| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| United Kingdom Diabetes Drugs Market Size 2023 |

USD 3,267.39 Million |

| United Kingdom Diabetes Drugs Market, CAGR |

3.12% |

| United Kingdom Diabetes Drugs Market Size 2032 |

USD 4,458.43 Million |

Market Overview

United Kingdom Diabetes Drugs Market size was valued at USD 3,267.39 million in 2023 and is anticipated to reach USD 4,458.43 million by 2032, at a CAGR of 3.12% during the forecast period (2023-2032).

The United Kingdom diabetes drugs market is primarily driven by the rising prevalence of diabetes, an aging population, and increasing healthcare awareness. The growing demand for innovative treatments, such as GLP-1 receptor agonists and SGLT-2 inhibitors, is also contributing to market growth. Advancements in drug formulations and personalized medicine, along with a focus on improving patient outcomes, are fueling the adoption of newer therapies. Furthermore, government initiatives promoting early diagnosis and better management of diabetes, coupled with a shift towards diabetes prevention programs, are strengthening market prospects. The increasing availability of affordable medications and the introduction of biosimilars are also expected to enhance market growth. Additionally, the growing trend of digital health solutions and remote monitoring for diabetes management is creating new opportunities for drug developers to offer integrated treatment options. These factors combined are set to shape the future trajectory of the UK diabetes drugs market.

The United Kingdom diabetes drugs market is characterized by significant regional demand driven by factors such as population size, healthcare infrastructure, and diabetes prevalence. Major cities like London, Manchester, Birmingham, and Scotland play key roles in driving market growth, with London being a major hub for healthcare services and pharmaceutical research. The market is highly competitive, with prominent global and local players dominating the landscape. Leading companies such as Novo Nordisk, Sanofi, Merck & Co., Eli Lilly, and AstraZeneca are at the forefront, offering a wide range of diabetes drugs, from insulin to advanced therapies like GLP-1 receptor agonists and SGLT-2 inhibitors. These companies are focused on improving treatment outcomes through innovation and strategic partnerships. Additionally, the market is supported by increasing government initiatives aimed at tackling the growing diabetes burden, further enhancing the demand for effective diabetes drugs across the country.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The United Kingdom diabetes drugs market was valued at USD 3,267.39 million in 2023 and is projected to reach USD 4,458.43 million by 2032, growing at a CAGR of 3.12% during the forecast period (2023-2032).

- Rising diabetes prevalence, an aging population, and increasing healthcare awareness are key market drivers.

- Advancements in drug development, particularly in GLP-1 receptor agonists and SGLT-2 inhibitors, are reshaping diabetes treatment.

- Increasing adoption of combination therapies and biosimilars are notable market trends that offer cost-effective alternatives.

- High treatment costs for newer therapies like GLP-1 agonists and SGLT-2 inhibitors pose challenges for market expansion.

- The UK market is highly competitive with key players such as Novo Nordisk, Sanofi, Merck & Co., and Eli Lilly leading the market share.

- Regional markets, such as London, Manchester, and Scotland, show varying levels of demand, with London contributing significantly to market growth.

Report Scope

This report segments the United Kingdom Diabetes Drugs Market as follows:

Market Drivers

Rising Prevalence of Diabetes

The increasing prevalence of diabetes is one of the most significant drivers of the United Kingdom diabetes drugs market. For instance, Diabetes UK reported that over 4.6 million people in the UK have been diagnosed with diabetes, with an additional 1.3 million estimated to have undiagnosed Type 2 diabetes. This growing diabetic population creates a sustained demand for medications to manage the condition. With the rise of Type 2 diabetes, which is largely influenced by lifestyle factors like obesity, there is an urgent need for effective therapeutic interventions. The growing burden of diabetes on the healthcare system emphasizes the need for innovative drugs that can help manage blood sugar levels, reduce complications, and improve the quality of life for patients.

