Market Overview:

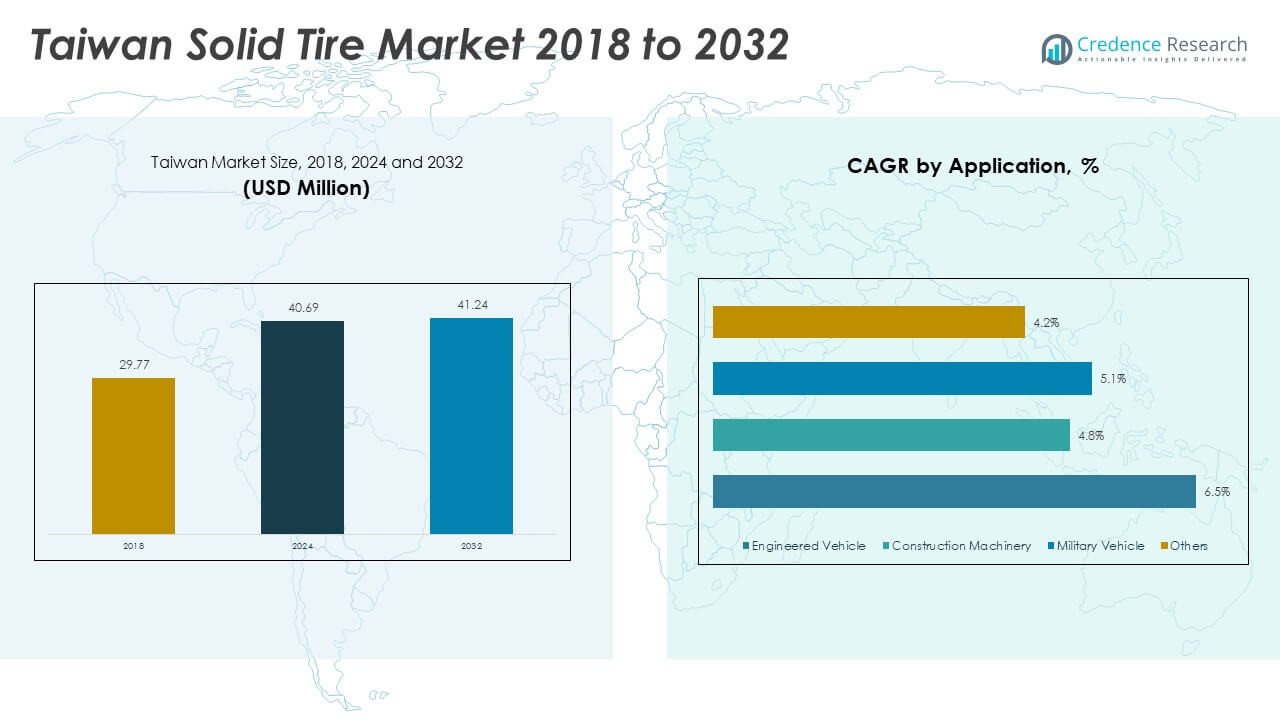

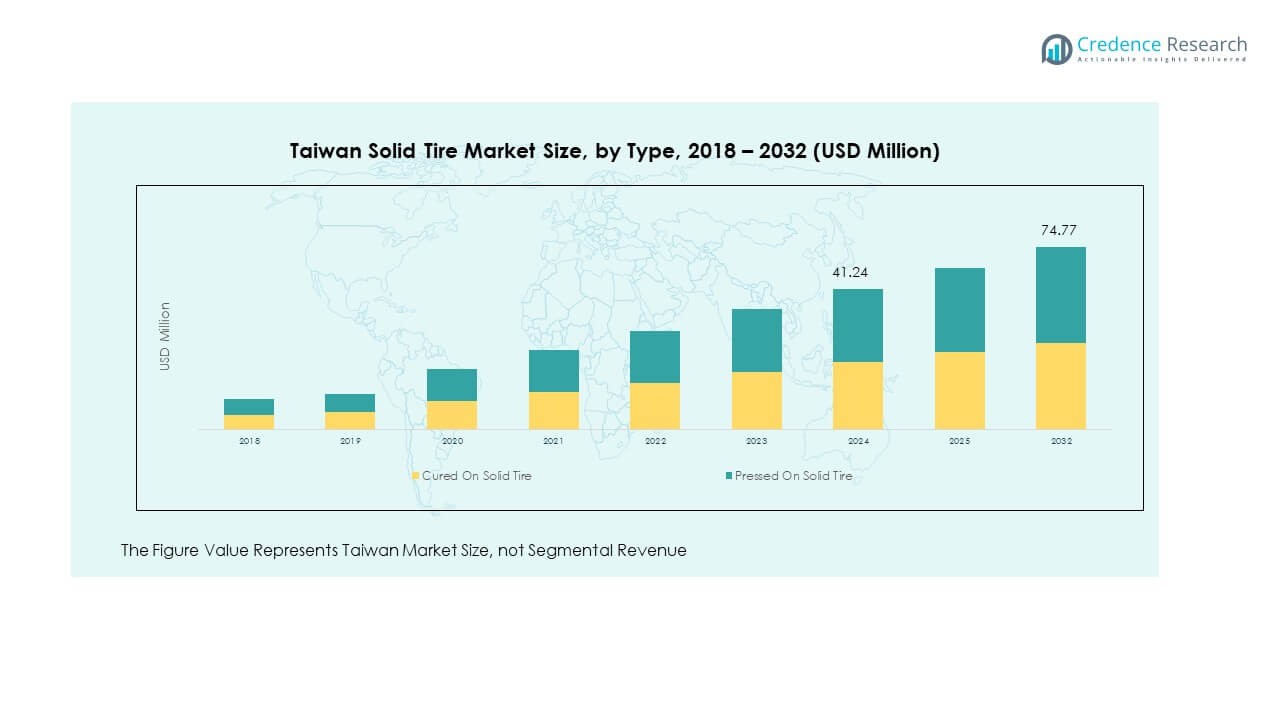

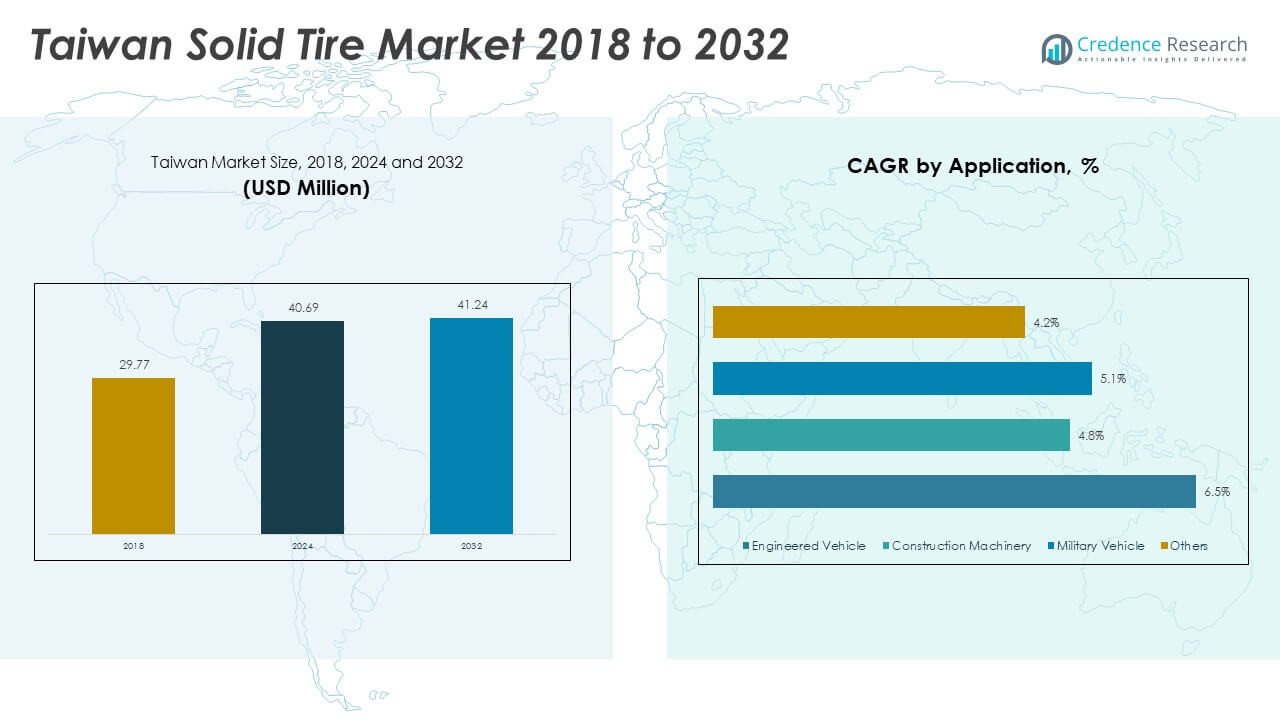

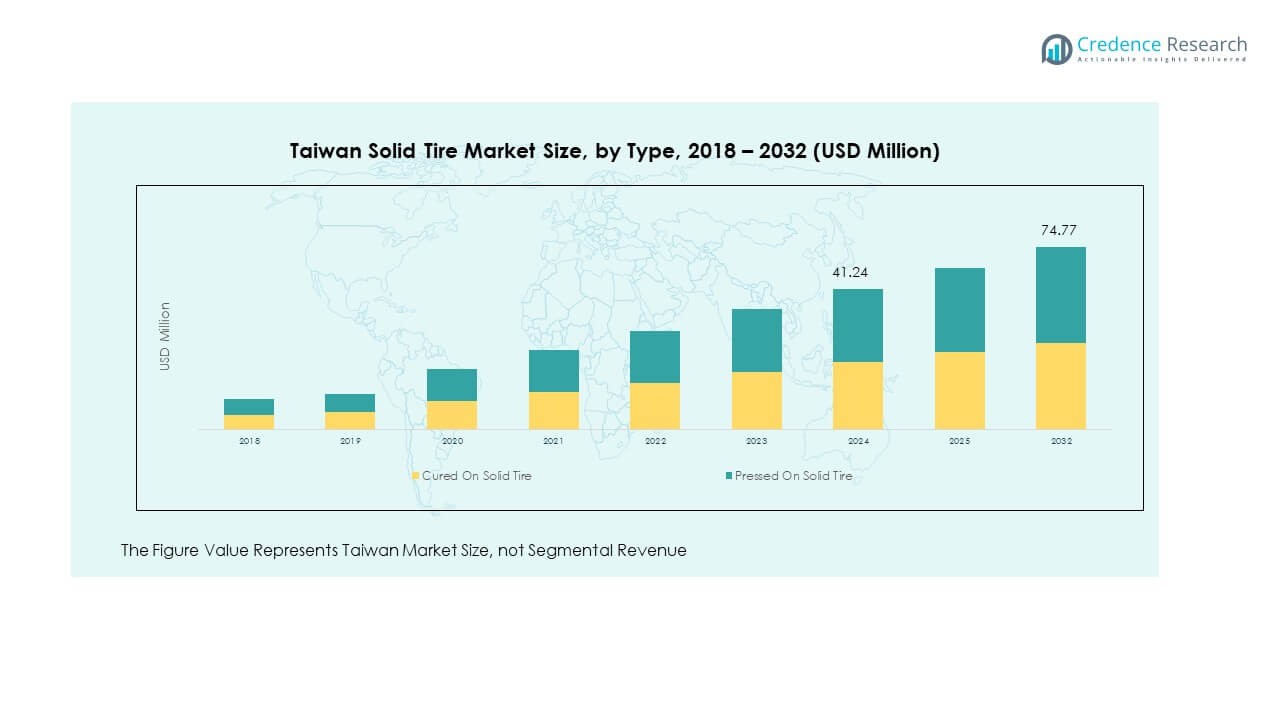

The Taiwan Solid Tire Market size was valued at USD 29.77 million in 2018 to USD 41.24 million in 2024 and is anticipated to reach USD 74.77 million by 2032, at a CAGR of 7.72% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Taiwan Solid Tire Market Size 2024 |

USD 41.24 Million |

| Taiwan Solid Tire Market, CAGR |

7.72% |

| Taiwan Solid Tire Market Size 2032 |

USD 74.77 Million |

The market growth is supported by rising industrial and logistics activities across Taiwan. Demand is strong in sectors such as warehousing, ports, and manufacturing, where durability and cost efficiency are critical. Increasing adoption of forklifts and heavy-duty material-handling vehicles drives solid tire usage due to their ability to withstand harsh conditions. Expanding infrastructure projects and urban construction further support growth, as solid tires reduce downtime and offer longer service life, making them attractive for operators seeking productivity gains and operational safety. Sustainability trends and demand for maintenance-free solutions also strengthen adoption.

Regionally, Taiwan benefits from its strong role as a logistics and manufacturing hub in East Asia. Demand is highly concentrated around port cities and industrial zones where import-export activity and high-volume warehousing take place. Northern Taiwan leads due to advanced logistics parks, while southern regions show growth from expanding industrial bases. Taiwan’s strategic trade links with China, Japan, and Southeast Asia enhance the market’s relevance, making the country both a consumer and re-exporter of equipment. Emerging demand in smaller urban centers also signals rising adoption beyond traditional hubs, reflecting wider industrial modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Taiwan Solid Tire Market size was valued at USD 29.77 million in 2018, reached USD 41.24 million in 2024, and is projected to reach USD 74.77 million by 2032, growing at a CAGR of 7.72% during the forecast period.

