Market Overview:

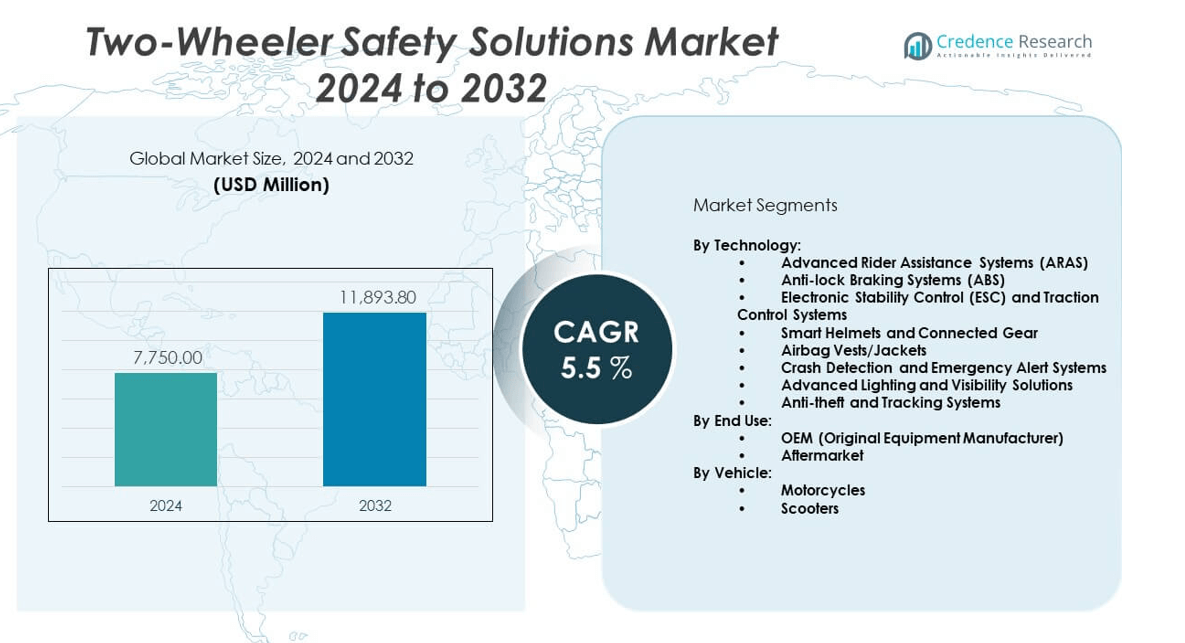

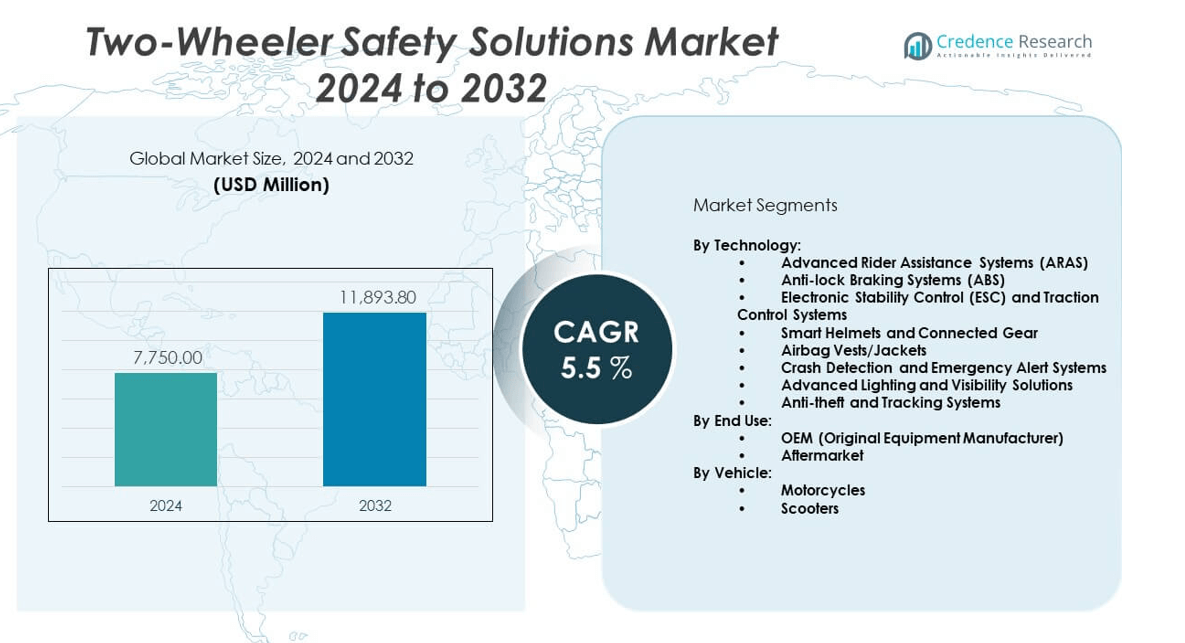

The Two-wheeler safety solutions market is projected to grow from USD 7,750 million in 2024 to an estimated USD 11,893.8 million by 2032, with a compound annual growth rate (CAGR) of 5.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| Two-wheeler safety solutions market Size 2024 |

USD 7,750 million |

| Two-wheeler safety solutions market, CAGR |

5.5% |

| Two-wheeler safety solutions market Size 2032 |

USD 11,893.8 million |

Rising road accident rates and growing regulatory pressure are pushing demand for advanced two-wheeler safety solutions. Manufacturers are prioritizing safety features such as anti-lock braking systems (ABS), traction control, collision alert, and smart helmets to meet evolving safety norms and consumer expectations. Increasing awareness about rider protection and insurance-linked safety compliance also drives technology integration. OEMs and suppliers are innovating with AI-enabled assistance systems and connected technologies to reduce fatalities and improve rider response times in real traffic scenarios.

Asia-Pacific dominates the two-wheeler safety solutions market, supported by high two-wheeler penetration in India, Indonesia, and Vietnam, where road safety remains a top concern. Regulatory mandates and government safety campaigns are helping accelerate adoption in these countries. Emerging markets in Latin America and Africa are witnessing a shift toward safer riding practices, while Europe and North America maintain a steady pace in adopting premium safety technologies driven by lifestyle and performance-oriented consumer segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Two-wheeler safety solutions market is projected to grow from USD 7,750 million in 2024 to USD 11,893.8 million by 2032, registering a CAGR of 5.5% during the forecast period.

- Rising incidence of road accidents and tightening regulatory frameworks globally are compelling OEMs to integrate advanced safety systems like ABS, CBS, and traction control across vehicle segments.