Advancements in Drug Development

Advancements in diabetes drug development are another crucial market driver in the United Kingdom. The development of new drug classes, such as GLP-1 receptor agonists, SGLT-2 inhibitors, and DPP-4 inhibitors, has revolutionized the treatment landscape for diabetes. These drugs not only effectively control blood sugar but also offer benefits like weight loss and cardiovascular protection, making them highly appealing to both patients and healthcare providers. Furthermore, continuous research into the potential of personalized medicine and precision therapies is expected to further drive market growth. These innovations are aimed at improving the efficacy and safety profiles of diabetes treatments, addressing unmet needs, and providing more tailored solutions for patients based on their genetic and lifestyle factors.

Government Support and Healthcare Initiatives

Government initiatives and policies supporting diabetes prevention, early diagnosis, and effective management play a crucial role in driving the growth of the diabetes drugs market. For instance, the NHS Diabetes Prevention Programme (NDPP) has successfully enrolled thousands of high-risk individuals in lifestyle intervention programs to delay or prevent the onset of Type 2 diabetes. Additionally, increased healthcare funding for diabetes-related treatments and healthcare services has created a favorable environment for pharmaceutical companies to innovate and introduce new diabetes drugs to the market. These efforts contribute to greater public awareness, early intervention, and better management of the disease, ultimately driving demand for diabetes drugs.

Rising Adoption of Digital Health Solutions

The adoption of digital health solutions is an emerging trend that is positively influencing the diabetes drugs market in the United Kingdom. Digital tools, such as diabetes management apps, continuous glucose monitors (CGMs), and insulin pumps, are being increasingly integrated with drug therapies to offer more comprehensive care for patients. These technologies provide real-time monitoring of blood sugar levels, enabling patients and healthcare providers to make informed decisions about drug dosages and lifestyle adjustments. The shift towards remote monitoring and telemedicine has also gained traction, particularly in the wake of the COVID-19 pandemic. As these digital solutions become more widely available and accepted, they will create opportunities for pharmaceutical companies to collaborate on integrated diabetes care, thus driving demand for complementary diabetes drugs.

Market Trends

Shift Towards Oral and Injectable Medications

A significant trend in the United Kingdom diabetes drugs market is the shift towards both oral and injectable medications that offer greater convenience and effectiveness. Oral therapies like SGLT-2 inhibitors and DPP-4 inhibitors have become popular due to their ease of use and effectiveness in controlling blood glucose levels. For instance, the National Institute for Health and Care Excellence (NICE) has recommended SGLT-2 inhibitors as a first-line treatment for patients with Type 2 diabetes and cardiovascular risks, emphasizing their dual benefits. On the other hand, injectable treatments, particularly GLP-1 receptor agonists, are gaining traction as they not only help regulate blood sugar levels but also offer added benefits such as weight loss and improved cardiovascular health. As patients and healthcare providers seek therapies that align with treatment goals and offer enhanced convenience, this trend is expected to continue driving the demand for both oral and injectable diabetes drugs.

Focus on Combination Therapies

Another prominent market trend is the increasing use of combination therapies for diabetes management. Many patients require multiple medications to effectively control their blood sugar levels, making combination therapies an attractive option. Drugs that combine different mechanisms of action in a single formulation, such as SGLT-2 inhibitors and metformin, are becoming increasingly popular due to their ability to provide enhanced therapeutic benefits. This trend not only simplifies the treatment regimen for patients but also improves medication adherence. Pharmaceutical companies are focusing on developing new combination therapies that offer better patient outcomes and fewer side effects, further fueling the market growth for diabetes drugs.

Growth in Biosimilars and Generic Drugs

The growing availability and adoption of biosimilars and generic drugs is another key trend in the UK diabetes drugs market. For instance, the British Generic Manufacturers Association (BGMA) has reported that biosimilar insulins, such as Basaglar, have significantly reduced treatment costs for the NHS while maintaining efficacy and safety. As patents for some of the leading diabetes drugs expire, biosimilars and generics are becoming more prevalent. These drugs offer a cost-effective alternative to branded therapies, making diabetes treatment more affordable and accessible to a larger population. The increasing pressure on healthcare budgets and the need for more sustainable healthcare solutions have driven the demand for biosimilars and generics, especially in a public healthcare system like the NHS. As a result, several pharmaceutical companies are focusing on developing and launching biosimilars of popular diabetes medications, which will continue to influence the market’s trajectory.