- North Taiwan holds 42% share, driven by dense industrial clusters, advanced logistics parks, and high port activity. Central Taiwan accounts for 28%, supported by strong manufacturing bases, while Southern Taiwan captures 20%, fueled by expanding export-oriented industries.

- The fastest-growing region is Southern Taiwan with 20% share, boosted by rising port modernization, industrial park development, and increased investment in heavy-duty logistics infrastructure.

- Pressed-On Solid Tires account for 63% of the market, reflecting strong adoption in warehousing and logistics due to durability and load capacity.

- Cured-On Solid Tires represent 37%, supported by their use in construction and manufacturing equipment requiring high resistance to wear and challenging environments.

Market Drivers:

Rising Industrialization and Expansion of Manufacturing Units Enhancing Tire Demand:

The Taiwan Solid Tire Market is driven by steady industrial growth and manufacturing expansion across the country. Heavy equipment such as forklifts, loaders, and port vehicles increasingly rely on solid tires for reliability in demanding conditions. Solid tires offer puncture resistance and longer service life, making them a preferred choice for industries operating with continuous workloads. Taiwan’s strong role in global electronics and machinery manufacturing strengthens tire adoption in production plants and logistics facilities. The expansion of small and medium enterprises also boosts demand for material-handling equipment fitted with durable tires. Port activity in key cities increases tire wear, creating recurring replacement needs. Growing warehousing networks designed for e-commerce further support solid tire sales by driving forklift usage.

- For instance, Gumonder Industrial Corp. (GMD Tire) has implemented an integrated quality assurance system from raw material acquisition to production, adhering to ISO 9001:2015 standards, CNS, E-MARK, DOT, and CCC certifications.

Growth in Warehousing, Logistics, and E-commerce Supply Chains Stimulating Market Expansion:

Rising logistics activities and e-commerce expansion push demand for resilient tires across warehouses and distribution hubs. Companies are investing in automated storage facilities where forklifts and tow tractors run nonstop, requiring maintenance-free tires to maximize uptime. Solid tires help reduce operational delays caused by frequent punctures in pneumatic alternatives. The growth of online retail increases demand for high-frequency delivery operations, amplifying warehouse and dockyard activity. Taiwan’s strategic position as a regional logistics hub supports consistent freight handling, leading to steady tire consumption. Cold storage facilities linked with pharmaceutical and food distribution also strengthen adoption. It supports operational safety by offering stability and load-bearing capacity for high-frequency movements.

- For instance, Apex Supply Chain Solutions specializes in supply chain performance management and facility automation, leveraging data-driven analytics to optimize inventory and improve labor productivity.

Infrastructure Development Projects Creating Strong Opportunities for Heavy-Duty Equipment Tires:

Ongoing urban development and infrastructure expansion projects require durable equipment, driving tire adoption in construction fleets. Solid tires perform effectively in rugged environments with debris and uneven terrains, reducing downtime for construction operators. Public investments in housing, road networks, and industrial parks continue to expand tire demand. Taiwan’s government-led urban transformation initiatives create opportunities for suppliers targeting the construction sector. Solid tires support critical safety requirements in cranes, skid steers, and earth-moving equipment used across large-scale projects. The resilience of solid tires makes them a cost-efficient option for operators seeking to minimize unexpected replacements. High adoption in infrastructure projects also boosts aftermarket sales channels. It secures recurring demand cycles linked with long-term development activities.

Rising Focus on Safety, Efficiency, and Sustainability in Industrial Operations:

Enterprises are prioritizing equipment safety, operational efficiency, and sustainability, supporting adoption of long-lasting tire solutions. The Taiwan Solid Tire Market benefits from growing preference for products that lower carbon footprints by reducing waste and replacement cycles. Solid tires meet safety requirements by providing better stability under heavy loads, enhancing workplace protection. Their resistance to punctures and wear reduces the frequency of tire disposal, aligning with sustainability initiatives. Energy efficiency in operations improves when equipment operates with low-maintenance, high-performing tires. Growing corporate commitments to environmental standards further encourage businesses to integrate solid tires in their fleets. Regulatory bodies encourage safer and cleaner industrial practices, indirectly promoting adoption. It highlights the strong link between operational safety and sustainable equipment choices.

Market Trends:

Adoption of Advanced Tire Materials and Enhanced Manufacturing Technologies:

Manufacturers are focusing on new material compositions to deliver superior performance in solid tires. Innovations include high-resilience rubber compounds and advanced bonding methods that improve load capacity and durability. Automation in tire manufacturing enhances precision and consistency, resulting in higher product reliability. The Taiwan Solid Tire Market sees local and international companies investing in R&D to improve heat resistance and longevity. Suppliers are also introducing environmentally friendly materials to align with global sustainability goals. Lightweight designs reduce energy consumption in vehicles, supporting operational efficiency. Technology-driven enhancements allow companies to differentiate products in a competitive market. It reflects a shift toward innovation as a strategic growth driver.

