| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Switzerland Autonomous Off-Road Vehicles And Machinery Market Size 2023 |

USD 121.31 Million |

| Switzerland Autonomous Off-Road Vehicles And Machinery Market, CAGR |

10.81% |

| Switzerland Autonomous Off-Road Vehicles And Machinery Market Size 2032 |

USD 305.88 Million |

Market Overview:

Switzerland Autonomous Off-Road Vehicles And Machinery Market size was valued at USD 121.31 million in 2023 and is anticipated to reach USD 305.88 million by 2032, at a CAGR of 10.81% during the forecast period (2023-2032).

Several factors are driving the adoption of autonomous off-road vehicles and machinery in Switzerland. Technological advancements, including the integration of artificial intelligence (AI), machine learning, and sophisticated sensor technologies, have enhanced the capabilities of autonomous systems to operate efficiently in complex terrains. The introduction of the Swiss Federal Ordinance on Automated Driving (OAD) in March 2025 has established a clear legal framework for the deployment of automated driving systems, facilitating innovation and deployment. Additionally, the Swiss Association for Autonomous Mobility oversees multiple initiatives, including driverless logistics solutions like Embotruck and Europe’s first autonomous grocery delivery vehicle, LOXO. These developments, coupled with the country’s emphasis on sustainability and efficiency, are accelerating the integration of autonomous machinery across various industries.

Switzerland’s diverse topography and decentralized economic structure influence the regional adoption of autonomous off-road vehicles and machinery. In the canton of Zurich, pilot projects are underway to deploy autonomous vehicles for public transportation, with operations beginning in areas such as Otelfingen, Boppelsen, Hüttikon, and Dänikon. These initiatives demonstrate the country’s commitment to integrating autonomous solutions into its transportation infrastructure. Furthermore, Switzerland’s strong tradition in precision agriculture and advanced manufacturing, particularly in regions like the Swiss Plateau and the Jura Mountains, provides fertile ground for the adoption of autonomous machinery in farming and industrial applications. The country’s robust research ecosystem, including institutions like ETH Zurich and EPFL, continues to drive innovation, ensuring that Switzerland remains at the forefront of autonomous technology development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- Switzerland’s Autonomous Off-Road Vehicles and Machinery market was valued at USD 121.31 million in 2023 and is expected to reach USD 305.88 million by 2032, growing at a CAGR of 10.81% during the forecast period (2023-2032).

- Global Autonomous Off-road Vehicles and Machinery size was valued at USD 23,300.00 million in 2023 and is anticipated to reach USD 68,887.09 million by 2032, at a CAGR of 12.80% during the forecast period (2023-2032).

- Technological advancements in AI, machine learning, and sensor integration are driving the adoption of autonomous off-road vehicles in Switzerland, enhancing efficiency in complex environments.

- The introduction of the Swiss Federal Ordinance on Automated Driving (OAD) in March 2025 provides a clear legal framework, encouraging innovation and the deployment of autonomous systems.

- Switzerland’s diverse topography and decentralized economy support regional adoption, with pilot projects underway in Zurich and rural areas focused on public transportation and farming applications.

- Autonomous vehicles are gaining traction in sectors such as agriculture, construction, and mining, with enhanced productivity and safety being key benefits.

- Increased focus on sustainability is driving demand for eco-friendly, autonomous machinery, particularly electric-driven models in agriculture and construction.

- Challenges such as high initial investment costs, regulatory barriers, and infrastructure requirements may slow the pace of adoption but are mitigated by strong support from government and research institutions.

Market Drivers:

Technological Advancements

The continuous evolution of technology plays a pivotal role in driving the growth of Switzerland’s autonomous off-road vehicles and machinery market. Significant advancements in artificial intelligence (AI), machine learning, and sensor technologies have dramatically enhanced the ability of autonomous systems to operate efficiently and safely in complex environments. These technologies enable autonomous vehicles and machinery to navigate challenging terrains, perform tasks with precision, and make real-time decisions without human intervention. For example, Zurich-based startup Fastree3D specializes in AI-powered 3D vision, developing real-time obstacle detection technology that enables autonomous vehicles to instantly respond to unpredictable events, significantly enhancing operational safety. As these systems become increasingly sophisticated, industries such as agriculture, construction, and mining are integrating autonomous solutions to improve productivity and operational efficiency. The increasing capabilities of machine learning algorithms to process vast amounts of data from sensors and cameras contribute to the overall optimization of autonomous off-road systems.

