| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Autonomous Off-Road Vehicles And Machinery Market Size 2023 |

USD 963.67 Million |

| UK Autonomous Off-Road Vehicles And Machinery Market, CAGR |

12.71% |

| UK Autonomous Off-Road Vehicles And Machinery Market Size 2032 |

USD 2,829.33 Million |

Market Overview:

UK Autonomous Off-Road Vehicles And Machinery Market size was valued at USD 963.67 million in 2023 and is anticipated to reach USD 2,829.33 million by 2032, at a CAGR of 12.71% during the forecast period (2023-2032).

Several factors are accelerating the adoption of autonomous off-road vehicles and machinery in the UK. Technological advancements in artificial intelligence, machine learning, and sensor technologies have made autonomous systems more reliable and efficient, capable of performing complex tasks in off-road environments. Additionally, the UK’s strong emphasis on sustainability and environmental stewardship is driving the adoption of autonomous machinery that can optimize resource use, reduce waste, and lower emissions. The growing need to address labor shortages in industries like agriculture and construction further fuels the demand for autonomous systems that can operate in challenging environments without human intervention. Moreover, the cost-saving potential of autonomous vehicles, through reduced operational expenses and increased productivity, is making them a viable option for UK businesses.

The UK is emerging as a key player in the European autonomous off-road vehicle market. The country benefits from a robust industrial base and a supportive policy environment aimed at fostering technological innovation and adoption. The UK government has been proactive in developing regulatory frameworks that encourage the safe deployment of autonomous vehicles, including the Automated Vehicles Act 2024, which aims to facilitate the use of autonomous transport across multiple sectors. Furthermore, the growing focus on environmental sustainability in the UK aligns with the benefits of autonomous machinery, such as lower emissions and more efficient resource utilization. As autonomous technology continues to mature, the UK is set to leverage its strong infrastructure and regulatory support to drive widespread adoption across key sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK autonomous off-road vehicles and machinery market was valued at USD 963.67 million in 2023 and is expected to reach USD 2,829.33 million by 2032, growing at a CAGR of 12.71% during the forecast period.

- Global Autonomous Off-road Vehicles and Machinery size was valued at USD 23,300.00 million in 2023 and is anticipated to reach USD 68,887.09 million by 2032, at a CAGR of 12.80% during the forecast period (2023-2032).

- Technological advancements in AI, machine learning, and sensor technologies have significantly enhanced the reliability and efficiency of autonomous systems in off-road environments.

- Sustainability and environmental concerns are driving the adoption of autonomous machinery, with a focus on reducing emissions, optimizing resource use, and improving operational efficiency in sectors like agriculture and construction.

- The need to address labor shortages in key industries like agriculture and construction is pushing the demand for autonomous systems that can operate autonomously in challenging environments.

- Government initiatives, such as the Automated Vehicles Act 2024, are creating a supportive regulatory framework that facilitates the safe deployment and integration of autonomous off-road vehicles.

- High initial investment costs remain a significant barrier to adoption, especially for SMEs in agriculture and construction, despite the long-term cost savings and efficiency improvements these systems offer.

- The UK market is regionally segmented, with Southern England leading the market share due to its strong industrial base, followed by the Midlands, Northern England, and the growing demand in Scotland and Wales.

Market Drivers:

Technological Advancements in Automation

The adoption of autonomous off-road vehicles in the UK is primarily driven by advancements in automation technologies. Significant developments in artificial intelligence (AI), machine learning, and sensor technologies have dramatically enhanced the capabilities of autonomous systems. For example, in May 2024, UK-based AI firm Wayve secured a $1.05 billion investment from major technology companies, including Microsoft, to develop the next generation of AI-driven autonomous vehicles. Wayve’s focus is on embodied AI, which enables vehicles to learn from real-world interactions and navigate complex, unpredictable scenarios far beyond the capabilities of conventional automation. These technologies enable off-road vehicles to navigate complex terrains with precision, making them more reliable and efficient in demanding environments such as construction sites, agricultural fields, and mining operations. The continuous improvement of AI algorithms allows these vehicles to make real-time decisions, enhancing their ability to operate safely and autonomously in unpredictable conditions. As these technologies evolve, autonomous off-road vehicles are becoming increasingly adept at performing tasks traditionally reliant on human operators, further accelerating their adoption across various industries.