- For instance, Yeun Diing Enterprise Co., Ltd. launched their largest solid tire model 45/60-51 U with an outer diameter of 2700mm and section width of 1143mm in 2024, designed to endure heavy loads on Caterpillar CAT990/992 and Komatsu WA800 loaders.

Integration of Digital Solutions in Tire Performance Monitoring Systems:

Smart technologies are being integrated into industrial equipment to track tire performance in real time. Tire sensors help monitor wear, load balance, and temperature to ensure safety and reduce downtime. Operators in Taiwan are adopting digital monitoring systems to optimize replacement schedules and minimize operational costs. The Taiwan Solid Tire Market aligns with global industrial digitalization by adopting smart tire management systems. These tools enhance predictive maintenance and support continuous operation in logistics and manufacturing hubs. Businesses benefit from reduced breakdowns and better utilization of fleet assets. Integration of data-driven solutions helps streamline inventory and procurement. It represents a trend toward merging traditional equipment with connected technologies.

- For instance, tire pressure monitoring systems (TPMS) equipped with sensors transmit real-time data on tire pressure and temperature to operators, enabling predictive maintenance and reducing downtime.

Customization of Tires for Sector-Specific Industrial Applications:

Suppliers are increasingly customizing tire designs to meet the unique requirements of specific industries. Specialized tread patterns and compounds are being introduced for warehouse forklifts, port vehicles, and construction machinery. The Taiwan Solid Tire Market demonstrates strong demand for application-specific products that ensure optimal efficiency. Businesses seek customized tires to reduce slippage, enhance grip, and improve stability in sector-focused tasks. Cold storage and pharmaceutical logistics require tires that can perform under low temperatures. Construction firms demand designs capable of handling sharp debris without compromising traction. Growing customer focus on tailored performance accelerates supplier innovations. It ensures industries gain reliable solutions aligned with operational conditions.

Expansion of Aftermarket Sales and Online Distribution Channels:

The growing importance of aftermarket sales strengthens accessibility of solid tires to a wider audience. Suppliers are expanding online channels to cater to small businesses and regional buyers. The Taiwan Solid Tire Market benefits from digital platforms that allow easy ordering and faster delivery. Businesses prefer online platforms for price comparisons, bulk purchases, and warranty services. Distributors also enhance reach by collaborating with e-commerce platforms and industrial suppliers. Improved logistics networks in Taiwan support efficient tire delivery across urban and rural areas. The rise of online sales improves transparency and customer engagement. It highlights a trend where digital distribution reshapes procurement in industrial sectors.

Market Challenges Analysis:

Rising Competition from Low-Cost Imports and Pressure on Local Suppliers:

The Taiwan Solid Tire Market faces challenges from low-cost imports flooding domestic channels. Regional suppliers from neighboring countries often provide cheaper alternatives, creating pricing pressure on local producers. This impacts profitability and limits opportunities for smaller Taiwanese manufacturers to scale. The availability of low-cost substitutes reduces brand loyalty and increases switching behavior among buyers. It forces domestic players to focus on quality differentiation and innovation rather than competing on price alone. The growing presence of international suppliers also intensifies rivalry in both OEM and aftermarket segments. High competition often leads to aggressive discounting strategies. It creates margin compression, which hinders sustainable growth for smaller firms.

Regulatory Compliance, Raw Material Costs, and Supply Chain Disruptions:

Rising raw material costs and complex regulatory requirements pose further challenges for suppliers. Compliance with safety, durability, and environmental regulations increases operational expenses for manufacturers. The Taiwan Solid Tire Market is vulnerable to fluctuations in global rubber prices, which directly affect production costs. Suppliers often face delays in sourcing raw materials during international supply chain disruptions. It impacts timely product delivery and leads to inventory shortages across distribution channels. Smaller firms struggle with the financial burden of meeting compliance and maintaining steady supply lines. Market uncertainty forces companies to adopt risk-mitigation strategies and long-term supplier partnerships. It underlines how external pressures significantly influence operational stability.

