Market Overview:

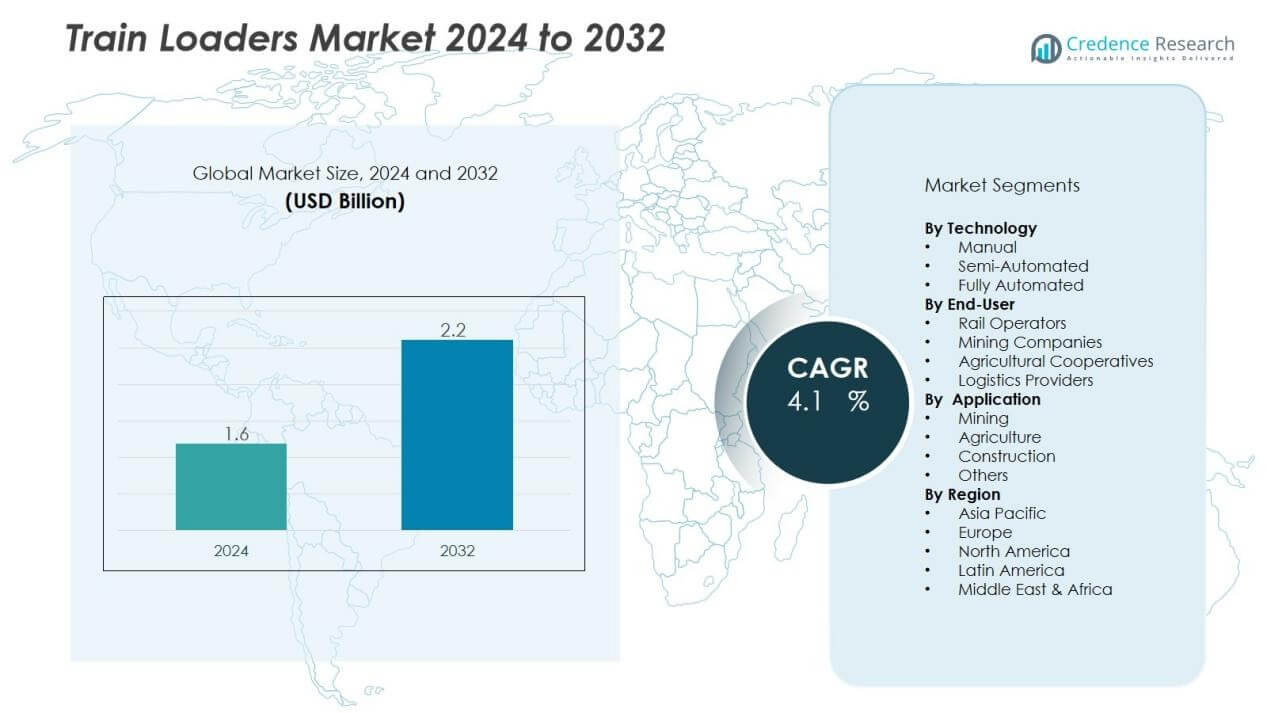

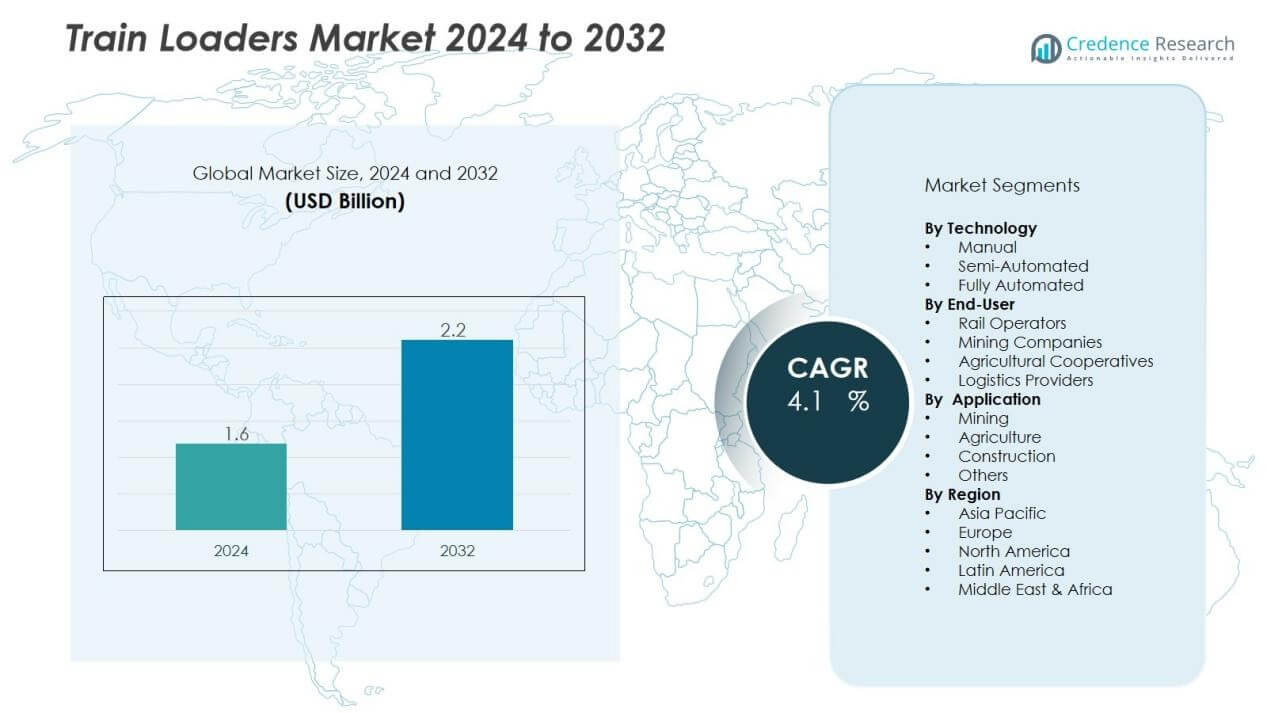

The train loaders market size was valued at USD 1.6 billion in 2024 and is anticipated to reach USD 2.2 billion by 2032, at a CAGR of 4.1 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Train Loaders Market Size 2024 |

USD 1.6 Billion |

| Train Loaders Market, CAGR |

4.1% |

| Train Loaders Market Size 2032 |

USD 2.2 Billion |

Key drivers include rising global trade in raw materials and the need for reliable, time-saving loading systems at rail terminals. The shift toward automation and digital integration further enhances operational safety and reduces labor costs. In addition, increasing emphasis on sustainability and energy efficiency pushes operators to adopt loaders with lower emissions and advanced dust-control systems.

Regionally, North America and Europe maintain strong market positions due to established rail freight networks and early adoption of advanced loading solutions. Asia-Pacific is projected to record the fastest growth, driven by rapid industrialization, mining expansion, and government investments in modern rail infrastructure across China, India, and Southeast Asia. Latin America and the Middle East & Africa also present growth potential, supported by rising infrastructure development and growing resource exports.

Market Insights:

- The train loaders market was valued at USD 1.6 billion in 2024 and is expected to reach USD 2.2 billion by 2032.

- Rising demand for efficient bulk material handling in mining, agriculture, and construction is fueling adoption.

- Automation, digital controls, and smart monitoring improve safety, precision, and cost efficiency for operators.

- High capital investment and complex maintenance remain major challenges for small and mid-sized operators.

- North America holds 32% market share, while Europe accounts for 29%, supported by advanced rail infrastructure.

- Asia-Pacific secures 27% market share, with China, India, and Southeast Asia driving rapid expansion.

- Latin America holds 7% share and the Middle East & Africa 5%, showing steady growth potential.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Efficient Bulk Material Handling in Industrial Sectors:

The train loaders market benefits from growing demand for efficient bulk material handling across mining, agriculture, and construction. Industries require faster loading operations to manage high transport volumes without delays. Automated loaders improve productivity and reduce dependence on manual labor. It helps companies meet strict timelines and ensures cost-effective rail logistics.

- For instance, the Port of Richards Bay Coal Terminal (RBCT) uses tandem tipplers capable of offloading coal from trains at a rate of 5,500 tonnes per hour. Coal is delivered to the terminal in trains with an average payload of 16,800 tonnes.

Expansion of Global Trade and Increasing Rail Freight Movements:

Expanding international trade and higher raw material exports create strong demand for modern train loading systems. Countries rely on rail networks for transporting coal, minerals, and agricultural commodities. The train loaders market supports these industries by offering reliable equipment for continuous operations. It ensures higher throughput at terminals and minimizes downtime during peak freight activity.

- For instance, FLSmidth has delivered 180 overland conveyor systems that handle up to 37,000 tonnes per hour over distances of up to 100 km

Advancements in Automation, Safety, and Energy Efficiency:

Automation is a critical driver, with manufacturers integrating digital controls and smart monitoring in loaders. These systems improve precision, reduce human error, and enhance workplace safety. The train loaders market gains momentum as operators seek low-emission, energy-efficient solutions that align with sustainability goals. It enables industries to lower operating costs and meet environmental standards effectively.

Infrastructure Development and Investments in Rail Modernization:

Large-scale investments in rail infrastructure across Asia-Pacific, Latin America, and Africa accelerate adoption of advanced train loaders. Governments and private operators invest in modern terminals to handle growing freight volumes. The train loaders market benefits from these projects by offering scalable, high-capacity equipment. It supports regional development goals while ensuring efficient supply chain operations.

