| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Off-the-Road Tire Market Size 2023 |

USD 754.15 Million |

| UK Off-the-Road Tire Market, CAGR |

4.41% |

| UK Off-the-Road Tire Market Size 2032 |

USD 1,112.95 Million |

Market Overview:

UK Off the Road Tire Market size was valued at USD 754.15 million in 2023 and is anticipated to reach USD 1,112.95 million by 2032, at a CAGR of 4.41% during the forecast period (2023-2032).

Several factors are propelling the growth of the UK’s OTR tire market. The construction and infrastructure sectors are experiencing a resurgence, leading to increased demand for heavy machinery equipped with durable OTR tires. This is further driven by large-scale projects such as the expansion of transport networks and urban development initiatives. Similarly, the mining industry is expanding, necessitating robust tires capable of withstanding harsh terrains and heavy loads, especially in remote and rugged locations. In agriculture, the shift towards mechanization and the adoption of advanced farming equipment are driving the need for specialized OTR tires that offer enhanced traction and durability, ensuring efficiency in crop production. Additionally, there is a growing emphasis on sustainability, prompting manufacturers to develop eco-friendly tire solutions that reduce carbon emissions and improve fuel efficiency, which aligns with global efforts to meet stringent environmental standards.

Within the UK, regional demand for OTR tires varies based on industrial activities and terrain. The South East region, characterized by dense urban populations and significant construction projects, exhibits high demand for construction and industrial vehicle tires, particularly due to ongoing infrastructure development. This demand is further fueled by government initiatives focusing on urban regeneration and transportation. The East and North East regions, with their agricultural and mining activities, respectively, show increased demand for durable OTR tires suitable for challenging environments, where durability and performance are paramount. The Midlands, known for its manufacturing base, also contributes to the demand for OTR tires, particularly in the industrial segment, where the need for high-performing equipment is vital. This regional diversity underscores the importance of tailored tire solutions to meet specific operational requirements across the UK, ensuring optimal performance and safety in various industries and terrains.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK OTR tire market was valued at USD 754.15 million in 2023 and is projected to reach USD 1,112.95 million by 2032, with a CAGR of 4.41% during the forecast period.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- The growth is driven by increased demand from the construction and infrastructure sectors, particularly with large-scale urban regeneration projects and transportation network expansions.

- The UK mining sector’s expansion also fuels the market, with high-performance OTR tires needed for operations in remote, rugged environments where durability is crucial.

- The mechanization of agriculture, including the adoption of advanced farming equipment, increases the demand for specialized OTR tires that provide enhanced traction and durability.

- Sustainability trends are shaping the market, with manufacturers focusing on eco-friendly tire solutions to reduce carbon emissions and improve fuel efficiency in line with the UK’s environmental goals.

- The South East region leads demand due to urban development and significant construction projects, followed by the East and North East, driven by agriculture and mining activities.

- Challenges include high OTR tire costs, fluctuations in raw material prices, and compliance with stringent environmental regulations, which can increase operational expenses for manufacturers.

Market Drivers:

Growing Infrastructure and Construction Projects

The UK’s OTR tire market is significantly driven by the ongoing surge in infrastructure and construction projects. For instance, Bridgestone has highlighted that the demand for OTR tires is closely linked to the rise in large-scale urban regeneration projects and the development of new transportation networks, which require heavy-duty machinery equipped with durable OTR tires. Government initiatives, including large-scale urban regeneration projects and the development of new transportation networks, are boosting the demand for heavy machinery equipped with durable OTR tires. As cities expand and new infrastructures are built, there is a growing need for construction equipment capable of operating in tough environments, including roads, bridges, and tunnels. The growing scale and complexity of these projects have heightened the demand for tires that can withstand the weight and rough conditions that such heavy-duty machinery endures. These infrastructure advancements, particularly in cities like London and Birmingham, further emphasize the importance of reliable OTR tires for maximizing efficiency and safety.