Market Opportunities:

Increasing Demand for Automation, Port Modernization, and Industrial Upgrades:

Automation across warehouses and manufacturing facilities creates strong opportunities for solid tire suppliers. The Taiwan Solid Tire Market benefits from government and private investments in port modernization projects. Expansion of smart warehouses and advanced logistics parks drives consistent tire demand. Port cities are adopting modern material-handling fleets equipped with solid tires to reduce downtime. The growth of high-value sectors such as electronics and pharmaceuticals enhances industrial upgrades. Companies are prioritizing reliable, long-lasting tires to optimize efficiency and safety. It opens avenues for suppliers offering premium products with advanced durability and load-handling capabilities.

Rising Export Potential and Global Supply Chain Integration Supporting Market Reach:

Taiwan’s role in global trade creates opportunities for exporting solid tires to international markets. The Taiwan Solid Tire Market positions itself as a reliable contributor to regional supply chains. Expanding ties with Southeast Asian and global trade partners open new revenue channels. Export growth allows suppliers to achieve economies of scale and improve competitiveness. International demand for high-quality, durable tires enhances Taiwan’s reputation as a manufacturing hub. Strengthened logistics networks provide reliable channels for global distribution. It allows the country’s suppliers to diversify markets and mitigate domestic competition challenges.

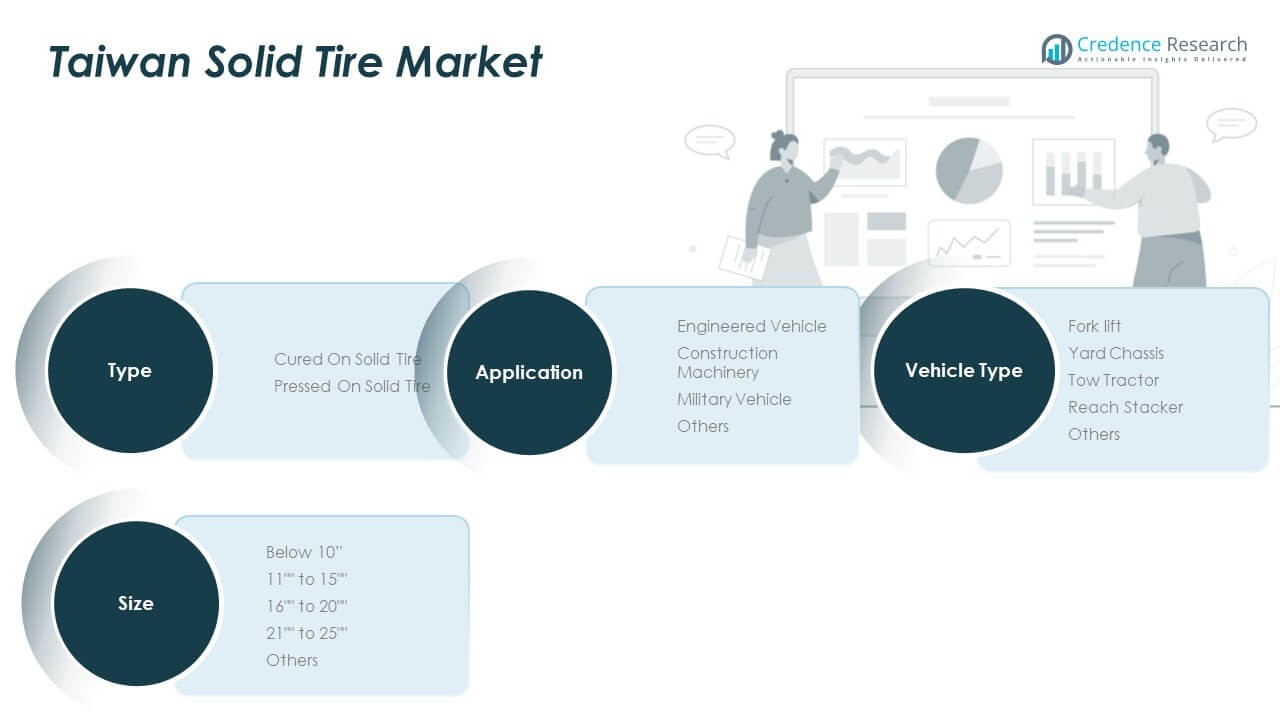

Market Segmentation Analysis:

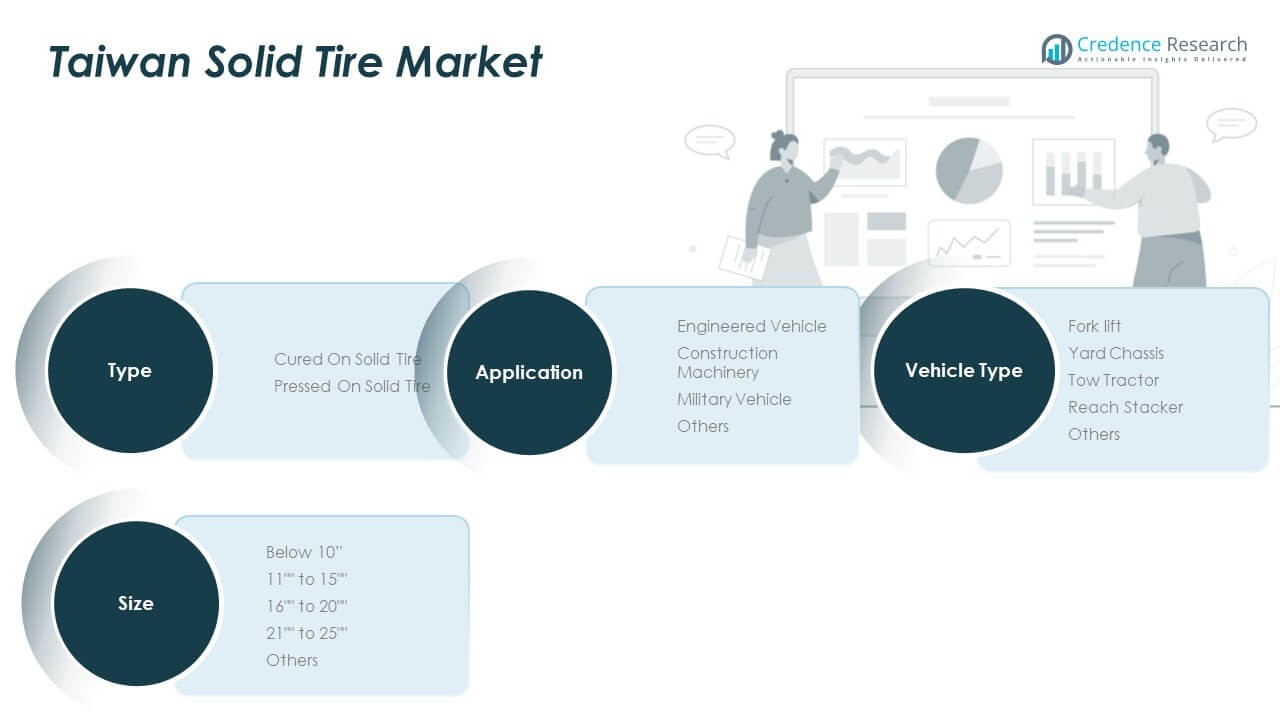

By Type

The Taiwan Solid Tire Market is divided into cured on solid tires and pressed on solid tires. Pressed on solid tires account for the larger share, driven by their durability, stability, and strong use in warehousing and logistics. Cured on solid tires show consistent demand in construction and heavy-duty machinery due to their resilience against harsh terrains. It benefits from regular replacement demand across industrial operations.

- For instance, press-on tires are favored in warehouse forklifts owing to their resistance to heavy wear and ability to maintain load-bearing capacity under frequent use conditions, as confirmed by product innovations focusing on wear resistance and vibration reduction technologies.

By Application

The market is segmented into engineered vehicles, construction machinery, military vehicles, and others. Engineered vehicles dominate with widespread use in warehouses, ports, and logistics centers. Construction machinery contributes strongly, supported by Taiwan’s ongoing infrastructure expansion. Military vehicles ensure steady demand, with reliability being a key requirement in defense fleets. It reflects balanced adoption across both commercial and defense sectors.

- For instance, Cheng Shin Rubber Industry Co. (Maxxis/CST) delivers tires with innovative features such as 3C Triple Compound technology and EXO Protection, which improve grip and puncture resistance.

By Size

Market segmentation by size includes below 10”, 11” to 15”, 16” to 20”, 21” to 25”, and others. The 11” to 15” and 16” to 20” categories lead the market, as they are most commonly fitted in forklifts, tow tractors, and yard equipment. Larger sizes above 21” cater to port machinery and specialized construction vehicles. It shows a broad adoption base across different industrial needs.

By Vehicle Type

The market includes forklifts, yard chassis, tow tractors, reach stackers, and others. Forklifts dominate due to their extensive use in logistics, warehousing, and e-commerce operations. Yard chassis and reach stackers provide significant demand in Taiwan’s ports, while tow tractors support industrial zones and manufacturing hubs. It underscores the importance of solid tires in sustaining high-load and high-frequency vehicle operations.

