| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Toy Market Size 2024 |

USD 13,950.23 Million |

| UK Toy Market, CAGR |

4.13% |

| UK Toy Market Size 2032 |

USD 19,285.62 Million |

Market Overview

UK Toy Market size was valued at USD 13,950.23 million in 2024 and is anticipated to reach USD 19,285.62 million by 2032, at a CAGR of 4.13% during the forecast period (2024-2032).

The UK toy market is driven by evolving consumer preferences, technological advancements, and increasing disposable income. A significant trend shaping the industry is the rising demand for educational and STEM-based toys, as parents prioritize cognitive development. Sustainability is also a key driver, with consumers favoring eco-friendly and recyclable toys. Digital integration, including augmented reality (AR) and interactive features, enhances engagement and drives sales. The growing popularity of collectibles, influenced by social media and entertainment franchises, further fuels market expansion. E-commerce plays a crucial role in distribution, offering convenience and a wide product range. Seasonal demand, especially during holidays, remains a strong sales driver. Additionally, licensing agreements with popular movies, TV shows, and video games significantly boost toy sales.

The UK toy market is geographically diverse, with key regions such as London, Manchester, Birmingham, and Scotland driving demand through strong retail networks and evolving consumer preferences. Urban centers benefit from high foot traffic in shopping districts, while online sales continue to grow across all regions, expanding market accessibility. The market is highly competitive, with major players such as Hasbro, Mattel, Lego Group, and The Entertainer dominating the landscape. These companies leverage strong brand recognition, extensive product portfolios, and strategic licensing agreements to maintain their market positions. Additionally, niche brands and emerging startups focusing on sustainable and tech-integrated toys are gaining traction. The rise of digital marketing, influencer collaborations, and e-commerce channels has further intensified competition, pushing companies to innovate continuously. As consumer preferences shift toward eco-friendly materials and interactive play experiences, both established and emerging players must adapt to evolving trends to sustain long-term growth in the UK toy industry.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK toy market was valued at USD 13,950.23 million in 2024 and is projected to reach USD 19,285.62 million by 2032, growing at a CAGR of 4.13% from 2024 to 2032.

- Increasing demand for educational and STEM-based toys is driving market growth as parents prioritize skill development and interactive learning.

- Sustainability is a key trend, with consumers favoring eco-friendly and recyclable toys, pushing manufacturers toward sustainable production.

- The industry faces strong competition, with major players like Hasbro, Mattel, and Lego leveraging brand recognition and licensing deals to maintain market dominance.

- Supply chain disruptions, rising raw material costs, and the shift toward digital entertainment present challenges for traditional toy manufacturers.

- London leads in sales due to high retail activity and online shopping, while cities like Manchester and Birmingham also contribute significantly to market expansion.

- The rise of influencer marketing, digital integration, and direct-to-consumer sales is reshaping how toys are marketed and sold in the UK.

Report Scope

This report segments the UK Market as follows:

Market Drivers

Growing Demand for Educational and STEM Toys

The increasing emphasis on child development and early learning has significantly driven demand for educational and STEM-based toys in the UK. Parents and educators prioritize toys that promote cognitive skills, problem-solving, and creativity, fueling the popularity of science, technology, engineering, and mathematics (STEM) toys. As schools incorporate hands-on learning experiences, toy manufacturers are aligning their products with curriculum-based content to enhance engagement. Additionally, government initiatives supporting STEM education further reinforce market growth. Brands investing in interactive and skill-enhancing toys gain a competitive edge, ensuring sustained demand for educational play solutions.

Sustainability and Eco-Friendly Toy Preferences

Environmental concerns and consumer awareness regarding sustainable products have led to a significant shift toward eco-friendly toys. Parents increasingly seek toys made from biodegradable, recyclable, and ethically sourced materials. For instance, Playmobil has transitioned 90% of its toddler range to plant-based materials, while its Wiltopia range uses an average of 80% recycled and bio-based materials. Similarly, Dantoy’s Blue Marine line, made from recycled maritime gear, has been recognized for its innovative approach to sustainability. Retailers are also responding by promoting green-certified products, such as those with the Nordic Swan Ecolabel, which emphasizes sustainability and safety. This shift not only aligns with environmental regulations but also strengthens brand reputation and customer loyalty in an increasingly conscious market.

