Market Overview:

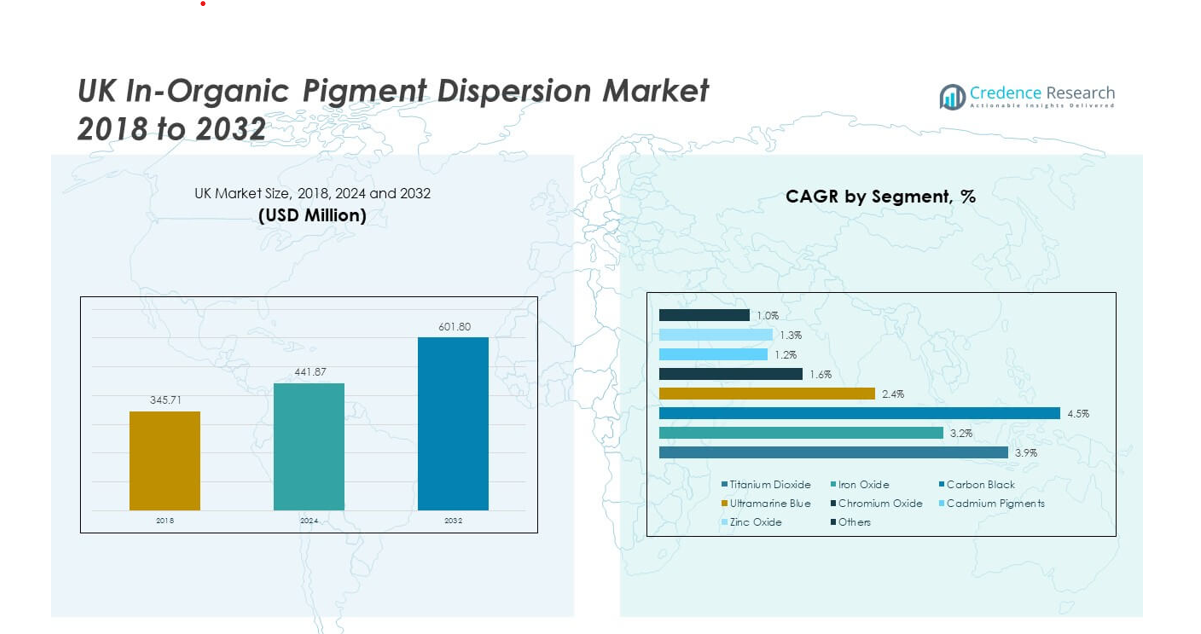

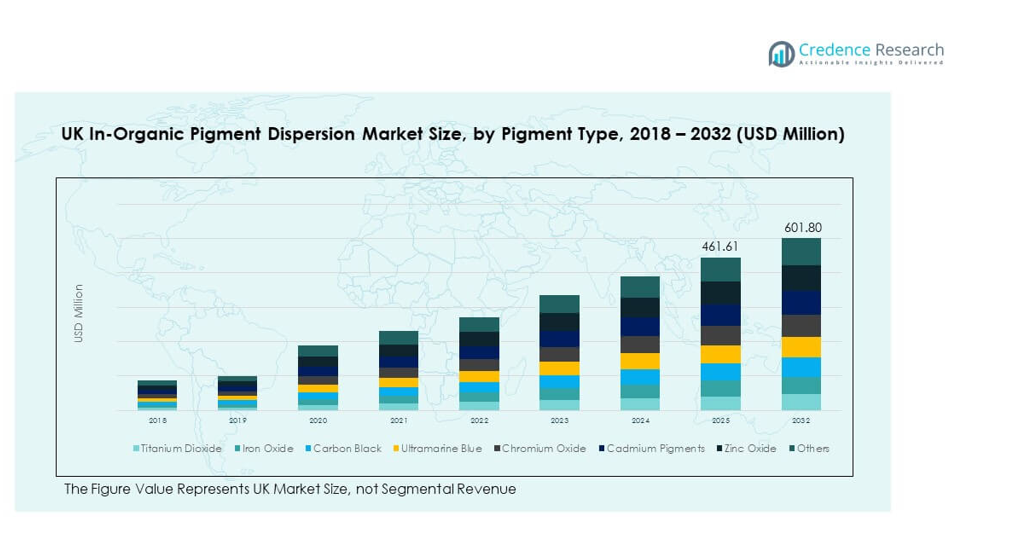

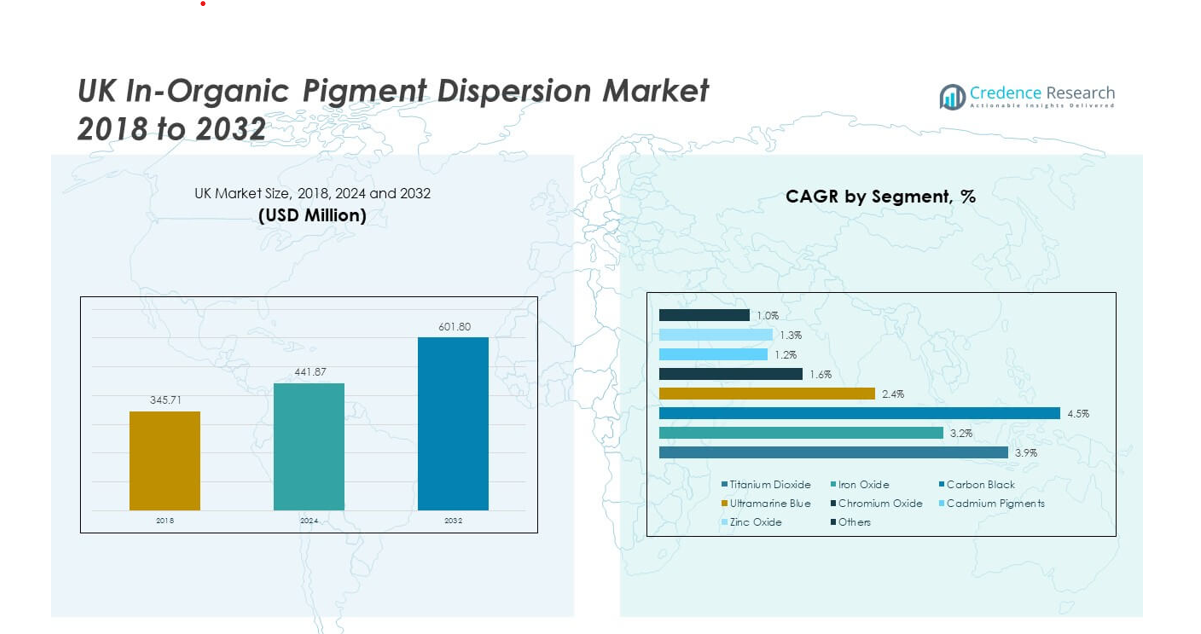

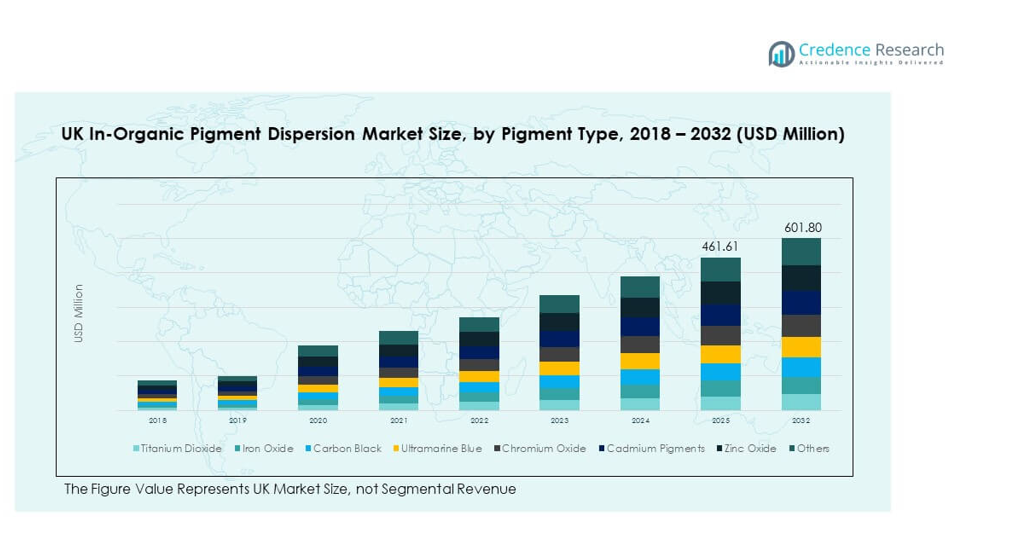

The UK In-Organic Pigment Dispersion Market size was valued at USD 345.71 million in 2018 to USD 441.87 million in 2024 and is anticipated to reach USD 601.80 million by 2032, at a CAGR of 3.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK In-Organic Pigment Dispersion Market Size 2024 |

