Market Overview

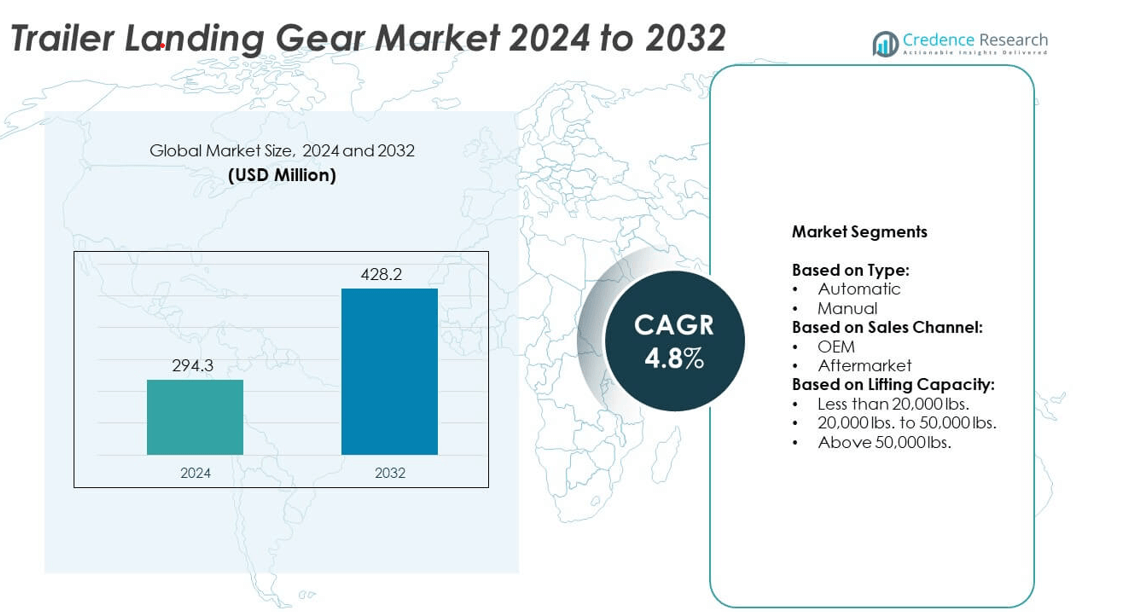

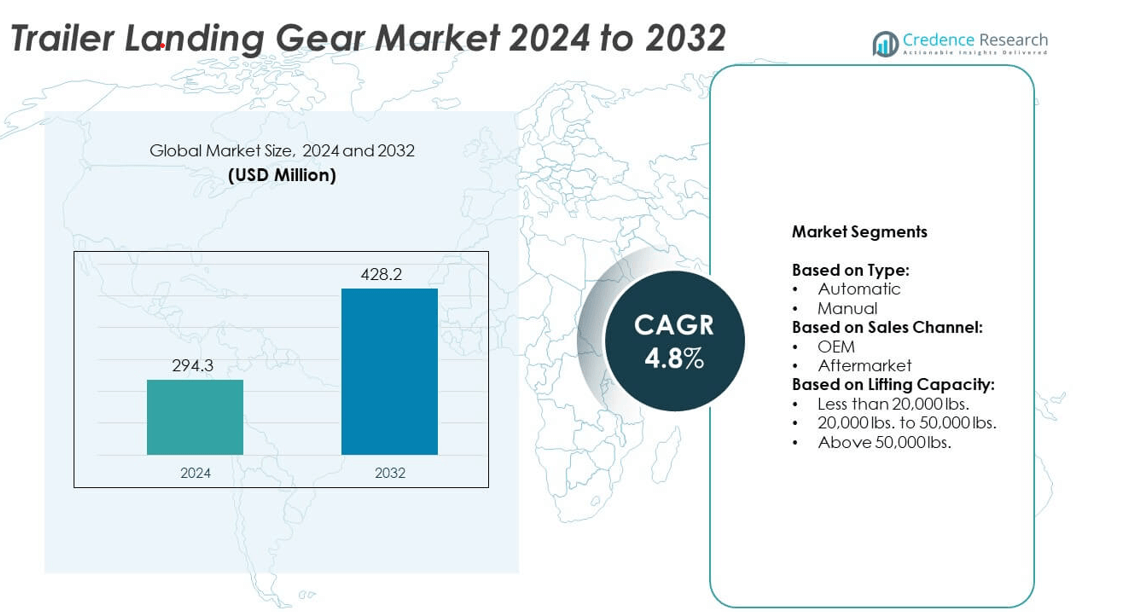

The Trailer Landing Gear Market size was valued at USD 294.3 million in 2024 and is anticipated to reach USD 428.2 million by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Trailer Landing Gear Market Size 2024 |