Integration of Digital Health in Diabetes Management

The integration of digital health technologies into diabetes management is a growing trend shaping the UK diabetes drugs market. Digital tools, such as continuous glucose monitoring (CGM) systems, insulin pumps, and diabetes management apps, are becoming integral to the management of diabetes. These technologies enable real-time monitoring of blood glucose levels, providing patients with valuable insights to make informed decisions about their treatment plans. The rise of telemedicine and remote consultations further supports the demand for digital health solutions. Pharmaceutical companies are increasingly exploring opportunities to integrate digital health tools with their drug offerings, creating comprehensive diabetes management systems. This trend is expected to enhance patient outcomes and drive demand for diabetes drugs that complement these digital solutions.

Market Challenges Analysis

High Cost of Innovative Therapies

One of the significant challenges facing the United Kingdom diabetes drugs market is the high cost associated with innovative therapies. While new drugs, such as GLP-1 receptor agonists and SGLT-2 inhibitors, have proven to be effective in managing diabetes and reducing complications, their high prices can limit patient access, especially in public healthcare systems like the NHS. For instance, Diabetes UK has highlighted that the annual cost of diabetes-related treatments exceeds £10 billion, with innovative therapies accounting for a substantial portion of this expenditure. These therapies, although offering multiple benefits beyond blood sugar control, come with significant financial burdens for both healthcare providers and patients. The NHS, which operates under a budgetary constraint, faces challenges in balancing the introduction of new therapies while managing costs. The high cost of newer diabetes medications is further compounded by the pricing pressures exerted by health regulators and insurers, which may slow down the widespread adoption of these therapies in the market.

Limited Patient Adherence and Lifestyle Barriers

Another challenge for the diabetes drugs market in the UK is the issue of patient adherence to prescribed treatment regimens. Despite the availability of advanced therapies, many patients struggle to follow their treatment plans consistently, which can affect the overall efficacy of diabetes management. Factors such as forgetfulness, side effects, or a lack of understanding about the importance of regular medication can hinder patient compliance. Additionally, lifestyle barriers, such as poor dietary habits, lack of physical activity, and mental health issues, can also interfere with the success of diabetes treatment. Although medications can help control blood sugar, they are often not enough on their own to manage diabetes effectively without proper lifestyle modifications. These challenges, coupled with the complexity of managing a chronic disease, present a significant barrier to achieving optimal patient outcomes, affecting the overall growth of the market.

Market Opportunities

The United Kingdom diabetes drugs market offers several opportunities driven by the increasing demand for innovative treatments and advancements in drug development. As the prevalence of diabetes continues to rise, there is a growing need for more effective therapies that not only control blood sugar but also address related complications such as cardiovascular diseases and obesity. This demand for multi-benefit drugs, such as GLP-1 receptor agonists and SGLT-2 inhibitors, creates significant opportunities for pharmaceutical companies to expand their portfolios and introduce novel treatments. Additionally, as personalized medicine gains traction, the potential for developing tailored therapies based on individual genetic profiles opens new avenues for drug developers to target specific patient populations, ensuring more efficient and effective treatments.

Furthermore, the increasing focus on digital health solutions presents a unique opportunity for the diabetes drugs market. The integration of digital tools, such as continuous glucose monitoring systems, insulin pumps, and mobile health applications, into diabetes management is transforming the landscape of treatment. These technologies enable real-time monitoring and help patients adhere to their medication regimens more effectively. By combining digital health solutions with drug therapies, pharmaceutical companies can offer comprehensive care systems that improve patient outcomes and enhance medication adherence. This trend toward integrated diabetes care systems will likely foster collaborations between pharmaceutical companies, tech firms, and healthcare providers, creating opportunities for innovation and growth in the diabetes drugs market.