USD 441.87 million |

| UK In-Organic Pigment Dispersion Market, CAGR |

3.86% |

| UK In-Organic Pigment Dispersion Market Size 2032 |

USD 601.80 million |

Growing demand across construction, automotive, and packaging industries drives steady expansion. The market benefits from rising use of pigment dispersions in coatings, plastics, and printing applications due to their durability and color stability. Environmental compliance and advancements in dispersion technology further stimulate adoption. Increased focus on high-performance, non-toxic formulations strengthens market acceptance. Sustainability goals also push manufacturers to develop eco-friendly dispersions, while regulatory support encourages industry adoption. Continuous investments in R&D enhance pigment quality and processing efficiency, securing the material’s role across industrial and consumer-focused sectors in the UK.

Regionally, England leads the UK In-Organic Pigment Dispersion Market with 58% share, supported by its strong industrial base and high demand from construction and automotive sectors. Scotland contributes 17% share, driven by infrastructure development, energy projects, and rising pigment usage in ceramics and plastics. Wales and Northern Ireland together account for 25%, benefiting from manufacturing activity, packaging demand, and consistent growth in construction materials.

Market Insights

- The UK In-Organic Pigment Dispersion Market was valued at USD 345.71 million in 2018, reached USD 441.87 million in 2024, and is projected to attain USD 601.80 million by 2032, expanding at a CAGR of 3.86%.

- England held the largest regional share at 58%, driven by its strong construction, automotive, and packaging industries that ensure consistent pigment demand.

- Scotland accounted for 17% of the market, supported by its infrastructure development and increasing use of pigments in ceramics and energy projects.

- Wales and Northern Ireland jointly represented 25% share, benefiting from manufacturing growth, packaging needs, and rising demand in construction materials.

- By pigment type, titanium dioxide led with 32% share, followed by iron oxide at 21%, while carbon black held 16%, reflecting their strong role across coatings, plastics, and printing inks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Construction and Infrastructure Sectors

The construction industry in the UK is a critical driver of pigment dispersion demand. Inorganic pigments are widely used in coatings, paints, and finishes to ensure durability and weather resistance. Large infrastructure projects, residential housing, and commercial developments continue to expand requirements for consistent, high-performance dispersions. Urban redevelopment programs further enhance usage of coatings with advanced dispersion qualities. It supports energy-efficient building practices through reflective coatings and improved surface durability. Government initiatives toward sustainable infrastructure directly stimulate pigment usage. Strong alignment with safety and quality standards boosts adoption in paints and coatings. The UK In-Organic Pigment Dispersion Market benefits significantly from these construction-focused requirements.

- For example, Venator Materials PLC is headquartered in Wynyard, UK, and manufactures titanium dioxide (TiO₂) pigments used across coatings, plastics, and industrial applications. The company sells its products in more than 109 countries.

Growing Automotive Industry Applications for Surface Coatings and Plastics

Automotive manufacturing in the UK continues to integrate pigment dispersions into multiple production stages. These pigments enhance vehicle aesthetics by offering stable color shades and resistance to weathering. Manufacturers prioritize dispersions for interior plastics and exterior coatings where long-term performance is essential. Increasing consumer preference for premium finishes elevates demand for high-quality pigment dispersions. Electric vehicle production expands opportunities for lightweight plastics that also require strong dispersion integration. It strengthens overall resistance to corrosion, heat, and UV radiation. Market players focus on delivering innovative pigment formulations to meet evolving automotive design needs. The UK In-Organic Pigment Dispersion Market gains momentum from strong automotive sector requirements.

Expanding Packaging Industry Adoption Driven by Consumer Goods Growth

Packaging is another sector driving pigment dispersion adoption across the UK. The rise of branded consumer goods fuels higher demand for vibrant, consistent, and durable packaging designs. Food packaging, pharmaceuticals, and personal care industries rely heavily on inorganic dispersions to maintain color quality. Regulatory compliance encourages the use of safe pigment formulations, further supporting market growth. Printing inks formulated with dispersions provide sharp visuals and long-lasting appeal. It enables manufacturers to maintain strong brand identity through packaging designs. Growing e-commerce also amplifies packaging requirements across diverse segments. The UK In-Organic Pigment Dispersion Market experiences continuous adoption within packaging and labeling solutions.

