Market Overview

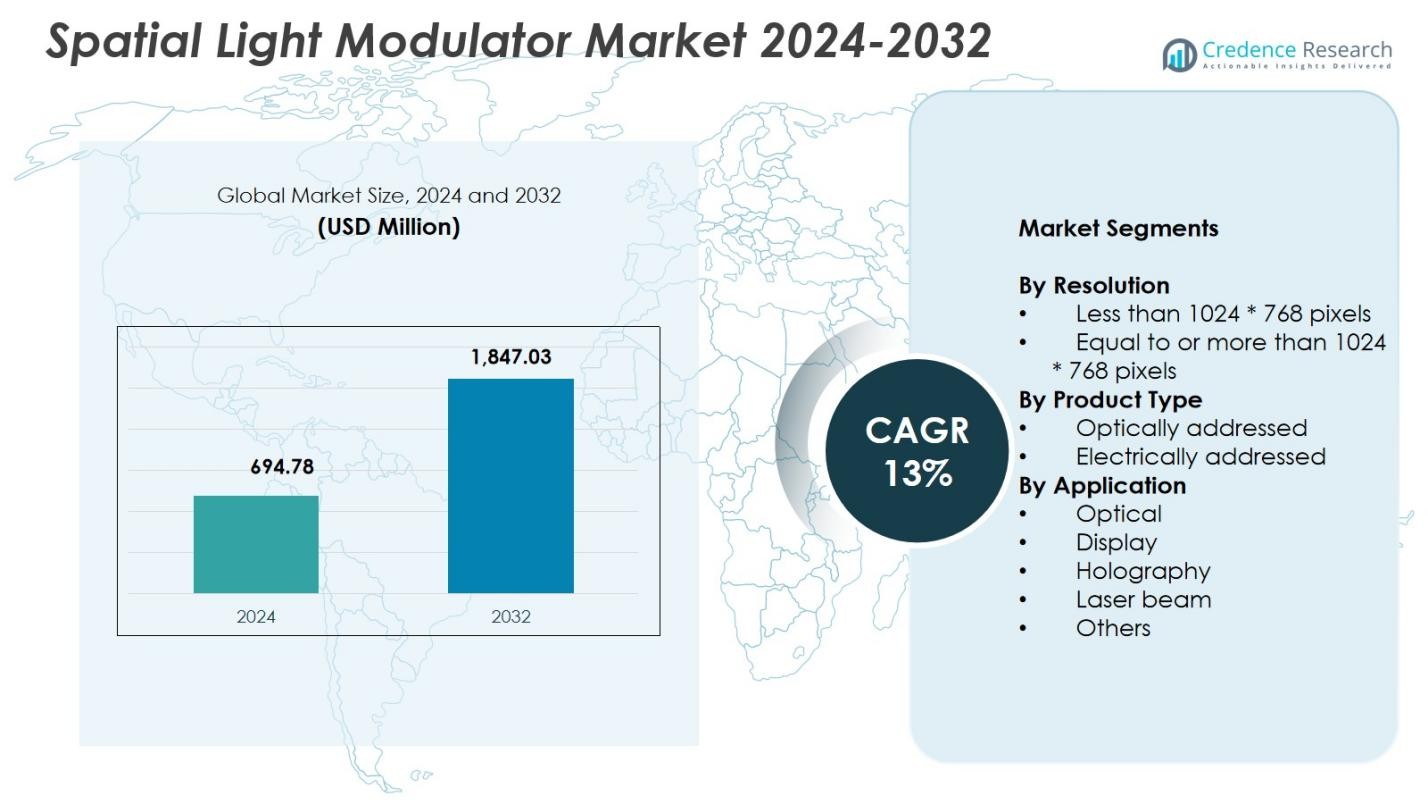

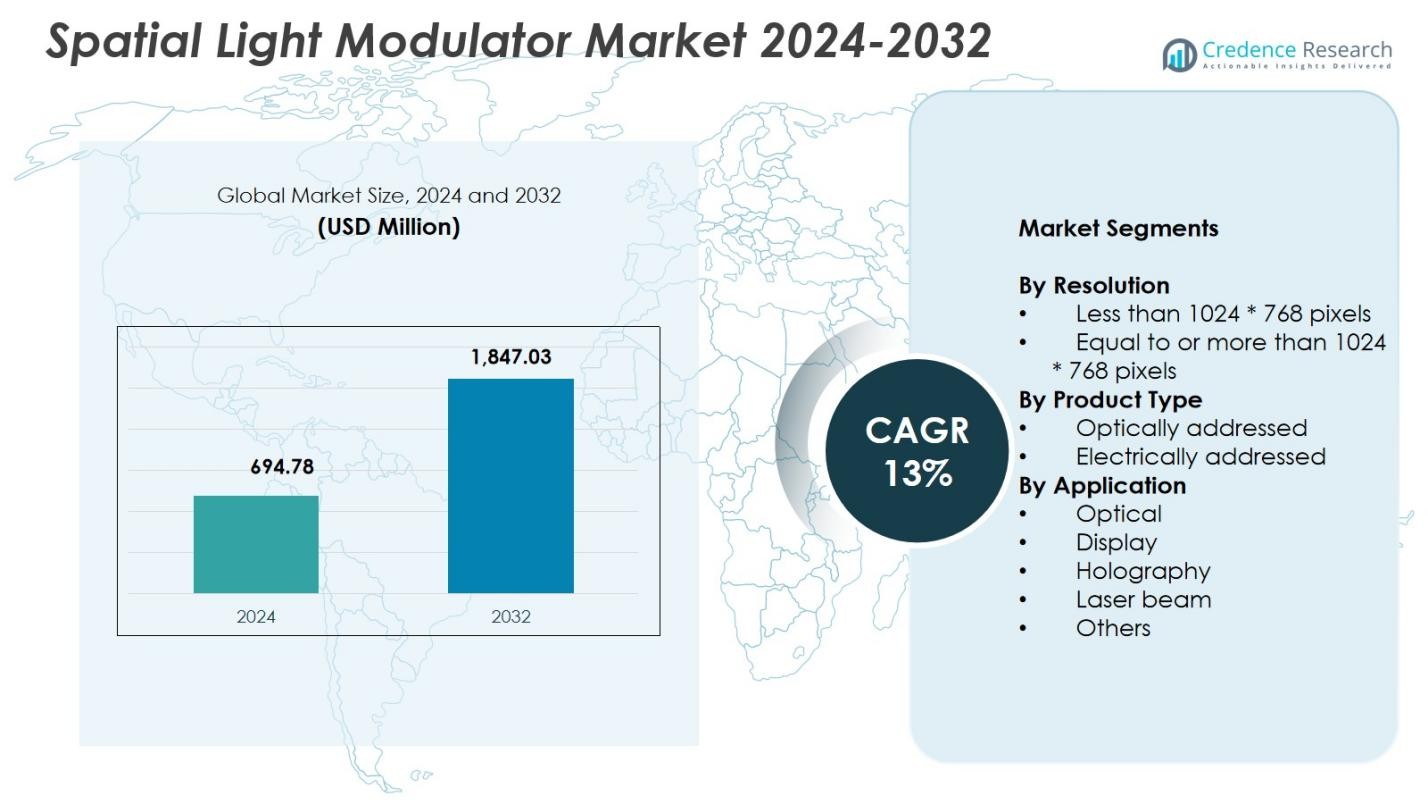

Spatial Light Modulator Market size was valued at USD 694.78 Million in 2024 and is anticipated to reach USD 1,847.03 Million by 2032, at a CAGR of 13% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Spatial Light Modulator Market Size 2024 |

USD 694.78 Million |

| Spatial Light Modulator Market , CAGR |

13% |

| Spatial Light Modulator Market Size 2032 |

USD 1,847.03 Million |

Spatial Light Modulator Market is shaped by leading players such as Hamamatsu Photonics K.K., Meadowlark Optics, JENOPTIK AG, HOLOEYE Photonics AG, Thorlabs Inc., PerkinElmer Inc., Texas Instruments Incorporated, Laser 2000, Santec Holdings Corporation, and KOPIN Corporation, each driving innovation in high-resolution LCoS, MEMS, and holographic modulation technologies. These companies strengthen market growth through advancements in AR/VR displays, laser beam shaping, adaptive optics, and quantum research applications. Regionally, North America led the market with 34.6% share in 2024, supported by strong adoption in research, industrial photonics, and advanced optical communication systems, followed closely by Europe and Asia-Pacific.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Spatial Light Modulator Market was valued at USD 694.78 Million in 2024 and will grow at a CAGR of 13% through 2032.

- Market growth is driven by increasing adoption of high-resolution SLMs in laser beam shaping, AR/VR systems, holography, microscopy, and optical communication technologies.

- Key trends include rapid advancements in LCoS and MEMS architectures, rising integration in quantum optics, and growing demand for ultra-fast, AI-optimized modulators across scientific and industrial applications.