Expansion of the Mining Industry

The expansion of the UK mining sector also plays a critical role in driving the demand for OTR tires. Mining operations, particularly in areas such as Cornwall and Wales, require high-performance tires that can withstand extreme conditions, including rough, uneven terrains and the heavy weight of mining equipment. With growing investments in both traditional mining and the extraction of materials for renewable energy technologies, the need for robust OTR tires has increased. For instance, according to JK Tyre & Industries, their latest OTR tires are engineered to excel in the most challenging terrains, offering unparalleled durability and efficiency for heavy-duty machinery in the mining sector. These tires must endure the wear and tear of tough environments while ensuring operational efficiency. Moreover, innovations in mining technologies and machinery have created a demand for OTR tires with enhanced durability, load-bearing capacity, and safety features. As the UK continues to invest in expanding its mineral resources and mining capabilities, the demand for advanced, high-quality OTR tires will remain strong.

Increased Agricultural Mechanization

Agriculture in the UK is undergoing a transformation with the increasing mechanization of farming operations. As more advanced farming equipment is adopted, such as tractors, harvesters, and plows, there is a corresponding need for specialized OTR tires that can handle the demands of large-scale farming. These tires are designed to provide optimal traction and durability on various soil types, enabling machinery to perform under different conditions such as muddy or uneven terrains. The shift towards precision farming, driven by technological advancements like GPS and IoT in agriculture, is also encouraging the adoption of machinery with specialized tires that can offer enhanced fuel efficiency and reduce soil compaction. As farmers continue to adopt high-tech machinery to improve productivity, the demand for OTR tires suitable for agricultural applications will continue to rise.

Focus on Sustainability and Eco-friendly Solutions

Sustainability is becoming an increasingly important factor in shaping the demand for OTR tires in the UK. With a global push towards environmental conservation, manufacturers are under pressure to develop eco-friendly tire solutions that help reduce the carbon footprint. In response to these environmental concerns, the tire industry has focused on innovation and the development of tires that not only improve fuel efficiency but also reduce harmful emissions during manufacturing and use. The UK’s commitment to achieving net-zero carbon emissions by 2050 has led to stricter regulations for industries to adopt more sustainable practices. This has prompted OTR tire manufacturers to create products made from renewable materials and to focus on reducing waste and enhancing recycling capabilities. The growing importance of sustainability in both the public and private sectors is, therefore, a key driver for the UK OTR tire market, pushing manufacturers to offer more environmentally responsible options.

Market Trends:

Technological Advancements in Tire Design

One of the key trends shaping the UK OTR tire market is the ongoing technological advancements in tire design. Manufacturers are investing heavily in research and development to produce tires that offer improved performance, longevity, and safety. For example, Continental launched a real-time digital tire monitoring solution for truck trailers in August 2023, which provides continuous data on tire pressure and temperature, allowing for more efficient maintenance and reduced downtime. The integration of advanced materials, such as synthetic rubber blends, and innovations in tread design is increasing the efficiency and durability of OTR tires. These advancements are particularly beneficial for industries such as mining and construction, where machinery operates in extreme conditions. Additionally, digital technologies like tire pressure monitoring systems (TPMS) and real-time data analytics are being integrated into tire management, helping to optimize tire usage, reduce downtime, and increase operational efficiency. As these technologies evolve, OTR tires will continue to provide better value and performance for users in the UK market.

Growth in Demand for Radial Tires

Another notable trend in the UK OTR tire market is the growing preference for radial tires over bias-ply tires. Radial tires, known for their durability, improved fuel efficiency, and better heat dissipation, are becoming the preferred choice for heavy-duty machinery in the construction, mining, and agriculture sectors. Radial tires are also more cost-effective in the long term due to their longer lifespan and reduced maintenance requirements. This trend is supported by the UK’s increasing focus on reducing operating costs and enhancing the overall efficiency of industrial operations. As more businesses recognize the long-term benefits of radial tires, their adoption in various OTR applications continues to rise, reflecting a shift in the market towards high-performance, durable tire solutions.