Technological Advancements Enhancing Efficiency and Sustainability of Dispersions

Advances in pigment dispersion technology provide a strong base for long-term adoption. R&D investments deliver improved dispersion quality, particle uniformity, and application versatility. Manufacturers adopt advanced processing equipment to enhance performance outcomes across end-user sectors. Energy-efficient dispersion systems reduce environmental impact, aligning with sustainability goals. It ensures compliance with EU and UK environmental regulations. Increasing focus on low-VOC and eco-friendly pigments enhances customer confidence. Smart pigment technologies that resist fading and chemical exposure expand industrial usage. The UK In-Organic Pigment Dispersion Market positions itself as an innovation-driven industry through these advancements.

- For example, in September 2024, Evonik launched TEGO® Wet 570 Terra and TEGO® Wet 580 Terra, two biosurfactant additives for coatings and inks. These products are 100% derived from renewable raw materials, readily biodegradable, and comply with EU Ecolabel standards. They enhance pigment and filler wetting, reduce grinding time, and lower energy consumption offering sustainable performance improvements for pigment dispersions.

Market Trends

Rising Popularity of Eco-Friendly and Low-Emission Pigment Formulations

Sustainability is a defining trend shaping the adoption of pigment dispersions. Eco-friendly formulations with low VOC emissions dominate new product launches across the UK. Manufacturers emphasize compliance with stringent environmental regulations to maintain market share. Demand for recyclable and biodegradable packaging supports innovation in dispersion chemistry. It influences industrial buyers to shift toward eco-conscious suppliers. Growing awareness among end-users accelerates replacement of conventional pigments. Coating industries benefit from sustainable dispersion systems that provide both durability and reduced environmental footprint. The UK In-Organic Pigment Dispersion Market continues to reflect this strong sustainability-focused transition.

- For example, in May 2025, BASF Coatings expanded its portfolio with over 250 biomass-balanced products, covering automotive OEM, refinish, and functional coatings. These solutions, already deployed in Europe, replaced fossil resources with renewables and reduced CO₂ emissions by nearly 8 million kilograms in 2024.

Increasing Integration of Digital Printing and Advanced Ink Systems

The expansion of digital printing technologies boosts pigment dispersion applications in printing inks. Commercial printing firms prefer dispersions with excellent flow, stability, and vibrancy. High-resolution packaging and textile designs rely heavily on inorganic pigment dispersions. Rising customization demands across consumer products strengthen this trend. It supports faster printing cycles with superior print durability. Manufacturers also explore dispersions tailored for UV-curable and water-based ink systems. This trend highlights the role of dispersions in supporting modern printing demands. The UK In-Organic Pigment Dispersion Market shows steady growth from integration with digital printing technologies.

Greater Use of Smart and Functional Pigments Across Industries

Smart pigment dispersions with added functionalities create unique market opportunities. These include UV-resistant pigments, heat-reflective pigments, and anti-corrosive dispersions. Demand grows in industries requiring advanced product durability and enhanced performance. Consumer sectors also prefer dispersions that deliver premium aesthetics combined with resilience. It encourages manufacturers to innovate with new pigment properties. The construction sector increasingly relies on reflective pigments to support energy-efficient buildings. Automotive coatings employ functional pigments for improved safety and longevity. The UK In-Organic Pigment Dispersion Market benefits from expanding adoption of functional pigment technologies.

- For example, in 2023, Merck KGaA’s Surface Solutions division generated €411 million in sales and employed approximately 1,200 people, including around 700 staff in Germany. The unit provided effect and functional pigment products used in coatings, industrial, and cosmetic applications.

Growing Adoption of Automation and Process Optimization in Manufacturing

Automation continues to influence pigment dispersion production processes. Advanced machinery improves consistency, quality, and efficiency in dispersion systems. Real-time monitoring supports manufacturers in maintaining uniform particle size and performance standards. It enhances productivity while reducing waste and energy use. Automation also helps address rising production costs and supply chain challenges. Integration of AI and IoT supports predictive maintenance and quality control. Market players invest heavily in automation to remain competitive. The UK In-Organic Pigment Dispersion Market aligns closely with this growing trend of automated manufacturing optimization.

Market Challenges Analysis

Stringent Regulatory Standards and Rising Environmental Compliance Costs

Strict environmental laws governing chemical use present major challenges to market growth. Regulatory bodies enforce tighter restrictions on pigments with hazardous elements. Manufacturers must invest significantly in R&D to develop compliant alternatives. It raises operational costs and delays product innovation cycles. Meeting low-VOC requirements demands complex adjustments to production processes. Small and medium enterprises often struggle to bear compliance expenses. Market participants also face testing requirements to maintain certifications. The UK In-Organic Pigment Dispersion Market continues to face pressure from evolving regulatory landscapes.

