Market Overview:

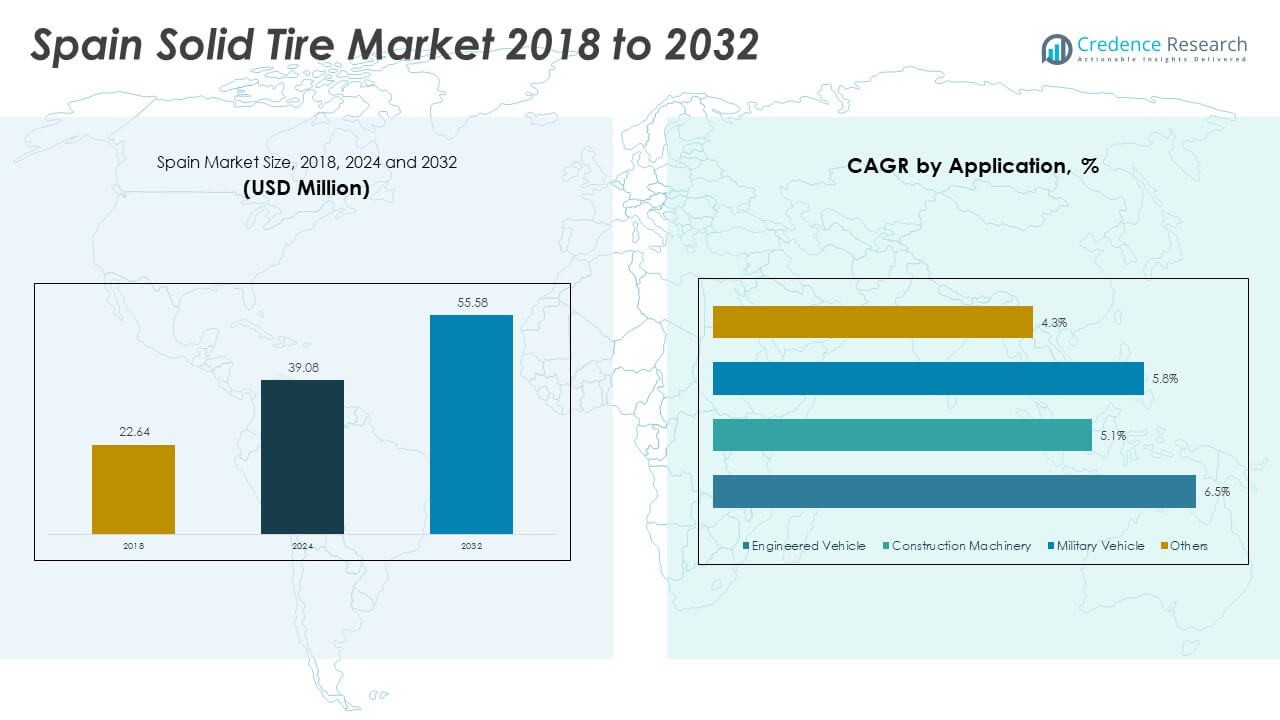

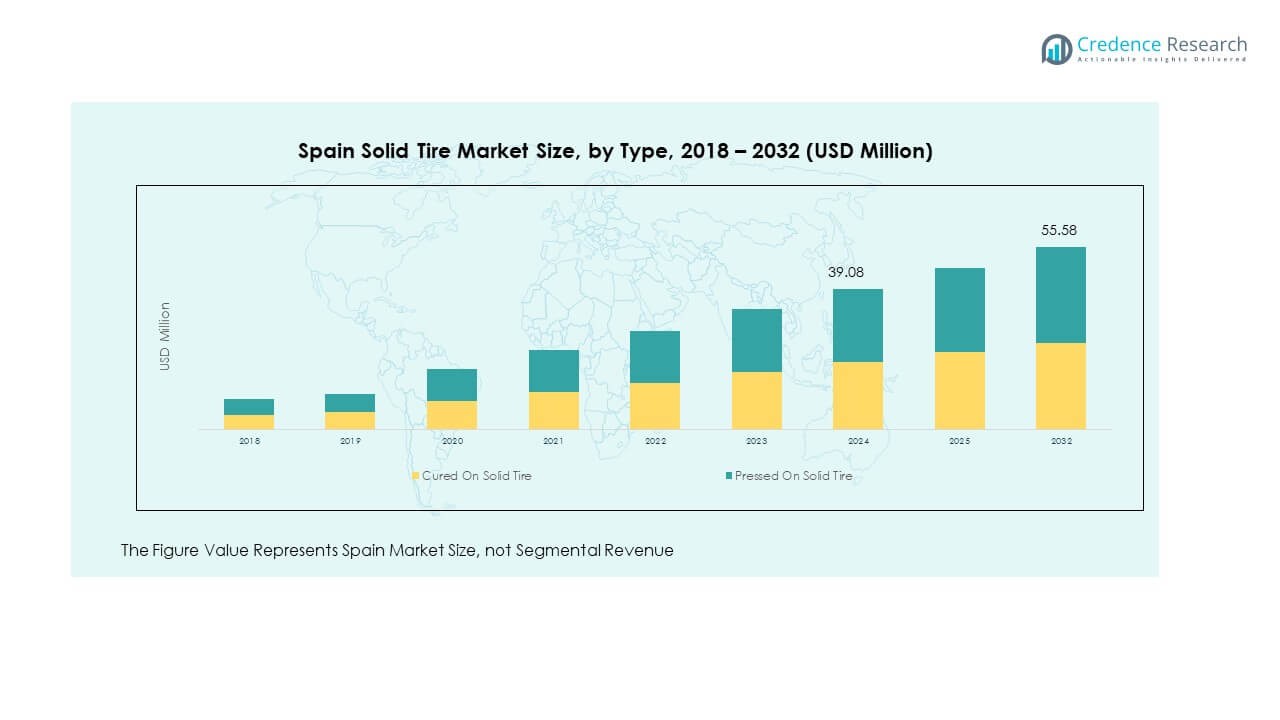

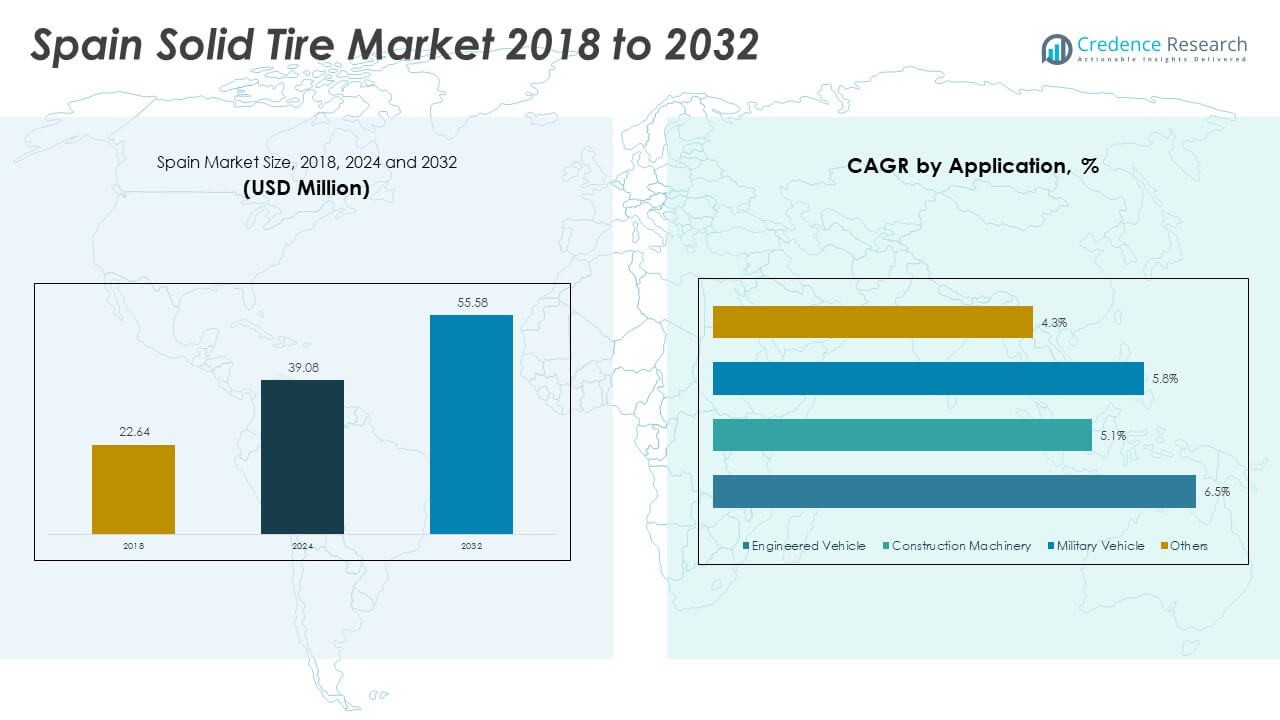

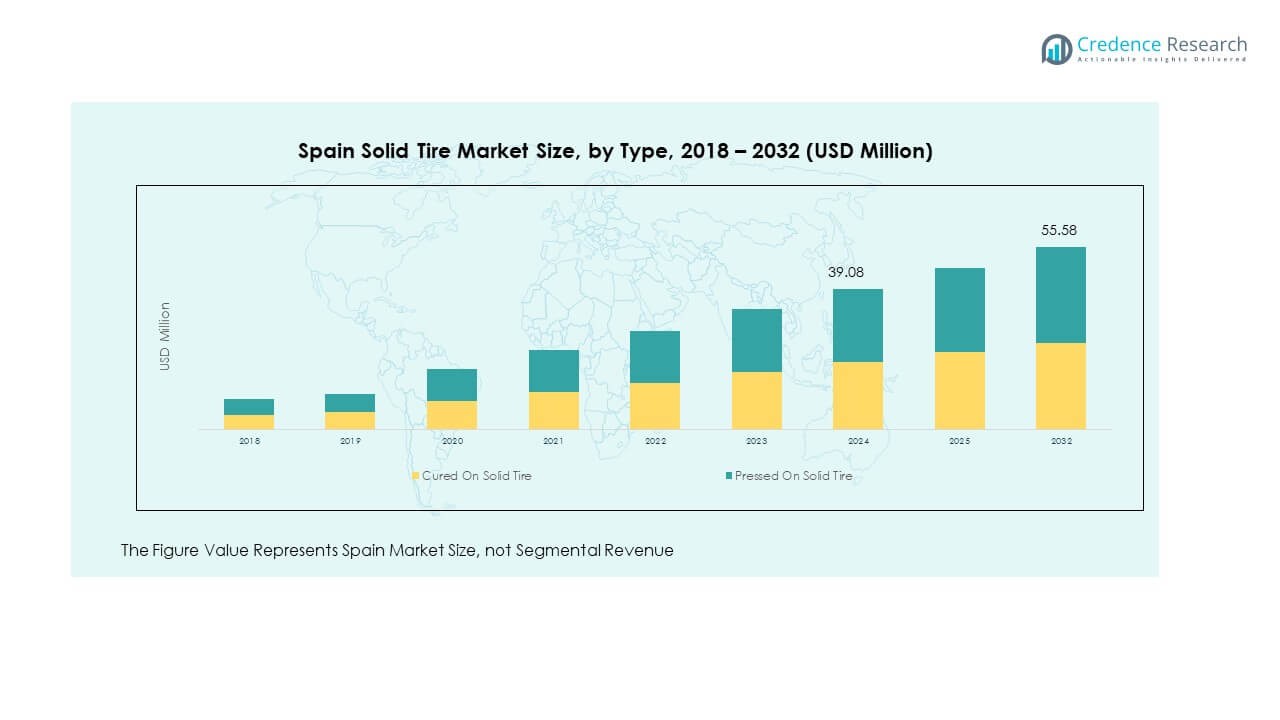

The Spain Solid Tire Market size was valued at USD 22.64 million in 2018 to USD 39.08 million in 2024 and is anticipated to reach USD 55.58 million by 2032, at a CAGR of 4.50% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spain Solid Tire Market Size 2024 |

USD 39.08 Million |

| Spain Solid Tire Market, CAGR |

4.50% |

| Spain Solid Tire Market Size 2032 |

USD 55.58 Million |

Growth in this market is supported by the rising demand for durable and puncture-resistant tires in industrial sectors. Expanding applications in forklifts, construction equipment, and material-handling machinery drive adoption. Companies are investing in advanced tire technologies that reduce maintenance costs and improve fuel efficiency. Increased infrastructure development and growing e-commerce activity also stimulate demand for efficient logistics solutions, strengthening the market outlook.

Regionally, Spain serves as a key market within Southern Europe due to its strong industrial base and logistics sector. Neighboring countries like Portugal and Italy are emerging markets, supported by increasing construction activity and urban infrastructure investments. Meanwhile, Northern European countries remain leaders in adoption due to higher automation levels and stronger sustainability regulations. Spain’s strategic location as a logistics hub further enhances its relevance in the regional solid tire landscape.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Spain Solid Tire Market size was valued at USD 22.64 million in 2018, expected to reach USD 39.08 million in 2024, and projected at USD 55.58 million by 2032, registering a CAGR of 4.50% during the forecast period.