- High cost of premium safety components and limited affordability in entry-level two-wheelers restrain adoption in cost-sensitive markets, delaying widespread implementation.

- Rapid urbanization and increasing two-wheeler use in developing nations support mass-scale integration of safety features to protect riders in high-risk traffic environments.

- Technological innovation in AI-driven rider assistance and connected devices enhances proactive safety, enabling real-time alerts and accident prevention mechanisms.

- Asia-Pacific leads the global market with a 38% share, fueled by large-scale adoption in India, Indonesia, and Vietnam where road safety is a national priority.

- Latin America and Africa show emerging potential, while North America and Europe continue to drive high-end safety adoption through lifestyle, insurance, and premium product positioning.

Market Drivers:

Government Regulations and Mandates Enforce Widespread Adoption:

Stringent road safety regulations across major countries are compelling OEMs to integrate advanced safety technologies in two-wheelers. Authorities mandate features such as Anti-lock Braking Systems (ABS) and Combined Braking Systems (CBS) in low- and high-displacement motorcycles alike. These regulations aim to reduce road fatalities, particularly in densely populated countries with high two-wheeler usage. The Two-wheeler safety solutions market benefits from legal pressure that accelerates technology adoption across entry-level and premium segments. Governments also support safety awareness campaigns that raise consumer consciousness and encourage safer riding habits. It gains further traction from public investments in improving road infrastructure and rider education. Industry players collaborate with authorities to meet compliance and roll out safety-enhancing features in phased implementations. Regulatory timelines create a continuous demand cycle, especially in emerging economies.