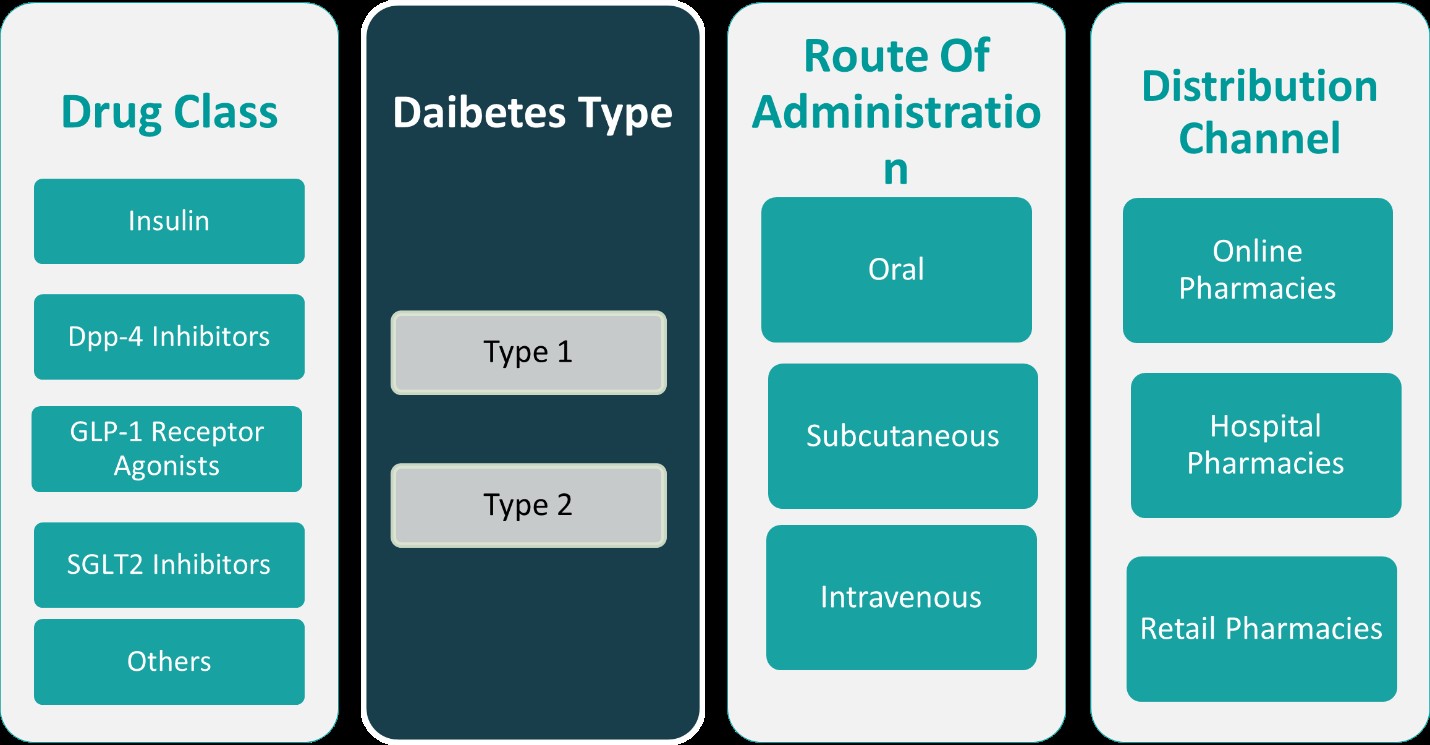

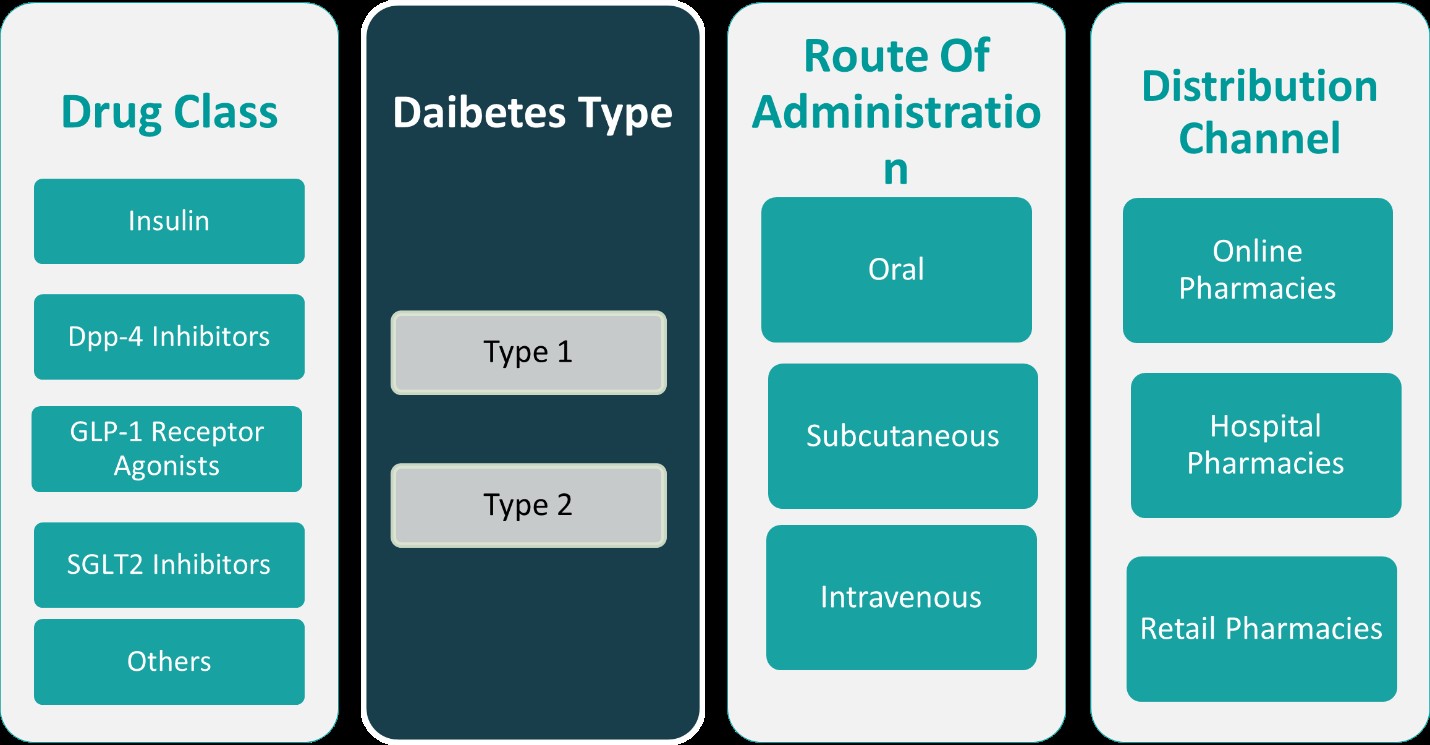

Market Segmentation Analysis:

By Drug Class:

The United Kingdom diabetes drugs market can be segmented based on drug class, with each class offering distinct therapeutic benefits to patients. Insulin remains one of the primary treatments for managing diabetes, particularly for Type 1 diabetes, where the body cannot produce insulin. It also plays a significant role in the management of Type 2 diabetes for patients whose insulin production is insufficient. DPP-4 inhibitors, such as sitagliptin, are another key segment, used to enhance insulin secretion and reduce blood sugar levels. They are often prescribed for Type 2 diabetes patients and are favored for their minimal side effects. GLP-1 receptor agonists, such as liraglutide and semaglutide, have gained popularity due to their ability to improve blood sugar control and promote weight loss. SGLT2 inhibitors, like empagliflozin, also address blood glucose control while providing cardiovascular benefits, making them ideal for Type 2 diabetes patients with heart-related issues. Other drug classes, including sulfonylureas and thiazolidinediones, continue to be used but face increasing competition from newer therapies.

