Market Overview:

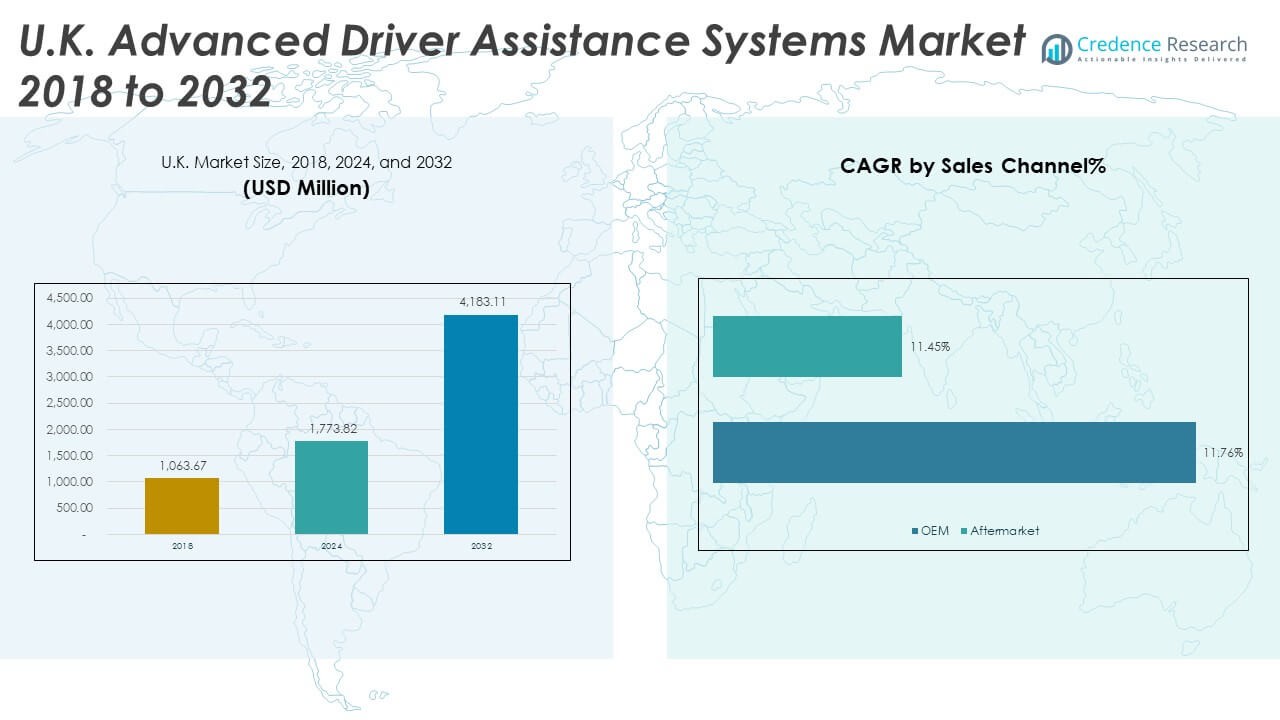

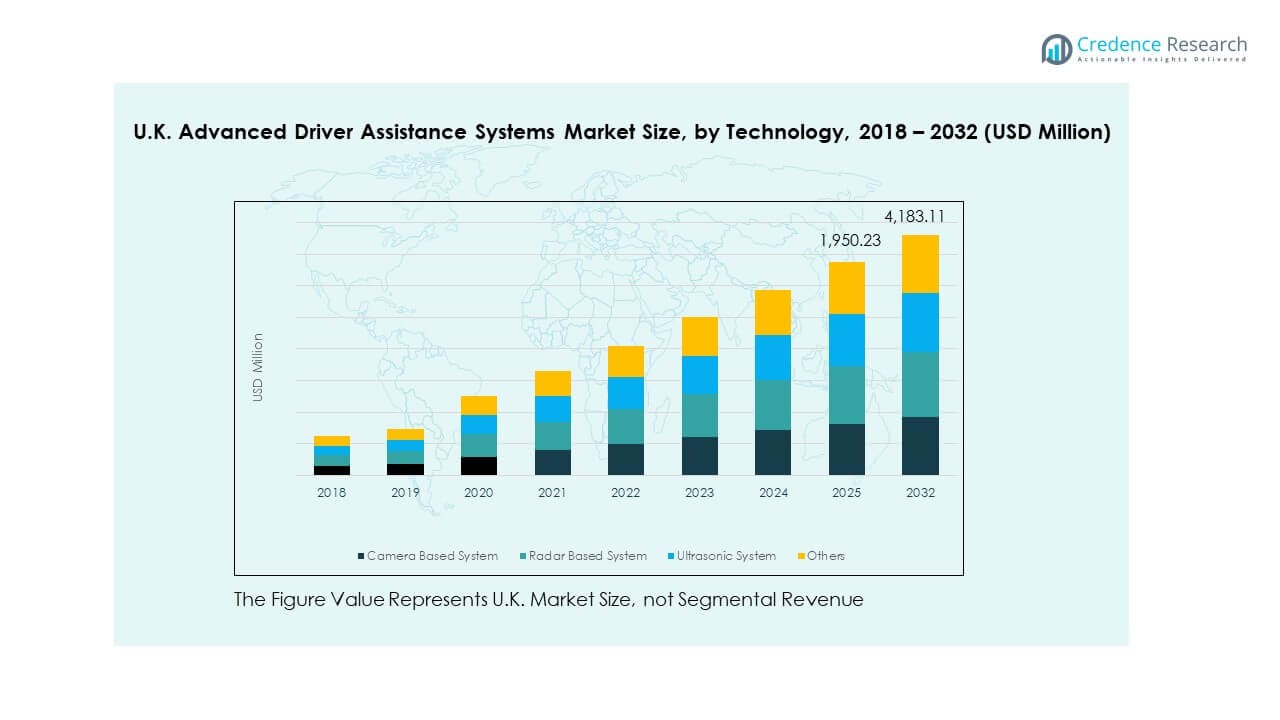

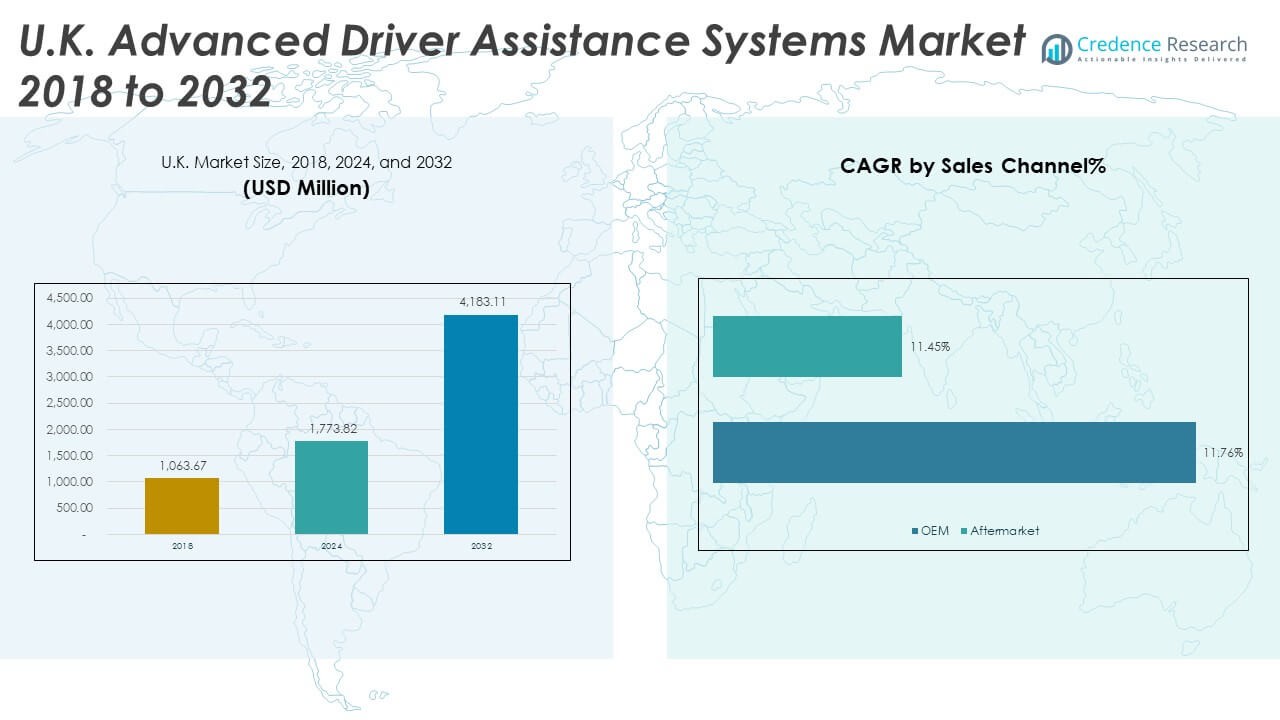

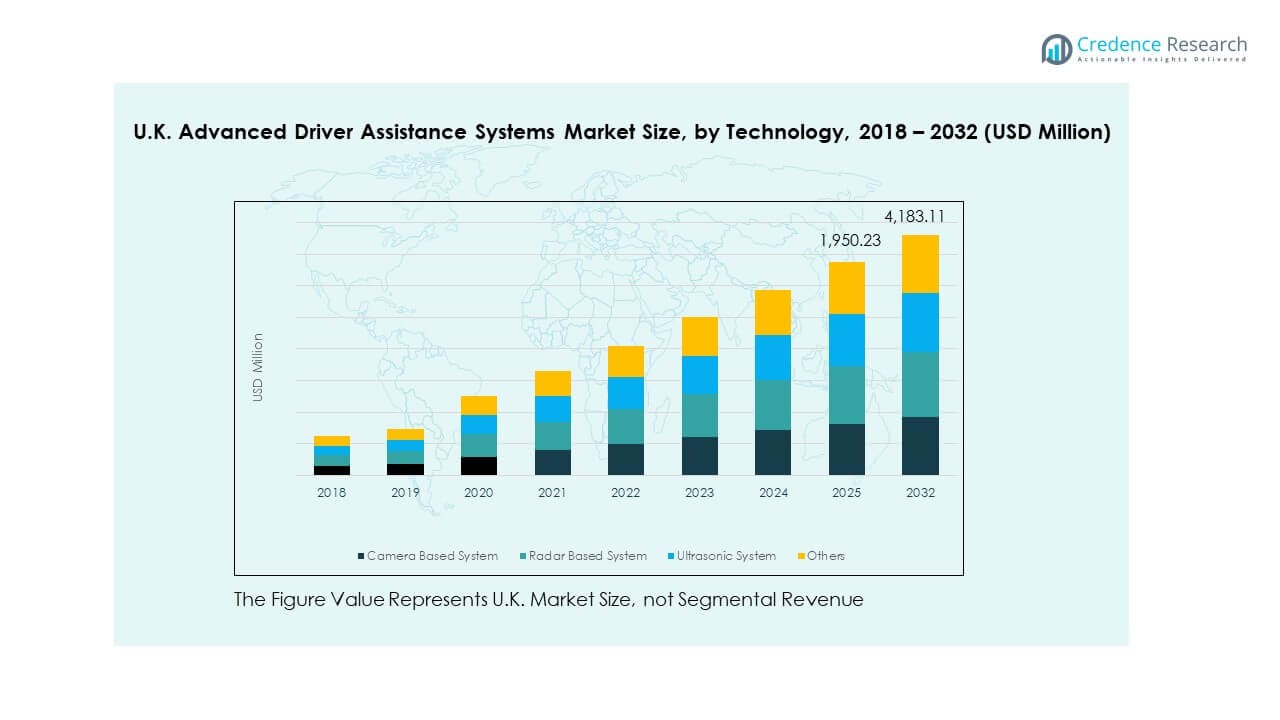

The U.K. Advanced Driver Assistance Systems Market size was valued at USD 1,063.67 million in 2018 to USD 1,773.82 million in 2024 and is anticipated to reach USD 4,183.11 million by 2032, at a CAGR of 11.32% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.K. Advanced Driver Assistance Systems Market Size 2024 |

USD 1,773.82 Million |

| U.K. Advanced Driver Assistance Systems Market, CAGR |

11.32% |

| U.K. Advanced Driver Assistance Systems Market Size 2032 |

USD 4,183.11 Million |

The market’s expansion is driven by growing regulatory pressure for vehicle safety and strong consumer demand for comfort and automation. Automakers integrate adaptive cruise control, lane