Market Overview:

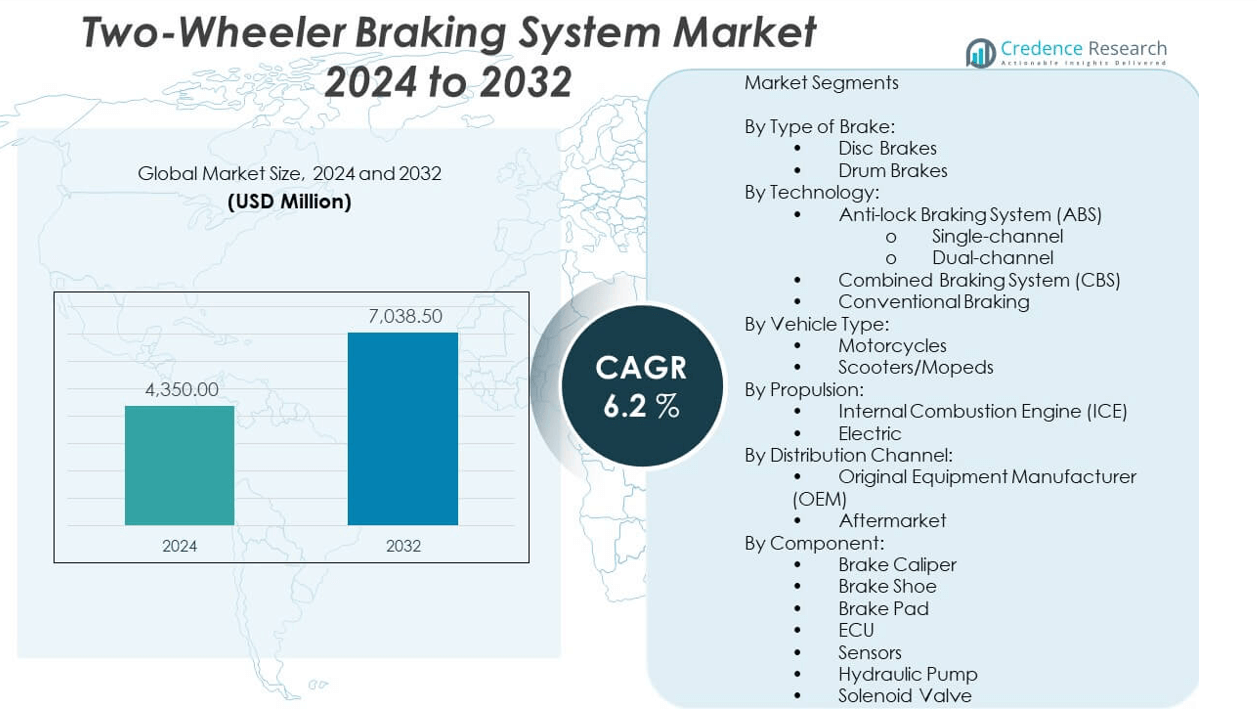

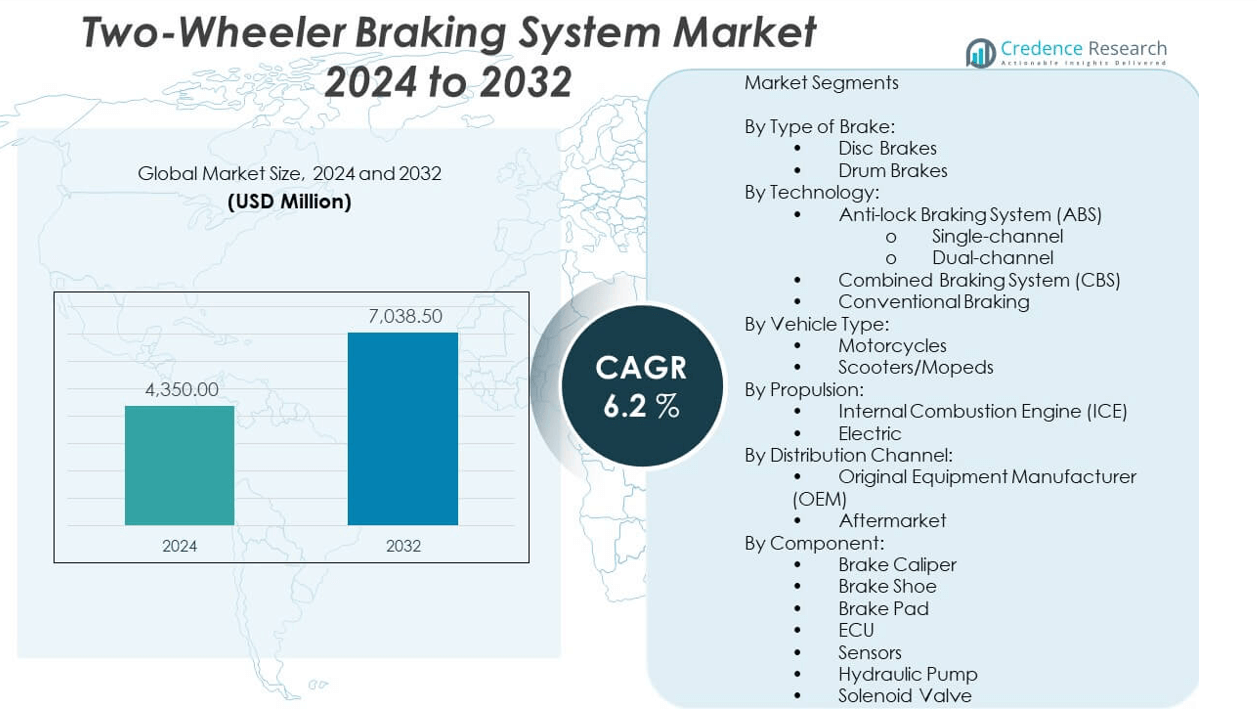

The Two-wheeler braking system market is projected to grow from USD 4,350 million in 2024 to an estimated USD 7,038.5 million by 2032, with a compound annual growth rate (CAGR) of 6.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Two-Wheeler Braking System Market Size 2024 |

USD 4,350 million |

| Two-Wheeler Braking System Market, CAGR |

6.2% |

| Two-Wheeler Braking System Market Size 2032 |

USD 7,038.5 million |

Growth in the two-wheeler braking system market is being driven by stricter safety regulations, growing consumer demand for advanced braking technologies, and increasing awareness of road safety. Manufacturers are integrating anti-lock braking systems (ABS) and combined braking systems (CBS) in response to mandates and customer expectations. The rising production of electric two-wheelers and high-performance motorcycles also fuels adoption of reliable braking components. OEMs are focusing on system efficiency and durability, while aftermarket demand is supported by increasing vehicle age and usage rates in emerging economies.

Asia-Pacific leads the two-wheeler braking system market due to the region’s high two-wheeler ownership and production volumes, especially in countries like India, China, and Indonesia. Europe shows steady growth, driven by the demand for premium motorcycles and stringent safety standards. Latin America and Africa represent emerging markets, benefiting from improving mobility infrastructure, urbanization trends, and rising disposable incomes that boost two-wheeler sales and safety feature adoption.

Market Insights:

- The Two-wheeler braking system market is projected to grow from USD 4,350 million in 2024 to an estimated USD 7,038.5 million by 2032, registering a CAGR of 6.2% during the forecast period.

- Growing adoption of ABS and CBS technologies due to regulatory mandates and rising consumer awareness is driving demand for advanced two-wheeler braking systems across multiple segments.

- Increasing urban traffic congestion and the need for reliable, responsive braking performance in high-density areas are pushing OEMs to prioritize safety-enhancing brake components.

- High cost of advanced braking systems, especially in developing markets, continues to limit penetration in price-sensitive entry-level and commuter motorcycle segments.

- Lack of trained technicians and insufficient service infrastructure in rural regions restrict widespread adoption and post-sale maintenance of modern braking technologies.

- Asia-Pacific leads the market due to high two-wheeler ownership and regulatory enforcement in countries like India, China, and Indonesia, followed by steady growth in Europe.