- Europe (34%), North America (27%), and Asia-Pacific (25%) hold the top shares due to strong industrial bases, high adoption of advanced machinery, and developed logistics sectors driving demand.

- Asia-Pacific, with a 25% share, represents the fastest-growing region, fueled by expanding e-commerce, infrastructure projects, and rapid industrialization across China and India.

- Pressed On Solid Tires accounted for the larger share of the Spain market in 2024, reflecting strong adoption in heavy-duty industrial and logistics applications.

- Cured On Solid Tires represented the smaller but stable portion of the market, supported by consistent use in specific material-handling and warehousing operations.

Market Drivers:

Rising demand for heavy-duty tires in construction and logistics operations:

The Spain Solid Tire Market benefits from increasing demand in construction, mining, and logistics sectors. Heavy-duty vehicles such as forklifts, loaders, and transport machinery require durable tires capable of handling rough surfaces. Solid tires provide a puncture-proof design that reduces downtime and enhances productivity in high-demand operations. Spain’s growing investment in large-scale infrastructure projects further strengthens demand for reliable tire solutions. The rise in e-commerce drives warehouse expansion, which increases the deployment of forklifts and material-handling vehicles. These dynamics create steady growth opportunities for tire manufacturers. It positions the market as a critical contributor to industrial efficiency.

- For instance, Camso’s Solideal RES Xtreme NMAS solid tires reduce vibration and heat build-up, enhancing operator comfort and extending tire life, specifically supporting load capacities of 1 to 9 tons in material handling applications. These dynamics create steady growth opportunities for tire manufacturers, positioning the market as a critical contributor to industrial efficiency.

Increased focus on cost efficiency and lower maintenance requirements:

Industries emphasize cost control while ensuring operational reliability, making solid tires attractive. Unlike pneumatic tires, solid tires offer a longer life cycle with minimal maintenance. This characteristic reduces replacement frequency and ensures stable performance in intensive operations. The Spain Solid Tire Market benefits from industrial players seeking efficient solutions for long working hours. Low maintenance enhances productivity in factories, ports, and logistics centers. Companies also prefer these tires to reduce operational risks linked to punctures or blowouts. Strong emphasis on durability drives consistent adoption across multiple industries. It helps businesses optimize costs while maintaining safety standards.

- For example, Continental’s Plus series solid tires feature a proprietary polymer-matrix compound incorporating high amounts of short-chained sulfur compounds and silica to significantly enhance wear resistance and durability, reducing tire cracking and heat build-up for prolonged service life. Companies also prefer these tires to reduce operational risks linked to punctures or blowouts.

Growing integration of automation and material-handling equipment:

Automation in warehouses and logistics centers fuels demand for specialized tires supporting advanced machinery. Solid tires provide stability, reliability, and consistent traction for automated guided vehicles and electric forklifts. With Spain’s logistics hubs expanding rapidly, equipment manufacturers rely on high-quality tire solutions. The Spain Solid Tire Market supports industrial growth by aligning with the trend toward smart warehouses. Increased adoption of automation in ports and manufacturing units accelerates demand for solid tires. Their strength against wear ensures optimal functioning of high-utilization equipment. Manufacturers also promote eco-friendly designs that complement automated systems. It reinforces the importance of solid tires in modern industrial operations.

Strengthening emphasis on sustainability and environmental compliance:

Spain’s industries face strict EU environmental policies, driving a shift toward sustainable tire solutions. Manufacturers focus on recyclable materials and energy-efficient production to meet these requirements. The Spain Solid Tire Market gains from innovations that align with sustainability targets in logistics and construction. Demand grows for tires with reduced carbon footprints, promoting eco-friendly industrial practices. Government-backed initiatives supporting greener operations accelerate this transition. Companies integrating sustainable solutions benefit from stronger compliance and brand reputation. Recycling programs and circular economy strategies further increase adoption of such tires. It underscores the role of solid tires in advancing sustainability goals in industrial sectors.