Sustainability and Environmental Impact

Sustainability has become a critical driver for the adoption of autonomous off-road vehicles in the UK. The government’s commitment to reducing carbon emissions and promoting eco-friendly practices is pushing industries to adopt solutions that enhance resource efficiency and minimize environmental impact. Autonomous systems, which can optimize fuel consumption and reduce waste, are seen as vital tools for achieving sustainability goals. In sectors like agriculture and construction, these vehicles can operate more efficiently, reduce soil erosion, and minimize the need for chemical inputs by precisely executing tasks such as planting, harvesting, or material transport. As environmental regulations tighten, autonomous off-road vehicles will play an increasingly important role in helping companies comply with sustainability standards, making them a preferred solution for forward-thinking businesses in the UK.

Labor Shortages and Operational Efficiency

Another significant driver behind the growth of autonomous off-road vehicles in the UK is the need to address labor shortages in key industries. In sectors like agriculture, mining, and construction, finding skilled labor has become increasingly challenging. Autonomous off-road vehicles provide an effective solution to this problem by reducing reliance on human operators, particularly for repetitive, physically demanding tasks. These vehicles can work around the clock, without the need for breaks or downtime, improving productivity and efficiency. Furthermore, autonomous vehicles can operate in hazardous environments where human workers would face safety risks, such as high temperatures, rough terrain, or exposure to harmful substances. This reduction in human labor requirements, coupled with the ability to maintain consistent productivity, makes autonomous systems an attractive alternative to traditional methods.

Government Support and Regulatory Frameworks

The UK’s regulatory environment plays a crucial role in driving the growth of autonomous off-road vehicles. The UK government has demonstrated a strong commitment to supporting the development and deployment of autonomous technologies through various policies and initiatives. For instance, the government has also committed over £150 million in funding for Connected and Automated Mobility (CAM) technologies through 2030, and £22.4 million was recently allocated to 22 R&D projects focused on off-road autonomy, involving companies such as Jaguar Land Rover and Caterpilla. The introduction of the Automated Vehicles Act 2024 provides a clear legal framework for the safe operation of autonomous vehicles, ensuring that businesses can adopt these technologies with confidence. Additionally, government funding and incentives are encouraging research and development in autonomous vehicle technologies, helping to lower the cost of adoption for businesses. As these regulatory frameworks evolve, they will continue to foster innovation and ensure that autonomous systems can be integrated seamlessly into the existing infrastructure, further accelerating their market adoption across the UK.

Market Trends:

Integration of AI and Machine Learning for Enhanced Decision-Making

A key trend in the UK autonomous off-road vehicle market is the increasing integration of artificial intelligence (AI) and machine learning technologies. These innovations are enabling autonomous vehicles to perform more sophisticated tasks, such as real-time obstacle detection, decision-making in unpredictable environments, and adaptive route planning. By leveraging AI, these vehicles can process large amounts of data from sensors, cameras, and LiDAR systems, enhancing their ability to navigate complex terrains with precision. This trend is particularly evident in sectors like agriculture, where precision farming techniques are being adopted to optimize crop yields and reduce resource consumption. AI and machine learning are transforming autonomous off-road vehicles into highly adaptable and intelligent systems capable of operating in diverse and challenging environments.

Collaboration Between Manufacturers and Technology Providers

Another emerging trend is the growing collaboration between autonomous off-road vehicle manufacturers and technology providers. Traditional vehicle manufacturers are partnering with tech firms specializing in automation, sensor technology, and data analytics to develop integrated solutions for off-road applications. For instance, the ServCity consortium, led by Nissan in partnership with Connected Places Catapult and Hitachi European R&D, focused on integrating advanced autonomous drive technology into the 100% electric Nissan LEAF. These collaborations are helping to accelerate the development of more reliable, cost-effective, and efficient autonomous vehicles. For example, sensor technology companies are playing a pivotal role in enhancing the precision and reliability of autonomous systems, enabling them to function safely in complex environments. Such partnerships are essential for scaling up the deployment of autonomous machinery across multiple industries, particularly where specialized technologies are needed for tasks like construction, mining, and agriculture.

