Market Overview:

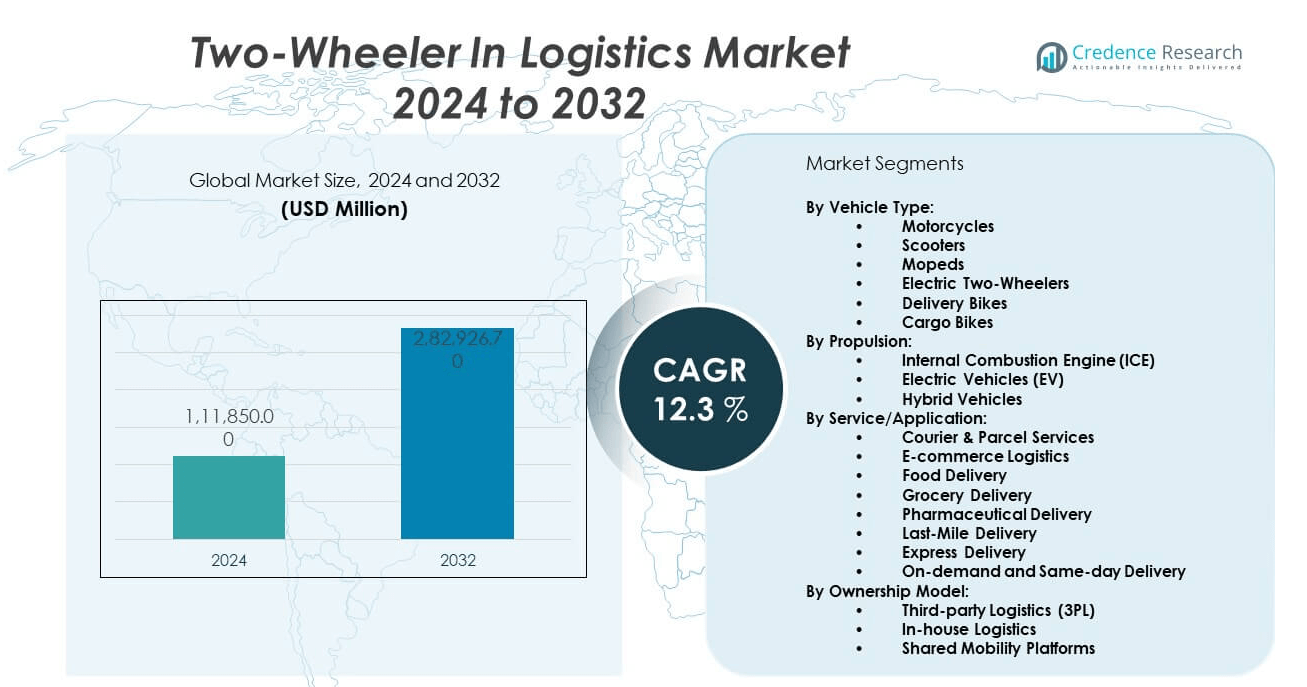

The Two-wheeler in logistics market is projected to grow from USD 111,850 million in 2024 to an estimated USD 282,926.7 million by 2032, with a compound annual growth rate (CAGR) of 12.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Two-Wheeler in Logistics Market Size 2024 |

USD 111,850 million |

| Two-Wheeler in Logistics Market, CAGR |

12.3% |

| Two-Wheeler in Logistics Market Size 2032 |

USD 282,926.7 million |

The growth of the two-wheeler in logistics market is driven by the surge in e-commerce and the rising need for fast, cost-effective last-mile delivery solutions. Businesses are increasingly adopting motorcycles and scooters to navigate congested urban environments and deliver goods swiftly. These vehicles offer greater fuel efficiency, lower emissions, and reduced operating costs compared to traditional four-wheel logistics vehicles. Additionally, the expansion of gig-based delivery platforms and on-demand services boosts adoption, particularly in emerging urban economies.