Market Trends:

Advancements in solid tire design and material innovation:

Manufacturers introduce advanced compounds and reinforced structures to improve durability and performance. The Spain Solid Tire Market evolves with designs that reduce rolling resistance and increase efficiency. New rubber blends enhance heat dissipation, reducing risks during prolonged usage. Market players invest in advanced engineering to meet the needs of high-intensity operations. Specialized treads improve grip in both indoor and outdoor environments. These advancements extend tire life while lowering replacement costs. Businesses prefer these innovations for consistent results in critical applications. It ensures the market stays aligned with evolving industrial requirements.

- For instance, Trelleborg’s adoption of sustainable silica from rice husks and recycled pyrolyzed carbon black, combined with machine learning to optimize compound formulation, improves wear resistance, heat dissipation, and aging resistance, prolonging tire life under harsh conditions.

Expansion of aftermarket services and distribution networks:

Aftermarket services expand rapidly, making replacement tires more accessible to diverse industries. Dealers and distributors invest in wider networks to address the growing demand across regions. The Spain Solid Tire Market witness’s significant growth from service providers offering tailored solutions. Mobile repair and quick replacement options reduce downtime for industrial operators. Distributors focus on stocking premium and budget tire options to serve varying client needs. Partnerships between manufacturers and service providers further improve accessibility. Digital platforms enable better customer engagement and product availability. It strengthens the aftermarket segment as a key growth contributor.

- For example, Setco’s innovative solid tires with air ride technology include dual rubber compounds and offset circular air holes which allow twice the deflection of conventional solid tires, providing superior shock absorption and ride comfort to reduce operator fatigue on heavy equipment. Distributors focus on stocking premium and budget tire options to serve varying client needs.

Increasing adoption of smart tires with embedded monitoring technologies:

Smart tire technologies gain momentum, offering embedded sensors for monitoring performance. The Spain Solid Tire Market incorporates solutions that track heat, pressure, and wear patterns. Data-driven insights enable predictive maintenance, reducing unexpected breakdowns. Industries benefit from real-time tracking of equipment performance and safety. These systems align with Spain’s growing adoption of industrial IoT solutions. Manufacturers highlight reduced downtime and cost savings as major advantages of smart tires. Warehousing and logistics sectors show the highest adoption of these technologies. It reflects the market’s focus on digital transformation and intelligent solutions.

Rising penetration in renewable energy and eco-friendly projects:

Renewable energy projects demand durable material-handling equipment supported by solid tires. The Spain Solid Tire Market finds opportunities in wind and solar energy installations. Heavy machinery at renewable energy sites requires puncture-resistant and reliable tire solutions. Industrial demand aligns with Spain’s strong renewable energy agenda, boosting tire adoption. Market players focus on eco-friendly tire production to meet sustainability targets. Expansion of such projects encourages long-term use of robust tire systems. These developments provide suppliers with stable growth prospects. It highlights the role of solid tires in advancing Spain’s green economy.

Market Challenges Analysis:

High initial investment and limited awareness among smaller enterprises

The Spain Solid Tire Market faces challenges due to the higher upfront cost of solid tires compared to pneumatic alternatives. Small and medium-sized enterprises often hesitate to adopt premium solutions due to budget constraints. Limited awareness about long-term savings and performance benefits reduces adoption in cost-sensitive segments. Distribution networks sometimes struggle to reach smaller businesses in regional areas. Lack of adequate training for handling and maintenance also restricts usage efficiency. Price competition from low-cost imports adds further pressure on local manufacturers. It creates barriers for wider acceptance among all industrial players.

Intense competition and reliance on raw material supply chains:

Manufacturers in the Spain Solid Tire Market face strong competition from international brands and regional suppliers. Continuous innovation is essential to maintain market share, but it increases development costs. Reliance on raw materials such as natural and synthetic rubber exposes the industry to price volatility. Global supply chain disruptions affect timely availability, raising operational risks for manufacturers. Intense competition also compresses margins, forcing companies to differentiate through quality and service. Regulatory compliance further increases production complexities and cost structures. It pushes businesses to balance affordability with premium quality offerings.

Market Opportunities:

Rising infrastructure investments and growth of logistics hubs:

Spain invests heavily in infrastructure projects, creating long-term demand for solid tires. Warehousing and logistics hubs expand rapidly to serve e-commerce, retail, and international trade. The Spain Solid Tire Market benefits from the rise of specialized equipment required in these sectors. Tire manufacturers offering customized designs gain opportunities to meet industry-specific requirements. Logistics expansion also drives demand for aftermarket services and maintenance solutions. Enhanced connectivity across Europe further strengthens Spain’s role as a logistics hub. It provides a favorable environment for the solid tire industry to grow.