USD 294.3 million |

| Trailer Landing Gear Market, CAGR |

4.8% |

| Trailer Landing Gear Market Size 2032 |

USD 428.2 million |

The Trailer Landing Gear market grows through rising freight demand, fleet modernization, and strict safety regulations. Operators adopt advanced landing gear to improve efficiency, reduce downtime, and ensure cargo stability. Automation features and lightweight, corrosion-resistant materials drive innovation across product lines. Expanding logistics networks and cross-border trade strengthen the need for reliable trailer components. The market also benefits from sustainability initiatives, pushing adoption of eco-friendly materials. These drivers and trends collectively support steady growth across global regions.

North America leads the Trailer Landing Gear market with strong fleet modernization and advanced logistics infrastructure. Europe follows with emphasis on safety regulations, lightweight materials, and automated systems. Asia-Pacific records the fastest growth, supported by rapid industrialization, e-commerce expansion, and increasing trailer production. Latin America and the Middle East & Africa show steady demand through infrastructure development and regional trade growth. Key players influencing the market include JOST Werke AG, SAF-HOLLAND, BPW Bergische Achsen KG, and Fuwa Group.

Market Insights

- The Trailer Landing Gear market was valued at USD 294.3 million in 2024 and is projected to reach USD 428.2 million by 2032, growing at a CAGR of 4.8%.

- Growth is driven by rising freight volumes, expanding logistics networks, and strict trailer safety regulations.

- Automation and lightweight, corrosion-resistant materials are shaping product design and innovation in landing gear systems.

- Leading players focus on OEM partnerships, aftermarket presence, and R&D investments to strengthen their market position.

- High maintenance costs, frequent replacements, and intense price competition act as restraints for market growth.

- North America leads with advanced fleet modernization, Europe emphasizes regulatory compliance, and Asia-Pacific records the fastest growth with industrialization and e-commerce.

- Latin America and the Middle East & Africa show steady growth supported by infrastructure upgrades, regional trade expansion, and increasing trailer adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Heavy-Duty Transportation and Logistics Expansion

The growth of global trade and e-commerce is fueling higher freight volumes across regions. The transportation industry requires durable trailer components that can handle heavy payloads. The Trailer Landing Gear market benefits from investments in efficient logistics infrastructure. Fleet operators are focusing on stability and reliability during loading and unloading. Strong landing gear systems reduce downtime and improve safety standards. It supports fleet modernization strategies aimed at meeting strict performance requirements.

- For instance, SAF-Holland produces various high-performance landing gear, such as the HOLLAND MARK V series, which has an ultimate load capacity of 200,000 lbs. (approximately 90,700 kg). The company also has a modular axle and suspension system, known as SAF MODUL, which offers customizable configurations for different vehicle requirements.

Stringent Safety Regulations and Compliance with Standards

Government bodies enforce strict safety norms for trailer equipment in major markets. These regulations push manufacturers to develop robust and reliable landing gear systems. The Trailer Landing Gear market is driven by compliance requirements that limit equipment failure. It ensures trailers meet standards for stability during parking and cargo operations. The focus on accident prevention is accelerating replacement of outdated systems. Regulatory compliance acts as a catalyst for innovation and design improvements.

- For instance, JOST Werke developed its Modul B landing gear, which is certified under various international standards, including the AAR. The standard Modul B offers a lifting capacity of 24,000 kg and a static test load of 50,000 kg.

Technological Advancements and Product Innovation in Trailer Components

Manufacturers are integrating advanced materials to reduce weight while maintaining strength. The Trailer Landing Gear market sees rising adoption of automation features for easier operation. It enhances driver convenience and improves overall efficiency in fleet operations. Companies invest in R&D to deliver higher load capacity and longer lifecycle products. Demand for cost-efficient and durable solutions drives continuous product upgrades. Lightweight and corrosion-resistant designs are gaining preference among fleet operators.

Fleet Modernization and Growth in Long-Haul Transportation

The rising number of trailers for long-haul operations increases demand for reliable landing gear. The Trailer Landing Gear market gains traction from investments in advanced fleets. It provides the stability and safety needed in challenging routes and conditions. Long-haul transportation growth highlights the need for durable components that extend service life. Fleet operators prioritize reducing maintenance costs and ensuring consistent performance. This shift strengthens market growth and broadens adoption across global regions.