Market Trends:

Integration of Automation, Digital Technologies, and Sustainability Features:

The train loaders market is witnessing a clear shift toward automation and digital integration. Manufacturers are equipping loaders with advanced control systems, real-time monitoring, and predictive maintenance tools. These features improve operational efficiency and extend equipment life cycles. The market is also embracing sustainability through energy-efficient motors, dust suppression systems, and reduced emission technologies. Customers demand solutions that align with stricter environmental regulations and corporate sustainability goals. It creates opportunities for suppliers to differentiate by offering smart and eco-friendly equipment.

- For instance, Amsted Digital Solutions offers the IQ Series gateway telematics device that provides real-time remote monitoring of railcars, including brake slide events and wheel health, enabling predictive maintenance and operational intelligence for over 600 railroads

Growing Focus on High-Capacity, Modular, and Customizable Loader Designs:

Companies operating in the train loaders market are prioritizing high-capacity systems to handle increasing freight volumes. Modular designs are gaining popularity as they allow flexible installation and easy upgrades at terminals. Operators also seek customizable solutions tailored to specific commodities such as coal, ore, or grains. This trend drives demand for versatile equipment that reduces downtime and maximizes throughput. It supports industries under pressure to improve supply chain efficiency and reliability. The shift toward scalable, commodity-specific loaders highlights the market’s focus on adaptability and customer-centric innovation.

- For example, BNSF Railway’s Dedicated Train service supports large-volume single-commodity unit trains, such as coal, with modern aluminum gondola cars that carry approximately 120 tons per car, with trains running up to 120 cars for optimized bulk transport capacity

Market Challenges Analysis:

High Capital Investment and Maintenance Complexity:

The train loaders market faces challenges due to the high upfront investment required for installation. Many small and mid-sized operators struggle to allocate sufficient funds for advanced loading systems. The cost of ongoing maintenance, spare parts, and skilled labor further increases operational expenses. It creates barriers for widespread adoption, particularly in developing regions with limited budgets. Long payback periods discourage companies from upgrading to modern equipment. This limits the pace of technological transition across certain markets.

Infrastructure Limitations and Regulatory Pressures:

Inadequate rail infrastructure and limited terminal capacities hinder the adoption of advanced train loaders in several regions. Many operators continue to rely on outdated facilities, which restricts efficiency gains from modern systems. The train loaders market also faces pressure from regulatory standards related to emissions, dust control, and workplace safety. It requires manufacturers to continuously invest in compliance-driven innovation, raising development costs. Delays in government approvals and infrastructure projects further slow deployment timelines. These factors collectively restrict market growth despite rising demand for efficient rail loading solutions.

Market Opportunities:

Adoption of Advanced Automation and Digital Solutions:

The train loaders market presents opportunities through the growing adoption of automation and digital technologies. Smart control systems, predictive maintenance, and IoT-enabled monitoring improve efficiency and reduce downtime. Demand for real-time data integration with terminal management systems is also expanding. It allows operators to enhance safety, optimize resource use, and cut operational costs. Manufacturers that invest in digital innovation gain a competitive advantage by meeting evolving customer needs. This creates strong potential for product differentiation and long-term partnerships.

Expansion in Emerging Markets and Infrastructure Investments:

Rapid industrialization and infrastructure projects in Asia-Pacific, Latin America, and Africa open new avenues for the train loaders market. Governments are funding modern rail terminals to manage higher freight volumes. Growing exports of commodities like coal, ore, and grain further fuel demand for efficient loading solutions. It enables manufacturers to target untapped markets with scalable and modular systems. Customization for specific industries provides additional opportunities to increase adoption rates. Rising emphasis on sustainable and high-capacity equipment strengthens growth prospects in these regions.

Market Segmentation Analysis:

By Technology:

The train loaders market is segmented into manual, semi-automated, and fully automated systems. Fully automated loaders are gaining dominance due to higher efficiency, reduced labor dependency, and improved safety. Semi-automated systems remain popular in cost-sensitive markets where investment constraints persist. Manual systems are declining but still serve small operators in developing regions. It reflects the industry’s shift toward digital integration and smart operations to improve long-term reliability.

- For Instance, In September 2024, OPS Australia facilitated an installation of a Telestack TC624R tracked radial stacker for a customer in Australia. The TC624R model is capable of achieving a throughput of up to 600 tonnes per hour (tph) for bulk material handling operations.

