| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Switzerland Off The Road Tire Market Size 2023 |

USD 94.93 Million |

| Switzerland Off The Road Tire Market, CAGR |

2.66% |

| Switzerland Off The Road Tire Market Size 2032 |

USD 120.32 Million |

Market Overview:

Switzerland Off The Road Tire Market size was valued at USD 94.93 million in 2023 and is anticipated to reach USD 120.32 million by 2032, at a CAGR of 2.66% during the forecast period (2023-2032).

The growth of the Switzerland off-the-road (OTR) tire market is primarily driven by several factors. Key drivers include the continuous development of infrastructure projects such as road construction and urban expansion, which increase the need for off-highway vehicles and specialized tires. Additionally, advancements in the agricultural sector, where modern machinery is increasingly used for tasks like tilling and harvesting, have created a higher demand for durable and efficient OTR tires. Technological innovations in tire designs and materials, such as improved tread patterns and enhanced durability, contribute to the market’s growth by providing longer-lasting and more reliable tires. Furthermore, the implementation of stricter environmental regulations in Switzerland promotes the adoption of tires that offer better fuel efficiency and lower emissions, which also spurs demand for advanced OTR tire solutions.

Regionally, Switzerland’s OTR tire market benefits from its strategic position within Europe, where it is part of the European Economic Area. This affiliation provides Switzerland with access to regional trade agreements, easing the importation and distribution of OTR tires. The country’s unique mountainous terrain and its emphasis on precision engineering make it a significant market for specialized off-road vehicles, further driving the demand for high-performance OTR tires. In addition, Switzerland’s strong regulatory framework ensures that only high-quality, environmentally compliant tires are available, influencing consumer preferences and market dynamics. This combination of regional characteristics positions Switzerland as a key player in the broader European OTR tire market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Switzerland OTR tire market is projected to grow from USD 94.93 million in 2023 to USD 120.32 million by 2032, with a CAGR of 2.66%.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Infrastructure development in Switzerland, including road construction and urban expansion, is increasing the demand for durable off-road vehicles and specialized tires.

- The agricultural sector’s adoption of high-tech machinery, such as automated tractors and harvesters, is fueling the demand for specialized OTR tires.

- Technological innovations, including puncture-resistant designs and smart tire technologies, are enhancing tire performance and operational efficiency, boosting market growth.

- Environmental regulations are driving the demand for eco-friendly OTR tires, with a focus on better fuel efficiency, lower emissions, and longer tire life.

- The high costs associated with advanced OTR tire technologies can be a barrier to adoption, particularly for small and medium-sized enterprises (SMEs).

- Switzerland’s strong regulatory framework and strategic location within the European Economic Area enable easier importation and distribution of OTR tires, further supporting market growth.

Market Drivers:

Infrastructure Development and Urbanization

Switzerland’s ongoing infrastructure development plays a pivotal role in driving the demand for off-the-road (OTR) tires. The country is heavily invested in large-scale projects, including road construction, tunnel building, and urban expansion, all of which require specialized machinery. As construction activities continue to increase, particularly in mountainous areas that demand robust, high-performance vehicles, the need for durable OTR tires is on the rise. These tires are essential for machinery used in earthmoving, lifting, and other heavy-duty construction tasks, which are prevalent in urbanization and infrastructure projects. The government’s continuous investment in infrastructure and real estate developments ensures a steady demand for OTR tires, further supporting market growth.

Advancements in Agricultural Machinery

The agricultural sector in Switzerland is becoming more technologically advanced, and the demand for modern, efficient machinery has resulted in a growing requirement for OTR tires. Swiss farmers are increasingly adopting high-tech equipment to meet the demands of precision farming, such as automated tractors, harvesters, and irrigation systems. These advanced machines rely on specialized OTR tires to operate effectively across diverse terrain, ensuring high productivity and efficiency. As Switzerland moves towards more sustainable farming practices, the need for tires that provide both longevity and superior performance under varying conditions continues to drive the OTR tire market.

Technological Innovations in Tire Design

Technological advancements in tire design are a significant driver in the Switzerland OTR tire market. Manufacturers are focusing on developing tires with improved tread patterns, advanced materials, and enhanced durability to meet the demands of industries such as mining, construction, and agriculture. For instance, leading companies have launched innovative products: for instance, Michelin introduced a new range of sustainable OTR tires composed of 60% recycled materials in 2023, and Bridgestone rolled out smart tire technology featuring real-time pressure and wear tracking in 2024.The integration of innovations like puncture-resistant tires, better load-bearing capabilities, and longer service life has made OTR tires more efficient and cost-effective for end-users. Additionally, manufacturers are leveraging smart tire technology, which includes sensors that provide real-time data on tire performance, wear, and pressure, further improving operational safety and reducing maintenance costs. These advancements help Swiss industries to maximize productivity while minimizing operational downtime, contributing to increased demand for OTR tires.