Technological Integration and Digital Influence

Advancements in technology continue to transform the UK toy industry, with smart toys, augmented reality (AR), and artificial intelligence (AI) becoming key growth drivers. For instance, AR-enhanced board games like “Tilt Five” and AI-powered toys such as Cozmo have been highlighted in industry reports for their ability to provide immersive and personalized play experiences. The rise of gaming-related toys and app-connected products, like Osmo Genius Starter Kit, further blurs the line between physical and digital play. Social media platforms and influencer marketing also play a crucial role in shaping purchasing decisions, with unboxing videos and trending toy content driving consumer interest. As digital entertainment evolves, toy manufacturers must innovate to meet the growing expectations of tech-savvy consumers.

E-Commerce Growth and Licensing Trends

The expansion of online retail has revolutionized toy distribution, offering consumers a convenient and diverse shopping experience. E-commerce platforms provide access to a wide range of toys, often at competitive prices, driving market penetration. Subscription-based toy services and direct-to-consumer models have also gained traction, catering to changing shopping behaviors. Additionally, licensed toys based on popular movies, TV shows, and video games continue to dominate sales. Collaborations with entertainment franchises boost brand visibility and generate consistent demand, particularly around blockbuster releases. As digital retail and entertainment partnerships grow, they will remain pivotal in shaping the UK toy market’s trajectory.

Market Trends

Rising Popularity of Educational and Sensory Toys

Educational and sensory toys are gaining traction in the UK market as parents prioritize child development through play. STEM-focused toys, puzzles, and building sets continue to see strong demand, aligning with efforts to enhance problem-solving and critical thinking skills. Additionally, toys designed to support sensory development, such as fidget toys and textured playsets, have become increasingly popular, particularly among children with special needs. As learning through play becomes a key purchasing factor, toy manufacturers are expanding their product lines to incorporate more interactive and educational features.

Sustainability and Eco-Conscious Toy Manufacturing

Sustainability is a growing priority in the UK toy market, with consumers demanding environmentally friendly products. For instance, Dantoy’s Blue Marine line, made from recycled maritime gear, has been recognized for its innovative approach to sustainability. Manufacturers are responding by introducing toys made from biodegradable, recycled, or plant-based materials, reducing reliance on traditional plastics. Retailers are also curating eco-friendly toy collections, promoting brands that emphasize ethical sourcing and responsible production. With sustainability becoming a key differentiator, companies that integrate green initiatives into their supply chains and marketing strategies are gaining a competitive advantage.

Digital and Tech-Enhanced Play Experiences

Technological advancements continue to shape the toy industry, with digital integration becoming a key trend. For instance, UNICEF’s Responsible Innovation in Technology for Children project, co-founded with the LEGO Group, highlights the transformative impact of augmented reality (AR) and artificial intelligence (AI) in enhancing play experiences. Smart toys that respond to voice commands or adapt to a child’s learning pace are growing in popularity. Additionally, video game-inspired toys and collectibles linked to digital platforms are driving cross-industry collaborations. As technology-driven play becomes more mainstream, companies must innovate to stay relevant in a competitive landscape.

Influencer and Franchise-Driven Toy Trends

Social media and entertainment franchises are playing a crucial role in shaping toy trends in the UK. Children are increasingly influenced by online content, with toy unboxing videos and influencer endorsements significantly impacting purchasing decisions. Popular movie and television franchises continue to drive demand for licensed toys, with blockbuster releases boosting sales. Additionally, collectible toys linked to digital media, such as YouTube and gaming personalities, are expanding their market presence. As digital engagement grows, brands must leverage influencer partnerships and entertainment tie-ins to maintain consumer interest and drive sales.

Market Challenges Analysis

Rising Production Costs and Supply Chain Disruptions

The UK toy industry faces significant challenges due to rising production costs and ongoing supply chain disruptions. Fluctuations in raw material prices, particularly for plastics and sustainable alternatives, have increased manufacturing expenses. Additionally, labor shortages and higher transportation costs have put pressure on pricing and profit margins. For instance, many mid-sized UK businesses report delayed deliveries and inventory shortages as key operational hurdles, exacerbated by geopolitical tensions and potential new trade tariffs. Global supply chain disruptions, including delays in shipping and port congestion, have led to inventory shortages and longer lead times. Retailers and manufacturers must adopt agile strategies, such as nearshoring production or diversifying supply sources, to mitigate these challenges and maintain steady product availability.