Market Trends

Adoption of Lightweight and High-Strength Materials in Trailer Components

Manufacturers are shifting toward advanced materials such as aluminum and high-strength steel. The Trailer Landing Gear market reflects this trend with designs that balance durability and weight reduction. It helps fleets lower fuel consumption and improve efficiency. Lightweight gear also reduces wear on tires and axles, supporting longer vehicle lifespan. The push for sustainability encourages wider acceptance of eco-friendly materials. This trend enhances operational performance while addressing environmental goals.

- For instance, BPW Bergische Achsen introduced ECO landing gear that utilizes high-strength steel and advanced design for weight reduction, contributing to improved transport efficiency. The ECO landing gear series includes models with a lifting capacity of 24,000 kg

Integration of Automation and Ease-of-Use Features

Operators seek landing gear systems that minimize manual effort and improve safety. The Trailer Landing Gear market experiences rising demand for semi-automatic and fully automatic solutions. It ensures faster deployment, reduced physical strain, and better efficiency in fleet operations. Automated gear aligns with the broader digitalization trend in transportation. Manufacturers continue to integrate sensors and simple controls for improved usability. This development supports driver productivity and reduces operational risks.

- For instance, Hyundai Translead’s standard landing gear has a lifting capacity of 50,000 lbs, with heavy-duty options featuring reinforced footplates offering a higher capacity of 62,500 lbs

Emphasis on Durability and Corrosion Resistance in Harsh Environments

Fleet operators prioritize landing gear that withstands extreme weather and rough terrains. The Trailer Landing Gear market benefits from coatings and treatments that enhance corrosion resistance. It extends service life and reduces long-term maintenance expenses. Demand is high in regions with snow, rain, and coastal conditions where rust is common. Heavy-duty construction ensures stability during frequent loading and unloading. This trend strengthens the shift toward advanced finishing technologies.

Growth of Global Logistics and Fleet Expansion Strategies

Expanding logistics networks drive strong demand for advanced trailer components worldwide. The Trailer Landing Gear market supports rapid growth in freight movement across borders. It enables fleet operators to scale operations while maintaining safety and reliability. Global trade intensification requires equipment that adapts to diverse road conditions. Fleet expansions in Asia-Pacific, Europe, and North America highlight this momentum. The trend reflects the strategic investments of logistics companies in high-performance equipment.

Market Challenges Analysis

High Maintenance Costs and Operational Downtime for Fleet Operators

Fleet owners face rising expenses from frequent repairs and replacements of trailer components. The Trailer Landing Gear market encounters resistance due to high lifecycle costs of equipment. It often requires regular inspection and servicing to prevent mechanical failures. Unexpected breakdowns increase downtime and reduce overall fleet efficiency. Small and mid-sized operators struggle with limited budgets to upgrade gear systems. This challenge slows adoption of advanced solutions in price-sensitive regions.

Intense Price Competition and Pressure on Profit Margins

Manufacturers face strong competition from regional and global suppliers offering low-cost alternatives. The Trailer Landing Gear market is impacted by shrinking margins and pressure to reduce prices. It limits the ability of companies to invest heavily in innovation. Customers often prioritize cost over advanced features, restricting premium product adoption. The presence of counterfeit and substandard products further complicates competition. These market conditions create significant challenges for sustainable growth and long-term profitability.

Market Opportunities

Rising Demand for Advanced Trailer Fleets and Infrastructure Growth

Expanding logistics networks and growing cross-border trade create strong opportunities for trailer component suppliers. The Trailer Landing Gear market benefits from investments in modern fleets designed for higher efficiency. It supports infrastructure upgrades in developing regions where freight transportation is rapidly expanding. Governments promote road connectivity projects, further boosting trailer adoption. The demand for safe, durable, and high-performance landing gear aligns with these investments. This opportunity enhances growth potential across both developed and emerging economies.

Adoption of Automation and Sustainable Material Solutions

Fleet operators seek gear systems with automated functions that reduce manual effort and improve safety. The Trailer Landing Gear market gains opportunities from the shift toward lightweight, corrosion-resistant, and eco-friendly materials. It addresses global sustainability targets while improving overall vehicle performance. Automated systems also appeal to large logistics companies focused on efficiency and driver well-being. Manufacturers introducing smart, durable, and environmentally friendly designs can capture higher market share. These opportunities pave the way for long-term industry innovation and expansion.