Environmental Regulations and Sustainability Trends

Stricter environmental regulations in Switzerland are encouraging the adoption of sustainable solutions across various industries, including the off-highway vehicle sector. As governments and industries strive to reduce carbon emissions and enhance environmental safety, the demand for eco-friendly OTR tires has surged. For instance, REMA TIP TOP repair system, for instance, enables the repair and reuse of large OTR tires, cutting costs and reducing waste by extending tire life even for massive tires up to 63 inches and over four tons in weight. Tires that offer better fuel efficiency, lower emissions, and longer durability are in high demand as they contribute to the reduction of environmental impact. Switzerland’s commitment to sustainability and green technology further drives the need for OTR tire solutions that comply with these regulations. Manufacturers are responding by producing tires with environmentally friendly materials and enhanced fuel efficiency, appealing to industries such as construction, mining, and agriculture that are heavily reliant on off-road vehicles.

Market Trends:

Technological Advancements in Tire Design

The Switzerland off-the-road (OTR) tire market is experiencing significant technological innovations aimed at enhancing performance and durability. Manufacturers are increasingly focusing on developing tires with advanced tread patterns, reinforced sidewalls, and improved rubber compounds to withstand the demanding conditions of off-highway applications. For instance, Trelleborg Tires has implemented real-time data processing through embedded sensors that monitor internal tire pressure and temperature, transmitting this information directly to fleet managers or operators. Additionally, the integration of smart technologies, such as sensors for real-time monitoring of tire pressure and temperature, is becoming more prevalent. These innovations not only improve the operational efficiency of machinery but also contribute to safety and cost-effectiveness by reducing the likelihood of tire failures and extending service life.

Shift Towards Sustainable and Green Tires

Environmental sustainability is becoming a central theme in the Switzerland OTR tire market. There is a growing trend towards the adoption of green tires, which are manufactured using eco-friendly materials and processes. For example, leading companies are now producing green tires using renewable materials such as nylon rubber and highly dispersible silica, which reduce rolling resistance and, consequently, fuel consumption and carbon emissions. These tires are designed to reduce rolling resistance, thereby improving fuel efficiency and lowering carbon emissions. The Swiss market is witnessing an increased demand for such sustainable tire solutions, driven by both regulatory pressures and a shift in consumer preferences towards environmentally responsible products. This trend aligns with Switzerland’s broader commitment to sustainability and environmental stewardship.

Growth in Specialized Equipment Segments

The demand for OTR tires in Switzerland is increasingly concentrated in specialized equipment segments, particularly in construction and mining sectors. There is a notable rise in the use of articulated dump trucks, crawler excavators, and backhoe loaders, all of which require specific tire types to optimize performance. This shift is influencing tire manufacturers to tailor their products to meet the unique requirements of these specialized vehicles. Consequently, the market is seeing a diversification in tire offerings, with a focus on providing solutions that cater to the specific needs of various off-highway machinery.

Expansion of Distribution Channels

The distribution landscape for OTR tires in Switzerland is evolving, with a noticeable expansion in both online and offline channels. Traditional brick-and-mortar retailers are increasingly complemented by online platforms, offering customers greater convenience and access to a wider range of products. This shift is particularly beneficial for end-users in remote areas who may have limited access to physical stores. The growth of e-commerce in the OTR tire market is facilitating a more streamlined purchasing process, allowing for quicker delivery times and enhanced customer service. This trend reflects the broader digital transformation occurring within the Swiss retail sector.

Market Challenges Analysis:

High Costs of Advanced OTR Tires

One of the significant challenges faced by the Switzerland off-the-road (OTR) tire market is the high cost associated with advanced tire technologies. For instance, OTR tires can cost several thousand dollars each, making them prohibitively expensive for some operators, especially small and medium-sized enterprises (SMEs) and sectors like agriculture and construction. Tires with enhanced durability, specialized tread designs, and integrated smart technologies come at a premium price. While these high-performance tires offer long-term benefits, such as reduced downtime and improved productivity, the initial investment required can be a barrier for small and medium-sized enterprises (SMEs) and certain sectors with tight budgets, such as agriculture and construction. This cost factor can slow the adoption rate of the latest OTR tire solutions, limiting market expansion.