Regulatory Support and Infrastructure Development

Switzerland’s commitment to fostering a supportive regulatory environment has significantly contributed to the adoption of autonomous off-road vehicles and machinery. The Swiss government has introduced regulations, such as the Swiss Federal Ordinance on Automated Driving, to provide a clear framework for the development and deployment of autonomous technologies. This legal clarity encourages investment and innovation within the sector, allowing companies to develop and test autonomous solutions with confidence. For instance, the Canton of Zurich, SBB (Swiss Federal Railways), and Swiss Transit Lab have partnered with tech company ioki to launch autonomous shuttles in the Furttal region, leveraging ioki’s on-demand software for seamless integration with public transport. Furthermore, Switzerland’s strong infrastructure, including advanced transportation networks and robust internet connectivity, supports the seamless integration of autonomous machinery into both urban and rural landscapes. Government initiatives promoting smart mobility, coupled with regional efforts to develop autonomous transportation solutions, further accelerate the market’s growth.

Economic Efficiency and Safety Concerns

The demand for autonomous off-road vehicles and machinery in Switzerland is also driven by the need for economic efficiency and enhanced safety. Autonomous systems can perform repetitive tasks with high precision, reducing labor costs and minimizing human errors. This capability is particularly valuable in industries like agriculture and construction, where the demand for skilled labor often exceeds supply. Autonomous machinery is capable of operating in hazardous environments, such as construction sites or mining operations, where human workers may be exposed to risks. By taking over these dangerous tasks, autonomous vehicles contribute to improving workplace safety, reducing accidents, and ensuring better compliance with safety regulations. Additionally, the ability of autonomous machines to work continuously without fatigue further boosts productivity and operational efficiency.

Sustainability and Environmental Concerns

Switzerland’s focus on sustainability is another significant driver of the autonomous off-road vehicles and machinery market. As environmental regulations become stricter globally, industries are under increasing pressure to reduce their carbon footprint and adopt greener technologies. Autonomous vehicles, particularly those integrated with electric drivetrains, offer a more environmentally friendly alternative to traditional fuel-powered machines. The shift towards automation not only contributes to energy savings but also aligns with Switzerland’s commitment to sustainability, which is central to the country’s industrial and agricultural policies. The use of autonomous systems in precision agriculture, for example, allows for more efficient use of resources like water and fertilizers, contributing to both environmental sustainability and increased crop yields. As the demand for green technologies rises, autonomous off-road machinery provides a viable solution for Swiss industries aiming to reduce environmental impact while maintaining high productivity levels.

Market Trends:

Advancements in Sensor Integration and AI Capabilities

The Swiss autonomous off-road vehicle and machinery market is experiencing significant advancements in sensor integration and artificial intelligence (AI) capabilities. The incorporation of LiDAR, radar, and advanced imaging systems, coupled with AI-driven decision-making algorithms, enhances the precision and reliability of autonomous systems operating in challenging terrains. For instance, LOXO, a Swiss company, has developed the LOXO Digital Driver™ system, which combines advanced AI with a sensor stack that includes solid-state LiDAR, radar, cameras, and ultrasonic sensors. These technological improvements enable vehicles to navigate complex environments with greater accuracy, thereby increasing operational efficiency and safety in sectors such as agriculture, construction, and forestry.

Expansion of Autonomous Fleet Operations

Switzerland is witnessing the expansion of autonomous fleet operations, particularly in rural and semi-urban areas. Pilot projects, such as those in the Furttal region of the canton of Zurich, demonstrate the practical application of autonomous vehicles in public transport. These initiatives involve the deployment of autonomous vehicles that operate on designated routes, offering flexible and efficient transportation solutions. The success of such projects is paving the way for broader adoption of autonomous fleets in various sectors, including logistics and passenger transport.