Sustainability and Eco-friendly Tires

Sustainability is an ongoing trend in the UK OTR tire market, with increasing demand for eco-friendly products. As environmental regulations become stricter and industries face pressure to reduce their carbon footprints, tire manufacturers are focusing on producing products with a reduced environmental impact. This includes the development of tires made from sustainable materials, such as bio-based rubber, and those designed to be more energy-efficient during manufacturing and usage. The trend towards recycling and tire re-manufacturing is also gaining traction, with a growing emphasis on extending the lifecycle of OTR tires. This shift towards sustainable practices is in line with the UK’s broader environmental goals, including its pledge to achieve net-zero emissions by 2050, and is expected to shape the OTR tire market in the coming years.

Emerging Demand for Smart Tires

Smart tires are an emerging trend in the UK OTR tire market. The integration of Internet of Things (IoT) technology into tire products has led to the development of smart tires, which can provide real-time data on tire performance, including pressure, temperature, and wear levels. Continental, for example, introduced a digital tire monitoring system for truck trailers in 2023, capable of delivering daily tire data for up to 28 days using a rechargeable battery. These smart tires are equipped with sensors that allow fleet managers to monitor the condition of tires remotely, thus enhancing maintenance and operational efficiency. The adoption of smart tires is gaining momentum, particularly in sectors where heavy-duty machinery is used in harsh conditions, such as mining, construction, and agriculture. By providing better control over tire performance and enabling predictive maintenance, smart tires are expected to become a significant trend in the UK OTR tire market.

Market Challenges Analysis:

High Cost of OTR Tires

A primary restraint in the UK OTR tire market is the high cost of these specialized tires. The price of OTR tires, especially those designed for heavy-duty machinery, can be considerably higher than standard tires. This cost is largely due to the advanced materials and technologies used in their manufacturing, as well as the need for tires that can withstand extreme conditions in industries such as mining, construction, and agriculture. These high upfront costs can be a significant barrier, particularly for smaller businesses or operators who may face difficulty in justifying the investment. For instance, the British Tyre Manufacturers Association (BTMA) has emphasized that “energy costs, which form a significant portion of manufacturing expenses, have surged dramatically in recent years, placing undue pressure on manufacturers and threatening jobs and economic stability. Moreover, the added cost of maintenance and replacement tires over time can further strain budgets, making it a challenge for businesses to adopt and maintain optimal tire solutions.

Fluctuations in Raw Material Prices

Another challenge faced by the UK OTR tire market is the fluctuation in raw material prices, particularly rubber and steel. The prices of these materials can be volatile, influenced by factors such as supply chain disruptions, geopolitical tensions, and changes in global demand. These price fluctuations can lead to unpredictable costs for manufacturers, impacting the pricing and profitability of OTR tires. Additionally, as raw material costs rise, tire manufacturers may struggle to maintain competitive pricing while still ensuring the quality and durability of their products. This issue is particularly challenging in a market where cost-efficiency is crucial for businesses operating in price-sensitive sectors like construction and agriculture.

Regulatory and Environmental Compliance

Compliance with stringent regulatory and environmental standards is another challenge for the UK OTR tire market. The tire industry is subject to a variety of regulations aimed at reducing environmental impact, including those related to tire disposal, recycling, and emissions during manufacturing. The increasing pressure to adopt eco-friendly practices and meet sustainability targets can raise operational costs for manufacturers. Companies that fail to comply with these standards may face penalties, which can hinder growth and market competitiveness. Additionally, meeting the growing demand for sustainable products requires significant investment in research and development, further adding to the challenges faced by the industry.

Market Opportunities:

The UK Off-the-Road (OTR) tire market presents significant growth opportunities driven by several key industry trends. One of the most prominent opportunities is the ongoing investment in infrastructure and construction projects across the country. As the UK government focuses on urban development and large-scale transportation initiatives, there is a rising demand for heavy-duty machinery equipped with durable OTR tires. These projects, including the construction of new roads, bridges, and public transportation systems, create a sustained need for specialized tires capable of handling challenging environments. Companies that offer high-performance, cost-efficient OTR tire solutions are well-positioned to capture a share of this expanding market.