- Leading players such as Hamamatsu Photonics, Meadowlark Optics, Thorlabs, and HOLOEYE Photonics advance the market through innovations in high-contrast, high-speed, and miniaturized SLM platforms, strengthening their presence in major application areas.

- North America held 34.6% share in 2024, followed by Europe with 27.8% and Asia-Pacific with 29.4%, while the equal to or more than 1024 × 768 pixels segment dominated the market with 63.4% share due to rising demand for high-precision optical modulation.

Market Segmentation Analysis:

By Resolution

The Spatial Light Modulator Market by resolution is dominated by the equal to or more than 1024 × 768 pixels segment, which captured 63.4% share in 2024. This leadership reflects its superior modulation precision, higher pixel density, and widespread adoption in holography, augmented reality systems, advanced microscopy, and laser beam shaping. Demand increases as research institutions and semiconductor manufacturers prioritize high-resolution SLMs for phase modulation accuracy, wavefront correction, and real-time optical computing. The less than 1024 × 768 pixels category continues to serve cost-sensitive uses such as basic optics experiments and entry-level display applications.

- For instance, HOLOEYE’s PLUTO-2.1 phase-only LCOS SLM features 1920 × 1080 pixel resolution with an 8.0 μm pixel pitch and 93% fill factor, enabling at least 2π phase retardation across 420-650 nm for holography and beam shaping tasks.

By Product Type

By product type, electrically addressed spatial light modulators (EASLMs) dominated the market with 58.7% share in 2024, driven by their fast response times, high frame rates, and ease of integration into digital optical systems. Their strong presence in beam steering, adaptive optics, and high-speed optical communication supports this segment’s leadership. Increasing deployment in VR/AR devices and precision imaging further strengthens adoption. Optically addressed SLMs (OASLMs) remain relevant for applications requiring high contrast and wavelength flexibility, although their slower speed limits uptake in dynamic modulation environments.

- For instance, Thorlabs’ Exulus-HD2 EASLM offers 1920 x 1200 WUXGA resolution with a 60 Hz frame rate and >92% fill factor for beam steering and holography applications.

By Application

The laser beam application segment led the Spatial Light Modulator Market with 41.2% share in 2024, supported by rapid uptake in industrial laser processing, biomedical imaging, optical trapping, and beam shaping for research laboratories. The ability of SLMs to precisely modulate amplitude, phase, and polarization in real time enhances demand. Holography and display applications also exhibit strong growth due to advancements in 3D visualization, AR micro-displays, and photonics-based data storage. Optical applications, including interferometry and wavefront control, continue expanding as defense and semiconductor industries adopt high-performance modulators for next-generation photonic systems.

Key Growth Drivers

Rising Adoption in Advanced Laser Beam Shaping and Industrial Photonics

The Spatial Light Modulator Market experiences strong growth as industries increasingly adopt SLMs for precision laser beam shaping, optical trapping, lithography, and micro-fabrication. Their ability to dynamically control phase, amplitude, and polarization enables higher accuracy in semiconductor processing, biomedical imaging, and materials research. As laser-based manufacturing accelerates globally, SLMs support improved throughput, finer patterning, and enhanced automation. These capabilities position SLMs as essential components in next-generation photonics systems, driving sustained demand across industrial and scientific applications.

- For instance, Fraunhofer ILT and Hamamatsu jointly deployed an industrial SLM head in Aachen for ultrashort‑pulsed laser material processing, operating up to 150 W average power to deliver dynamic beam shaping for high‑throughput micromachining applications.

Expanding Use in Holography, AR/VR, and 3D Display Technologies

Demand for spatial light modulators surges due to their expanding roles in holographic displays, augmented reality, virtual reality, and advanced 3D visualization systems. Their high-resolution phase modulation enhances depth rendering, optical field reconstruction, and immersive display performance. As consumer electronics manufacturers and research institutions invest heavily in next-generation display architectures, SLMs provide essential optical control for high-fidelity imaging. The technology’s ability to support real-time holographic projection and wavefront modulation continues to accelerate its adoption, particularly in entertainment, medical visualization, and simulation environments.

- For instance, Santec’s SLM-200 provides WUXGA (1920 x 1200) resolution with 10-bit phase control (1024 levels) and phase stability below 0.001 π rad., supporting wavefront correction and holographic reconstruction across 400-1600 nm wavelengths.

Growing Adoption in Optical Communication and Adaptive Optics

The market benefits from the rising need for adaptive optics and coherent optical communication, where SLMs enable wavefront correction, phase alignment, channel multiplexing, and distortion mitigation. Their integration improves signal integrity in free-space optical links, satellite communication, and astronomical imaging. As bandwidth demand increases and data transmission systems evolve toward photonics-based architectures, SLMs support modulation flexibility and low-latency control. This trend strengthens adoption in telecommunications, aerospace, and scientific observatories, driving long-term growth.