Asia-Pacific dominates the two-wheeler in logistics market, led by densely populated nations such as India, China, and Indonesia where two-wheelers are already integral to transport ecosystems. These countries benefit from established manufacturing capabilities and a large rider workforce. Latin America and parts of Africa are emerging as high-potential regions, driven by urbanization, growing digital commerce, and limited public transport infrastructure encouraging affordable delivery mobility solutions.

Market Insights:

- The Two-wheeler in logistics market is projected to grow from USD 111,850 million in 2024 to USD 282,926.7 million by 2032, at a CAGR of 12.3% from 2024 to 2032.

- Rapid e-commerce expansion and increasing preference for cost-efficient, quick last-mile delivery are primary growth drivers.

- Two-wheelers offer superior maneuverability, lower fuel consumption, and reduced emissions compared to traditional logistics vehicles.

- Proliferation of gig economy and on-demand delivery platforms accelerates two-wheeler fleet adoption across urban centers.

- Infrastructure gaps, regulatory inconsistencies, and safety risks pose operational challenges, especially in developing regions.

- Asia-Pacific leads the market due to high population density, widespread two-wheeler use, and strong local manufacturing ecosystems.

- Latin America and Africa show rising potential supported by digital commerce adoption and affordable mobility needs in urbanizing areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Fast and Cost-Effective Last-Mile Delivery:

The expansion of e-commerce platforms and hyperlocal delivery services strongly supports the Two-wheeler in logistics market. Businesses seek faster last-mile fulfillment, and two-wheelers provide superior agility in congested urban areas. They lower fuel consumption and reduce delivery costs, making them an economical alternative to four-wheel vehicles. Consumer expectations for same-day and next-day delivery continue to rise, pushing logistics companies to adopt fleet strategies centered on two-wheelers. It enables better navigation through narrow streets and high-traffic zones, minimizing delivery delays. The rise of food delivery, pharmaceutical logistics, and instant grocery services further elevates two-wheeler utility. Urban dwellers rely on short delivery windows, and two-wheelers effectively meet this demand. The market benefits from lower total cost of ownership and flexible operation models supported by gig workers.

- For instance,Lalamove highlights its “Logistics Triangle” model, leveraging freight digitization and artificial intelligence to optimize urban logistics. According to their 2025 disclosures, over 80% of Lalamove’s international users are SMEs, and the company’s digital platform has consistently achieved a 99.9% injury-free operation rate annually since 2022. Their advanced route optimization system, built on scalable, cloud-native streaming and analytics, ensures fast, efficient routing, and enables drivers to take optimal paths, directly contributing to both customer service and emissions reduction

Increasing Urbanization and Congestion Drive Adoption:

Urban sprawl and escalating traffic congestion make traditional delivery vehicles less viable for time-sensitive logistics. The Two-wheeler in logistics market gains momentum as cities prioritize compact and mobile delivery modes. Two-wheelers reduce time spent in traffic and allow for flexible routing and parking, streamlining delivery operations. They support high-frequency deliveries that align with dynamic demand patterns in metropolitan areas. Infrastructure challenges in emerging economies encourage businesses to deploy scalable two-wheeler fleets. Municipal regulations promoting low-emission and compact vehicles also reinforce this shift. Dense cityscapes create barriers for large transport trucks, making two-wheelers essential for first and last-mile coverage. It enables reliable performance despite infrastructure limitations or unpredictable road conditions.

- For instance, Stuart Delivery, a leading European logistics tech company, has deployed urban two-wheeler fleet in over 120 cities, enabling order deliveries in under 30 minutes on average for 85% of same-day parcel—a direct response to traffic congestion and curb access challenges in dense metropolitan areas.

Growth in Gig Economy and Freelance Delivery Workforce:

The proliferation of gig economy platforms such as food delivery apps and parcel services strengthens the Two-wheeler in logistics market. Independent delivery riders prefer two-wheelers due to lower entry costs and flexible usage. It helps companies expand their distribution reach without incurring full-time staffing overhead. The model supports scalability, allowing platforms to ramp up services during peak demand. Freelance delivery partners using two-wheelers contribute to improved service responsiveness and real-time order fulfillment. Fleet operators also integrate rented or partner-owned two-wheelers into their supply chain. The growing preference for asset-light operations in logistics further fuels demand for two-wheel vehicles. This dynamic enables rapid market penetration in cost-sensitive and high-demand geographies.