- Emerging opportunities exist in retrofitting older vehicles with upgraded brake kits, along with demand growth in semi-urban and rural mobility markets supported by rising disposable incomes.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Government Regulations Mandating Advanced Braking Systems:

The increasing implementation of safety norms is a major force driving the Two-wheeler braking system market. Regulatory bodies across major economies are enforcing mandatory integration of systems such as Anti-lock Braking Systems (ABS) and Combined Braking Systems (CBS) to reduce accident-related fatalities. In India, ABS is mandatory for bikes above 125cc, prompting OEMs to adapt rapidly. This regulatory environment pushes manufacturers to improve braking technologies and expand compliant product portfolios. Consumers are becoming more conscious of safety features during purchase decisions. OEMs are aligning development roadmaps with government timelines. It strengthens the link between legislation and safety technology uptake. The Two-wheeler braking system market benefits directly from regulatory compliance pressures on manufacturers.

- For instance, Continental Automotive Indiareached a major milestone with the production of 10 million Electronic Brake Systems (EBS) and 100 million Wheel Speed Sensors (WSS) for two-wheelers, supporting the rapid adoption of ABS (Anti-lock Braking Systems) as mandated by Indian regulations.

Growing Urbanization and Traffic Congestion Increasing Safety Concerns:

High traffic density in urban areas escalates the need for responsive braking systems to ensure rider safety. Commuters prefer two-wheelers for maneuverability and fuel efficiency in congested environments. However, frequent stop-and-go conditions increase the importance of reliable braking. Cities are witnessing more accidents due to inadequate stopping performance in older two-wheelers. It prompts both consumers and manufacturers to prioritize enhanced braking systems. Riders demand quick response, lower stopping distances, and better control. Municipal and state-level safety campaigns elevate awareness about braking efficiency. The Two-wheeler braking system market gains traction through its role in improving real-world riding safety in growing urban regions.

- For instance, Robert Bosch GmbHdevelops and supplies advanced wheel speed sensors, which form a key part of modern brake control systems used widely in urban commuter bikes.

Increased Penetration of Electric Two-Wheelers Requiring Specialized Braking:

The shift toward electric mobility introduces new demands for braking system design and integration. Electric scooters and motorcycles often require regenerative braking integration along with mechanical systems. This transition is creating strong demand for lightweight, compact, and electronically adaptable brake components. OEMs are redesigning chassis platforms to accommodate EV-specific braking systems. Suppliers are collaborating with electric vehicle start-ups to co-develop optimized systems. It expands the application range of modern braking technologies beyond ICE models. Regenerative braking further enhances energy efficiency and reduces wear, enhancing value. The Two-wheeler braking system market is diversifying its product strategies to cater to the rising EV segment globally.

Consumer Shift Toward Premium and High-Performance Two-Wheelers:

A global rise in the popularity of premium and performance-oriented motorcycles supports braking system innovation. Riders of larger-displacement bikes demand superior control and enhanced safety at high speeds. Advanced systems like dual-channel ABS, radial-mounted calipers, and disc brakes are becoming standard in these models. It encourages component makers to deliver precision-engineered, durable systems. Manufacturers aim to differentiate through braking performance in competitive segments. Consumers evaluate braking capabilities as a key factor in premium bike purchases. Sports and adventure motorcycles highlight advanced brake specifications in marketing efforts. The Two-wheeler braking system market aligns product innovation with aspirational and performance-driven consumer preferences.

Market Trends:

Integration of Electronic Brake Control Systems for Enhanced Modulation:

The Two-wheeler braking system market is witnessing a growing shift toward electronically controlled braking solutions. Electronic brake force distribution and smart ABS systems offer precise modulation during diverse riding conditions. Manufacturers are embedding sensors, control units, and advanced ECUs to enable responsive feedback. Riders benefit from optimized force distribution between wheels during panic stops or slippery roads. These innovations are evolving into standard features in upper mid-range and premium models. OEMs are designing software interfaces to allow braking customization through mobile apps. The trend supports seamless integration with other safety systems like traction control. It creates a pathway for full electronic brake-by-wire systems in the future.

- For instance, Brembo S.p.A. has developed and commercialized its brake-by-wire system called SENSIFY, which began production in 2024. SENSIFY enables precise real-time modulation of braking forces at each wheel, without hydraulic lines, improving dynamic control, stability, and rider safety.