Another major opportunity lies in the agriculture sector, which continues to modernize through increased mechanization. As UK farmers increasingly adopt advanced machinery for crop production and land management, the need for specialized tires that provide enhanced traction, durability, and reduced soil compaction is growing. Additionally, with the UK’s commitment to sustainability, there is an opportunity for manufacturers to develop eco-friendly tire solutions that align with both government regulations and consumer preferences for environmentally responsible products. By focusing on innovation, such as smart tires that offer real-time performance data and solutions that improve fuel efficiency, tire manufacturers can tap into a rising demand for high-quality, sustainable products, ensuring long-term success in the UK OTR tire market.

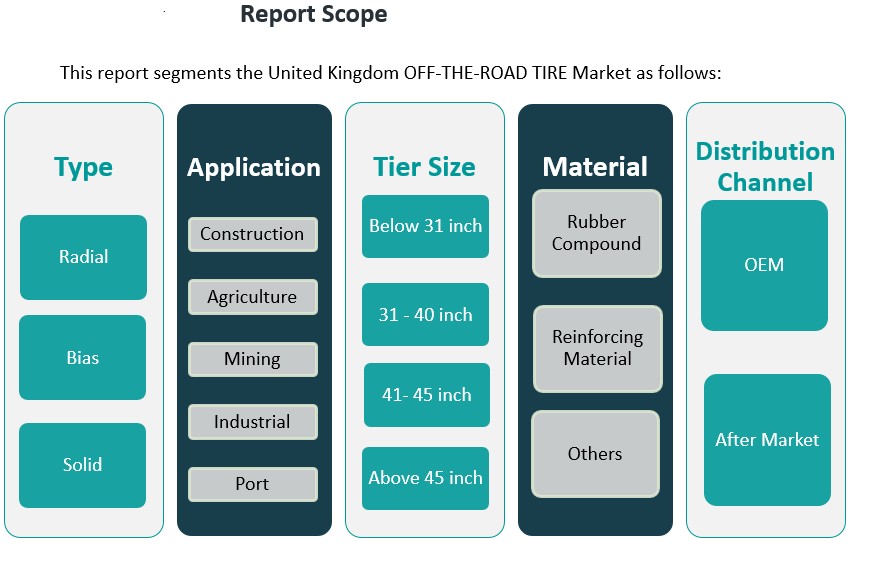

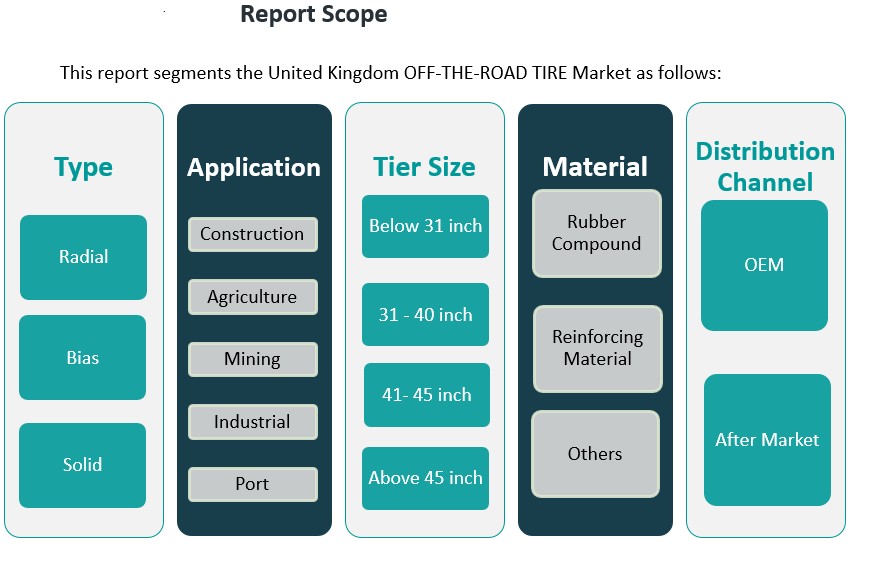

Market Segmentation Analysis:

The UK Off-the-Road (OTR) tire market can be segmented across various categories, each driven by distinct industry requirements.