Fuel Efficiency and Environmental Compliance Encouragement:

Two-wheelers offer high fuel efficiency and lower emissions compared to vans and trucks, aligning with global sustainability goals. The Two-wheeler in logistics market benefits from pressure on logistics providers to reduce carbon footprints. Businesses adopt electric two-wheelers to comply with emission norms and meet ESG commitments. Government policies incentivize EV adoption through tax rebates and grants, accelerating electric two-wheeler integration into fleets. Logistics firms improve operational sustainability while reducing maintenance and fuel costs. It helps businesses strengthen brand image by adopting eco-conscious delivery models. Increasing consumer support for green logistics solutions also enhances market traction. The shift toward energy-efficient transport continues to shape procurement strategies in logistics.

Market Trends:

Integration of Electric Two-Wheelers Across Urban Fleets:

Fleet electrification continues to gain prominence in the Two-wheeler in logistics market, especially across last-mile delivery services. Companies invest in electric two-wheelers to reduce long-term operating costs and meet clean mobility targets. Shared mobility and gig platforms promote EVs due to their low maintenance and charging cost advantages. Urban distribution centers are setting up dedicated charging infrastructure to support growing electric delivery fleets. The market sees heightened collaboration between logistics firms and EV startups for leasing or subscription-based models. Battery-swapping networks enhance operational continuity and reduce downtime. Sustainable logistics models are becoming part of ESG roadmaps, which boosts electric two-wheeler penetration. It enables delivery networks to scale while complying with environmental norms.

- For instance, The number of shared electric two-wheelers globally surpassed 1.8 million units in 2023, and more than 150 cities worldwide now offer electric moped and scooter sharing.

Expansion of On-Demand Logistics and Hyperlocal Services:

Real-time delivery expectations push the Two-wheeler in logistics market toward hyperlocal distribution frameworks. Businesses design logistics models that enable fulfillment within a few kilometers, often in under an hour. It drives demand for agile two-wheelers capable of completing high volumes of short-range trips. Grocery, pharmaceutical, and cloud kitchen segments depend on rapid delivery cycles supported by two-wheeler networks. Advanced route optimization software improves delivery timeframes and rider efficiency. Many platforms integrate AI and predictive analytics to match orders with nearby riders. Urban retailers use two-wheelers to offer instant delivery as a service differentiator. The growing prominence of q-commerce (quick commerce) contributes directly to two-wheeler deployment expansion.

- For instance, NextBillion.ai, a technology provider for delivery route optimization, reports its AI-powered tools enable food and parcel delivery firms in India to cut travel time by up to 20%, and fuel costs by as much as 15%, through smarter routing and dynamic order matching to nearby riders.

Adoption of Fleet Management and Telematics Technologies:

Technology integration plays a pivotal role in modernizing the Two-wheeler in logistics market. Companies use GPS, IoT, and telematics to track deliveries, monitor rider behavior, and enhance route efficiency. Fleet managers optimize scheduling and improve asset utilization using real-time data analytics. Safety systems and alerts reduce accident risk, improving rider accountability and reducing liability. Predictive maintenance technologies help reduce downtime and extend two-wheeler service life. Data-backed insights support performance benchmarking across regions and delivery partners. Logistics operators deploy dashboards for live monitoring of delivery KPIs. It enhances transparency, allowing quicker decision-making and customer communication improvements.