Strong potential in green industrial practices and circular economy adoption:

Spain’s commitment to sustainability provides opportunities for eco-friendly tire solutions. The Spain Solid Tire Market grows with manufacturers focusing on recyclable materials and energy-efficient processes. Industries demand tires that align with corporate social responsibility goals. Circular economy initiatives encourage recycling and re-manufacturing of tires, reducing environmental impact. Green certifications and EU regulations support suppliers offering sustainable options. Companies adopting eco-friendly tires improve compliance and market positioning. It positions the solid tire market as a partner in Spain’s sustainable industrial transformation.

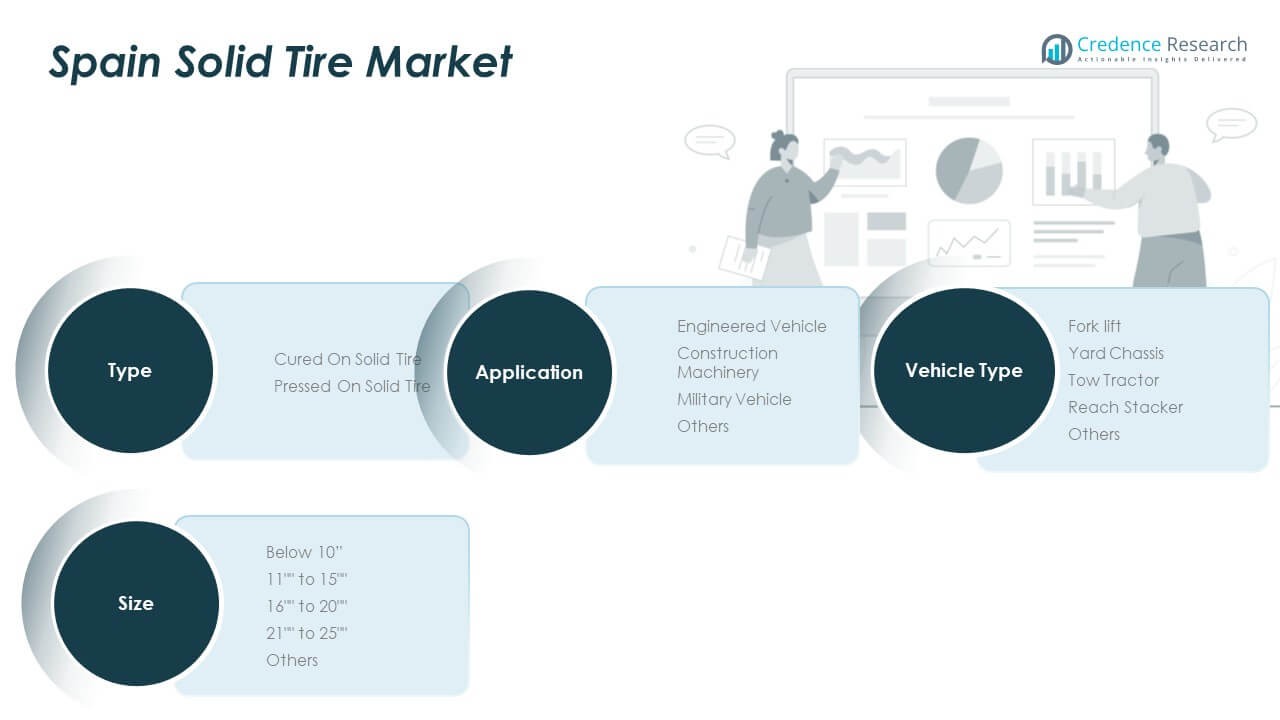

Market Segmentation Analysis:

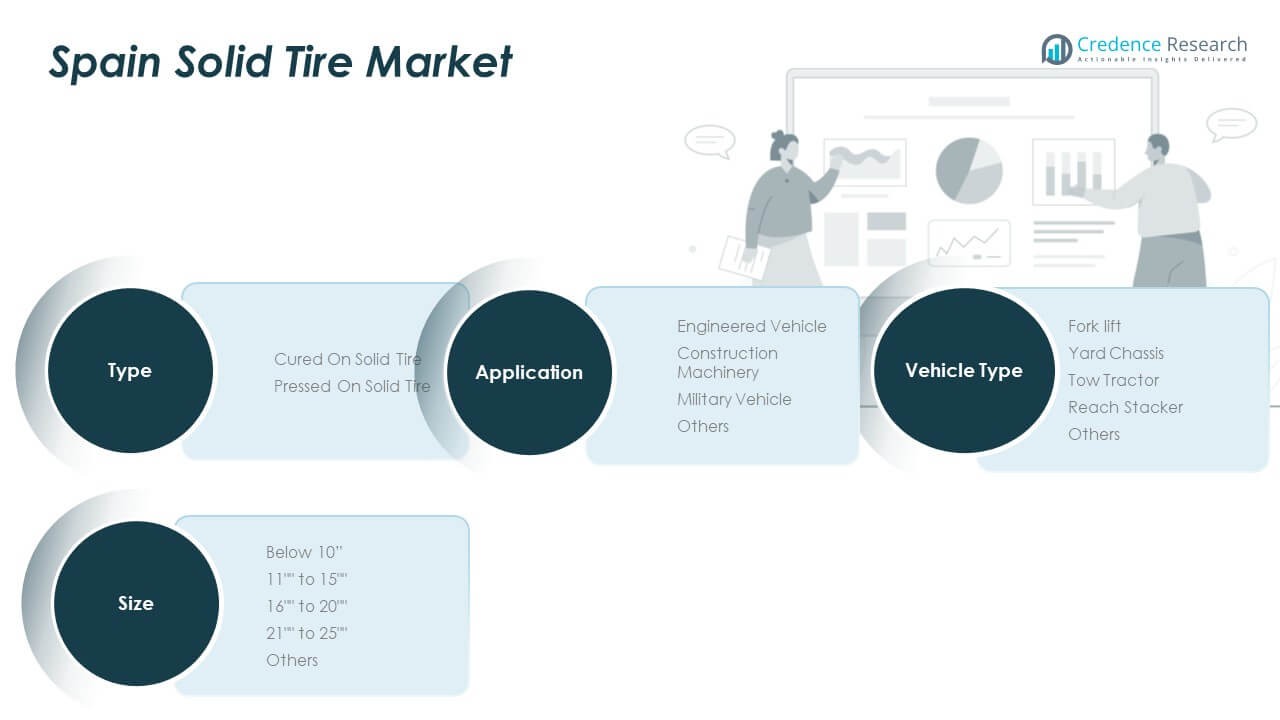

By Type

The Spain Solid Tire Market is segmented into cured on solid tires and pressed on solid tires. Pressed on solid tires hold a stronger share due to their durability and ease of replacement in heavy-duty applications. Cured on solid tires remain relevant in specialized uses where flexibility and cost efficiency are priorities. Both categories serve industries demanding resistance to punctures and minimal downtime.

- For instance, Nexen Solid Pro tires designed for industrial use provide varying load capacities up to 4,785 kg, optimized with multi-tread patterns to prevent distortion and extend tire service life in heavy handling equipment.

By Application

The market spans engineered vehicles, construction machinery, military vehicles, and others. Construction machinery leads the demand, supported by Spain’s infrastructure projects and logistics expansion. Engineered vehicles, including specialized handling equipment, represent consistent adoption in warehousing and port operations. Military vehicles contribute steadily, driven by the need for resilient tire solutions under challenging conditions. Other applications provide additional niche growth opportunities.

- For instance, Superior Tire & Rubber Corp. collaborates with OEMs to develop customized track pads and tire-wheel assemblies proven to reduce operating costs and maximize performance through optimized material usage and extended durability, supporting various industrial and defense vehicle applications.

By Size

The market includes below 10”, 11” to 15”, 16” to 20”, 21” to 25”, and others. Sizes between 16” and 20” dominate due to extensive use in forklifts and mid-capacity vehicles. Smaller sizes under 10” serve compact equipment, while larger ranges above 21” cater to heavy industrial machinery. Diverse sizing ensures adaptability across multiple vehicle categories.

By Vehicle Type

The market covers forklifts, yard chassis, tow tractors, reach stackers, and others. Forklifts hold the largest share, reflecting high adoption in warehouses, ports, and manufacturing hubs. Tow tractors and reach stackers also gain importance with rising logistics and container handling activities. Yard chassis and other specialized vehicles expand their roles in industrial transport, reinforcing broad demand across the market.