departure warning, and automatic emergency braking to comply with safety standards and reduce accident rates. Rising awareness of driver assistance features enhances purchasing decisions across premium and mid-range vehicles. Technological innovation, supported by AI, LiDAR, and radar advancements, reinforces system reliability and real-time responsiveness, encouraging widespread adoption.

Regionally, England leads the market due to its developed automotive sector, research ecosystem, and high adoption of connected vehicles. Scotland is emerging as a strong growth hub through electric mobility initiatives and advanced infrastructure. Wales and Northern Ireland show increasing demand from fleet modernization and aftermarket installations. The presence of innovation-driven OEMs and technology suppliers sustains the country’s competitive edge and supports continuous ADAS deployment across commercial and passenger vehicles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.K. Advanced Driver Assistance Systems Market was valued at USD 1,063.67 million in 2018, reached USD 1,773.82 million in 2024, and is expected to hit USD 4,183.11 million by 2032, expanding at a CAGR of 11.32%.

- England leads the market with 52% share, supported by its advanced manufacturing base and strong R&D ecosystem, while Scotland follows with 21% due to EV growth, and Wales with 15% driven by smart infrastructure projects.

- Northern Ireland is the fastest-growing region, holding 12% share, driven by connected vehicle programs, government incentives, and improving transport infrastructure.

- Camera-based systems dominate with 41% share, driven by their precision in object recognition and integration in adaptive cruise and lane-keeping systems.