Changing Consumer Preferences and Market Competition

Evolving consumer preferences and intense market competition pose another major challenge for the UK toy industry. The growing demand for digital entertainment and screen-based play options has led to a shift away from traditional toys, forcing manufacturers to innovate rapidly. Additionally, sustainability expectations are rising, requiring companies to adapt their product lines while balancing costs. The market is also highly competitive, with established brands facing pressure from emerging startups and direct-to-consumer models. To remain competitive, toy companies must continuously evolve their offerings, invest in digital engagement strategies, and align with shifting consumer expectations.

Market Opportunities

The UK toy market presents significant opportunities driven by evolving consumer preferences and technological advancements. The growing demand for educational and STEM-based toys offers manufacturers the chance to expand their product lines to cater to parents seeking developmental benefits for their children. Interactive and skill-building toys, including coding kits, robotics, and science experiment sets, are gaining popularity, aligning with the increasing emphasis on early learning. Additionally, the rise of sustainability-conscious consumers creates an opportunity for brands to differentiate themselves by offering eco-friendly and ethically sourced toys. Companies that invest in biodegradable materials, recyclable packaging, and carbon-neutral production can build strong brand loyalty and appeal to environmentally aware buyers.

The rapid expansion of e-commerce and digital retail channels further enhances growth prospects in the UK toy industry. Online marketplaces, direct-to-consumer platforms, and subscription-based toy services provide companies with new revenue streams and wider market reach. Leveraging social media and influencer marketing can drive engagement and brand visibility, particularly among younger audiences who are heavily influenced by digital content. Moreover, partnerships with entertainment franchises and gaming brands create lucrative opportunities for licensing agreements, boosting sales through character-driven toys and collectibles. As the toy industry continues to evolve, businesses that embrace digital transformation, sustainability, and innovation will be well-positioned to capture long-term growth.