- For instance, Robert Bosch GmbH announced in September 2024 the deployment of six new radar-based rider assistance systems, including five world-firsts, at EICMA 2024. Four of these innovations—front collision warning, adaptive cruise control, lane assist, and more—will debut in KTM production models by 2025. Internal data from Bosch Accident Research shows these systems have the potential to prevent one in six motorcycle accidents on German roads, a measurable improvement over previous systems that prevented one in seven accidents

Rise in Road Traffic Accidents Spurs Preventive Safety Integration:

Escalating two-wheeler accident rates have prompted manufacturers to redesign safety features with a stronger focus on rider protection. Safety statistics published by global agencies continue to highlight the vulnerability of two-wheeler users in collisions. This situation pushes OEMs to invest in technologies such as traction control systems, adaptive headlights, and blind-spot detection. The Two-wheeler safety solutions market finds momentum in the public demand for protective systems that lower injury severity. Advanced rider assistance systems (ARAS) are gradually transitioning from premium to mid-range models due to rising safety concerns. Urban commuters seek enhanced visibility and real-time alerts that prevent mishaps in traffic-heavy environments. Insurers also incentivize the use of integrated safety equipment by offering lower premiums. Consumer pressure and data-driven insights fuel rapid innovation across product portfolios.

- For instance, Continental AG’s Advanced Rider Assistance Systems (ARAS), now in global production, include 4D imaging radar enabling features like blind-spot detection and lane-change assist. The latest ARAS can provide a lane-change warning roughly 3.5 seconds before a vehicle enters the blind spot, supporting timely intervention and reducing collision likelihood. Since 2019, Continental has also offered single-channel ABS modules for 125-200cc bikes, aligning with mandatory ABS thresholds in multiple countries

Growth in Electric Two-Wheelers Drives Next-Gen Safety Features:

The global surge in electric two-wheelers creates a new avenue for embedded safety technologies. Manufacturers are designing EVs with factory-fitted safety systems that align with software-driven vehicle dynamics. It benefits from the digital flexibility of EV platforms, which support features like smartphone-enabled controls and real-time diagnostics. The Two-wheeler safety solutions market aligns closely with the EV transition, offering smarter and more customizable safety options. Integrated systems, such as regenerative braking combined with ABS, enhance control in electric scooters and motorcycles. Governments and urban planners promote electric mobility alongside safer commuting practices. Brands are marketing safety as a value proposition in the growing e-mobility landscape. The availability of safety-oriented EV models accelerates the market’s penetration in Asia-Pacific and European regions.

Increased Consumer Awareness and Premiumization of Features:

Shifting consumer behavior plays a pivotal role in the uptake of safety systems, particularly in urban and semi-urban markets. Buyers increasingly seek vehicles that offer more than basic transport, valuing protection and comfort equally. It reflects a global trend toward lifestyle mobility where product differentiation includes safety-enhancing technologies. The Two-wheeler safety solutions market benefits from rising disposable incomes and aspirational buying patterns. Premium models equipped with high-end safety gear are gaining traction, especially in Southeast Asia, Latin America, and parts of Africa. Tech-savvy youth prioritize digital integration and safety assurance while purchasing motorcycles or scooters. Rider training programs and safety-focused marketing campaigns have reshaped user expectations. The market continues to gain ground in developed and developing regions where awareness and access rise in parallel.