- Radar-based systems hold 32% share, growing with applications in collision warning and blind-spot detection, ensuring robust performance in varied driving conditions.

Market Drivers

Rising Demand for Vehicle Safety and Regulatory Compliance

The U.K. Advanced Driver Assistance Systems Market experiences strong growth due to strict vehicle safety standards. The government enforces Euro NCAP regulations requiring advanced safety technologies. Automakers respond by installing lane departure warnings, adaptive cruise control, and automatic emergency braking across vehicle categories. Consumers value enhanced protection, reduced collision risks, and lower insurance premiums. It benefits from growing public awareness of road safety and accident prevention. Advanced sensors and AI-based control systems increase vehicle reliability. These measures align with national goals to minimize traffic fatalities. Continuous innovation drives adoption across both new and existing vehicle fleets.

Technological Advancements in Sensor Fusion and AI Integration

Rapid improvement in radar, camera, and LiDAR technologies boosts system precision and response times. The market expands as automotive OEMs incorporate sensor fusion for real-time decision-making. AI algorithms enhance predictive driving assistance, improving hazard detection accuracy. It supports automation across various driving environments, including urban and highway scenarios. Tier-1 suppliers invest in adaptive hardware architectures for scalable deployment. Software updates extend ADAS functionality through remote access and cloud connectivity. Companies adopt over-the-air upgrades to maintain compliance with evolving regulations. Increasing collaboration between carmakers and tech firms accelerates product innovation and market penetration.

- For instance, Aptiv plc launched its Gen 8 Radars and PULSE Sensor platforms in 2025, integrating ultra-short-range radar and camera data to enable automakers to reduce sensor count and lower system cost by up to around 15-20%, with recognition from Frost & Sullivan for product leadership.

Government Support for Smart Mobility and Road Safety Programs

Public sector initiatives strengthen the implementation of smart transport systems and autonomous technologies. The U.K. government funds projects promoting connected and self-driving vehicles. Grants and pilot programs encourage automakers to integrate advanced driver assistance features. It gains momentum from safety campaigns advocating automated braking and pedestrian detection systems. Partnerships between automotive companies and academic institutions drive innovation. Regulatory frameworks incentivize compliance with advanced safety norms. Ongoing infrastructure upgrades complement vehicle technologies for safer mobility. These efforts establish the U.K. as a leader in automotive safety modernization.

- For instance, Oxbotica received £8.6 million in funding from Innovate UK and the Centre for Connected and Autonomous Vehicles to expand autonomous vehicle testing on public roads between Oxford and London under the DRIVEN consortium program.

Increasing Consumer Preference for Comfort and Automation

Consumer expectations for seamless driving experiences encourage ADAS adoption across all price segments. Buyers seek enhanced comfort features such as intelligent park assist and adaptive headlights. It grows with higher acceptance of semi-autonomous systems in daily commuting. Technological literacy and awareness foster interest in connected car capabilities. Automakers market ADAS features as lifestyle enhancements, not just safety tools. Premium and mid-range vehicles integrate these systems as standard packages. Rising urban congestion promotes interest in adaptive cruise and traffic jam assist functions. Comfort combined with safety strengthens ADAS integration in modern vehicle design.

Market Trends

Market Trends

Shift Toward Autonomous and Semi-Autonomous Driving Technologies

The U.K. Advanced Driver Assistance Systems Market moves toward higher automation levels. Semi-autonomous systems such as lane-centering assist and adaptive cruise control gain popularity. Automakers design vehicles capable of handling multiple driving scenarios with minimal driver input. It progresses toward Level 3 automation supported by advanced algorithms and real-time analytics. New models integrate machine learning to improve decision-making accuracy. Testing programs for self-driving vehicles strengthen public trust in automation. Fleet operators and logistics providers adopt automation to enhance efficiency. These developments pave the path toward fully autonomous mobility ecosystems.

- For instance, the Nissan Ariya featuring ProPILOT Assist 2.0 rated “Very Good” by Euro NCAP in 2024 offers hands-off driving on approved motorways with certified lane-centering and adaptive cruise functionalities under defined safety conditions.

Integration of Connected Vehicle Technologies with ADAS Platforms

Connectivity drives major transformation in ADAS performance and functionality. Vehicles now communicate with surrounding infrastructure, other cars, and cloud systems. The U.K. Advanced Driver Assistance Systems Market benefits from V2X communication adoption. It enables quicker reaction to hazards, improved route planning, and enhanced driver awareness. Software-defined vehicles rely on cloud-based diagnostics and analytics for safety insights. Data sharing across networks creates real-time safety alerts. Automakers collaborate with telecom providers to deploy 5G-enabled systems. Integration of connectivity and automation enhances both vehicle intelligence and operational efficiency.