Rise of Micro-Warehousing and Local Fulfillment Hubs:

To support high-frequency two-wheeler deliveries, businesses are investing in micro-warehouses closer to end consumers. The Two-wheeler in logistics market aligns with this trend by reducing transit time between local hubs and delivery points. Decentralized inventory placement supports rapid fulfillment and reduces return rates. Two-wheelers navigate short trips efficiently, enabling more daily deliveries per rider. Retailers and third-party logistics providers adopt dark stores and local fulfillment centers to maximize delivery speed. Smaller vehicles like scooters and mopeds enhance hub-to-doorstep reliability. Micro-hubs also reduce storage costs for businesses targeting dense urban zones. It enables faster response times during peak hours and enhances customer satisfaction levels.

Market Challenges Analysis:

Lack of Standardization and Infrastructure Hurdles:

One major challenge facing the Two-wheeler in logistics market is the absence of standardized regulations across regions. Variability in licensing, safety compliance, and insurance policies limits the scalability of cross-border or pan-regional logistics models. Poor road conditions, lack of designated lanes, and inadequate parking zones hinder smooth two-wheeler operations in many cities. Logistics firms must navigate diverse legal frameworks while ensuring consistent rider training and safety practices. Infrastructure gaps create inefficiencies, especially during peak hours or adverse weather. Many emerging markets still lack the charging infrastructure to support electric two-wheeler adoption at scale. These barriers increase fleet management complexity and slow the transition to modernized delivery systems.

Operational Safety and Rider Management Constraints:

Safety concerns present a consistent challenge in the Two-wheeler in logistics market, particularly with freelance or gig-based delivery models. Riders often operate under tight deadlines, increasing accident risks due to fatigue or aggressive driving. Lack of formal training and inadequate use of safety gear further elevates exposure to injury. Logistics providers face difficulties enforcing standardized rider behavior or safety compliance among independent contractors. High turnover and limited rider availability during demand surges also strain service reliability. Urban theft and vandalism risks affect fleet integrity, especially in regions with weak enforcement. Companies must invest in monitoring tools and incentive structures to reduce safety-related disruptions.

Market Opportunities:

Expansion of Electric Mobility Ecosystem in Emerging Markets:

Governments across Asia-Pacific, Latin America, and Africa are accelerating electrification through policy incentives and infrastructure development. The Two-wheeler in logistics market has strong potential in these regions due to rising urban demand and cost-sensitive delivery needs. Companies can partner with local EV providers, battery-swapping networks, and fintech platforms to build scalable delivery ecosystems. Electric two-wheelers offer a competitive edge in cost, efficiency, and sustainability, particularly in congested metro areas with poor public transport.

Innovation in Subscription-Based Fleet and Leasing Models:

The shift toward asset-light business models offers opportunities for logistics companies to adopt subscription-based two-wheeler fleets. Startups and OEMs provide monthly leasing options bundled with maintenance, insurance, and telematics, reducing entry barriers for small logistics players. It helps companies manage costs while scaling operations in fast-growth urban corridors. Subscription models also support rapid fleet renewal, ensuring operational uptime and compliance with emission norms.

Market Segmentation Analysis:

By Vehicle Type

The Two-wheeler in logistics market includes motorcycles, scooters, mopeds, electric two-wheelers, delivery bikes, and cargo bikes. Motorcycles dominate due to their speed and maneuverability, while scooters and mopeds appeal in high-density cities for their compact design and fuel efficiency. Electric two-wheelers are rapidly expanding with support from emission mandates and cost savings. Delivery bikes and cargo bikes offer enhanced payload capacity, making them ideal for food, parcel, and grocery deliveries.

- For instance, In New York City, cargo bikes—used by major carriers including UPS—made over 130,000 trips in 2022. New models tested by FedEx and others can carry 170kg for 45 miles per charge, directly replacing delivery van functions for short-range city loads.

By Propulsion

Internal combustion engine (ICE) vehicles currently hold the majority share, offering familiarity and broad service coverage. However, electric vehicles (EVs) are witnessing fast adoption as companies transition to low-emission fleets to meet environmental goals. Hybrid vehicles remain a transitional option, appealing to businesses seeking to balance range with fuel efficiency. It continues to see evolving fleet strategies focused on fuel economy and sustainability.