Market Trends:

Integration of AI-Based Rider Assistance Systems Expands:

Artificial Intelligence is transforming conventional safety frameworks into intelligent, adaptive systems. OEMs are embedding AI-enabled rider assistance into new two-wheeler models, providing real-time hazard alerts and behavioral analytics. These systems analyze traffic movement, speed, and rider posture to trigger timely interventions. The Two-wheeler safety solutions market aligns with this shift by investing in predictive safety tools that preempt accidents. It supports automated response mechanisms such as collision avoidance and emergency braking. Manufacturers emphasize AI’s role in customizing responses to varying road and rider conditions. Urban mobility solutions now include sensors and embedded analytics for enhanced rider decision-making. Demand is growing for AI-integrated dashboards that combine safety, navigation, and performance indicators. Tech startups and legacy players are collaborating on scalable AI modules for mid- and high-tier bikes.

- For instance, NXP Semiconductors’ Two-Wheeler Digital Connected Cluster (DCC) reference platform introduces an AI/ML-powered dashboard (i.MX 95 processor) for mid- to high-end bikes. These systems enable three-way Bluetooth pairing, true AI-based hazard recognition, and secure phone projection, providing advanced connectivity and behavioral analytics deployed in OEM models since 2024

Rise in Wearable and Smart Safety Accessories Supplements On-Vehicle Systems:

Smart helmets, connected gloves, and rider jackets with embedded sensors are transforming passive safety into active engagement. These wearable devices offer GPS tracking, fall detection, and SOS messaging, bridging the gap between vehicle and rider safety. It expands beyond traditional system integration, strengthening the ecosystem of the Two-wheeler safety solutions market. Consumers are adopting wearables that pair with smartphones or two-wheeler dashboards to share real-time alerts and diagnostics. Startups are innovating with lightweight, weather-resistant designs tailored to regional climates. The trend supports multi-channel product sales and encourages aftermarket upgrades among existing vehicle owners. Riders appreciate safety gear that combines comfort, technology, and protection without compromising mobility. Integration between wearables and two-wheeler platforms continues to create cross-functional innovations.

- For instance, Autoliv Inc. is set to commercialize its first motorcycle “bag-on-bike” airbag system in Q1 2025, designed to significantly reduce the risk of serious injury in frontal crashes. The airbag system includes an integrated, in-house electronic crash sensor, setting a new benchmark for rider safety through wearable and on-vehicle synergy

Increased Focus on Lightweight and Modular Safety Component Design:

Manufacturers are redesigning safety hardware to reduce bulk and integrate seamlessly into diverse two-wheeler formats. Compact sensors, miniaturized electronic control units, and flexible wiring harnesses are replacing bulky traditional parts. The Two-wheeler safety solutions market evolves through modular product engineering that allows compatibility across scooters, motorcycles, and electric models. It supports rapid assembly and easier servicing, which appeals to OEMs and maintenance providers. New safety components are being developed with weatherproofing, vibration resistance, and energy efficiency in mind. R&D teams collaborate across disciplines to maintain high safety standards without increasing vehicle weight. Modular components lower production costs while supporting scalable safety integration. This trend is especially prevalent in Asia-Pacific and Europe where smaller displacement vehicles dominate.

Growing Adoption of Cloud-Connected and Telematics-Enabled Platforms:

Cloud and telematics technologies are entering the two-wheeler safety space, enabling remote diagnostics, over-the-air updates, and fleet monitoring. Safety systems can now track usage patterns, route data, and rider behavior through cloud integration. The Two-wheeler safety solutions market leverages this shift by offering fleet solutions for commercial two-wheelers used in delivery and shared mobility. It creates opportunities for centralized safety analytics and preventive maintenance. Service providers offer subscription models that bundle cloud safety features with real-time support. Emerging markets benefit from low-cost telematics kits that upgrade existing two-wheelers with smart capabilities. These platforms support government traffic monitoring initiatives and insurance telematics programs. Companies prioritize data privacy and system security while expanding connectivity.