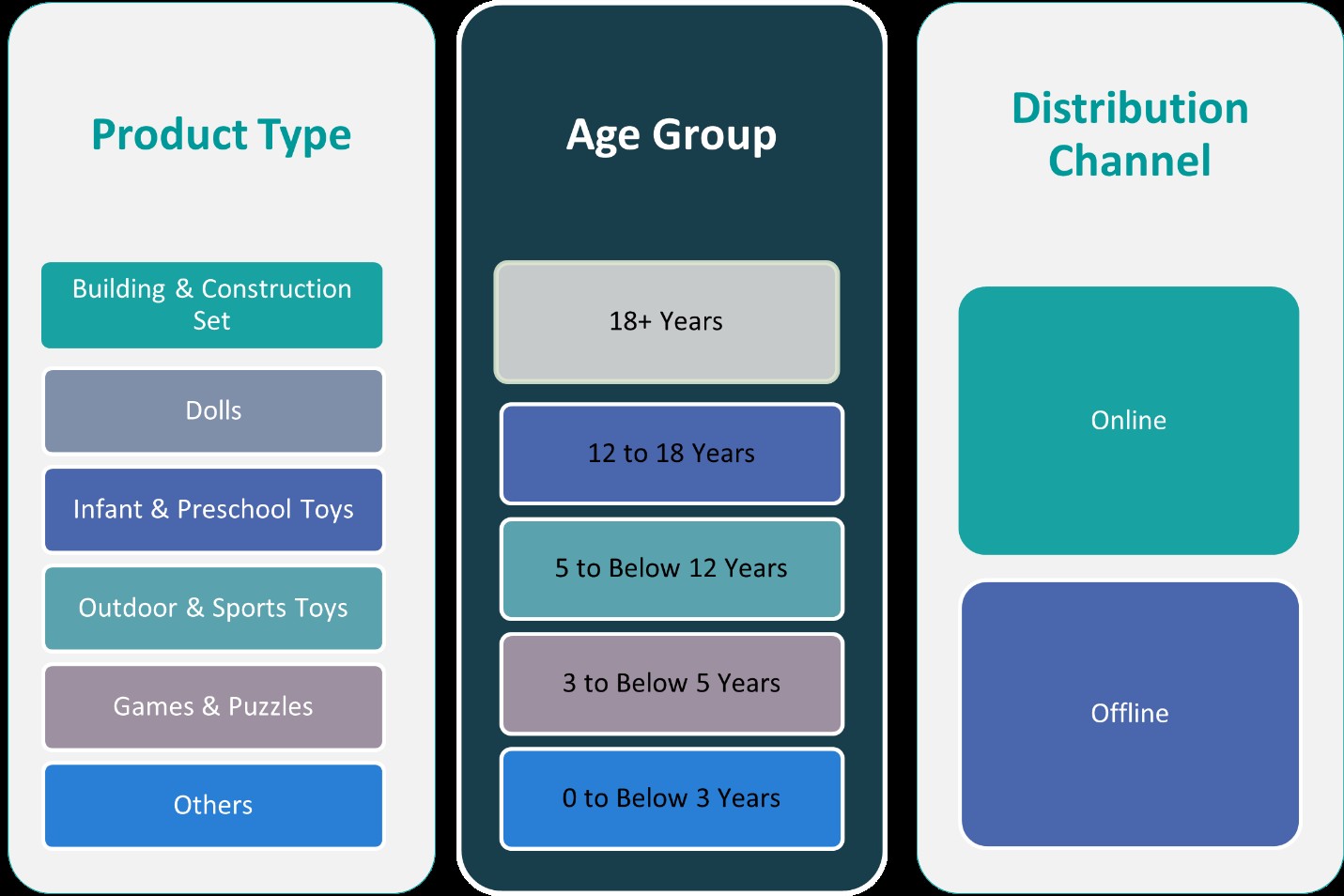

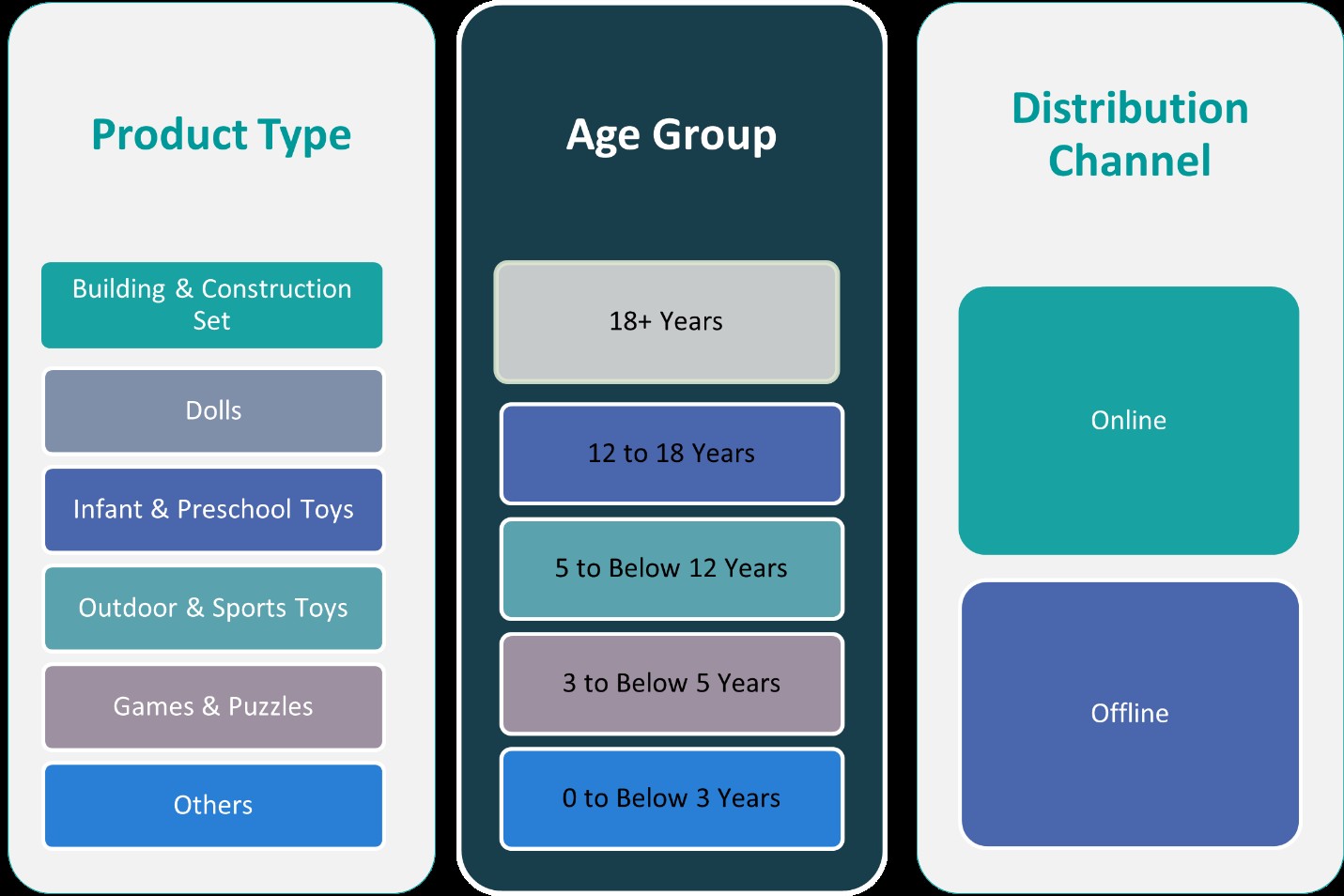

Market Segmentation Analysis:

By Product Type:

The UK toy market is segmented into various product categories, each catering to different consumer preferences and play experiences. Building and construction sets remain a strong segment, driven by their ability to enhance creativity and problem-solving skills. Brands like LEGO continue to dominate, with licensed sets from popular franchises boosting sales. Dolls remain a staple in the industry, with traditional and interactive smart dolls gaining traction, particularly those featuring storytelling elements or customization options. Infant and preschool toys focus on early learning and sensory development, with a growing preference for eco-friendly materials and Montessori-inspired designs. Outdoor and sports toys see consistent demand, particularly during warmer months, as parents prioritize active play to encourage physical development. The segment benefits from trends in sustainable materials, such as wooden or biodegradable outdoor toys. Games and puzzles have experienced a resurgence, fueled by family-oriented activities and the rising interest in strategy-based board games. This category continues to evolve with digital integration and interactive features.

By Age Group:

The UK toy industry is further segmented based on age groups, reflecting diverse play needs and developmental stages. The 0 to below 3 years segment primarily includes sensory and educational toys designed for early motor skill development, with a rising demand for soft toys and interactive learning devices. The 3 to below 5 years category focuses on preschool learning, featuring toys that enhance creativity and cognitive abilities, such as shape sorters, activity centers, and simple construction sets. The 5 to below 12 years segment represents a significant market share, encompassing a wide range of products, including board games, action figures, and outdoor play equipment. Older age groups, such as 12 to 18 years, show a growing interest in collectibles, gaming-related merchandise, and STEM-based kits. The 18+ years segment, although niche, includes adult collectibles, high-end model kits, and complex board games catering to enthusiasts. With evolving consumer interests, manufacturers must tailor their product offerings to meet the diverse demands of these age groups.

Segments:

Based on Product Type:

- Building & Construction Set

- Dolls

- Infant & Preschool Toys

- Outdoor & Sports Toys

- Games & Puzzles

Based on Age Group:

- 18+ Years

- 12 to 18 Years

- 5 to Below 12 Years

- 3 to Below 5 Years

- 0 to Below 3 Years

Based on Distribution Channel:

Based on the Geography:

- London

- Manchester

- Birmingham

- Scotland

Regional Analysis

London

London holds the largest market share at approximately 35%, driven by its high population density, strong retail infrastructure, and affluent consumer base. The city’s diverse demographic profile fuels demand for a wide range of toys, from premium and collectible items to educational and tech-based products. London also benefits from a robust e-commerce ecosystem, with online toy sales experiencing consistent growth. The presence of flagship stores, specialty retailers, and entertainment-driven toy launches further solidifies the capital’s dominant position in the market.

Manchester

Manchester accounts for around 20% of the UK toy market share, emerging as a key player in toy sales and distribution. The city’s thriving retail landscape, including shopping centers and independent toy stores, contributes to strong market performance. Manchester’s growing population and increasing disposable income levels drive demand for educational, outdoor, and family-oriented toys. Additionally, the city hosts various gaming and pop culture events that boost sales of licensed and collectible toys. With a rising preference for sustainable and interactive play products, manufacturers and retailers in Manchester are increasingly adopting innovative strategies to capture market opportunities.

Birmingham

Birmingham represents approximately 18% of the UK toy market share, supported by a well-established retail sector and a diverse consumer base. The city’s strong logistics network facilitates efficient distribution, ensuring steady product availability across both physical and online stores. Demand in Birmingham is particularly high for STEM toys, puzzles, and outdoor play equipment, reflecting parents’ focus on skill development and active play. Seasonal trends, such as holiday-driven sales and back-to-school purchases, play a significant role in shaping toy market dynamics in the region. With the growing influence of digital marketing and e-commerce platforms, Birmingham’s toy industry continues to expand.