- For instance, FedEx’s European fleet now uses more than 70 e-cargo bikes in select cities, slashing CO₂ compared to diesel vans for urban routes. The battery-driven bikes can haul substantial loads (up to 170kg per trip). DHL in Germany and other global couriers are piloting both electric and hybrid two-wheelers to balance range, reliability, and environmental targets in last-mile logistics.

By Service/Application

The market is highly driven by food delivery, e-commerce logistics, and last-mile delivery services. Courier and parcel services remain vital, while grocery and pharmaceutical delivery are expanding with growing consumer demand for home-based essentials. Express delivery and on-demand services push for faster, more frequent delivery cycles. It aligns with consumer preferences for speed and flexibility in urban distribution.

Segmentation:

By Vehicle Type:

- Motorcycles

- Scooters

- Mopeds

- Electric Two-Wheelers

- Delivery Bikes

- Cargo Bikes

By Propulsion:

- Internal Combustion Engine (ICE)

- Electric Vehicles (EV)

- Hybrid Vehicles

By Service/Application:

- Courier & Parcel Services

- E-commerce Logistics

- Food Delivery

- Grocery Delivery

- Pharmaceutical Delivery

- Last-Mile Delivery

- Express Delivery

- On-demand and Same-day Delivery

By Ownership Model:

- Third-party Logistics (3PL)

- In-house Logistics

- Shared Mobility Platforms

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leads with Rapid Urbanization and Dense Delivery Networks

Asia-Pacific dominates the Two-wheeler in logistics market with a commanding market share of 45%, driven by high population density, expanding e-commerce, and rapid urbanization. Countries like India, China, Indonesia, and Vietnam deploy two-wheelers at scale to support hyperlocal delivery demands in congested urban zones. Governments encourage electric two-wheeler adoption through subsidies and local manufacturing incentives. Logistics players leverage low-cost labor and vehicle affordability to operate asset-light models efficiently. Dense city layouts and narrow road infrastructure further boost two-wheeler preference for last-mile logistics. It enables high-frequency, low-cost deliveries critical to retail, food, and pharmaceutical sectors. The region continues to attract global investments in electric mobility platforms and micro-distribution hubs.

North America Maintains Strong Position Through Tech-Enabled Fleet Operations

North America accounts for 24% of the global Two-wheeler in logistics market, supported by advanced logistics infrastructure and digitalized fleet management systems. The U.S. and Canada experience growing adoption in urban centers where congestion and delivery density support two-wheeler logistics models. Food delivery services, courier startups, and major retailers increasingly deploy scooters and e-bikes for quick order fulfillment. It benefits from widespread integration of telematics, route optimization, and driver behavior monitoring platforms. The presence of shared mobility and subscription fleet operators adds flexibility to logistics operations. Rising EV penetration and sustainability mandates also accelerate the transition toward electric two-wheeler fleets in key metropolitan areas.

Europe Focuses on Sustainability and Urban Mobility Compliance

Europe holds a 20% share in the Two-wheeler in logistics market, propelled by environmental regulations, zero-emission delivery zones, and a strong cycling culture. Cities in Germany, the Netherlands, France, and the UK support two-wheeler logistics through dedicated lanes, urban mobility incentives, and EV funding programs. Logistics operators increasingly choose electric mopeds and cargo bikes to meet last-mile delivery targets in emission-restricted zones. It aligns with European Green Deal goals and helps companies reduce their carbon footprint. E-commerce players partner with local micro-fulfillment providers to shorten delivery distances and improve efficiency. The region sees consistent innovation in compact electric vehicles designed for urban delivery applications.

Rest of the World Shows Gradual Uptake in Niche Applications

The Rest of the World represents 11% of the Two-wheeler in logistics market, with growing adoption in Latin America, the Middle East, and Africa. These regions face infrastructure constraints and fuel cost pressures that create opportunities for two-wheeler logistics. It gains relevance in informal retail, last-yard services, and emerging on-demand delivery platforms. Countries like Brazil, South Africa, and the UAE support ecosystem development through regulatory reforms and mobility-as-a-service models. While market penetration remains lower than global averages, expanding digital payment access and mobile commerce will drive future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Stuart Delivery Ltd.