Adoption of Lightweight Materials to Improve Performance and Efficiency:

Manufacturers in the Two-wheeler braking system market are adopting lightweight materials like carbon composites and high-strength aluminum alloys. These materials reduce unsprung weight, leading to improved vehicle handling and responsiveness. Brake rotors and calipers with reduced mass improve thermal performance and fuel efficiency. Cost-effective casting methods help expand these materials into mass-market segments. Racing-inspired materials are migrating into road models, reflecting performance trickle-down trends. R&D centers focus on balancing cost, heat resistance, and strength. Lightweight materials support the goals of electric vehicle platforms by reducing energy consumption. The trend signals a fundamental change in brake component engineering practices.

- For instance, Nissin Kogyomanufactures 4-pot radial monoblock calipers using precision aluminum casting, providing high performance at reduced weight. These calipers, proven in racing, are now adopted in road motorcycles for improved handling and energy efficiency.

Smart Connectivity and Integration with Rider Assistance Systems:

The evolution of smart two-wheelers brings braking systems under the umbrella of connected technologies. The Two-wheeler braking system market is exploring connectivity with vehicle control units and mobile applications. Advanced models allow diagnostics, usage tracking, and predictive maintenance notifications through smartphone apps. Braking data contributes to rider behavior analysis and insurance telematics. Developers are pairing ABS with cornering sensors, lean-angle detection, and GPS modules for intelligent braking. It opens possibilities for adaptive braking modes based on road type or rider profile. OEMs promote these integrations as part of the “smart mobility” trend. The future scope may include OTA updates and brake control personalization.

Rising OEM Collaborations and Tier-I Supplier Partnerships:

Collaboration between two-wheeler manufacturers and global brake system suppliers continues to shape the industry. The Two-wheeler braking system market benefits from technology transfer and co-development initiatives across regions. Joint ventures and long-term contracts ensure consistent quality and integration compatibility. OEMs leverage supplier R&D for cutting-edge solutions without in-house investment. Global suppliers localize production to meet cost targets and delivery timelines. This trend improves platform standardization and simplifies maintenance logistics for dealers. Partnerships also enable rapid compliance with evolving regional safety mandates. It facilitates expansion in high-volume emerging markets with reliable support structures.

Market Challenges Analysis:

High Cost of Advanced Systems Reducing Mass Market Penetration:

Advanced braking systems such as ABS, especially multi-channel variants, increase vehicle production cost significantly. Entry-level and mid-range two-wheelers dominate sales in developing regions, where consumers remain price-sensitive. Manufacturers must balance feature offerings with affordability to maintain competitiveness. Cost-conscious buyers may resist models with high-tech braking due to initial price hikes. Even though safety is important, economic constraints override in many rural and semi-urban markets. Suppliers face difficulties in scaling down features without compromising safety or performance. This limits widespread adoption and slows replacement cycles in budget-conscious segments. The Two-wheeler braking system market encounters pricing pressure that hinders full-scale deployment in lower-cost vehicle tiers.

Limited Aftermarket Awareness and Technician Expertise in Emerging Markets:

In several developing countries, aftermarket service providers lack adequate training to diagnose and repair modern braking systems. Technicians unfamiliar with ABS calibration or sensor diagnostics struggle to maintain system integrity. Consumers may face high repair costs or system bypassing due to misinformation. Unorganized repair markets dominate rural and semi-urban areas, offering limited support for advanced brakes. This reduces consumer trust and impacts resale value of equipped models. OEMs must invest in service network training and knowledge dissemination. Without reliable post-sales infrastructure, market expansion suffers in high-volume regions. The Two-wheeler braking system market requires broader ecosystem development to support technology diffusion.

Market Opportunities:

Expanding Demand for Retrofit and Modular Braking Kits:

The rising age of two-wheeler fleets in emerging countries presents opportunities for aftermarket braking upgrades. Consumers are exploring retrofit kits to enhance older models with CBS or ABS. It creates a viable secondary revenue stream for OEMs and brake system suppliers. Modular kits allow customization based on vehicle type and regional regulations. Governments supporting vehicle safety improvements further encourage upgrade campaigns. The Two-wheeler braking system market can capitalize on retrofit programs targeting road safety enhancement and rider education.