Growing Demand for Electric Vehicles with Built-In ADAS Capabilities

Electric vehicle manufacturers include advanced driver assistance systems as standard to enhance safety and performance. The U.K. Advanced Driver Assistance Systems Market expands alongside EV growth. Integrated sensors and digital control systems optimize both energy use and driver safety. It benefits from EV-specific ADAS that support regenerative braking and torque control. EV platforms allow better placement of cameras and radars for improved visibility. Automakers develop modular designs compatible with future upgrades. Charging infrastructure development supports ADAS testing under varied conditions. EV innovation aligns with environmental goals and automated driving readiness.

- For instance, the Polestar 3 earned a five-star Euro NCAP safety rating in 2024, achieving a 93% Child Occupant Protection score and 87% overall. Advanced ADAS features such as automated emergency braking were key contributors.

Emergence of Predictive Maintenance and Data Analytics in ADAS

Predictive analytics reshapes how vehicles manage maintenance and performance. ADAS systems now analyze data from sensors to forecast potential failures. The U.K. Advanced Driver Assistance Systems Market evolves through data-driven improvements in reliability. It supports proactive maintenance strategies that lower operational costs. Fleet operators use analytics to optimize uptime and vehicle safety. OEMs introduce subscription models for software-based safety enhancements. Cloud platforms host performance records for regulatory and insurance purposes. Data utilization enhances transparency, compliance, and customer satisfaction in the evolving automotive ecosystem.

Market Challenges Analysis

Market Challenges Analysis

High Cost of Implementation and Integration Complexity

The U.K. Advanced Driver Assistance Systems Market faces cost barriers in production and adoption. Advanced sensors, cameras, and processors increase vehicle prices significantly. OEMs struggle to balance affordability with innovation across mid-range models. It faces integration challenges due to compatibility between legacy vehicle systems and new technologies. Smaller manufacturers encounter limitations in scaling ADAS solutions. The complexity of software calibration and validation extends product development cycles. Limited economies of scale in domestic production raise costs further. Cost-sensitive consumers may delay adoption until affordable options become available.

Cybersecurity, Liability, and Infrastructure Readiness Concerns

The rising interconnectivity of vehicles introduces significant data protection challenges. The U.K. Advanced Driver Assistance Systems Market contends with cyber threats targeting control systems and cloud communication. It faces concerns about driver accountability in automated incidents. Legal frameworks struggle to assign liability during ADAS malfunctions. Limited public infrastructure for connected vehicles slows full-scale adoption. Data privacy laws require strict compliance in storage and transmission. Technical vulnerabilities in software updates heighten risks of system breaches. Continuous improvement in cybersecurity protocols remains critical for long-term market growth.

Market Opportunities

Development of Smart Road Infrastructure and Autonomous Ecosystems

Government investment in smart cities and connected infrastructure supports ADAS expansion. The U.K. Advanced Driver Assistance Systems Market benefits from cooperative mobility initiatives and digital road mapping. It leverages sensor-embedded highways that improve vehicle response accuracy. Partnerships between public agencies and automotive firms accelerate testing of next-gen systems. Integration of roadside units enhances communication between vehicles and control centers. Startups specializing in data analytics and mapping technologies gain traction. These advancements create favorable conditions for autonomous transport expansion nationwide.

Growing Aftermarket Demand for Retrofitted Assistance Systems

The increasing need for safety upgrades in older vehicles fuels aftermarket demand. The U.K. Advanced Driver Assistance Systems Market gains from retrofitting solutions for fleet operators and private users. It supports installation of blind spot detection and parking assist systems in existing models. Small and medium-sized suppliers expand product availability through modular sensor kits. Workshops and garages adopt diagnostic tools to handle system calibration. Insurance discounts for safety-equipped vehicles stimulate aftermarket interest. Expansion of affordable retrofit options opens new revenue streams for suppliers and service providers.