Fluctuating Raw Material Costs and Global Supply Chain Volatility

Raw material price instability impacts the profitability of pigment dispersion manufacturers. Dependence on imported mineral sources increases exposure to global supply fluctuations. It creates uncertainty for production planning and cost management. Supply chain disruptions from geopolitical events or transport delays intensify these risks. Volatile energy costs further increase manufacturing expenses. Competitive pricing pressure limits the ability to pass costs to customers. Market participants must adopt strategic sourcing practices to remain stable. The UK In-Organic Pigment Dispersion Market faces significant hurdles from these raw material and supply chain challenges.

Market Opportunities

Expanding Role of Advanced Coatings in Infrastructure and Automotive Projects

Opportunities continue to grow from increased usage of advanced coatings in construction and automotive sectors. Demand for high-performance pigment dispersions rises with the focus on energy-efficient infrastructure. Automotive firms adopt dispersions for new electric vehicle models requiring lightweight yet durable coatings. It supports projects emphasizing sustainability and safety. Government-backed investments in smart cities further stimulate the coatings segment. Partnerships between coating manufacturers and pigment suppliers create new prospects. The UK In-Organic Pigment Dispersion Market leverages these opportunities to expand market reach across strategic industries.

Rising Innovation in Packaging and Consumer-Centric Product Designs

Packaging innovations offer another important area for growth. Consumer brands prioritize appealing designs with strong color performance and durability. Pigment dispersions enable companies to maintain identity across diverse packaging formats. E-commerce expansion accelerates demand for durable and vibrant packaging inks. It strengthens pigment application in branding, labeling, and visual marketing. Technological progress in eco-friendly pigments enhances adoption in consumer-focused goods. Market participants investing in packaging-focused dispersion systems can secure a competitive edge. The UK In-Organic Pigment Dispersion Market unlocks strong growth potential through packaging-centered opportunities.

Market Segmentation Analysis

By pigment type, titanium dioxide leads the UK In-Organic Pigment Dispersion Market due to its widespread use in coatings, plastics, and construction materials. It delivers high opacity, brightness, and weather resistance, making it essential across end-use industries. Iron oxide follows with significant demand in construction, ceramics, and automotive applications. Carbon black remains important for plastics and printing inks, providing durability and strong color intensity. Other pigments such as ultramarine blue, chromium oxide, cadmium pigments, and zinc oxide contribute niche demand in cosmetics, ceramics, and specialty applications.

- For example, in May 2025, AkzoNobel announced the upcoming launch of its upgraded Dulux Easycare paint line in the UK. The new range will incorporate BASF’s biomass-balanced (BMB) acrylic binders, which are designed to reduce the product’s carbon footprint by at least 5% while maintaining durability and performance standards.

By application, paints and coatings dominate the UK In-Organic Pigment Dispersion Market with strong usage across residential, commercial, and industrial construction projects. Printing inks represent the next major segment, supported by packaging and labeling requirements across retail and e-commerce sectors. Plastics maintain steady adoption, particularly in automotive interiors and consumer goods. Construction materials also reflect a consistent demand base due to infrastructure expansion and architectural finishes. Ceramics and glass contribute specialized demand, while cosmetics rely on dispersions for safe, vibrant, and long-lasting formulations. It highlights the market’s wide integration across both industrial and consumer-oriented applications, ensuring stable growth across multiple sectors.

- For example, in 2024, Sun Chemical showcased its extended Streamline ink range at FESPA 2024, presenting both wide- and super-wide-format inkjet inks. The inks, including the newly introduced Streamline SGR solvent ink series for Ricoh Gen 5 printheads, were manufactured and supported from its facility in South Normanton, UK. The Streamline range features GREENGUARD Gold-certified formulations designed for low indoor emissions, reinforcing Sun Chemical’s commitment to eco-conscious printing solutions.

Segmentation

By Pigment Type

- Titanium Dioxide

- Iron Oxide

- Carbon Black

- Ultramarine Blue

- Chromium Oxide

- Cadmium Pigments

- Zinc Oxide

- Others

By Application

- Paints & Coatings

- Printing Inks

- Plastics

- Construction Materials

- Ceramics and Glass

- Cosmetics

- Others

Regional Analysis

England

England holds the largest share of the UK In-Organic Pigment Dispersion Market, accounting for 58%. Strong industrial activity, coupled with a robust construction and automotive base, sustains its leadership position. Demand for high-quality coatings and plastics drives continuous adoption of inorganic dispersions. The packaging sector further supports growth through vibrant and durable designs. England’s regulatory framework enforces environmental compliance, pushing manufacturers toward low-VOC pigment solutions. It benefits from a concentration of key industry players that provide advanced pigment technologies and drive innovation across applications.