Untapped Rural and Semi-Urban Mobility Markets with Growing Disposable Income:

Rural mobility patterns are shifting due to rising income levels and transportation needs. Two-wheelers remain a primary mode of transport, creating space for safety-feature differentiation. Educated rural consumers are starting to prioritize quality and safety. Manufacturers can launch region-specific models with simplified braking systems that balance safety with affordability. Targeted awareness campaigns and financing options may boost demand. The Two-wheeler braking system market can achieve deeper market penetration through rural-focused innovations and outreach.

Market Segmentation Analysis:

By Type of Brake:

Disc brakes dominate in performance-oriented motorcycles due to superior stopping power, heat dissipation, and reliability. Drum brakes, though less efficient, continue to be used in entry-level and budget scooters for cost-effectiveness and ease of maintenance. Demand is shifting toward disc brakes as OEMs enhance safety across all price segments.

- For instance, the Nissin Kogyo 4-pot radial caliperfeatures advanced machining and monoblock construction, enhancing braking force distribution and heat management. This technology is utilized by leading OEMs, such as Honda in the CBR250RR, for models prioritizing disc brake upgrades over traditional drums.

By Technology:

Anti-lock Braking System (ABS) leads the market due to regulatory mandates and improved rider safety. Dual-channel ABS is gaining adoption in high-performance motorcycles, while single-channel remains common in commuter bikes. Combined Braking System (CBS) is prevalent in scooters and small-displacement models, offering balanced braking at lower costs. Conventional braking still exists in some regions with minimal safety regulations.

- For instance, Continental AGrecently announced a new generation of two-channel ABS, integrating innovative sensor technology directly into the ABS circuit board. Production for OEMs began in 2024.

By Vehicle Type:

Motorcycles account for the larger market share, driven by greater adoption of ABS and disc brakes. Scooters and mopeds are increasingly integrating CBS and improved braking designs, especially in urban mobility applications. Both segments are being influenced by electric propulsion and regulatory shifts.

By Propulsion:

ICE two-wheelers currently dominate the market, but the electric segment is rapidly growing. Electric vehicles demand compact, regenerative-compatible braking systems, pushing innovation in the segment. Governments supporting EV adoption are indirectly accelerating the deployment of advanced braking technologies in e-scooters and e-bikes.

By Distribution Channel:

OEMs dominate sales as braking systems are installed during manufacturing. With rising safety awareness, OEMs are integrating more sophisticated systems even in low-cost models. Aftermarket growth is moderate but increasing, particularly in retrofit kits and replacement parts for aging fleets in developing regions.

By Component:

Brake pads and calipers are key revenue-generating components due to frequent replacements. ABS-specific components like ECUs, sensors, hydraulic pumps, and solenoid valves are gaining market share with wider ABS adoption. Technological advancements in sensor accuracy and electronic integration are driving component-level innovation.

Segmentation:

By Type of Brake:

By Technology:

- Anti-lock Braking System (ABS)

- Single-channel

- Dual-channel

- Combined Braking System (CBS)

- Conventional Braking

By Vehicle Type:

- Motorcycles

- Scooters/Mopeds

By Propulsion:

- Internal Combustion Engine (ICE)

- Electric

By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket

By Component:

- Brake Caliper

- Brake Shoe

- Brake Pad

- ECU

- Sensors

- Hydraulic Pump

- Solenoid Valve

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific

Asia-Pacific dominates the two-wheeler braking system market, accounting for approximately 61.8% of the global share in 2024. High two-wheeler ownership, strong domestic manufacturing bases, and stringent safety mandates in countries like India, China, Indonesia, and Vietnam contribute to this leadership. Governments in India and China have enforced ABS or CBS requirements on new vehicles, accelerating system integration. Local OEMs and suppliers support low-cost, high-volume production tailored to commuter and mid-range motorcycles. Rapid urbanization and a growing middle class continue to push demand for safe and efficient two-wheelers. The region remains a production and consumption hub for both conventional and electric two-wheelers.

Europe

Europe holds approximately 17.2% of the two-wheeler braking system market in 2024, driven by premium motorcycle demand, strict safety regulations, and high consumer awareness. Countries like Germany, Italy, and France promote advanced braking technologies through safety-focused legislation and incentives. Dual-channel ABS is standard in most mid- to high-performance models due to EU requirements. The region also has a strong presence of premium OEMs and brake system innovators like Bosch and Brembo. Consumers in Europe prioritize technology and performance, supporting demand for high-end braking components. Electric mobility growth in urban zones further stimulates system innovation.