Volatility in Raw Material Prices

The price volatility of raw materials used in OTR tire production is another challenge for the Swiss market. Natural rubber, steel, and other key materials required for tire manufacturing are subject to global supply chain fluctuations and geopolitical factors. Any significant increase in the cost of these raw materials directly impacts the overall production cost of OTR tires. These price hikes often lead to higher retail prices, which may discourage end-users from replacing their tires regularly, thereby affecting the market’s growth prospects. Manufacturers are continually exploring cost-effective solutions, but raw material price instability remains a persistent challenge.

Regulatory Compliance and Environmental Constraints

Stricter environmental regulations in Switzerland are pushing tire manufacturers to comply with stringent standards on waste disposal, carbon emissions, and tire recycling. While these regulations align with the country’s sustainability goals, they can also increase operational complexity and costs for tire producers. Compliance with these regulations requires significant investment in research and development (R&D) to create environmentally friendly tire solutions, which may limit the ability of smaller players to compete in the market. Furthermore, the emphasis on eco-friendly tires could impact the price competitiveness of standard OTR tires in the market.

Market Opportunities:

The Switzerland off-the-road (OTR) tire market presents significant opportunities driven by technological advancements and a growing focus on sustainability. As industries such as construction, mining, and agriculture continue to modernize, there is an increasing demand for high-performance tires that can enhance operational efficiency and safety. The shift towards smart OTR tires, equipped with sensors for real-time monitoring of tire pressure, temperature, and wear, offers manufacturers an opportunity to meet the evolving needs of these sectors. The integration of such advanced technologies not only improves tire longevity but also reduces downtime, offering substantial cost savings for businesses. This trend provides a promising opportunity for tire manufacturers to innovate and expand their product offerings in the Swiss market.

Moreover, the rising emphasis on sustainability in Switzerland presents a favorable opportunity for the development of green OTR tires. With a strong commitment to environmental regulations and reducing carbon emissions, Switzerland’s demand for eco-friendly and energy-efficient tire solutions is growing. Manufacturers can capitalize on this by producing tires that are made from renewable or recyclable materials, offering lower rolling resistance and improved fuel efficiency. This market opportunity aligns with the country’s focus on sustainable development and offers tire producers the chance to capture the attention of environmentally-conscious businesses across various industries. As demand for sustainable solutions continues to rise, manufacturers who prioritize green technologies will be well-positioned to lead the market.