Integration of Remote Monitoring and Predictive Maintenance

The integration of remote monitoring and predictive maintenance technologies is becoming a prevalent trend in Switzerland’s autonomous off-road vehicle market. By utilizing Internet of Things (IoT) sensors and telematics, operators can monitor the health and performance of autonomous machinery in real time. For example, Timly provides GPS trackers and asset management software that collect and analyze data on asset usage, maintenance history, and performance, allowing operators to optimize maintenance schedules and reduce unplanned downtime. Predictive analytics tools analyze this data to forecast potential failures and optimize maintenance schedules, thereby reducing downtime and maintenance costs. This trend is particularly beneficial in industries where equipment reliability is critical, such as mining and agriculture.

Collaboration Between Public and Private Sectors

Collaborations between public institutions and private enterprises are fostering innovation and accelerating the deployment of autonomous off-road vehicles and machinery in Switzerland. Partnerships, such as those between the Canton of Zurich, Swiss Federal Railways (SBB), and technology providers like ioki and WeRide, are facilitating the development and implementation of autonomous transport solutions. These collaborations leverage the expertise and resources of both sectors to create integrated mobility solutions that enhance efficiency and accessibility in public transportation systems.

Market Challenges Analysis:

Regulatory and Legal Barriers

One of the significant challenges facing the adoption of autonomous off-road vehicles and machinery in Switzerland is the evolving regulatory landscape. For instance, as of March 1, 2025, Switzerland introduced the Swiss Federal Ordinance on Automated Driving (OAD), which provides a legal framework for the approval and operation of autonomous vehicles, including regulations for highway pilot systems, driverless vehicles on designated routes, and automated parking. Although Switzerland has made strides in creating regulations for autonomous vehicles, the legal framework for off-road autonomous machinery remains less defined. As technology advances rapidly, there is a need for continuous updates to regulatory policies to ensure safety, environmental compliance, and operational standards. Moreover, legal challenges related to liability in the event of accidents or failures can create hesitancy among companies and stakeholders looking to implement these technologies. The complexities of aligning autonomous machinery with international regulatory standards may slow the widespread adoption of such systems.

High Initial Investment Costs

The high initial costs associated with developing and deploying autonomous off-road vehicles and machinery pose another restraint for the Swiss market. While these technologies promise long-term operational efficiency and cost savings, the upfront investment in autonomous systems, sensors, AI software, and vehicle modifications can be prohibitively expensive for many companies, particularly small and medium-sized enterprises (SMEs). The need for specialized infrastructure, maintenance, and workforce training further elevates costs, limiting access to advanced autonomous solutions. As a result, the financial barrier remains a significant challenge for broader adoption across various sectors, including agriculture and construction.

Technological Integration and Infrastructure Requirements

Integrating autonomous off-road vehicles and machinery into existing operations presents a technical challenge. Many organizations rely on legacy systems and infrastructure, which may not be compatible with the latest autonomous technologies. The transition to fully autonomous operations requires a substantial overhaul of equipment, software, and connectivity. Additionally, remote or rural operational environments, common in Switzerland’s agricultural and forestry sectors, may lack the required connectivity and digital infrastructure needed to support real-time data transmission, making integration more complex and slower.

Public Perception and Trust Issues

Finally, public perception and trust in autonomous off-road vehicles remain a challenge. Despite technological advancements, many stakeholders, including operators and the general public, still harbor concerns regarding the safety and reliability of autonomous systems. In sectors like agriculture and construction, where human lives are often at risk, there is significant resistance to fully embracing autonomous solutions until they can be proven to operate with the same reliability and safety as human-driven machinery.

Market Opportunities:

Switzerland’s autonomous off-road vehicles and machinery market is poised for significant growth, driven by a confluence of technological advancements, regulatory support, and evolving industry demands. The introduction of the Swiss Federal Ordinance on Automated Driving (OAD) in March 2025 has established a comprehensive legal framework for the approval and operation of autonomous vehicles, including off-road machinery. This regulatory clarity facilitates innovation and deployment, positioning Switzerland as a leader in autonomous mobility. Furthermore, Switzerland’s robust AI ecosystem, supported by institutions like ETH Zurich and EPFL, fosters rapid innovation in autonomous driving technologies. Swiss startups specializing in AI-powered navigation, motion planning, and real-time perception are contributing to the development of smarter and safer autonomous systems. These advancements open avenues for the integration of autonomous machinery in sectors such as agriculture, construction, and logistics, enhancing operational efficiency and sustainability.