Market Segmentation Analysis:

By Type:

The Trailer Landing Gear market is divided into automatic and manual systems. Automatic landing gear is gaining adoption due to its efficiency, reduced labor needs, and safety benefits. Fleet operators in large-scale logistics prefer automatic gear for time savings and consistent performance. Manual systems still hold a considerable share in cost-sensitive markets where affordability is critical. It offers durability and simplicity, making it suitable for smaller fleets and regions with limited access to advanced technologies. The demand trend indicates a gradual shift toward automation in developed economies while manual systems remain relevant in emerging markets.

- For instance, Alcoa Wheels supplies forged aluminum wheels for trucks and trailers in European fleets. These wheels offer significant weight savings compared to steel wheels. In 2015, a specific low-deck Alcoa wheel weighed 41% less than a comparable steel wheel, resulting in a 117 kg saving on a three-axle trailer.

By Sales Channel:

The Trailer Landing Gear market is segmented into OEM and aftermarket. OEM sales dominate due to direct integration of advanced systems into new trailers. Manufacturers focus on equipping fleets with reliable gear during production to ensure long-term safety and performance. Aftermarket demand is strong, driven by replacement needs and fleet modernization. It reflects opportunities for suppliers providing durable gear that meets regulatory standards. Growing wear and tear in high-volume freight markets sustains aftermarket sales across multiple regions.

- For instance, Schmitz Cargobull delivered 57,122 vehicles in the 2022/2023 financial year, a majority of which were to Europe, while also expanding its global footprint into new markets like India and Central Asia.

By Lifting Capacity:

The Trailer Landing Gear market is segmented into less than 20,000 lbs., 20,000 lbs. to 50,000 lbs., and above 50,000 lbs. The 20,000 lbs. to 50,000 lbs. segment holds the largest share, driven by its suitability for medium to heavy-duty trailers. It supports diverse freight requirements, balancing durability and cost efficiency. Less than 20,000 lbs. gear serves lighter trailers, often used in regional transport and smaller fleets. Above 50,000 lbs. capacity gear caters to specialized heavy-duty trailers handling oversized cargo. This segment sees growth in industries such as mining, construction, and energy transportation where extreme durability is essential.

Segments:

Based on Type:

Based on Sales Channel:

Based on Lifting Capacity:

- Less than 20,000 lbs.

- 20,000 lbs. to 50,000 lbs.

- Above 50,000 lbs.

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Trailer Landing Gear market, accounting for 32% in 2024. The region benefits from a highly developed freight network, strong trucking industry, and early adoption of advanced technologies. Fleet operators prioritize automatic and corrosion-resistant landing gear to enhance operational efficiency and safety. It is supported by strict government regulations related to trailer safety and stability standards. The presence of established OEMs and strong aftermarket demand further strengthens regional growth. Rising investments in cross-border trade between the U.S., Canada, and Mexico continue to fuel demand. Long-haul routes, combined with large fleet modernization initiatives, ensure sustained consumption of advanced trailer landing gear systems.

Europe

Europe represents 27% of the global Trailer Landing Gear market in 2024, driven by stringent safety regulations and environmental standards. The region emphasizes lightweight and durable designs, reflecting efforts to improve fuel efficiency and reduce emissions. It is supported by large logistics and freight companies operating in cross-border trade within the EU. Advanced manufacturing hubs in Germany, France, and the UK foster innovation and rapid adoption of automated systems. The aftermarket is also strong, supported by replacement needs across an aging fleet base. Demand for gear systems with corrosion-resistant coatings is high due to varied climates across the region. Government support for sustainable transportation continues to encourage adoption of modern trailer components.

Asia-Pacific

Asia-Pacific accounts for 24% of the Trailer Landing Gear market in 2024 and records the fastest growth rate. The region benefits from expanding logistics infrastructure, rapid industrialization, and strong growth in e-commerce. China, India, and Southeast Asian countries are key contributors to market expansion. It is driven by large-scale investments in transportation networks and cross-border trade routes, including Belt and Road initiatives. Fleet operators focus on affordable yet durable manual gear, while adoption of automatic systems grows in advanced economies like Japan and South Korea. The aftermarket is also robust, reflecting frequent fleet upgrades and high freight activity. Increasing demand for cost-effective solutions ensures rising opportunities for global and regional manufacturers.