By Diabetes Types:

The market is also segmented by diabetes types, each requiring different treatment approaches. Type 1 diabetes, which typically affects younger individuals, often requires insulin-based therapies as the pancreas cannot produce insulin. Type 2 diabetes, the most common form, is increasingly managed with oral medications like DPP-4 inhibitors, GLP-1 receptor agonists, and SGLT2 inhibitors in combination with insulin therapy. Type 3 diabetes, often referred to as Alzheimer’s disease-related diabetes, is an emerging focus area, and research into targeted treatments for this condition is growing. Type 4 and Type 5 diabetes, which are less common and sometimes associated with specific conditions or causes, are still under investigation for suitable drug treatments. For all types, personalized medicine is gaining attention, as tailored therapies based on individual characteristics may improve outcomes and reduce complications. The increasing recognition of diverse diabetes types offers opportunities for more specialized treatments and innovations in diabetes care.

Segments:

Based on Drug Class:

- Insulin

- DPP-4 Inhibitors

- GLP-1 Receptor Agonists

- SGLT2 Inhibitors

- Others

Based on Diabetes Types:

- Type 1

- Type 2

- Diabetes Type 3

- Diabetes Type 4

- Diabetes Type 5

Based on Route of Administration:

- Oral

- Subcutaneous

- Intravenous

- Route of Administration 4

- Route of Administration 5

Based on Technology:

- Technology 1

- Technology 2

- Technology 3

Based on Distribution Channel:

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

- Distribution Channel 4

- Distribution Channel 5

Based on the Geography:

- London

- Manchester

- Birmingham

- Scotland

Regional Analysis

London

London, as the capital city, holds a significant portion of the market due to its large population, high healthcare demand, and a concentration of medical research institutions and healthcare facilities. London accounts for approximately 30% of the overall UK market share. This region is home to a diverse demographic, leading to a broad range of diabetes types, from Type 1 to Type 2, further driving the demand for both traditional and innovative diabetes treatments. The presence of a robust healthcare infrastructure and access to the latest diabetes therapies makes London a key market driver for diabetes drugs in the UK.

Manchester

Manchester, a major metropolitan area in the North West of England, represents about 20% of the diabetes drug market share. As one of the largest urban centers outside London, Manchester’s growing population and expanding healthcare needs contribute to its substantial market share. The city is known for its strong healthcare services and significant investment in medical research, particularly in the fields of diabetes management and pharmaceutical development. With a focus on improving patient outcomes and addressing the needs of a large diabetes population, Manchester is a key region for the adoption of advanced therapies like GLP-1 receptor agonists and SGLT-2 inhibitors.

Birmingham

Birmingham, located in the West Midlands, holds around 15% of the market share. As the second-largest city in the UK, Birmingham has a diverse population and a strong presence of healthcare institutions. The city faces a growing prevalence of Type 2 diabetes, influenced by urbanization and lifestyle factors, thereby increasing the demand for diabetes drugs. With ongoing efforts to improve diabetes management and integrate innovative treatments, Birmingham is a significant player in the regional market. The region’s healthcare providers are adopting newer therapies to address the needs of a diverse diabetic population.

Scotland

Scotland, though a smaller market compared to the larger cities in England, still holds a notable share of around 10% in the UK diabetes drugs market. Scotland’s healthcare system, which includes public initiatives such as the Scottish Diabetes Group, has a strong focus on addressing the growing diabetes burden. The region has seen increased investment in diabetes care and treatment, particularly in rural and underserved areas, which has contributed to market growth. Furthermore, Scotland’s aging population and rising incidence of Type 2 diabetes are expected to drive further demand for diabetes medications, including both traditional and newer, innovative therapies.

Key Player Analysis

- Novo Nordisk A/S

- Sanofi

- Merck & Co., Inc

- Eli Lilly and Company

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International GmbH

- Novartis AG

- Johnson & Johnson Services, Inc.