Key Trends & Opportunities

Integration of SLMs in Quantum Optics and Photonic Computing

A major trend shaping the Spatial Light Modulator Market is the growing integration of SLMs into quantum information systems, photonic computing, and quantum simulation setups. Their precise phase modulation enables quantum state manipulation, beam routing, and spatial mode encoding. As global research accelerates in quantum technologies, SLMs offer versatile tools for laboratory experimentation and early-stage quantum hardware development. This creates substantial opportunities for manufacturers to target research institutions and emerging quantum startups seeking high-performance optical control components.

- For instance, at MIT’s Englund lab, Santec deployed seven SLM-200 units, one SLM-300, and one SLM-210 for quantum computer research, leveraging their reliability and phase stability to form optical wavefronts and generate focused optical tweezers beams.

Shift Toward High-Resolution, Fast-Response, and AI-Optimized Modulators

An important opportunity emerges from the industry’s shift toward ultra-high-resolution SLMs with faster refresh rates and AI-enhanced control algorithms. Advances in liquid crystal on silicon (LCoS), MEMS-based SLMs, and holographic modulation enable improved accuracy for AR/VR micro-displays, biomedical diagnostics, and dynamic beam shaping. AI-driven calibration and error correction further enhance stability and optical fidelity. Manufacturers investing in intelligent SLM platforms can address growing demand from semiconductor fabrication, autonomous systems, and high-precision scientific applications.

- For instance, Sony’s 1.3‑type 4K OLED and LCOS microdisplays, used in AR/VR headsets and mixed‑reality systems, integrate high‑speed driver circuits that support frame rates around 90 fps with brightness near 1,000 cd/m², improving motion clarity and visual fidelity for ultra‑high‑resolution immersive displays.

Key Challenges

High Cost of Advanced SLM Technologies and Integration Complexity

One of the key challenges is the high cost of developing and integrating advanced spatial light modulators, particularly LCoS and MEMS variants requiring specialized materials, precise fabrication, and complex driver electronics. These costs hinder adoption across price-sensitive industries and limit scalability in volume-driven markets such as consumer electronics. Additionally, integration into optical setups often demands extensive alignment, calibration, and thermal management, increasing system complexity and deployment time for manufacturers and end users.

Performance Limitations Affecting Speed, Contrast, and Wavelength Flexibility

Despite technological advances, SLMs still face performance constraints that limit their application in high-speed or broadband environments. Liquid-crystal-based SLMs often exhibit slower response times and restricted wavelength compatibility, reducing effectiveness in fast laser modulation or multi-spectral imaging. MEMS devices, while faster, may face limitations in achieving high contrast and phase stability. These constraints restrict widespread adoption in demanding sectors such as ultrafast optics, high-power laser systems, and real-time holography, presenting ongoing technical challenges for developers.

Regional Analysis

North America

North America held 34.6% share of the Spatial Light Modulator Market in 2024, driven by strong demand from advanced research institutions, semiconductor manufacturing, and industrial laser processing sectors. The U.S. leads adoption due to extensive investment in holography, AR/VR development, optical communication, and defense-based adaptive optics programs. Growing integration of SLMs in biomedical imaging and quantum research further strengthens regional growth. Major photonics companies and universities continue to expand R&D initiatives, supporting rapid technological advancements and accelerating commercialization of high-resolution, fast-response modulators across scientific, industrial, and commercial applications.

Europe

Europe accounted for 27.8% share of the market in 2024, supported by strong photonics ecosystems in Germany, the U.K., and France. The region benefits from significant deployment of SLMs in automotive lidar research, optical metrology, precision manufacturing, and holographic display development. Government-funded photonics programs and active university collaborations contribute to continuous innovation in beam shaping, adaptive optics, and 3D imaging technologies. Demand from aerospace, microscopy, and semiconductor inspection applications further drives adoption. Europe’s emphasis on high-accuracy optical instrumentation ensures steady growth for advanced LCoS and MEMS-based SLM platforms.

Asia-Pacific

Asia-Pacific led global expansion momentum and captured 29.4% share in 2024, driven by robust semiconductor fabrication, consumer electronics manufacturing, and accelerating adoption of holographic and AR/VR technologies. China, Japan, and South Korea dominate regional demand due to strong photonics production capabilities and rapid investments in industrial lasers, optical computing, and biomedical imaging. The growing presence of OEMs focused on high-resolution displays and quantum optics research strengthens SLM deployment. Favorable government support for advanced manufacturing and photonics innovation positions Asia-Pacific as a long-term growth hub for next-generation modulators.