Segmentation:

By Type

- Cured On Solid Tire

- Pressed On Solid Tire

By Application

- Engineered Vehicle

- Construction Machinery

- Military Vehicle

- Others

By Size

- Below 10”

- 11” to 15”

- 16” to 20”

- 21” to 25”

- Others

By Vehicle Type

- Forklift

- Yard Chassis

- Tow Tractor

- Reach Stacker

- Others

Regional Analysis:

Northern Taiwan: Industrial and Logistics Hub

Northern Taiwan holds the largest share of the market at 42%, supported by its concentration of industrial parks, advanced logistics centers, and proximity to key port facilities. The region’s dominance is reinforced by the presence of major warehouses serving e-commerce and electronics sectors. Forklifts, tow tractors, and yard chassis contribute significantly to demand, ensuring high adoption of pressed-on solid tires. The Taiwan Solid Tire Market benefits from strong replacement cycles in this region, driven by continuous port activities and large-scale trade operations. It maintains a leadership position due to its role in international logistics and high industrial density.

Central Taiwan: Manufacturing and Construction Growth

Central Taiwan accounts for 28% of the market, driven by its strong manufacturing ecosystem and growing construction activities. The region is home to several mid-sized factories and industrial zones that rely heavily on solid tires for material handling. Rising infrastructure investments also boost demand for cured-on solid tires in construction machinery. Warehousing growth in cities such as Taichung adds momentum to forklift tire sales. The Taiwan Solid Tire Market gains steady growth here, with local manufacturers benefiting from proximity to production hubs. It continues to expand as industrial development strengthens regional demand.

Southern Taiwan: Fastest-Growing Region with Emerging Opportunities

Southern Taiwan holds a 20% share and represents the fastest-growing region, supported by port modernization projects and industrial expansion. The development of Kaohsiung Port as a logistics hub boosts demand for solid tires in reach stackers, yard chassis, and heavy-duty port vehicles. Investments in petrochemical and export-driven industries enhance the need for reliable, long-lasting tires. The Taiwan Solid Tire Market experiences rising adoption in this region as companies upgrade fleets to meet higher trade volumes. It shows significant growth potential, with emerging opportunities linked to industrial diversification and logistics infrastructure upgrades.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Gumonder Industrial Corp. (GMD Tire)

- Apexway Products Corp.

- Yeun Diing Enterprise Co., Ltd. (T.Y. Cushion Tires)

- Goodtime Rubber Co., Ltd.

- Cheng Shin Rubber Industry Co. (Maxxis / CST)

- Kenda Rubber Industrial Company

- Nankang Rubber Tire Corporation Ltd.

- Federal Corporation (Federal Tires & Hero)

Competitive Analysis:

The Taiwan Solid Tire Market is highly competitive, with domestic manufacturers and international players actively engaged. Companies such as Gumonder Industrial Corp., Apexway Products Corp., and Cheng Shin Rubber Industry Co. leverage extensive product portfolios and global networks to maintain strong positions. Intense rivalry drives firms to focus on quality, durability, and cost efficiency, while investments in R&D fuel innovation in tire materials and design. Local producers emphasize customized solutions for logistics and construction sectors, ensuring relevance in specialized applications. International brands exert pressure by offering advanced technologies and wider distribution reach. It continues to evolve as firms expand export potential and strengthen regional presence through strategic collaborations and product diversification.

Recent Developments:

- Kenda Rubber Industrial Company launched the VEZDA UHP MAX+ ultra-high-performance tire in February 2025, designed for superior grip and durability, and announced an expansion of their Formula DRIFT driver lineup for 2025. Additionally, Kenda is exploring the possibility of establishing a manufacturing plant in the United States as part of its international expansion efforts announced in August 2025.

- In the Taiwan solid tire market, Gumonder Industrial Corp. (GMD Tire) continues to maintain its reputation as a leading exporter of various types of industrial tires, focusing on high-quality standards and environmental efforts as of late 2024.

Report Coverage:

The research report offers an in-depth analysis based on type, application, size, and vehicle type segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Taiwan Solid Tire Market will expand with industrial growth and modernization across logistics hubs.

- Demand for pressed-on solid tires will remain strong due to their widespread use in forklifts.

- Infrastructure and construction projects will sustain the role of cured-on solid tires.

- Southern Taiwan will record the fastest growth, supported by port upgrades and industrial diversification.

- Northern Taiwan will retain leadership with concentrated industrial parks and logistics activity.

- Advancements in tire materials and eco-friendly production will shape future product innovation.

- Aftermarket expansion will continue through digital platforms and regional distributor networks.

- Export opportunities will rise as Taiwan strengthens its role in global supply chains.

- Competition will intensify as international players expand their presence in the domestic market.

- Long-term growth will be influenced by sustainability policies and evolving industrial requirements.