Market Challenges Analysis:

High Cost of Advanced Safety Technologies in Entry-Level Segments:

Cost continues to restrict the penetration of premium safety technologies into low-cost two-wheeler categories. OEMs face difficulties integrating advanced systems like traction control or adaptive cruise in models targeted at price-sensitive buyers. The Two-wheeler safety solutions market struggles to maintain balance between feature-rich offerings and affordability. It must overcome resistance in regions where basic transportation needs outweigh safety concerns. High production and R&D costs limit the rollout of cutting-edge systems across all product lines. Many manufacturers rely on phased deployments or optional add-ons, which reduces universal adoption. Government subsidies or mandates sometimes offset costs but are inconsistent across regions. Distributors face the challenge of convincing customers of safety’s long-term value. Without scale, safety system costs remain a bottleneck for market expansion.

Limited Infrastructure and Standardization in Emerging Economies:

Lack of uniform road infrastructure and varying safety norms across developing countries restrict the effectiveness of safety systems. It creates compatibility issues for manufacturers attempting to standardize technologies across markets. The Two-wheeler safety solutions market finds it difficult to scale in areas with poor road quality, unregulated traffic, and limited enforcement. OEMs must tailor systems to regional conditions, increasing development timelines and costs. Urban-rural safety gaps remain wide, and limited access to service centers hampers product support. Consumer education about safety is also lower in many high-volume markets, reducing willingness to pay for advanced features. Technical standards for safety components are not harmonized, which affects interoperability and global supply chains. These infrastructure gaps reduce the commercial feasibility of sophisticated systems in critical growth regions.

Market Opportunities:

Growing Demand for Custom Safety Systems in Premium Urban Mobility:

Urban populations are increasingly seeking two-wheelers with safety packages tailored to commuting and city navigation. It creates a strong opportunity for companies to offer modular safety systems, designed around urban-specific use cases. The Two-wheeler safety solutions market benefits from urban mobility trends where riders prefer smart, protective, and connected features. Brands can monetize this demand through tiered product offerings and software-based safety subscriptions. Startups and established players can collaborate on customizable, app-integrated solutions.

Aftermarket and Retrofit Safety Kits Open New Revenue Streams:

With millions of existing two-wheelers lacking modern safety systems, retrofitting presents a scalable opportunity. Manufacturers and third-party solution providers can design safety kits that are compatible with legacy vehicles. It helps the Two-wheeler safety solutions market expand beyond new vehicle sales and tap into the aftermarket. Partnerships with repair centers and dealers can streamline installation. These solutions can also appeal to delivery fleets and commercial users looking to upgrade safety standards affordably.

Market Segmentation Analysis:

By Technology: Safety Systems Diversify Across Use Cases

The Two-wheeler safety solutions market features a wide range of technologies addressing rider protection, control, and awareness. Anti-lock Braking Systems (ABS) lead adoption due to regulatory mandates and proven effectiveness in reducing braking-related accidents. Electronic Stability Control (ESC) and traction control systems are increasingly integrated into performance motorcycles to improve handling. Advanced Rider Assistance Systems (ARAS), including collision alerts and adaptive cruise control, are emerging in premium models. Smart helmets and connected gear are gaining momentum among urban riders for real-time navigation and communication. Crash detection and emergency alert systems enhance rider response in emergencies, while airbag vests and jackets offer impact protection. Advanced lighting solutions improve visibility in low-light conditions, and anti-theft tracking systems address rising concerns over vehicle security.

- For instance, Continental’s ARAS and Valeo’s Smart Safety 360 are expanding integration of multi-sensor ADAS (up to 12 ultrasonic sensors and radar/camera fusion). Valeo’s system, adopted for a premium European OEM in June 2025, can cover full perimeter detection, providing optimal safety for L2+ “hands-off” operation and enhancing real-time collision avoidance

By End Use: OEMs Drive Adoption, Aftermarket Gains Flexibility

OEMs dominate the market by integrating safety features at the production stage. This segment ensures regulatory compliance and system reliability, particularly in regions with safety mandates. It enables consistent delivery of core technologies like ABS and traction control. The aftermarket segment is growing steadily, fueled by rider demand for upgrades such as smart gear, lighting enhancements, and emergency systems. Affordability and retrofit compatibility make the aftermarket appealing in developing markets with large existing two-wheeler fleets.