- GoGoX

- Shippify Inc.

- Bringg

- Lalamove

- Budbee

- Blu Couriers

- Roadie Inc.

- Deliverect

- Instabox

- UPS

- FedEx

- Ryder

Competitive Analysis:

The Two-wheeler in logistics market features a mix of global logistics giants and agile, tech-driven delivery startups. Companies such as UPS, FedEx, and Ryder integrate two-wheelers to support last-mile delivery within broader logistics networks. Startups like Lalamove, GoGoX, and Budbee specialize in urban delivery with flexible fleet models and advanced route optimization platforms. Players differentiate through service speed, geographic reach, rider management, and integration with e-commerce platforms. Many adopt electric two-wheelers to reduce operational costs and comply with sustainability goals. The market favors scalability, and companies often rely on partnerships and platform-based models to extend delivery capacity. It remains highly dynamic, with innovation and cost-efficiency driving competition in dense urban zones.

Recent Developments:

- In January 2025, GoGoX partnered with Carousell to launch “Carousell Official Delivery,” a logistics solution designed to facilitate the delivery of bulky furniture and appliances during peak demand seasons in Singapore. This collaboration leverages GoGoX’s expertise to streamline large-item transactions, offering services such as assembly, disassembly, and damage coverage, and aims to enhance the convenience of secondhand trading for users.

- In June 2025, Lalamove Singapore strengthened its support for delivery platform workers by officially recognizing the National Delivery Champions Association (NDCA) as the representative for its driver partners. This formal partnership follows an MoU signed in November 2024 and builds on joint initiatives to improve digital literacy, working conditions, and dispute resolution processes—demonstrating Lalamove’s commitment to the wellbeing and empowerment of its delivery workforce.

- In April 2025, Bringg announced the launch of a new platform extension, “Dynamic Delivery Slots.” With this feature, retailers and logistics providers can offer more precise, real-time delivery windows during eCommerce checkout. The innovation aims to prevent overbooking, optimize fleet utilization, and improve customer satisfaction by providing accurate delivery promises based on real-time operational data.

- In March 2025, Budbee and Instabox completed their $1.7 billion merger, creating a consolidated entity named Instabee. This move represents a significant step toward bolstering sustainable last-mile delivery across Europe, combining their expertise to achieve greater scale, operational efficiency, and innovation. The combined company is positioned to set new standards in the European logistics sector.

- In June 2025, Roadie, a UPS company, entered a strategic partnership with Essendant, a business supplies distributor. The partnership will integrate Roadie’s crowdsourced delivery platform with Essendant’s national distribution network, enabling faster and more flexible last-mile delivery solutions for businesses throughout the United States and enhancing supply chain efficiency.

Market Concentration & Characteristics:

The Two-wheeler in logistics market exhibits moderate concentration, with a few large players dominating in mature regions and numerous local and regional startups driving growth in emerging markets. It is fragmented across services and geographies, promoting innovation and flexible fleet strategies. It remains asset-light, often relying on gig workers and shared mobility platforms. High competition encourages pricing efficiency and tech adoption.

Report Coverage:

The research report offers an in-depth analysis based on vehicle type, propulsion type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for last-mile delivery will increase in both urban and semi-urban regions.

- Electric two-wheelers will see wider adoption due to fuel savings and emissions mandates.

- Gig economy platforms will continue to expand logistics partnerships.

- On-demand delivery models will push for faster and more frequent fleet rotations.

- AI and route optimization will enhance delivery accuracy and reduce operational costs.

- Companies will invest in micro-hubs and urban fulfillment centers.

- EV infrastructure growth will support electrification of two-wheeler fleets.

- New entrants will disrupt traditional models through digital-only logistics platforms.

- Hybrid ownership models will emerge, blending in-house fleets with third-party riders.

- Regulatory harmonization across cities will shape growth potential in large regions.