Market Segmentation Analysis

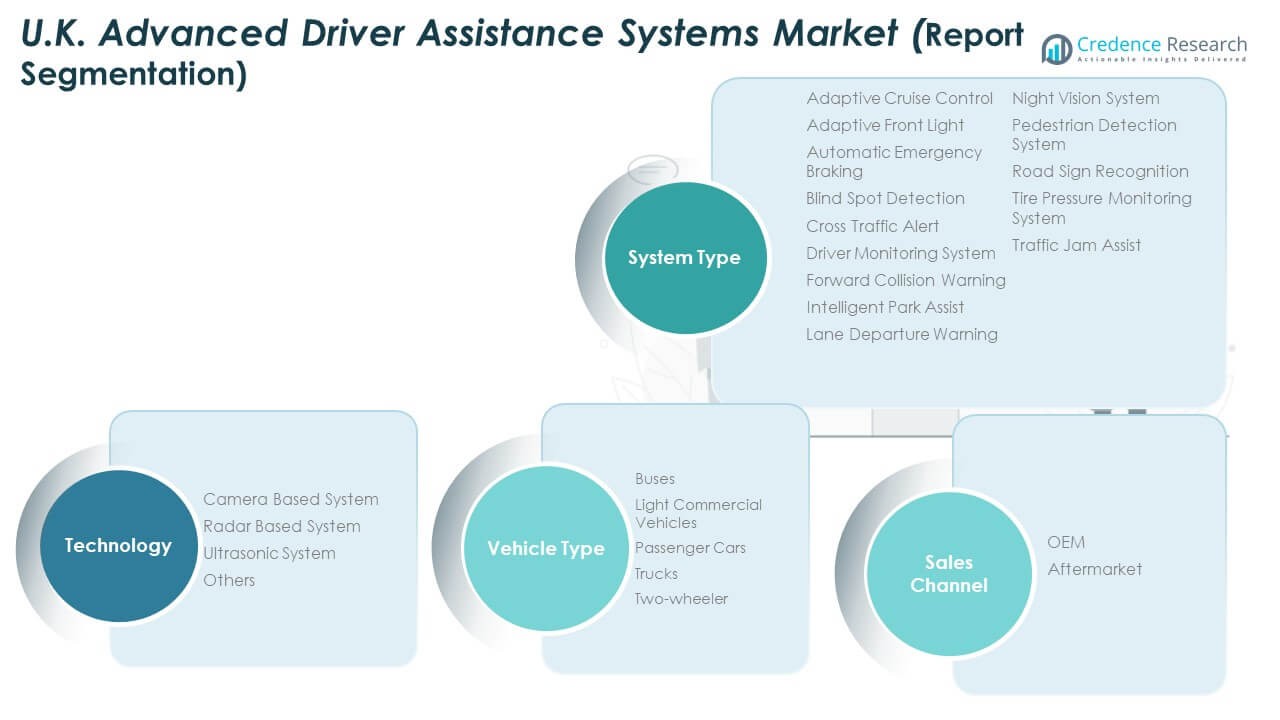

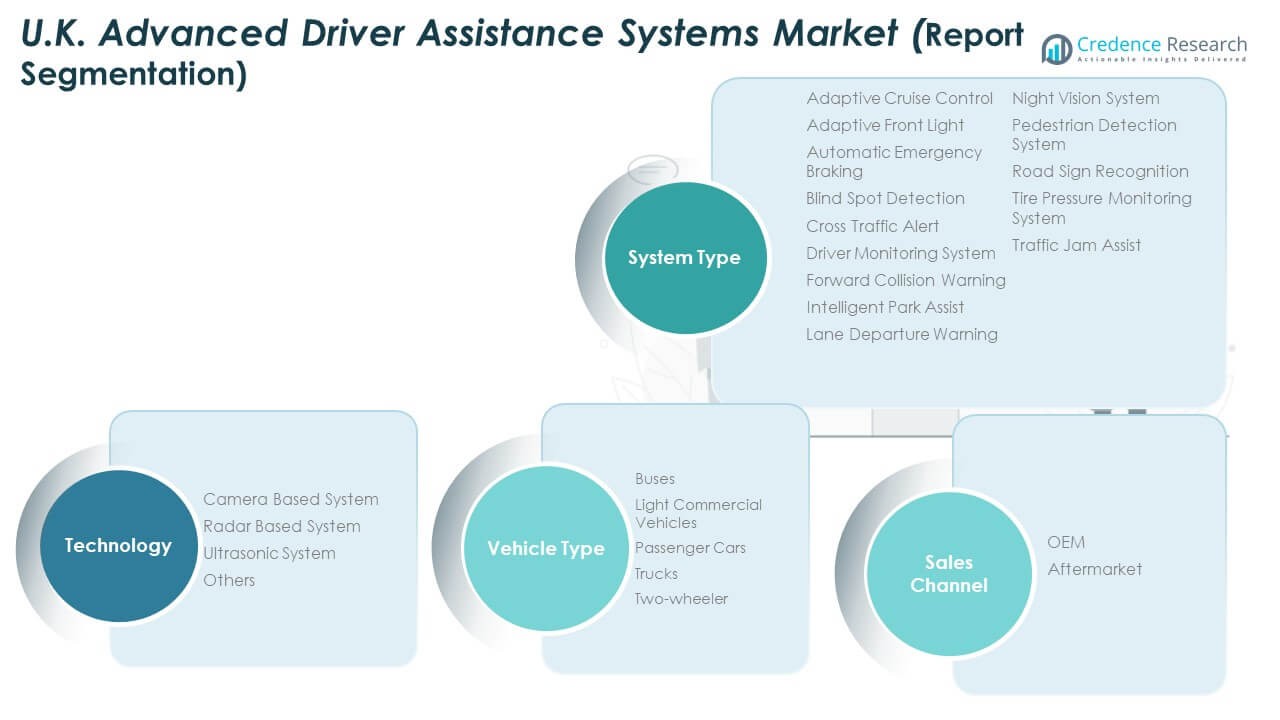

By System Type

The U.K. Advanced Driver Assistance Systems Market includes technologies that enhance driver awareness and vehicle control. Adaptive cruise control dominates due to its role in maintaining safe distances automatically. Automatic emergency braking and lane departure warning systems follow with widespread OEM adoption. It benefits from increasing installations of blind spot detection and cross-traffic alerts for urban safety. Driver monitoring systems support fatigue prevention, while road sign recognition aids compliance. Night vision and pedestrian detection technologies enhance safety during poor visibility. Tire pressure monitoring and traffic jam assist gain traction in premium vehicles.

- For instance, the 2023 BMW 5 Series features adaptive cruise control with stop-and-go capability operating up to 130 km/h and achieved a 95% adult occupant protection score in Euro NCAP testing. Similarly, the Audi Q7 includes automatic emergency braking with pedestrian detection effective at speeds up to 60 km/h.

By Technology

Camera-based systems lead due to their high precision in image processing and object recognition. Radar-based systems maintain demand for adaptive cruise control and blind spot detection. The U.K. Advanced Driver Assistance Systems Market embraces sensor fusion combining radar, camera, and ultrasonic data. It supports real-time obstacle detection and automatic response under complex conditions. Ultrasonic systems are favored in parking assistance and low-speed maneuvers. Emerging technologies integrate LiDAR for enhanced perception in autonomous scenarios. Software optimization continues to refine decision-making speed. Multimodal sensing improves both system redundancy and safety performance.

By Vehicle Type

Passenger cars dominate due to widespread ADAS integration in both luxury and mass-market models. Light commercial vehicles gain share through fleet automation initiatives. The U.K. Advanced Driver Assistance Systems Market also sees growth in heavy trucks adopting lane assist and collision avoidance. It supports bus operators using driver monitoring and pedestrian alert systems for urban transport safety. Two-wheelers begin adopting simpler assistance features like tire pressure monitoring. Government policies encouraging safer logistics accelerate adoption among commercial users. Technological adaptability enables deployment across diverse vehicle categories.