- For instance, OEMs remain the main channel for two-wheeler safety integration. Bosch’s collaborations, such as with KTM, demonstrate phased rollouts and cross-brand adoption cycles. The aftermarket, meanwhile, is seeing robust growth for sensor-rich wearables—Murata’s positioning and inertial sensor solutions, for example, are being integrated by leading smart helmet and gear manufacturers, supporting scalable retrofit safety upgrades for millions of riders in 2025

By Vehicle: Motorcycles Dominate, Scooters Accelerate in Urban Spaces

Motorcycles hold the largest share of the market, supported by their use in intercity travel and performance-based commuting, which necessitate comprehensive safety systems. Manufacturers prioritize ARAS, stability control, and enhanced lighting for this segment. Scooters are rapidly gaining traction, driven by rising urbanization and electric vehicle growth. Compact design and city-focused use make scooters ideal platforms for smart helmets, anti-theft systems, and visibility enhancements. It supports widespread safety adoption across both personal and commercial use cases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segmentation:

By Technology:

- Advanced Rider Assistance Systems (ARAS)

- Anti-lock Braking Systems (ABS)

- Electronic Stability Control (ESC) and Traction Control Systems

- Smart Helmets and Connected Gear

- Airbag Vests/Jackets

- Crash Detection and Emergency Alert Systems

- Advanced Lighting and Visibility Solutions

- Anti-theft and Tracking Systems

By End Use:

- OEM (Original Equipment Manufacturer)

- Aftermarket

By Vehicle:

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe Maintain Technological Leadership

North America holds a 25% share in the two-wheeler safety solutions market, led by the U.S. and Canada, where regulatory compliance and consumer preference for advanced features drive consistent demand. Strong enforcement of vehicle safety standards, alongside widespread awareness of road risks, supports technology integration across both commuter and recreational segments. The market benefits from early adoption of anti-lock braking systems, traction control, and wearable safety devices. Europe accounts for 22% of the market, with key contributions from Germany, Italy, France, and the UK. High two-wheeler usage in urban mobility, combined with government mandates for ABS on new vehicles, strengthens growth. It also benefits from collaboration between OEMs and safety tech providers that deliver region-specific innovations.

Asia-Pacific Commands Dominant Volume Share through Mass Adoption

Asia-Pacific leads the two-wheeler safety solutions market with a commanding 38% share, driven by massive vehicle volumes in countries such as India, China, Indonesia, and Vietnam. Governments in this region have introduced ABS and CBS regulations for various engine capacities, pushing manufacturers to integrate essential safety features across all models. Rapid urbanization and rising accident rates have further accelerated awareness and consumer demand for protective systems. OEMs operate extensive local manufacturing hubs, which help lower costs and improve distribution of safety-enabled models. The presence of budget-conscious buyers requires tailored solutions that meet safety mandates without excessive pricing. It continues to expand due to the region’s fast-growing electric two-wheeler market, where safety technology is built into digital ecosystems.

Latin America and Middle East & Africa Offer Gradual Uptake Potential

Latin America captures 9% of the two-wheeler safety solutions market, supported by growing two-wheeler sales in Brazil, Colombia, and Argentina. The region’s gradual shift toward stricter safety regulations and urban commuting trends contributes to steady product penetration. Awareness of rider protection is improving, although pricing remains a barrier in several markets. The Middle East & Africa region holds 6% of the market, where two-wheeler usage is expanding across delivery and utility sectors in countries like Egypt, Kenya, and the UAE. It faces infrastructure limitations and inconsistent policy enforcement, which slow high-end technology adoption. Manufacturers address these gaps by introducing modular and cost-effective safety kits suitable for local conditions.

Key Player Analysis:

- Robert Bosch GmbH

- Continental AG

- ZF Friedrichshafen AG

- Denso Corporation

- Autoliv Inc.