By Application:

Applications span mining, agriculture, construction, and others, with mining holding the leading share. The sector relies heavily on train loaders for transporting coal, iron ore, and other bulk commodities. Agriculture also contributes strongly, supported by rising grain and fertilizer exports. Construction projects depend on these loaders for handling cement, aggregates, and raw materials. It ensures continuous demand across industries that rely on bulk rail logistics.

- For instance, Fortescue, an Australian mining company, developed the Infinity Train, a battery-electric locomotive that uses regenerative braking to recharge itself while descending with a loaded iron ore train. With each train set consisting of hundreds of ore cars, its payload is approximately 34,404 tonnes per trip, a process that significantly improves efficiency

By End-User:

End-users include rail operators, mining companies, agricultural cooperatives, and logistics providers. Mining companies represent the largest end-user group, driven by demand for efficient, high-capacity systems. Rail operators and logistics providers are investing in modern infrastructure to support trade volumes. Agricultural cooperatives adopt loaders to streamline commodity transport from farms to terminals. It highlights diverse adoption across sectors, with growth strongest where freight volumes continue to rise.

Segmentations:

By Technology:

- Manual

- Semi-Automated

- Fully Automated

By Application:

- Mining

- Agriculture

- Construction

- Others

By End-User:

- Rail Operators

- Mining Companies

- Agricultural Cooperatives

- Logistics Providers

By Region:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America and Europe:

North America holds 32% market share, while Europe accounts for 29% market share in the train loaders market. Both regions benefit from well-established rail freight networks and advanced bulk handling infrastructure. Operators in these regions prioritize automation, energy efficiency, and compliance with strict environmental regulations. It drives strong adoption of digital control systems and low-emission loaders. Mining, agriculture, and construction sectors remain key end users across both markets. Continuous investments in rail modernization further reinforce their leading positions globally.

Asia-Pacific:

Asia-Pacific secures 27% market share in the train loaders market, supported by rapid industrialization and large-scale infrastructure development. China, India, and Southeast Asia drive demand through growing exports of coal, ore, and agricultural commodities. Governments are investing heavily in modernizing rail terminals and expanding freight capacity. It creates opportunities for suppliers offering scalable and modular loading systems. Strong demand for cost-effective and high-capacity equipment enhances adoption in both private and public sectors. The region is forecast to record the fastest growth rate during the coming years.

Latin America and Middle East & Africa:

Latin America holds 7% market share, while the Middle East & Africa account for 5% market share in the train loaders market. Resource-rich economies such as Brazil, South Africa, and GCC countries contribute significantly to demand. Infrastructure upgrades, coupled with increasing commodity exports, encourage adoption of efficient train loading systems. It supports long-term market growth despite challenges in capital investment and regulatory frameworks. International partnerships and government-led projects play an important role in expanding market reach. These regions continue to represent attractive opportunities for manufacturers targeting developing economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The train loaders market is highly competitive, with global and regional players focusing on technological innovation and capacity expansion. Key companies include Liebherr, Doosan, Yanmar, New Holland, SANY, John Deere, and Komatsu. These firms invest in automation, energy-efficient designs, and digital integration to strengthen their product portfolios. It helps them cater to industries such as mining, agriculture, and construction, where efficiency and reliability are critical. Partnerships with logistics operators and government infrastructure projects also drive market penetration. Competitive strategies center on product customization, after-sales services, and expanding footprints in emerging economies. The presence of both multinational leaders and regional manufacturers intensifies rivalry, pushing companies to innovate continuously and maintain cost-effectiveness.

Recent Developments:

- In April 2025, Liebherr was acquired by Bigge Crane and Rigging Co. with the delivery of three new Liebherr LTM 1100−5.3 all-terrain cranes at Bauma 2025.

- In April 2025, Adanaport expanded with a new Liebherr mobile harbour crane agreement to add the Liebherr LHM 550 crane to its operations.

- In March 2025, Yanmar launched a new Electrification Unit focused on driving zero-emission solutions for compact off-highway machinery.

Report Coverage:

The research report offers an in-depth analysis based on Technology, Application, End-User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The train loaders market will see rising adoption of automation and digital monitoring solutions.

- Energy-efficient and low-emission designs will gain traction due to strict environmental standards.

- Manufacturers will focus on modular and customizable systems tailored to specific commodities.

- Infrastructure investments in Asia-Pacific, Latin America, and Africa will create strong growth opportunities.

- Integration of IoT and predictive maintenance tools will enhance equipment reliability and reduce downtime.

- Mining and agriculture industries will remain key demand drivers for high-capacity loaders.

- Safety features and compliance-driven innovations will play a central role in equipment design.

- Partnerships between global suppliers and regional operators will expand market penetration.

- Sustainable dust suppression and material handling technologies will become standard offerings.

- The market will experience steady technological upgrades to meet evolving industrial and regulatory needs.