Scotland

Scotland contributes 17% of the total market share, supported by construction and energy-related projects. The region’s architectural coatings demand pigments that withstand extreme weather and environmental conditions. Growth in the plastics sector, particularly for packaging applications, strengthens dispersion consumption. The government’s focus on renewable energy infrastructure creates opportunities for pigment use in specialized materials. It also benefits from niche demand in ceramics and glass, which require durable pigment formulations. Scotland’s regional manufacturers adopt advanced technologies to align with environmental standards and performance requirements.

Wales and Northern Ireland

Wales and Northern Ireland together represent 25% of the UK In-Organic Pigment Dispersion Market. Manufacturing activity in Wales promotes usage of pigments in coatings, plastics, and ceramics. The presence of diverse industrial applications ensures steady pigment demand. Northern Ireland shows growing adoption within packaging and printing inks, supported by its expanding retail sector. Construction materials also represent a consistent market driver across both subregions. It reflects the influence of government infrastructure projects that encourage high-performance coatings. These regions maintain growth potential, driven by localized manufacturing and increasing demand for durable dispersions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Heubach GmbH

- Lanxess AG

- Venator Materials PLC

- Cabot Corporation

- Ferro Corporation

- DIC Corporation

- Sudarshan Chemical Industries

- Huntsman Corporation

- Chromaflo

Competitive Analysis

The UK In-Organic Pigment Dispersion Market is characterized by intense competition among multinational and domestic players. BASF SE, Clariant AG, and Lanxess AG dominate through extensive product portfolios, advanced R&D, and established distribution networks. Venator Materials PLC and Heubach GmbH strengthen their positions by providing cost-effective and specialized pigment solutions. It remains a market where innovation and sustainability determine competitive advantage. Sudarshan Chemical Industries and DIC Corporation expand their presence with eco-friendly pigments tailored for packaging and printing applications. Huntsman Corporation and Cabot Corporation focus on advanced dispersions for automotive and construction sectors. Chromaflo emphasizes customized solutions for industrial coatings, building long-term customer relationships. Competitive strategies center on new product development, mergers, and regional expansions to meet evolving demand across multiple applications.

Recent Developments

- In March 2025, Venator launched its TIOXIDE® TR81 pigment in the United Kingdom, specifically reformulated to be TMP- and TME-free as part of the company’s drive for sustainable inorganic pigment dispersion solutions.

- In June 2025, Clariant AG launched HOSTAPHAT OPS 100, a dispersing agent specifically developed for metal-containing pigments and their dispersions, supporting advanced pigment preparations in industrial coatings and related markets.

- In May 2025, BASF SE introduced Pluriol® A 2400 I, a new reactive polyethylene glycol designed for polycarboxylate ethers used in construction, which also serves as a dispersant for inorganic pigments, helping deliver higher performance and improved sustainability for pigment dispersion applications in Europe.

- In March 2025, Sudarshan Chemical Industries Limited (SCIL) announced the successful completion of its acquisition of the Germany-based Heubach Group, executed through its wholly owned subsidiary, Sudarshan Europe, utilizing a combination of asset and share transactions. In this development, SCIL significantly expanded its product portfolio and gained access to a globally diversified manufacturing and distribution network with reach across 19 international locations.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced coatings will expand as construction and infrastructure projects increase in scale.

- Automotive production will drive pigment adoption, particularly for premium finishes and durable plastics.

- Packaging applications will gain traction due to e-commerce growth and rising branding requirements.

- Eco-friendly and low-VOC formulations will dominate product innovations across multiple end-use sectors.

- Digital printing growth will reinforce pigment use in printing inks, supporting customization and design needs.

- Functional pigments such as UV-resistant and reflective dispersions will strengthen industrial applications.

- Automation in pigment dispersion manufacturing will improve efficiency, quality, and cost control.

- Raw material sustainability initiatives will reshape sourcing strategies and reduce environmental footprints.

- Collaborative R&D between global leaders and UK manufacturers will accelerate technological advancements.

- Regional demand from England, Scotland, Wales, and Northern Ireland will ensure balanced long-term growth.