By Sales Channel

OEMs hold the largest share through factory-installed systems in new vehicles. Automakers focus on offering ADAS features as standard to meet safety ratings. The U.K. Advanced Driver Assistance Systems Market witnesses rising aftermarket participation. It enables retrofitting options for older or budget-friendly models. Independent service providers supply calibration, diagnostics, and upgrade solutions. It strengthens customer access to safety innovations beyond premium vehicle segments. Collaboration between OEMs and aftermarket players enhances overall coverage. Growing consumer awareness sustains demand across both original and replacement channels.

- For instance, Mercedes-Benz made adaptive cruise control, lane assist, and automatic emergency braking standard across its 2024 C-Class lineup in the U.K., with Thatcham Research continuing to certify service centers nationwide for ADAS calibration.

Segmentation

By System Type

- Adaptive Cruise Control

- Adaptive Front Light

- Automatic Emergency Braking

- Blind Spot Detection

- Cross Traffic Alert

- Driver Monitoring System

- Forward Collision Warning

- Intelligent Park Assist

- Lane Departure Warning

- Night Vision System

- Pedestrian Detection System

- Road Sign Recognition

- Tire Pressure Monitoring System

- Traffic Jam Assist

By Technology

- Camera-Based System

- Radar-Based System

- Ultrasonic System

- Others

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Trucks

- Buses

- Two-Wheeler

By Sales Channel

- OEM (Original Equipment Manufacturer)

- Aftermarket

Regional Analysis

England: Established Manufacturing Base and Technological Dominance (Share: 52%)

England holds the largest share of the U.K. Advanced Driver Assistance Systems Market, driven by its strong automotive production network and research infrastructure. Major car manufacturers and Tier-1 suppliers maintain R&D centers across the Midlands and Southeast regions. It benefits from advanced testing facilities and partnerships between automakers, universities, and technology developers. Government-backed programs supporting connected and autonomous vehicles accelerate system integration. The region’s mature supply chain and high adoption rate of premium vehicles reinforce demand for adaptive cruise control, lane assist, and emergency braking technologies. England continues to lead in innovation, regulatory compliance, and large-scale deployment of smart mobility solutions.

