toy market will become more diverse, catering to both traditional and modern play preferences, appealing to a broader demographic.