Latin America

Latin America holds 9% of the Trailer Landing Gear market in 2024, supported by gradual modernization of freight fleets. Brazil and Mexico are the major markets, benefiting from trade expansion and industrial growth. It is influenced by demand for reliable manual gear that balances cost and performance. OEM penetration is rising, but aftermarket sales remain dominant due to the region’s reliance on fleet maintenance. Harsh road conditions and extended operational use increase replacement demand. Adoption of advanced gear remains slow, but growing logistics investments create future opportunities. Government initiatives to improve transportation efficiency are expected to strengthen demand over the forecast period.

Middle East & Africa

The Middle East & Africa region represents 8% of the Trailer Landing Gear market in 2024, with steady growth supported by infrastructure projects and logistics expansion. Gulf countries invest heavily in logistics hubs, creating strong demand for durable landing gear. It is driven by long-haul freight movements across deserts and challenging terrains. Africa records rising demand, particularly in South Africa, due to growing industrialization and trade activities. Manual gear dominates due to cost considerations, but OEMs are gradually introducing advanced solutions. Harsh environmental conditions increase the need for corrosion-resistant systems that ensure long-term stability. Expanding trade routes and regional connectivity projects create sustained opportunities for manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- JOST Werke AG

- Yangzhou Tongyi Machinery Co., Ltd.

- Butler Products Corp.

- SAF-HOLLAND

- Zhenjiang Baohua Semi-Trailer Parts Co., Ltd.

- haacon

- Sinotruck Howo Sales Co., Ltd.

- BPW Bergische Achsen KG

- Fuwa Group

- D. Trailers Pvt. Ltd.

- AXN Heavy Duty

Competitive Analysis

The leading players in the Trailer Landing Gear market include JOST Werke AG, SAF-HOLLAND, BPW Bergische Achsen KG, Fuwa Group, Butler Products Corp., haacon, Sinotruck Howo Sales Co., Ltd., Yangzhou Tongyi Machinery Co., Ltd., Zhenjiang Baohua Semi-Trailer Parts Co., Ltd., H.D. Trailers Pvt. Ltd., and AXN Heavy Duty. These companies compete on product durability, technological advancements, and cost efficiency. Global players focus on integrating automation, lightweight materials, and corrosion-resistant designs to meet diverse fleet requirements. Regional manufacturers target cost-sensitive markets with reliable manual systems, supporting affordability while maintaining safety standards. Strong OEM partnerships enable major suppliers to secure long-term contracts with trailer manufacturers. The aftermarket also plays a key role, where competitive pricing and availability of replacement parts strengthen brand presence. Innovation remains a defining factor, with companies investing in research and development to differentiate offerings. Automation in landing gear is gaining momentum, giving established players an advantage in developed markets. At the same time, smaller regional firms compete on pricing strategies, especially in Asia-Pacific and Latin America. Competitive intensity is expected to increase as logistics expansion drives fleet modernization globally. This dynamic environment ensures continuous product upgrades and evolving strategies among leading players.

Recent Developments

- In 2025, Randoncorp, a Brazilian manufacturer of trailer components, announced the acquisition of AXN Heavy Duty. This integration is expected to broaden AXN’s product portfolio and market reach.

- In 2024, JOST has made significant progress in automation, with its KKS automatic coupling system, which includes the Modul E-Drive electric landing gear. While the E-Drive was not a new product in 2024, it was a central component of JOST’s automation push for safer and faster trailer operations.

- In 2023, BPW introduced the ePower generator axle, which provides an independent power source for electric and hybrid refrigeration systems on trailers. This development is part of the larger shift toward electrifying logistics and reducing transport emissions.

Report Coverage

The research report offers an in-depth analysis based on Type, Sales Channel, Lifting Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Trailer Landing Gear market will see steady growth supported by global freight expansion.

- Automatic landing gear adoption will rise as fleets prioritize efficiency and driver safety.

- Manual systems will remain relevant in cost-sensitive and developing regions.

- Demand for lightweight and corrosion-resistant materials will strengthen product innovation.

- OEM sales will dominate with integration of advanced systems in new trailers.

- Aftermarket demand will grow due to replacement needs in aging fleets.

- Asia-Pacific will record the fastest growth driven by logistics investments and e-commerce.

- North America and Europe will maintain strong shares with advanced fleet modernization.

- Manufacturers will focus on automation, durability, and eco-friendly material solutions.

- Rising global trade and infrastructure projects will expand opportunities across emerging economies.