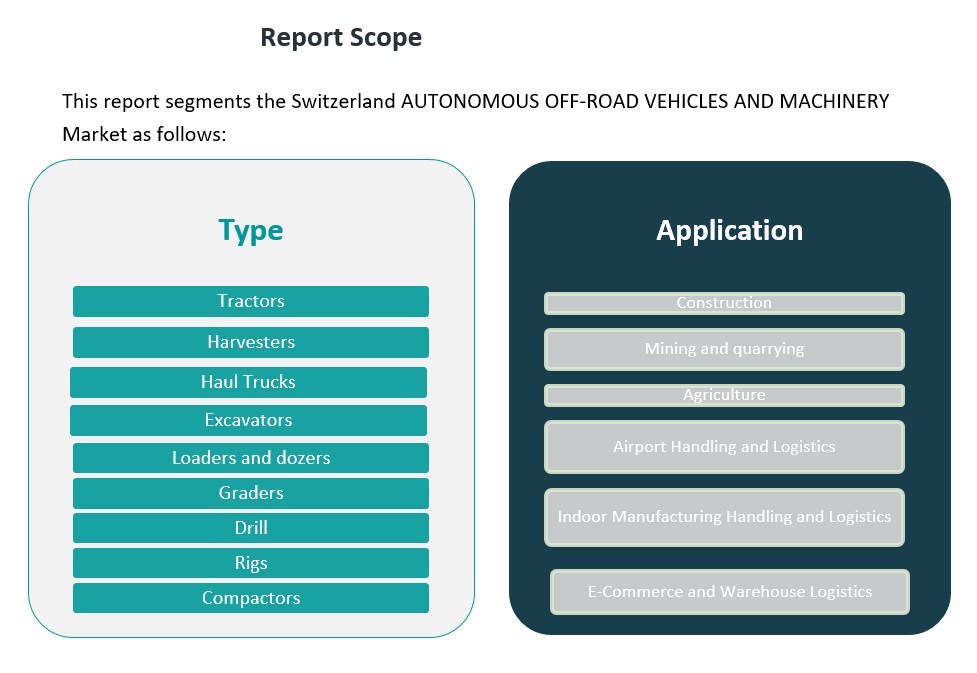

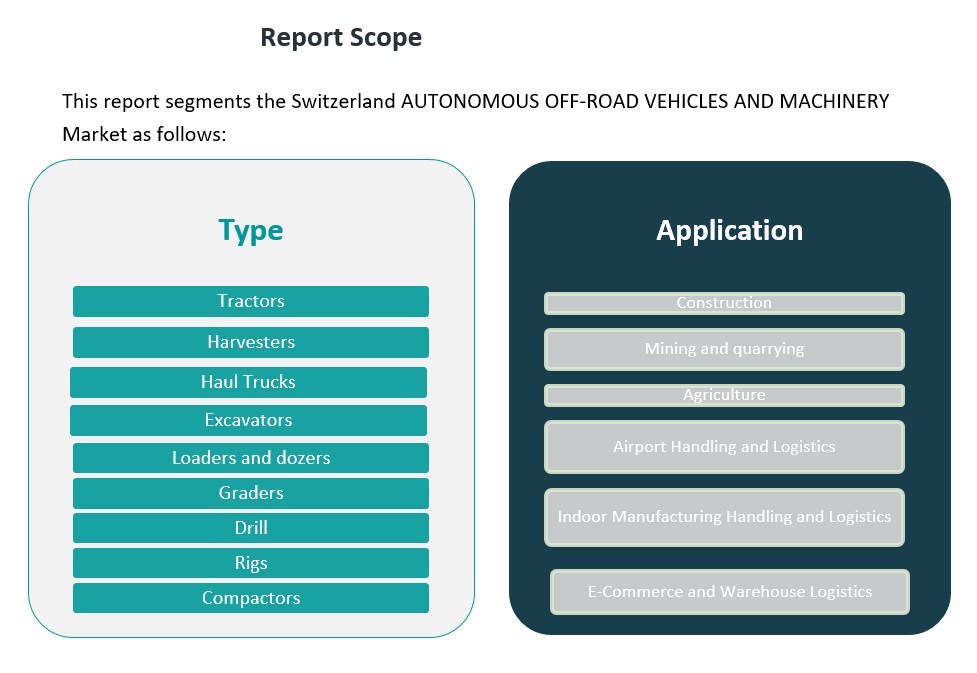

Market Segmentation Analysis:

Switzerland’s autonomous off-road vehicle and machinery market is characterized by a diverse range of vehicle types and applications, each contributing to the sector’s growth and development.