- NXP Semiconductors

- Valeo

- Delphi Automotive

- Knorr-Bremse AG

- Hitachi Automotive Systems Ltd.

- Johnson Electric

- Murata Manufacturing Co., Ltd.

Competitive Analysis:

The Two-wheeler safety solutions market features strong competition among global OEMs, Tier-1 suppliers, and specialized technology providers. Leading companies focus on integrated systems that combine braking, traction, and sensor-based solutions to meet evolving safety norms. It attracts investments in R&D for AI-driven rider assistance, wearable tech, and smart connectivity. Key players compete through innovation, localization, and pricing strategies tailored to diverse markets. Established firms such as Bosch, Continental, and Honda lead on technology scale and regulatory alignment. Regional manufacturers emphasize affordability and compliance, targeting mass-market penetration. Strategic collaborations between vehicle makers and safety tech firms continue to define market differentiation. New entrants focus on modular and aftermarket safety kits to tap cost-conscious user segments.

Recent Developments:

- In September 2024, Robert Bosch GmbH unveiled six new radar-based rider assistance systems for motorcycles, including five world-firsts at the EICMA 2024 expo in Milan. Four of these new functions will enter production in 2025 with leading manufacturer KTM. Bosch’s advanced systems—such as adaptive cruise control, front collision warning, and lane-assist—are engineered to help prevent as many as one in six motorcycle accidents, further raising the bar for two-wheeler safety solutions worldwide.

- In July 2024, Continental AG showcased advanced ARAS (Advanced Rider Assistance Systems) for two-wheelers at the Bharat Mobility Global Expo in India. These radar-based safety systems are already in production globally and Continental is actively collaborating with top Indian OEMs to bring ARAS technology—such as adaptive cruise control and collision warning—to both ICE and EV two-wheelers within the Indian market, helping address the growing demand for enhanced rider safety.

- In May 2025, ZF Friedrichshafen AG introduced new intelligent ADAS (Advanced Driver Assistance Systems) safety solutions at the UITP Summit. While primarily focused on the bus and coach sector, ZF demonstrated technical advancements in driveline, brake, and ADAS solutions—many of which are cross-applicable to two-wheeler safety technologies—underscoring ZF’s commitment to delivering smarter and safer mobility on a global scale.

- In April 2025, Denso Corporation formed a strategic partnership with Horizon Robotics to co-develop high-performance advanced driving assistance solutions tailored to the unique road conditions of China. This collaboration aims to enhance ADAS technology—leveraging Denso’s sensor expertise and Horizon’s processing hardware—which can be extended to two-wheeler safety system development as well.

Market Concentration & Characteristics:

The Two-wheeler safety solutions market shows moderate-to-high concentration, with a mix of global giants and regional players competing in innovation, cost efficiency, and regulatory compliance. It exhibits strong vertical integration, with OEMs often collaborating closely with component manufacturers to customize safety systems. Tier-1 suppliers dominate the advanced safety segment, while smaller players serve niche or aftermarket needs. The market is technology-intensive, compliance-driven, and shaped by regional safety mandates. It continues to evolve with a blend of embedded and wearable safety innovations.

Report Coverage:

The research report offers an in-depth analysis based on technology, vehicle and end use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption of AI-powered rider assistance will expand across mid- and high-end segments.

- Smart helmets and wearables will gain traction in connected safety ecosystems.

- OEM-supplier partnerships will drive rapid innovation and cost optimization.

- ABS and CBS technologies will reach deeper penetration in entry-level vehicles.

- Regulatory enforcement will intensify safety standard implementation globally.

- Integration of V2X and telematics will reshape proactive safety applications.

- Aftermarket safety kits will grow in price-sensitive regions.

- Urban electric two-wheelers will serve as platforms for safety technology pilots.

- Insurance incentives will influence consumer preference for safer models.

- Modular safety systems will support customization across varied vehicle types.