Scotland

Scotland contributes around 12% to the UK toy market, with major urban centers such as Glasgow and Edinburgh driving demand. The region’s consumer preferences lean toward traditional toys, board games, and outdoor recreational products, reflecting a strong cultural emphasis on family and group activities. Scotland’s toy market benefits from tourism-driven sales, particularly in heritage-themed and locally made toy products. However, challenges such as logistics constraints in remote areas impact distribution efficiency. Despite these challenges, the increasing adoption of online shopping and the demand for sustainable toys present growth opportunities for retailers and manufacturers in the region.

Key Player Analysis

- Hasbro, Inc.

- Hornby Hobbies

- The Entertainer

- Mattel, Inc.

- Lego Group

Competitive Analysis

The UK toy market is highly competitive, with major players such as Hasbro, Mattel, Lego Group, The Entertainer, and Hornby Hobbies dominating the industry. These companies leverage strong brand recognition, extensive product portfolios, and strategic licensing agreements to maintain their market positions. Innovation plays a crucial role, with industry leaders continuously expanding their offerings through technology-driven toys, licensing agreements, and interactive play experiences. The market is also witnessing a strong focus on sustainability, with companies integrating eco-friendly materials and ethical production practices to align with consumer preferences. Retail strategies are evolving, with a growing emphasis on e-commerce, direct-to-consumer sales, and influencer-driven marketing. Digital engagement through social media and gaming collaborations has become a key competitive advantage, allowing brands to capture a wider audience. Additionally, niche players specializing in collectibles, STEM-based toys, and personalized play experiences are gaining traction, increasing competition. To sustain growth, companies must focus on product differentiation, omnichannel retail strategies, and adapting to shifting consumer expectations in an increasingly digital and sustainability-conscious market.

Recent Developments

- In March 2025, the LEGO Group launched a wide range of new sets, including LEGO Architecture, LEGO Art, and LEGO Formula 1, with over 40 sets released on March 1st, including the Trevi Fountain and several Formula 1 Speed Champions sets.

- In March 2025, MGA Entertainment’s Little Tikes brand announced a partnership with BBC Studios to launch a line of Bluey-inspired toys, including the Bluey Grannies Car Coupe, Bluey Bushland Adventures Splash Pad, Bluey Beach Day Sand Box, and Bluey Beach Water Table.

- In March 2025, the LEGO Group announced a new multi-year partnership with The Pokémon Company International to bring LEGO Pokémon sets starting in 2026.

- In March 2025, Spin Master announced the renewal of its global master toy licensee agreement with DreamWorks Animation for Gabby’s Dollhouse.

- In March 2025, Hasbro participated in the North American International Toy Fair, showcasing new products and collaborations, including a PLAY-DOH Barbie line and Marvel’s Iron Man toys.

- In March 2025, Mattel renewed its multi-year global licensing agreement with Disney for Toy Story, planning new products for the franchise’s 30th anniversary and Toy Story 5.

Market Concentration & Characteristics

The UK toy market exhibits a moderate to high level of market concentration, with a few dominant players controlling a significant share of sales. Leading companies benefit from strong brand loyalty, extensive distribution networks, and exclusive licensing agreements with popular entertainment franchises. The market is characterized by rapid innovation, with an increasing focus on educational toys, digital integration, and sustainability. Consumer preferences are evolving, driving demand for eco-friendly materials, interactive play experiences, and collectibles linked to digital media. While traditional brick-and-mortar retailers remain relevant, e-commerce and direct-to-consumer sales channels are growing, reshaping the competitive landscape. Seasonal demand, particularly during holidays, plays a crucial role in revenue generation, making inventory management and supply chain efficiency critical for success. Despite competition from emerging brands, established players maintain their market position through continuous product development, strategic partnerships, and strong marketing initiatives, ensuring sustained growth in the evolving UK toy industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The UK toy market is expected to experience steady growth, driven by increasing demand for educational and STEM-based toys.

- Sustainability will continue to shape the industry, with more manufacturers adopting eco-friendly materials and packaging.

- Digital integration in toys, including augmented reality and artificial intelligence, will enhance interactive play experiences.

- E-commerce and direct-to-consumer sales will expand, reshaping traditional retail models and increasing online competition.

- Licensing agreements with popular entertainment franchises will remain a key driver of toy sales.

- Supply chain innovations and localized manufacturing will help mitigate disruptions and reduce production costs.

- Influencer marketing and social media-driven promotions will play a crucial role in consumer purchasing decisions.

- The demand for collectible toys and adult hobby products will grow, expanding beyond traditional children’s markets.

- Personalization and customization in toys will gain popularity, offering unique and tailored play experiences.

- The industry will continue evolving with technological advancements, sustainability initiatives, and changing consumer preferences.