Increased Adoption of Remote Monitoring and Fleet Management Systems

The trend towards the adoption of remote monitoring and fleet management systems is gaining momentum in the UK’s autonomous off-road vehicle sector. With the growing complexity of operations, businesses are increasingly relying on cloud-based platforms to monitor the performance of autonomous vehicles in real-time. These systems provide operators with valuable insights into vehicle health, performance, and efficiency, allowing for proactive maintenance and minimizing downtime. For instance, companies like Microlise provide integrated vehicle telematics systems that offer real-time tracking, driver performance management, and proactive maintenance alerts, allowing operators to optimize fleet utilization and minimize downtime. Furthermore, remote monitoring enables fleet managers to optimize vehicle deployment, track vehicle movements, and ensure safety compliance. This trend is particularly important for industries that require 24/7 operation, such as mining and large-scale construction projects, where the efficient management of autonomous vehicle fleets can significantly improve productivity.

Shift Toward Electrification and Sustainability

As environmental concerns continue to rise, there is a noticeable shift towards the electrification of autonomous off-road vehicles in the UK. Many manufacturers are developing electric autonomous machinery to meet both sustainability goals and regulatory requirements for reducing emissions. Electric vehicles (EVs) are increasingly seen as an ideal solution for off-road applications because they offer lower operational costs and reduced environmental impact compared to traditional diesel-powered machinery. The shift to electric autonomous vehicles is also being driven by advancements in battery technology, which have led to longer-lasting, faster-charging power sources capable of supporting demanding off-road operations. This trend is poised to reshape the market, particularly in industries such as agriculture and construction, where sustainability is becoming an increasingly important focus.

Market Challenges Analysis:

High Initial Investment Costs

One of the primary challenges facing the adoption of autonomous off-road vehicles in the UK is the high initial investment required for these advanced systems. The integration of cutting-edge technologies such as artificial intelligence, machine learning, and specialized sensors drives up the cost of autonomous vehicles. Additionally, the need for supporting infrastructure, including charging stations for electric vehicles and advanced fleet management systems, further contributes to the overall investment. While these vehicles offer long-term cost savings through increased efficiency and reduced labor costs, the upfront capital expenditure remains a significant barrier for many small and medium-sized enterprises (SMEs) operating in industries like agriculture and construction. This financial challenge often slows the rate of adoption, especially for businesses with limited resources.

Regulatory and Safety Concerns

Another significant restraint is the regulatory uncertainty surrounding autonomous vehicles in the UK. While the government has made strides in creating a legal framework for autonomous systems, there are still concerns regarding safety standards and liability in the event of accidents or system malfunctions. For instance, the UK’s Automated Vehicles Act establishes a set of national safety principles that require automated vehicles to operate at least as safely as a careful and competent human driver. The UK is in the early stages of developing regulations that can keep pace with rapid technological advancements, and this regulatory ambiguity can create hesitancy among potential adopters. Businesses are concerned about the potential for stringent regulations that could increase compliance costs or delay the deployment of autonomous systems. Moreover, establishing consistent safety protocols for autonomous machinery in off-road environments remains a challenge, as these vehicles often operate in unpredictable, hazardous conditions.

Technological Limitations

Despite significant progress, technological limitations continue to be a challenge for the widespread deployment of autonomous off-road vehicles. The complexity of off-road environments, characterized by uneven terrain, unpredictable weather, and limited infrastructure, presents significant hurdles for autonomous systems. While advancements in AI and sensor technologies have improved the reliability of these vehicles, there are still concerns about their ability to operate seamlessly in all conditions. Issues such as limited sensor range, poor connectivity in remote locations, and difficulties in handling extreme weather conditions can hamper the performance of autonomous off-road vehicles, limiting their adoption in certain sectors.

Market Opportunities:

The UK autonomous off-road vehicle market presents significant opportunities driven by the increasing demand for automation across industries like agriculture, construction, and mining. As businesses face labor shortages and rising operational costs, autonomous off-road vehicles offer a cost-effective solution by improving productivity and reducing the reliance on manual labor. The integration of artificial intelligence, machine learning, and sensor technologies in these vehicles enables them to perform complex tasks autonomously, enhancing operational efficiency in challenging environments. Moreover, the growing focus on sustainability presents an opportunity for electric autonomous off-road vehicles, which can reduce emissions and align with the UK’s stringent environmental goals. Companies that adopt these technologies can gain a competitive edge by optimizing their operations and contributing to sustainability efforts.