Latin America

Latin America represented 4.1% share of the Spatial Light Modulator Market in 2024, supported by expanding adoption of laser technologies in medical diagnostics, industrial inspection, and academic research. Countries such as Brazil and Mexico increasingly incorporate SLMs in optical laboratories, materials processing, and display research initiatives. Growth is driven by rising investment in scientific infrastructure and partnerships with global photonics suppliers. Although the market remains in early development stages, increasing demand for precision optics and educational deployments indicates strong long-term potential for advanced modulation technologies across the region.

Middle East & Africa

The Middle East & Africa market accounted for 4.1% share in 2024, driven by emerging adoption in defense optics, laser-based surveying, and scientific research institutions. Countries such as the UAE, Israel, and Saudi Arabia invest in photonics innovation, fostering deployment of SLMs in holography, adaptive optics, and remote sensing. Industrial sectors increasingly utilize laser beam shaping and optical testing tools, supporting gradual market expansion. While overall penetration remains lower than other regions, growing national research programs and technology diversification efforts are expected to elevate SLM demand throughout the forecast period.

Market Segmentations:

By Resolution

- Less than 1024 * 768 pixels

- Equal to or more than 1024 * 768 pixels

By Product Type

- Optically addressed

- Electrically addressed

By Application

- Optical

- Display

- Holography

- Laser beam

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Spatial Light Modulator Market features key players such as Hamamatsu Photonics K.K., Meadowlark Optics, Santec Holdings Corporation, JENOPTIK AG, HOLOEYE Photonics AG, Texas Instruments Incorporated, PerkinElmer Inc., Laser 2000, Thorlabs Inc., and KOPIN Corporation. The market is shaped by continuous innovation in high-resolution LCoS, MEMS-based, and fast-response modulators tailored for holography, AR/VR, industrial lasers, and quantum research. Companies focus on enhancing phase stability, pixel density, and refresh rates to meet rising demand across scientific, commercial, and industrial applications. Strategic partnerships with research institutes, expansion into next-generation display technologies, and development of AI-assisted calibration platforms accelerate product differentiation. Leading vendors increasingly invest in miniaturized SLMs for AR micro-projectors, ultrafast beam shaping modules for semiconductor manufacturing, and high-contrast modulators for biomedical imaging. Continuous R&D investment, portfolio diversification, and global distribution strengthening remain critical to sustaining competitive advantage in this rapidly evolving photonics market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Meadowlark Optics, Inc. (U.S.)

- Santec Holdings Corporation (Japan)

- JENOPTIK AG (Germany)

- Thorlabs, Inc. (U.S.)

- HOLOEYE Photonics AG (Germany)

- PerkinElmer Inc. (U.S.)

- Texas Instruments Incorporated (U.S.)

- Laser 2000 (Germany)

- Hamamatsu Photonics K.K. (Japan)

- KOPIN Corporation (U.K.)

Recent Developments

- In 2025, Santec AOC Corporation introduced the SLM-310, an LCOS-based spatial light modulator designed for high-power laser applications like metal 3D printing.

- In July 2024, Kopin Corporation launched high-resolution ferroelectric LCOS spatial light modulators for fluorescence super-resolution microscopy in biomedical research.

- In November 2024, HOLOEYE Photonics AG partnered with Fraunhofer Institute for Photonic Microsystems to develop next-generation LCOS microdisplays and spatial light modulation solutions.

Report Coverage

The research report offers an in-depth analysis based on Resolution, Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of high-resolution SLMs in holography, AR/VR, and advanced display systems.

- Demand for precision laser beam shaping will accelerate usage across industrial photonics and semiconductor fabrication.

- Advancements in LCoS and MEMS technologies will enable faster response, higher contrast, and improved optical stability.

- Quantum computing and quantum optics research will create new opportunities for high-performance modulation platforms.

- Integration of AI-driven calibration and control will enhance accuracy and reduce operational complexity.

- Miniaturized SLMs will gain traction in wearable optics, AR micro-projectors, and smart imaging devices.

- Adoption in biomedical imaging and life-science research will continue to strengthen due to improved phase modulation.

- Defense and aerospace applications will expand with growing use in adaptive optics and high-precision sensing.

- Growth in optical communication will boost demand for SLMs supporting wavefront shaping and multiplexing.

- Increasing government and institutional funding in photonics research will support long-term technological advancements.