Segmentation:

By Type

- Cured On Solid Tire

- Pressed On Solid Tire

By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

By Size

- Below 10”

- 11” to 15”

- 16” to 20”

- 21” to 25”

- Others

By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

Regional Analysis:

Industrial Hubs Driving the Largest Market Share (42%)

The Spain Solid Tire Market records its highest demand in Catalonia, Madrid, and the Basque Country, together holding 42% share. Catalonia dominates with its automotive cluster, industrial base, and major ports requiring forklifts and yard chassis. Madrid adds strong logistics and distribution demand, supported by retail and e-commerce growth. The Basque Country contributes through specialized manufacturing and heavy industries. It reinforces the dominance of Spain’s industrial and logistics hubs. These regions remain the backbone of solid tire adoption in the country.

Southern Spain as a Growing Contributor (26%)

Andalusia and Valencia together account for about 26% share of the market, driven by construction, warehousing, and agricultural applications. Andalusia shows increasing demand for construction machinery and agricultural vehicles needing durable tire solutions. Valencia benefits from its port activity and industrial exports, expanding demand for forklifts and material-handling equipment. It highlights southern Spain’s transition into a stronger player in logistics and manufacturing. Both regions continue to attract investments that sustain demand for solid tires. Their contribution makes them an important secondary growth cluster.

Emerging Opportunities in Smaller Regions (32%)

Galicia, Aragon, and Castilla-La Mancha, along with other smaller regions, collectively hold around 32% share of the Spain Solid Tire Market. Galicia benefits from shipbuilding and port operations requiring resilient tires. Aragon strengthens demand through its automotive sector and industrial hubs. Castilla-La Mancha relies on agricultural machinery, which drives steady growth in rural operations. It shows how emerging areas complement the leading hubs. These regions ensure balanced growth and broaden market penetration nationwide. Their rising adoption supports long-term expansion across Spain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Spain Solid Tire Market is moderately consolidated with global players such as Camso, Continental, Trelleborg, and Global Rubber Industries competing with regional manufacturers. It is shaped by product differentiation, durability, and cost-efficiency in industrial and logistics operations. Leading companies focus on expanding tire portfolios, strengthening aftermarket services, and enhancing distribution networks. Local manufacturers compete by offering competitive pricing and custom solutions tailored for construction, warehousing, and agricultural applications. Innovation in eco-friendly materials and advanced tire designs is also becoming a strategic focus. Companies engage in partnerships and capacity expansion to secure long-term contracts. It reflects a balance between established global brands and agile regional players striving for market relevance.

Recent Developments:

- In September 2025, Camso, part of the Michelin Group, was acquired by Indian tyre major CEAT in a landmark $225 million deal. This acquisition includes two manufacturing facilities in Sri Lanka and grants CEAT permanent global ownership of the Camso brand after a three-year licensing period, aiming to expand its presence in premium markets across Europe and North America.

- In June 2025, Continental AG signed an agreement with Mutares SE to transfer its drum brakes production and R&D location in Cairo Montenotte, Italy, which includes all employees and business activities. This acquisition is expected to close in the fourth quarter of 2025 and strengthens Mutares’ automotive and mobility segment while allowing Continental to better focus on its core tire business and future technologies.

- NEXEN Tire announced in August 2025 its expansion in Europe, Latin America, and the Middle East by establishing new branch offices, including one in Spain. This strategic move aims to localize operations, improve distribution efficiency, and boost competitiveness in growing tire markets across these regions.

- Superior Tire & Rubber Corp. announced in August 2025 a multi-million-dollar capital investment plan to scale production capacity and optimize manufacturing processes to meet growing market demands, focusing on delivering innovative tire and wheel technology alongside collaborations with OEMs.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Size, and Vehicle Type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for solid tires will expand with increasing industrial automation in logistics and warehousing.

- Construction activities in Spain will continue to drive adoption in heavy machinery and equipment.

- Forklifts will remain the leading vehicle type, supported by growth in e-commerce and distribution hubs.

- Mid-size categories between 16” and 20” will dominate the size segment due to versatile industrial use.

- Pressed on solid tires will maintain leadership, while cured on variants serve niche applications.

- Regional hubs like Catalonia and Madrid will lead demand, supported by port and logistics infrastructure.

- Sustainability goals will encourage the adoption of recyclable and eco-friendly tire designs.

- Smart tire technologies with embedded monitoring will gain traction in high-performance applications.

- Partnerships between manufacturers and distributors will strengthen aftermarket service availability.

- Market players will invest in R&D to enhance durability, efficiency, and performance under demanding conditions.