The UK government’s commitment to supporting innovation and technological advancements also creates a favorable environment for the expansion of the autonomous off-road vehicle market. The introduction of regulations such as the Automated Vehicles Act 2024 aims to provide a clear legal framework for the deployment of autonomous systems, ensuring safety and boosting investor confidence. Additionally, government incentives and funding for research and development in autonomous technologies provide an opportunity for businesses to reduce the financial burden of adopting these advanced solutions. As the market matures, the collaboration between autonomous vehicle manufacturers and technology providers will further drive innovation, creating opportunities for the development of more advanced, cost-efficient, and versatile autonomous off-road systems.

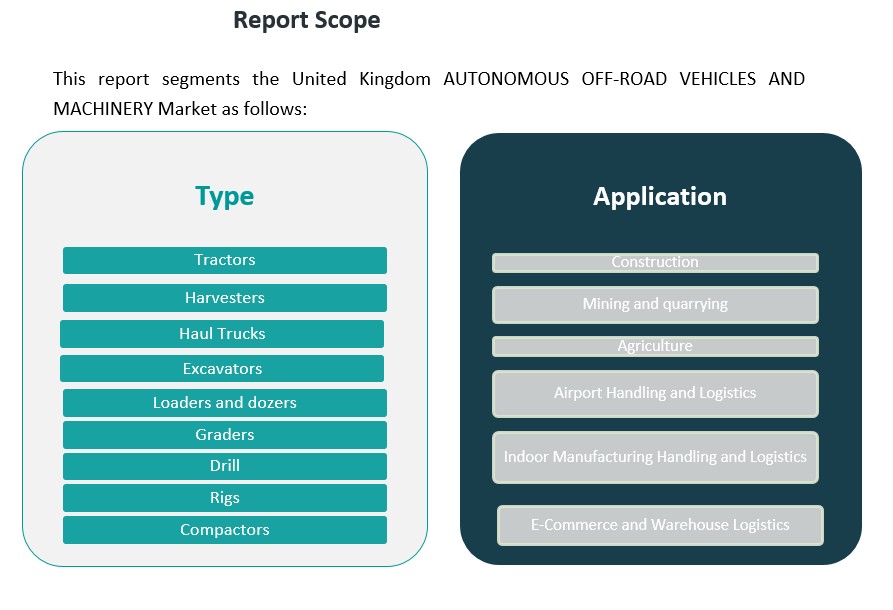

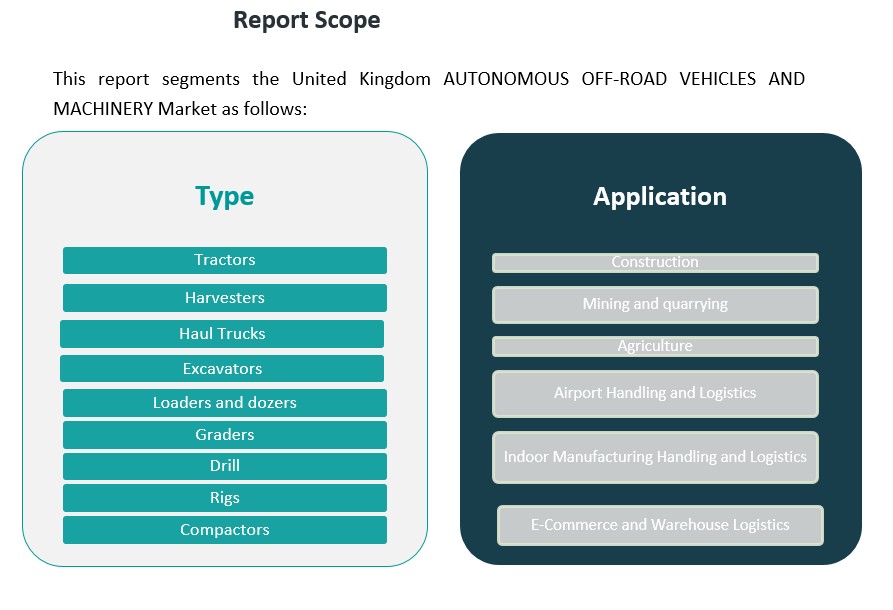

Market Segmentation Analysis:

By Type Segment

Tractors in agriculture enhance efficiency by automating tasks like plowing and harvesting, reducing labor costs. Harvesters are also widely used in farming to optimize grain harvesting, improving productivity. Haul Trucks in mining and construction automate material transport, increasing safety and reducing costs. Excavators automate digging, lifting, and material handling in construction, improving precision. Loaders and Dozers handle grading and earthmoving in construction, with autonomous versions increasing efficiency. Graders improve surface leveling and grading in road construction. Drills in mining automate material extraction, enhancing safety. Rigs in oil and gas increase precision in drilling while minimizing human intervention. Compactors in construction automate soil and material compaction, improving efficiency.