By Type Segment:

In the OTR tire market, radial tires dominate due to their durability, fuel efficiency, and longer lifespan compared to bias and solid tires. Radial tires are particularly sought after for construction and mining applications where machinery operates in challenging conditions. Bias tires, while less common, still cater to specific applications that require robust performance in uneven terrains. Solid tires, known for their puncture resistance and ability to handle heavy loads, are primarily used in industrial environments such as ports.

By Application Segment:

The demand for OTR tires is high across several industries, with the construction sector leading due to ongoing urbanization and infrastructure development. Agriculture follows closely as mechanization increases in farming, creating a need for specialized tires that offer traction and minimize soil compaction. The mining sector also contributes significantly, requiring tires that can endure extreme conditions in mining operations. Industrial and port applications require heavy-duty tires that can support large machinery handling high operational loads.

By Tire Size Segment:

Tire size varies based on application, with tires below 31 inches commonly used in smaller machinery, while those in the 31 – 40-inch and 41 – 45-inch ranges are prevalent in larger construction and mining equipment. Tires above 45 inches cater to the most heavy-duty machinery, such as those used in large-scale mining or industrial applications.

By Material Segment:

The key materials in OTR tires include rubber compounds, which provide flexibility and durability, and reinforcing materials such as steel, which enhance strength and load-bearing capacity. Other materials include additives used to improve tire performance in different conditions.

By Distribution Channel Segment:

The OTR tire market is primarily driven by two distribution channels: OEM (Original Equipment Manufacturer) and the aftermarket. OEM deals are critical for new machinery, while the aftermarket segment caters to the replacement and maintenance needs of existing equipment.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

The UK Off-the-Road (OTR) tire market exhibits a diverse regional demand driven by varying industrial activities and geographic factors. The market is primarily influenced by construction, agriculture, mining, and industrial sectors, with regional characteristics playing a key role in shaping the demand for OTR tires.

South East Region

The South East region, which includes London and its surrounding areas, leads the demand for OTR tires in the UK. This is primarily due to the heavy concentration of urban development and large-scale construction projects. The South East accounts for approximately 35% of the overall market share. The construction sector here is supported by both public and private investments in infrastructure, resulting in a substantial requirement for construction machinery and associated OTR tires. Additionally, the region’s proximity to key ports and transportation hubs further fuels demand for industrial and port-related OTR tires.

Midlands Region

The Midlands, including cities such as Birmingham and Coventry, also represents a significant portion of the UK OTR tire market, contributing about 25% to the market share. Known for its strong manufacturing base, the Midlands has a high demand for OTR tires in the industrial sector, particularly for machinery used in manufacturing, logistics, and materials handling. The region’s diverse industrial base, combined with ongoing investments in infrastructure, makes it a key driver of OTR tire demand. The expansion of both automotive and heavy-duty manufacturing industries further bolsters tire requirements.

North West and North East Regions

The North West and North East regions, which are home to extensive agricultural land and growing mining operations, together hold around 20% of the market share. In these regions, the demand for OTR tires is largely driven by agriculture and mining industries, where specialized tires are required for equipment such as tractors, harvesters, and mining vehicles. The North East, particularly, is known for its mining activities, which require tires that can withstand rough terrain and heavy loads.