By Type segment includes several key machinery types, such as tractors, harvesters, haul trucks, excavators, loaders and dozers, graders, drills, rigs, and compactors. These vehicles are critical to industries such as agriculture, mining, and construction, where automation promises to increase productivity and reduce labor costs. Tractors and harvesters, for example, are increasingly integrated into precision agriculture, while haul trucks and excavators are revolutionizing large-scale mining and construction projects with their ability to operate autonomously in complex environments.

By Application segment highlights the primary industries utilizing autonomous machinery. Construction is a significant area of adoption, with autonomous equipment like graders and dozers improving efficiency and reducing operational risks on large construction sites. In mining and quarrying, autonomous haul trucks and excavators are enhancing productivity and safety by operating in hazardous environments. The agriculture sector benefits from autonomous tractors and harvesters, improving resource management and optimizing crop yields. Additionally, sectors like airport handling and logistics, indoor manufacturing handling, and e-commerce and warehouse logistics are increasingly leveraging autonomous vehicles to streamline operations, reduce costs, and improve supply chain efficiency. These applications are seeing rapid growth in Switzerland, driven by the increasing need for smart, scalable solutions to manage complex, high-volume tasks across industries.

Segmentation:

By Type Segment:

- Tractors

- Harvesters

- Haul Trucks

- Excavators

- Loaders and Dozers

- Graders

- Drill

- Rigs

- Compactors

By Application Segment:

- Construction

- Mining and Quarrying

- Agriculture

- Airport Handling and Logistics

- Indoor Manufacturing Handling and Logistics

- E-Commerce and Warehouse Logistics

Regional Analysis:

Switzerland’s autonomous off-road vehicles and machinery market exhibits regional variations influenced by technological adoption, infrastructure readiness, and regulatory frameworks. While specific regional market share data is limited, key developments in various cantons provide insights into the market’s distribution and growth potential.

Zurich and Central Switzerland

The canton of Zurich stands out as a hub for autonomous mobility initiatives. In spring 2025, autonomous vehicles are set to operate in the Furttal region, enhancing public transportation connectivity. Additionally, a pilot project in Schaffhausen, utilizing dual-mode technology, commenced in April 2023. These initiatives indicate a progressive approach towards integrating autonomous systems in urban and peri-urban areas.

Western Switzerland

In the French-speaking region, particularly around Geneva, autonomous vehicle testing is gaining momentum. Collaborations between public transport authorities and private companies are facilitating the deployment of autonomous shuttles and delivery vehicles. These projects aim to improve mobility solutions and reduce traffic congestion in urban centers.

Eastern Switzerland

Eastern Switzerland, including cantons like St. Gallen and Thurgau, is witnessing the introduction of autonomous machinery in agriculture and logistics. Pilot programs focusing on autonomous tractors and harvesters are being tested, aiming to enhance efficiency and sustainability in farming practices. These initiatives align with Switzerland’s commitment to innovation in agriculture.

Southern Switzerland

In Ticino, the Italian-speaking canton, autonomous vehicles are being integrated into public transport systems to connect remote areas with urban centers. These efforts are part of a broader strategy to improve accessibility and reduce carbon emissions in mountainous regions.

Key Player Analysis:

- Caterpillar Inc

- Komatsu Ltd

- Sandvik AB

- John Deere

- Liebherr Group

- Jungheinrich AG

- Daifuku Co. Ltd.