By Application Segment

In Construction, autonomous machines like excavators and haul trucks improve efficiency by automating digging, transport, and grading tasks. Mining and Quarrying adopt autonomous vehicles for excavation and transport, enhancing safety and productivity. Agriculture benefits from autonomous tractors, harvesters, and drones that optimize farming practices and reduce labor costs. Airport Handling and Logistics sees autonomous systems for baggage and cargo handling, improving operational speed. In Indoor Manufacturing Handling and Logistics, autonomous robots and forklifts automate material transport in factories and warehouses. E-Commerce and Warehouse Logistics leverages autonomous robots and forklifts to streamline inventory management and order fulfillment. These applications significantly improve operational efficiency and safety across industries.

Segmentation:

By Type Segment:

- Tractors

- Harvesters

- Haul Trucks

- Excavators

- Loaders and Dozers

- Graders

- Drill

- Rigs

- Compactors

By Application Segment:

- Construction

- Mining and Quarrying

- Agriculture

- Airport Handling and Logistics

- Indoor Manufacturing Handling and Logistics

- E-Commerce and Warehouse Logistics

Regional Analysis:

The UK autonomous off-road vehicles and machinery market is experiencing significant growth, driven by technological advancements, government initiatives, and increasing demand for automation across various industries. The market can be segmented regionally to understand the dynamics in key areas of the UK.

Southern England

Southern England holds the largest market share in the UK autonomous off-road vehicles and machinery market, accounting for approximately 40% of the total market. This region benefits from a strong industrial base, particularly in agriculture, construction, and logistics, where autonomous systems are increasingly being adopted to improve productivity and safety. The presence of major infrastructure projects and high-tech companies in cities like London and Bristol further boosts the region’s dominance. The government’s focus on smart cities and innovation hubs in the south has contributed to the accelerated adoption of autonomous solutions.

Midlands

The Midlands region follows closely, contributing around 30% of the market share. This region is known for its strong manufacturing and agricultural sectors, both of which are key drivers for the implementation of autonomous vehicles and machinery. The agricultural industry in the Midlands has embraced automation to address labor shortages, while construction and mining sectors are investing heavily in autonomous machinery to improve operational efficiency. Additionally, with ongoing government support for advanced technologies and smart farming, the Midlands region is poised for further growth in autonomous vehicle adoption.

Northern England

Northern England represents roughly 20% of the UK market share for autonomous off-road vehicles and machinery. The region is traditionally strong in industries like mining, agriculture, and logistics. In recent years, there has been a notable shift toward automation to overcome labor shortages and increase operational efficiency. Key cities such as Manchester and Sheffield are witnessing the rise of autonomous technology integration in their industrial sectors, particularly in agriculture, where autonomous tractors and drones are gaining popularity for fieldwork and monitoring.

Scotland and Wales

Scotland and Wales together account for about 10% of the UK market share. Although these regions have smaller market shares compared to the rest of the UK, they are growing rapidly due to the increasing demand for autonomous solutions in agriculture and forestry. In Scotland, autonomous vehicles are being tested for use in challenging terrains, while Wales is focusing on the deployment of autonomous systems in agriculture and construction to support sustainability goals.

Key Player Analysis:

- Caterpillar Inc.

- Komatsu Ltd.

- Sandvik AB

- John Deere

- Liebherr Group

- Jungheinrich AG

- Daifuku Co. Ltd.

- KION Group

- NAVYA

- EasyMile

Competitive Analysis:

The UK autonomous off-road vehicle and machinery market is characterized by a blend of established global manufacturers and innovative domestic startups. Leading international players such as Caterpillar Inc., Komatsu Ltd., and John Deere are actively expanding their presence in the UK, offering advanced autonomous solutions tailored for agriculture, construction, and mining sectors. These companies leverage their extensive experience and global networks to deliver cutting-edge technology and robust support services. In parallel, UK-based startups are making significant strides in autonomous vehicle technology. Oxa (formerly Oxbotica), headquartered in Oxfordshire, has developed a platform-agnostic autonomy software capable of operating in GPS-denied environments, positioning it as a key player in industrial automation. Additionally, Munro Vehicles, based in Glasgow, specializes in electric off-road vehicles, offering sustainable alternatives for rugged terrains. These domestic innovators are contributing to the diversification and growth of the UK’s autonomous off-road vehicle sector. The competitive landscape is further enriched by companies like SafeAI, which retrofits existing heavy machinery with autonomous technology, and Volvo Autonomous Solutions, providing tailored autonomous transport solutions. Collectively, these entities are driving technological advancements and fostering a dynamic market environment in the UK.