- Bayer AG

- Biocon

- Pfizer

Competitive Analysis

The United Kingdom diabetes drugs market is highly competitive, with several global and local pharmaceutical giants leading the market. Key players include Novo Nordisk, Sanofi, Merck & Co., Eli Lilly, AstraZeneca, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim, Novartis, Johnson & Johnson, Bayer AG, Biocon, and Pfizer. These companies have a strong presence in the UK, offering a wide range of diabetes drugs that cater to both Type 1 and Type 2 diabetes patients. Leading companies focus on providing a broad range of treatments, including insulin, GLP-1 receptor agonists, SGLT-2 inhibitors, and DPP-4 inhibitors, to address the diverse needs of diabetes patients. Innovation plays a crucial role in the competition, with significant efforts directed towards developing new drug classes, improving treatment outcomes, and enhancing patient adherence. The market is also witnessing a shift towards combination therapies, which are becoming increasingly popular due to their ability to offer more effective treatment regimens and simplify management for patients. Additionally, the rise of biosimilars and generic drugs is contributing to market competition by offering more affordable alternatives to branded medications. Companies are focusing on increasing the accessibility of their products while ensuring they meet the evolving demands of both healthcare providers and patients. Price sensitivity remains a challenge in a public healthcare system like the NHS, where budget constraints drive competition among pharmaceutical companies. To stay competitive, firms are adopting strategies like partnerships, acquisitions, and investments in research and development to stay ahead of emerging trends and expand their product offerings.

Recent Developments

- In March 2025, Novo Nordisk signed a deal worth up to $2 billion for the rights to UBT251, a new obesity and diabetes drug developed by United BioTechnology. The drug combines GLP-1, GIP, and glucagon to manage blood sugar and reduce hunger.

- In February 2025, Sanofi received FDA approval for MERILOG, the first rapid-acting insulin aspart biosimilar, to improve glycemic control in adults and pediatric patients with diabetes.

- In December 2024, JD Health began offering Merck’s GLUCOPHAGE XR (Reduce Mass) online in China, enhancing access to metformin hydrochloride extended-release tablets for type 2 diabetes patients.

- In December 2024, Torrent Pharma acquired three diabetes brands from Boehringer Ingelheim, including those with Empagliflozin, to strengthen its anti-diabetes portfolio

- In November 2024, AstraZeneca presented promising early data for its obesity pipeline, including AZD5004, an oral GLP-1 receptor blocker, at ObesityWeek 2024.

Market Concentration & Characteristics

The United Kingdom diabetes drugs market exhibits a moderate to high level of market concentration, with several global pharmaceutical giants dominating the landscape. Leading companies control a significant share of the market, primarily due to their extensive product portfolios, robust research and development capabilities, and strong brand recognition. These companies drive innovation through the development of new drug classes, such as GLP-1 receptor agonists and SGLT-2 inhibitors, which have transformed diabetes treatment. The market is characterized by a growing emphasis on combination therapies and personalized medicine, responding to the diverse needs of patients with Type 1 and Type 2 diabetes. Additionally, there is a rising trend toward biosimilars and generic drugs, which help increase market accessibility and affordability, particularly in a cost-sensitive healthcare system like the NHS. Despite the competitive environment, the market remains attractive due to the high and growing demand for effective diabetes management solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Diabetes Types, Route of Administration, Technology, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The United Kingdom diabetes drugs market is expected to grow steadily due to the increasing prevalence of diabetes and an aging population.

- Advancements in drug development will lead to the introduction of more innovative therapies, particularly in the areas of GLP-1 receptor agonists and SGLT-2 inhibitors.

- The demand for combination therapies will continue to rise as patients seek more effective and convenient treatment options.

- The shift towards personalized medicine will enable more tailored treatment plans, improving patient outcomes.

- Biosimilars and generic drugs will gain more traction, offering cost-effective alternatives to branded medications.

- Government initiatives focusing on early diagnosis and diabetes prevention will drive demand for diabetes drugs.

- Digital health solutions, such as glucose monitoring devices and mobile apps, will increasingly integrate with diabetes therapies.

- Competition in the market will intensify as companies develop innovative therapies and strategic partnerships to expand their market share.

- The rise of Type 2 diabetes will continue to be a significant factor, increasing the need for long-term management solutions.

- Regulatory bodies will play a critical role in ensuring the affordability and accessibility of diabetes medications within the public healthcare system.