Scotland: Expanding Adoption Through Sustainable Mobility and Electric Vehicles (Share: 21%)

Scotland experiences rapid growth in ADAS adoption due to rising electric vehicle penetration and sustainability initiatives. The government’s focus on zero-emission transportation drives strong investments in advanced safety systems. The U.K. Advanced Driver Assistance Systems Market in Scotland gains momentum through pilot projects in smart transport corridors and city-based automation trials. It benefits from renewable energy infrastructure that supports intelligent mobility ecosystems. Local authorities encourage fleet modernization across logistics and public transport sectors. Collaboration with universities and technology firms enhances research in radar and camera-based assistance systems. The shift toward clean mobility positions Scotland as a key emerging subregion.

Wales and Northern Ireland: Infrastructure Development and Growing Aftermarket Demand (Share: 27%)

Wales and Northern Ireland collectively contribute nearly one-fourth of the market share, supported by gradual infrastructure modernization and aftermarket expansion. Wales invests in smart road projects and urban connectivity programs that favor ADAS installations. Northern Ireland benefits from cross-border trade and regulatory alignment with European safety standards. The U.K. Advanced Driver Assistance Systems Market witnesses increasing retrofitting demand from fleet operators and logistics companies in these regions. It expands through rising partnerships between local workshops and technology distributors. Both subregions improve vehicle safety compliance through government-backed training and awareness programs. Their growth reflects a balanced mix of public initiatives and private investment in intelligent vehicle systems.

Key Player Analysis

- Altera Corporation

- Robert Bosch GmbH

- Continental AG

- DENSO Corporation

- JLR Corporate

- ZF Friedrichshafen AG

- Aptiv PLC

- Valeo SA

- Mobileye

- Magna International

- Renault UK

- Other Key Players

Competitive Analysis

The U.K. Advanced Driver Assistance Systems Market features strong competition among global and domestic manufacturers focusing on innovation and reliability. Leading players such as Bosch, Continental AG, Aptiv, ZF Friedrichshafen, and Valeo dominate through strategic partnerships with automakers and software firms. It emphasizes development of scalable, sensor-based solutions integrating radar, camera, and LiDAR technologies. Companies strengthen portfolios with AI-driven decision-making systems and predictive analytics to enhance performance. Continuous investment in R&D and manufacturing facilities supports early compliance with safety regulations. Emerging firms specializing in V2X communication, driver monitoring, and sensor calibration expand niche opportunities. Competitive strategies include mergers, pilot testing, and regional collaborations for connected vehicle ecosystems. Increasing demand for semi-autonomous and electric vehicles sustains the market’s momentum and intensifies rivalry among established and upcoming players.

Recent Developments

- In October 2025, Magna ramped up deployment of its driver and occupant monitoring systems (DMS) in China and Europe, partnering with new OEMs and expanding volume deployment in the European market.

- In October 2025, Aptiv PLC launched its latest advanced radar technology aimed at significantly boosting vehicle safety, detection, and automation within driver-assistance systems; this innovation supports next-gen ADAS requirements for European manufacturers.

- In September 2025, Bosch announced the integration of NVIDIA DRIVE AGX Thor into its ADAS compute platform, enhancing OEM implementation flexibility and performance. Bosch also expanded its collaboration with Horizon Robotics, unveiling new multipurpose cameras based on Horizon’s Journey 6B and securing design wins from multiple OEMs for its ADAS product family.

- In March 2025, Magna and NVIDIA announced a new collaboration to deliver AI-powered solutions for next-gen vehicle intelligence and autonomy, solidifying Magna’s market leadership in advanced ADAS technologies.

- In December 2024, DENSO and onsemi reinforced their decade-long partnership by announcing plans for further collaboration and procurement of advanced ADAS and autonomous driving technologies. DENSO also declared its intent to acquire onsemi shares, deepening their supply chain integration for continuous innovation in safety and vehicle intelligence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on System Type, Technology, Vehicle Type and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The U.K. Advanced Driver Assistance Systems Market will expand rapidly with rising vehicle automation and safety mandates.

- Integration of AI-driven control systems will improve decision-making precision across all vehicle categories.

- Automakers will focus on compact sensor modules and modular ADAS architectures to reduce manufacturing costs.

- Demand for semi-autonomous driving functions will grow due to rising consumer preference for comfort and convenience.

- Electric and hybrid vehicles will increasingly feature ADAS as a standard component to enhance operational safety.

- Government investments in connected infrastructure and smart mobility projects will strengthen adoption nationwide.

- Aftermarket opportunities will widen as fleet operators retrofit safety features into older vehicles.

- Collaboration between automakers and technology firms will drive innovation in radar, camera, and LiDAR fusion systems.

- Software upgrades and cloud-based analytics will become key differentiators for long-term customer engagement.

- Growing focus on driver well-being, predictive maintenance, and data transparency will redefine future mobility strategies.

Market Trends

Market Trends Market Challenges Analysis

Market Challenges Analysis