Recent Developments:

- In January 2025, John Deereunveiled several new autonomous machines and its second-generation autonomy kit at CES 2025, expanding its technology stack across agriculture, construction, and landscaping. The new kit leverages advanced AI and computer vision, enabling machines like the 9RX Tractor to operate autonomously with improved efficiency. Later that month, John Deere announced its 2025 Startup Collaborator cohort, partnering with startups focused on digital twins, advanced LiDAR, and automation to further drive innovation in autonomous machinery.

- In July 2024, Liebherr Groupand Fortescue formalized a partnership to develop and validate a fully integrated Autonomous Haulage Solution (AHS), including a fleet management system and machine guidance solution. This collaboration, building on their zero-emission haul truck project, aims to deliver the first AHS operating zero-emissions vehicles globally, with ongoing validation at Fortescue’s Christmas Creek mine in Australia.

- In April 2025, Aurrigo International plc announced the global launch of its Auto-Cargo® autonomous electric vehicle, marking a significant advancement in autonomous off-road and airside logistics in the UK. Developed in partnership with UPS, Innovate UK, the Centre for Connected and Autonomous Vehicles (CCAV), and East Midlands Airport, Auto-Cargo® is engineered to move heavy cargo loads—up to 16,500kg when towing a standard trailer—between aircraft and terminals.

Market Concentration & Characteristics:

The UK autonomous off-road vehicle and machinery market is moderately concentrated, with a blend of established global manufacturers and emerging domestic innovators. International companies like Caterpillar, Komatsu, and John Deere dominate the landscape, leveraging their extensive experience and technological advancements to offer autonomous solutions across sectors such as agriculture, construction, and mining. These global players benefit from economies of scale, established supply chains, and a broad customer base, positioning them as leaders in the market. In contrast, UK-based companies are carving out niches by focusing on specific applications and technologies. For instance, Oxa (formerly Oxbotica), headquartered in Oxfordshire, has developed a platform-agnostic autonomy software capable of operating in GPS-denied environments, positioning it as a key player in industrial automation. Similarly, Munro Vehicles, based in Glasgow, specializes in electric off-road vehicles, offering sustainable alternatives for rugged terrains. These domestic innovators are contributing to the diversification and growth of the UK’s autonomous off-road vehicle sector. The market is characterized by rapid technological advancements, particularly in artificial intelligence, machine learning, and sensor technologies, which enhance the capabilities of autonomous systems. Additionally, the UK’s regulatory environment is evolving to support the deployment of autonomous vehicles, with initiatives such as the Automated Vehicles Act 2024 providing a framework for testing and integration. However, challenges such as high initial investment costs, infrastructure limitations, and regulatory complexities continue to impact market dynamics.

Report Coverage:

The research report offers an in-depth analysis based on Type and Application It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK autonomous off-road vehicle market will see increased adoption across agriculture, construction, and mining sectors due to improved operational efficiency.

- Technological advancements in AI, machine learning, and sensor technologies will enable autonomous vehicles to navigate more complex terrains.

- The shift towards electric autonomous vehicles will grow as industries align with the UK’s sustainability and emission reduction goals.

- Government policies, including the Automated Vehicles Act 2024, will continue to support innovation and safety standards, facilitating market growth.

- Increased collaboration between global manufacturers and UK-based tech companies will drive innovation in autonomous vehicle capabilities.

- Rising labor shortages in key industries will push more businesses towards adopting autonomous systems to reduce dependency on human workers.

- Remote monitoring and fleet management systems will become integral to operations, improving maintenance and operational oversight.

- Autonomous off-road vehicles will become more affordable as technologies mature and economies of scale come into play.

- Data-driven insights and predictive maintenance will optimize fleet performance and reduce downtime.

- The market will expand regionally as the UK strengthens its position in Europe’s autonomous vehicle ecosystem.