- KION Group

- NAVYA

- EasyMile

Competitive Analysis:

Switzerland’s autonomous off-road vehicles and machinery sector is characterized by a dynamic landscape of domestic innovators and international technology providers. Embotech, a Zurich-based startup, has emerged as a key player, securing a multi-year contract with BMW for its Automated Vehicle Marshalling (AVM) solution, which autonomously guides vehicles between assembly facilities. Additionally, Embotech is preparing for a large-scale deployment of its Autonomous Terminal Tractor (ATT) solution at Europe’s largest port, Rotterdam, underscoring its capabilities in port and yard logistics applications. WeRide, a Chinese autonomous driving technology firm, has also established a significant presence in Switzerland. The company has been selected as the technology provider for a pilot project in the Furttal region, deploying autonomous vehicles in collaboration with the Canton of Zurich and Swiss Federal Railways (SBB). This initiative aims to enhance public transportation options in suburban areas, complementing Switzerland’s extensive train network. These developments illustrate a competitive environment where both local startups and international firms are actively contributing to the advancement of autonomous off-road vehicles and machinery in Switzerland, each bringing unique technological expertise and strategic partnerships to the market.

Recent Developments:

- In November 2024, Caterpillar Inc. successfully demonstrated the fully autonomous operation of its Cat® 777 off-highway truck at Luck Stone’s Bull Run plant in Chantilly, Virginia. This milestone reflects Caterpillar’s commitment to delivering autonomous hauling solutions for quarry and aggregates sectors, building on a partnership with Luck Stone initiated in December 2022 to accelerate autonomous technology development for quarry applications.

- In May 2023, Komatsu Ltd. and Toyota Motor Corporation launched a joint project to develop an Autonomous Light Vehicle (ALV) that will operate on Komatsu’s Autonomous Haulage System (AHS). This collaboration aims to improve safety and productivity in mining operations by integrating autonomous haul trucks with automated ALVs controlled by AHS, with proof of concept testing planned at customer sites

Market Concentration & Characteristics:

Switzerland’s autonomous off-road vehicles and machinery market is characterized by moderate concentration, with a mix of domestic innovators and international technology providers. Domestic companies like Embotech, based in Zurich, have secured significant contracts, such as a multi-year agreement with BMW for Automated Vehicle Marshalling (AVM) solutions, indicating strong local capabilities in autonomous technology development. Additionally, Embotech is preparing for a large-scale deployment of its Autonomous Terminal Tractor (ATT) solution at Europe’s largest port, Rotterdam, showcasing its expertise in port and yard logistics applications. International firms are also active in the Swiss market. WeRide, a Chinese autonomous driving technology company, has been selected as the technology provider for a pilot project in the Furttal region, deploying autonomous vehicles in collaboration with the Canton of Zurich and Swiss Federal Railways (SBB). This initiative aims to enhance public transportation options in suburban areas, complementing Switzerland’s extensive train network. The market is characterized by a high degree of technological innovation, with advancements in AI, sensor integration, and autonomous navigation systems driving the development of autonomous machinery. Regulatory support, such as the Swiss Federal Ordinance on Automated Driving (OAD) introduced in March 2025, provides a clear legal framework for the deployment of autonomous vehicles, further encouraging investment and innovation in this sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type and Application It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Swiss autonomous off-road vehicles and machinery market is expected to expand rapidly, driven by advances in AI and sensor technologies.

- Switzerland’s regulatory framework, including the Swiss Federal Ordinance on Automated Driving, will provide clarity and boost industry confidence.

- Increased demand for autonomous solutions in agriculture will lead to greater adoption of autonomous tractors and harvesters.

- The construction sector will benefit from autonomous graders, dozers, and excavators, improving efficiency and reducing operational risks.

- Switzerland’s growing emphasis on sustainability will fuel the demand for eco-friendly, autonomous machinery with electric drivetrains.

- Collaborative projects between public and private entities will accelerate autonomous vehicle testing and deployment across various sectors.

- The adoption of autonomous logistics vehicles will rise, particularly in warehouses and e-commerce operations.

- Swiss startups like Embotech will continue to drive innovation, particularly in autonomous transport and machinery for industrial applications.

- Cross-border initiatives with neighboring countries will create opportunities for Swiss companies to expand their autonomous solutions.

- The integration of predictive maintenance and remote monitoring technologies will become standard for autonomous machinery, enhancing operational efficiency.