South West and Other Regions

The South West and other smaller regions, such as Yorkshire and the Humber, represent the remaining 20% of the market share. While these areas do not have the same concentration of large-scale industrial operations, they still contribute to OTR tire demand, particularly from agricultural sectors. These regions require high-quality tires for farm machinery and off-road vehicles used in agriculture and small-scale construction projects.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- Ascenso

- Kal Tire

Competitive Analysis:

The UK Off-the-Road (OTR) tire market is characterized by a competitive landscape dominated by global and regional players offering a wide range of tire solutions across various industrial sectors. Key players such as Michelin, Bridgestone, Goodyear, and Continental lead the market, leveraging their strong brand presence, extensive distribution networks, and advanced technological innovations. These companies focus on delivering high-performance tires designed for durability, safety, and efficiency, catering to sectors like construction, mining, agriculture, and industrial applications. Regional players, such as Tyre Group International and BKT Tires, are gaining traction by providing cost-effective and customized solutions tailored to local market needs. The competition in the market is further intensified by the growing trend of sustainability, with manufacturers investing in eco-friendly and recyclable tire technologies to meet evolving environmental regulations. As the market continues to expand, these companies must focus on innovation and customer satisfaction to maintain their competitive edge.

Recent Developments:

- In March 2024, Goodyear, a major global tire manufacturer, introduced the RL-5K OTR tire, specifically engineered for heavy-duty loaders and wheel dozers. This new product features a three-star load capacity rating, which enhances durability and performance for demanding operations, reflecting Goodyear’s ongoing advancements in OTR tire technology with a focus on efficiency and operational resilience.

- In January 2025, Apollo Tyres announced a significant partnership to boost its brand visibility in Spain through La Liga, one of the world’s most prestigious football leagues. This agreement allows Apollo Tyres to showcase its premium Vredestein tyre brand on pitch-side LED boards at 28 La Liga matches across multiple stadiums, starting from January 19, 2025, during the Girona vs Sevilla game.

- Hankook Tire launched its new Optimo sub-brand in Europe on January 22, 2025. The introduction of Optimo is a strategic effort to increase Hankook Tire’s market share across Europe, including Spain, by offering a reliable and streamlined product portfolio that covers all seasons and a wide range of customer requirements.

- In February 2025, Goodyear completed the sale of its global Off-the-Road (OTR) tire business to Yokohama Rubber for $905 million. This strategic move is part of Goodyear’s transformation plan, allowing the company to streamline its portfolio and focus on core products and services. The acquisition includes assets and operations relevant to the OTR segment, which is significant for markets like Spain where off-road tires are essential for construction, mining, and agriculture.

Market Concentration & Characteristics:

The UK Off-the-Road (OTR) tire market exhibits moderate concentration, with a few dominant global players controlling a significant portion of the market share. Leading manufacturers such as Michelin, Bridgestone, Goodyear, and Continental hold a strong competitive position due to their extensive product portfolios, advanced technologies, and established distribution networks. These companies cater to large-scale industries, including construction, mining, agriculture, and logistics, by offering high-performance, durable tire solutions. However, the market also has room for regional and niche players, such as BKT Tires and Tyre Group International, which focus on providing cost-effective and customized solutions. The market is characterized by innovation-driven growth, with companies increasingly investing in sustainable tire technologies and smart tire solutions. The need for robust, long-lasting tires that can withstand harsh operating conditions further drives competition, prompting manufacturers to continually improve their offerings to meet the evolving demands of the industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK OTR tire market is expected to grow steadily as infrastructure projects continue to expand across urban areas.

- Demand for high-performance, durable tires will rise with the ongoing mechanization of agriculture.

- Mining operations in the North East and South West regions will continue to drive the need for heavy-duty OTR tires.

- Increased focus on sustainability will encourage the development of eco-friendly and recyclable tire technologies.

- The shift towards radial tires over bias and solid tires will dominate due to their longer lifespan and improved efficiency.

- Smart tire technologies, including real-time monitoring and data analytics, will gain traction for better fleet management.

- Advancements in tire materials, such as bio-based rubbers and advanced compounds, will support growth in performance and sustainability.

- Regional players will expand their market share by offering cost-effective solutions tailored to UK-specific needs.

- OEM distribution channels will remain critical, with strong demand for tires in new machinery sales.

- The aftermarket segment will continue to grow as machinery owners prioritize maintenance and tire replacements for cost savings.