North America, Latin America, and Middle East & Africa

North America accounts for 10.6% of the market, supported by cruiser and sports motorcycle segments in the U.S. and Canada. The market benefits from a strong aftermarket for upgrades and replacements, especially in premium bikes. Latin America holds 6.1%, led by Brazil and Mexico, where cost-sensitive commuter motorcycles dominate. Governments are gradually pushing safety reforms, though adoption rates vary. The Middle East & Africa region represents 4.3%, with growth driven by increasing two-wheeler usage in urban centers and informal transport networks. It faces challenges in service infrastructure but presents long-term potential through rising income levels and mobility expansion initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Robert Bosch GmbH

- Continental AG

- Brembo S.p.A

- Endurance Technologies

- Nissin Kogyo Co., Ltd

- Brakes India Limited

- Akebono Brake Industry Co., Ltd.

- BWI Group

- Tenneco Inc

Competitive Analysis:

The Two-wheeler braking system market is highly competitive, led by global players such as Bosch, Continental, Brembo, and Nissin Kogyo. These companies invest heavily in R&D to develop advanced ABS, CBS, and electronic braking solutions tailored to both ICE and electric platforms. Strategic partnerships with OEMs enable integration of braking systems into production cycles at scale. Regional players like Endurance Technologies and Brakes India maintain strong footholds in cost-sensitive Asian markets. Competitive advantage depends on technology innovation, compliance with safety regulations, and supply chain efficiency. Market participants differentiate through product reliability, price positioning, and aftersales support. The Two-wheeler braking system market favors firms that can balance performance, affordability, and customization across various displacement segments.

Recent Developments:

- In June 2025, Brembo S.p.A debuted a new collaboration, partnering with Specialized to introduce a next-generation braking system for high-end bicycles. The new system, which includes advanced 4-piston calipers and a highly adjustable master cylinder, demonstrates Brembo’s ability to expand specialized braking technology across two-wheeler segments. While focused on bicycles, the system’s innovation is expected to also influence upcoming motorcycle and electric two-wheeler platforms.

- In January 2025, Robert Bosch GmbH undertook a significant long-distance validation of its new hydraulic brake-by-wire system, completing a public road test from Germany to the Arctic Circle. This system eliminates the mechanical connection between the brake lever and brake system, transmitting braking requests solely through electrical signals, and is slated for commercial launch from fall 2025. The trial demonstrated system reliability under various climate and traffic conditions, gathering crucial data to refine its deployment for both cars and motorcycles.

Market Concentration & Characteristics:

The Two-wheeler braking system market shows moderate concentration, with a few multinational companies controlling significant shares in premium and technologically advanced segments. It also features a large number of regional suppliers catering to entry-level and mid-range models. The market exhibits a strong OEM orientation, with high integration during vehicle production. It is technology-driven, safety-focused, and shaped by government mandates. Competitive dynamics vary by region, with local cost pressures influencing product offerings and design strategies. It relies on long-term OEM partnerships, economies of scale, and continuous innovation.

Report Coverage:

The research report offers an in-depth analysis based on brake type, technology, vehicle type, propulsion, distribution channel and component. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Mandatory safety regulations will drive widespread adoption of ABS and CBS across all two-wheeler categories.

- OEMs will integrate more lightweight, regenerative-compatible braking systems in electric vehicle platforms.

- Market expansion will benefit from increasing two-wheeler ownership in urban and rural emerging markets.

- Consumer preference for premium and performance models will accelerate demand for dual-channel ABS and advanced components.

- Innovation in sensor-based and electronically controlled braking systems will reshape product development strategies.

- Manufacturers will invest in local production facilities to serve high-volume demand in Asia and Latin America.

- The aftermarket will grow through retrofit kits, especially in older fleets requiring safety upgrades.

- Partnerships between global suppliers and local OEMs will strengthen, enabling cost-effective technology transfer.

- Training and certification for service networks will become crucial to support advanced braking system maintenance.

- Market participants will explore digital integration, enabling smart diagnostics, predictive maintenance, and app-based brake controls.