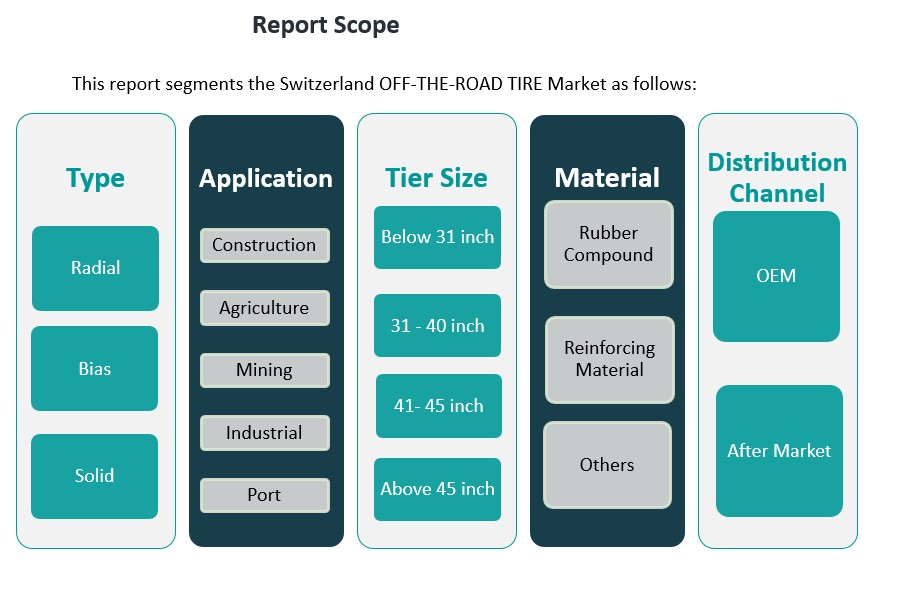

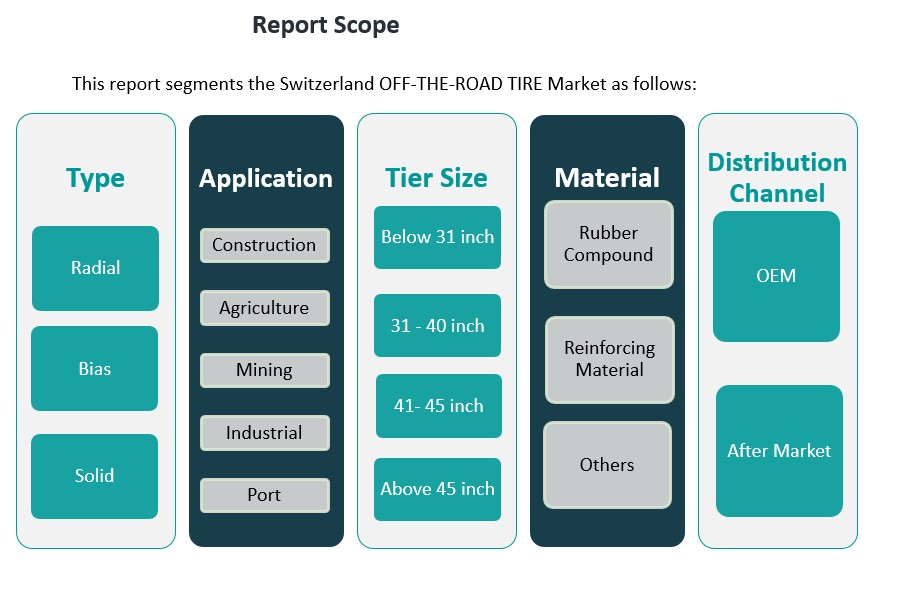

Market Segmentation Analysis:

The Switzerland off-the-road (OTR) tire market is segmented across several categories, each contributing to the overall market dynamics.

By Type, the market is dominated by radial tires, known for their superior performance, longer lifespan, and better fuel efficiency. Bias tires and solid tires follow, with bias tires offering enhanced load capacity and solid tires providing durability in extreme conditions such as those encountered in construction and mining operations. These tire types are critical for specialized vehicles across multiple industries.

By Application-wise, the construction segment holds a significant share, driven by ongoing infrastructure projects requiring heavy machinery and robust tire solutions. The agriculture segment follows closely, as advancements in farming machinery continue to drive the need for durable OTR tires. The mining segment is another major contributor, with tires designed to withstand harsh environments and heavy load demands. Additionally, the industrial and port segments are growing, with an increasing need for high-performance tires in material handling and logistics operations.

By tier size, tires ranging from 31 – 40 inches are particularly popular, offering a balanced combination of durability and flexibility. The above 45-inch segment is witnessing steady growth, driven by larger machinery used in construction and mining sectors.

By material, rubber compounds dominate, followed by reinforcing materials, which provide enhanced strength and durability for tires used in demanding applications.

By Distribution channels are largely split between OEM and aftermarket segments, with OEM tires being primarily used in new equipment and aftermarket tires catering to replacement needs in established machinery.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The Switzerland off-the-road (OTR) tire market, while a niche segment within Europe, is influenced by regional dynamics, including key infrastructure projects, industrial activities, and agricultural advancements. Switzerland is strategically located within the European market, and its OTR tire industry benefits from broader regional trends that shape demand and growth.

Western Europe (Switzerland): Switzerland itself is a significant player in the European OTR tire market, benefiting from its robust economy and advanced industrial capabilities. The country’s strong focus on infrastructure, mining, and agriculture has created a stable demand for OTR tires. Switzerland contributes approximately 2-3% to the overall European off-highway tire market, with construction and mining being the leading industries driving demand. The agricultural sector, though smaller compared to other European countries, also plays a vital role in driving demand for specialized tires. The market in Switzerland is expected to continue growing as modernization efforts in agriculture and infrastructure projects, including road construction and urban development, require high-performance, durable tires.

Europe Market Overview: Within the broader European context, Western Europe holds the largest share, with countries like Germany, France, and the UK having a dominant presence in the OTR tire market. Germany, in particular, holds a significant portion of the market share (around 25-30%), driven by its well-established construction and mining sectors. Other regions in Europe, such as Eastern Europe, are witnessing growing demand for OTR tires due to industrialization and increasing infrastructure projects, although their contribution is lower compared to Western Europe. Switzerland’s market share in Europe is relatively modest but is poised for steady growth due to its focus on sustainable development and continued investment in key sectors.

Global Outlook and Other Key Regions: Beyond Europe, key regions such as North America and Asia-Pacific also impact the OTR tire market. North America, with its extensive mining and construction sectors, holds a considerable share of the global OTR tire market, followed by Asia-Pacific, where countries like China and India contribute significantly to demand growth due to their rapidly expanding infrastructure and industrial activities. Although Switzerland is not a major contributor to the global OTR tire market, its strategic position in Europe ensures it remains an important player within the region, benefiting from these global industry trends.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- Magna Tyres

Competitive Analysis:

The Switzerland off-the-road (OTR) tire market is highly competitive, with a mix of global and regional players offering specialized solutions across various sectors such as construction, mining, and agriculture. Major international manufacturers like Michelin, Bridgestone, and Goodyear dominate the market, leveraging their technological advancements, extensive distribution networks, and established brand presence. These companies offer a wide range of high-performance tires designed to meet the diverse needs of heavy machinery and off-highway vehicles. Local Swiss tire manufacturers also compete in the market, focusing on providing tailored solutions that meet the specific demands of Swiss industries, particularly in agriculture and infrastructure. The competition is further intensified by the growing emphasis on sustainability, with companies investing in eco-friendly tire technologies and innovative designs to address environmental regulations. The competitive landscape is expected to remain dynamic, with technological innovation and sustainability initiatives driving differentiation among key players.

Recent Developments:

- In February 2025, The Goodyear Tire & Rubber Company completed the sale of its Off-the-Road (OTR) tyre business to The Yokohama Rubber Company Ltd. for $905 million in cash. This transaction, announced in July 2024, streamlines Goodyear’s portfolio and allows the company to focus on its core products and services, while Yokohama integrates Goodyear’s OTR assets—including mining and construction tyre lines—into its global operations, aiming for significant growth in the sector.

- In March 2025, Guizhou Tire Co. Ltd. (GTC) launched its 2026 PCR Program, marking its entry into the global passenger car tire market with a focus on intelligent manufacturing and sustainability. The company also celebrated receiving the Lighthouse Factory Award for AI-driven manufacturing and the EcoVadis Silver Medal for sustainability, and announced plans for a second overseas production facility to strengthen its global supply chain.

- In January 2025, Prinx Chengshan (Shandong) Tire Co. Ltd. signed a strategic cooperation agreement with its supplier Bekaert to enhance high-quality development and innovation in the tire industry. Additionally, Prinx Chengshan launched two new all-terrain tires—the Prinx HiCountry AT2 and Fortune Tormenta AT2—set for North American distribution in February 2025, with expanded size offerings and advanced tread designs.

- In April 2025, Apollo Tyres introduced three new sizes for its AWE 723+ excavator tyre range at Bauma 2025, Europe’s largest construction and industrial machinery event in Munich. This expansion allows the AWE 723+ range to cater to excavators from six to 26 tonnes, enhancing options for operators seeking improved stability, traction, and wear resistance under challenging conditions.

Market Concentration & Characteristics:

The Switzerland off-the-road (OTR) tire market is moderately concentrated, with a few key players dominating the market share. Leading global manufacturers such as Michelin, Bridgestone, Goodyear, and Continental account for a significant portion of the market, benefiting from their advanced technological capabilities, extensive distribution networks, and strong brand recognition. These companies leverage their global presence to maintain a competitive edge in the Swiss market, offering a diverse range of high-performance tires for various off-highway applications. The market is characterized by a growing focus on innovation, sustainability, and tire longevity. Key players are increasingly investing in environmentally friendly solutions, such as green tires made from renewable materials, to meet strict environmental regulations. Additionally, technological advancements, including smart tire technologies and enhanced durability, are key differentiators in this market. Despite the dominance of large players, regional companies also contribute to the market by offering specialized, localized solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for OTR tires in Switzerland will continue to grow due to increasing infrastructure and urbanization projects.

- Technological advancements in tire design, such as smart tire systems, will drive the market towards more efficient and durable solutions.

- Sustainability trends will propel the development of eco-friendly tires made from renewable and recyclable materials.

- The agriculture sector’s modernization will drive demand for specialized OTR tires in farming machinery.

- Rising demand for construction equipment in mountainous terrains will continue to favor the use of high-performance OTR tires.

- OTR tire manufacturers will invest more in R&D to enhance tire longevity, fuel efficiency, and performance under harsh conditions.

- Switzerland’s focus on environmental regulations will increase demand for tires with lower carbon footprints and better fuel efficiency.

- The shift towards larger machinery in construction and mining will boost the demand for larger-sized OTR tires.

- Online retail and e-commerce channels will become more prominent, enhancing access to OTR tire solutions.

- Competition will intensify as regional and global players innovate to meet specific market needs and sustainability standards.